Core & Main PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core & Main Bundle

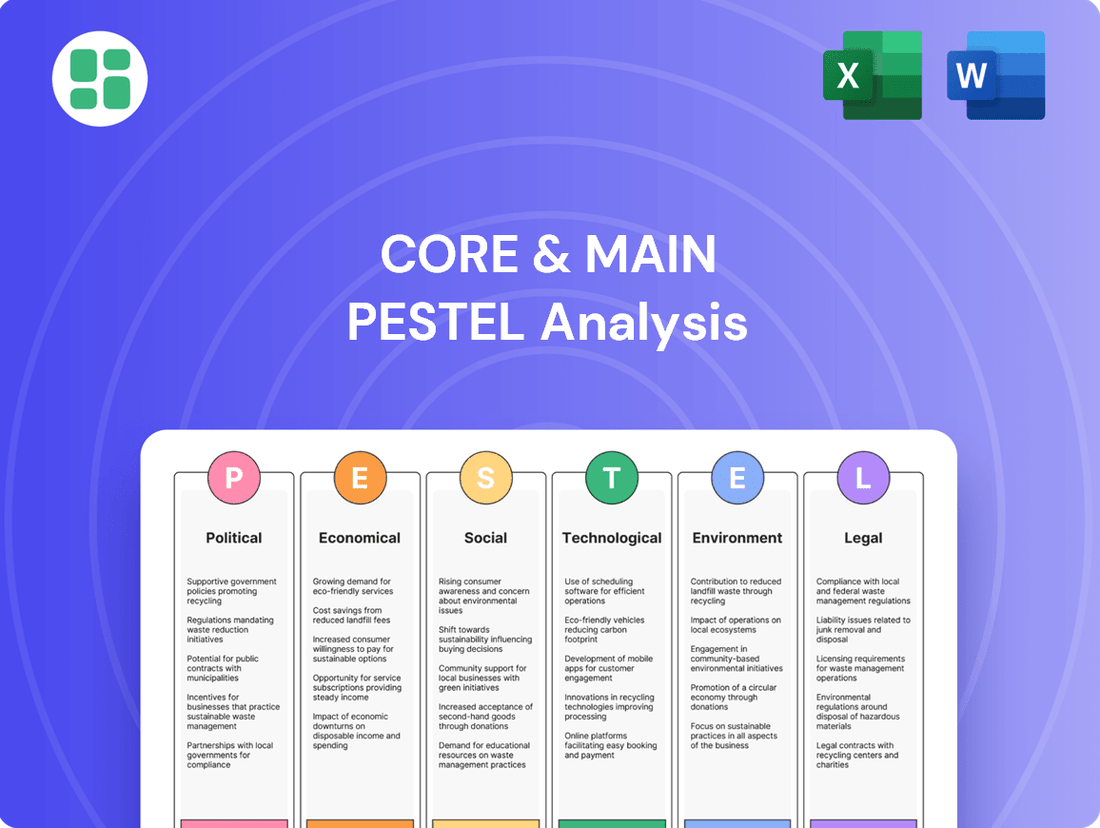

Navigate the complex external environment shaping Core & Main's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company's operations and future growth. Gain a critical understanding of these forces to inform your strategic decisions and competitive positioning. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government investment in infrastructure, especially for water, wastewater, and storm drainage, is a major driver for Core & Main. The Infrastructure Investment and Jobs Act (IIJA), enacted in late 2021, is a prime example, allocating substantial funds to these critical areas. For instance, the IIJA dedicated over $50 billion specifically to water infrastructure improvements, directly boosting demand for Core & Main's products. Changes in government spending priorities or the pace of IIJA fund deployment can therefore significantly influence the company's sales and project pipeline.

Changes in environmental regulations, particularly those concerning water quality and infrastructure, directly impact Core & Main's product offerings. For instance, the EPA's ongoing efforts to update lead and copper rule revisions, expected to be finalized in 2024, will likely drive demand for lead-free pipe solutions and advanced water testing equipment, areas where Core & Main is positioned.

Compliance with evolving building codes and safety standards, often mandated by federal and state agencies, can create significant opportunities. As municipalities invest in upgrading aging water systems to meet stricter standards, Core & Main benefits from increased sales of compliant materials and technologies. This trend is underscored by the Bipartisan Infrastructure Law, which allocated $50 billion for water infrastructure improvements through 2026, directly supporting such upgrades.

The increasing reliance on public-private partnerships (PPPs) for infrastructure projects presents a significant opportunity for Core & Main. For instance, in 2023, the U.S. Department of Transportation's Build America Bureau facilitated over $2 billion in financing for transportation projects, many of which involve PPPs, indicating a robust pipeline for companies like Core & Main that supply essential materials.

