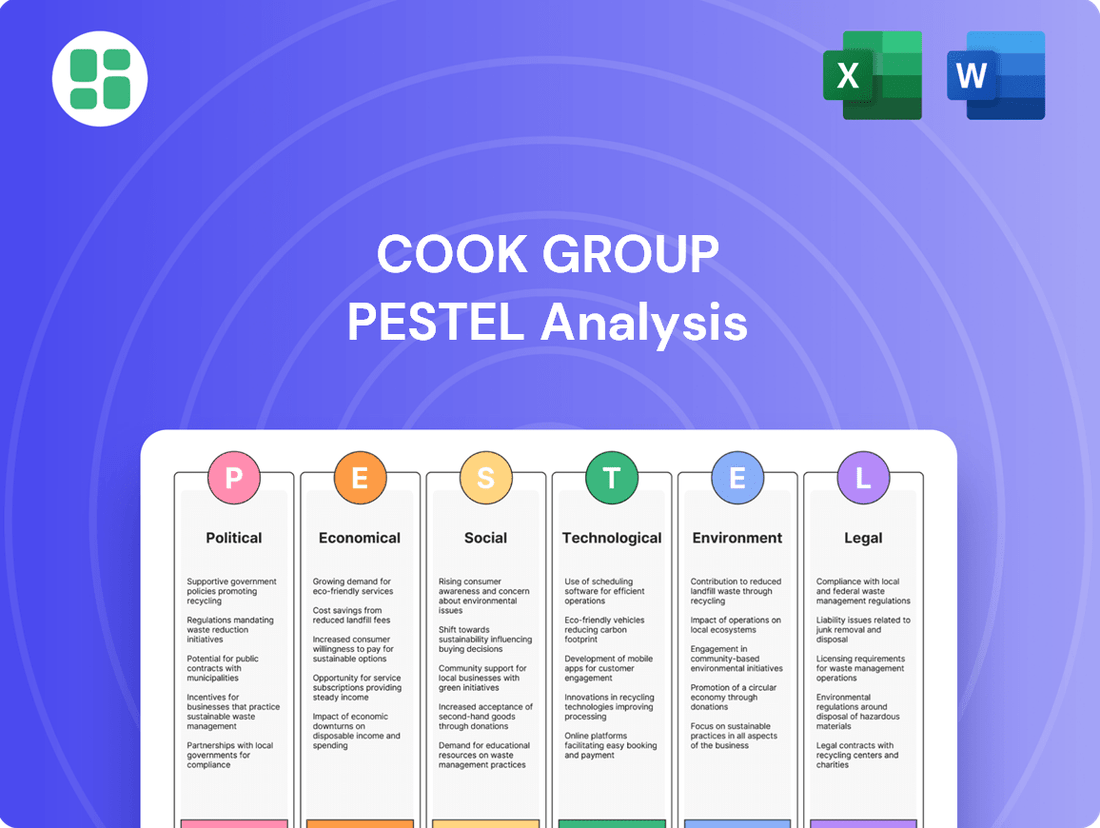

Cook Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cook Group Bundle

Navigate the complex external forces impacting Cook Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping their industry. Gain a strategic advantage by leveraging these insights to anticipate challenges and identify opportunities. Download the full PESTLE analysis now for actionable intelligence to inform your business decisions.

Political factors

Government healthcare policies are a huge deal for companies like Cook Group, a big player in making medical devices. Think about how Medicare and Medicaid in the U.S., or national health services in Europe, decide what they'll pay for. These decisions directly affect how quickly new devices get used and how many get sold. For instance, if a policy makes it easier to get paid for a new type of stent, Cook Group's sales for that product will likely jump.

In 2024, we're seeing continued focus on value-based care models, which reward outcomes over just the volume of services. This means Cook Group needs to demonstrate not only the efficacy of its devices but also their cost-effectiveness. For example, a study published in late 2023 showed that Cook Medical's advanced wound care devices reduced hospital readmission rates by 15%, a statistic that could strongly influence reimbursement decisions from payers like CMS.

Conversely, if governments decide to tighten their belts and reduce reimbursement rates for certain procedures or devices, it can put a damper on sales. This is especially true for innovative but expensive technologies. The ongoing debate around healthcare spending and the potential for budget caps in various countries means Cook Group must constantly adapt its strategies to navigate these shifting policy landscapes.

Cook Group operates within a highly regulated landscape, with agencies like the U.S. Food and Drug Administration (FDA) and the EU Medical Device Regulation (MDR) significantly shaping its operations. These bodies impose strict requirements on product development, testing, approval processes, and ongoing market surveillance, directly impacting Cook Group's ability to bring new innovations to market and maintain existing product lines.

