Comerica SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comerica Bundle

Comerica's market position is shaped by its strong regional presence and commitment to community banking, but it also faces evolving digital competition and economic uncertainties. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Comerica's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

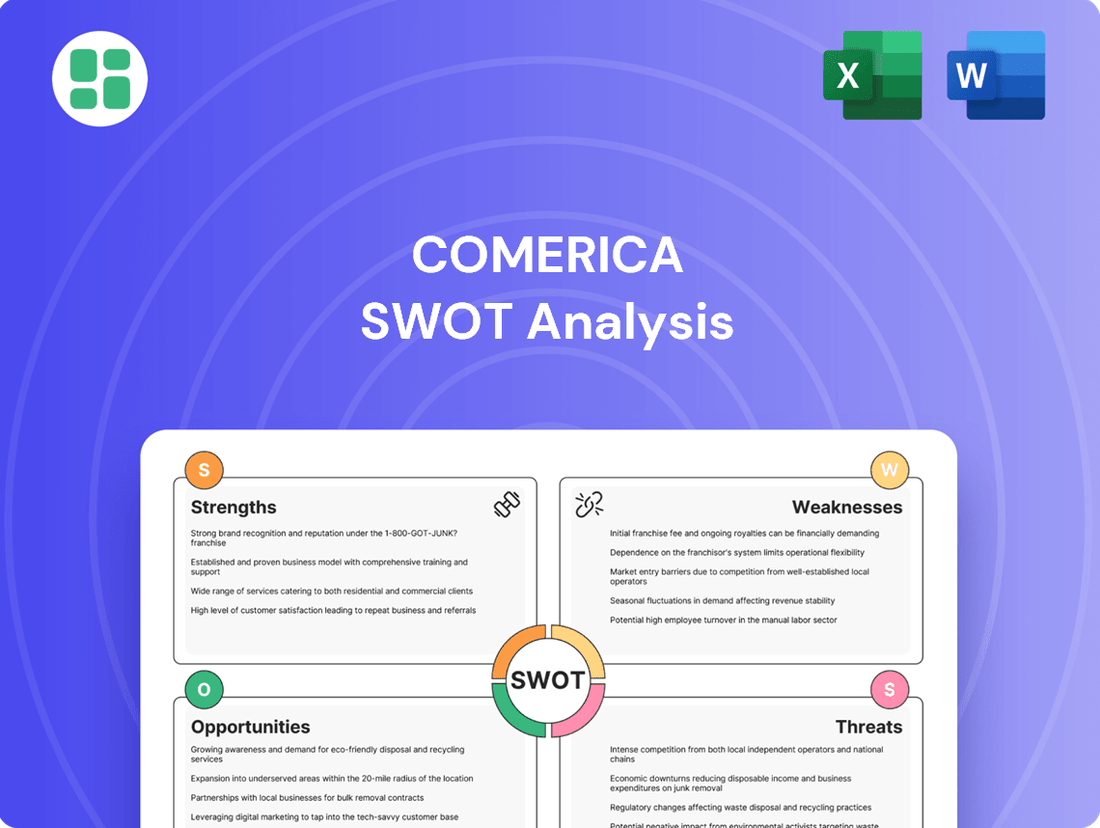

Strengths

Comerica boasts a diverse service portfolio, encompassing retail banking, business banking, wealth management, and institutional banking. This broad offering allows them to serve a wide range of clients, from individuals to large institutions, creating multiple avenues for revenue generation. For instance, as of the first quarter of 2024, their total revenue reached $774 million, showcasing the breadth of their financial activities.

Comerica boasts a robust regional footprint, with a significant presence in economically vital states such as Texas, Michigan, California, Arizona, and Florida. This established network within large, dynamic markets provides a strong base for customer engagement and operational efficiency.

The bank is actively pursuing strategic expansion, notably entering new markets like North Carolina and Colorado. This forward-looking approach demonstrates a commitment to diversifying its geographic reach and tapping into emerging economic opportunities, building on its established strengths.

Comerica consistently exhibits robust credit quality, evidenced by net charge-offs that have historically remained below industry averages. For instance, in the first quarter of 2024, Comerica reported net charge-offs of 0.12% of average loans, a figure that underscores its prudent lending practices and effective risk management.

The bank's capital management is equally impressive, with a Common Equity Tier 1 (CET1) capital ratio standing at a healthy 11.7% as of the first quarter of 2024. This ratio comfortably exceeds regulatory requirements, providing a substantial buffer against potential economic shocks and reinforcing investor confidence in the institution's financial strength.

