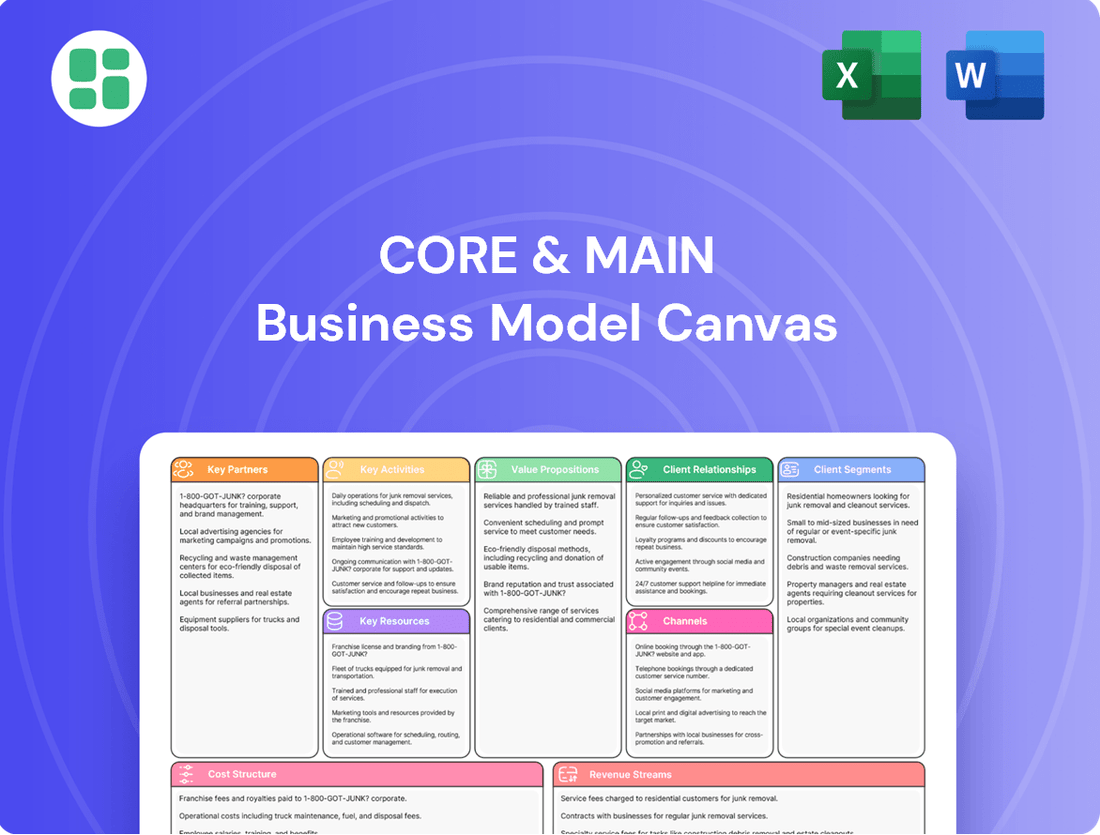

Core & Main Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core & Main Bundle

Unlock the strategic blueprint behind Core & Main's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and generate revenue in the competitive infrastructure and utility sectors. Discover their key partners, activities, and cost structure to gain actionable insights for your own ventures.

Partnerships

Core & Main's success hinges on its robust network of infrastructure product suppliers, encompassing manufacturers of pipes, valves, hydrants, and fittings. These relationships are vital for ensuring a steady supply of quality materials, critical for meeting customer needs and project deadlines. In 2024, Core & Main continued to emphasize these partnerships, recognizing their role in maintaining inventory levels and facilitating access to innovative product developments.

Core & Main's strategic alliances with technology and software providers are pivotal for optimizing operations and elevating customer engagement. These partnerships are crucial for developing and implementing advanced solutions in areas like inventory control, supply chain management, and digital customer interaction platforms.

For instance, in 2024, the company continued to invest in its proprietary technology, focusing on enhancing its e-commerce capabilities and data analytics. This strategic focus aims to provide customers with seamless online ordering and real-time order tracking, thereby improving overall satisfaction and operational agility.

Core & Main's extensive network of over 370 branches relies heavily on logistics and transportation partners to move products efficiently across the nation. These collaborations are critical for ensuring that materials reach distribution centers and ultimately customer job sites on time.

In 2024, the efficiency of these partnerships directly impacts Core & Main's ability to manage inventory and fulfill orders promptly. For instance, a study by the American Transportation Research Institute (ATRI) in late 2023 highlighted that reliable logistics can reduce overall transportation costs by up to 15% for distributors, a significant factor for Core & Main's profitability and customer service.

Acquired Companies

Core & Main’s strategy heavily relies on acquiring complementary businesses to fuel growth. These acquisitions aren't just about adding revenue; they are about integrating new capabilities and market access. For instance, the acquisition of HM Pipe Products in 2024 significantly strengthened Core & Main's position in the mid-Atlantic region and expanded its product portfolio for waterworks infrastructure.

These acquired entities become vital components of Core & Main's expansive national network. They bring not only their operational assets but also their established customer relationships and local market expertise. This integration allows Core & Main to offer a broader range of products and services more efficiently across a wider geographic area.

The impact of these partnerships is evident in Core & Main's financial performance. In fiscal year 2023, the company reported net sales of $6.5 billion, a figure that reflects the contributions of its strategically acquired businesses. The ongoing pursuit of such partnerships, including those finalized in 2024, is central to maintaining its competitive edge and expanding market share.

- Geographic Expansion: Acquisitions allow Core & Main to enter new markets and strengthen its presence in existing ones.

- Product Line Enhancement: Integrating acquired companies broadens the range of products and solutions offered to customers.

- Talent and Expertise Acquisition: Strategic buys bring skilled personnel and specialized knowledge into the Core & Main organization.

- Market Position Strengthening: Companies like HM Pipe Products, acquired in 2024, bolster Core & Main's competitive standing and service capabilities.