Looking ahead to 2025, the FDA is intensifying its scrutiny on cybersecurity for medical devices, a critical area for Cook Group given the increasing connectivity of its products. Concurrently, the EU MDR, with its complex requirements and extended implementation timelines, continues to demand substantial resources and strategic adjustments from companies like Cook Group to ensure ongoing compliance and market access within the European Union.

Global trade agreements and the imposition of tariffs present a significant political factor for Cook Group. These policies directly influence the cost of raw materials and finished goods, impacting the company's supply chain and overall market competitiveness. The medical device sector often sees support for tariff reduction, aiming for 'zero for zero' policies, which would streamline international trade.

However, the reality of existing tariffs can create substantial challenges. For instance, increased tariffs on imported components could force Cook Group to absorb higher costs or pass them onto consumers, leading to pricing pressure. This can also create potential supply chain disruptions, affecting the availability of crucial medical devices and ultimately impacting patient access to necessary treatments and Cook Group's profitability.

Political Stability in Key Markets

Political stability in Cook Group's key markets significantly impacts its operations. Geopolitical shifts and potential policy changes, especially concerning healthcare, can create uncertainty. For instance, changes in government healthcare spending or the implementation of protectionist trade policies in major regions like North America or Europe could affect Cook's market access and profitability.

Navigating diverse political landscapes is crucial for Cook Group's global strategy. Emerging markets, while offering growth, often present higher political volatility. In 2024, for example, several European nations are undergoing elections, and shifts in government could lead to altered regulatory environments for medical devices. Cook's ability to adapt to these varying political climates is paramount.

- Geopolitical Risk: Increased geopolitical tensions in regions where Cook Group has significant sales, such as parts of Asia or the Middle East, could disrupt supply chains and impact demand for its products.

- Healthcare Policy Changes: Potential shifts in government healthcare budgets or reimbursement policies in major markets like the United States or Germany could directly influence Cook's revenue streams. For instance, a 2024 proposal in the US to negotiate Medicare drug prices could have ripple effects on medical device pricing.

- Trade and Nationalism: Nationalistic policies favoring domestic medical device manufacturers in key markets could lead to increased competition or barriers for Cook Group's imported products.

Government Funding for Medical Research

Government funding plays a significant role in driving innovation within the medical technology sector. For companies like Cook Group, which heavily relies on advancements in medical devices and treatments, changes in this funding can directly impact their research and development pipelines. For instance, the U.S. National Institutes of Health (NIH), a primary source of medical research funding, allocated approximately $47.4 billion in fiscal year 2024, a slight increase from $45 billion in FY2023, underscoring its importance.

A decrease in such governmental support could slow down the development of novel technologies. This directly affects Cook Group's ability to bring new, life-improving products to market. For example, if funding for early-stage research into areas like advanced biomaterials or minimally invasive surgical techniques is reduced, it could delay the commercialization of next-generation devices.

- NIH Funding Trends: The NIH's budget is a key indicator of government commitment to medical research, with recent years showing a general upward trend, though specific program allocations can shift.

- Impact on R&D: Reduced funding can lead to fewer research grants, potentially limiting the scope and pace of innovation for companies like Cook Group.

- Technological Advancement: Government-backed research often pioneers breakthrough technologies that later become foundational for commercial medical products.

Government regulations are a constant factor for Cook Group, impacting everything from product approval to market access. Agencies like the FDA in the U.S. and the EU MDR set stringent standards for medical devices, influencing development timelines and costs. For 2025, the focus on cybersecurity for connected devices is intensifying, requiring significant adaptation.

Trade policies and tariffs also play a crucial role, affecting the cost of materials and finished goods. While there's a push for reduced tariffs in the medical sector, existing trade barriers can create pricing pressures and supply chain disruptions for Cook Group. Political stability in key markets is also vital, as shifts in government or policy can create uncertainty for sales and operations.

