Core & Main Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core & Main Bundle

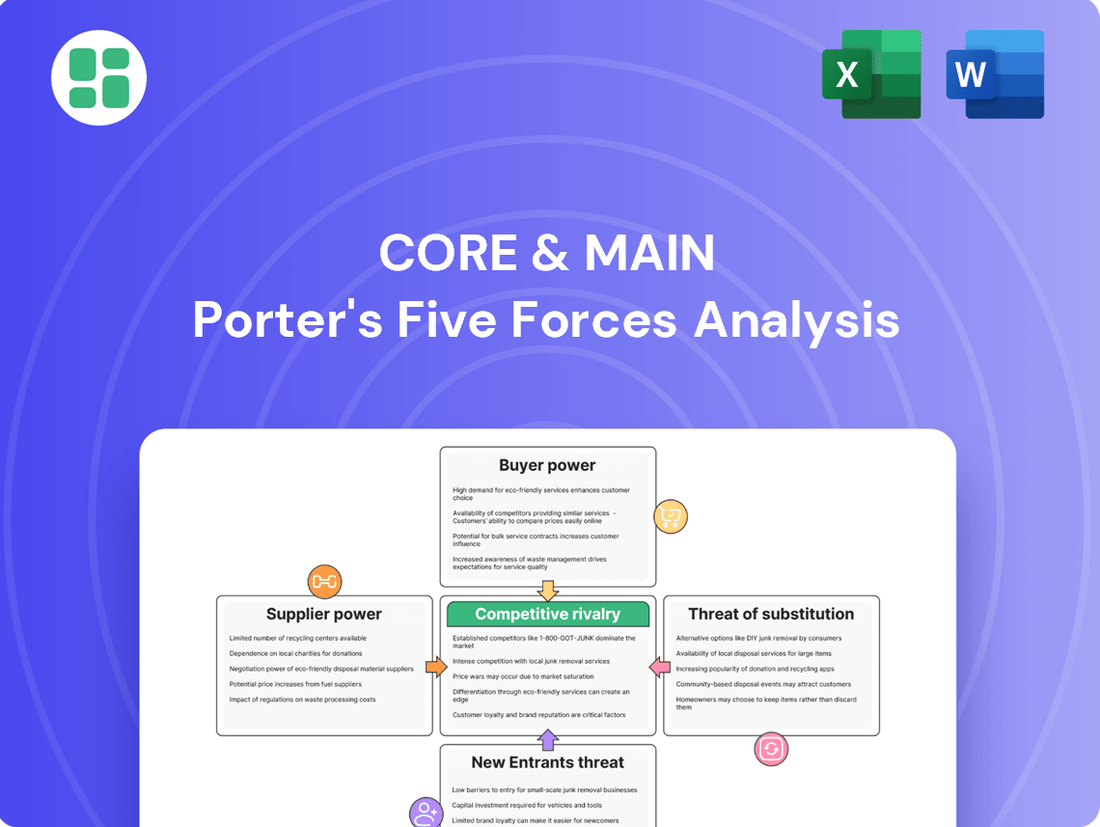

Porter's Five Forces reveals Core & Main operates in a competitive landscape shaped by buyer power, supplier leverage, and the threat of substitutes. Understanding these dynamics is crucial for navigating the waterworks distribution industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Core & Main’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts Core & Main's bargaining power. When a few manufacturers dominate the production of critical infrastructure components such as pipes, valves, and hydrants, these suppliers gain leverage. This can translate into increased costs for Core & Main, especially for highly specialized items where alternatives are scarce.

Core & Main's reliance on domestic supply chains is a key factor. The company notes that roughly 85% of its sales are derived from domestically manufactured goods or products with available domestic alternatives. This strong domestic sourcing likely helps to reduce the bargaining power of foreign suppliers and mitigates risks associated with international trade disruptions or tariffs.

