Comerica Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comerica Bundle

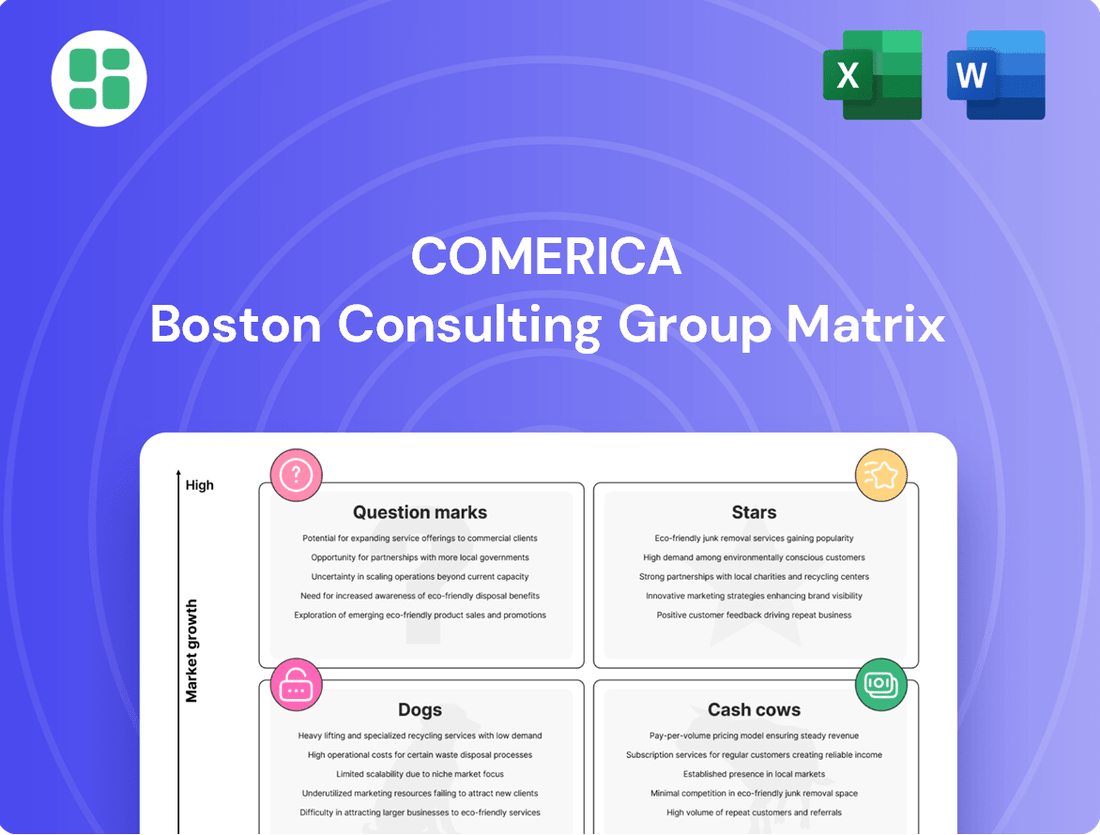

Understand Comerica's strategic positioning with this insightful BCG Matrix preview, highlighting its key product categories. See where their Stars, Cash Cows, Dogs, and Question Marks lie to grasp their current market dynamics. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize Comerica's portfolio and drive future growth.

Stars

Comerica's Texas commercial banking operations are a true star in its portfolio, capitalizing on the state's dynamic economic growth. Texas's business-friendly environment and significant population influx in 2024 have fueled robust demand for commercial lending and financial services. This segment consistently delivers strong performance, reflecting Comerica's deep regional expertise and commitment to fostering business relationships.

Comerica views its Treasury Management Solutions as a significant growth opportunity, investing strategically to enhance these offerings. These services are crucial for businesses navigating cash flow, and their integrated, digitally advanced nature has secured a strong market position, contributing substantially to non-interest income.