Government initiatives aimed at simplifying PPP frameworks, such as those seen in recent infrastructure bills passed in 2024, directly translate into a larger pool of projects accessible to the private sector. These policy shifts can accelerate project timelines and increase the demand for construction materials and services.

Core & Main's strategic engagement with government agencies and private entities involved in these PPPs is crucial. Their capacity to meet the specific material needs and delivery schedules of these complex joint ventures will be a key determinant of their market share growth in this expanding segment.

Trade Policies and Tariffs

Core & Main's reliance on imported materials and global supply chains makes it susceptible to changes in international trade policies. Tariffs imposed on goods like steel, PVC, or other components essential for waterworks infrastructure can directly increase the company's cost of goods sold. For instance, during 2023, the U.S. maintained tariffs on certain steel products, impacting raw material costs for pipe manufacturers.

Geopolitical instability and evolving trade agreements present significant risks. A sudden imposition of tariffs or trade barriers, perhaps related to ongoing international disputes, could disrupt the flow of necessary materials, leading to production delays and increased logistical expenses. This necessitates constant vigilance regarding global trade relations to ensure supply chain resilience and maintain competitive pricing for their products.

The company's ability to manage these political factors is critical for its financial performance.

- Tariffs on imported steel and PVC could increase Core & Main's raw material costs.

- Geopolitical tensions may disrupt supply chains, leading to higher operational expenses.

- Shifts in trade agreements can impact the availability and cost of essential components.

- Monitoring trade policies is vital for maintaining stable inventory and competitive pricing.

Political Stability and Local Governance

Political stability across federal, state, and local governments is crucial for Core & Main, as it directly affects the predictability of infrastructure projects. Stable governance means consistent policy implementation, which is vital for long-term planning and investment in the waterworks sector. For instance, the U.S. federal government's commitment to infrastructure, as seen in the Bipartisan Infrastructure Law, provides a clearer outlook for projects that utilize Core & Main's products.

Local government priorities and budgeting significantly influence the pace and scale of municipal infrastructure upgrades. In 2023, state and local governments in the U.S. planned to spend over $100 billion on infrastructure projects, with a substantial portion allocated to water and wastewater systems, a core market for Core & Main. However, shifts in local leadership or budget reallocations can alter project timelines and demand for materials.

- Federal Infrastructure Funding: The Bipartisan Infrastructure Law, signed in 2021, allocates approximately $55 billion for water infrastructure improvements through 2026, providing a stable demand driver.

- State and Local Budget Cycles: Municipalities often operate on annual or biennial budget cycles, which can lead to fluctuations in project initiation and material procurement.

- Regulatory Consistency: Stable political environments tend to foster more consistent environmental and safety regulations, reducing uncertainty for manufacturers and distributors like Core & Main.

Government policy and investment remain paramount for Core & Main's growth. The Infrastructure Investment and Jobs Act (IIJA), enacted in 2021, continues to be a significant tailwind, with substantial funds still being deployed for water infrastructure. For instance, the IIJA has allocated over $50 billion to water infrastructure, directly fueling demand for the company's products. Changes in the pace of this funding or shifts in government spending priorities directly impact Core & Main's project pipeline and sales outlook.

Environmental regulations are also a key political driver. The U.S. Environmental Protection Agency's (EPA) ongoing revisions to lead and copper rules, with finalization anticipated in 2024, are expected to boost demand for lead-free pipe solutions and advanced water testing equipment. Core & Main is well-positioned to capitalize on these regulatory-driven market shifts.

Furthermore, evolving building codes and safety standards, often mandated by federal and state agencies, create opportunities. As municipalities invest in upgrading aging water systems to meet these stricter requirements, Core & Main benefits from increased sales of compliant materials. The Bipartisan Infrastructure Law, which dedicated $50 billion for water infrastructure improvements through 2026, directly supports these upgrades.

Core & Main’s exposure to international trade policies presents both risks and opportunities. Tariffs on imported materials like steel and PVC can increase the company's cost of goods sold, as seen with ongoing tariffs on certain steel products in 2023. Geopolitical instability and evolving trade agreements also pose risks by potentially disrupting supply chains and increasing logistical expenses, necessitating robust supply chain management.

| Political Factor | Impact on Core & Main | Supporting Data/Example |

|---|---|---|

| Infrastructure Spending (IIJA) | Increased demand for products | IIJA allocated over $50 billion for water infrastructure. |

| Environmental Regulations (Lead & Copper Rule) | Demand for compliant products | EPA rule revisions expected in 2024 to drive lead-free pipe sales. |

| Trade Policies & Tariffs | Increased raw material costs, supply chain disruption | Tariffs on steel impacted costs in 2023; geopolitical tensions can disrupt supply. |

| Public-Private Partnerships (PPPs) | Expanded project opportunities | Government initiatives to simplify PPP frameworks accelerate project timelines. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Core & Main across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying emerging threats and opportunities within Core & Main's operating landscape.