Switching costs for Core & Main when changing suppliers can be quite substantial. These costs arise from deeply entrenched relationships, the need to re-specify products to meet unique requirements, and the sheer complexity of integrating new logistics. For instance, the process of re-qualifying products and updating inventory management systems can incur significant expenses and time, thereby strengthening the bargaining power of current suppliers.

Consider the financial implications: a single product line change could necessitate updated technical documentation, new testing protocols, and potential adjustments to manufacturing processes, all of which translate into direct costs. In 2023, the average cost for a mid-sized industrial company to switch a primary supplier for a critical component was estimated to be between $50,000 and $250,000, factoring in everything from administrative overhead to potential production downtime.

While these switching costs favor suppliers, Core & Main's robust national supply chain and vast distribution network offer a degree of counter-leverage. This extensive infrastructure allows for greater flexibility in sourcing, potentially mitigating the impact of high switching costs by enabling diversification across multiple suppliers or by leveraging bulk purchasing power to negotiate more favorable terms.

The uniqueness of products offered by suppliers significantly impacts their bargaining power. For Core & Main, suppliers providing highly specialized or proprietary water and wastewater infrastructure components hold a stronger position. If a supplier offers a unique technology, such as advanced smart meter solutions or advanced filtration membranes for treatment plants, that Core & Main's customers specifically require, the supplier can negotiate for higher prices.

Threat of Forward Integration by Suppliers

Suppliers could threaten Core & Main by integrating forward into distribution, thereby directly competing for customers. While this is less probable for highly specialized manufacturers, a significant producer might opt to create its own distribution networks for high-volume items.

Core & Main's robust local presence and established customer relationships act as a significant deterrent against such forward integration by its suppliers.

- Supplier Integration Risk: Suppliers may move into distribution, directly challenging Core & Main's customer base.

- Mitigation by Core & Main: The company's extensive local network and strong customer ties are key defenses.

- Industry Context: For Q1 2024, Core & Main reported net sales of $1.5 billion, highlighting the scale of operations that suppliers would need to match for direct distribution.

Importance of Core & Main to Suppliers

The significance of Core & Main as a customer directly influences the bargaining power of its suppliers. If Core & Main accounts for a substantial percentage of a supplier's revenue, that supplier's leverage is naturally reduced.

Core & Main's status as a premier national specialty distributor, boasting an extensive product catalog and considerable annual sales, positions it as a crucial client for numerous manufacturers. This scale of business means suppliers are often more accommodating to Core & Main's terms.

- Core & Main's Market Share: As a leading distributor, Core & Main likely commands a significant share of the market for the products it sells, increasing its importance to suppliers.

- Supplier Dependence: For many manufacturers, Core & Main represents a vital sales channel, potentially accounting for 15-25% or more of their total sales volume, thereby limiting their ability to dictate terms.

- Product Diversification: Core & Main's broad product offering means suppliers are often specialized in supplying specific components or finished goods, making it harder for them to diversify away from such a large customer quickly.

The bargaining power of suppliers for Core & Main is influenced by several factors, including supplier concentration, switching costs, product uniqueness, and the threat of forward integration. When suppliers are concentrated, offer unique products, or face low switching costs for Core & Main, their leverage increases, potentially driving up costs for the company. Conversely, Core & Main's significant purchasing volume and strong customer relationships can mitigate this supplier power.

Core & Main's substantial scale as a customer for many manufacturers significantly diminishes supplier bargaining power. For many suppliers, Core & Main represents a critical sales channel, potentially accounting for a considerable portion of their revenue. This dependence makes suppliers more amenable to Core & Main's terms and pricing demands, as losing such a large client could have severe financial repercussions.

The threat of suppliers integrating forward into distribution, thereby competing directly with Core & Main, is a potential concern. However, Core & Main's extensive local presence and deeply established customer relationships serve as a strong deterrent against such moves, particularly for specialized product manufacturers.