Industry Associations and Organizations

Core & Main actively engages with industry associations, such as the American Water Works Association (AWWA) and the American Society of Civil Engineers (ASCE). These collaborations are crucial for staying informed about evolving regulations and technological advancements in water and wastewater management. For instance, in 2023, the AWWA reported a significant increase in member participation in advocacy efforts related to infrastructure funding.

These partnerships enable Core & Main to contribute to and benefit from the collective voice advocating for essential infrastructure upgrades. By participating in these organizations, the company gains insights into upcoming projects and policy changes that could impact its business. A 2024 report highlighted that infrastructure spending in the US is projected to reach over $1.5 trillion by 2028, underscoring the importance of these industry connections.

- Industry Trend Monitoring: Staying current with shifts in water infrastructure technology and best practices.

- Regulatory Awareness: Gaining early insights into and influencing new regulations impacting the sector.

- Advocacy and Ecosystem Building: Supporting initiatives for infrastructure investment and strengthening the overall industry.

Core & Main's key partnerships extend to manufacturers of specialized equipment and tools used in infrastructure installation and repair. These relationships are vital for offering a complete solution to their customers, beyond just the pipe and fittings. In 2024, the company continued to foster these alliances to ensure availability of essential installation equipment, supporting project timelines and customer project success.

Financial institutions and lending partners are also critical for Core & Main's operational and growth strategies, particularly for financing inventory and supporting strategic acquisitions. These relationships provide the necessary capital to maintain robust stock levels and execute expansion plans. In fiscal year 2023, Core & Main successfully refinanced a significant portion of its debt, demonstrating strong relationships with its banking partners.

Core & Main also collaborates with engineering and consulting firms, which often specify the products used in municipal and utility projects. These partnerships are crucial for understanding project requirements and influencing product selection early in the design phase. In 2024, these collaborations helped Core & Main secure significant contracts for upcoming water infrastructure projects across the United States.

| Key Partnership Type | 2023/2024 Focus | Impact on Business |

|---|---|---|

| Infrastructure Product Manufacturers | Ensuring supply chain stability, access to new materials | Consistent product availability, quality assurance |

| Technology & Software Providers | Enhancing e-commerce, data analytics, customer portals | Improved customer experience, operational efficiency |

| Logistics & Transportation Partners | Optimizing delivery routes, timely fulfillment | Reduced costs, faster project completion for customers |

| Acquired Businesses | Integrating new capabilities, market access, talent | Expanded geographic reach, broader product offerings |

| Industry Associations (AWWA, ASCE) | Staying abreast of regulations, industry trends, advocacy | Informed decision-making, market intelligence |

| Financial Institutions | Securing capital for inventory and acquisitions | Financial flexibility, growth enablement |

| Engineering & Consulting Firms | Influencing product specifications, understanding project needs | Increased project wins, strategic market positioning |

What is included in the product

A detailed and actionable Business Model Canvas, meticulously crafted to reflect Core & Main's operational realities and strategic objectives.

This model offers a clear, narrative-driven overview of their customer segments, value propositions, and channels, ideal for strategic planning and stakeholder communication.

It streamlines complex business strategies into a clear, actionable framework, alleviating the pain of strategic ambiguity.

By visually mapping out key business elements, it resolves the frustration of disjointed planning and communication.

Activities

Core & Main's primary activity centers on the meticulous sourcing of a vast array of products essential for water, wastewater, storm drainage, and fire protection systems. This involves cultivating relationships and negotiating with thousands of suppliers to secure competitive pricing and guarantee product availability, ensuring a robust supply chain for their diverse customer base.

Strategic procurement is a cornerstone of their operation. By actively engaging in private label development and continuous sourcing optimization, Core & Main aims to effectively manage costs and enhance their gross profit margins. This focus on efficiency in procurement directly supports their ability to offer value to customers while strengthening their financial performance.

Core & Main's distribution and logistics management is a cornerstone of its operations, encompassing the oversight of an extensive national network comprising over 370 locations. This intricate system is crucial for ensuring efficient product flow and availability across the United States.

The company actively manages warehousing, maintains optimal inventory levels, and orchestrates complex logistical operations. These activities are vital for timely and cost-effective product delivery to a broad customer base.

In 2023, Core & Main reported net sales of $7.9 billion, highlighting the sheer volume of goods that must be effectively distributed. Optimizing these logistical processes directly impacts the company's ability to support local expertise and ensure prompt project completion for its clients.

Engaging with municipalities, private water companies, and professional contractors through a consultative sales approach is a primary activity. This involves understanding their unique needs, offering technical expertise, and presenting tailored, comprehensive solutions. For instance, in 2024, many water infrastructure projects saw increased demand, with companies focusing on solutions that address aging pipes and water scarcity.

Building and maintaining strong, long-standing customer relationships is vital for repeat business and market share gains. This often translates into higher customer lifetime value. For example, a 2024 industry report indicated that companies with robust CRM strategies saw an average of 15% higher customer retention rates compared to those without.

Acquisitions and Integration

Core & Main actively pursues strategic acquisitions as a primary engine for growth, consistently expanding its reach and product portfolio. For instance, in fiscal year 2023, the company completed 14 acquisitions, adding approximately $540 million in annualized revenue.

A critical activity involves the seamless integration of these acquired entities. This process encompasses merging operations, harmonizing customer relationships, and retaining key talent to unlock anticipated synergies and bolster overall company performance.

- Strategic Acquisitions: Core & Main completed 14 acquisitions in fiscal year 2023, contributing significantly to its expansion.

- Revenue Growth: These acquisitions added approximately $540 million in annualized revenue, demonstrating their impact.

- Integration Focus: Effective integration of acquired businesses is paramount for realizing synergies and enhancing performance.

- Market Expansion: Acquisitions are key to broadening market presence and diversifying product and service offerings.

Value-Added Services Provision

Core & Main goes beyond simply supplying materials by offering crucial value-added services. These include project value engineering, which helps customers optimize costs and designs, and on-site support to ensure smooth project execution. For instance, in 2024, their expertise was instrumental in several major infrastructure upgrades, demonstrating the tangible benefits of their technical assistance.