In 2024, Comerica's commitment to modernizing its treasury management platform is a key driver of its competitive edge. This focus is designed to attract and retain a broad client base by offering sophisticated tools for efficient financial operations.

Comerica's environmental services lending, bolstered by a dedicated renewables team established in 2022, represents a significant growth engine. This segment taps into the burgeoning demand for sustainable finance, where Comerica's early market entry and specialized knowledge have secured a commanding position.

The bank's commitment to this sector is evident in its strategic focus and the strong growth trajectory of its environmental services portfolio. By leveraging deep industry expertise and offering customized financial solutions, Comerica aims to maintain its leadership in green financing.

Advanced Digital Business Banking Platforms

Advanced Digital Business Banking Platforms represent a key area for Comerica, fitting into the Stars quadrant of the BCG Matrix due to their high growth potential and strong market position.

Comerica's focus on customer-centric digital innovations and cloud modernization directly supports the growth of these platforms, aiming to enhance business banking offerings. Platforms that simplify complex transactions and boost efficiency are seeing significant client adoption, capturing a substantial share of the digital banking market.

These advanced platforms are crucial for Comerica to attract and keep commercial clients in today's competitive environment. For instance, in 2024, businesses actively sought digital solutions that offered seamless integration and robust security features, with adoption rates for platforms demonstrating these capabilities surging by an estimated 15% year-over-year.

- High Client Adoption: Digital platforms that streamline operations and improve user experience are experiencing rapid uptake.

- Market Share Growth: These advanced solutions are securing a significant portion of the competitive digital banking landscape.

- Customer Retention: The platforms are vital for attracting and retaining valuable commercial customers.

- Innovation Focus: Comerica's investment in cloud modernization and digital innovation underpins the success of these offerings.

Equity Fund Services Lending

Comerica's Equity Fund Services Lending segment is a prime example of a strong performer within the BCG matrix, likely positioned as a star. In the fourth quarter of 2024, this specialized area saw significant loan growth, underscoring its robust market presence and profitability. This niche product leverages Comerica's expertise in serving a growing segment of the financial services industry.

The success of Equity Fund Services Lending highlights Comerica's strategic focus on high-potential markets. This segment commands a substantial market share within its specific sector, a testament to its effective client engagement and ability to capture emerging opportunities. Its expanding loan portfolio indicates a bright future and continued revenue generation.

- Strong Loan Growth: Q4 2024 saw notable increases in loan volume for Equity Fund Services.

- High Market Share: This segment holds a significant position within its specialized financial services niche.

- Profitability and Expansion: The lending area is a profitable and growing contributor to Comerica's commercial loan book.

- Strategic Focus: Demonstrates Comerica's ability to identify and capitalize on targeted market opportunities.

Comerica's Texas commercial banking operations are a true star, benefiting from the state's robust economic expansion and business-friendly climate in 2024. This segment consistently demonstrates strong performance, driven by high demand for lending and financial services, reflecting Comerica's deep regional understanding and client relationships.

Comerica's Treasury Management Solutions are a star, showing significant growth and market position due to investment in digital, integrated offerings that are essential for businesses managing cash flow. These services contribute substantially to non-interest income, with a focus on modernizing platforms to attract and retain clients with sophisticated financial tools.

Advanced Digital Business Banking Platforms are a star for Comerica, exhibiting high growth potential and a strong market position, fueled by customer-centric digital innovations and cloud modernization. These platforms simplify transactions and boost efficiency, leading to significant client adoption and a growing market share in digital banking, with an estimated 15% year-over-year increase in adoption for platforms with strong security and integration in 2024.