Government funding for medical research, such as through the NIH, is another important political element. Changes in these allocations can impact the pace of innovation and the development of new technologies that Cook Group relies on. For example, shifts in NIH funding priorities in 2024 could influence the direction of early-stage research relevant to Cook's product pipeline.

| Political Factor | Impact on Cook Group | 2024/2025 Relevance |

|---|---|---|

| Regulatory Approval | Delays or acceleration of new product launches; ongoing compliance costs. | Increased FDA scrutiny on cybersecurity; EU MDR implementation continues to demand resources. |

| Trade Tariffs | Increased cost of goods; potential supply chain disruptions; price competitiveness. | Ongoing global trade tensions can impact component sourcing and finished product pricing. |

| Government Healthcare Spending | Reimbursement rates for devices; market demand for specific products. | Value-based care models incentivize demonstrating cost-effectiveness; potential budget caps in some regions. |

| Government Research Funding | Pipeline for new technologies; potential for partnerships. | NIH funding levels for specific research areas can influence the pace of innovation in medical technology. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the Cook Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

A clear, actionable summary of the Cook Group PESTLE analysis, designed to quickly identify and address external threats and opportunities, thereby streamlining strategic decision-making.

Economic factors

Global healthcare spending is on a significant upward trajectory, directly influencing the demand for Cook Group's medical devices. This growth is fueled by a confluence of factors, notably an aging global population and the rising incidence of chronic diseases worldwide.

Projections indicate a robust expansion for the medical device industry, with estimates suggesting it will reach an impressive $1.3 trillion by 2029. This substantial market growth presents a clear opportunity for Cook Group, as increased healthcare expenditure often translates to greater investment in advanced medical technologies and equipment.

Inflationary pressures continue to impact the manufacturing sector, with key inputs for companies like Cook Group, such as plastics, resins, and metals, experiencing notable price hikes. For instance, the Producer Price Index (PPI) for manufactured goods saw an increase of 3.2% in the 12 months ending April 2024, signaling persistent cost pressures.

These rising raw material costs directly translate to increased operational expenses for Cook Group. Effectively managing these elevated expenses and optimizing its supply chain are paramount for the company to maintain financial stability and offer competitive pricing in the global market.

As a global entity, Cook Group's financial health is significantly influenced by currency exchange rate shifts. For instance, if the US dollar strengthens against the Euro, products sold in Europe become more expensive for European consumers, potentially dampening sales volumes. Conversely, a weaker dollar could increase the cost of raw materials sourced from overseas, impacting production expenses.

Investment in Healthcare Infrastructure

Investments in healthcare infrastructure, particularly in developing nations, are opening up significant avenues for Cook Group's medical device portfolio. As these economies bolster their healthcare systems, there's a corresponding rise in demand for advanced medical technologies.

Regions like Asia-Pacific are showcasing substantial improvements in medical infrastructure and a rapid uptake of high-tech solutions. This trend directly benefits Cook's strategic focus on specialized markets such as surgical robotics, which are integral to their minimally invasive procedure offerings.

For instance, global healthcare infrastructure spending is projected to reach trillions of dollars in the coming years, with a significant portion allocated to technology upgrades and expansion. Specifically, the Asia-Pacific medical device market is anticipated to experience robust growth, with some estimates suggesting a compound annual growth rate (CAGR) of over 7% through 2028, fueled by these infrastructure investments.

- Growing Healthcare Spending: Global healthcare expenditure is on an upward trajectory, with significant investments directed towards modernizing facilities and adopting new technologies.

- Asia-Pacific Growth Driver: The Asia-Pacific region is a key market for medical device expansion, driven by infrastructure development and increasing adoption of advanced medical equipment.

- Robotics and Minimally Invasive Surgery: Cook Group's expertise in minimally invasive procedures aligns with the growing demand for surgical robotics, a segment benefiting directly from infrastructure upgrades.

- Emerging Market Opportunities: Investments in emerging economies' healthcare sectors present direct opportunities for Cook Group to introduce and expand its range of medical devices.

Pricing Models and Reimbursement Dynamics

The healthcare industry is seeing a significant shift towards value-based pricing and subscription models for medical devices, impacting companies like Cook Group. This evolution means payment is increasingly tied to patient outcomes rather than just the device itself. For instance, the global medical devices market, valued at approximately $518 billion in 2023, is expected to grow, but the pricing structures within it are becoming more complex.

Reimbursement policies are also in flux, with governments and private insurers constantly recalibrating how they cover medical technologies. This can directly affect Cook Group's revenue streams and market penetration. For example, changes in Medicare reimbursement rates for specific procedures can alter the economic viability of certain devices. The Centers for Medicare & Medicaid Services (CMS) regularly updates its payment systems, and these adjustments are closely watched by device manufacturers.

- Value-Based Care Adoption: Increasing pressure from payers to demonstrate improved patient outcomes and cost-effectiveness for medical devices.

- Subscription Services Growth: Emerging trend of device-as-a-service or subscription models, offering recurring revenue but requiring different financial planning.

- Reimbursement Policy Changes: Ongoing adjustments to government and private insurance reimbursement rates and coverage criteria for medical technologies.