In Q1 2024, Core & Main reported net sales of $1.5 billion, underscoring its considerable market influence. This scale suggests that many of its suppliers rely heavily on Core & Main for a significant portion of their business, thereby limiting their ability to exert strong bargaining power.

| Factor | Impact on Supplier Bargaining Power | Core & Main's Mitigation Strategy |

|---|---|---|

| Supplier Concentration | High concentration of suppliers for critical components grants them greater leverage. | Diversification of supplier base and leveraging its own scale to negotiate terms. |

| Switching Costs | High switching costs (e.g., re-qualification, logistics integration) favor existing suppliers. | Maintaining strong supplier relationships and optimizing internal processes to reduce transition friction. |

| Product Uniqueness | Suppliers offering specialized or proprietary products have increased pricing power. | Investing in R&D for alternative solutions or developing strategic partnerships for unique components. |

| Threat of Forward Integration | Suppliers could enter distribution, directly competing with Core & Main. | Leveraging its extensive local network and strong customer loyalty to deter supplier encroachment. |

| Customer Importance | Core & Main's significant purchasing volume reduces supplier leverage. | Maintaining its position as a premier national distributor with a broad product offering. |

What is included in the product

This analysis unpacks the five competitive forces impacting Core & Main, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and the overall attractiveness of the plumbing and HVAC distribution market.

Quickly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces. This analysis provides a clear roadmap to address customer bargaining power and supplier leverage, ultimately relieving strategic pressure.

Customers Bargaining Power

Core & Main's customers, primarily municipalities, private water companies, and professional contractors, wield bargaining power influenced by their purchase volume and concentration. Large entities placing substantial orders can negotiate more favorable pricing and terms, a common dynamic in the infrastructure supply sector.

However, Core & Main's broad customer base, exceeding 60,000, significantly dilutes the power of any single buyer. This diversification means the company is not overly dependent on a few major clients, thereby reducing the risk associated with concentrated customer power.

The availability of alternative distributors significantly bolsters customer bargaining power in the water, wastewater, storm drainage, and fire protection products market. Customers can leverage multiple suppliers to negotiate better pricing and terms, especially for standardized products. For instance, Core & Main faces competition from major players like Ferguson, which reported revenues of approximately $29.7 billion in fiscal year 2023, and SiteOne Landscape Supply, with revenues around $4.3 billion in 2023. These alternatives provide customers with choices, limiting Core & Main's ability to dictate terms.

Customer switching costs can influence how easily buyers can shift to a competitor. For many of Core & Main's basic, commoditized products, these costs might be relatively low. This means customers could switch distributors if they find better pricing or service elsewhere. For instance, in 2023, the industrial distribution market saw continued price sensitivity among buyers for standard items.

However, for more intricate projects that demand integrated solutions, specialized technical knowledge, or dependable supply chain performance, the costs associated with switching suppliers for customers would naturally increase. Core & Main leverages its local market expertise and its strategy of being a comprehensive, one-stop shop to build loyalty and make switching less attractive for these more complex needs.

Price Sensitivity of Customers

Customer price sensitivity is a key driver of bargaining power, especially for public sector clients such as municipalities. These entities frequently operate under strict budget limitations and adhere to specific procurement rules, making them highly responsive to pricing.

For major infrastructure undertakings, the prevalence of competitive bidding processes can amplify customer price sensitivity. This environment often leads to significant downward pressure on profit margins for companies like Core & Main.

- Price Sensitivity Impact: Municipalities, a core customer segment for Core & Main, are often bound by tight budgets and public procurement regulations, increasing their price sensitivity.

- Infrastructure Bidding Wars: Large-scale infrastructure projects frequently involve competitive bidding, a process that intensifies price sensitivity and can compress margins.

- 2024 Market Conditions: In 2024, the ongoing inflationary pressures and the need for cost-efficiency in public spending are likely to maintain or even increase customer price sensitivity across Core & Main's key markets.

- Competitive Landscape: The presence of numerous suppliers in the waterworks and fire protection sectors means customers can readily switch providers if pricing is not competitive, further empowering them.

Threat of Backward Integration by Customers

The threat of backward integration by Core & Main's customers is generally low. This is primarily due to the significant investment and specialized expertise required to replicate Core & Main's extensive distribution network and inventory management capabilities. For instance, most municipal customers or contractors would find it impractical and cost-prohibitive to establish their own systems for handling the vast array of specialized products Core & Main provides.