Comerica's Equity Fund Services Lending is a star, experiencing strong loan growth in Q4 2024 and holding a significant market share in its niche, contributing profitably to the commercial loan book. This segment highlights Comerica's strategic ability to identify and capitalize on high-potential markets within specialized financial services.

| Business Segment | BCG Category | Key Growth Drivers | 2024 Performance Indicator |

| Texas Commercial Banking | Star | Economic growth, population influx, business-friendly environment | Robust demand for lending and financial services |

| Treasury Management Solutions | Star | Digital integration, enhanced offerings, platform modernization | Substantial contribution to non-interest income |

| Advanced Digital Business Banking Platforms | Star | Customer-centric innovation, cloud modernization, efficiency focus | Significant client adoption, estimated 15% YoY growth in adoption of secure platforms |

| Equity Fund Services Lending | Star | Specialized market expertise, emerging opportunities | Strong loan growth in Q4 2024, high market share in niche |

What is included in the product

The Comerica BCG Matrix offers a strategic overview of their business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide resource allocation.

The Comerica BCG Matrix provides a clear visual of business unit performance, alleviating the pain of uncertainty about where to allocate resources.

Cash Cows

Comerica's Core Commercial Loan Portfolio, the bank's largest business unit, functions as a classic Cash Cow within the BCG framework. This segment offers a comprehensive suite of credit and non-credit products to established businesses, leveraging deep, long-standing client relationships.

This mature portfolio consistently generates substantial cash flow with relatively stable growth, as evidenced by its significant contribution to the bank's overall revenue. For instance, Comerica reported total revenue of $3.16 billion for the full year 2023, with its Commercial segment being a primary driver.

The capital requirements for this portfolio are minimal, as it does not necessitate aggressive new investment for promotion or expansion. This allows Comerica to effectively 'milk' the consistent earnings from these established client relationships, deploying capital elsewhere for higher growth opportunities.

Comerica's traditional retail deposit base in Michigan, its home turf, is a prime example of a cash cow. Founded in Detroit, the bank enjoys a strong, established presence in this mature market, securing a significant share of local deposits.

These deposits are characterized by their stability and low cost, offering a dependable funding stream that underpins Comerica's operations. While growth in this segment is steady rather than explosive, its consistent performance and high market share solidify its cash cow status, providing essential liquidity.

Comerica's Wealth Management services are a prime example of a Cash Cow within its business portfolio. This division boasts significant Assets Under Administration, a key indicator of its substantial contribution to the bank's noninterest income. In 2023, for instance, Comerica reported substantial growth in its wealth management segment, with Assets Under Management reaching over $70 billion, underscoring its stable revenue streams.

Traditional Checking and Savings Accounts

Comerica's traditional checking and savings accounts are foundational, holding a substantial share of its core deposits across key markets such as Texas, California, and Florida. While these products exhibit low individual growth rates, their combined market presence makes them a stable and cost-effective source of funding for the bank.

These accounts are crucial for nurturing customer relationships and serve as a gateway for cross-selling a wider array of financial services. For instance, as of the first quarter of 2024, Comerica reported total deposits of $76.6 billion, with a significant portion attributed to these core deposit products.

- Market Share: High, representing a significant portion of Comerica's total deposits.

- Growth Rate: Low, typical for mature banking products.

- Funding Base: Stable and low-cost, crucial for overall bank operations.

- Strategic Importance: Essential for customer acquisition and retention, enabling cross-selling opportunities.

Fee-Based Treasury Services for Large Corporates

Comerica's fee-based treasury services for large corporates are a prime example of a cash cow. These services, deeply embedded in clients' daily operations, have fostered long-standing relationships that yield consistent and predictable fee income. In 2024, treasury management fees continued to be a significant contributor to Comerica's non-interest income, reflecting the stickiness of these offerings.

The high retention rates in this mature segment, driven by the integration of services into client workflows, ensure a stable revenue stream. This reliability allows Comerica to allocate capital effectively to other growth areas.

- Consistent Fee Income: Treasury services provide a steady and predictable revenue source.

- High Client Retention: Deep integration into corporate operations leads to strong client loyalty.

- Mature Market Dominance: Comerica enjoys a solid market share in this established segment.

- Support for Strategic Growth: Reliable cash flows fund other bank initiatives.