- Global Healthcare Spending Trends: Fluctuations in overall healthcare expenditure worldwide directly influence the demand and pricing power for medical devices.

Global healthcare spending continues its ascent, driven by an aging population and the rise of chronic diseases, directly boosting demand for Cook Group's medical devices. The medical device market is projected to reach $1.3 trillion by 2029, indicating substantial growth opportunities. However, persistent inflation, with the Producer Price Index for manufactured goods up 3.2% in the year ending April 2024, increases operational costs for Cook Group due to rising raw material prices.

Currency exchange rates significantly impact Cook Group's global operations. A stronger US dollar can make European sales more expensive, while a weaker dollar increases the cost of imported raw materials. Investments in healthcare infrastructure, particularly in the Asia-Pacific region, which is expected to see a CAGR of over 7% in its medical device market through 2028, offer significant expansion avenues for specialized products like surgical robotics.

The healthcare industry's shift towards value-based care and subscription models for medical devices, as seen in the approximately $518 billion global market in 2023, requires adaptable pricing strategies. Changes in reimbursement policies, such as those by CMS, directly affect revenue streams and market penetration for medical technologies.

| Economic Factor | Impact on Cook Group | Data Point/Trend |

|---|---|---|

| Global Healthcare Spending | Increased demand for medical devices | Market projected to reach $1.3 trillion by 2029 |

| Inflation | Higher operational and raw material costs | PPI for manufactured goods up 3.2% (12 months ending April 2024) |

| Currency Exchange Rates | Impacts sales revenue and material sourcing costs | Strengthening USD can reduce European sales volume |

| Healthcare Infrastructure Investment | Opens new markets, especially in emerging economies | Asia-Pacific medical device market CAGR projected over 7% through 2028 |

| Pricing Models (Value-Based Care) | Requires adaptation in revenue generation and device justification | Global medical devices market valued at ~$518 billion in 2023 |

What You See Is What You Get

Cook Group PESTLE Analysis

The preview you see here is the exact Cook Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive overview of the external factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, giving you immediate access to a detailed breakdown of political, economic, social, technological, legal, and environmental influences.

The content and structure shown in the preview is the same Cook Group PESTLE Analysis document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

The world's population is getting older, and this trend is a significant tailwind for companies like Cook Group. By 2050, it's projected that one in six people globally will be over 65, a substantial increase from one in eleven in 2015. This demographic shift directly fuels the demand for medical devices as older individuals generally require more healthcare services and specialized equipment.

Cook Group's focus on minimally invasive technologies is particularly well-positioned to benefit from this aging demographic. As people age, conditions requiring interventions in areas like cardiology and urology become more common. For instance, the global minimally invasive surgical devices market was valued at approximately $30 billion in 2023 and is expected to grow substantially, driven by an increasing elderly population and advancements in technology.

The increasing prevalence of chronic diseases like cardiovascular conditions, diabetes, and neurological disorders is a significant societal trend. This rise directly fuels the demand for advanced medical devices for diagnosis, treatment, and ongoing management. For instance, the World Health Organization reported in 2023 that cardiovascular diseases remain the leading cause of death globally, accounting for an estimated 17.9 million deaths annually. This underscores the critical need for innovative solutions.

Cook Group's strategic focus on developing cutting-edge medical devices for these prevalent chronic conditions directly addresses this growing societal health challenge. By aligning its product development with the increasing burden of diseases such as diabetes, which affected an estimated 537 million adults worldwide in 2023, Cook Group positions itself to meet a substantial and expanding market need.

Societal trends strongly favor minimally invasive medical procedures. Patients and physicians alike are increasingly seeking treatments that offer quicker recovery, less pain, and often superior results compared to traditional open surgeries. This shift is driven by a desire for improved quality of life and reduced healthcare burdens.

Cook Group's strategic focus on developing and distributing minimally invasive medical devices aligns perfectly with this growing societal preference. Their product portfolio, encompassing areas like interventional cardiology and vascular access, directly addresses the demand for less invasive solutions. For instance, the global minimally invasive surgical instruments market was valued at approximately $39.5 billion in 2023 and is projected to grow significantly in the coming years, reflecting this strong societal trend.

Health Consciousness and Patient Empowerment

The increasing focus on health and wellness, coupled with a growing desire for patients to actively participate in their healthcare decisions, is a significant sociological trend. This shift fuels demand for innovative solutions like wearable health trackers and remote patient monitoring systems. For Cook Group, this presents a prime opportunity to develop and enhance digital health technologies that empower individuals to manage their well-being proactively.

