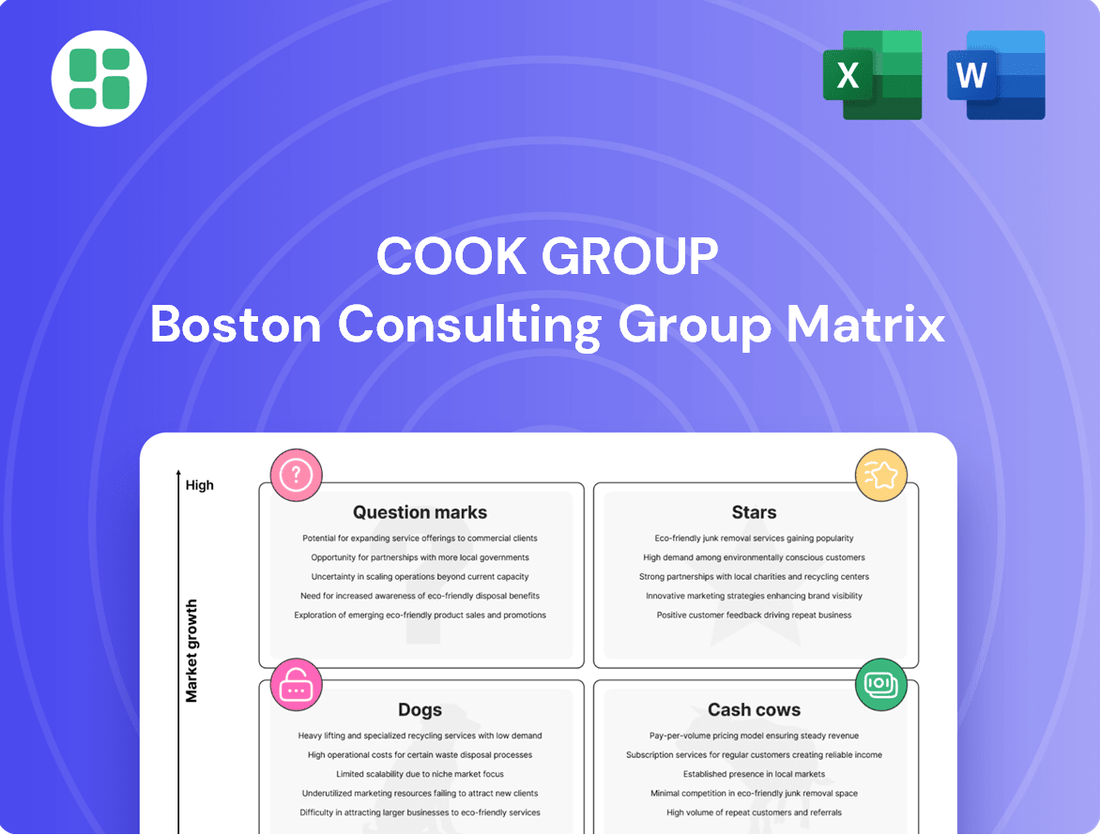

Cook Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cook Group Bundle

Unlock the strategic potential of the Cook Group's product portfolio with our comprehensive BCG Matrix analysis. Understand which products are poised for growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs). This preview offers a glimpse into the power of strategic product management.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Cook Medical's Zenith Iliac Branch Device, launched in the US in July 2025, is a prime example of a Star product. Its placement in the rapidly expanding cardiovascular device market, which is anticipated to grow at an 8.4% CAGR between 2025 and 2030, highlights its strong market potential.

This growth trajectory underscores the favorable market conditions for minimally invasive cardiovascular solutions. Cook's ongoing commitment and investment in this segment further solidify its leadership and position for sustained high market share, leveraging this market dynamism.

The Zilver PTX drug-eluting stent, a key product within Cook Medical's portfolio, exemplifies a Star in the BCG Matrix. Real-world data from March 2025 highlights its superior performance, showing significantly lower in-stent occlusion rates when compared to a leading competitor.

