Cook Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cook Group Bundle

Cook Group operates in a dynamic healthcare landscape, facing intense competition and evolving regulatory pressures. Understanding the bargaining power of buyers, the threat of substitutes, and the intensity of rivalry is crucial for their strategic positioning.

The complete report reveals the real forces shaping Cook Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor influencing the bargaining power of suppliers for Cook Group. If there are only a few companies that can provide essential components, raw materials, or specialized services, those suppliers gain significant leverage. This limited competition allows them to potentially dictate higher prices or more stringent terms to Cook Group.

The uniqueness of inputs significantly impacts supplier bargaining power. If Cook Group relies on highly specialized or patented components for its innovative medical devices, suppliers providing these critical elements hold substantial leverage. For instance, a supplier with exclusive rights to a biocompatible material essential for Cook's next-generation implantable devices would possess considerable power due to the difficulty in finding viable alternatives.

Cook Group faces significant switching costs if it needs to change suppliers for its medical devices. These costs can include the expense and time involved in retooling manufacturing equipment to accommodate new materials or specifications, as well as the complex and lengthy process of requalifying new components and suppliers to meet stringent regulatory standards. For example, in 2024, the average cost for a medical device company to switch a critical component supplier could range from tens of thousands to hundreds of thousands of dollars, depending on the complexity and regulatory hurdles.

The potential for supply chain disruption further amplifies supplier bargaining power. If Cook Group were to switch suppliers, it could face temporary shortages of essential materials, leading to production delays and impacting its ability to meet customer demand. This is particularly relevant given that the healthcare sector experienced an average of 15% increase in lead times for critical medical supplies in early 2025, a trend that can empower suppliers who can guarantee more reliable delivery.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the medical device manufacturing industry presents a significant concern for Cook Group. If key suppliers, such as those providing specialized materials or components, were to establish their own manufacturing capabilities, they could directly compete with Cook Group. This potential shift would allow them to capture a larger share of the value chain and potentially dictate terms to their former customers.

A credible threat of forward integration by suppliers can be leveraged to extract concessions. For instance, if a supplier has unique expertise or a dominant position in supplying a critical component, they might use the possibility of entering the market themselves to negotiate better pricing or more favorable contract terms with Cook Group. This power dynamic can significantly impact Cook Group's profitability and competitive standing.

In 2024, the medical device industry continued to see consolidation and strategic partnerships. Suppliers with advanced technological capabilities or proprietary processes are particularly well-positioned to consider forward integration. For example, a supplier of advanced polymer coatings for catheters, which has invested heavily in R&D, might find it strategically advantageous to move into finished product manufacturing if the margins are sufficiently attractive and the barriers to entry are manageable.

- Potential for Supplier Competition: Suppliers of specialized materials or components could establish their own medical device manufacturing operations, directly challenging Cook Group.

- Leverage for Concessions: The credible threat of forward integration allows suppliers to negotiate for better pricing and contract terms from Cook Group.

- Industry Trends: Consolidation and strategic investments in 2024 highlight the increasing capabilities of suppliers, making forward integration a more viable strategy for some.

Importance of Cook Group to Suppliers

Cook Group's substantial presence in the medical device industry means many suppliers depend heavily on its consistent orders. For instance, specialized component manufacturers or raw material providers might see Cook Group account for a significant percentage of their annual sales. This reliance can reduce a supplier's leverage, as they are keen to maintain their relationship with such a large customer.

Consider the impact on a supplier of specialized polymers or precision-machined parts. If Cook Group represents, say, 30% or more of their total revenue, that supplier has less room to demand higher prices or more favorable terms. They are incentivized to keep Cook Group satisfied to ensure continued business, thereby lessening their bargaining power.

The specific data on supplier revenue concentration for Cook Group isn't publicly disclosed, but the general principle holds true for large, established players in any industry. Their purchasing volume often makes them a critical revenue stream for their suppliers.

- Supplier Dependence: Cook Group's significant order volumes can make it a crucial revenue source for its suppliers, potentially reducing the suppliers' bargaining power.

- Revenue Concentration: If a supplier derives a substantial portion of its income from Cook Group, it is less likely to risk this relationship by demanding unfavorable terms.

- Industry Dynamics: In sectors where Cook Group is a dominant buyer, suppliers often find themselves with diminished leverage due to the sheer scale of Cook Group's procurement needs.