Commitment to Small Business Growth

Comerica is making a significant push to support small businesses, a crucial part of the economic landscape. This commitment is evident in their strategic moves, such as increasing the number of small business bankers and introducing platforms like Comerica BusinessHQ™. These efforts are designed to nurture community development and tap into a rapidly expanding market segment.

This targeted approach to small business growth is more than just community engagement; it's a smart business strategy. By providing dedicated resources and tailored solutions, Comerica aims to build lasting relationships with these businesses. This can translate into enhanced customer loyalty and a more stable, growing revenue base for the bank.

- Increased Small Business Banker Presence: Comerica has strategically expanded its team of dedicated small business bankers to offer more personalized support and expertise.

- Comerica BusinessHQ™ Launch: This digital platform provides small businesses with tools and resources to manage their finances, access capital, and grow their operations.

- Focus on High-Growth Sector: Small businesses represent a vital and often high-growth segment of the economy, offering significant opportunities for customer acquisition and long-term relationship building.

- Community Development and Loyalty: By fostering small business growth, Comerica strengthens local economies and cultivates deep customer loyalty, which can lead to sustained revenue streams.

Ongoing Digital Transformation and Efficiency Focus

Comerica is actively pursuing a digital transformation, emphasizing cloud modernization and enhanced cybersecurity to foster customer-centric innovation. This strategic push aims to streamline operations and improve the overall customer experience.

The bank's focus on efficiency is evident in its efforts to reduce noninterest expenses. For instance, in the first quarter of 2024, Comerica reported an efficiency ratio of 61.8%, a notable improvement reflecting their commitment to operational excellence.

- Cloud Modernization: Significant investments are being made to upgrade technological infrastructure.

- Cybersecurity: Robust measures are in place to protect customer data and maintain trust.

- Data-Driven Decisions: Leveraging data analytics to enhance product development and customer service.

- Efficiency Ratio Improvement: A key metric showing progress in cost management and operational effectiveness.

Comerica's diverse revenue streams, spanning retail, business, wealth, and institutional banking, provide a solid foundation. This breadth, demonstrated by $774 million in total revenue in Q1 2024, allows for multiple avenues of financial engagement and income generation.

The bank's strong regional presence in key economic hubs like Texas and California offers significant customer engagement opportunities. Coupled with a strategic expansion into growing markets such as North Carolina and Colorado, Comerica is well-positioned for continued market penetration and growth.

Comerica's commitment to small business development, highlighted by increased banker presence and the Comerica BusinessHQ™ platform, fosters community ties and taps into a high-growth economic sector. This focus cultivates loyalty and stable revenue streams.

The bank's robust credit quality, with Q1 2024 net charge-offs at a low 0.12%, and strong capital management, evidenced by an 11.7% CET1 ratio in Q1 2024, underscore its financial stability and prudent risk management.

What is included in the product

Analyzes Comerica’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address Comerica's strategic challenges.

Weaknesses

Comerica's significant concentration in key states like Texas, Michigan, California, Arizona, and Florida, while a strength in those markets, also presents a notable weakness. This geographic focus makes the bank particularly vulnerable to regional economic downturns or adverse regulatory shifts within these specific areas. For instance, a slowdown in the energy sector in Texas or manufacturing challenges in Michigan could have a more pronounced negative effect on Comerica's overall financial health compared to banks with a broader national footprint.

Comerica is experiencing moderated loan demand, a notable weakness. This is particularly evident in their Commercial Real Estate (CRE) and National Dealer Services segments. For instance, the bank has projected a potential decrease in average loans for 2024, which could directly affect their net interest income.

Despite a robust loan pipeline, customer apprehension about the broader economic climate is causing a slowdown. This caution is likely to postpone any substantial recovery in loan origination, creating a headwind for growth.

Comerica has seen a notable dip in its noninterest income, with capital markets income and card fees experiencing declines. For instance, in the first quarter of 2024, total noninterest income was $295 million, down from $324 million in the same period of 2023, highlighting this weakness.

This trend points to a vulnerability in the bank's fee-generating activities, possibly influenced by a more conservative consumer spending environment and prevailing market dynamics. Such reliance on fee income makes the bank susceptible to economic slowdowns.

Strengthening and diversifying these noninterest income streams is therefore a key strategic imperative for Comerica. This diversification would help mitigate the inherent risks associated with interest income, which is significantly impacted by interest rate movements.

Competition from Diverse Financial Entities

Comerica navigates a highly competitive landscape, facing pressure not only from established national banks but also from agile fintech firms and niche financial service providers. These diverse entities often leverage technology to offer specialized products or streamlined customer experiences, posing a challenge to traditional banking models. For instance, the rise of digital-only banks and payment platforms means Comerica must constantly innovate to retain customers.