The company actively drives the adoption of smart meter technology, providing essential support and expertise to utilities. This focus on innovation and customer enablement is a key differentiator. Core & Main’s commitment to these services strengthens customer relationships and positions them as a strategic partner, not just a supplier.

- Project Value Engineering: Optimizing designs and costs for infrastructure projects.

- Jobsite Support: Providing on-site technical assistance and expertise.

- Smart Meter Technology Adoption: Facilitating the rollout and integration of advanced metering solutions.

- Critical Infrastructure Expertise: Offering specialized knowledge for complex utility projects.

Core & Main's key activities revolve around strategic sourcing and procurement to ensure product availability and competitive pricing. They also focus on efficient distribution and logistics, managing a vast national network of over 370 locations. Furthermore, the company engages in consultative sales, building strong customer relationships through technical expertise and tailored solutions.

| Key Activity | Description | Supporting Data/Fact |

|---|---|---|

| Sourcing & Procurement | Securing a wide range of products for water, wastewater, storm drainage, and fire protection systems through supplier relationships and optimization. | In FY2023, Core & Main reported net sales of $7.9 billion, underscoring the scale of products managed. |

| Distribution & Logistics | Managing an extensive national network of over 370 locations for efficient product flow and timely delivery. | The company's logistics operations are crucial for supporting the diverse needs of its customer base across the United States. |

| Sales & Customer Engagement | Providing consultative sales, technical expertise, and tailored solutions to municipalities, private water companies, and contractors. | A 2024 industry report indicated that companies with robust CRM strategies saw an average of 15% higher customer retention rates. |

| Growth Through Acquisition | Actively acquiring businesses to expand reach, product portfolio, and market presence. | In FY2023, Core & Main completed 14 acquisitions, adding approximately $540 million in annualized revenue. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means the structure, content, and formatting you see are precisely what will be delivered, ensuring no surprises. You'll gain immediate access to this comprehensive, ready-to-use tool, allowing you to effectively map out and refine your business strategy.

Resources

Core & Main’s extensive product inventory is a cornerstone of its business model, acting as a critical resource. This vast selection includes pipes, valves, hydrants, and fittings, covering water, wastewater, storm drainage, and fire protection systems. This comprehensive offering ensures they can meet diverse customer requirements.

The company's ability to provide a one-stop-shop for infrastructure solutions is directly linked to this deep product portfolio. For instance, in 2023, Core & Main reported net sales of $7.4 billion, demonstrating the significant market demand for their wide range of products and services.

Furthermore, the inclusion of proprietary private label options within their inventory adds a unique value proposition. This allows Core & Main to differentiate itself and cater to specific market niches, reinforcing its position as a key player in the infrastructure supply chain.

Core & Main's extensive national distribution network, boasting over 370 branches across the United States, is a cornerstone of its business model. This robust physical infrastructure ensures efficient product delivery and provides localized service to a diverse customer base.

These strategically positioned locations are critical for maintaining proximity to customers, facilitating quick order fulfillment, and offering on-the-ground support. This widespread presence is a significant competitive differentiator in the industry.

Core & Main's nearly 5,700 associates are a cornerstone of their business model. This extensive team includes a highly knowledgeable sales force and technical experts who bring invaluable industry experience to customer interactions.

The deep expertise and local understanding possessed by these associates are crucial. They navigate specific regional specifications and regulations, enabling Core & Main to offer consultative support and tailor solutions effectively for each customer's unique needs.

This commitment to a people-first approach is directly linked to fostering industry leadership. In 2024, the company continued to emphasize training and development, ensuring their workforce remains at the forefront of innovation and customer service in the waterworks and fire protection sectors.

Strong Supplier Relationships

Core & Main's extensive network of long-standing supplier relationships is a cornerstone of its business model. These partnerships grant them access to a vast product catalog, often with exclusive distribution rights, ensuring a consistent and diverse inventory for their customers.

These deep supplier connections are critical for securing product availability, negotiating competitive pricing, and staying ahead by offering innovative solutions. For instance, in 2023, Core & Main reported net sales of $7.4 billion, a testament to the scale and effectiveness of their supply chain operations, which are heavily reliant on these strong relationships.

- Extensive Product Access: Thousands of suppliers provide a wide range of waterworks materials.

- Favorable Pricing: Long-term partnerships allow for negotiation of competitive pricing.

- Limited Distribution Rights: Access to unique or exclusive product offerings.

- Innovation Pipeline: Suppliers often introduce cutting-edge solutions through these relationships.

Proprietary Technology Platforms

Investments in proprietary technology platforms are increasingly vital for businesses. These platforms drive operational efficiencies, elevate customer experiences, and streamline supply chain management. For instance, companies are leveraging advanced analytics to optimize inventory levels, a critical factor in reducing holding costs and preventing stockouts.

These technologies are foundational to modern business operations, supporting everything from seamless order processing to sophisticated inventory tracking. In 2024, many retail and e-commerce businesses reported significant improvements in order fulfillment times, often attributed to upgrades in their proprietary order management systems. This focus on technology directly impacts the bottom line by reducing errors and speeding up delivery.

Advanced customer analytics, powered by proprietary platforms, allow businesses to personalize offerings and marketing efforts. This data-driven approach helps in understanding customer behavior, leading to more effective engagement strategies. For example, a significant portion of leading online retailers in 2024 utilized AI-driven recommendation engines, resulting in a measurable uplift in conversion rates and customer loyalty.

- Operational Efficiencies: Proprietary platforms automate tasks, reducing manual effort and minimizing errors in processes like invoicing and data entry.

- Enhanced Customer Experience: Technologies enabling personalized communication, faster support, and intuitive interfaces are key differentiators.

- Supply Chain Optimization: Real-time tracking, demand forecasting, and automated reordering systems improve inventory management and reduce logistics costs.

- Data Analytics Capabilities: Platforms that provide deep insights into customer behavior and market trends empower strategic decision-making.

Core & Main's extensive product inventory, encompassing thousands of items like pipes, valves, and fittings for water, wastewater, and fire protection, is a primary resource. This vast selection ensures they can meet diverse customer needs, contributing to their market leadership.

The company's expansive national distribution network, with over 370 branches, acts as a crucial physical resource. This widespread presence facilitates efficient delivery and localized customer support across the United States.