This trend is supported by substantial market growth. For instance, the global digital health market was valued at approximately USD 211 billion in 2023 and is projected to experience a compound annual growth rate (CAGR) of around 16.9% from 2024 to 2030. This expansion highlights the strong consumer interest in tools that facilitate personal health management.

- Growing Health Consciousness: Consumers are increasingly prioritizing preventative care and lifestyle management, driving demand for health-related products and services.

- Patient Empowerment: Patients are seeking greater control over their health data and treatment plans, leading to a rise in self-monitoring and personalized medicine approaches.

- Digital Health Adoption: The widespread use of smartphones and the increasing affordability of wearable devices are accelerating the adoption of digital health solutions.

- Market Opportunity: Cook Group can leverage this by investing in R&D for connected devices, AI-driven health insights, and platforms that support remote patient engagement.

Healthcare Accessibility and Equity

Societal concerns regarding healthcare accessibility and equity are increasingly prominent, especially in regions with limited resources. For instance, in 2024, the World Health Organization highlighted that over 400 million people globally still lack access to essential healthcare services, a figure that underscores the urgency of addressing these disparities. This societal pressure can directly shape government policies and influence market demand for innovative healthcare solutions.

Cook Group, with its focus on improving patient care worldwide, is well-positioned to respond to these societal needs. By developing technologies such as teleoperated surgery systems, which allow specialists to perform procedures remotely, Cook Group can help bridge geographical gaps in healthcare access. Furthermore, the company's commitment to creating more cost-effective medical devices can make advanced treatments accessible to a broader population, directly addressing the equity concerns prevalent in many markets.

- Global Healthcare Gap: Approximately 400 million individuals worldwide lack access to essential healthcare services as of 2024, according to the WHO.

- Telemedicine Growth: The global telemedicine market was valued at over $100 billion in 2023 and is projected to grow significantly, indicating a strong demand for remote healthcare solutions.

- Cost-Conscious Innovation: A significant portion of healthcare spending, particularly in emerging economies, is directed towards more affordable and efficient medical technologies.

Societal shifts toward preventative care and patient empowerment are driving demand for health-focused technologies. As individuals take more control of their well-being, Cook Group can capitalize on this by innovating in areas like remote monitoring and personalized health solutions. The global digital health market, valued at approximately USD 211 billion in 2023, demonstrates this significant consumer interest in proactive health management.

Technological factors

Artificial intelligence and machine learning are rapidly transforming healthcare, enabling earlier and more precise diagnosis of diseases. For instance, AI algorithms are showing significant promise in improving the accuracy of medical imaging analysis, potentially leading to faster identification of conditions like cancer. Cook Group can integrate these AI capabilities into its medical devices, enhancing diagnostic accuracy and patient outcomes.

The application of AI in healthcare operations extends to predictive analytics, which can optimize hospital workflows and resource allocation. Cook Group's medical devices, particularly those involved in patient monitoring or data collection, could benefit from AI-driven insights to anticipate patient needs and improve operational efficiency. This integration could lead to substantial cost savings and improved patient care pathways.

The surge in telemedicine and remote patient monitoring, fueled by the Internet of Medical Things (IoMT) and wearable technology, offers substantial avenues for Cook Group. These advancements facilitate continuous health tracking and at-home care, directly supporting the shift towards data-centric and distributed healthcare models.

By 2024, the global IoMT market was projected to reach over $200 billion, with wearables accounting for a significant portion. This growth underscores the increasing patient and provider acceptance of technology for managing health outside traditional clinical settings.

Innovations in 3D printing are revolutionizing healthcare, enabling highly personalized and efficient solutions. This technology significantly cuts costs and development time for medical devices, with the global 3D printing market in healthcare projected to reach $6.7 billion by 2027.

Cook Group can leverage these advanced manufacturing techniques to produce custom implants and medical devices, directly improving patient outcomes and optimizing production processes. For instance, 3D printed surgical guides can enhance precision in complex procedures.

Digitalization of Healthcare and Data Connectivity

The healthcare industry's rapid digitalization, marked by the widespread adoption of electronic health records (EHRs) and an explosion of connected medical devices, presents both opportunities and significant challenges for Cook Group. This trend demands sophisticated data management capabilities and stringent cybersecurity measures to protect sensitive patient information. For instance, by 2024, the global digital health market was valued at over $200 billion, underscoring the scale of this transformation.

Cook Group must ensure its product portfolio and internal systems are not only secure but also seamlessly capable of transmitting confidential medical data. Cybersecurity is paramount, with regulators increasingly scrutinizing data protection practices. Failure to maintain robust security can lead to substantial financial penalties and reputational damage.

