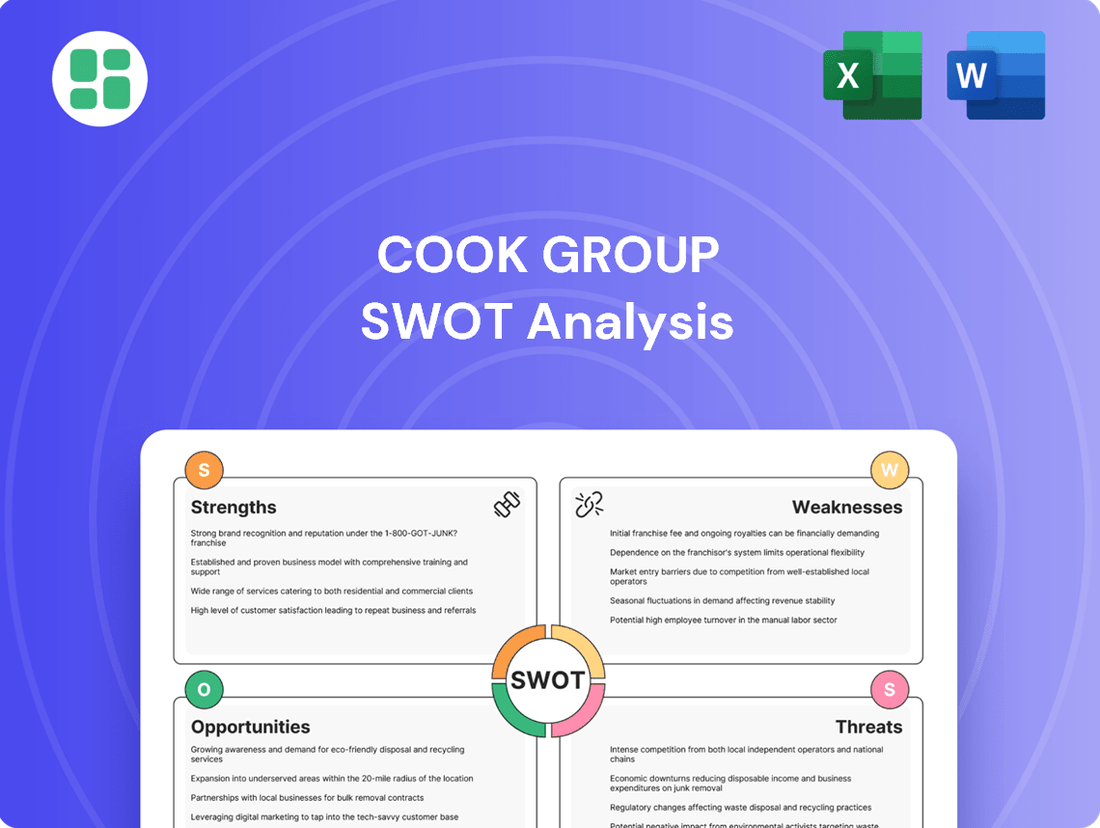

Cook Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cook Group Bundle

The Cook Group's robust market presence and commitment to innovation are key strengths, but understanding their potential weaknesses and the evolving industry landscape is crucial for strategic advantage. Our comprehensive SWOT analysis dives deep into these dynamics, offering actionable insights to navigate opportunities and mitigate risks.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cook Group's global market presence is a significant strength, with operations and distribution networks spanning numerous countries worldwide. This international footprint, as of early 2024, allows Cook Group to access a wide array of healthcare markets and effectively diversify its revenue streams, reducing dependence on any single geographical region.

The company's diversified medical portfolio is another key asset, focusing on critical areas such as cardiology, urology, and gastroenterology. This breadth of product offerings, which are predominantly in the minimally invasive medical device sector, caters to a wide spectrum of patient needs and clinical applications, contributing to a robust and stable revenue base.

Cook Group's unwavering commitment to innovation, particularly in minimally invasive technologies, is a significant strength. Their collaborative approach with physicians ensures that new product development directly addresses clinical needs, leading to solutions that enhance patient outcomes and reduce procedural invasiveness. For instance, their ongoing investment in R&D, which saw significant allocation in 2024, fuels the creation of advanced medical devices, reinforcing their market leadership.