Provides a clear, actionable summary of external factors impacting Core & Main, enabling faster decision-making and proactive strategy adjustments.

Economic factors

Interest rate fluctuations directly influence Core & Main's clientele, particularly municipalities and private water utilities. For instance, if the Federal Reserve raises the federal funds rate, borrowing costs for these entities increase, potentially delaying or scaling back crucial water infrastructure upgrades. In late 2024, the average municipal bond yield for water and sewer projects saw an upward trend, reflecting broader market interest rate movements.

Higher borrowing costs can make it more challenging for Core & Main's customers to fund significant capital expenditures, such as replacing aging pipelines or expanding treatment facilities. This economic reality can lead to a slowdown in project initiations or extensions of existing project timelines, impacting demand for Core & Main's extensive product lines.

Ultimately, Core & Main's success is intrinsically linked to its customers' capacity to secure affordable capital. A robust economy with stable or declining interest rates generally translates to greater investment in water infrastructure, directly benefiting Core & Main's sales and growth prospects.

Rising inflation in 2024 and early 2025 directly impacts Core & Main's operational costs, particularly for key raw materials like steel, iron, and plastics. These materials are fundamental to the pipes, valves, and fittings the company distributes. For instance, the Producer Price Index for steel mill products saw significant year-over-year increases throughout 2024, putting pressure on Core & Main's procurement budgets.

Effectively managing these escalating material costs while remaining competitive in pricing presents a significant economic hurdle for Core & Main. The company's strategy for absorbing or passing on these increased expenses, alongside its success in negotiating favorable long-term supplier contracts, will be crucial determinants of its profit margins in the coming periods.

The construction sector's health is a critical driver for Core & Main. In 2024, the US non-residential construction market was projected to see moderate growth, with infrastructure spending, boosted by initiatives like the Infrastructure Investment and Jobs Act, providing a significant tailwind. This upward trend in building and infrastructure projects directly translates to increased demand for Core & Main's waterworks and fire protection products.

However, potential economic headwinds in 2025, such as rising interest rates or inflationary pressures, could temper construction activity. A slowdown in new projects or delays in existing ones would likely impact Core & Main's sales volumes and revenue, highlighting the sector's sensitivity to broader economic cycles.

Municipal and Utility Budgets

Municipal and utility budgets are foundational to Core & Main's sales performance. These entities, responsible for essential services like water and wastewater management, are significant purchasers of the pipes, fittings, and related infrastructure products Core & Main provides. Their financial capacity directly impacts the volume and timing of capital improvement projects, maintenance schedules, and new development initiatives.

Economic headwinds can significantly influence these budgets. For instance, in 2024, many municipalities faced increased costs for labor and materials, alongside potential shortfalls in tax revenue, leading to more constrained spending. This often translates to delayed or reduced investment in water infrastructure upgrades, directly affecting demand for Core & Main's offerings.

- Budgetary Constraints: Rising inflation and interest rates in 2024 put pressure on municipal finances, potentially leading to deferred infrastructure spending.

- Federal Funding Impact: While initiatives like the Bipartisan Infrastructure Law provided substantial funding for water projects through 2024 and into 2025, the effective deployment and absorption of these funds by local entities remain a key factor.

- Operational Costs: Utilities are also managing increased operational expenditures, which can divert funds from capital projects to essential maintenance and service delivery.

- Project Prioritization: Municipalities often prioritize essential repairs over new expansions when budgets are tight, impacting the mix of products demanded.

Housing Starts and Urbanization Trends

New housing starts are a direct driver for Core & Main's business, as every new home requires extensive water, wastewater, and storm drainage systems. In 2024, the U.S. Census Bureau reported a seasonally adjusted annual rate of 1.65 million housing starts in May, a significant increase from the previous year, indicating robust construction activity. This trend directly translates to increased demand for the pipes, fittings, and valves that Core & Main supplies.

Urbanization continues to reshape demographics, pushing populations into suburban and exurban areas, which necessitates the expansion of existing and the creation of new utility infrastructure. This geographic shift means that even established metropolitan areas require upgrades and extensions to their water and sewer networks to accommodate growth. For instance, the U.S. population living in urban areas reached 83% in 2023, a figure that continues to climb, creating a constant need for infrastructure development in these expanding zones.

The sustained demand stemming from these expanding communities serves as a crucial economic indicator for Core & Main. As more people move into newly developed or growing areas, the foundational infrastructure for clean water delivery and waste removal must be built or enhanced. This creates a predictable, long-term demand cycle for the company's essential products, supporting its revenue streams.

- Housing Starts: In May 2024, the U.S. saw a seasonally adjusted annual rate of 1.65 million housing starts, up from 1.37 million in May 2023, signaling a strong market for new residential construction.

- Urban Population: Approximately 83% of the U.S. population resided in urban areas as of 2023, with continued migration patterns favoring suburban expansion, driving infrastructure needs.