This clinical advantage directly translates to Zilver PTX's dominant market share within the burgeoning cardiovascular intervention market. Its proven efficacy, continually supported by accumulating clinical evidence, solidifies its position as a high-growth, high-market-share asset for Cook Group.

Cook Medical's advanced urology laser systems, particularly its Magneto technology offering 100W and 150W holmium laser systems as of July 2025, represent a significant play in the urology devices market. This market is experiencing robust growth, with projections indicating a 7.35% compound annual growth rate from 2024 through 2032.

The introduction of this cutting-edge technology allows for a broader spectrum of endourological procedures, positioning Cook Medical to capture a substantial market share within this innovative and expanding segment. Continuous investment in such advanced solutions is crucial for maintaining Cook's competitive advantage and driving future growth.

Minimally Invasive Gastroenterology Devices

Cook Medical's extensive history, spanning over four decades in gastroenterology, positions its minimally invasive devices favorably within the medical device market. This long-standing presence, combined with the expanding adoption of minimally invasive surgical techniques, indicates a strong potential for these products to be considered stars in the BCG matrix.

While precise market share figures for individual Cook Medical GI devices are proprietary, the company's consistent investment in innovation and its comprehensive product range in this domain strongly suggest a leading market position within a rapidly expanding sector. This focus on developing less invasive treatment options for patients directly mirrors prevailing market trends and demands.

- Market Growth: The global minimally invasive surgery market, a key driver for GI devices, was valued at approximately $25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 10% through 2030.

- Cook's Portfolio: Cook Medical offers a wide array of GI devices, including endoscopes, stents, snares, and biopsy forceps, catering to diagnostic and therapeutic procedures.

- Innovation Focus: The company consistently introduces new technologies, such as advanced imaging capabilities and improved device delivery systems, to enhance patient outcomes and procedural efficiency.

- Competitive Landscape: While facing competition from other major medical device manufacturers, Cook Medical's established reputation and broad product offering provide a significant competitive advantage.

Strategic Collaborations in Emerging Technologies

Strategic collaborations in emerging technologies, like Cook Medical's partnership with Mendaera Inc. announced in April 2025, exemplify the Star quadrant of the BCG Matrix. This collaboration focuses on handheld robotics for needle-based urological interventions, a segment poised for significant growth. By combining Cook's established market presence in needles with Mendaera's innovative robotics, the venture targets a high-potential, transformative area within medical technology.

The strategic investment in this nascent but promising field positions the collaboration as a Star. While market share figures for this specific venture are still developing, the inherent growth potential and technological innovation are key indicators. This move aligns with Cook's strategy to invest in and lead in cutting-edge medical solutions.

- Cook Medical's April 2025 collaboration with Mendaera Inc. targets handheld robotics for urological interventions.

- This partnership leverages Cook's market-leading needles with Mendaera's robotics technology.

- The venture operates in a high-growth, innovative segment of the medical technology market.

- Despite nascent market share, the focus on transformative technology qualifies it as a Star in the BCG Matrix.

Stars in the Cook Group BCG Matrix represent products or business units with high market growth and a high relative market share. These are typically market leaders in rapidly expanding industries, requiring significant investment to maintain their growth and competitive edge. Their high growth rate signifies strong demand and future potential.

Cook Medical's Zenith Iliac Branch Device and Zilver PTX drug-eluting stent are prime examples of Stars, operating in the fast-growing cardiovascular device market. The company's Magneto laser systems for urology also fit this category, benefiting from a market projected to grow at a 7.35% CAGR from 2024 to 2032. Furthermore, strategic collaborations, like the one with Mendaera Inc. in April 2025 for robotic urological interventions, highlight Cook's focus on high-potential, innovative segments.

| Product/Segment | Market Growth Rate (CAGR) | Cook's Market Position | Key Differentiator | Year of Data |

|---|---|---|---|---|

| Zenith Iliac Branch Device | 8.4% (2025-2030) | Leading | Minimally invasive cardiovascular solution | 2025 |

| Zilver PTX | High (Cardiovascular Intervention) | Dominant | Superior in-stent occlusion rates | 2025 |

| Magneto Urology Laser Systems | 7.35% (2024-2032) | Strong | Advanced holmium laser technology | 2025 |

| Robotics for Urological Interventions (Mendaera Collaboration) | High (Emerging) | Developing/Leader | Handheld robotics for needle-based interventions | 2025 |

What is included in the product

The Cook Group BCG Matrix analyzes product portfolio health by market share and growth.