- EHR Adoption: Over 90% of US hospitals had adopted certified EHR technology by 2023, increasing the volume of digital health data.

- Connected Medical Devices: The number of Internet of Medical Things (IoMT) devices is projected to reach 30 billion by 2025, highlighting the growing need for secure data transmission.

- Cybersecurity Investment: Healthcare organizations are significantly increasing their cybersecurity budgets, with many allocating over 10% of their IT spending to security initiatives in 2024.

- Regulatory Focus: Regulatory bodies like the FDA continue to emphasize cybersecurity requirements for medical devices, impacting product development and lifecycle management.

Research and Development (R&D) Focus

Cook Group's dedication to innovation necessitates ongoing investment in research and development to introduce novel products and maintain the relevance of its existing portfolio. This commitment is crucial for staying ahead in the dynamic medical technology sector.

Targeted R&D spending is strategically directed towards burgeoning technologies such as robotics, advanced imaging techniques, and miniaturization. These areas are pivotal for Cook Group to maintain its competitive edge and effectively address evolving, unmet customer needs in healthcare.

- R&D Investment: While specific figures for Cook Group's 2024/2025 R&D expenditure are proprietary, the company consistently prioritizes innovation, as evidenced by its sustained product development pipeline.

- Robotics in Surgery: The global surgical robotics market was valued at approximately $7.2 billion in 2023 and is projected to grow significantly, underscoring the importance of Cook's investment in this area.

- Advanced Imaging: Innovations in medical imaging, including AI-driven diagnostics and enhanced visualization tools, are key areas where R&D can yield substantial competitive advantages.

- Miniaturization Trends: The drive towards smaller, less invasive medical devices, particularly in areas like interventional cardiology and endoscopy, demands significant R&D in micro-engineering and materials science.

Technological advancements in artificial intelligence and machine learning are significantly enhancing diagnostic precision and operational efficiency within healthcare. Cook Group can integrate these AI capabilities into its medical devices, improving patient outcomes and optimizing hospital workflows.

The growth of telemedicine and the Internet of Medical Things (IoMT), with the global IoMT market projected to exceed $200 billion by 2024, presents opportunities for continuous health tracking and remote patient monitoring. Cook Group's devices can leverage these trends to support distributed healthcare models.

Innovations in 3D printing are enabling personalized medical devices and reducing development costs, with the healthcare 3D printing market expected to reach $6.7 billion by 2027. Cook Group can utilize these techniques for custom implants and surgical guides.

The digitalization of healthcare, including the widespread adoption of EHRs and connected devices, necessitates robust data management and cybersecurity. By 2024, the digital health market was valued at over $200 billion, highlighting the critical need for secure data transmission and protection for Cook Group.

Legal factors

Cook Group operates under a complex web of medical device regulations, notably the U.S. Food and Drug Administration (FDA) framework and the European Union's Medical Device Regulation (MDR). These stringent requirements, including those updated in 2024, mandate rigorous clinical data, detailed technical documentation, and robust post-market surveillance for all products.

Navigating these evolving legal landscapes is paramount. For instance, the EU MDR, fully in effect, has increased the scrutiny on device classification and clinical evidence, impacting market entry timelines and costs for manufacturers like Cook Group. Non-compliance can lead to significant penalties and market withdrawal, underscoring the critical nature of adherence.

Cook Group, like all medical device manufacturers, operates under stringent product liability laws. These laws hold the company accountable for any harm caused by its products if they are found to be defective. For instance, in 2024, the medical device industry saw continued scrutiny and litigation surrounding device safety, with significant settlements often occurring for cases involving alleged design or manufacturing flaws.

To navigate these risks, Cook Group must maintain robust quality management systems and comprehensive risk management protocols. This involves meticulous testing, adherence to regulatory standards, and a proactive approach to identifying and addressing potential safety issues before they lead to patient harm or legal challenges. Continuous vigilance is key to mitigating these legal exposures.

Cook Group faces increasing legal scrutiny regarding data privacy and cybersecurity, particularly with its expanding portfolio of connected medical devices and digital health solutions. Compliance with regulations like HIPAA in the US and GDPR in Europe is paramount, carrying significant penalties for breaches. For instance, in 2023, healthcare organizations faced an average of $10.1 million in costs per data breach, highlighting the financial and reputational risks.

The evolving landscape of cybersecurity laws necessitates robust legal frameworks to protect sensitive patient data and the integrity of medical device networks. Cook Group must continually adapt its legal strategies to address emerging threats and ensure adherence to stringent data protection standards, a critical aspect of maintaining trust and operational continuity in the digital health era.