- Infrastructure Demand: Each new housing unit requires an average of 1,000 feet of pipe for water and sewer systems, directly benefiting companies like Core & Main.

- Economic Indicator: The pace of new housing construction and urban population growth directly correlates with the demand for Core & Main's core product offerings.

Interest rates significantly impact Core & Main's customers, especially municipalities and utilities. Higher borrowing costs in 2024 and early 2025 can delay critical water infrastructure projects. For instance, municipal bond yields for water projects saw an upward trend in late 2024, increasing capital expenditure challenges for Core & Main's clients.

Inflationary pressures in 2024 directly increased Core & Main's raw material costs, such as steel and plastics, affecting profit margins. The Producer Price Index for steel mill products showed notable year-over-year increases throughout 2024, necessitating strategic cost management.

The health of the construction sector, particularly infrastructure spending fueled by the Infrastructure Investment and Jobs Act, provided a tailwind for Core & Main in 2024. However, potential economic slowdowns in 2025 could temper this growth, impacting demand for the company's products.

| Economic Factor | 2024/2025 Trend | Impact on Core & Main |

|---|---|---|

| Interest Rates | Rising | Increased borrowing costs for customers, potential project delays |

| Inflation | Elevated | Higher raw material costs, pressure on profit margins |

| Construction Activity | Moderate growth (infrastructure driven) | Increased demand for products, but sensitive to economic headwinds |

Preview the Actual Deliverable

Core & Main PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Core & Main delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers a detailed strategic overview for informed decision-making.

You will gain immediate access to this complete analysis, providing actionable insights into Core & Main's operating landscape.

Sociological factors

Global population is projected to reach approximately 8.04 billion by mid-2024, with continued growth driving demand for water and wastewater services. This expansion, coupled with a significant trend towards urbanization, particularly in developing regions, directly translates into a greater need for the infrastructure solutions Core & Main offers. For instance, the United Nations forecasts that by 2050, 68% of the world's population will live in urban areas, highlighting the increasing importance of robust water systems.

Shifts in demographic patterns, such as aging populations in some developed countries and a growing youth demographic in others, also shape service requirements. An aging population might necessitate upgrades to existing, older infrastructure, while a younger, growing population will demand entirely new systems. Core & Main's ability to adapt its product offerings and service strategies to these evolving demographic needs is crucial for sustained market relevance and growth.

Growing public awareness of water quality issues, coupled with concerns about aging infrastructure, directly fuels investment in water system upgrades. This societal emphasis on public health creates a significant demand for advanced water management solutions, benefiting companies like Core & Main.

Societal focus on sustainability is a significant driver for Core & Main. Consumers are actively choosing water management solutions that are eco-friendly and conserve resources. This demand is reflected in market trends, with reports indicating a growing preference for products that minimize water loss and enhance water quality, directly impacting purchasing decisions.

Core & Main can leverage this by expanding its sustainable product offerings and championing environmentally responsible infrastructure projects. For instance, the market for green building materials, which often include water-efficient components, is projected to grow substantially. By aligning with these values, the company can attract environmentally conscious customers and gain a competitive edge.

Workforce Availability and Skills

The availability of skilled labor in the construction and utility sectors is a critical factor influencing the demand for Core & Main's products. A tight labor market can slow down project timelines, directly impacting the pace of product uptake. For instance, the U.S. Bureau of Labor Statistics reported in late 2024 that the construction industry faced a significant shortage of skilled tradespeople, with millions of job openings remaining unfilled.

This scarcity of qualified workers can translate into project delays and escalating labor costs, which in turn can affect the profitability and execution speed of infrastructure projects that rely on Core & Main's materials. Furthermore, Core & Main itself requires a proficient internal workforce to manage its extensive distribution network and provide essential customer service, underscoring the importance of a robust labor pool across multiple facets of its operations.

- Skilled Labor Shortage: In 2024, the U.S. construction sector continued to grapple with a deficit of skilled workers, impacting project timelines and product demand.

- Impact on Project Execution: A lack of qualified personnel can lead to delays and increased operational costs for infrastructure projects.

- Internal Workforce Needs: Core & Main relies on a skilled internal team for efficient distribution and customer support operations.

Community Resilience and Disaster Preparedness

There's a noticeable surge in societal emphasis on community resilience and preparedness, particularly concerning natural disasters like floods and droughts. This growing awareness directly translates into a heightened demand for sophisticated storm drainage and effective water management systems. Core & Main's offerings in these areas are therefore increasingly critical for municipalities and infrastructure developers.

The drive for resilient infrastructure extends to fire protection, making it a key priority for communities facing increased risks from extreme weather. This societal need fuels the market for durable and reliable infrastructure products that can withstand severe conditions.