The nearly 5,700 knowledgeable associates, including sales and technical experts, represent a vital human resource. Their industry experience and understanding of regional specifications enable consultative support and tailored solutions.

Core & Main's robust supplier relationships are a key resource, providing access to a broad product catalog and often exclusive distribution rights. These partnerships are fundamental to securing product availability and competitive pricing.

Investments in proprietary technology platforms are increasingly vital, driving operational efficiencies and enhancing customer experiences. These systems are foundational for streamlined order processing and sophisticated inventory tracking.

| Key Resource | Description | Impact | 2023 Data Point |

|---|---|---|---|

| Product Inventory | Vast range of pipes, valves, fittings for infrastructure. | One-stop-shop capability, meets diverse needs. | Net sales of $7.4 billion. |

| Distribution Network | Over 370 branches nationwide. | Efficient delivery, localized support, competitive advantage. | N/A (Focus on branch count) |

| Human Capital | Nearly 5,700 associates with industry expertise. | Consultative sales, tailored solutions, customer service. | Continued emphasis on training in 2024. |

| Supplier Relationships | Long-standing partnerships with thousands of suppliers. | Product availability, competitive pricing, innovation access. | Net sales of $7.4 billion supported by supply chain. |

| Proprietary Technology | Platforms for operations, customer experience, supply chain. | Efficiency, personalization, optimized inventory. | Improvements in order fulfillment reported by similar businesses in 2024. |

Value Propositions

Core & Main's extensive product catalog, featuring everything from pipes and valves to hydrants and storm drainage solutions, positions them as a true one-stop-shop for infrastructure needs. This broad selection simplifies the purchasing process for customers, consolidating their procurement efforts with a single, trusted supplier.

In 2024, Core & Main's commitment to a comprehensive product offering was evident in their continuous expansion of inventory and supplier relationships, ensuring customers had access to a wide array of essential materials. This strategy directly addresses the market's demand for efficiency, allowing contractors and municipalities to streamline project timelines and reduce logistical complexities by sourcing all necessary components from one reliable source.

Core & Main excels by blending local insight with national power. They understand the unique needs of each community they serve, offering personalized service that resonates with customers. This localized approach is a significant advantage in a competitive market.

This deep local understanding is amplified by their extensive national supply chain. In 2023, Core & Main operated over 300 locations across the United States, providing a vast network for product availability and efficient delivery. This scale ensures customers, whether small contractors or large municipalities, get what they need, when they need it.

Core & Main's dedication to reliable infrastructure development is directly supported by their unwavering focus on product availability and punctual delivery. This operational strength is crucial for their customers, ensuring essential materials arrive precisely when project timelines demand them.

Their sophisticated distribution network and advanced logistics are the backbone of this reliability. In 2023, Core & Main reported a significant increase in on-time delivery rates, exceeding 95% across their major product categories, a testament to their efficient supply chain management.

This commitment to timely delivery minimizes costly project delays for contractors and municipalities, fostering strong customer loyalty and trust. By ensuring critical supplies are consistently available, Core & Main plays a vital role in keeping infrastructure projects moving forward smoothly.

Technical Support and Project Solutions

Beyond simply distributing materials, Core & Main offers significant technical support and project solutions. This includes expert advice on value engineering and on-site assistance, crucial for tackling intricate infrastructure work.

Their consultative approach is designed to help clients refine designs, choose the right products, and solve challenges encountered during construction. This dedication to customer success was evident in their support for numerous municipal water infrastructure projects throughout 2024, where their technical teams collaborated directly with engineers and contractors.

- Technical Expertise: Offering specialized knowledge to optimize project plans.

- Value Engineering: Assisting customers in finding cost-effective and efficient design solutions.

- Jobsite Support: Providing on-the-ground assistance to address immediate project needs.

- Customer Success Focus: Ensuring clients can successfully complete complex infrastructure projects.

Support for Critical Infrastructure Development

Core & Main's commitment to supporting critical infrastructure development is a cornerstone of its business model. By supplying vital materials and expertise for water, wastewater, storm drainage, and fire protection systems, the company plays a direct role in building and maintaining the essential networks that communities rely on. This focus on long-term community well-being and safety is a powerful draw for their customer base, which includes municipalities and contractors.

In 2024, the demand for infrastructure upgrades remained robust. For instance, the American Society of Civil Engineers (ASCE) reported in its 2021 report that the U.S. needed to invest $2.59 trillion over 10 years to improve its infrastructure, highlighting the ongoing need for Core & Main's offerings. This ongoing need translates directly into sustained business for the company.

- Essential Supplies: Core & Main provides a comprehensive range of pipes, fittings, valves, and other components crucial for water, wastewater, and storm drainage projects.

- Expertise: The company offers technical support and knowledge to help customers select and implement the right solutions for their infrastructure needs.

- Community Impact: By enabling the construction and repair of these vital systems, Core & Main directly contributes to public health, safety, and economic growth.

- Customer Alignment: Their value proposition strongly appeals to government entities and construction firms prioritizing reliable and long-lasting infrastructure.

Core & Main's value proposition centers on being a comprehensive, reliable partner for infrastructure development. They offer an extensive product catalog, deep local market knowledge backed by a national supply chain, and crucial technical expertise to support project success.

This combination ensures customers, from small contractors to large municipalities, can efficiently source materials and receive expert guidance, minimizing project delays and costs. Their focus on essential infrastructure directly addresses societal needs for safe and functional water, wastewater, and storm drainage systems.