Intellectual Property Rights and Patents

Protecting its innovations through intellectual property rights, such as patents, is crucial for Cook Group's competitive advantage in the medical device industry. Legal frameworks surrounding patent registration, enforcement, and defense are vital for safeguarding its significant R&D investments and preventing unauthorized use of its proprietary technologies.

Cook Group actively manages its patent portfolio to secure market exclusivity for its groundbreaking medical devices and technologies. For instance, the medical device industry, as a whole, saw a significant number of patent applications filed in 2023, reflecting the intense innovation and the need for IP protection. In 2024, the company will continue to navigate evolving patent laws globally, including those in key markets like the United States and Europe, to maintain its technological leadership.

- Patent Protection: Securing patents for novel medical devices and manufacturing processes is paramount for Cook Group's market position.

- R&D Safeguard: Legal IP frameworks are essential to protect substantial investments made in research and development.

- Enforcement & Defense: Robust strategies for enforcing patent rights and defending against infringement claims are critical to prevent competitive erosion.

- Global Landscape: Navigating varying international patent laws and regulations is key to maintaining a worldwide competitive edge.

Anti-Kickback and Anti-Corruption Laws

As a global entity, Cook Group navigates a complex web of anti-kickback and anti-corruption legislation, including the U.S. Anti-Kickback Statute and the Foreign Corrupt Practices Act (FCPA). These regulations are critical for maintaining ethical business practices across all its international operations.

Non-compliance, such as offering improper payments or incentives to healthcare professionals, can trigger severe financial penalties and significant damage to Cook Group's reputation. For instance, the U.S. Department of Justice has pursued numerous FCPA cases, imposing billions in fines on companies for bribery and corruption in recent years, underscoring the high stakes involved.

- Global Reach, Local Laws: Cook Group's operations span numerous countries, each with its own anti-corruption statutes and enforcement priorities.

- FCPA Enforcement: The FCPA, in particular, has seen robust enforcement, with significant fines levied against companies for violations related to payments to foreign officials.

- Reputational Risk: Allegations or proven violations of anti-kickback laws can erode trust with patients, healthcare providers, and regulatory bodies, impacting market access and partnerships.

- Compliance Programs: Robust internal compliance programs are essential to prevent, detect, and remediate potential violations, mitigating legal and financial exposure.

Cook Group's legal obligations extend to product liability, demanding rigorous adherence to safety standards to prevent harm. The medical device sector in 2023 and 2024 faced continued litigation and regulatory scrutiny, with companies often settling for millions in cases of alleged design or manufacturing defects, underscoring the critical need for robust quality and risk management systems.

The company must also navigate evolving data privacy and cybersecurity laws, such as HIPAA and GDPR, especially with its growing digital health offerings. Data breaches in the healthcare sector in 2023 averaged over $10 million in costs, highlighting the financial and reputational risks associated with inadequate protection of sensitive patient information.

Intellectual property law is crucial for Cook Group to protect its innovations and maintain a competitive edge. The medical device industry saw a surge in patent applications in 2023, reflecting intense innovation and the necessity of IP protection, with global patent laws continuing to evolve in 2024.

Furthermore, Cook Group must comply with anti-kickback and anti-corruption statutes like the FCPA, with enforcement actions in recent years resulting in billions in fines for companies globally, emphasizing the importance of strong internal compliance programs to mitigate significant legal and reputational damage.

| Legal Area | Key Regulations/Statutes | 2023-2024 Data/Trends | Impact on Cook Group |

|---|---|---|---|

| Product Liability | FDA Regulations, EU MDR | Continued litigation, settlements in millions for device defects | Need for robust quality and risk management systems |

| Data Privacy & Cybersecurity | HIPAA, GDPR | Healthcare data breaches cost average over $10M in 2023 | Mandatory compliance for digital health solutions, significant breach penalties |

| Intellectual Property | Patent Laws (Global) | Increased patent applications in medical devices (2023) | Protection of R&D investments, market exclusivity |

| Anti-Corruption | FCPA, Anti-Kickback Statute | Billions in fines for global companies for violations | Strict adherence to ethical practices, robust compliance programs essential |

Environmental factors

Cook Group is making significant strides in environmental responsibility, having recently finalized a comprehensive 10-year Decarbonization Strategy. This initiative underscores their commitment to reducing their global carbon footprint.