This competitive intensity necessitates significant and ongoing investment in technology and digital capabilities. Such investments are crucial for developing new services and improving existing ones to match or exceed competitor offerings. The pressure to adapt can strain financial resources, impacting profitability and operational efficiency as Comerica strives to maintain its market position.

- Fintech Disruption: Competitors like Square (now Block) and PayPal continue to expand their service offerings beyond payments, encroaching on areas like lending and business banking, which are core to Comerica's strategy.

- Digital Experience Gap: While Comerica invests in digital transformation, some fintechs offer a more seamless and intuitive digital-first experience, attracting younger demographics and businesses prioritizing convenience.

- Specialized Lending: Niche lenders focusing on specific industries or customer segments can offer more tailored products and potentially more attractive terms than a diversified bank like Comerica.

Sensitivity to Interest Rate Fluctuations

Comerica, like many traditional banks, faces a significant weakness in its sensitivity to interest rate fluctuations. Its profitability is closely tied to its net interest margin, which can be squeezed by unexpected changes in monetary policy. For instance, if interest rates rise sharply, the cost of deposits might increase faster than the yield on loans, impacting earnings.

While Comerica experienced net interest margin expansion in recent quarters, this trend isn't guaranteed. An inverted yield curve, where short-term rates are higher than long-term rates, could particularly hurt income from its loan portfolio. This sensitivity means that shifts in Federal Reserve policy or broader economic conditions can directly affect Comerica's financial performance.

Managing this interest rate risk is a constant challenge. Comerica needs to employ sophisticated balance sheet management techniques and develop proactive strategies to mitigate potential negative impacts. This includes carefully structuring its assets and liabilities to reduce exposure to adverse rate movements. For example, as of Q1 2024, Comerica reported a net interest income of $657 million, highlighting the direct link between interest rates and its revenue streams.

- Net Interest Margin Sensitivity: Comerica's core profitability is directly impacted by the spread between interest earned on assets and interest paid on liabilities.

- Monetary Policy Risk: Unexpected shifts in interest rates, whether upward or downward, can adversely affect net interest income.

- Yield Curve Dynamics: An inverted yield curve, a scenario where short-term rates exceed long-term rates, poses a particular risk to banks like Comerica.

- Balance Sheet Management: Proactive and effective management of assets and liabilities is crucial to mitigate the negative effects of interest rate volatility.

Comerica's concentrated geographic footprint, primarily in Texas, Michigan, California, Arizona, and Florida, exposes it to significant regional economic risks. A downturn in any of these key states could disproportionately impact the bank's overall performance compared to more geographically diversified institutions. For instance, challenges in Michigan's manufacturing sector or Texas's energy industry directly affect Comerica's loan portfolio and revenue streams.

Moderated loan demand, particularly in Commercial Real Estate and National Dealer Services, presents another weakness. Comerica projected a potential decrease in average loans for 2024, directly impacting its net interest income. This slowdown is attributed to customer apprehension regarding the broader economic climate, delaying loan origination and hindering growth prospects.

A notable decline in noninterest income, with capital markets income and card fees experiencing decreases, is a key concern. In Q1 2024, total noninterest income fell to $295 million from $324 million in Q1 2023. This trend highlights vulnerability in fee-generating activities, potentially influenced by conservative consumer spending and market dynamics, making the bank susceptible to economic slowdowns.

What You See Is What You Get

Comerica SWOT Analysis

This is the actual Comerica SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can trust that the insights and structure you see here are representative of the complete, in-depth report. Unlock the full professional analysis by completing your purchase.

Opportunities

Comerica is actively pursuing expansion, having already entered markets like North Carolina and Colorado. This move signals a clear strategy to access new growth opportunities beyond its traditional strongholds.

Further strategic expansion into underserved or rapidly developing metropolitan areas presents a significant opportunity for Comerica to attract new customers and increase its loan portfolio. This geographic diversification can also serve to reduce the risks tied to over-reliance on its existing core states.

Comerica can significantly boost customer satisfaction and streamline operations by investing more in its digital banking offerings. This includes enhancing mobile apps, online banking tools, and exploring collaborations with fintech firms.

By modernizing its infrastructure, adopting cloud technologies, and utilizing advanced data analytics, Comerica can appeal to a younger, tech-oriented customer base and improve how it delivers services. This strategy directly supports the broader digital shift in banking and meets the changing demands of consumers.

For instance, as of Q1 2024, digital sales at Comerica represented a growing portion of their business, indicating a strong customer preference for these channels. Continued investment in this area is crucial for capturing market share.