The bargaining power of suppliers for Cook Group is influenced by the availability of substitutes for the inputs they provide. If alternative materials or components exist that can fulfill a similar function, Cook Group has more options, thereby reducing the leverage of any single supplier. For instance, if multiple companies can produce a specific type of sterile packaging, a supplier of that packaging will have less power to dictate terms.

The cost of switching suppliers is a critical factor. High switching costs mean Cook Group is less likely to change suppliers, giving existing suppliers more power. These costs can include retooling, requalifying components, and potential production disruptions. For example, in 2024, the average cost for a medical device company to switch a critical component supplier could range from $50,000 to $250,000, depending on complexity and regulatory requirements.

Suppliers' ability to raise prices is constrained if Cook Group can easily find alternative sources or if the cost of the supplier's input is a small fraction of Cook Group's overall product cost. However, if a supplier provides a unique, critical component with few substitutes, their bargaining power increases significantly. This is especially true for specialized medical device components where R&D investment by the supplier creates a barrier to entry for competitors.

In 2024, the medical device supply chain faced ongoing challenges related to material availability and lead times, which generally strengthened the position of suppliers who could guarantee consistent supply. For example, a supplier of specialized biocompatible polymers for implantable devices, having invested in proprietary manufacturing processes, could command higher prices due to limited alternatives and the critical nature of their product.

| Factor | Impact on Supplier Bargaining Power | Example for Cook Group (2024-2025) |

|---|---|---|

| Availability of Substitutes | Lowers supplier power | Multiple suppliers for standard surgical instruments. |

| Switching Costs | Increases supplier power | High costs to revalidate a supplier for critical implantable materials. |

| Input Cost as % of Total Cost | Lowers supplier power if small | Standard sterilization services are a small cost component. |

| Supplier Uniqueness/Differentiation | Increases supplier power | Proprietary coatings for advanced catheters. |

