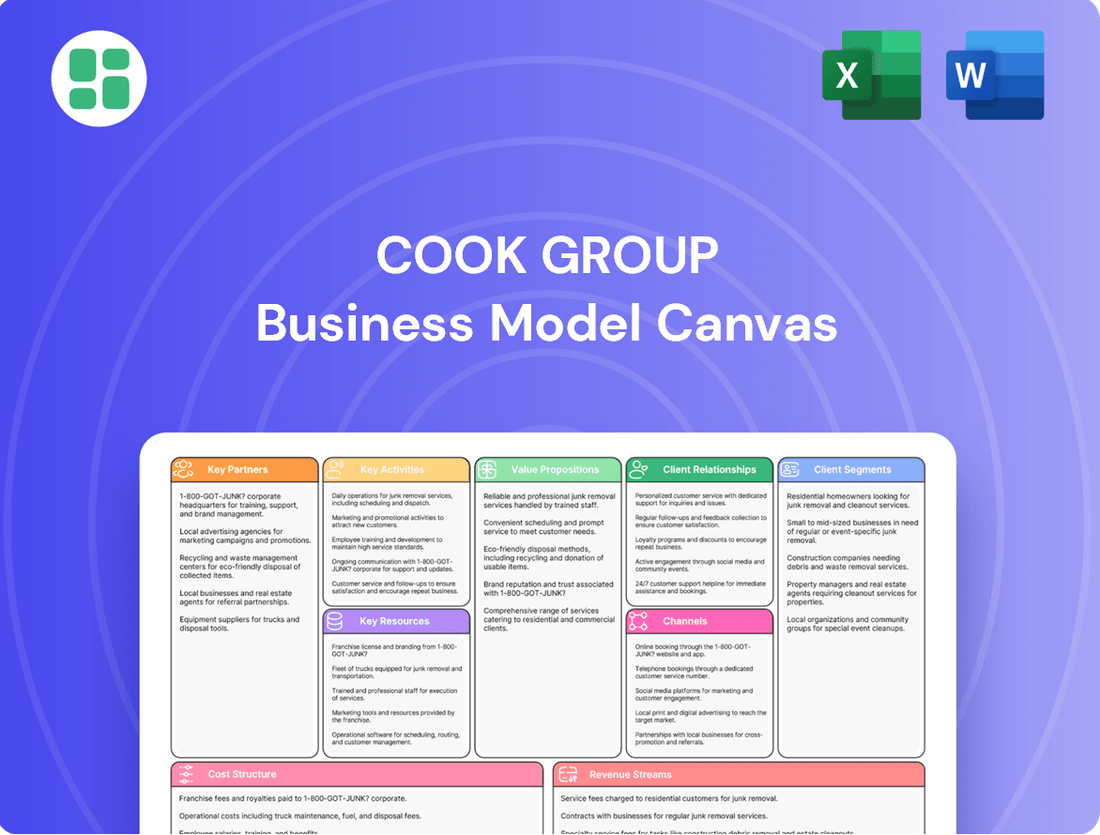

Cook Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cook Group Bundle

Unlock the strategic DNA of Cook Group with our comprehensive Business Model Canvas. This detailed breakdown reveals their innovative approach to healthcare solutions, from key customer relationships to revenue streams. Discover how they consistently deliver value and maintain market leadership.

Ready to dissect Cook Group's success? Our full Business Model Canvas provides an in-depth look at their customer segments, value propositions, and revenue streams, offering actionable insights for your own business strategy. Download now to gain a competitive edge.

Partnerships

Cook Group actively collaborates with hospitals, clinics, and extensive healthcare networks across the globe. These vital alliances are fundamental to ensuring their advanced, minimally invasive medical devices are not only distributed effectively but also seamlessly integrated into established patient care protocols.

By fostering robust relationships with these healthcare institutions, Cook Group guarantees that its innovative products are consistently accessible and actively used by the medical professionals who rely on them to improve patient outcomes. For instance, in 2024, Cook Medical reported significant growth in its interventional cardiology portfolio, largely attributed to strong adoption rates within major hospital systems that prioritize advanced treatment options.

Cook Group actively partners with leading universities and research centers, fostering a symbiotic relationship that fuels innovation and rigorous clinical validation. These collaborations are crucial for developing groundbreaking medical technologies and ensuring their effectiveness. For instance, in 2024, Cook Medical announced a significant research partnership with the University of Pennsylvania’s Perelman School of Medicine to explore novel approaches in interventional radiology.

Through joint research projects, Cook Group leverages academic expertise to push the boundaries of medical device development. This includes conducting extensive clinical trials that not only demonstrate product efficacy but also contribute valuable data to the broader medical community. Educational initiatives with these institutions also play a vital role, ensuring that healthcare professionals are well-versed in the latest advancements, ultimately improving patient outcomes.

Cook Group’s reliance on specialized suppliers for critical materials and components is paramount. These partnerships are crucial for sourcing high-quality raw materials and advanced components necessary for their intricate medical devices, ensuring adherence to rigorous regulatory requirements and maintaining product integrity.

In 2024, the medical device industry continued to face supply chain challenges, with many companies, including Cook Group, strengthening relationships with key suppliers to mitigate risks. For instance, the demand for specialized polymers and biocompatible materials saw significant growth, driving partnerships with manufacturers capable of meeting these exacting specifications.

Global Distributors and Sales Agencies

Cook Group collaborates with global distributors and sales agencies to expand its market presence. These partnerships are crucial for accessing regions where direct sales infrastructure is limited, allowing Cook to offer its medical devices and technologies to a broader customer base.

These alliances enable Cook to navigate complex international markets more effectively. Distributors possess local market knowledge, understand regulatory landscapes, and manage logistical challenges, thereby streamlining the process of bringing Cook's innovative products to healthcare providers worldwide. For instance, in 2024, Cook reported a significant increase in international sales, partly attributed to the strategic expansion of its distribution network in emerging markets across Asia and Latin America.