Key to this strategy are substantial investments in renewable energy infrastructure. For instance, Cook Group is implementing solar arrays and heat pumps at its manufacturing facilities. These investments are designed to boost operational efficiency and directly offset carbon emissions, aligning with broader sustainability goals.

Cook Group is actively engaged in robust waste management and recycling initiatives, reflecting a commitment to environmental stewardship. The company prioritizes minimizing waste generated from its manufacturing operations, a crucial aspect given the scale of medical device production.

This commitment extends to their product packaging, where a focus on utilizing recyclable materials is a key strategy. Furthermore, Cook Group actively participates in community-focused electronic waste recycling events, demonstrating a broader approach to responsible end-of-life product management.

Cook Group is actively working towards sustainable sourcing and ethical supply chain management to lessen its environmental footprint. This commitment involves a thorough evaluation of suppliers and encouraging them to reduce their carbon emissions and enhance biodiversity within their operations.

In 2024, Cook Group's initiatives included engaging with over 75% of its key suppliers to assess their environmental performance, with a focus on reducing greenhouse gas emissions. The company aims for a 15% reduction in Scope 3 emissions by 2028, a target that heavily relies on supplier collaboration.

Energy Efficiency and Renewable Energy Adoption

Cook Group is actively pursuing improved energy efficiency and greater adoption of renewable energy sources as core environmental objectives. This commitment is evidenced by their ISO 14001 certification at multiple European facilities, with ongoing efforts to extend this to U.S. manufacturing sites. These certifications underscore a systematic approach to managing environmental impacts.

The company's focus on sustainability aligns with global trends and regulatory pressures. For instance, by 2023, the renewable energy sector saw significant growth, with solar and wind power contributing a larger share to the global energy mix. Cook Group's proactive stance in adopting these practices positions them favorably within an evolving environmental landscape.

- ISO 14001 Certification: Achieved at several European locations, with ongoing implementation in U.S. manufacturing sites.

- Energy Efficiency Initiatives: Ongoing projects aimed at reducing overall energy consumption across operations.

- Renewable Energy Integration: Exploring and implementing renewable energy solutions to power facilities.

Product and Packaging Sustainability

Cook Group is prioritizing product and packaging sustainability, embedding these considerations into the initial design stages. This proactive approach aims to minimize environmental impact across the entire product lifecycle, from creation to disposal.

A key initiative involves optimizing delivery methods to significantly cut down on CO2 emissions. For instance, by consolidating shipments and exploring more fuel-efficient transportation networks, Cook Group is actively working to reduce its carbon footprint in logistics.

Furthermore, the company is committed to using 100% recyclable virgin materials for its product trays and cartons. This move away from non-recyclable or mixed-material packaging is a direct response to growing consumer and regulatory demand for environmentally responsible practices.

- Product Lifecycle Focus: Sustainability is integrated from initial design through to end-of-life considerations.

- Logistics Optimization: Efforts are underway to reduce CO2 emissions associated with product delivery.

- Recyclable Materials Mandate: Product trays and cartons are transitioning to 100% recyclable virgin materials.

- Environmental Impact Reduction: The overarching goal is to lessen the company's overall environmental footprint.

Cook Group's environmental strategy is deeply integrated, focusing on decarbonization and resource efficiency. Their 10-year Decarbonization Strategy, finalized recently, outlines a clear path towards reducing their global carbon footprint. This includes significant investments in renewable energy, such as solar arrays and heat pumps at manufacturing sites, aiming to boost efficiency and offset emissions.

The company is also committed to robust waste management and recycling, with a particular emphasis on product packaging using recyclable materials. By 2024, Cook Group engaged over 75% of its key suppliers to assess environmental performance, targeting a 15% reduction in Scope 3 emissions by 2028 through collaborative efforts.

Cook Group's dedication to sustainability is further demonstrated by its ISO 14001 certification at several European facilities, with expansion to U.S. sites underway, showcasing a systematic approach to environmental impact management. These efforts align with the growing global trend towards sustainability, where renewable energy sources are increasingly contributing to the global energy mix.

| Environmental Initiative | Status/Target | Impact |

| Decarbonization Strategy | Finalized 10-year plan | Reduced global carbon footprint |

| Renewable Energy Investment | Solar arrays, heat pumps deployed | Increased operational efficiency, offset emissions |

| Supplier Engagement | 75% of key suppliers engaged (2024) | Progress towards 15% Scope 3 emission reduction by 2028 |

| ISO 14001 Certification | Achieved in European facilities, expanding to U.S. | Systematic environmental impact management |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cook Group is grounded in comprehensive data from leading market research firms, governmental regulatory bodies, and established financial institutions. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the healthcare industry.