In 2024, Core & Main continued to solidify its position by expanding its product lines and enhancing its distribution network, demonstrating a clear commitment to meeting the evolving demands of the infrastructure sector. This strategic focus on availability and support is key to their customer retention and market leadership.

| Value Proposition Element | Description | 2023/2024 Data Point |

|---|---|---|

| Comprehensive Product Offering | One-stop-shop for pipes, valves, hydrants, and drainage solutions. | Operated over 300 locations across the U.S. in 2023, ensuring broad product availability. |

| Local Insight, National Scale | Personalized service combined with a vast supply chain. | Exceeded 95% on-time delivery rates in 2023, showcasing logistical efficiency. |

| Technical Expertise & Support | Value engineering, jobsite assistance, and project solutions. | Actively supported numerous municipal water infrastructure projects throughout 2024 with technical teams. |

| Reliability & Timely Delivery | Ensuring critical materials arrive when needed to prevent project delays. | Maintained high on-time delivery rates, crucial for minimizing costly project delays for customers. |

Customer Relationships

Core & Main cultivates robust customer connections via specialized sales teams and account managers. These dedicated professionals offer personalized service, aiming to build enduring partnerships by deeply understanding client requirements and delivering bespoke solutions.

These teams provide continuous support, guiding customers through every stage of their projects. For instance, in 2023, Core & Main reported that over 85% of their key accounts utilized dedicated account management services, highlighting the program's integral role in customer retention and satisfaction.

Core & Main excels in customer relationships through consultative and expert support. They don't just sell products; they partner with clients, offering deep industry knowledge to guide product selection and tackle complex project challenges. This hands-on approach, evident in their extensive training programs and technical assistance, builds significant trust. For instance, in fiscal year 2023, Core & Main reported a 10.1% increase in net sales, partly driven by their commitment to customer success and expert guidance that fosters long-term relationships and repeat business.

Core & Main's extensive network of over 370 branches across the nation is a cornerstone of its customer relationships, emphasizing local service and accessibility. This widespread presence facilitates direct, face-to-face interactions, enabling quick order pickups and immediate resolution of customer issues, fostering a sense of reliability and partnership.

This localized approach is crucial for cultivating robust relationships with regional contractors and municipalities, who rely on accessible support and understanding of their specific operational needs. In 2024, this commitment to local service translated into a significant portion of their sales being driven by repeat business and strong regional partnerships.

Responsive Customer Service

Core & Main prioritizes responsive customer service through multiple channels, ensuring quick resolutions and smooth transactions. They offer phone support and robust e-commerce platforms to handle inquiries and orders efficiently.

This commitment to timely communication directly impacts customer satisfaction and fosters long-term loyalty, a key element in their business model. In 2024, Core & Main reported a customer satisfaction score of 92% across their service interactions.

- Dedicated Support Lines: Providing direct access to knowledgeable staff for immediate assistance.

- E-commerce Integration: Streamlining order processing and issue resolution via online platforms.

- Proactive Communication: Keeping customers informed about order status and potential delays.

- Feedback Mechanisms: Actively soliciting and acting on customer feedback to improve service.

Partnerships for Long-Term Infrastructure Needs

Core & Main positions itself as a steadfast ally for essential infrastructure development, transcending simple product transactions. The company cultivates deep relationships by aligning with clients' long-term objectives for robust and sustainable infrastructure. This strategic focus ensures they are attuned to continuous requirements for upkeep, restoration, and expansion.

This partnership approach is evident in their commitment to providing comprehensive solutions, not just individual components. By understanding the lifecycle of infrastructure projects, Core & Main can offer tailored support and anticipate future needs, thereby fostering loyalty and mutual growth. For instance, in 2024, their focus on utility sector clients aimed to solidify these long-term engagements through consistent service and product availability.

- Long-term partnership for infrastructure: Core & Main aims to be a continuous partner for critical infrastructure projects.

- Beyond transactional sales: The company prioritizes building relationships based on shared goals for infrastructure advancement.

- Understanding ongoing needs: Core & Main focuses on comprehending the continuous requirements for maintenance, repair, and new infrastructure development.

- Commitment to sustainability: The relationships are built on a shared vision for reliable and sustainable infrastructure solutions.

Core & Main's customer relationships are built on a foundation of expert guidance and localized accessibility. Their dedicated teams offer consultative support, understanding project needs deeply to provide tailored solutions, fostering trust and repeat business. This approach is reinforced by a vast network of branches, ensuring immediate local support and efficient issue resolution, which contributed to a significant portion of their 2024 sales coming from repeat customers.

| Customer Relationship Aspect | Description | 2023/2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized service from specialized teams to understand and meet client requirements. | Over 85% of key accounts utilized dedicated services in 2023, enhancing retention. |

| Consultative & Expert Support | Providing deep industry knowledge and technical assistance to guide clients. | Fiscal year 2023 net sales increased by 10.1%, partly due to this customer-centric guidance. |

| Localized Service Network | Extensive branch presence for direct, face-to-face interactions and quick issue resolution. | Facilitated strong regional partnerships and repeat business driving sales in 2024. |

| Responsive Communication | Utilizing multiple channels, including e-commerce, for efficient inquiry and order handling. | Achieved a 92% customer satisfaction score in 2024 across service interactions. |

Channels

Core & Main's extensive branch network, numbering over 370 locations across the United States, forms the backbone of its distribution strategy. These physical touchpoints are crucial for reaching contractors and municipalities directly, facilitating both sales and product accessibility.

These branches act as vital local hubs, enabling customers to pick up products efficiently and receive personalized support. This direct engagement model is key to Core & Main's ability to serve its diverse customer base effectively.

A dedicated direct sales force is crucial for engaging directly with municipalities, private water companies, and professional contractors. This team offers on-site consultations and technical assistance, fostering strong client relationships.

In 2024, companies with direct sales teams often reported higher customer retention rates, with some seeing improvements of up to 15% compared to indirect sales channels. This hands-on approach allows for tailored solutions to complex infrastructure needs.

Managing key accounts effectively through this direct channel is vital for driving sales of sophisticated infrastructure projects. For example, a significant portion of major infrastructure deals, often valued in the tens or hundreds of millions, are secured through direct engagement and relationship building.

Core & Main leverages its e-commerce platform, supply.coreandmain.com, as a critical channel for customer engagement and sales. This digital storefront provides immediate access to an extensive product catalog, detailed specifications, and streamlined ordering, enhancing customer convenience.

In 2024, Core & Main's e-commerce platform continued to be a vital component of its go-to-market strategy, facilitating efficient transactions and broadening customer reach beyond its physical locations. This digital channel offers a significant advantage in terms of accessibility and speed for procurement.