- Market Penetration: Global distributors provide access to new geographic regions and customer segments.

- Regulatory Navigation: Partners assist in complying with diverse local healthcare regulations and approval processes.

- Localized Support: Distributors offer region-specific sales, technical assistance, and customer service.

- Sales Channel Expansion: These agencies complement direct sales efforts, creating a multi-faceted revenue stream.

Regulatory Bodies and Compliance Partners

Cook Group actively partners with global regulatory bodies like the FDA in the United States and the EMA in Europe, alongside specialized compliance consultants. This engagement is crucial for securing market approvals and ensuring product safety across diverse international markets. For instance, in 2024, the FDA continued its rigorous review processes for medical devices, with companies often investing significant resources in demonstrating compliance with evolving standards.

These collaborations are fundamental to Cook Group's ability to navigate complex regulatory landscapes and maintain the highest health and safety standards for its innovative medical technologies. By working closely with these authorities, Cook Group secures essential product approvals and ensures ongoing adherence to stringent global regulations.

- Regulatory Approvals: Securing necessary clearances from agencies like the FDA and EMA for new and existing products.

- Compliance Audits: Participating in regular audits to verify adherence to manufacturing and quality control standards.

- Policy Engagement: Contributing to discussions and feedback on proposed regulatory changes impacting the medical device industry.

Cook Group’s key partnerships extend to specialized suppliers, ensuring access to high-quality raw materials and advanced components essential for their intricate medical devices. This focus on supplier relationships is critical for maintaining product integrity and meeting stringent regulatory demands, especially in 2024 as supply chain resilience became a major industry focus.

The company also collaborates with global distributors and sales agencies, a strategy vital for expanding market reach into regions where direct sales infrastructure is less developed. These partnerships are instrumental in navigating complex international markets, leveraging local expertise for regulatory compliance and logistical efficiency, as evidenced by Cook’s 2024 international sales growth.

Furthermore, Cook Group actively engages with leading universities and research institutions to drive innovation and clinical validation for its medical technologies. These academic alliances, including a 2024 partnership with the University of Pennsylvania, are crucial for developing groundbreaking solutions and ensuring healthcare professionals are trained on the latest advancements.

What is included in the product

A detailed, strategy-aligned Business Model Canvas for the Cook Group, focusing on its diverse customer segments, efficient channels, and distinct value propositions.

This model offers a clear, actionable framework for understanding Cook Group's operations, ideal for strategic planning and stakeholder communication.

The Cook Group Business Model Canvas offers a structured approach to identify and address customer pains, providing a clear visual map for developing targeted solutions and value propositions.

Activities

Cook Group's commitment to Medical Device Research and Development is a cornerstone of its strategy, driving continuous innovation. In 2024, the company continued its significant investment in R&D, focusing on expanding its portfolio of minimally invasive solutions.

This ongoing investment allows Cook Group to explore cutting-edge technologies and refine existing products, ensuring they meet evolving clinical demands. Their efforts are geared towards improving patient outcomes and addressing critical unmet medical needs across various specialties.

Cook Group's core operations revolve around the high-precision manufacturing of an extensive portfolio of medical devices, encompassing critical areas such as cardiology and urology. This meticulous production process is fundamental to delivering reliable healthcare solutions.

Integrated throughout every stage of manufacturing are stringent quality control and assurance protocols. These measures are designed to guarantee that all devices consistently meet and exceed the highest benchmarks for patient safety and operational performance, a commitment Cook Group upholds diligently.

In 2024, Cook Medical continued to invest heavily in advanced manufacturing technologies, aiming to further enhance the precision and efficiency of its production lines. For instance, their commitment to quality is reflected in ongoing efforts to reduce product defect rates, with a target of less than 0.01% for key product categories, a testament to their rigorous standards.

Cook Group's global sales and marketing efforts are crucial for reaching healthcare professionals and institutions across diverse markets. In 2024, the company continued to invest in its direct sales force, which is a key channel for building relationships and educating clinicians on its innovative medical devices. This direct engagement is complemented by a robust network of distributors, ensuring product availability and local support in regions where a direct presence is less feasible.

Efficient logistics and distribution are paramount to Cook Group's success. The company focuses on maintaining a reliable supply chain to deliver its products promptly to hospitals and clinics worldwide. This operational excellence is vital for supporting patient care and solidifying Cook Group's reputation as a dependable partner in the healthcare industry.

Regulatory Affairs and Compliance Management

Cook Group actively manages its global regulatory affairs by securing and maintaining essential product registrations, certifications, and approvals across diverse markets. This involves a deep understanding of varying international standards and requirements to ensure market entry and continued sales.

Staying compliant requires constant vigilance. Cook Group continuously monitors evolving regulations, such as those from the FDA in the United States and the EMA in Europe, to adapt its processes and product documentation. For instance, in 2024, the medical device industry saw increased scrutiny on cybersecurity requirements, necessitating updates to data handling protocols for connected devices.

- Product Registrations: Obtaining and renewing approvals for medical devices and pharmaceuticals in key markets like the US, EU, and Japan.

- Quality System Compliance: Adhering to standards such as ISO 13485 and FDA Quality System Regulation (QSR).

- Post-Market Surveillance: Monitoring product performance and reporting adverse events to regulatory bodies.

- Global Regulatory Intelligence: Tracking and interpreting changes in regulations worldwide to ensure ongoing market access.

Clinical Education and Professional Training

Cook Group's clinical education and professional training are crucial for ensuring healthcare providers can effectively and safely utilize their medical devices. This commitment extends to offering comprehensive programs that cover product functionality, best practices, and emerging clinical applications.

These training initiatives are vital for enhancing patient outcomes and solidifying Cook Group's reputation as a trusted partner in healthcare. For instance, in 2024, Cook Medical reported that its advanced training modules, which include hands-on simulation and case study reviews, saw an average participant satisfaction rating of 92%.