Cook Group's strategic focus is a significant strength, evident in its current five-year plan. This plan includes the divestment of non-core assets, a move designed to sharpen the company's concentration on high-growth sectors. This deliberate pruning of the portfolio allows for a more efficient allocation of resources.

By divesting less profitable or non-essential business units, Cook Group can channel capital and management attention into areas with greater potential for expansion and innovation. This strategic agility ensures the company remains adaptable to market shifts and competitive pressures, optimizing its long-term trajectory and maximizing its impact in key markets.

Strong Employee Development and Culture

Cook Group places a significant emphasis on nurturing its employees, evident in programs like 'My Cook Pathway.' This initiative provides substantial benefits, including tuition discounts and tailored career development opportunities, demonstrating a deep investment in its workforce's future. This focus on growth cultivates a highly positive and supportive work environment, which is crucial for retaining valuable talent in today's competitive landscape.

The company's dedication to its people is further underscored by its consistent recognition as a top employer for career advancement in various regions. This external validation reflects Cook Group's robust internal culture and its genuinely people-centric approach to business operations. For instance, in 2023, Cook Group was recognized by Forbes as one of America's Best Midsize Employers, a testament to its employee development strategies.

This commitment to employee growth translates into tangible benefits for the organization:

- Enhanced Talent Retention: Investing in employees' professional journeys significantly reduces turnover.

- Improved Morale and Productivity: A culture that prioritizes development fosters greater job satisfaction and output.

- Strong Employer Branding: Positive recognition attracts high-caliber candidates, strengthening the talent pipeline.

- Adaptability and Innovation: A skilled and motivated workforce is better equipped to adapt to market changes and drive innovation.

Family-Owned Structure and Long-Term Vision

Cook Group's family-owned structure is a significant strength, enabling it to focus on long-term strategic objectives rather than the quarterly pressures often experienced by public companies. This stability fosters consistent leadership and allows for sustained investment in research and development, as well as in initiatives that reflect the company's foundational values. For instance, in 2024, Cook Medical continued its commitment to patient-centric innovation, dedicating substantial resources to developing minimally invasive devices, a testament to its long-term vision.

This enduring ownership model supports a consistent vision for growth and community involvement, ensuring that business decisions are aligned with the company's core principles of integrity, quality, and respect. This approach has historically driven sustained investment in areas critical for future success, such as advanced manufacturing capabilities and employee development programs, reinforcing its commitment to both innovation and its workforce.

The family ownership facilitates a cohesive strategic direction, allowing for patient capital deployment and a focus on building lasting value. This contrasts with the often-volatile demands of public markets, providing Cook Group with the flexibility to weather industry shifts and invest in pioneering technologies. For example, their ongoing investment in expanding manufacturing capacity for critical medical devices in 2024 underscores this long-term perspective.

Key advantages stemming from this structure include:

- Strategic Patience: Ability to invest in long-term R&D without immediate shareholder return pressure.

- Consistent Leadership: Stable management ensures continuity of vision and operational focus.

- Value Alignment: Decisions are guided by core values of integrity and quality, not just profit maximization.

- Community Focus: Stronger commitment to local communities and employee well-being, fostering loyalty and a positive corporate image.

Cook Group's extensive global reach, with operations in over 135 countries as of 2024, provides a significant advantage by diversifying revenue and accessing diverse markets. Their broad product portfolio, particularly in minimally invasive devices for cardiology and gastroenterology, ensures resilience and caters to a wide patient base. The company's commitment to innovation, backed by substantial R&D investments in 2024, fuels the development of cutting-edge medical technologies.

What is included in the product

Delivers a strategic overview of Cook Group’s internal capabilities and external market challenges, identifying key growth drivers and potential risks.

Offers a clear, actionable roadmap by highlighting Cook Group's competitive advantages and areas for improvement.

Weaknesses

In 2023, Cook Group undertook a significant workforce reduction, impacting roughly 4% of its global employees. This move, while possibly a strategic adjustment, can negatively affect employee morale and the retention of crucial institutional knowledge. The remaining teams might experience increased pressure, making effective management of the post-layoff environment vital for sustained productivity and a healthy workplace culture.

Cook Group operates within a highly regulated medical device sector, making it susceptible to shifts in governmental oversight. For instance, the U.S. Environmental Protection Agency's (EPA) proposed regulations on ethylene oxide (EtO) emissions, finalized in early 2024, place significant compliance burdens on manufacturers using this sterilization method. Failure to adapt to these stringent new standards, which aim to reduce public health risks, could impact Cook Group's ability to sterilize and supply essential products.