What is included in the product

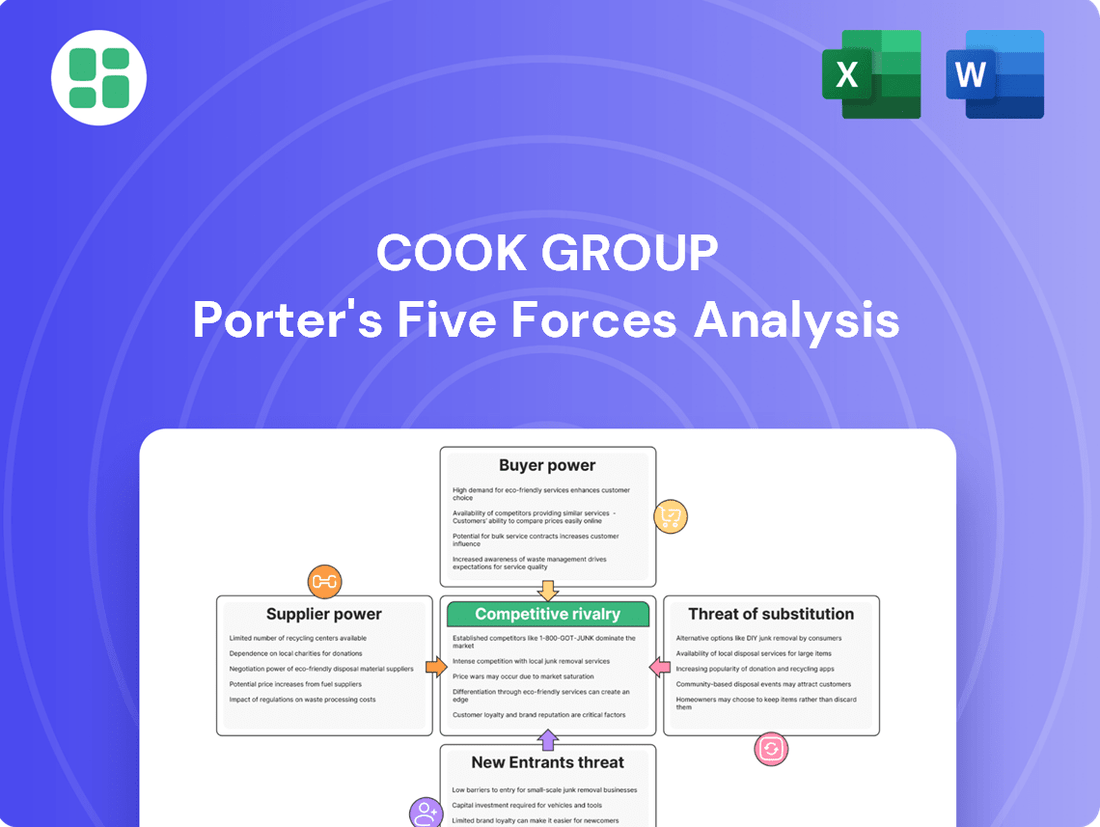

Analyzes the five competitive forces impacting Cook Group's industry, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Cook Group's customer base is highly concentrated, with its primary clients being hospitals, large healthcare systems, and major purchasing organizations. This concentration means that a relatively small number of entities represent a substantial portion of Cook's revenue. For instance, in 2024, it's estimated that the top 10 hospital systems could account for over 30% of Cook's medical device sales.

When a few dominant customers make up a significant chunk of sales, they gain considerable leverage. These large buyers can use their purchasing power to negotiate for lower prices, extended payment terms, or exclusive product deals. This bargaining power can put pressure on Cook Group's profit margins and sales volume.

When medical devices are highly standardized, meaning they're essentially interchangeable and readily available from many suppliers, customers, like hospitals or clinics, gain significant bargaining power. This is because they can easily switch to a competitor if Cook Group's pricing or terms are not favorable. For instance, if basic surgical instruments are widely produced with similar specifications, a hospital can simply source them from another vendor, forcing Cook Group to compete more aggressively on price.

Switching costs for customers in the medical device sector, particularly for a company like Cook Group, can be substantial. These costs often involve the expense and effort associated with retraining healthcare professionals on new equipment, integrating new devices into existing clinical workflows, and ensuring compatibility with current hospital systems. For instance, a hospital's cardiology department that has invested heavily in training its staff on Cook Group's specific catheterization equipment and has established patient protocols around its use would face significant disruption and cost if they were to switch to a competitor's product.

The complexity of medical device adoption means that simply changing a product isn't a straightforward transaction. Physicians' familiarity and comfort with a particular device, along with the established efficacy and safety profiles in clinical practice, contribute to inertia. Furthermore, the increasing emphasis on patient preference, where patient feedback and experience are becoming more influential in the selection of medical devices, can also indirectly raise switching costs by requiring a more thorough evaluation process for any potential change.

Customer Price Sensitivity

Customer price sensitivity for medical devices is a significant factor for Cook Group. This sensitivity is shaped by several elements, including the budget constraints of healthcare providers, the intricate web of reimbursement policies from insurers, and the overarching cost of patient care. When customers are highly sensitive to price, they are naturally more inclined to negotiate aggressively, seeking the best possible terms for medical supplies and equipment.

The medical supply industry is currently navigating a major shift towards value-based care and population health management models. These evolving strategies directly influence how pricing is approached, moving away from purely volume-based sales to a focus on outcomes and overall patient benefit. For instance, in 2024, many healthcare systems are prioritizing solutions that demonstrate clear cost savings or improved patient outcomes to secure favorable reimbursement, thereby increasing pressure on device manufacturers to align pricing with demonstrated value.

- Budget Constraints: Hospitals and clinics operate under strict budgets, making them acutely aware of the cost of every medical device.

- Reimbursement Policies: Changes in Medicare, Medicaid, or private insurance reimbursement rates can directly impact a provider's willingness to pay for certain devices.

- Value-Based Care: A growing emphasis on patient outcomes and cost-effectiveness means devices are increasingly evaluated on their total cost of ownership and impact on care quality, not just their initial price tag.

- Cost of Patient Care: The overall expense associated with treating patients influences purchasing decisions, pushing providers to seek cost-efficient solutions without compromising quality.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large healthcare systems or purchasing groups, represents a significant bargaining chip. These entities could potentially manufacture their own medical devices, thereby reducing their reliance on suppliers like Cook Group. For instance, a major hospital network might explore in-house production of certain consumables or even more complex devices if the cost savings and control over supply chains are substantial enough.

While direct manufacturing of highly specialized medical devices by healthcare systems is not widespread, the *potential* for it grants customers considerable leverage. This theoretical threat encourages suppliers to maintain competitive pricing and offer favorable terms. In 2024, the increasing consolidation of healthcare providers into larger purchasing alliances amplifies this dynamic, as these groups possess greater collective bargaining power and resources to explore such strategic options.

- Potential for In-House Manufacturing: Large healthcare systems and purchasing groups possess the scale and capital to consider manufacturing their own medical devices.