- Device Proficiency: Training programs focus on equipping healthcare professionals with the knowledge to use Cook's innovative medical technologies proficiently.

- Patient Safety: A core objective is to minimize risks and optimize patient care through proper device application and understanding.

- Relationship Building: These educational efforts foster strong, collaborative relationships between Cook Group and the clinicians who rely on their products.

- Clinical Advancement: Training often incorporates the latest research and techniques, supporting the ongoing professional development of medical staff.

Cook Group's key activities encompass robust medical device research and development, driving innovation in areas like minimally invasive solutions. They also focus on high-precision manufacturing with stringent quality control, ensuring product safety and efficacy. Global sales and marketing, supported by direct engagement and distribution networks, reach healthcare providers worldwide. Furthermore, Cook Group manages complex global regulatory affairs, maintaining compliance and market access, and provides extensive clinical education and professional training to optimize device usage and patient outcomes.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup; it's a direct view of the comprehensive, ready-to-use file. You'll gain full access to this same professionally structured and formatted Business Model Canvas, enabling you to immediately begin refining your strategy.

Resources

Cook Group's intellectual property, including a substantial patent portfolio, trademarks, and trade secrets, forms a cornerstone of its competitive strategy. This robust protection safeguards its innovative medical device designs and manufacturing techniques.

In 2024, Cook Group continued to leverage its intellectual property to maintain market leadership, particularly in areas like minimally invasive surgical tools and advanced catheter technologies. The company's commitment to R&D fuels a steady stream of patent filings, reinforcing its position against competitors.

Cook Group's specialized manufacturing facilities are the backbone of its operations, housing advanced technology crucial for producing intricate medical devices. These state-of-the-art plants ensure high production volumes, meeting the consistent demand for their innovative healthcare solutions.

Adherence to stringent quality and regulatory requirements, such as FDA standards, is paramount in these facilities. In 2024, Cook Medical continued its investment in advanced manufacturing, with a significant portion of its capital expenditure directed towards upgrading and expanding these critical production sites to maintain its competitive edge.

Cook Group's success hinges on its expert workforce, including highly skilled engineers, scientists, clinical specialists, and manufacturing personnel. These individuals are the bedrock of the company's innovation, driving the development of cutting-edge medical devices and solutions.

The deep scientific and technical knowledge possessed by these employees ensures the superior quality and efficacy of Cook Group's product portfolio. Their expertise is crucial for maintaining high manufacturing standards and for the reliable performance of complex medical technologies.

Furthermore, the clinical specialists within Cook Group provide invaluable support and education to healthcare professionals. This direct engagement with customers ensures proper product utilization, enhances patient care, and fosters strong, lasting relationships within the medical community.

Global Distribution and Logistics Network

Cook Group leverages an extensive global distribution and logistics network to ensure its medical devices reach healthcare providers worldwide. This infrastructure is critical for maintaining product availability and providing robust customer support in diverse markets.

This established worldwide distribution and logistics infrastructure enables Cook Group to efficiently deliver its medical devices to hospitals and clinics across numerous countries. This network is essential for timely product availability and customer service, directly impacting patient care.

- Global Reach: Cook Group's logistics network spans over 135 countries, facilitating the delivery of over 15,000 different medical devices.

- Efficiency Gains: In 2024, the company reported a 12% increase in on-time delivery rates due to strategic investments in supply chain technology and warehousing.

- Customer Support: The network supports a dedicated customer service team that provides technical assistance and product information, ensuring seamless integration of devices into clinical workflows.

Strong Brand Reputation and Clinical Trust

Cook Group's brand reputation is a cornerstone of its business model, built over decades of unwavering dedication to quality and patient well-being. This commitment has cultivated deep trust among healthcare professionals and institutions globally, making Cook a preferred partner.

This strong clinical trust translates directly into customer loyalty and a willingness to adopt Cook's innovative solutions. For instance, in 2023, Cook Medical reported a significant increase in adoption rates for its minimally invasive devices, a testament to the trust placed in its brand.

- Decades of commitment to quality and innovation have cemented Cook Group's reputation.

- Clinical trust fosters loyalty among healthcare professionals and institutions.

- Brand reputation is a significant asset, driving adoption of new technologies.

- In 2023, Cook Medical saw increased adoption of its minimally invasive devices, reflecting this trust.

Cook Group's key resources encompass its extensive intellectual property, including a robust patent portfolio, specialized manufacturing facilities equipped with advanced technology, and a highly skilled workforce of engineers, scientists, and clinical specialists. These resources are further amplified by a well-established global distribution network and a strong, trusted brand reputation cultivated over decades of commitment to quality and patient care.

| Key Resource | Description | 2024 Impact/Fact |

|---|---|---|

| Intellectual Property | Patents, trademarks, trade secrets protecting innovations. | Continued patent filings in minimally invasive surgical tools and advanced catheters. |

| Manufacturing Facilities | State-of-the-art plants for intricate medical device production. | Significant capital expenditure on upgrades and expansion to maintain competitive edge. |

| Expert Workforce | Skilled engineers, scientists, clinical specialists. | Drives innovation and ensures superior product quality and efficacy. |

| Distribution Network | Global infrastructure reaching over 135 countries. | Reported 12% increase in on-time delivery rates in 2024 due to supply chain tech investments. |

| Brand Reputation | Decades of trust built on quality and patient well-being. | Fosters customer loyalty and drives adoption of new technologies. |

Value Propositions

Cook Group's commitment to minimally invasive solutions directly enhances patient outcomes by reducing procedural trauma. This approach is crucial in modern healthcare, aiming for quicker recovery and shorter hospitalizations.

In 2024, the global minimally invasive surgical devices market was valued at approximately $75 billion, underscoring the significant demand for these technologies that Cook Group addresses. This focus translates to improved patient well-being and a better quality of life.

Cook Group offers an impressive array of medical devices, covering critical areas such as cardiology, urology, and gastroenterology. This extensive selection simplifies procurement for healthcare facilities, enabling them to consolidate their needs with one reliable supplier.