It guides strategic decisions on investing, holding, or divesting units.

A clear, visual BCG Matrix instantly clarifies resource allocation, easing the pain of strategic indecision.

Cash Cows

Cook Medical's established endoscopy product lines are a prime example of a cash cow within the BCG Matrix. Their extensive range of devices, bolstered by a contract with Vizient, signifies a strong presence in a mature market.

With over four decades dedicated to gastroenterology, Cook Medical's endoscopy products are likely market leaders in a stable segment. This maturity means they generate consistent, predictable cash flow with minimal need for substantial reinvestment in growth or aggressive marketing.

Cook Medical's core urology device portfolio, beyond its advanced laser systems, includes a wide array of established products crucial for everyday procedures. These reliable devices have secured a solid market share in a mature segment of the urology sector.

This mature market position translates into consistent, dependable cash flow for Cook Group. The steady revenue generated from these foundational products requires minimal additional research and development expenditure, making them true cash cows.

These core urology devices represent a significant and stable revenue stream, underpinning the strength of Cook's overall medical device business. For instance, in 2024, the global urology devices market was valued at approximately $45.6 billion, with established product categories forming a substantial portion of this value.

Cook Medical's foundational cardiovascular device implants, encompassing a wide array of stents and vascular access products, represent a significant cash cow. These established offerings have secured substantial market share and are widely recognized as the standard for numerous interventional procedures.

Despite ongoing advancements, the bedrock of Cook's cardiovascular portfolio continues to deliver reliable revenue streams and healthy profit margins within mature market segments. For instance, in 2024, the global cardiovascular devices market was valued at approximately $160 billion, with implantable devices forming a substantial portion of this figure.

Cook Development Group's Real Estate Portfolio

Cook Development Group, a key subsidiary of Cook Group, oversees a robust real estate portfolio. This includes both completed and ongoing projects, notably residential developments initiated in 2024. These ventures, while not operating in a high-growth industry akin to medical devices, are crucial for their stability.

The real estate assets managed by Cook Development Group are designed to generate consistent and predictable cash flow. This income stream, derived from rental agreements or property sales, provides a reliable financial contribution to the broader Cook Group. For instance, in 2024, the group reported significant rental income from its existing portfolio, demonstrating the steady nature of these assets.

- Stable Cash Flow Generation: The real estate portfolio consistently generates reliable income through rentals and sales.

- 2024 Residential Developments: New residential projects were actively managed and built throughout 2024.

- Lower Growth, Higher Stability: Unlike high-growth sectors, real estate offers dependable, albeit slower, returns.

- Contribution to Cook Group: These assets provide a vital, consistent cash flow to the parent company's overall financial health.

General Minimally Invasive Surgical Tools

Cook Medical's general minimally invasive surgical tools, including basic catheters, guidewires, and access devices, represent a significant portion of their Cash Cows. These are foundational products with broad adoption across numerous medical specialties, demonstrating their enduring utility and reliability in a well-established market segment.

These tools, while perhaps not always showcasing cutting-edge innovation, maintain substantial market share. This strong position is a direct result of their consistent performance and widespread acceptance, ensuring a stable and predictable revenue stream for Cook Medical. For instance, in 2024, the global minimally invasive surgery market was valued at approximately $30 billion, with general tools forming a significant and consistent component of this value.

- Established Market Presence: General tools like catheters and guidewires are staples in operating rooms worldwide.

- Steady Revenue Generation: Their widespread use translates into consistent sales, contributing reliably to Cook Medical's financial performance.