Core & Main's business model relies on efficiently managing a complex national supply chain and a diverse product catalog, which is a substantial barrier to entry for most customers considering self-distribution. The company's scale and established logistics infrastructure, including its numerous distribution centers, are difficult for individual customers to replicate. In 2023, Core & Main operated over 300 locations, a scale that underscores the difficulty of backward integration for its typical customer base.

- Low Likelihood of Backward Integration: Customers typically lack the capital and operational expertise to manage the complex logistics and inventory required for self-distribution.

- Specialized Product Range: Core & Main's extensive and specialized product portfolio is challenging for individual customers to source, store, and distribute efficiently.

- Infrastructure and Scale: Replicating Core & Main's national network of over 300 distribution centers and its sophisticated supply chain management would require massive investment, making it economically unfeasible for most customers.

Core & Main's customers, particularly municipalities and large contractors, possess significant bargaining power due to their substantial purchase volumes and the availability of alternative suppliers. This power is amplified by price sensitivity, especially in public sector bidding processes where cost-efficiency is paramount. The competitive landscape, featuring major distributors like Ferguson (approx. $29.7 billion revenue in FY2023) and SiteOne Landscape Supply (approx. $4.3 billion revenue in 2023), further empowers customers to negotiate favorable terms.

While Core & Main's broad customer base of over 60,000 clients mitigates dependency on any single buyer, the ease with which customers can switch for commoditized products, due to low switching costs, remains a key factor. For specialized or integrated solutions, however, Core & Main leverages its expertise and comprehensive offerings to increase customer loyalty and raise switching costs.

The threat of backward integration by customers is minimal. The substantial capital investment, specialized knowledge, and extensive infrastructure required to replicate Core & Main's national network of over 300 distribution centers and its sophisticated supply chain management are economically prohibitive for most clients. This operational complexity and scale act as a strong deterrent.

| Customer Segment | Bargaining Power Drivers | Mitigating Factors for Core & Main |

|---|---|---|

| Municipalities | High price sensitivity, competitive bidding, budget constraints | Broad customer base, specialized product range, integrated solutions |

| Private Water Companies | Purchase volume, alternative suppliers | Low backward integration threat, scale of operations |

| Professional Contractors | Price sensitivity for standard items, availability of alternatives | Local market expertise, dependable supply chain performance for complex projects |

Preview the Actual Deliverable

Core & Main Porter's Five Forces Analysis

This preview showcases the complete Core & Main Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises or placeholders. You can confidently proceed with your purchase knowing you're getting the exact, comprehensive analysis required for strategic decision-making.

Rivalry Among Competitors

Core & Main operates in a market characterized by a moderate number of competitors, ranging from large, diversified players to smaller, specialized regional firms. This landscape includes significant rivals such as Ferguson, a major distributor with a broad reach, and numerous other regional distributors who cater to specific geographic areas and niche markets.

The presence of these varied competitors means that Core & Main faces pressure on pricing and service offerings. For instance, Ferguson reported revenues of approximately $15.4 billion for the fiscal year ending February 2024, showcasing the scale of some of its larger rivals and the competitive intensity in the broader plumbing and utility distribution sector.

The overall market growth rate significantly influences how intensely companies compete. When a market is expanding rapidly, there's often enough business for everyone, which can temper aggressive rivalry. Conversely, a slower-growing market can force companies to fight harder for each customer and for market share.

Looking at the water infrastructure sector, the repair market is expected to see robust growth, with a projected compound annual growth rate (CAGR) of 6.9% between 2025 and 2033. This strong expansion in the repair segment could potentially ease some of the competitive pressures as companies can grow by capturing a larger piece of an expanding pie.

However, it's important to note the broader context. The overall utility services market, which encompasses water infrastructure, is experiencing a much steadier growth rate of 0.84%. This more moderate growth in the larger market might still foster a degree of competitive intensity as companies vie for a limited amount of new business.