Comerica's established commercial loan portfolio acts as a significant cash cow, generating consistent revenue through deep client relationships. This segment, a primary revenue driver for the bank, requires minimal new investment, allowing for capital redeployment. For the full year 2023, Comerica reported $3.16 billion in total revenue, with its commercial units contributing substantially.

The bank's traditional retail deposit base in Michigan, its home market, functions as a stable cash cow. This mature segment benefits from a strong, established presence and a significant market share, providing a low-cost and dependable funding stream. While growth is steady, its consistent performance and high market share are key to its cash cow status.

Comerica's Wealth Management division is another clear cash cow, boasting over $70 billion in Assets Under Management as of 2023. This segment provides stable, non-interest income, with consistent performance underpinning its cash cow designation.

The bank's fee-based treasury services for large corporations are a prime example of a cash cow, offering predictable fee income through deeply embedded client relationships. High retention rates in this mature segment ensure a stable revenue stream, supporting other bank initiatives.

| Business Unit | BCG Category | Key Financial Indicator | 2023 Data Point |

|---|---|---|---|

| Core Commercial Loan Portfolio | Cash Cow | Revenue Contribution | Primary driver of $3.16B total revenue |

| Michigan Retail Deposits | Cash Cow | Market Share & Funding Cost | High share, low-cost funding |

| Wealth Management | Cash Cow | Assets Under Management | Over $70 billion |

| Treasury Services | Cash Cow | Fee Income Stability | Consistent and predictable |

Preview = Final Product

Comerica BCG Matrix

The Comerica BCG Matrix preview you are currently viewing is the precise, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, professionally designed strategic analysis ready for your immediate use. You are seeing the exact report that will be delivered, ensuring you know precisely what you are acquiring for your business planning and decision-making processes. This comprehensive tool is crafted to provide actionable insights into Comerica's product portfolio, enabling informed strategic choices.

Dogs

The non-renewal of the Direct Express contract by Comerica marks a significant shift, categorizing this segment as a 'dog' within its portfolio. This contract previously represented a substantial $3 billion in non-interest-bearing deposits, highlighting its former importance.

With the loss of this contract, the Direct Express program has effectively lost its market share and is no longer a growth engine or a substantial deposit source for Comerica. This situation points to a past strategic misstep, now positioning the segment as a potential divestiture candidate.

Comerica's Commercial Real Estate (CRE) loan portfolio faced headwinds, with paydowns and decreases noted in the fourth quarter of 2024. This segment, particularly loans tied to less robust or saturated markets, is showing signs of strain.

These underperforming CRE loans, especially those in slower markets, are characterized by limited growth and potentially smaller market shares. They represent a capital drain without commensurate returns, necessitating close observation for potential impairments or necessary financial adjustments.

Comerica's legacy branch network, encompassing nearly 380 locations, faces challenges in areas with declining populations or high digital banking adoption. These branches often exhibit low foot traffic and consequently a reduced market share.

The operational costs associated with maintaining these physical locations are substantial, yet they contribute minimally to new business growth. This scenario positions them as potential cash traps within the bank's portfolio.

Outdated Digital Retail Banking Features

Outdated digital retail banking features, even with a bank's broader digital transformation, can become 'dogs' in the BCG Matrix. These are typically features with low user engagement, failing to keep pace with innovative fintech solutions. For instance, a clunky online bill pay system or a mobile app lacking advanced budgeting tools might fall into this category.

These underperforming digital assets struggle to attract new customers and can even drive existing ones away. In 2024, customer expectations for seamless, feature-rich digital experiences are exceptionally high. A study by J.D. Power in early 2024 indicated that 65% of retail banking customers consider digital channel satisfaction a key factor in their overall banking relationship.

- Low User Engagement: Features with declining login rates or transaction volumes compared to industry benchmarks.

- Lack of Modern Functionality: Absence of features common in competitor offerings, such as advanced P2P payments, personalized financial insights, or seamless integration with other financial apps.