The wealth management sector represents a substantial growth avenue for Comerica, fueled by demographic shifts like an aging population and the significant intergenerational transfer of wealth. By enhancing its advisory services and investment capabilities, Comerica can attract and retain more high-net-worth clients.

This strategic focus is particularly timely as an estimated $84 trillion is expected to transfer from baby boomers to heirs in the U.S. alone over the next two decades, according to Cerulli Associates. Capturing even a small portion of this massive wealth transfer can significantly boost Comerica's assets under management and fee-based revenue.

Leveraging Data Analytics and AI

Comerica can significantly boost its competitive edge by deepening its investment in data analytics and artificial intelligence. This strategic move allows for a more granular understanding of customer behavior, emerging market trends, and robust risk management practices. For instance, by analyzing transaction data, Comerica can identify patterns that inform more effective lending strategies and fraud detection.

The integration of AI can revolutionize operations, from automating routine tasks to offering highly personalized customer services and sophisticated predictive modeling. This translates into smarter decision-making, optimized product development, and streamlined efficiency across all business units. In 2024, many financial institutions are reporting substantial ROI from AI investments, with some seeing efficiency gains of up to 20% in areas like customer service through AI-powered chatbots.

- Enhanced Customer Insights: Deeper analysis of customer data can lead to more personalized product offerings and improved customer retention.

- Optimized Risk Management: AI-powered predictive models can more accurately assess credit risk and detect fraudulent activities, potentially reducing loan loss provisions.

- Operational Efficiency Gains: Automation of tasks through AI can free up human capital for more strategic initiatives and reduce operational costs.

- Targeted Marketing: Data analytics enables more precise segmentation of customer bases, leading to more effective and cost-efficient marketing campaigns.

Cross-Selling and Relationship Deepening

Comerica can leverage its broad range of services, from personal banking to specialized business and wealth management, to offer more products to its existing clientele. This cross-selling approach is a significant opportunity to boost revenue and customer loyalty. For instance, a business client using commercial lending could be offered treasury management services or wealth management for their executives, thereby increasing the bank's penetration within that relationship.

By focusing on integrated solutions and tailored advice, Comerica can enhance the value proposition for its customers, leading to greater stickiness and reduced churn. This strategy directly addresses the goal of increasing customer lifetime value. In 2024, banks that effectively cross-sell typically see a substantial uplift in revenue per customer compared to those who don't. For example, a study by Accenture indicated that banks with strong cross-selling capabilities can achieve up to a 15% increase in revenue per customer.

This strategy also allows Comerica to gather more comprehensive data on customer needs, enabling even more precise product offerings and personalized engagement. This deeper understanding fosters stronger relationships and creates a competitive advantage. By offering a more holistic financial partnership, Comerica can solidify its position as a trusted advisor, which is crucial in today's competitive banking landscape.

Key opportunities in cross-selling and relationship deepening include:

- Expanding Product Bundles: Creating attractive packages that combine checking, savings, loans, and investment services for both retail and business customers.

- Proactive Needs Identification: Utilizing data analytics to anticipate customer needs and proactively offer relevant solutions before the customer even asks.

- Enhanced Digital Integration: Ensuring seamless integration of all services through digital platforms, making it easy for customers to access and manage multiple products.

- Personalized Relationship Management: Assigning dedicated relationship managers who understand the full spectrum of a client's financial life to guide them through available services.

Comerica's strategic expansion into new geographic markets, such as North Carolina and Colorado, presents a clear path for growth and diversification. The bank can further capitalize on this by targeting underserved or rapidly growing metropolitan areas, aiming to attract new customers and expand its loan portfolio. This geographic diversification also serves to mitigate risks associated with over-reliance on its existing core states.

Threats

Comerica faces a significant threat from potential economic downturns and recession risks, especially within its key operating areas in the U.S. A contraction in economic activity could translate to higher loan defaults across its portfolio, diminished appetite for new borrowing, and a decrease in the valuation of its assets. For instance, the Federal Reserve's projections in early 2024 indicated a continued focus on managing inflation, suggesting interest rates might remain elevated, which historically can precede slower economic growth.

Persistent inflation and elevated interest rates, coupled with ongoing geopolitical tensions, are key drivers of this economic uncertainty. These macro-economic factors directly influence consumer and business spending, impacting loan demand and increasing the likelihood of credit deterioration for banks like Comerica. The bank's financial health, the quality of its loan book, and its overall profitability are therefore vulnerable to these broader economic headwinds.

Comerica faces a highly competitive landscape. Traditional banks, credit unions, and a surge of agile fintech companies are all actively seeking market share. This means Comerica is constantly challenged to differentiate its offerings and maintain its customer base.