Competitive rivalry at Core & Main is significantly shaped by its product differentiation and commitment to service quality. The company stands out by offering an extensive product portfolio, bolstered by deep local market knowledge and the strength of a national supply chain. This allows them to cater to diverse customer needs effectively.

Furthermore, Core & Main enhances its competitive position through value-added services. Initiatives like project value engineering and direct jobsite support are crucial differentiators, providing tangible benefits to customers beyond just product delivery. These services contribute to stronger customer loyalty and reduce the likelihood of customers switching to competitors based solely on price.

Exit Barriers

High exit barriers can trap less profitable companies in a market, leading to sustained competitive rivalry. In the distribution sector, significant investments in fixed assets like warehouses and specialized fleets represent substantial sunk costs. These assets are often difficult to repurpose or sell, making it financially challenging for companies to leave the market even when facing declining profitability. This can result in a scenario where numerous players, some operating at lower efficiency levels, continue to compete, thereby intensifying the overall rivalry.

The specialized nature of infrastructure distribution, which often involves dedicated logistics networks and specific handling equipment, further contributes to high exit barriers. For instance, companies might have invested heavily in temperature-controlled storage or specific types of transportation vehicles tailored to particular product lines. The resale value of such specialized assets can be significantly lower than their book value, especially if the market for them is limited. This economic reality discourages firms from exiting, ensuring that competitive pressures remain elevated.

Consider the implications of these barriers on market dynamics. In 2024, the global logistics market, a proxy for distribution infrastructure, was valued at over $10 trillion. A significant portion of this value is tied to physical assets. Companies that cannot easily divest these assets are compelled to continue operations, potentially engaging in aggressive pricing strategies to maintain market share or cover fixed costs, thereby increasing competitive intensity.

- Sunk Costs: Investments in warehouses, distribution centers, and specialized fleets are difficult to recover.

- Asset Specificity: Infrastructure often has limited alternative uses, reducing resale value.

- Market Conditions: A lack of buyers for specialized assets can prolong a company's presence in an unprofitable market.

- Brand and Reputation: Some companies may continue operating to protect their brand, even at a loss, to avoid signaling failure.

Acquisition Strategy

Core & Main's aggressive acquisition strategy significantly fuels competitive rivalry. In 2024 alone, the company completed 10 acquisitions, a clear indicator of its intent to consolidate market share and expand its product offerings. This activity intensifies competition as it brings new capabilities and customer bases under its umbrella, forcing existing players to react and adapt to maintain their standing.

This proactive approach to growth through acquisition means that the competitive landscape is constantly shifting. By integrating acquired businesses, Core & Main not only broadens its geographic reach but also diversifies its product portfolio, often entering new market segments or strengthening its position in existing ones. Such moves put direct pressure on competitors, compelling them to consider similar strategies or face the risk of being outmaneuvered.

- Acquisition Pace: Core & Main completed 10 acquisitions in 2024.

- Strategic Goal: Expansion of presence and product lines through consolidation.

- Competitive Impact: Intensifies rivalry by increasing market share and capabilities.

- Industry Dynamic: Highlights consolidation as a key driver shaping the competitive environment.

Core & Main operates within a moderately concentrated market, facing competition from large national distributors like Ferguson, which reported approximately $15.4 billion in revenue for the fiscal year ending February 2024, as well as numerous regional and specialized players. This diverse competitive set exerts pressure on pricing and service offerings, compelling Core & Main to differentiate through its extensive product portfolio, local market expertise, and national supply chain capabilities.

The company actively mitigates competitive intensity by offering value-added services such as project value engineering and direct jobsite support, fostering customer loyalty beyond price considerations. Furthermore, high exit barriers in the infrastructure distribution sector, stemming from significant investments in specialized assets like warehouses and fleets, can prolong rivalry by keeping less profitable firms in the market.