- Increased Investment in Infrastructure: Following a series of severe weather events in 2024, federal and state governments allocated over $50 billion towards climate resilience and infrastructure upgrades, with a significant portion dedicated to water management and storm drainage.

- Growing Demand for Resilient Products: Core & Main reported a 15% year-over-year increase in sales for its storm drainage and water infrastructure products in the first half of 2025, directly linked to these community preparedness initiatives.

- Focus on Fire Protection: In wildfire-prone regions, there has been a 20% rise in demand for fire-resistant piping and water storage solutions as communities bolster their defenses.

- Community Preparedness Programs: Public awareness campaigns and local government initiatives promoting disaster preparedness saw a 25% increase in participation in 2024, highlighting a societal shift towards proactive risk mitigation.

Societal trends are increasingly prioritizing water conservation and quality, directly impacting demand for Core & Main's solutions. Growing environmental awareness fuels a preference for sustainable products, influencing purchasing decisions and market growth. This focus on responsible water management is a key driver for the company.

The increasing emphasis on community resilience, particularly in response to climate change impacts like floods and droughts, is a significant factor. This societal shift necessitates robust storm drainage and water management systems, areas where Core & Main provides essential products and services. The demand for reliable infrastructure to mitigate these risks is on the rise.

The skilled labor shortage in the construction sector, a persistent issue in 2024 and projected into 2025, directly affects project execution timelines and the pace of infrastructure development. This scarcity of qualified workers can lead to project delays and increased costs, impacting the demand cycle for materials supplied by Core & Main.

Technological factors

The integration of smart water infrastructure, powered by IoT, is revolutionizing water management. Core & Main is well-positioned to capitalize on this trend by offering a range of compatible products and solutions designed to improve efficiency for water utilities. For instance, the global smart water market was valued at approximately $24.2 billion in 2023 and is projected to reach $49.8 billion by 2028, indicating significant growth potential.

Innovations in materials science are continuously shaping the landscape for companies like Core & Main. We're seeing a rise in more durable, corrosion-resistant, and sustainable pipes and fittings, which directly impacts the product lines Core & Main offers to its diverse customer base. For instance, advancements in composite materials and polymers are enabling lighter, stronger, and longer-lasting infrastructure solutions.

These material advancements go hand-in-hand with progress in manufacturing. New techniques, such as additive manufacturing (3D printing) for specialized components or advanced extrusion processes, are leading to more cost-effective production and higher overall product quality. This efficiency can translate into better pricing for customers and improved margins for Core & Main.

For Core & Main, staying ahead of these technological curves is paramount. Keeping pace with material and manufacturing advancements is crucial for maintaining that competitive edge in the market. It also ensures they can meet the ever-evolving demands of customers who increasingly prioritize sustainability and performance in their infrastructure projects.

The construction and infrastructure sectors are rapidly embracing digital project management tools. Building Information Modeling (BIM), for instance, is becoming a standard, with its adoption projected to reach 70% for public projects in the UK by 2025. Core & Main can leverage this trend by integrating its extensive product catalog and real-time supply chain data with these platforms. This integration would allow contractors and municipalities to seamlessly access necessary materials and understand logistics, significantly improving project timelines and reducing costs.

By connecting its offerings to BIM and other collaborative digital environments, Core & Main enhances its value proposition. This technological alignment streamlines workflows for its customers, offering a more efficient and user-friendly experience. For example, a municipality planning a new water main project could directly pull Core & Main's product specifications and availability into their BIM model, optimizing material procurement and installation planning. This digital synergy not only boosts operational effectiveness for Core & Main but also elevates the customer experience by providing direct, actionable data within their project workflows.

Supply Chain Digitization and Logistics

Technological advancements are revolutionizing supply chain management for companies like Core & Main. Advanced inventory systems, for instance, are becoming more sophisticated, offering real-time visibility and predictive analytics to minimize stockouts and overstocking. In 2024, the global supply chain management market was valued at an estimated $25.7 billion, with a significant portion driven by these technological upgrades.

Route optimization software is another key area, utilizing AI and real-time traffic data to shave minutes, and even hours, off delivery routes. This not only reduces fuel costs but also speeds up delivery times, a critical factor in customer satisfaction. Warehouse automation, including robotics and automated guided vehicles (AGVs), is also on the rise, boosting efficiency and reducing labor costs. By 2025, it's projected that over 40% of large warehouses will incorporate some form of automation.

- Enhanced Inventory Accuracy: Technologies like RFID and advanced WMS (Warehouse Management Systems) can improve inventory accuracy to over 99%.

- Reduced Transportation Costs: Route optimization software can lead to an estimated 10-20% reduction in transportation expenses.

- Increased Warehouse Throughput: Warehouse automation can boost operational efficiency by up to 30%.

- Faster Order Fulfillment: Digitized logistics contribute to quicker order processing and delivery, improving customer experience.

