Comerica Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comerica Bundle

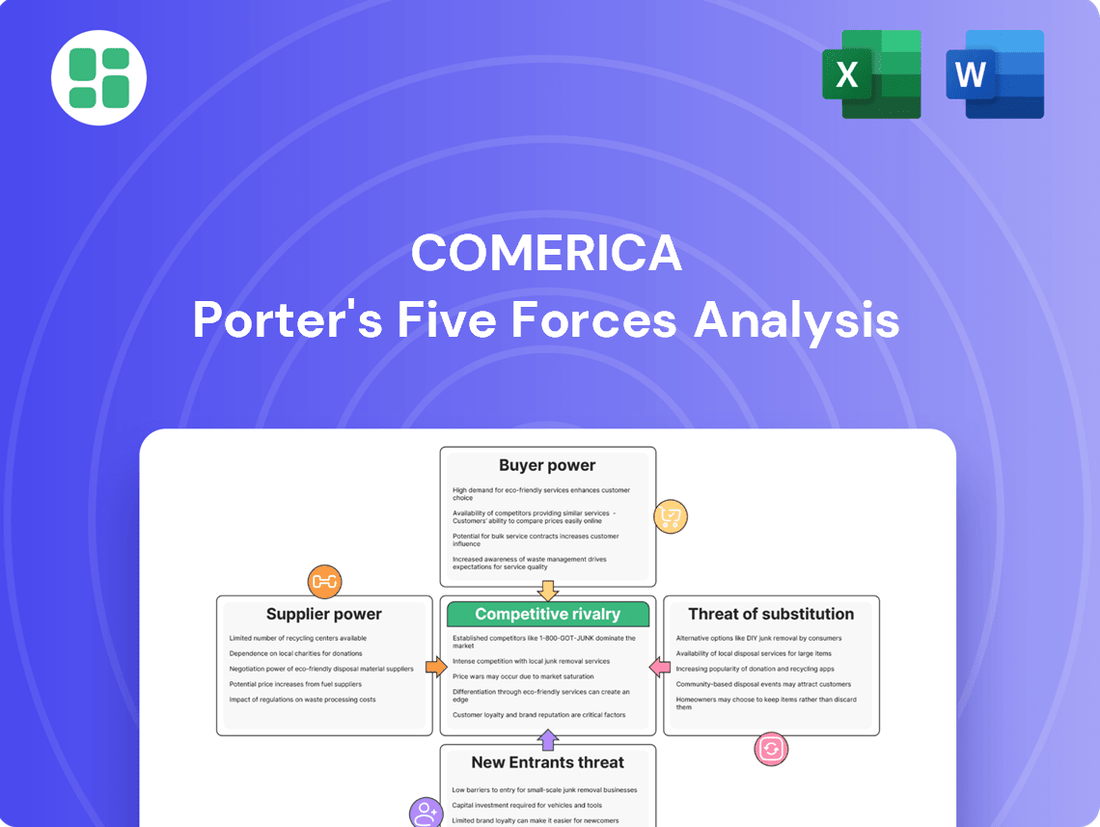

Understanding Comerica's competitive landscape requires a deep dive into the five forces shaping its industry. This analysis reveals how buyer power, supplier leverage, and the threat of substitutes impact its profitability.

The full Porter's Five Forces Analysis offers a comprehensive view of Comerica's market, detailing the intensity of rivalry and the barriers to entry for new players. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology and software providers hold considerable bargaining power over Comerica. The bank's reliance on these vendors for critical functions like core banking systems and digital platforms means that disruptions or price hikes from these suppliers can significantly impact operations and customer service. For instance, the ongoing digital transformation in banking, with a surge in demand for AI-driven analytics and cloud infrastructure, amplifies the leverage of specialized tech firms. In 2023, the global banking software market was valued at over $40 billion, with a projected compound annual growth rate of around 8% through 2028, indicating the increasing importance and value of these technology partners.

Suppliers of advanced data analytics and AI tools are gaining significant bargaining power, especially within the banking industry. These services are now indispensable for crucial functions like tailoring customer experiences, identifying fraudulent activities, and effectively managing risks. For instance, the global big data and business analytics market was projected to reach $312.2 billion in 2024, highlighting the immense value and demand for these capabilities.

The capacity to harness big data and artificial intelligence for generating actionable insights and automating processes grants these data providers substantial leverage. Comerica, like its peers, relies on access to these sophisticated analytics to refine its service portfolio and ensure it remains competitive in a rapidly evolving financial landscape.

The banking sector, including institutions like Comerica, relies heavily on specialized human capital. Areas such as cybersecurity, data analytics, and digital innovation require highly skilled professionals. A scarcity of talent in these critical fields can significantly amplify the bargaining power of both individual employees and the recruitment agencies that source them.