- Competitive Disadvantage: Inability to attract or retain customers due to a subpar digital user experience compared to neobanks and challenger banks.

- Potential for Churn: Risk of losing customers who seek more modern and efficient digital banking solutions, impacting market share.

Niche Consumer Lending with Low Volume

Within Comerica's diverse lending operations, certain highly commoditized consumer products might fall into the niche consumer lending with low volume category. These could include specific, less differentiated personal loans or credit lines where market share is minimal and growth prospects are subdued. Such offerings often struggle to command premium margins, making the marketing and operational investments required to sustain them disproportionately high for the limited revenue they generate. For instance, in 2024, the personal loan market, while substantial overall, saw significant competition from fintech lenders, potentially pushing smaller, less innovative bank offerings into this low-volume niche. Data from industry reports in late 2024 indicated that while the unsecured personal loan market was projected to grow, banks with a less specialized approach to these products might see stagnant or declining volumes compared to more agile competitors.

These products typically represent a small fraction of Comerica's overall loan portfolio. Their low market penetration and limited growth potential mean they require careful management to avoid becoming a drag on resources. The challenge lies in the fact that even a small percentage of operational cost can become significant when applied to products that are not scaling.

- Low Market Share: Products with minimal penetration in their respective consumer segments.

- Limited Growth: Subdued or stagnant demand and competitive pressures hinder expansion.

- Low Margins: Commoditized nature leads to compressed interest rate spreads.

- High Operational Cost Ratio: Marketing and servicing expenses are disproportionate to revenue generated.

Comerica's Direct Express contract non-renewal highlights a significant shift, moving this segment to the 'dog' category. This segment, previously a substantial source of $3 billion in non-interest-bearing deposits, now lacks market share and growth potential, signaling a past strategic misstep and a potential divestiture candidate.

The bank's Commercial Real Estate (CRE) loan portfolio, particularly loans in less robust markets, experienced paydowns and decreases in late 2024. These underperforming CRE loans exhibit limited growth and smaller market shares, representing a capital drain without commensurate returns and requiring close monitoring for impairments.

Comerica's legacy branch network, with nearly 380 locations, faces challenges in areas with declining populations or high digital adoption, resulting in low foot traffic and reduced market share. The substantial operational costs of these branches contribute minimally to new business growth, positioning them as potential cash traps.

Outdated digital retail banking features, such as a clunky online bill pay system, are categorized as 'dogs' due to low user engagement and failure to keep pace with fintech innovations. In 2024, customer expectations for seamless digital experiences are high, with a J.D. Power study indicating 65% of retail banking customers consider digital channel satisfaction key.

| Segment | BCG Category | Key Characteristics | 2024 Data/Observation |

| Direct Express Contract | Dog | Loss of $3B deposits, no growth engine | Non-renewal of contract |

| Commercial Real Estate Loans (select markets) | Dog | Limited growth, smaller market share, potential impairments | Paydowns and decreases in Q4 2024 |

| Legacy Branch Network | Dog | Low foot traffic, high operational costs, minimal new business | Nearly 380 locations |

| Outdated Digital Features | Dog | Low user engagement, lack of modern functionality, competitive disadvantage | 65% of customers prioritize digital satisfaction (J.D. Power, early 2024) |

Question Marks

Comerica's strategic expansion into the Southeast Market, specifically North Carolina, positions it within a high-growth geographic area. This move aligns with the company's objective to capture a larger share in developing markets. In 2024, North Carolina's banking sector saw robust growth, with total deposits increasing by approximately 6.5% year-over-year, signaling a fertile ground for expansion.

As a relatively new entrant building brand awareness and market share, Comerica faces the typical challenges of establishing a competitive foothold. This necessitates substantial investment in marketing, branch networks, and talent acquisition to effectively compete against established regional and national players. The bank's commitment to this market reflects a long-term vision for sustained growth and market leadership.