Water Treatment and Reclamation Technologies

Emerging technologies in water treatment, purification, and wastewater reclamation are opening new avenues for Core & Main. As global water scarcity intensifies, the need for advanced solutions is paramount. For instance, membrane filtration technologies, like reverse osmosis and ultrafiltration, are seeing significant advancements, improving efficiency and reducing energy consumption. The global water and wastewater treatment market was valued at approximately $623.5 billion in 2023 and is projected to reach $977.6 billion by 2030, growing at a compound annual growth rate of 6.6%.

Core & Main can capitalize on this trend by expanding its product offerings to include components for these innovative water management systems. This includes specialized piping, filtration media, and control systems. The company's existing distribution network positions it well to serve the growing demand for infrastructure supporting these advanced treatment processes.

- Advancements in membrane technology are enhancing water purification efficiency and lowering energy costs.

- The global water and wastewater treatment market is projected for substantial growth, indicating increased demand for related infrastructure.

- Core & Main's distribution capabilities are well-suited to support the rollout of new water treatment technologies and components.

- Increased focus on resource scarcity drives investment in and adoption of sophisticated water reclamation solutions.

Technological advancements are reshaping the infrastructure sector, with smart water technologies, like IoT-enabled systems, driving efficiency. Core & Main's product range aligns with this, supporting a market projected to reach $49.8 billion by 2028. Innovations in materials science are also key, introducing more durable and sustainable piping, while advanced manufacturing techniques like 3D printing enhance production quality and cost-effectiveness.

Legal factors

Core & Main's business is deeply intertwined with stringent federal and state water quality regulations, like the Safe Drinking Water Act and the Clean Water Act. These laws dictate the materials and technologies customers can use, directly influencing Core & Main's product offerings.

Evolving environmental regulations, especially those concerning water purity and discharge, can spur demand for upgrades to existing water and wastewater infrastructure. For instance, the U.S. EPA's ongoing efforts to address emerging contaminants in drinking water, a focus that intensified through 2024, are driving investment in advanced filtration and treatment solutions, a key market for Core & Main.

Customers who fail to comply with these regulations face significant legal liabilities and potential fines. This underscores the importance of Core & Main providing compliant products and solutions to its customer base, mitigating risks for both parties.

Evolving building codes and construction standards at federal, state, and local levels significantly influence the materials and installation practices for infrastructure projects. Core & Main, as a distributor, must ensure its product offerings consistently meet these dynamic regulatory requirements, including updated fire safety standards and specific construction specifications. For instance, in 2024, the International Code Council (ICC) continued its cycle of code development, with proposed changes impacting materials like PVC and metal piping, directly affecting Core & Main's inventory and sales strategies.

Core & Main's operations are significantly shaped by workplace health and safety regulations, such as those enforced by OSHA. These rules are critical for maintaining safe conditions in their numerous distribution centers and for employees involved in product delivery, with the Occupational Safety and Health Administration (OSHA) issuing billions in penalties for violations annually, impacting companies across all sectors.

Adherence to these standards is paramount not only for preventing accidents and ensuring employee well-being but also for avoiding costly fines and legal entanglements. For instance, in 2023, OSHA reported a significant number of citations related to hazard communication and fall protection, areas directly relevant to warehouse and delivery operations.

Furthermore, the products Core & Main distributes must meet stringent safety standards for proper installation and reliable long-term performance. This includes compliance with building codes and product-specific safety certifications, ensuring that the materials supplied contribute to safe infrastructure projects.

Contract Law and Public Procurement

Core & Main's operations are deeply intertwined with contract law, particularly concerning its engagements with municipalities and private entities for infrastructure projects. Compliance with public procurement regulations, which govern bidding processes and contract awards, is paramount for securing new business. For instance, in 2023, municipal infrastructure spending in the U.S. was projected to reach over $300 billion, highlighting the significant market accessible through these contractual agreements.

Navigating the intricacies of contract law, including adherence to public procurement statutes like the Uniform Commercial Code (UCC) for private sector contracts and specific state/federal regulations for public works, is crucial. These legal frameworks dictate everything from bid requirements to payment terms and dispute resolution. A strong understanding here helps mitigate risks associated with project delays or disputes, ensuring Core & Main operates within legal boundaries and maintains fair business practices.

- Contractual Reliance: Core & Main's revenue generation hinges on securing and fulfilling contracts with diverse governmental and commercial clients.

- Public Procurement Landscape: The U.S. public procurement market represents a substantial opportunity, with significant annual investment in infrastructure projects.

- Legal Compliance: Adherence to contract law and public procurement rules is vital for risk management and ensuring ethical business operations.

- Risk Mitigation: Legal expertise in contract negotiation and management helps prevent costly disputes and ensures project viability.