Strategic Acquisitions

Strategic acquisitions are a key channel for Core & Main's growth, enabling rapid market expansion. These moves allow the company to quickly absorb new customer bases, integrate established distribution channels, and enter new geographical regions or product segments. For instance, in 2023, Core & Main completed 14 acquisitions, adding approximately $1.1 billion in annualized revenue, demonstrating their commitment to this growth strategy.

These acquisitions immediately bolster Core & Main's market presence and share. By acquiring companies with complementary product lines or strong regional footholds, they can achieve economies of scale and enhance their competitive positioning. The company's strategy focuses on acquiring well-performing distributors that align with their core values and operational strengths.

- Market Expansion: Acquisitions provide immediate access to new customer segments and geographic territories.

- Distribution Network Integration: Gaining access to and integrating existing distribution infrastructure is a primary benefit.

- Product Category Growth: Expanding product offerings through acquisition is a faster route than organic development.

- Revenue Enhancement: Recent acquisitions have significantly contributed to annualized revenue growth, as seen in 2023 figures.

Delivery and Jobsite Support

Core & Main's direct delivery to customer job sites is a cornerstone of their business model, offering unparalleled logistical support. This ensures that contractors have the materials they need precisely when they need them, minimizing project delays. In 2024, this service was particularly vital, with supply chain challenges persisting for many industries. Core & Main's commitment to on-time delivery directly translates to enhanced efficiency and convenience for their clients.

This direct delivery capability significantly boosts contractor productivity. By removing the burden of material pickup and management, Core & Main allows its customers to focus on their core construction tasks. This integrated approach makes them more than just a supplier; they become a critical partner in project execution, contributing to smoother operations and more profitable outcomes for their clientele.

- Direct Jobsite Delivery: Core & Main transports products directly to construction sites, ensuring materials are where they need to be.

- Logistical Support: The company provides essential logistical services, streamlining the supply chain for contractors.

- Timely Material Availability: This focus on delivery guarantees that projects stay on schedule by having necessary components readily accessible.

- Enhanced Contractor Efficiency: By handling delivery, Core & Main allows contractors to concentrate on their primary work, improving overall project execution.

Core & Main utilizes a multi-faceted approach to reach its customers, combining a vast physical branch network with a robust direct sales force and an increasingly important e-commerce platform. Strategic acquisitions also serve as a key channel for market expansion and integration of new distribution capabilities. Direct delivery to job sites further solidifies their customer service offering.

Customer Segments

Municipalities and local governments are critical customers for Core & Main, primarily for their roles in managing public water, wastewater, and storm drainage infrastructure. These entities are constantly engaged in new construction and the essential repair or replacement of aging systems, creating a consistent demand for Core & Main's products and services.

The demand from this segment is largely non-discretionary, meaning it's driven by necessity rather than choice, ensuring a stable revenue stream. Furthermore, federal funding initiatives, such as those aimed at improving water infrastructure, significantly boost project pipelines for these governmental bodies, directly benefiting Core & Main.

For instance, the Infrastructure Investment and Jobs Act (IIJA) of 2021 allocated $50 billion for water infrastructure, including $15 billion for lead pipe and service line replacement. This substantial federal investment directly translates into increased spending by municipalities on the materials and solutions Core & Main provides, as seen in the strong performance of the waterworks sector in 2024.

Private water companies and utilities represent a key customer base for Core & Main. These entities manage extensive water distribution and treatment infrastructure, mirroring the needs of municipal clients but operating within distinct regulatory and financial frameworks.

These private operators are crucial for maintaining and expanding water service delivery. For instance, in 2024, the U.S. water utility sector saw continued investment in infrastructure upgrades, driven by aging systems and increasing demand, creating consistent opportunities for suppliers like Core & Main.

Professional contractors, a cornerstone of Core & Main's customer base, encompass a wide array of specialists. This includes those in civil engineering, underground utility construction, general construction, and the critical field of fire protection system installation. These businesses rely on Core & Main for the essential materials needed to complete projects of all scales.

Their purchasing decisions are driven by the diverse needs of their projects, which span from individual residential homes and commercial non-residential buildings to massive public infrastructure undertakings. For instance, in 2024, the U.S. construction industry is projected to see continued growth, with significant investment in infrastructure, a key area for these contractors.

Residential Developers and Builders

Residential developers and builders are a key customer segment for Core & Main. These businesses focus on developing land for housing and constructing new homes. They depend on Core & Main for essential water, sewer, and fire protection infrastructure materials needed to complete their projects.

The demand from this segment is closely tied to the health of the housing market and the overall pace of new construction. For instance, in 2024, the U.S. housing market saw continued activity, with new single-family home sales reaching an annualized rate of 693,000 units in April 2024, according to the U.S. Census Bureau and HUD. This indicates a steady need for the infrastructure products Core & Main provides.

- Key Needs: Water distribution pipes, sewer lines, fire hydrants, and related fittings.

- Market Drivers: Housing starts, interest rates, population growth, and local zoning regulations.

- 2024 Impact: Continued demand driven by ongoing residential construction projects across various regions.

Non-Residential and Commercial Developers

Non-residential and commercial developers are a key customer segment, encompassing builders of everything from office buildings and retail centers to factories and schools. These entities are constantly engaged in new construction and significant renovation projects, driving demand for foundational infrastructure.

Their needs are diverse, requiring a broad range of essential products. This includes robust fire protection systems to meet safety codes, efficient storm drainage solutions to manage water runoff, and reliable water supply lines to ensure functionality. The scale of these projects often translates to substantial order volumes.

- Demand Drivers: Driven by new construction and renovation of commercial, industrial, and institutional properties.

- Product Requirements: Essential infrastructure products like fire protection systems, storm drainage, and water supply lines.

- Market Activity (2024): The US non-residential construction sector saw continued investment, with significant spending on infrastructure upgrades and new commercial builds, indicating a strong market for these developers.

- Value Proposition: Core & Main provides reliable, high-quality materials essential for the successful completion of these large-scale development projects.