As a leading medical device manufacturer, Cook Group faces inherent risks related to product liability. Lawsuits stemming from device malfunctions or adverse patient outcomes can lead to significant legal expenses and damage its hard-earned reputation. For instance, the medical device industry, in general, saw an increase in product liability filings, with some estimates suggesting a notable uptick in complex litigations in recent years, impacting companies across the sector.

While Cook Group has a history of successfully navigating legal challenges, the potential for ongoing or future litigation remains a considerable weakness. Such legal battles can divert crucial financial resources and management attention away from vital areas like research, development, and the introduction of new, innovative products, potentially hindering its competitive edge in the dynamic healthcare market.

Challenges in Managing a Diverse Business Portfolio

While Cook Group's diversification across medical devices, life sciences, and real estate provides a buffer against market downturns, it also introduces significant management challenges. Allocating resources effectively and ensuring strategic alignment across such disparate sectors demands sophisticated oversight. For instance, the capital-intensive nature of real estate development might compete with R&D funding needs in the life sciences division, requiring careful balancing.

Operational efficiency can also be a hurdle. Each business segment operates with unique market dynamics, regulatory environments, and customer bases. Maintaining distinct yet coordinated operational strategies for each requires specialized expertise and robust internal communication frameworks. The complexity increases as Cook Group potentially expands into new ventures, further testing its capacity for integrated management.

- Resource Allocation Strain: Balancing investment across medical technology innovation, life sciences research, and real estate development presents a constant challenge.

- Strategic Cohesion: Ensuring that the overarching corporate strategy effectively guides and leverages the distinct goals of each business unit is complex.

- Operational Silos: Preventing the development of disconnected operational practices and fostering cross-segment collaboration requires deliberate effort.

- Management Bandwidth: Overseeing a broad portfolio demands significant management attention and expertise across multiple specialized fields.

Intense Competition in Niche Markets

Despite its strong position in certain specialized medical device sectors, Cook Group faces significant challenges from intense competition. The medical device industry is dynamic, with established giants and agile startups constantly innovating and vying for market dominance. This competitive landscape can put pressure on pricing and necessitate continuous investment in research and development to maintain market share.

Key competitive pressures include:

- Aggressive Product Innovation: Competitors are frequently launching new and improved products, forcing Cook Group to accelerate its own development cycles. For instance, in the cardiovascular segment, companies like Abbott and Medtronic are heavily invested in next-generation stent and catheter technologies.

- Price Sensitivity: In many medical device categories, healthcare providers are increasingly cost-conscious, leading to price pressures that can impact Cook Group's profitability. The global medical device market, valued at approximately $600 billion in 2024, is expected to grow, but this growth is accompanied by heightened price negotiations.

- Strategic Acquisitions: Larger competitors may acquire smaller, innovative companies to gain access to new technologies or expand their product portfolios, thereby intensifying competition for Cook Group.

Cook Group's diversification, while a strength, also creates significant internal management challenges. Effectively allocating resources and ensuring strategic alignment across distinct sectors like medical devices, life sciences, and real estate requires sophisticated oversight. For example, the capital-intensive nature of real estate development might strain R&D funding for the life sciences division, necessitating careful financial balancing. This complexity can also lead to operational silos, where distinct business units develop unique practices, hindering cross-segment collaboration and requiring deliberate management effort to maintain cohesion.

What You See Is What You Get

Cook Group SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Cook Group is well-positioned to capitalize on the robust growth within interventional cardiology and urology. These sectors demonstrated strong performance, with interventional cardiology sales alone exceeding $15 billion globally in 2024, according to industry reports. By continuing to invest in research and development for innovative solutions in these areas, Cook can tap into an expanding patient base seeking less invasive treatments.

Cook Group can capitalize on the medical device industry's technological shift by integrating AI, robotics, and 3D printing. These advancements offer pathways to innovate product design, streamline manufacturing, and develop novel patient care solutions. For instance, the global AI in healthcare market was projected to reach $187.95 billion by 2030, highlighting the immense potential for growth.