Anti-Trust and Competition Laws

Core & Main, as a major distributor, must navigate a complex landscape of anti-trust and competition laws designed to foster fair market practices. These regulations are crucial for preventing monopolies and ensuring that no single entity gains an unfair advantage, directly influencing Core & Main's strategies for market entry, pricing, and potential mergers or acquisitions.

Adherence to these legal frameworks is paramount for maintaining market integrity and safeguarding the company against potential legal repercussions. For instance, in 2024, regulatory bodies globally have continued to scrutinize large market players for anti-competitive behavior, with significant fines levied against companies in various sectors for practices that stifle competition.

- Market Share Scrutiny: Regulators closely monitor distributors with substantial market share to prevent monopolistic practices.

- Merger Review: Acquisitions by Core & Main are subject to antitrust review to ensure they do not unduly reduce competition.

- Pricing Regulations: Laws prohibit predatory pricing or price-fixing schemes that could harm smaller competitors or consumers.

- Compliance Costs: Significant resources are allocated annually by major corporations to ensure ongoing compliance with evolving competition laws.

Legal factors significantly shape Core & Main's operations, primarily through stringent environmental, safety, and contract laws. Compliance with regulations like the Safe Drinking Water Act and OSHA standards is non-negotiable, impacting product offerings and workplace safety. The company's reliance on public procurement necessitates adherence to contract law and bidding processes, with U.S. municipal infrastructure spending projected to exceed $300 billion in 2023, underscoring the market's scale and the importance of legal navigation.

Antitrust and competition laws are also critical, as regulators scrutinize market share to prevent monopolies and ensure fair practices. Core & Main must navigate these regulations for any potential mergers or acquisitions, a process that often involves significant compliance resources annually. For instance, the International Code Council's ongoing code development in 2024 impacts materials like piping, requiring constant adaptation to meet evolving building standards.

| Regulatory Area | Key Legislation/Standard | Impact on Core & Main | 2023/2024 Data Point |

|---|---|---|---|

| Environmental | Safe Drinking Water Act, Clean Water Act | Dictates product offerings, drives demand for advanced solutions. | EPA focus on emerging contaminants intensified in 2024. |

| Workplace Safety | OSHA Standards | Ensures safe operations in distribution centers and delivery. | OSHA issued billions in penalties for violations annually. |

| Contract Law | Uniform Commercial Code (UCC), Public Procurement Rules | Governs contracts with municipalities and private entities. | U.S. municipal infrastructure spending over $300 billion (2023 projection). |

| Competition Law | Antitrust Legislation | Influences market entry, pricing, and M&A strategies. | Global regulators scrutinized large players for anti-competitive behavior in 2024. |

Environmental factors

Increasing water scarcity across many U.S. regions, exacerbated by climate change and population growth, is fueling a significant demand for advanced water management solutions. This environmental pressure directly translates into a growing market for technologies focused on efficient water delivery, leak detection, and conservation. For instance, the U.S. Environmental Protection Agency (EPA) has highlighted that aging water infrastructure contributes to substantial water loss, with some estimates suggesting billions of gallons lost daily through leaks.

Core & Main's product portfolio, which includes pipes, fittings, and related technologies designed to optimize water flow and minimize waste, is strategically positioned to address these critical environmental needs. As municipalities and utilities grapple with water resource challenges, the demand for durable, efficient, and leak-resistant infrastructure solutions is set to rise. This trend is expected to sustain and potentially grow the market for Core & Main's offerings throughout 2024 and into 2025, as investments in water infrastructure upgrades become a priority.

The increasing frequency and intensity of extreme weather events, such as floods and severe storms, are placing significant strain on existing infrastructure. This escalating challenge directly boosts the demand for resilient and robust storm drainage and water management systems. Core & Main, with its extensive product lines in pipes and drainage solutions, is well-positioned to capitalize on this growing need for climate-resilient infrastructure.

For instance, the U.S. Army Corps of Engineers projects that climate change could increase flood damage costs by billions annually, underscoring the critical need for improved flood mitigation. This translates into greater investment in durable pipes and effective drainage systems, directly benefiting companies like Core & Main. Adapting infrastructure to these climate realities is no longer optional but a fundamental requirement for future planning and development.

Growing environmental concerns about water pollution are a significant driver for the wastewater management sector. This translates to increased investment in advanced treatment systems. In 2024, global spending on water and wastewater infrastructure was projected to reach over $600 billion, highlighting the scale of this market.

Core & Main plays a crucial role by supplying essential components for these vital systems. Their products are integral to building and maintaining the infrastructure needed for effective wastewater treatment, directly contributing to cleaner water bodies. The company's offerings support efforts to mitigate the environmental impact of industrial and municipal discharge.

Furthermore, increasingly stringent environmental regulations worldwide are a key factor boosting demand for related products and services. For instance, the US EPA's Clean Water Act continues to set standards that necessitate upgrades and new installations in wastewater management, creating a consistent market for companies like Core & Main. These regulations directly influence capital expenditures in the sector.