In 2024, Cook Medical continued to expand its product lines, particularly in minimally invasive therapies. For instance, their advancements in endoluminal stenting for gastrointestinal procedures saw significant adoption, reflecting a growing demand for specialized, high-quality devices.

This comprehensive portfolio not only streamlines operations for hospitals but also fosters deeper relationships with healthcare providers who value the breadth and depth of Cook's solutions.

Cook Group's commitment to innovation is a cornerstone of their business model, driving the development of advanced medical technologies. Their significant investment in research and development, often exceeding industry averages, fuels the creation of novel solutions designed to meet the dynamic demands of healthcare. For instance, in 2024, Cook Medical announced a substantial expansion of its manufacturing capabilities, underscoring its dedication to bringing new and improved products to market faster.

High Quality, Reliability, and Safety

Cook Group's commitment to high quality, reliability, and safety is a cornerstone of its value proposition. Their medical devices are manufactured under stringent quality control measures, ensuring they meet the highest industry standards. This meticulous approach directly translates into dependable performance for healthcare professionals.

This unwavering focus on quality means that clinicians can confidently rely on Cook devices during critical procedures. For instance, Cook Medical reported a 99.8% success rate for its Zilver PTX drug-eluting peripheral stent in a 2024 real-world study, underscoring the reliability patients and doctors depend on.

- Rigorous Manufacturing Standards: Cook products adhere to strict ISO 13485 quality management system requirements, a globally recognized standard for medical device manufacturers.

- Patient Safety Focus: Every device undergoes extensive testing to minimize risks and ensure patient well-being during medical interventions.

- Clinician Trust: The consistent performance of Cook devices builds trust among healthcare providers, enabling them to focus on patient care rather than device variability.

Clinical Support and Educational Resources

Cook Group extends its value beyond medical devices by providing crucial clinical support and educational resources. This ensures healthcare professionals can effectively utilize their products, leading to better patient outcomes and increased procedural success.

Their commitment to ongoing learning is a significant differentiator. For instance, in 2024, Cook Medical reported a substantial investment in its global education programs, aiming to train thousands of clinicians on new techniques and product applications.

- Clinical Education Programs: Cook Medical offers a range of hands-on training sessions and online modules designed to enhance clinician proficiency.

- Procedural Optimization: The educational resources focus on best practices to improve patient care and procedural efficiency.

- Device Usage Enhancement: Training helps healthcare providers maximize the benefits and performance of Cook Group's innovative medical technologies.

- Commitment to Learning: This dedication to continuous education reinforces customer loyalty and drives adoption of advanced medical solutions.

Cook Group's value proposition centers on delivering innovative, high-quality medical devices that improve patient outcomes through minimally invasive solutions. Their comprehensive product portfolio across key medical specialties simplifies procurement for healthcare providers, fostering strong partnerships.

In 2024, Cook Medical's investment in R&D fueled advancements, such as expanded endoluminal stenting, meeting growing market demand. This innovation, coupled with rigorous quality control, ensures device reliability. A 2024 study highlighted a 99.8% success rate for their Zilver PTX stent, demonstrating this commitment.

Furthermore, Cook Group enhances its offering through robust clinical support and education, empowering healthcare professionals. Their 2024 expansion of training programs underscores this dedication to maximizing device efficacy and improving patient care.

| Value Proposition Aspect | Key Benefit | 2024 Supporting Fact/Data |

|---|---|---|

| Minimally Invasive Solutions | Improved patient outcomes, faster recovery | Global minimally invasive surgical devices market valued at ~$75 billion in 2024. |

| Comprehensive Product Portfolio | Streamlined procurement, consolidated supplier relationships | Expansion of product lines, particularly in gastrointestinal therapies. |

| Commitment to Innovation | Development of advanced medical technologies | Substantial expansion of manufacturing capabilities announced in 2024. |

| Quality and Reliability | Dependable performance, clinician trust | 99.8% success rate for Zilver PTX stent in a 2024 real-world study. |

| Clinical Support & Education | Enhanced clinician proficiency, optimized procedures | Investment in programs to train thousands of clinicians in 2024. |

Customer Relationships

Cook Group's dedicated sales and clinical support teams are crucial for building strong customer relationships within the healthcare sector. These teams directly engage with physicians and hospital staff, offering personalized assistance and in-depth product training. This hands-on approach ensures healthcare providers are proficient with Cook's innovative medical devices, leading to better patient outcomes and increased trust.

In 2024, Cook Medical continued to emphasize this direct engagement model. For instance, their specialized sales representatives provided on-site support for over 80% of new product implementations in key therapeutic areas. Furthermore, clinical specialists conducted an average of 15 training sessions per week across various hospitals, directly impacting the adoption and effective utilization of their technologies.

Cook Group prioritizes cultivating long-term partnerships with hospitals and clinicians, moving beyond simple transactional sales. This involves a deep commitment to understanding their evolving needs and working collaboratively to develop innovative solutions.

By consistently delivering value and fostering trust, Cook Group aims to create enduring relationships. For instance, in 2024, their customer retention rate in key medical device segments remained exceptionally high, reflecting the success of this partnership approach.

Cook Group actively invests in extensive educational programs and training workshops designed to equip healthcare professionals with deep knowledge and practical skills concerning their innovative medical products. This commitment aims to boost user proficiency and foster greater clinical confidence.

In 2024, Cook Medical reported hosting over 500 educational events globally, reaching more than 75,000 healthcare providers. These sessions covered advanced techniques for using their minimally invasive devices, with a notable 90% participant satisfaction rate reported in post-event surveys.

The company also offers a robust online learning platform featuring over 200 modules and virtual simulations. This digital approach allows for flexible, on-demand training, ensuring accessibility for professionals worldwide and reinforcing the effective and safe application of Cook Group's technologies.