Comerica's expansion into Colorado, part of its Mountain West market strategy, positions it within a high-growth economic landscape. This move reflects a commitment to capturing opportunities in a region experiencing significant population and business expansion.

While Colorado presents substantial growth prospects, Comerica's market share in this new territory is likely nascent. This necessitates considerable investment in building brand recognition, establishing a physical presence, and acquiring local talent to compete effectively.

For instance, Colorado's GDP grew by an estimated 3.5% in 2023, outpacing the national average, and Denver's tech sector saw a 15% increase in venture capital funding in the first half of 2024. These figures underscore the potential for Comerica to establish a strong foothold.

Comerica is actively investigating AI and ML to boost its banking and financing offerings. These technologies are poised for significant growth in the financial sector, with early estimates suggesting the AI in banking market could reach $20 billion by 2024, and projected to grow substantially further.

While Comerica is exploring these high-potential areas, its current market share in specific, newly integrated AI/ML services is likely low. This positions these services as potential question marks within the BCG matrix, requiring further investment and development to capture market share as the technology matures and adoption increases.

Comerica BusinessHQ™ Initiatives in New Locations

Comerica is strategically rolling out its BusinessHQ™ and CoWorkSpaces into new markets, focusing on the burgeoning small business sector. These ventures are designed to attract and serve high-growth small businesses with tailored offerings, though initial market penetration in these new areas is still building. This expansion represents a significant investment aimed at establishing a strong foothold and driving adoption.

The expansion into new locations for Comerica BusinessHQ™ initiatives is a key component of their strategy to capture a vital, high-growth segment of the small business market. While the unique value proposition is clear, market share in these nascent locations is still in its early stages of development. Comerica's commitment is evident in the substantial investment required to foster widespread adoption and achieve significant market impact.

Key aspects of Comerica's BusinessHQ™ expansion include:

- Targeting High-Growth Small Businesses: The initiatives are specifically designed to meet the evolving needs of dynamic small businesses.

- Developing Market Share: Initial market share in newly entered locations is currently under development, reflecting the early stage of these ventures.

- Substantial Investment: Significant capital is being allocated to ensure the success and widespread adoption of these new locations and services.

- Unique Value Proposition: The BusinessHQ™ and CoWorkSpaces offer distinct advantages aimed at attracting and retaining small business clients.

Targeted Small Business Banking Teams

Comerica is actively bolstering its small business banking teams, signaling a strategic commitment to this crucial economic sector. These expanded teams are focused on capturing significant market share within competitive niches.

The bank's investment in specialized expertise and relationship management for small businesses aims to drive growth. For instance, in 2024, Comerica reported a notable increase in the number of dedicated small business bankers deployed across its key geographic regions.

- Strategic Focus: Comerica's expansion of targeted small business banking teams highlights a deliberate strategy to serve this vital market segment.

- Market Share Ambition: These teams are tasked with building substantial market share in competitive sub-segments of the small business landscape.

- Investment in Expertise: The growth reflects an investment in specialized skills and relationship-building capabilities essential for small business clients.

- Economic Engine: Small businesses are recognized as key drivers of economic growth, making this a strategically important area for Comerica.

Comerica's exploration of AI and machine learning in banking represents a strategic move into a high-growth, emerging technology sector. While the potential is significant, with the AI in banking market estimated to reach $20 billion by 2024, Comerica's current market share in these specific, newly integrated services is likely low. This positions these AI/ML initiatives as question marks, requiring continued investment to mature and capture a larger share as the technology gains broader adoption.

| BCG Category | Comerica's Position | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Marks | AI/ML Banking Services | High | Low | Requires significant investment to build market share and achieve leadership. |

| Question Marks | New Market BusinessHQ™/CoWorkSpaces | High (Small Business Sector) | Low (in new locations) | Invest to gain traction and establish dominance in these nascent markets. |

BCG Matrix Data Sources

Our Comerica BCG Matrix leverages comprehensive data from financial reports, market research, and industry analyses to provide accurate strategic insights.