When demand for these niche skills outstrips supply, it naturally drives up labor costs. For instance, in 2024, the average salary for a cybersecurity analyst in the financial services sector saw a notable increase, reflecting this tight labor market. This pressure on wages can directly impact a bank's operational expenses and its capacity to invest in crucial areas like technological advancement and new product development.

Payment Network Providers

Payment network providers like Visa and Mastercard wield considerable power over banks such as Comerica. Their networks are fundamental to facilitating credit and debit card transactions, making them indispensable for Comerica's card services and payment processing operations.

The significant costs and operational disruption associated with switching to alternative payment networks severely limit Comerica's ability to negotiate favorable terms. This reliance, coupled with the extensive and deeply entrenched infrastructure of these major networks, constrains Comerica's bargaining leverage.

- High Switching Costs: Migrating from established payment networks involves substantial investment in new technology, retraining staff, and potential customer disruption, making it a costly endeavor for financial institutions.

- Network Dominance: Visa and Mastercard collectively processed over 200 billion transactions globally in 2023, highlighting their market ubiquity and the difficulty for any single bank to exert significant influence.

- Essential Infrastructure: These networks provide the critical backbone for electronic payments, meaning banks cannot simply bypass them without losing access to a vast customer base and revenue streams.

Real Estate and Infrastructure Providers

Comerica, despite the digital shift, still relies on a substantial physical footprint across key states like Texas, Michigan, California, Arizona, and Florida. This necessitates ongoing relationships with real estate and infrastructure providers for branch operations and corporate offices. In 2024, the demand for commercial real estate, particularly for specialized banking facilities, can grant these providers a degree of leverage, especially given the long-term nature of leases and the specific requirements for bank construction and maintenance.

The specialized nature of bank branch construction and maintenance, coupled with long-term lease agreements, can provide real estate developers and facility management companies with some bargaining power. This is particularly true for locations where finding suitable, compliant properties is challenging.

However, the ongoing digital transformation within the banking sector is a counteracting force. As Comerica and its peers continue to optimize their physical networks and potentially reduce branch count over time, the bargaining power of real estate and infrastructure providers in this specific segment may gradually diminish.

Technology and software providers hold significant bargaining power over Comerica due to the bank's dependence on them for core banking systems and digital platforms. The increasing demand for AI and cloud services in banking, a market valued at over $40 billion in 2023, further amplifies the leverage of specialized tech firms. This reliance means price increases or service disruptions from these vendors can directly impact Comerica's operations and customer experience.

Suppliers of advanced data analytics and AI tools possess considerable leverage as these services are critical for customer experience, fraud detection, and risk management. The global big data and business analytics market was projected to reach $312.2 billion in 2024, underscoring the value these providers offer. Comerica, like its competitors, needs access to these sophisticated analytics to stay competitive.

Payment network providers such as Visa and Mastercard exert substantial influence over Comerica, as their networks are essential for processing credit and debit card transactions. The high costs and operational complexities involved in switching payment networks severely limit Comerica's ability to negotiate favorable terms, reinforcing the dominance of these established players.

| Supplier Type | Bargaining Power Factor | Impact on Comerica |

|---|---|---|

| Technology & Software | Reliance on critical systems, rising demand for AI/cloud | Potential for price hikes, operational disruption |

| Data Analytics & AI | Indispensability for customer insights and risk management | Leverage due to high market value and demand |

| Payment Networks (Visa, Mastercard) | Dominance, high switching costs, essential infrastructure | Limited negotiation power, dependence on their terms |

What is included in the product

This analysis dissects the competitive forces impacting Comerica, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Instantly visualize competitive intensity with a dynamic, interactive dashboard, pinpointing key threats and opportunities for Comerica.

Customers Bargaining Power

For retail banking customers, switching costs for basic services like checking and savings accounts are often quite low. The proliferation of digital-first banks and services designed to simplify the switching process means individuals can move their primary banking relationships with relative ease. In 2024, many fintech companies and challenger banks continue to offer attractive sign-up bonuses and streamlined digital onboarding, making it even simpler for customers to explore alternatives.

The rise of online banks and fintech platforms has dramatically expanded customer options, giving them more leverage. For instance, by the end of 2024, the global fintech market was projected to reach over $1.1 trillion, indicating a massive shift towards digital financial solutions. This increased choice allows customers to easily switch to providers offering better rates or lower fees.

These digital alternatives frequently provide superior convenience and specialized services, further amplifying customer bargaining power. Many fintech apps, for example, offer seamless onboarding and intuitive interfaces, attracting customers away from traditional banking models. This forces established institutions like Comerica to invest heavily in digital innovation to stay competitive.