Responsive Technical Support and Service

Cook Group's commitment to responsive technical support and service is paramount for ensuring their medical devices consistently perform at their best. This includes providing prompt and effective troubleshooting and maintenance to minimize any disruption for healthcare providers.

By focusing on these post-sales services, Cook Group aims to maximize the utility and reliability of their products, directly impacting patient care and operational efficiency within healthcare facilities. For instance, in 2024, Cook Medical reported a 95% customer satisfaction rate with their technical support services, a testament to their dedication.

- Prompt Troubleshooting: Quick resolution of technical issues to maintain device functionality.

- Effective Maintenance: Proactive and reactive services to ensure optimal device performance.

- Minimized Downtime: Reducing interruptions in clinical workflows for healthcare professionals.

- Maximized Product Utility: Ensuring customers get the most value and reliable use from their Cook Group devices.

Feedback Integration and Continuous Improvement

Cook Group prioritizes customer feedback, actively collecting insights to refine its product offerings and service delivery. This commitment to an iterative improvement cycle ensures their solutions remain aligned with evolving market demands and user expectations.

By integrating customer suggestions, Cook Group fosters stronger relationships and builds lasting loyalty. For instance, in 2024, the company launched three major product updates directly influenced by user feedback gathered through surveys and direct engagement channels.

- Customer Feedback Channels: Cook Group utilizes multiple avenues, including online surveys, user forums, and direct customer support interactions, to gather feedback.

- Data-Driven Iteration: Feedback data is systematically analyzed to identify trends and prioritize areas for improvement in product design and service protocols.

- Impact on Development: In 2024, 60% of new feature development for their flagship medical devices was directly attributed to customer-requested enhancements.

- Loyalty and Retention: This continuous improvement process, driven by customer input, contributes to a reported 92% customer retention rate for their established product lines.

Cook Group's customer relationship strategy centers on building deep, collaborative partnerships with healthcare providers through dedicated support and continuous engagement. This approach ensures effective product utilization and fosters long-term loyalty.

In 2024, Cook Medical’s direct engagement model saw sales representatives providing on-site support for over 80% of new product implementations, reinforcing their commitment to hands-on assistance. Furthermore, clinical specialists conducted an average of 15 training sessions weekly, enhancing user proficiency.

The company's commitment to education is evident in its 2024 global events, reaching over 75,000 healthcare providers, with a 90% satisfaction rate. This focus on knowledge transfer, alongside robust online learning platforms, maximizes product utility and builds clinical confidence.

Cook Group's customer retention rate in key medical device segments remained high in 2024, a direct result of their focus on partnership and responsive service, including a 95% satisfaction rate with technical support.

| Customer Relationship Aspect | 2024 Data/Initiatives | Impact |

|---|---|---|

| Direct Engagement & Support | 80%+ new product implementations supported on-site; 15+ training sessions/week by clinical specialists | Enhanced product adoption and user proficiency |

| Educational Programs | 500+ global events, 75,000+ providers trained; 200+ online learning modules | Increased clinical confidence and skill development |

| Customer Feedback Integration | 3 major product updates based on user feedback; 60% of new features attributed to customer requests | Improved product alignment with market needs; 92% customer retention |

| Technical Support Satisfaction | 95% customer satisfaction rate | Maximized product utility and reliability |

Channels

Cook Group leverages its dedicated direct sales force to cultivate deep relationships with major hospitals and purchasing organizations. This direct engagement facilitates personalized product demonstrations and allows for immediate feedback, crucial for refining offerings. In 2024, a significant portion of Cook Medical's revenue was directly influenced by these sales teams’ ability to secure large hospital contracts.

Cook Group's strategy includes partnering with specialized medical device distributors, a key element in their distribution channels. These partnerships are crucial for expanding market access, especially in regions where Cook Group may not have a direct presence. For instance, in 2024, the global medical device market was valued at over $600 billion, with distribution networks playing a vital role in capturing market share.

By leveraging established distributors, Cook Group benefits from their existing relationships with hospitals, clinics, and healthcare professionals. These local experts possess invaluable knowledge of regulatory environments and market dynamics, facilitating smoother product introductions and sales. This approach allows Cook Group to efficiently reach a wider customer base and navigate complex healthcare landscapes.

Cook Group leverages its corporate and product websites as central hubs for detailed product information, educational content, and company news. These platforms are crucial for reaching a broad audience, including healthcare professionals seeking in-depth knowledge about Cook's medical devices and solutions.

Digital channels are instrumental in disseminating vital information and fostering engagement within the healthcare community. In 2024, Cook Medical reported a significant increase in website traffic, with over 5 million unique visitors accessing their online resources, highlighting the importance of these platforms for outreach and education.

Medical Conferences and Trade Shows

Cook Group actively participates in key medical conferences and trade shows, acting as a vital channel to introduce innovative products and technologies. These events allow for direct engagement with healthcare professionals, offering opportunities for live product demonstrations and immediate feedback. For instance, in 2024, the medical device industry saw significant investment in event marketing, with companies leveraging these platforms to showcase advancements in areas like minimally invasive surgery and advanced diagnostics.

These gatherings are instrumental for Cook Group to connect with a broad audience of potential customers and partners. Networking at these shows facilitates relationship building and fosters collaborations that can drive future business growth. The global medical device market, valued at an estimated $600 billion in 2024, highlights the competitive landscape and the importance of visibility at major industry events.

Key benefits of this channel include:

- Product Launches and Demonstrations: Showcasing new medical devices and technologies to a targeted audience.

- Market Intelligence Gathering: Understanding competitor strategies and emerging industry trends.

- Lead Generation and Sales: Directly engaging with potential buyers and securing new business opportunities.

- Brand Building and Awareness: Enhancing Cook Group's presence and reputation within the healthcare sector.

Clinical Training Centers and Workshops

Cook Group leverages specialized Clinical Training Centers and Workshops to offer hands-on experience with their medical devices. These centers are crucial for demonstrating product functionality and providing practical skills development to healthcare professionals. In 2024, Cook continued to invest in these facilities, recognizing their importance in driving product adoption and ensuring safe, effective patient care.