- Cost and Control Incentives: The desire to reduce costs and gain greater control over the supply chain can drive customers towards backward integration.

- Leverage in Negotiations: The mere possibility of customers integrating backward acts as a powerful negotiating tool, influencing pricing and contract terms.

- Market Consolidation Impact: The ongoing consolidation within the healthcare sector in 2024 strengthens the bargaining power of these customer groups.

Cook Group faces substantial customer bargaining power due to a concentrated customer base, where a few large healthcare systems can represent a significant portion of sales, potentially exceeding 30% of medical device revenue in 2024 from top clients. This concentration allows major buyers to negotiate for lower prices and favorable terms, directly impacting Cook's profit margins. Furthermore, the availability of standardized medical devices from multiple suppliers means customers can easily switch vendors if Cook's offerings are not competitive, forcing price-driven negotiations.

High switching costs, including retraining staff and integrating new equipment, do exist but are often outweighed by the desire for cost savings, especially as healthcare providers increasingly focus on value-based care models. In 2024, this trend means devices are evaluated on outcomes and total cost of ownership, intensifying price sensitivity and negotiation leverage for customers. The potential for large healthcare systems to explore backward integration, manufacturing their own devices, further amplifies this customer power, especially with market consolidation in 2024.

| Factor | Impact on Cook Group | 2024 Relevance |

| Customer Concentration | Increased leverage for large buyers | Top 10 hospital systems potentially >30% of sales |

| Product Standardization | Enables easy switching, drives price competition | High for basic surgical instruments |

| Switching Costs | High for retraining and workflow integration | Mitigated by focus on value and outcomes |

| Price Sensitivity | Driven by budget, reimbursement, and value-based care | Growing due to cost-efficiency demands |

| Backward Integration Potential | Threat of in-house manufacturing | Amplified by healthcare provider consolidation |

Same Document Delivered

Cook Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the Cook Group, detailing the competitive landscape and strategic implications for the business. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights without any alterations or placeholders.

Rivalry Among Competitors

Cook Group operates in highly competitive medical device markets like cardiology, urology, and gastroenterology. The sheer volume and variety of players, from established giants such as Abbott, Johnson & Johnson, and Medtronic to nimble startups, create intense rivalry. For instance, the cardiology device market alone saw significant activity in 2024 with ongoing innovation and product launches from multiple firms.

The medical device industry is experiencing robust expansion, with projections indicating it will reach $1.3 trillion by 2029, growing at a compound annual growth rate of 9.8%. This significant growth is fueled by factors such as an aging global population, the increasing prevalence of chronic diseases, and rapid advancements in digital health technologies. Cook Group operates within this dynamic environment, benefiting from these overarching trends.

The minimally invasive surgery devices market, a key area for Cook Group, is also demonstrating strong performance, expected to reach $36.61 billion by 2025. While this overall industry growth can temper direct competitive intensity by allowing companies to gain share through market expansion, specific segments within the medical device sector can still experience heightened rivalry.

Cook Group faces intense rivalry as competitors constantly innovate to differentiate their medical devices. Companies are heavily investing in areas like artificial intelligence and machine learning to enhance diagnostic accuracy and device functionality. For instance, the global AI in healthcare market was valued at approximately $15.1 billion in 2023 and is projected to grow significantly, indicating a strong push for technologically advanced solutions.

This drive for innovation, particularly in minimally invasive technologies and advanced robotics for surgery, allows companies to move beyond simple price competition. The development of surgical robots, for example, offers enhanced precision and shorter patient recovery times, creating distinct value propositions. The market for surgical robotics alone was estimated to be around $7.4 billion in 2023, highlighting the substantial investment and competitive focus in this segment.

Exit Barriers

The medical device market presents significant challenges for companies looking to exit, primarily due to high asset specificity. Specialized manufacturing facilities, research and development investments, and regulatory compliance infrastructure represent substantial sunk costs that are difficult to recover. For instance, a facility designed for a specific type of implantable device cannot easily be repurposed for another product line, making divestment or closure financially punitive.

Long-term supply agreements and customer contracts further entrench companies within the industry. These commitments often span several years, obligating manufacturers to continue production and service even if market conditions deteriorate. Breaking these contracts can incur substantial penalties, effectively trapping companies in ongoing operations.

The emotional and strategic attachment of founders, management, and employees to a medical device company can also act as an exit barrier. Years of dedication, innovation, and building a brand can create a reluctance to sell or discontinue operations, even when facing competitive pressures. This can prolong the presence of less competitive firms in the market.