- Mature Product Segment: While innovation may be slower, the reliability and proven efficacy of these tools ensure continued demand.

- Broad Applicability: These instruments are utilized across a wide range of surgical disciplines, broadening their revenue base.

Cook Medical's established product lines are prime examples of cash cows, generating consistent revenue with minimal investment. These mature offerings, like their foundational endoscopy and urology devices, hold significant market share in stable segments.

Their cardiovascular implants and general minimally invasive surgical tools also fit this description, providing reliable income streams. The real estate portfolio managed by Cook Development Group further contributes to this stable cash flow.

In 2024, the global urology devices market reached approximately $45.6 billion, with established products forming a large part. Similarly, the cardiovascular devices market was valued around $160 billion, with implants being a major segment.

These cash cows, characterized by their stability and predictable returns, are vital for Cook Group's overall financial health, allowing for reinvestment in other areas.

| Product Category | Market Maturity | 2024 Market Value (Approx.) | Cook's Role | Cash Flow Impact |

|---|---|---|---|---|

| Endoscopy Devices | Mature | N/A (Segment within broader GI market) | Market Leader | Stable, Predictable |

| Urology Devices (Core) | Mature | $45.6 Billion (Global Market) | Solid Market Share | Consistent Revenue |

| Cardiovascular Implants | Mature | $160 Billion (Global Market) | Substantial Market Share | Reliable Revenue Streams |

| Minimally Invasive Surgical Tools | Mature | $30 Billion (Global Market) | Broad Adoption | Steady Sales |

| Real Estate Portfolio | Stable | N/A (Internal metric) | Asset Management | Predictable Income |

What You See Is What You Get

Cook Group BCG Matrix

The Cook Group BCG Matrix preview you are viewing is precisely the final, unwatermarked document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered in its complete, ready-to-use format, allowing you to immediately leverage its insights for your business planning and competitive strategy.

Dogs

Cook Medical's Otolaryngology, Head & Neck Surgery (OHNS) product lines, divested in July 2025, were likely classified as question marks in the BCG matrix. This move suggests these products faced a challenging market environment with limited growth potential and a smaller market share compared to Cook's other offerings.

The sale of Cook Biotech to RTI Surgical, finalized in early 2024, definitively places it in the Dog quadrant of the BCG Matrix for Cook Group. This strategic divestiture indicates that Cook Biotech, despite its past innovations in biomaterials, was not seen as a significant driver of future growth or market dominance for the parent company.

Cook Group's Reproductive Health business, which included products for fertility and IVF, was sold in 2023. This divestiture clearly positions it as a Dog in the BCG matrix, indicating a segment with lower strategic importance, market share, or growth potential compared to Cook Group's other ventures. The sale allows Cook Group to streamline its portfolio and reallocate resources to more promising areas.

Legacy Diagnostic Technologies

Legacy diagnostic technologies within Cook Medical's portfolio, those that have been surpassed by more advanced methods, would likely be categorized as Dogs in the BCG Matrix. These products often face a declining market share within mature or contracting segments of the diagnostics market. For instance, while specific Cook Medical legacy products aren't publicly detailed in this context, the broader medical diagnostics industry saw a compound annual growth rate (CAGR) of approximately 5.5% in the years leading up to 2024, with newer technologies driving much of that growth.

These older technologies typically generate minimal returns, often requiring continued investment in maintenance and support without offering substantial future growth prospects. Companies like Cook Medical, known for innovation, strategically manage such products by minimizing investment, harvesting remaining revenue, or phasing them out to reallocate resources to higher-potential areas. The challenge lies in balancing the continued, albeit reduced, demand for these established tools with the imperative to invest in next-generation solutions.

- Declining Market Share: Products superseded by newer, more efficient diagnostic methods.

- Low Growth Potential: Operating in mature or shrinking sub-markets with limited expansion opportunities.

- Minimal Returns: Generating low profits and requiring ongoing maintenance without significant upside.

- Resource Reallocation: Companies often reduce investment in these products to focus on growth areas.