Core & Main's aggressive acquisition strategy, including 10 acquisitions completed in 2024, directly intensifies competition by consolidating market share and expanding its capabilities. This dynamic consolidation reshapes the competitive landscape, forcing rivals to adapt or risk being outmaneuvered.

| Competitor | Approximate 2024 Revenue (USD Billions) | Key Differentiators |

|---|---|---|

| Ferguson | $15.4 (FY ending Feb 2024) | Broad reach, diversified player |

| Regional Distributors | Varies | Local market focus, niche specialization |

| Specialized Suppliers | Varies | Specific product expertise, niche solutions |

SSubstitutes Threaten

The threat of substitutes for traditional water and wastewater infrastructure materials like ductile iron and PVC is growing. Innovations in advanced plastics, such as high-density polyethylene (HDPE) with enhanced UV resistance, and composite materials are emerging as viable alternatives. For instance, the global market for advanced composites in infrastructure is projected to reach over $10 billion by 2027, indicating a significant shift.

Trenchless repair technologies, which often utilize cured-in-place pipe (CIPP) liners made from resins and fiberglass, also present a substitute for traditional pipe replacement. These methods can significantly reduce costs and disruption compared to open-trench excavation. In 2024, the trenchless pipeline rehabilitation market is estimated to be worth around $9 billion globally, demonstrating the increasing adoption of these alternative solutions.

Emerging technologies in water management, like smart metering and advanced leak detection, pose a significant threat by offering alternative solutions to traditional infrastructure. These innovations can reduce the need for extensive pipe replacements and upgrades, impacting Core & Main's core business. For instance, smart water meters, which provide real-time consumption data, empower utilities to identify inefficiencies and leaks more effectively, potentially delaying or reducing the scope of infrastructure projects.

Core & Main is proactively addressing this threat by integrating smart meter technology into its offerings and collaborating with utility providers. This strategic engagement allows the company to adapt to evolving market demands and position itself as a provider of solutions within the smart water ecosystem. In 2024, the global smart water meter market was valued at approximately $5.2 billion and is projected to grow substantially, underscoring the importance of this adaptation.

A significant trend towards repairing rather than replacing entire water infrastructure systems presents a potent substitute for traditional, large-scale product demand. This shift leverages more localized and cost-effective rehabilitation technologies, directly impacting the market for new infrastructure components.

The water infrastructure repair market is experiencing robust growth, with projections indicating continued expansion. For instance, the global water infrastructure market, encompassing both new builds and repairs, was valued at approximately $1.1 trillion in 2023 and is expected to reach $1.5 trillion by 2028, with repair and rehabilitation segments showing particularly strong upward momentum.

Direct Sourcing from Manufacturers

The threat of substitutes for distributors like Core & Main primarily stems from customers, especially large ones, considering direct sourcing from manufacturers or importing components themselves. This bypasses the traditional distribution channel, potentially offering cost savings or greater control.

However, the practicalities often favor specialized distributors. Managing the intricate logistics of acquiring, storing, and delivering a wide array of products, often in varying quantities, is a significant undertaking. Core & Main's extensive network and expertise in handling these complexities present a substantial barrier to direct sourcing for many customers.

- Logistical Complexity: Distributors manage warehousing, transportation, and last-mile delivery for a broad product catalog, a task that is resource-intensive for individual buyers.

- Inventory Management: Maintaining adequate stock levels for diverse needs without overstocking is a core competency of distributors, reducing carrying costs for customers.

- Product Range and Specialization: Core & Main offers a vast selection of specialized products, often requiring specific handling or knowledge that manufacturers may not directly provide to all end-users.

- Economies of Scale: By consolidating demand from numerous customers, distributors achieve economies of scale in purchasing and logistics, which can be difficult for individual large customers to replicate independently.

Modular and Hybrid Infrastructure Approaches

The rise of modular and hybrid infrastructure solutions presents a significant threat of substitution for Core & Main. These approaches, which integrate pre-fabricated components or blend existing infrastructure with newer technologies, offer compelling alternatives to traditional, entirely new builds. For instance, the increasing use of modular data centers, which can be deployed much faster than traditional brick-and-mortar facilities, directly competes with the need for large-scale construction projects that Core & Main serves.