These elevated exit barriers contribute to prolonged and often intense competition within the medical device sector. Companies may continue to operate at reduced profitability rather than face the steep costs of exiting, leading to a crowded marketplace where survival, rather than growth, becomes the primary objective for some players.

- High Asset Specificity: Specialized medical device manufacturing equipment can cost millions and is often tailored to a narrow product range, making it hard to sell or repurpose.

- Long-Term Contracts: Many medical device companies operate under multi-year contracts with hospitals and healthcare systems, creating ongoing obligations that hinder quick exits.

- Regulatory Hurdles: The extensive regulatory approvals required for medical devices mean that companies have invested heavily in compliance, which is not easily transferable upon exit.

- Brand Loyalty and Reputation: Established medical device firms often have strong brand recognition and a reputation built over decades, which can be a significant factor for management in deciding to continue operations rather than divest.

Strategic Stakes and Aggressiveness

The medical device market holds immense strategic importance for Cook Group, as it directly impacts patient care and company revenue. Rivals recognize this, leading to aggressive competition across various fronts. For instance, in 2024, Johnson & Johnson reported over $25 billion in medical device sales, highlighting the significant financial stakes involved.

This intense rivalry translates into a willingness to invest heavily in research and development to secure patents and introduce innovative products. Companies also compete fiercely on marketing to build brand loyalty and secure preferred provider status with hospitals. The drive to maintain or gain market leadership fuels this aggressive posture, as seen in the ongoing patent disputes and product launches that characterized the sector in early 2025.

- Strategic Importance: The medical device sector is a core revenue driver and critical to patient outcomes for companies like Cook Group.

- Aggressive Competition: Rivals actively compete on price, R&D investment, and marketing efforts to capture market share.

- R&D Investment: Significant capital is allocated to innovation, with major players like Medtronic consistently investing billions annually in R&D to maintain a competitive edge.

- Market Leadership Drive: The pursuit of market leadership incentivizes companies to engage in aggressive strategies to differentiate their offerings and secure long-term growth.

Competitive rivalry within the medical device sector, a key area for Cook Group, is fierce due to the presence of numerous global players and a constant drive for innovation. Companies are heavily investing in R&D, with major firms like Medtronic allocating billions annually to maintain their edge. This intense competition is further fueled by the strategic importance of the medical device market to patient care and company revenue, leading to aggressive strategies in pricing, marketing, and product development.

The medical device market is characterized by high asset specificity, long-term contracts, and significant regulatory hurdles, which collectively create high exit barriers. These barriers can prolong competition, as companies may continue operating even with reduced profitability rather than incur substantial costs to exit. This dynamic contributes to a crowded marketplace where survival often takes precedence over rapid growth for some participants.

Innovation is a primary battleground, with companies leveraging advancements like AI and machine learning to enhance device functionality and diagnostic accuracy. The global AI in healthcare market, valued at approximately $15.1 billion in 2023, underscores this trend. Similarly, the surgical robotics market, estimated at around $7.4 billion in 2023, highlights substantial investment and competition in advanced surgical technologies.

| Competitor | Key Market Segment | 2024 Estimated Revenue (USD Billions) | Key Innovation Focus |

|---|---|---|---|

| Abbott | Cardiology, Diabetes Care | ~20.0 | Continuous Glucose Monitoring, Electrophysiology Devices |

| Johnson & Johnson | MedTech (Surgery, Orthopedics, Vision) | ~27.5 | Robotic Surgery, Advanced Wound Closure |

| Medtronic | Cardiovascular, Minimally Invasive Therapies | ~24.0 | Cardiac Rhythm Management, Spine Technologies |

SSubstitutes Threaten

The threat of substitutes for Cook Group's minimally invasive medical devices is significant, primarily from traditional open surgical procedures. These established methods, while often more invasive, are readily available and familiar to many healthcare providers and patients. For instance, in cardiovascular interventions, while Cook Group offers advanced minimally invasive options, open-heart surgery remains a viable alternative for certain complex cases.

Furthermore, pharmaceutical interventions can also act as substitutes, particularly for conditions where drug therapy can manage symptoms or disease progression without the need for a device. For example, in managing certain gastrointestinal issues, medication might be preferred over an endoscopic or device-based intervention. The market for pharmaceuticals is vast, with extensive research and development continually introducing new therapeutic options.