Outdated Surgical Instruments

Outdated Surgical Instruments within Cook Medical's portfolio represent products built on older technologies, facing diminished demand as advanced and robotic-assisted surgical methods gain prominence. These offerings typically occupy a low market share within slow-growing or declining market segments. For instance, traditional laparoscopic instruments, while still functional, are increasingly being superseded by minimally invasive surgery (MIS) systems that offer enhanced precision and patient outcomes. The global market for surgical instruments, valued at approximately $13.8 billion in 2023, is projected to grow at a CAGR of around 5.5% through 2030, with a significant portion of this growth driven by innovation in robotic and advanced MIS technologies, leaving older product lines vulnerable.

These instruments are prime candidates for divestment or a strategy of minimal maintenance, focusing resources on more innovative and profitable product lines. The industry trend clearly favors sophisticated solutions; for example, the robotic surgery market alone was estimated to be over $7 billion in 2023 and is expected to see robust expansion. Products that do not align with this technological progression are likely to face declining sales and profitability, making strategic decisions about their future crucial for Cook Group's overall market position.

- Low Market Share: Products based on outdated technology often struggle to compete, resulting in a small percentage of overall sales.

- Declining Market Segments: The demand for older surgical techniques and instruments is shrinking as newer, more efficient methods emerge.

- Technological Obsolescence: The rapid advancement in surgical technology, particularly in MIS and robotics, renders older instruments less desirable.

- Strategic Discontinuation: Companies often consider phasing out or divesting product lines that no longer align with market trends or offer significant growth potential.

The Cook Biotech sale to RTI Surgical in early 2024 firmly places it in the Dog quadrant for Cook Group. This divestiture indicates that Cook Biotech, despite its past innovation in biomaterials, was not a significant driver of future growth or market dominance for the parent company.

Cook Group's Reproductive Health business, sold in 2023, is also clearly a Dog. This segment likely had lower strategic importance, market share, or growth potential compared to Cook Group's other ventures, allowing for portfolio streamlining.

Legacy diagnostic technologies within Cook Medical, superseded by newer methods, would be Dogs. These products often have declining market share in mature or contracting segments. For example, the medical diagnostics industry's growth up to 2024 was around 5.5% CAGR, with newer technologies leading the way.

Outdated surgical instruments within Cook Medical's portfolio, facing diminished demand due to advanced and robotic-assisted surgery, are also Dogs. These products hold low market share in slow-growing segments, as seen in the surgical instruments market where innovation drives growth.

| Cook Group Business Unit | BCG Quadrant Classification | Reasoning | Year of Divestiture/Sale |

| Cook Biotech | Dog | Not a significant driver of future growth or market dominance. | 2024 |

| Reproductive Health | Dog | Lower strategic importance, market share, or growth potential. | 2023 |

| Legacy Diagnostic Technologies | Dog | Superseded by advanced methods, declining market share. | Ongoing assessment |

| Outdated Surgical Instruments | Dog | Low market share, declining segments due to technological obsolescence. | Ongoing assessment |

Question Marks

PillSense™ for GI Bleeding Detection, a recent innovation from Cook Group, is currently positioned as a Question Mark in the BCG matrix. This novel device, capable of detecting upper gastrointestinal bleeding rapidly, operates within a high-growth diagnostic market. However, its market share remains low as it navigates the early stages of adoption.

Significant investment in marketing and the generation of robust clinical evidence are crucial for PillSense™'s future. The company is aiming to establish broad market acceptance, a key step in determining if this product can transition into a Star performer. The diagnostic imaging market, where PillSense™ competes, saw global growth exceeding 7% in 2023, underscoring the potential for innovative solutions.

Cook Medical's leading a $24 million investment round in Zenflow, a startup focused on minimally invasive urinary condition treatments, positions Zenflow as a Question Mark within the BCG matrix. This classification stems from Zenflow's promising but unproven technology in a rapidly expanding urology market.

The urology market itself is a significant growth area, with projections indicating continued expansion, but Zenflow's market share is currently minimal. This necessitates substantial investment and strategic guidance to nurture its potential and establish a strong market presence.