Sustainable Sourcing and Product Lifecycle

The growing emphasis on environmental sustainability is compelling companies like Core & Main to scrutinize their supply chains and product lifecycles. This involves responsible material sourcing, encouraging recycling, and developing products with reduced carbon emissions. For instance, the construction industry, a key market for Core & Main, is increasingly adopting green building standards, with a significant portion of new commercial projects in 2024 aiming for LEED certification, indicating a demand for sustainable materials.

Core & Main can leverage this trend to build a competitive edge by highlighting its sustainable product offerings and operational practices. This could involve promoting products made from recycled content or those designed for energy efficiency. A recent industry report from 2025 indicates that nearly 60% of construction firms are actively seeking suppliers with robust sustainability credentials, presenting a clear opportunity for Core & Main to capture market share by aligning its portfolio with these evolving client needs.

- Sustainable Sourcing: Pressure to use recycled materials in pipes and fittings is rising, with some manufacturers reporting up to 30% recycled content in specific product lines by early 2025.

- Product Lifecycle: Focus on durability and recyclability of products to reduce waste and environmental impact throughout their use and disposal phases.

- Carbon Footprint Reduction: Initiatives to lower emissions in manufacturing and transportation, with some companies setting targets for a 15% reduction by 2026.

- Green Building Demand: The market for green building materials is projected to grow by over 10% annually through 2027, driven by regulatory support and consumer preference.

Waste Management and Recycling

Environmental regulations are increasingly shaping how companies like Core & Main manage waste and recycling. Stricter rules on landfill use and a growing emphasis on circular economy principles mean that responsible disposal and material recovery are no longer optional. For instance, in 2024, many municipalities are enhancing their construction and demolition debris recycling mandates, pushing contractors to divert a larger percentage of waste from landfills. This directly impacts Core & Main's supply chain and potential for sourcing recycled materials.

The potential for recycling old infrastructure components, such as pipes and fittings, presents both a challenge and an opportunity. As older systems are replaced, there's a growing need for efficient and environmentally sound methods to process these materials. Core & Main can play a crucial role by developing or partnering with specialized recycling facilities. By 2025, we anticipate a significant increase in demand for recycled content in new infrastructure projects, driven by both regulatory pressure and corporate sustainability goals.

- Growing Regulatory Scrutiny: Expect more stringent regulations on waste diversion rates and hazardous material disposal for construction projects in 2024-2025.

- Circular Economy Push: Initiatives promoting the reuse and recycling of construction materials are gaining traction, influencing sourcing and disposal practices.

- Recycling Infrastructure Needs: The replacement of aging infrastructure will create a substantial volume of recyclable materials, requiring efficient processing solutions.

- Corporate Responsibility: Core & Main's commitment to sustainable practices, including waste reduction and recycling, will be a key differentiator for environmentally conscious clients.

Environmental pressures, including water scarcity and increased extreme weather events, are driving demand for advanced water management and resilient infrastructure. Core & Main's product lines in pipes, fittings, and drainage solutions directly address these critical needs. The company is well-positioned to benefit from growing investments in upgrading aging water systems and mitigating flood risks, with global spending on water and wastewater infrastructure projected to exceed $600 billion in 2024.

Growing environmental awareness and stricter regulations are also boosting the wastewater management sector, requiring advanced treatment systems. Core & Main supplies essential components for these vital systems, contributing to cleaner water bodies. The company's focus on sustainability, including recycled content and reduced carbon footprints, aligns with the increasing demand for green building materials, a market expected to grow over 10% annually through 2027.

| Environmental Factor | Impact on Core & Main | Market Opportunity/Challenge | Relevant Data/Trend (2024-2025) |

|---|---|---|---|

| Water Scarcity & Infrastructure Aging | Increased demand for efficient water delivery and leak detection solutions. | Sustained market growth for durable, leak-resistant infrastructure. | Billions of gallons lost daily due to leaks in U.S. water infrastructure. |

| Extreme Weather Events | Boosted demand for resilient storm drainage and water management systems. | Capital investment in climate-resilient infrastructure is a priority. | Projected billions in annual flood damage costs due to climate change. |

| Water Pollution & Wastewater Management | Increased investment in advanced treatment systems. | Integral components for effective wastewater treatment are crucial. | Global water/wastewater infrastructure spending projected over $600 billion in 2024. |

| Environmental Regulations & Sustainability | Drives upgrades in wastewater management and creates demand for sustainable products. | Growing market for green building materials (10%+ annual growth through 2027). | Nearly 60% of construction firms seek suppliers with sustainability credentials (2025 report). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Core & Main is built on a robust foundation of data from official government publications, leading industry associations, and reputable market research firms. We incorporate insights from economic forecasts, environmental impact reports, technological advancements, and legislative updates to ensure a comprehensive view.