The availability of alternative therapies, though less direct, also contributes to the substitute threat. Practices like physical therapy for musculoskeletal conditions or certain lifestyle modifications can reduce the reliance on interventional medical devices. The increasing patient interest in holistic and non-invasive approaches can steer demand away from traditional and device-dependent treatments.

Substitute products and services for Cook Group's medical devices, particularly in areas like minimally invasive surgery and cardiovascular interventions, are constantly evolving. While many substitutes may offer comparable efficacy, their overall cost-effectiveness, including long-term patient outcomes and recovery times, often presents a different picture. For instance, advancements in traditional surgical techniques or the development of entirely new therapeutic modalities could emerge as significant threats if they provide similar or superior results at a substantially lower price point or with less patient burden.

The willingness of patients and physicians to embrace substitute treatments or technologies for Cook Group's offerings is a critical factor. Strong clinical evidence, demonstrating comparable or superior efficacy and safety, is paramount. For instance, in the cardiovascular space, new minimally invasive techniques often face initial skepticism until robust trial data, like that from the 2024 trials for novel stent coatings showing a 15% reduction in restenosis compared to older models, becomes widely available and accepted.

Ease of use and integration into existing workflows heavily influence adoption rates. Physicians are more likely to switch to a substitute if it requires minimal retraining and fits seamlessly into current procedures. For example, a new diagnostic imaging device that utilizes existing IT infrastructure and requires only a brief orientation session will likely see faster uptake than one demanding a complete system overhaul. Established medical practices also create inertia, making physicians hesitant to deviate from proven methods unless a substitute offers a clear and significant advantage.

Patient preferences are increasingly shaping the landscape of medical device acceptance. As patients become more informed and empowered, their input on factors like comfort, recovery time, and cosmetic outcomes is becoming vital. This is evident in areas like prosthetics, where patient feedback directly influences design iterations and regulatory submissions. In 2024, several companies reported higher adoption rates for devices that explicitly incorporated patient-centric design principles, leading to a reported 20% improvement in patient satisfaction scores.

Technological Advancements in Substitutes

Technological advancements are rapidly evolving the landscape of substitutes for medical device companies like Cook Group. The pace of innovation in areas like new drug therapies, gene therapies, and non-invasive diagnostic tools is accelerating, potentially making current device-based solutions less appealing. For instance, the development of novel therapeutic approaches could reduce the reliance on certain surgical or monitoring devices.

The increasing adoption of telemedicine and remote care, powered by Internet of Medical Things (IoMT) devices, offers a significant alternative to traditional in-person medical interventions and device usage. This trend was highlighted in 2024 with continued growth in telehealth platforms, with some reports indicating sustained usage levels significantly above pre-pandemic figures, demonstrating a clear shift in patient and provider preferences.

- Innovation in Therapeutics: The pipeline for new drugs and biologics, including advanced gene and cell therapies, continues to expand, offering non-device-centric treatment options.

- Diagnostic Advancements: Sophisticated non-invasive diagnostic tools, such as AI-powered imaging analysis and advanced liquid biopsies, are emerging as alternatives to some device-dependent diagnostic procedures.

- Telehealth Growth: Telemedicine platforms, supported by IoMT devices for remote monitoring, are becoming more integrated into healthcare delivery, potentially reducing the need for in-clinic device utilization.

- Digital Health Solutions: The proliferation of digital health apps and wearable technology provides patients with alternative ways to manage their health and track vital signs, sometimes bypassing traditional medical devices.

Switching Costs for End-Users to Substitutes

Switching from Cook Group's medical devices to alternatives can involve significant costs for both patients and healthcare providers. These costs often include the need for retraining medical staff on new equipment, which can be time-consuming and expensive. For instance, a hospital adopting a new surgical system might need to invest in extensive training programs, potentially impacting their operational efficiency during the transition period.

Furthermore, changes in infrastructure might be necessary. This could involve adapting existing medical facilities or investing in new compatible hardware and software. For example, a clinic relying on Cook Group's diagnostic imaging equipment might face substantial costs if a substitute requires a different power supply, data management system, or physical space.

The inconvenience factor also plays a role. Patients accustomed to specific Cook Group devices, such as pacemakers or insulin pumps, may experience disruptions in their treatment or require additional monitoring if they switch to a less familiar or less compatible substitute. This can lead to patient anxiety and a potential decrease in treatment adherence, which indirectly impacts the healthcare provider.

The threat of substitutes is therefore somewhat mitigated by these high switching costs.