Fintechs, in particular, present a significant threat with their specialized digital services that often outpace traditional banking models in terms of speed and user experience. For instance, the digital payments sector alone saw a projected global market size of $2.4 trillion in 2024, a figure that continues to grow rapidly.

This intensified competition directly impacts Comerica’s profitability. It creates downward pressure on fees and interest rates, leading to narrower profit margins. Consequently, the bank must invest heavily in continuous innovation and technology upgrades just to keep pace, which adds to operational costs.

The banking sector's stringent regulatory environment presents a significant threat to Comerica. For instance, the Federal Reserve's stress tests, which evaluate banks' capital adequacy under adverse economic conditions, can necessitate adjustments to business strategies. Increased capital requirements, as seen in potential Basel III endgame proposals, could directly impact profitability and lending capacity.

New regulations concerning consumer protection and data privacy, such as those evolving around digital banking and cybersecurity, impose substantial compliance costs. Comerica must invest heavily in systems and personnel to ensure adherence, diverting resources from other growth initiatives. The ongoing scrutiny from regulatory bodies like the OCC and CFPB means potential fines or operational restrictions are always a risk.

Cybersecurity Risks and Data Breaches

As a financial institution, Comerica faces significant cybersecurity risks. The bank is a prime target for cybercriminals seeking to access sensitive customer data. A successful breach could lead to substantial financial losses and irreparable damage to its reputation.

These threats are not hypothetical. In 2023, the financial services sector experienced a notable increase in cyberattacks, with ransomware incidents costing businesses billions. Comerica must continually invest in advanced security measures to protect its systems and customer information from evolving threats.

- Target for Cybercriminals: Financial institutions like Comerica are high-value targets for malicious actors.

- Data Breach Impact: Compromised customer data can lead to identity theft, financial fraud, and a severe loss of customer trust.

- Operational Disruption: Cyberattacks can halt critical banking operations, impacting service delivery and revenue.

- Ongoing Investment: Significant and continuous investment in cybersecurity infrastructure and talent is essential to counter these evolving threats.

Fluctuations in Interest Rates and Yield Curve

Fluctuations in interest rates present a significant threat to Comerica. If the Federal Reserve enacts aggressive rate hikes, or if the yield curve remains inverted for an extended period, it could squeeze the bank's net interest margin, directly impacting profitability. For instance, a sustained inverted yield curve, where short-term rates are higher than long-term rates, makes it more expensive for banks to borrow short-term and less profitable to lend long-term.

Comerica's profitability is particularly sensitive to the Federal Reserve's monetary policy. Changes in the federal funds rate directly influence the bank's cost of funds and the yields it can earn on its loan portfolio. In 2023, as the Federal Reserve raised interest rates, many banks saw an initial boost to their net interest income, but the risk of rapid increases or prolonged periods of high rates can also lead to increased funding costs and potential loan defaults, thereby posing a threat.

- Net Interest Margin Compression: Unfavorable shifts in interest rates can reduce the difference between what Comerica earns on loans and what it pays on deposits.

- Federal Reserve Policy Impact: Decisions by the Federal Reserve on interest rates directly affect Comerica's cost of funds and loan yields.

- Yield Curve Risk: A prolonged inverted yield curve, as seen at various points in 2023 and early 2024, can negatively impact lending profitability.

- Increased Funding Costs: Rising interest rates can lead to higher costs for Comerica to attract and retain deposits and other funding sources.

Comerica faces significant competition from agile fintech companies and traditional banks, potentially eroding market share and pressuring profit margins. The rapid growth in digital payments, a sector projected to reach $2.4 trillion globally in 2024, highlights the need for continuous investment in technology to remain competitive.

Stringent regulatory environments, including potential capital requirement increases from Basel III endgame proposals, pose a threat by impacting profitability and lending capacity. The evolving landscape of consumer protection and data privacy regulations also necessitates substantial compliance investments, diverting resources from growth initiatives.

Cybersecurity risks are paramount, with financial institutions being prime targets for data breaches that could result in significant financial losses and reputational damage. The financial services sector saw a notable increase in cyberattacks in 2023, underscoring the need for continuous, advanced security investments.

Economic downturns and elevated interest rates present substantial threats. A recession could lead to increased loan defaults, while persistent inflation and higher rates, as indicated by the Federal Reserve's focus in early 2024, can squeeze net interest margins and impact overall profitability.

SWOT Analysis Data Sources

This Comerica SWOT analysis is built upon a foundation of robust data, including Comerica's official financial statements, comprehensive market research reports, and insights from reputable industry analysts to provide a well-rounded and actionable assessment.