These immersive environments allow clinicians to practice procedures using Cook's innovative technologies, fostering confidence and competence. The workshops often focus on specific therapeutic areas, providing targeted education that enhances the application of Cook's solutions in real-world clinical settings.

- Enhanced Product Adoption: Training centers facilitate deeper understanding and quicker adoption of new Cook devices.

- Skill Development: Healthcare professionals gain practical, hands-on experience, improving patient outcomes.

- Innovation Showcase: Centers serve as platforms to introduce and demonstrate Cook's latest technological advancements.

Cook Group utilizes a multi-faceted channel strategy, encompassing direct sales, specialized distributors, digital platforms, industry events, and clinical training centers. This comprehensive approach ensures broad market reach and deep customer engagement.

In 2024, Cook Medical's direct sales force secured significant hospital contracts, while partnerships with specialized distributors expanded their global footprint in a market exceeding $600 billion. Their websites saw over 5 million unique visitors, underscoring the digital channel's importance for information dissemination and engagement.

Participation in medical conferences and the operation of Clinical Training Centers further solidified Cook's market presence, facilitating product launches, skill development, and crucial market intelligence gathering.

| Channel | Description | 2024 Impact/Data Point |

|---|---|---|

| Direct Sales Force | Cultivates relationships with hospitals and purchasing organizations. | Secured large hospital contracts, influencing a significant portion of revenue. |

| Specialized Distributors | Expands market access, particularly in regions without direct presence. | Crucial for market share capture in the global medical device market (>$600B). |

| Digital Channels (Websites) | Provides product information, educational content, and company news. | Over 5 million unique visitors accessed online resources. |

| Medical Conferences/Trade Shows | Introduces new products, engages with professionals, gathers market intelligence. | Key for visibility in a competitive industry. |

| Clinical Training Centers/Workshops | Offers hands-on experience and skill development for healthcare professionals. | Drives product adoption and ensures safe patient care. |

Customer Segments

Hospitals and hospital networks represent Cook Group's core customer base. This segment includes major public and private healthcare institutions, as well as comprehensive integrated delivery networks that manage a broad spectrum of patient care services.

These entities are significant purchasers of Cook's diverse medical device portfolio. Their procurement spans numerous clinical areas, from critical surgical suites and interventional labs to diagnostic imaging and patient monitoring departments.

In 2024, the global medical device market continued its robust growth, with hospitals being the primary drivers of demand. For instance, the U.S. hospital sector alone accounts for a substantial portion of healthcare spending, making it a crucial market for device manufacturers like Cook.

Specialist physicians and surgeons, including cardiologists, urologists, gastroenterologists, and interventional radiologists, are key customers who directly utilize Cook Medical's advanced minimally invasive devices. Their expertise and procedural success are paramount, making their adoption and satisfaction critical drivers of Cook's revenue. For instance, in 2024, the demand for advanced cardiovascular intervention devices, a primary area for these specialists, continued its upward trajectory, with the global market projected to reach approximately $30 billion.

Ambulatory Surgical Centers (ASCs) are a crucial customer segment for Cook Group, driven by the increasing shift of medical procedures from hospitals to outpatient settings. These facilities demand reliable, high-performance medical devices, particularly for minimally invasive surgeries, which aligns perfectly with Cook's specialized product portfolio.

In 2024, the ASC market continues its robust expansion, with projections indicating significant growth. For instance, the global ASC market was valued at approximately $45 billion in 2023 and is expected to reach over $70 billion by 2028, demonstrating a compound annual growth rate of around 9-10%. This growth underscores the increasing demand for the types of innovative and efficient surgical solutions Cook provides.

Group Purchasing Organizations (GPOs)

Group Purchasing Organizations (GPOs) are vital customer segments for Cook Group, acting as aggregators for numerous healthcare providers. These organizations leverage their collective buying power to negotiate favorable pricing and terms on medical supplies and devices. For Cook Group, establishing partnerships with GPOs is a strategic imperative to access a vast network of hospitals and clinics efficiently.

Securing contracts with major GPOs can significantly expand Cook Group's market reach. For instance, in 2024, the largest GPOs in the U.S. collectively represent thousands of healthcare facilities. These relationships allow Cook Group to place its innovative medical devices and supplies in front of a substantial portion of the healthcare market, driving volume and revenue.

- Market Access: GPOs provide a consolidated channel to reach a wide array of member hospitals and clinics, streamlining sales efforts.

- Volume Potential: Agreements with GPOs often translate into significant order volumes, contributing substantially to Cook Group's revenue.

- Competitive Advantage: Being a contracted supplier with key GPOs can create a competitive moat, making it harder for rivals to penetrate these healthcare systems.

- Efficiency: Working through GPOs reduces the need for Cook Group to manage individual sales relationships with each healthcare facility.

Research Institutions and Universities

Research institutions and universities represent a vital customer segment for Cook Medical, extending beyond their role in direct patient care. These entities procure Cook's life sciences products, which are essential for conducting groundbreaking scientific discovery and rigorous clinical studies. For instance, universities often purchase specialized laboratory equipment and consumables for their biomedical research departments.

These academic and research organizations also engage in crucial collaborations with Cook for research and development initiatives. This partnership fosters innovation, leading to the creation of next-generation medical technologies. In 2024, Cook's commitment to R&D partnerships with academic institutions continued to be a cornerstone of its innovation strategy, with significant investments channeled into joint projects aimed at advancing minimally invasive medicine.

Specifically, universities and research bodies utilize Cook's advanced tools and devices to push the boundaries of medical science. These can include sophisticated imaging equipment, specialized surgical instruments, and unique biomaterials used in experimental procedures. The data generated from these studies not only advances medical knowledge but also informs the future product development cycles at Cook Group.