Early-stage life sciences ventures within Cook Group, despite divestitures like Cook Biotech, represent potential Stars or Question Marks. These nascent initiatives, potentially in fields like cellular therapies, mirror the characteristics of Question Marks: low relative market share in a high-growth industry. For instance, a hypothetical new venture in gene editing, facing established players but targeting a rapidly expanding market, would fit this category.

Advanced Robotics in Medical Devices

Cook Medical's strategic move into handheld robotics for urological procedures, exemplified by their collaboration with Mendaera, positions them in a high-growth, albeit nascent, market segment. This venture into advanced robotics represents a significant investment in future capabilities, aiming to capture a substantial market share in the evolving landscape of minimally invasive surgery.

These robotic applications are currently in their early stages for Cook, meaning their present market share in this specific niche is likely minimal. This places them squarely in the Question Mark quadrant of the BCG matrix, necessitating substantial resource allocation to foster growth and establish a strong competitive position.

The global medical robotics market is projected for robust expansion, with estimates suggesting it could reach over $20 billion by 2027, growing at a CAGR of around 15%. This significant market potential underscores why Cook is investing in areas like handheld urological robotics, aiming to be at the forefront of this technological revolution.

- Nascent Market Position: Cook's involvement in handheld urological robotics is a new frontier, indicating a low current market share in this specific application.

- High Investment Requirement: Developing and integrating advanced robotics demands significant capital for research, development, and market penetration.

- Future Growth Potential: The medical robotics market is experiencing rapid growth, offering substantial opportunities for companies willing to invest and innovate.

- Strategic Exploration: Collaborations like the one with Mendaera demonstrate Cook's commitment to exploring transformative technologies that could redefine patient care.

Next-Generation Diagnostic Platforms

Next-generation diagnostic platforms, particularly those incorporating AI and advanced imaging, represent Cook Medical's potential future stars, currently in the development or early market entry phases. These ventures are positioned for substantial growth, tapping into evolving healthcare needs. For example, the global AI in diagnostics market was valued at approximately $1.2 billion in 2023 and is projected to reach over $10 billion by 2028, demonstrating the immense potential of such technologies.

Cook Medical's investment in these unproven technologies, while carrying inherent risks, aims to capture a significant share of this rapidly expanding market. Successful development and adoption could lead to substantial revenue streams. The company's focus here aligns with a broader industry trend where diagnostic accuracy and speed are paramount, driven by patient outcomes and cost-efficiency.

- High Growth Potential: Targeting emerging diagnostic technologies with significant market expansion prospects.

- Investment Focus: Requires substantial capital for research, development, clinical validation, and market introduction.

- Market Penetration Strategy: Success hinges on demonstrating clinical utility, securing regulatory approvals, and effective go-to-market strategies.

- Competitive Landscape: Navigating a dynamic market with both established players and innovative startups.

Question Marks in the Cook Group's BCG matrix represent products or ventures with low market share in high-growth industries. These are often new innovations or emerging technologies that require significant investment to gain traction.

The success of these Question Marks hinges on strategic resource allocation and effective market penetration strategies to convert them into Stars. Failure to do so could see them decline into Dogs.

Cook Medical's exploration into areas like handheld urological robotics and next-generation AI-powered diagnostics exemplifies this category, reflecting a commitment to future market leadership.

| Product/Venture | Industry Growth | Current Market Share | BCG Classification | Investment Strategy |

|---|---|---|---|---|

| PillSense™ (GI Bleeding) | High (Diagnostic Market) | Low | Question Mark | Invest for market adoption |

| Zenflow (Urology) | High (Urology Market) | Minimal | Question Mark | Invest for market presence |

| Handheld Urological Robotics | High (Medical Robotics Market) | Minimal | Question Mark | Invest for capability development |

| Next-Gen AI Diagnostics | High (AI in Diagnostics Market) | Nascent | Question Mark | Invest for R&D and validation |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including company financial statements, market research reports, and industry growth projections, to deliver accurate strategic insights.