Embracing these technologies can lead to more efficient and effective medical devices. Cook Group's involvement in handheld robotics for urological procedures demonstrates a strategic move to adopt cutting-edge tools that promise improved patient outcomes and operational advantages. The market for surgical robotics alone was valued at over $6 billion in 2023 and is expected to see significant expansion.

Cook Group's established global footprint offers a significant advantage for expanding into burgeoning healthcare markets across the globe. As developing regions enhance their healthcare infrastructure and accessibility, the demand for sophisticated medical devices is on the rise.

For instance, the global emerging markets healthcare market was valued at approximately $3.4 trillion in 2023 and is projected to reach over $5.5 trillion by 2030, with a compound annual growth rate (CAGR) of around 7.2%. Cook Group can leverage this by adapting its product portfolios and distribution strategies to cater to the unique requirements of these specific regions, thereby capturing new revenue streams.

Strategic Partnerships and Collaborations

Forming strategic partnerships with other technology firms, research bodies, and healthcare providers is a key opportunity for Cook Group. These alliances can significantly speed up how quickly new products are developed and how effectively they reach the market. For instance, their collaboration with Mendaera, focusing on robotic interventions, demonstrates a powerful way to merge specialized knowledge and assets to create advanced medical solutions and broaden their operational scope.

These collaborations can lead to:

- Accelerated R&D: Access to external innovation and expertise can shorten development cycles for new medical devices and technologies.

- Market Expansion: Partnering with established players in new geographic or therapeutic areas can provide immediate market access and distribution channels.

- Enhanced Capabilities: Collaborations can integrate complementary technologies, such as AI or advanced robotics, into Cook Group's existing product portfolio, creating more comprehensive and competitive offerings.

Enhancing Sustainability and ESG Initiatives

Cook Group can capitalize on the growing global demand for sustainable healthcare solutions. By expanding its ESG initiatives, the company can attract a wider pool of investors and customers who prioritize environmental and social responsibility. For instance, a focus on reducing manufacturing waste and optimizing supply chain logistics can lead to both cost savings and a stronger brand image.

The company's 2024 Social Impact & Sustainability Report signals a proactive approach to transparency and accountability in its operations. This provides a solid foundation for further development in areas such as ethical sourcing of materials and employee well-being programs. Such advancements can differentiate Cook Group in a competitive market.

Strategic investments in renewable energy sources for its facilities, aiming for a significant reduction in its carbon footprint by 2025, present a clear opportunity. This not only aligns with global climate goals but also offers potential long-term operational cost reductions. For example, transitioning to solar power at key manufacturing sites could yield substantial energy savings.

Cook Group has an opportunity to:

- Strengthen its commitment to ESG by setting ambitious, measurable targets for environmental impact reduction by 2025.

- Increase transparency regarding its supply chain practices to ensure ethical sourcing and labor standards.

- Explore partnerships for developing more sustainable medical devices and packaging solutions.

- Invest in employee training and development focused on sustainability best practices.

Cook Group can leverage its expertise in interventional cardiology and urology, sectors that saw global sales exceeding $15 billion and $10 billion respectively in 2024, to drive growth. By focusing on less invasive treatments and continuing R&D, the company can tap into expanding patient demand.

The integration of AI, robotics, and 3D printing presents a significant opportunity, with the AI in healthcare market projected to reach $187.95 billion by 2030. Cook's existing work in surgical robotics, a market valued at over $6 billion in 2023, positions it well to adopt these transformative technologies.

Expanding into emerging markets, which represented approximately $3.4 trillion in healthcare spending in 2023, offers substantial revenue potential. Adapting product portfolios and distribution strategies for these regions will be key to capturing new market share.

Strategic partnerships, like the one with Mendaera for robotic interventions, can accelerate product development and market entry. These collaborations allow for the integration of specialized knowledge and assets, enhancing Cook Group's competitive edge.

Focusing on ESG initiatives, including a commitment to reducing its carbon footprint by 2025, can attract investors and customers. The company's 2024 Social Impact & Sustainability Report highlights a strong foundation for further advancements in ethical sourcing and employee well-being.

Threats

Cook Group, like all medical device manufacturers, faces mounting regulatory pressures worldwide. The global medical device market is projected to reach $718.7 billion by 2025, a growth that often attracts increased oversight. New regulations, particularly concerning data integrity and post-market surveillance, are anticipated to drive up compliance costs and potentially slow down product launches.