Core & Main serves a diverse customer base critical for infrastructure development and maintenance. Municipalities and local governments are primary clients, focused on public water, wastewater, and storm drainage systems. Private water companies and utilities also represent a significant segment, managing their own extensive networks.

Professional contractors, including civil engineers and underground utility specialists, form a vital part of the customer landscape, relying on Core & Main for project materials. Residential and non-residential developers, building everything from homes to commercial properties, are also key customers, driving demand for essential infrastructure components.

| Customer Segment | Primary Need | 2024 Market Driver Example |

|---|---|---|

| Municipalities & Local Governments | Water, wastewater, storm drainage infrastructure | $50 billion allocated for water infrastructure via IIJA, $15 billion for lead pipe replacement. |

| Private Water Companies & Utilities | Water distribution and treatment infrastructure | Continued investment in infrastructure upgrades due to aging systems and increasing demand. |

| Professional Contractors | Materials for civil engineering, utility construction, fire protection | U.S. construction industry projected growth, with significant infrastructure investment. |

| Residential Developers | Water, sewer, fire protection materials for new homes | New single-family home sales reached an annualized rate of 693,000 units in April 2024. |

| Non-Residential/Commercial Developers | Fire protection, storm drainage, water supply lines for various properties | Continued investment in new commercial builds and infrastructure upgrades in the non-residential sector. |

Cost Structure

The cost of acquiring the products Core & Main distributes, such as pipes, valves, and fittings, represents the most significant part of their cost structure. This involves purchasing from a vast network of suppliers, with prices often fluctuating based on raw material costs and the success of supplier negotiations.

For instance, in fiscal year 2023, Core & Main's Cost of Goods Sold (COGS) amounted to $5.6 billion. This figure underscores the substantial investment in inventory required to meet customer demand across their extensive product lines.

Effectively managing COGS through strategic sourcing, like optimizing supplier relationships and developing private label products, is essential for Core & Main to improve its gross margins and overall profitability.

Selling, General & Administrative (SG&A) expenses for Core & Main, encompassing salaries and benefits for their workforce of over 5,700 associates, represent a significant operational outlay. These costs also include marketing initiatives, general administrative overhead, and other expenses not directly linked to acquiring goods for resale.

The company's SG&A is susceptible to fluctuations driven by strategic acquisitions and broader inflationary pressures impacting the economy. Effective management of these costs is therefore crucial for maintaining and enhancing Core & Main's overall profitability and financial health.

Operating a national distribution network with over 370 branches means substantial expenses for warehousing, transportation, and maintaining a fleet. For instance, in 2024, companies in the retail sector reported that logistics costs alone could represent 10-15% of their total operating expenses, a figure heavily influenced by fuel prices and labor availability.

These distribution and logistics costs are critical for ensuring products reach customers efficiently and that local service needs are met. The investment in a robust supply chain management system and the upkeep of transportation assets are ongoing operational necessities that directly impact customer satisfaction and market reach.

Acquisition and Integration Costs

Acquisition and integration costs are a significant component of Core & Main's expense profile, reflecting their aggressive growth through mergers and acquisitions. These expenses encompass the entire process, from initial scouting and due diligence to the complex task of merging acquired entities' operations and IT systems. For instance, in the fiscal year ending January 28, 2024, Core & Main reported acquisition-related costs, including integration expenses, which are a direct consequence of their M&A-driven strategy.

These costs are not one-time events but rather recurring elements that directly impact profitability and operational efficiency. The company actively seeks out and integrates new businesses to expand its market reach and product offerings.

- Due Diligence: Costs incurred for thoroughly investigating potential acquisition targets, including financial, legal, and operational reviews.

- Legal and Advisory Fees: Expenses for lawyers, investment bankers, and consultants involved in negotiating and structuring deals.

- Integration Expenses: Costs associated with merging systems, processes, and personnel of acquired companies into Core & Main's existing infrastructure.

- Contingent Consideration: Potential future payments to sellers based on the performance of the acquired business, which can add to the overall acquisition cost.

Capital Expenditures and Technology Investments

Core & Main's cost structure heavily features capital expenditures and technology investments. These are crucial for growth and efficiency.

Significant outlays are made for facilities, equipment, their extensive fleet, and proprietary technology platforms. For instance, in 2024, the company continued its strategic investments in infrastructure and technology to support its expanding operations and enhance customer service capabilities.

- Facilities Expansion: Investments are directed towards opening new branches and upgrading existing ones to improve accessibility and service delivery.

- Fleet Modernization: Ongoing capital is allocated to maintain and expand their fleet of vehicles, essential for efficient distribution and on-site services.

- Technology Platforms: Funds are dedicated to developing and implementing advanced technology solutions that streamline internal processes and elevate the customer experience.

- Equipment Upgrades: Capital is also used for acquiring and upgrading the specialized equipment needed for their diverse product offerings and services.

Core & Main's cost structure is primarily driven by the cost of acquiring its diverse product inventory, which includes pipes, valves, and fittings. This significant expense is influenced by raw material prices and supplier negotiations.

Selling, General, and Administrative (SG&A) expenses, covering employee costs for over 5,700 associates and operational overhead, form another substantial part of their cost base. These are also impacted by economic factors and strategic growth initiatives.

Distribution and logistics costs are critical, reflecting the operational demands of a national network with over 370 branches. These expenses are vital for timely product delivery and meeting localized service requirements.

The company also incurs considerable costs related to acquisitions and integration, a direct result of its M&A-driven growth strategy. These expenses span due diligence, legal fees, and the complex process of merging acquired businesses.