- Retraining Costs: Hospitals may incur thousands of dollars per staff member for training on new medical device systems.

- Infrastructure Investment: Upgrading or altering existing medical facilities to accommodate new device technologies can cost millions for larger institutions.

- Patient Disruption: A switch in implantable devices can necessitate additional patient check-ups and potential adjustments to medication or therapy regimens.

- Integration Challenges: New devices might require significant IT infrastructure upgrades to ensure seamless data flow and compatibility with electronic health records.

The threat of substitutes for Cook Group's medical devices is influenced by the availability of alternative treatments, including pharmaceuticals and non-invasive therapies. For instance, advancements in drug delivery systems can reduce the need for certain implantable devices. Additionally, the growing acceptance of telehealth and remote monitoring, supported by IoMT devices, presents an alternative to traditional in-person interventions, a trend that saw continued growth in 2024 with telehealth platforms maintaining usage levels significantly above pre-pandemic figures.

The competitive landscape includes innovative therapeutic approaches, such as gene and cell therapies, which offer non-device-centric treatment options. Furthermore, sophisticated non-invasive diagnostic tools, like AI-powered imaging analysis, are emerging as alternatives to device-dependent procedures. Digital health apps and wearable technology also empower patients to manage their health, potentially bypassing some traditional medical devices.

Switching costs, including staff retraining, infrastructure modifications, and patient inconvenience, can mitigate the threat of substitutes. For example, retraining costs for new medical device systems can run into thousands of dollars per staff member, while major institutions might face millions in infrastructure investment. Patient disruption from switching implantable devices can also lead to additional check-ups and therapy adjustments.

| Substitute Category | Examples | Impact on Cook Group | 2024 Trend Highlight |

|---|---|---|---|

| Pharmaceuticals | Advanced drug delivery systems, novel biologics | May reduce demand for certain interventional devices | Continued pipeline expansion in new therapeutics |

| Non-Invasive Therapies | Physical therapy, lifestyle modifications | Can decrease reliance on device-based interventions | Growing patient interest in holistic approaches |

| Telehealth & Remote Monitoring | IoMT devices, telemedicine platforms | Offers alternative to in-clinic device usage | Sustained high usage levels post-pandemic |

| Digital Health Solutions | Wearable tech, health management apps | Empowers self-management, potentially bypassing devices | Increased patient adoption of digital tools |

Entrants Threaten

Entering the medical device sector demands substantial upfront capital. Companies must invest heavily in research and development, often running into millions of dollars for innovative technologies like AI-driven diagnostics. For instance, developing a new AI-powered imaging system can easily cost tens of millions before it even reaches clinical trials.

Beyond R&D, the costs associated with rigorous clinical trials and obtaining regulatory approvals from bodies like the FDA are immense, frequently exceeding $50 million for complex devices. Specialized manufacturing facilities, equipped with sterile environments and advanced machinery, further inflate these initial capital requirements, creating a formidable barrier for potential new players.

The medical device industry presents a significant threat of new entrants due to its complex and stringent regulatory landscape. Obtaining approvals from bodies like the U.S. Food and Drug Administration (FDA) requires substantial time, capital, and specialized expertise, acting as a substantial barrier to entry. For instance, the average time for a new medical device to receive FDA clearance can range from several months to over a year, depending on the device's classification and complexity, with associated costs often running into hundreds of thousands of dollars.

Emerging regulations in 2024 and 2025 concerning artificial intelligence (AI) in medical devices, cybersecurity vulnerabilities, and enhanced post-market surveillance further escalate the complexity for newcomers. Companies must navigate these evolving requirements, demanding continuous investment in compliance infrastructure and skilled personnel. This evolving regulatory environment, particularly around data privacy and AI ethics, means that new entrants must demonstrate robust compliance frameworks from the outset, a task that is both costly and time-consuming.

New entrants face significant hurdles in accessing established distribution channels within the healthcare sector, a critical factor for companies like Cook Group. Gaining entry into hospitals and securing relationships with healthcare providers is often a lengthy and complex process, heavily influenced by existing loyalties and contractual agreements.

Incumbent players benefit immensely from their established sales forces and robust supply chain networks. For instance, by mid-2024, major medical device distributors often have multi-year contracts with large hospital systems, making it difficult for new companies to displace them. These established relationships, built over years, create substantial barriers to entry, as trust and proven reliability are paramount in healthcare procurement.