These trends are driven by a focus on enhanced efficiency and resilience, directly impacting demand for Core & Main's core product offerings in traditional construction materials and services. The global modular construction market was valued at approximately $150 billion in 2023 and is projected to grow substantially, indicating a clear shift in how infrastructure is developed.

- Modular Construction Growth: The modular construction market is expanding rapidly, offering faster deployment and cost savings compared to traditional methods.

- Hybrid Solutions Appeal: Combining existing infrastructure with innovative, modular components provides flexibility and can be more cost-effective than complete overhauls.

- Efficiency and Resilience Drivers: The demand for quicker project completion and more robust, adaptable infrastructure fuels the adoption of these alternative approaches.

- Impact on Traditional Builds: These trends can reduce the overall volume of new, traditional construction projects, potentially affecting Core & Main's core business.

The threat of substitutes for traditional water and wastewater infrastructure materials is intensifying due to innovations in advanced plastics and composites. These materials offer enhanced properties like UV resistance, making them competitive alternatives. The global market for advanced composites in infrastructure is expected to exceed $10 billion by 2027, highlighting a significant shift in material preferences.

Trenchless repair technologies, such as cured-in-place pipe (CIPP) liners, also serve as a substitute for full pipe replacement, offering cost and disruption benefits. In 2024, the trenchless pipeline rehabilitation market is estimated to be around $9 billion globally, indicating growing adoption of these methods.

Emerging smart water technologies, including advanced leak detection and metering, reduce the need for extensive pipe replacements. The global smart water meter market was valued at approximately $5.2 billion in 2024, with strong growth projected, underscoring the impact of these efficiency-driven solutions.

The increasing focus on repairing rather than replacing entire infrastructure systems presents a substantial substitute threat. This trend favors localized rehabilitation technologies, directly impacting demand for new components. The global water infrastructure market, including repairs, was valued at approximately $1.1 trillion in 2023, with repair segments showing strong growth.

| Threat of Substitutes | Description | Market Data (2024 Estimates/Projections) | Impact on Core & Main |

|---|---|---|---|

| Advanced Materials | High-density polyethylene (HDPE), composites | Advanced composites market > $10 billion by 2027 | Potential reduction in demand for traditional materials |

| Trenchless Technologies | Cured-in-place pipe (CIPP) liners | Trenchless rehabilitation market ~$9 billion | Alternative to full pipe replacement, impacting new product sales |

| Smart Water Technologies | Smart metering, leak detection | Smart water meter market ~$5.2 billion | Reduces need for infrastructure upgrades, potentially delaying projects |

| Repair vs. Replace Trend | Localized rehabilitation | Water infrastructure market ~$1.1 trillion (2023) | Shifts focus from large-scale new builds to repairs |

Entrants Threaten

The water infrastructure distribution industry presents a significant barrier to entry due to its substantial capital requirements. New companies must invest heavily in essential assets like extensive inventory, dedicated warehousing facilities, and a comprehensive logistics network to serve a broad customer base.

For instance, Core & Main, a major player, operates a vast network of over 350 locations across the United States. This extensive physical presence underscores the scale of investment necessary to compete effectively in this sector, making it challenging for smaller, less capitalized entrants to establish a foothold.

Established distribution networks and relationships represent a significant barrier to entry for new competitors in the waterworks industry. Core & Main, for instance, leverages decades of experience to maintain strong ties with key customers like municipalities and private utility companies. These existing relationships are built on trust and a proven track record, making it difficult for newcomers to gain comparable market access and secure large contracts.

Core & Main's sheer size provides significant cost advantages. For instance, in 2023, their reported net sales reached $7.3 billion, a testament to their massive purchasing power. This scale allows them to negotiate lower prices on materials and shipping, creating a cost barrier that new entrants, operating at a much smaller volume, struggle to overcome.