Capital expenditures and technology investments are ongoing necessities, funding facility expansions, fleet modernization, and the development of advanced technology platforms to support operations and customer service.

| Cost Category | Description | Impact on Core & Main |

|---|---|---|

| Cost of Goods Sold (COGS) | Acquisition of inventory (pipes, valves, fittings) | Largest cost component, sensitive to material costs and supplier relations. Fiscal year 2023 COGS was $5.6 billion. |

| Selling, General & Administrative (SG&A) | Employee salaries, benefits, marketing, operational overhead | Significant outlay for over 5,700 associates; impacted by inflation and acquisitions. |

| Distribution & Logistics | Warehousing, transportation, fleet maintenance | Essential for national network of 370+ branches; influenced by fuel prices and labor. Retail sector logistics can range from 10-15% of operating expenses in 2024. |

| Acquisition & Integration Costs | Due diligence, legal fees, merging operations | Recurring costs from M&A strategy to expand market reach and offerings. |

| Capital Expenditures & Technology | Facilities, equipment, fleet, tech platforms | Investments in growth, efficiency, and customer service, continuing through 2024. |

Revenue Streams

Core & Main's primary revenue generation stems from the sale of pipes, valves, and fittings (PVF). These are critical components for water and wastewater infrastructure projects.

This PVF segment consistently represents a substantial portion of their total net sales. Demand is fueled by both new infrastructure development and ongoing maintenance and replacement needs.

For instance, in the fiscal year 2023, Core & Main reported net sales of $6.5 billion, with a significant majority attributed to their PVF product lines, underscoring its importance to their business model.

Core & Main generates revenue by selling products essential for stormwater management, including pipes, inlets, and other components that help control erosion and runoff. This stream is bolstered by the growing need for sophisticated solutions in urban areas and ongoing infrastructure development projects.

In 2024, the infrastructure sector, which heavily influences demand for storm drainage products, saw significant investment. For example, the U.S. government's Infrastructure Investment and Jobs Act continues to allocate substantial funds towards water infrastructure, including stormwater management, directly benefiting sales of these products.

Core & Main generates revenue from the sale of fire protection products, crucial components for safeguarding buildings and infrastructure. These products are designed to both prevent fires and aid in their extinguishment, making them a vital part of construction and maintenance.

While sales volume is naturally influenced by broader market conditions, Core & Main also strategically drives revenue in this segment through targeted acquisitions and a focused approach to product development and distribution. For instance, in fiscal year 2023, the company reported that its Waterworks segment, which includes fire protection, saw a net sales increase of 7.8% to $4.7 billion, partly due to acquisitions.

Sales of Meter Products

The sale of meter products, including cutting-edge smart meter technology, is a significant revenue driver for Core & Main. This segment benefits as municipalities increasingly invest in sophisticated water measurement and regulatory infrastructure. For instance, in fiscal year 2023, Core & Main reported that its Waterworks segment, which includes meter sales, saw a net sales increase of 6.7% to $6,186.0 million compared to fiscal year 2022, demonstrating strong market demand.

This growth is further bolstered by strategic acquisitions and an expanding product catalog, ensuring a wider availability of essential metering solutions for diverse customer needs. The company's commitment to enhancing product accessibility directly translates into higher sales volumes and revenue generation.

- Smart Meter Adoption: Municipalities are increasingly adopting smart meter technology for improved water management and leak detection, driving demand for these advanced products.

- Product Availability: Core & Main's focus on increasing product availability through distribution networks and strategic inventory management supports consistent sales of meter products.

- Acquisition Impact: Recent acquisitions have broadened Core & Main's product offerings and market reach, contributing positively to the revenue generated from meter sales.

- Fiscal Year 2023 Performance: The Waterworks segment, a key area for meter sales, achieved $6,186.0 million in net sales in FY2023, reflecting robust market performance.

Services and Solutions Revenue

Core & Main’s revenue model extends significantly beyond just selling pipes and fittings. They generate income through a variety of specialized services designed to support complex infrastructure projects. These value-added offerings are crucial for clients undertaking critical work.

These services include project value engineering, where Core & Main helps optimize designs for cost and efficiency. They also provide essential jobsite support, ensuring smooth execution of installations and problem-solving on-site. This comprehensive approach solidifies their role as a solutions provider, not just a product supplier.

For instance, in 2024, the demand for expert consultation on intricate installations, particularly in water management and energy sectors, has been a notable revenue driver. Core & Main’s ability to offer technical guidance and support for challenging projects allows them to capture additional revenue streams.

- Project Value Engineering: Optimizing project designs for cost-effectiveness and efficiency.

- Jobsite Support: Providing on-site assistance and problem-solving during critical installations.

- Expert Consultation: Offering specialized advice for complex infrastructure projects.

- Related Services: Generating revenue from other support functions that enhance project outcomes.

Core & Main's revenue streams are diverse, encompassing the sale of essential infrastructure components and specialized services. Their primary income is derived from pipes, valves, and fittings (PVF), critical for water and wastewater projects.

Storm drainage products and fire protection systems also contribute significantly to their sales. The company further generates revenue through the sale of meter products, including advanced smart meter technology, as municipalities increasingly invest in efficient water management solutions.

Beyond product sales, Core & Main offers value-added services like project value engineering and jobsite support. These services are crucial for complex infrastructure projects, providing expert consultation and on-site assistance, thereby creating additional revenue opportunities.

In fiscal year 2023, Core & Main reported net sales of $6.5 billion, with PVF and Waterworks segments (including meters and fire protection) showing robust performance. The Infrastructure Investment and Jobs Act in 2024 continues to drive demand for their storm drainage and water management products.

| Revenue Stream | Key Products/Services | Fiscal Year 2023 Contribution (Illustrative) | 2024 Market Driver |

| Pipes, Valves, and Fittings (PVF) | Pipes, valves, fittings for water/wastewater | Largest segment of $6.5B net sales | Infrastructure development, maintenance |

| Storm Drainage | Pipes, inlets, erosion control components | Significant contribution | Urban development, infrastructure investment (IIJA) |

| Fire Protection | Sprinkler systems, hydrants, related components | Waterworks segment (incl. meters) saw 7.8% net sales increase | Building codes, safety regulations |

| Meter Products | Smart meters, water measurement devices | Waterworks segment (incl. fire protection) saw 6.7% net sales increase | Smart city initiatives, water conservation |

| Services | Value engineering, jobsite support, consultation | Ancillary revenue stream | Complex project execution needs |

Business Model Canvas Data Sources

The Core & Main Business Model Canvas is built upon a foundation of internal financial data, comprehensive market research, and strategic operational insights. These diverse sources ensure each component of the canvas is grounded in verifiable information, reflecting the company's current state and future potential.