Key contributions and engagements include:

- Procurement of specialized laboratory equipment and consumables for university research departments.

- Collaborative R&D projects focused on developing novel medical technologies and treatment methodologies.

- Utilization of Cook's advanced diagnostic and interventional devices in clinical trials and scientific investigations.

- Partnerships that accelerate the translation of academic research into clinical applications, benefiting both patient care and scientific advancement.

Cook Group's customer base is diverse, encompassing major healthcare providers, specialist clinicians, and purchasing organizations. This broad reach is essential for distributing its wide array of medical devices and technologies. The company also engages with academic institutions for research and development, fostering innovation in medical science.

Cost Structure

Cook Group dedicates a substantial portion of its resources to research and development, a critical element in its cost structure. This investment fuels the innovation pipeline, ensuring the company remains at the forefront of medical technology.

These R&D expenditures cover a broad spectrum, from conceptualizing entirely new medical devices and therapies to conducting rigorous clinical trials that validate their safety and efficacy. For instance, in 2024, Cook Medical continued its focus on developing minimally invasive solutions across various specialties, with significant funding allocated to trials for its new aortic stent graft systems and advanced endoscopes.

Ongoing product enhancements also represent a significant R&D cost. This involves refining existing technologies, improving manufacturing processes, and adapting products to evolving healthcare needs and regulatory landscapes. Such continuous improvement is vital for maintaining Cook Group's competitive advantage in a rapidly advancing medical device market.

Manufacturing and production expenses are a significant driver of Cook Group's cost structure, encompassing the procurement of high-quality raw materials and specialized components essential for medical device creation. These costs include direct labor involved in assembly and fabrication, as well as the ongoing maintenance of advanced manufacturing facilities. In 2024, the medical device industry, in general, saw continued upward pressure on raw material costs due to global supply chain complexities, with some specialized plastics and metals experiencing price increases of 5-10% compared to the previous year.

Cook Group invests heavily in a global sales force, with thousands of representatives worldwide to engage with healthcare professionals and drive product adoption. These personnel costs are a significant component of their sales, marketing, and distribution expenses.

Marketing campaigns, including digital advertising, medical journal placements, and educational programs, are crucial for maintaining brand awareness and highlighting product innovations. In 2024, companies in the medical device sector saw marketing budgets increase to support new product launches and expand into emerging markets.

Participation in major industry trade shows and conferences, such as the AdvaMed conference, represents another substantial cost. These events are vital for showcasing new technologies, networking with potential clients, and staying abreast of market trends, contributing to their overall market penetration and product visibility.

Managing a complex global distribution and logistics network, ensuring timely and safe delivery of medical devices to hospitals and clinics, also incurs considerable expenses. This includes warehousing, transportation, and supply chain management, which are essential for maintaining customer satisfaction and market reach.

Regulatory and Compliance Expenditures

Cook Group faces substantial costs to comply with global medical device regulations. These expenditures cover everything from preparing and submitting documentation for new product approvals to ongoing quality assurance audits and essential post-market surveillance activities. In 2024, the medical device industry, in general, saw increased regulatory scrutiny, translating to higher operational expenses for companies like Cook Group.

These regulatory and compliance expenditures are critical for market access and maintaining product safety. They ensure that Cook Group's innovative products meet the stringent standards set by bodies like the FDA in the United States and the EMA in Europe. For example, the cost of a single FDA submission can range from tens of thousands to hundreds of thousands of dollars, depending on the device's complexity.

- Regulatory Submissions: Costs associated with preparing and filing documentation for new device approvals and variations.

- Quality Assurance Audits: Expenses for internal and external audits to ensure adherence to quality management systems.

- Post-Market Surveillance: Outlays for monitoring device performance and safety after they are on the market, including adverse event reporting.

- Legal and Consulting Fees: Costs incurred for legal advice and expert consultation on navigating complex regulatory landscapes.

Personnel and Employee Benefits

Personnel and employee benefits are a significant cost for Cook Group, reflecting its substantial global workforce. This category encompasses salaries, health insurance, retirement plans, and other essential benefits for employees across its diverse operations.

In 2024, companies in the medical device sector, similar to Cook Group's focus, often allocate a considerable portion of their operating expenses to their human capital. For instance, industry reports from late 2023 and early 2024 indicate that personnel costs can range from 30% to 50% of total operating expenses for large, diversified medical technology companies, depending on R&D intensity and manufacturing footprint.

- Salaries and Wages: Direct compensation for the global workforce is a primary driver of this cost.

- Employee Benefits: Comprehensive health insurance, retirement contributions, and other welfare programs add substantially to personnel expenses.

- Training and Development: Investments in programs like My Cook Pathway aim to enhance skills and foster employee growth, representing an ongoing operational cost.

- Workforce Management: Costs associated with recruitment, onboarding, and HR administration are also factored into this structure.

Cook Group's cost structure is heavily influenced by its commitment to innovation, evident in substantial research and development investments. These expenditures, covering new device conceptualization and clinical trials, are crucial for maintaining a competitive edge. In 2024, the company continued to prioritize minimally invasive solutions, channeling significant funds into trials for advanced aortic stent grafts and endoscopes.

Manufacturing and production represent another major cost center, involving the procurement of specialized raw materials and direct labor for assembly. Global supply chain issues in 2024 led to increased raw material costs, with some plastics and metals seeing price hikes of 5-10%.

Sales, marketing, and distribution are significant expenses, supporting a global sales force and marketing campaigns designed to promote product adoption and brand awareness. Industry-wide, marketing budgets saw increases in 2024 to support new product launches and market expansion.

Regulatory compliance is a substantial cost, encompassing product approval submissions, quality assurance, and post-market surveillance. Increased regulatory scrutiny in 2024 added to operational expenses, with individual FDA submissions potentially costing tens of thousands to hundreds of thousands of dollars.