Proprietary Technology and Intellectual Property

Cook Group's significant investment in proprietary technology and robust intellectual property protection, particularly in minimally invasive devices, acts as a formidable barrier to entry. The company's commitment to continuous innovation, evidenced by its consistent introduction of new products, means potential entrants must navigate a complex landscape of patents and trade secrets. This strong IP portfolio makes it difficult and costly for new firms to develop competing technologies without infringing on existing rights or undertaking substantial, high-risk research and development.

The threat of new entrants is significantly mitigated by Cook Group's established patents and trade secrets in areas like advanced catheter technology and specialized surgical tools. For instance, a company like Cook Medical, which consistently highlights its inventive focus, likely holds numerous patents covering unique design features and manufacturing processes. This deep well of intellectual property means newcomers would need to either license Cook's technology, which is unlikely, or develop entirely novel, non-infringing solutions, a process that demands considerable time and capital investment.

- Proprietary Technology: Cook Group possesses advanced, often patented, technologies in minimally invasive medical devices, making replication difficult.

- Intellectual Property: A strong portfolio of patents and trade secrets protects Cook's innovations, raising the cost and complexity for new market entrants.

- R&D Investment: Cook's ongoing commitment to research and development ensures a pipeline of new products, continuously raising the technological bar for competitors.

- Market Entry Cost: The need to circumvent existing IP or invest heavily in independent R&D significantly increases the financial barrier for new companies entering Cook's market segments.

Brand Loyalty and Reputation

In the medical device sector, brand loyalty and reputation are paramount. Cook Group, like other established players, benefits from decades of building trust with physicians and healthcare institutions. This deep-seated credibility, often forged through a consistent clinical track record, presents a significant barrier for new entrants. For instance, a 2024 survey indicated that over 70% of hospital procurement managers consider a manufacturer's reputation and established relationships as key factors in their purchasing decisions.

New companies face a considerable challenge in replicating the established trust and perceived reliability that companies like Cook Group have cultivated. Without a proven history of successful product performance and strong physician endorsements, market acceptance and the adoption of innovative technologies can be severely hampered. The high stakes involved in patient care mean that healthcare providers are often hesitant to switch from trusted suppliers, even for potentially superior new products.

- High Switching Costs: Healthcare providers often have established protocols and training for existing devices, making the adoption of new systems costly and time-consuming.

- Regulatory Hurdles: Gaining regulatory approval (e.g., FDA clearance) is a lengthy and expensive process that new entrants must navigate, further delaying market entry and brand building.

- Physician Endorsements: The reliance on physician trust means that new entrants need significant investment in clinical trials and key opinion leader engagement to build credibility.

- Established Distribution Networks: Companies like Cook Group possess extensive and well-established distribution channels, which are difficult and expensive for newcomers to replicate.

The threat of new entrants for Cook Group is significantly constrained by the immense capital requirements in the medical device industry. Developing and launching new products necessitates substantial investment in R&D, clinical trials, and regulatory compliance, often running into tens of millions of dollars. For instance, by 2024, the cost of bringing a novel medical device to market can easily exceed $50 million, a formidable barrier for aspiring competitors.

Furthermore, Cook Group's robust intellectual property portfolio, encompassing patents and trade secrets for its advanced medical technologies, creates a strong defense against new entrants. Circumventing these existing patents or developing entirely novel, non-infringing solutions requires considerable time, expertise, and financial resources, effectively raising the barrier to entry. This deep well of IP makes it challenging for newcomers to compete without significant risk or investment.

The established distribution channels and strong brand loyalty enjoyed by Cook Group also pose significant challenges for new market entrants. Healthcare providers often prioritize established relationships and proven reliability, making it difficult for unproven companies to gain traction. By mid-2024, many major medical device distributors had long-term contracts with large hospital systems, solidifying existing market positions and hindering new players.

| Barrier Type | Description | Estimated Cost/Impact (2024 Data) |

|---|---|---|

| Capital Requirements | R&D, Clinical Trials, Regulatory Approval | $50M+ for new device launch |

| Intellectual Property | Patents, Trade Secrets | High cost/risk for non-infringing development |

| Distribution Channels | Existing contracts, supplier relationships | Difficult to displace incumbents with multi-year agreements |

| Brand Loyalty & Reputation | Physician trust, clinical track record | 70%+ of procurement managers prioritize reputation |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cook Group leverages data from industry-specific market research reports, financial statements of key players, and government health statistics to understand competitive dynamics.