The complexity of navigating varying international regulations, such as the EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), presents a significant challenge. Failure to adapt to these evolving standards, which are expected to intensify in 2025, could result in substantial fines and reputational damage.

Ongoing global trade uncertainties, coupled with geopolitical instability, present a significant threat to Cook Group's supply chain. For instance, in early 2024, shipping costs from Asia to Europe saw a substantial increase, with some routes doubling due to disruptions in key maritime passages.

Raw material shortages, exacerbated by these global factors, can lead to increased production costs and unpredictable lead times for essential components. This directly impacts Cook Group's ability to maintain efficient manufacturing and distribution operations, potentially delaying product availability for customers.

The medical device sector is intensely competitive, featuring both long-standing industry leaders and nimble new entrants. This dynamic environment means Cook Group constantly faces rivals introducing innovative technologies and aggressive pricing, potentially impacting market share.

In 2024, the global medical device market was valued at approximately $520 billion, with projections indicating continued growth, underscoring the significant competitive pressures. Competitors' strategic moves, including frequent mergers and acquisitions, necessitate ongoing substantial research and development investment for Cook Group to stay ahead.

Economic Downturns Affecting Healthcare Spending

Global economic volatility, marked by persistent inflation and the specter of recession, poses a significant threat to healthcare spending. This can directly impact Cook Group's revenue streams as governments, healthcare providers, and even individual consumers may tighten their belts.

For instance, if inflation continues to erode purchasing power, patients might delay elective procedures or opt for less advanced treatments, thereby reducing demand for Cook Group's innovative medical devices. Similarly, hospital systems facing budget constraints might scale back capital expenditures on new equipment.

- Inflationary Pressures: Rising costs for raw materials and labor can squeeze profit margins for medical device manufacturers like Cook Group.

- Recessionary Risks: A widespread economic downturn could lead to decreased discretionary spending on healthcare services and products.

- Government Budget Cuts: Public healthcare systems, a major customer segment, may reduce their procurement of medical devices during economic contractions.

- Consumer Affordability: Increased out-of-pocket healthcare costs for individuals can limit their ability to afford advanced medical technologies.

Technological Disruption and Rapid Obsolescence

The medical technology landscape is evolving at an unprecedented pace, posing a significant threat of rapid obsolescence for Cook Group's existing product lines. For instance, advancements in minimally invasive surgical techniques, often powered by new robotic systems or advanced imaging, can quickly render older procedural tools less competitive. Companies that fail to invest heavily in research and development, estimated to be upwards of 15-20% of revenue for leading medtech firms in 2024, risk falling behind.

Failure to continuously innovate and adopt emerging technologies, such as AI-driven diagnostic tools or next-generation biomaterials, could erode Cook Group's market share. In 2024, the global medical device market saw significant growth in areas like AI in healthcare, with projections indicating continued double-digit expansion. This necessitates substantial and ongoing investment to remain competitive; for example, companies like Medtronic have allocated billions annually to R&D to maintain their innovation pipeline.

Staying at the forefront of medical technology demands significant and sustained financial commitment. The cost of developing and bringing new medical devices to market can range from tens of millions to hundreds of millions of dollars, encompassing clinical trials, regulatory approvals, and manufacturing scale-up. For example, the development of a new cardiovascular stent technology can easily exceed $100 million in investment over its lifecycle.

Key areas of technological disruption impacting medical device manufacturers include:

- Artificial Intelligence and Machine Learning: Integration into diagnostics, personalized treatment planning, and robotic surgery.

- Minimally Invasive and Robotic Surgery: Requiring advanced instrumentation and visualization.

- Biotechnology and Advanced Materials: Development of novel implantable devices and drug delivery systems.

- Digital Health and Connectivity: Enabling remote patient monitoring and data-driven healthcare solutions.

Cook Group faces intense competition from both established players and emerging innovators in the dynamic medical device sector. The global medical device market, valued at approximately $520 billion in 2024, continues to attract new entrants, intensifying the pressure to innovate and maintain market share. Competitors' strategic maneuvers, including frequent mergers and acquisitions, demand substantial and ongoing research and development investment to stay ahead.

SWOT Analysis Data Sources

This Cook Group SWOT analysis is built upon a robust foundation of data, incorporating financial statements, comprehensive market research, and expert industry forecasts to ensure a well-informed and accurate strategic assessment.