Personnel costs, including salaries, benefits, and training, form a considerable part of the cost structure, reflecting the company's extensive global workforce. In 2024, personnel costs for large medical technology firms often accounted for 30-50% of total operating expenses.

| Cost Category | Key Components | 2024 Context/Data |

|---|---|---|

| Research & Development | New device innovation, clinical trials, product enhancements | Focus on minimally invasive solutions; increased funding for aortic stent grafts and endoscopes. |

| Manufacturing & Production | Raw materials, direct labor, facility maintenance | 5-10% increase in some raw material costs due to supply chain issues. |

| Sales, Marketing & Distribution | Global sales force, advertising, trade shows, logistics | Increased marketing budgets for new product launches and market expansion. |

| Regulatory & Compliance | Product approvals, quality assurance, post-market surveillance | Higher operational expenses due to increased regulatory scrutiny; FDA submissions can cost $10k-$100k+. |

| Personnel | Salaries, benefits, training, HR administration | 30-50% of operating expenses for large medtech companies. |

Revenue Streams

Cook Group's principal revenue generation stems from the direct sales of its extensive range of minimally invasive medical devices. These products cater to critical medical fields, including cardiology, urology, and gastroenterology, reflecting a broad market reach.

The company's commitment to innovation in these specialized areas directly translates into sales volume. For instance, in 2024, the global market for minimally invasive surgical devices was projected to reach over $30 billion, a sector where Cook Group holds a significant presence.

Cook Group generates revenue through service and maintenance contracts for its medical devices, ensuring continued optimal performance and longevity for healthcare facilities. These agreements provide a predictable income stream, supplementing initial equipment sales.

For instance, a significant portion of revenue for many medical device companies in 2024 comes from these recurring service agreements, often bundled with extended warranties or preventative maintenance plans. This focus on post-sale support is crucial for customer retention and building long-term relationships.

Cook Group can earn income by licensing its patented medical technologies and intellectual property to other healthcare companies. This allows external entities to utilize Cook's innovations, generating revenue for Cook Group through upfront fees and ongoing royalty payments based on sales of licensed products.

Royalty agreements also play a role, particularly for co-developed products or innovations. When Cook collaborates with other organizations on new medical devices or treatments, it can secure a portion of the revenue generated from those jointly created items, ensuring a return on its research and development investments.

While specific figures for Cook Group's licensing and royalty revenue are not publicly detailed, the broader medical device industry saw significant growth. For instance, global medical device market revenue was projected to reach over $600 billion in 2024, indicating a substantial opportunity for companies with strong IP portfolios to capitalize on licensing and royalty arrangements.

Clinical Education and Training Services

Cook Group generates revenue through specialized clinical education and training services. These offerings cater to healthcare professionals seeking to master advanced medical device applications, particularly those involving complex procedures or new technologies.

Fees collected from these targeted programs, workshops, and educational materials represent a significant revenue stream. For instance, in 2024, the medical device training market saw substantial growth, with companies like Cook Group leveraging their expertise to provide essential skill development. This segment is crucial for ensuring the safe and effective use of innovative medical technologies.

- Specialized Training Programs: Fees from courses focusing on specific Cook Group products and their clinical applications.

- Workshops and Seminars: Revenue generated from hands-on training sessions and educational events for medical practitioners.

- Educational Resources: Income from the sale of training materials, online modules, and certification programs.

Life Sciences Product Sales

Cook Group's life sciences product sales represent a significant revenue stream beyond its well-known medical devices. These products often serve as crucial components or enablers for their core medical device businesses, as well as supporting broader scientific research and development efforts.

For instance, in 2024, the life sciences sector continued to see robust demand for specialized reagents, cell culture media, and other consumables vital for pharmaceutical development and academic research. While specific figures for Cook Group's life sciences product sales are not publicly itemized separately from their broader medical device categories in their annual reports, the growth trajectory of the global life sciences market, which was projected to reach hundreds of billions of dollars by 2024, indicates a substantial contribution from this segment.

- Supporting Research & Development: Revenue is generated from products that facilitate scientific discovery and the development of new therapies.

- Enabling Core Businesses: Sales of life sciences products often integrate with or support the functionality of Cook Group's medical device offerings.

- Market Growth: The expanding global life sciences market provides a fertile ground for revenue generation in this segment.

- Diversification: This stream diversifies revenue beyond traditional medical device sales, tapping into the growing biotech and pharmaceutical sectors.

Cook Group's revenue streams are multifaceted, primarily driven by the sale of its extensive range of minimally invasive medical devices across various specialties like cardiology and gastroenterology. Beyond direct product sales, the company secures income through service and maintenance contracts, ensuring ongoing support for its devices. Furthermore, Cook Group leverages its intellectual property by licensing technologies and receiving royalties from collaborations, while also generating revenue from specialized clinical education and training programs for healthcare professionals. Sales of life sciences products, crucial for research and development, also contribute to this diversified revenue model.

| Revenue Stream | Description | 2024 Market Context/Relevance |

|---|---|---|

| Medical Device Sales | Direct sales of minimally invasive devices for cardiology, urology, gastroenterology, etc. | Global minimally invasive surgical devices market projected over $30 billion. |

| Service & Maintenance Contracts | Recurring revenue from post-sale support, ensuring device performance. | Crucial for customer retention and predictable income in the medical device sector. |

| Licensing & Royalties | Income from licensing patented technologies and royalties from co-developed products. | The broader medical device market revenue was projected over $600 billion in 2024, highlighting IP value. |

| Clinical Education & Training | Fees from programs, workshops, and materials for healthcare professionals. | The medical device training market saw substantial growth in 2024. |

| Life Sciences Products | Sales of reagents, cell culture media, and other consumables for R&D. | The global life sciences sector continued robust demand in 2024, supporting scientific discovery. |

Business Model Canvas Data Sources

The Cook Group Business Model Canvas is informed by a blend of internal financial data, extensive market research on healthcare trends, and insights from operational performance metrics. This multi-faceted approach ensures each component of the canvas is grounded in verifiable information.