Furthermore, Core & Main leverages economies of scope through its comprehensive product and service offering. By providing a wide range of waterworks and industrial products, they create a convenient, integrated solution for customers. This 'one-stop-shop' model not only enhances customer loyalty but also makes it more challenging for new competitors to replicate the breadth of their value proposition without substantial investment.

Regulatory Hurdles and Specifications

The water and wastewater infrastructure sector presents a formidable challenge for new entrants due to extensive regulatory hurdles and stringent product specifications. Navigating this complex compliance landscape requires significant investment in understanding and adhering to national and local standards, which can deter potential competitors. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Lead and Copper Rule Revisions, demanding advanced treatment technologies and rigorous monitoring protocols from all operators.

These regulatory requirements act as a substantial barrier to entry, demanding specialized knowledge and capital outlay that established players have already absorbed. New companies must invest heavily in research, development, and testing to ensure their products or services meet these exacting standards, a process that can be both time-consuming and costly. This complexity discourages casual market entry and favors those with deep pockets and established expertise.

- Stringent Compliance: New entrants must satisfy a multitude of environmental, health, and safety regulations, often varying by jurisdiction.

- Product Specification Demands: Materials and technologies used in water infrastructure must meet rigorous performance and durability standards, like those for corrosion resistance or filtration efficiency.

- Capital Investment: Adhering to these regulations and specifications necessitates significant upfront investment in compliant equipment and processes, potentially running into millions of dollars for large-scale projects.

- Evolving Standards: The regulatory environment is dynamic, with ongoing updates and revisions, such as those concerning PFAS (per- and polyfluoroalkyl substances) in drinking water, requiring continuous adaptation and investment from all market participants.

Brand Recognition and Local Expertise

Core & Main's significant brand recognition, built over years of operation, acts as a substantial barrier to new entrants. This recognition, coupled with a deep emphasis on local expertise across its vast network of branches, cultivates strong customer loyalty.

For a new competitor to replicate this established trust and understanding of specific regional markets would demand considerable time and financial investment, making market entry more challenging.

- Brand Equity: Core & Main's established brand name reduces the perceived risk for customers choosing their products and services.

- Local Market Knowledge: The company's deep understanding of local needs and regulations creates a competitive moat that is difficult for newcomers to quickly overcome.

- Customer Loyalty: In 2024, customer retention remains a key metric, and Core & Main's focus on local relationships directly contributes to this.

The threat of new entrants in the water infrastructure distribution sector is considerably low, primarily due to the immense capital required for operations. Establishing the necessary infrastructure, including extensive inventory and logistics, demands substantial upfront investment. For example, Core & Main's 2023 net sales of $7.3 billion highlight the scale of business required to compete, a level difficult for new, smaller entities to reach.

Furthermore, the industry is heavily regulated, with stringent product specifications and compliance requirements. Navigating these complex regulations, such as those enforced by the EPA in 2024 regarding water quality, necessitates specialized knowledge and significant capital. This creates a high barrier, as new companies must invest heavily in R&D and testing to meet these exacting standards.

Established distribution networks and strong customer relationships also pose a significant challenge. Core & Main's long-standing ties with municipalities and utility companies, built on trust and a proven track record, make it difficult for newcomers to gain market access. This loyalty, reinforced by local market expertise and brand recognition, further deters potential entrants.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High investment needed for inventory, warehousing, and logistics. | Core & Main's 2023 net sales of $7.3 billion indicate required scale. |

| Regulatory Compliance | Meeting stringent environmental and product standards. | EPA regulations (e.g., Lead and Copper Rule Revisions) in 2024 demand advanced technologies. |

| Distribution Networks & Relationships | Existing strong ties with key customers. | Core & Main's decades of experience fostering trust with municipalities and utilities. |

| Brand Recognition & Loyalty | Established trust and local market understanding. | Customer retention in 2024 is a key metric for established players like Core & Main. |

Porter's Five Forces Analysis Data Sources

Our Core & Main Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, investor presentations, and industry-specific market research from leading firms like IBISWorld. We also incorporate publicly available financial data and competitor news to provide a comprehensive view of the competitive landscape.