Customers today are keenly aware of pricing, especially when it comes to fees and interest rates. In 2024, data suggests that a significant portion of consumers, upwards of 30%, consider high fees a major driver for switching banks. This heightened price sensitivity means Comerica must constantly benchmark its offerings against competitors to ensure its pricing remains attractive and its fee structures are clear.

Fragmented Customer Base for Retail and Small Business

Comerica's customer base is quite diverse, encompassing many individual consumers and small to medium-sized businesses. This fragmentation means that no single customer or small group has substantial individual power to dictate terms or prices. For instance, as of Q1 2024, Comerica served over 2.7 million consumer customers, with the vast majority being individuals rather than large corporate entities.

While individual customers have limited sway, their collective behavior can still influence Comerica. A widespread shift in customer preference or dissatisfaction, perhaps driven by competitor offerings or economic conditions, could collectively exert pressure. For example, a trend towards digital-only banking could force Comerica to invest more heavily in its online platforms to retain this dispersed customer base.

- Fragmented Customer Base: Comerica's strength lies in serving millions of individual and small business clients, diluting the power of any single entity.

- Collective Influence: While individually powerless, the sheer volume of customers means a mass exodus or shift in sentiment can impact the bank's strategy.

- Value and Service Focus: To counter potential collective action, Comerica must continuously focus on delivering competitive value and high-quality service across its diverse customer segments.

Sophisticated Corporate and Institutional Clients

While individual retail customers typically wield minimal bargaining power, Comerica's sophisticated corporate and institutional clients represent a significant counterforce. These entities, often requiring complex, bespoke financial solutions, can leverage the substantial volume and value of their business to negotiate more favorable terms. For instance, in 2024, large corporate clients engaging Comerica's treasury management services, which handle substantial transaction volumes, can exert considerable influence over pricing and service level agreements.

Comerica's strategic focus on institutional banking and treasury management acknowledges this dynamic. The bank cultivates these relationships by offering highly customized services, recognizing that tailored solutions are paramount for client retention and satisfaction within this segment. This approach is crucial as these clients can easily switch providers if their specific needs for services like complex cash management or international payments are not met with competitive terms.

- High Volume Transactions: Institutional clients often process millions or billions in transactions annually, giving them leverage in negotiating fees and service costs.

- Customized Solutions: The need for tailored treasury management and complex financial products allows these clients to demand specific features and pricing.

- Relationship Value: Comerica's ability to build strong, long-term relationships with these key accounts is vital to mitigating their bargaining power.

- Competitive Landscape: The presence of other large financial institutions willing to cater to institutional needs intensifies the negotiation process.

The bargaining power of customers for a bank like Comerica is influenced by several factors, primarily the ease of switching and the availability of alternatives. While individual retail customers have limited power due to the fragmented nature of the customer base, their collective sentiment can still exert pressure. In 2024, the digital banking landscape continued to expand, offering customers more choices and pushing banks to enhance their digital offerings and pricing strategies.

Institutional clients, however, hold significant bargaining power. Their large transaction volumes and need for specialized financial services allow them to negotiate favorable terms. Comerica's focus on these clients means it must continually offer competitive pricing and tailored solutions to retain their business, as these clients can readily switch to other providers if their demands aren't met.

| Customer Segment | Bargaining Power Drivers | Comerica's Response |

|---|---|---|

| Retail Customers | Low switching costs, digital alternatives, price sensitivity | Digital innovation, competitive fees, attractive rates |

| Institutional Clients | High transaction volumes, need for bespoke solutions, competitive landscape | Customized treasury management, relationship building, tailored pricing |

What You See Is What You Get

Comerica Porter's Five Forces Analysis

This preview showcases the comprehensive Comerica Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the bank. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability for your business insights.

Rivalry Among Competitors

Comerica faces intense competition from giants like JPMorgan Chase, Bank of America, and Wells Fargo. These national banks boast significantly larger branch networks, advanced technological capabilities, and more diverse product offerings, creating a formidable competitive landscape.

The sheer scale of these larger institutions allows them to achieve substantial economies of scale. This cost advantage, coupled with their ability to cross-sell a wide range of financial services, intensifies pressure on Comerica across all its operating segments, making it harder to gain market share.

For instance, as of the first quarter of 2024, JPMorgan Chase reported total assets of over $3.9 trillion, dwarfing Comerica's approximately $87 billion in total assets. This vast difference in resources directly translates into a stronger competitive position for the larger banks.

Comerica operates in a landscape of robust regional bank competition, particularly within its key markets such as Texas, Michigan, California, Arizona, and Florida. These established regional players often boast strong local relationships and a quicker ability to adapt to specific community financial needs, intensifying the contest for both deposits and loan opportunities.

For instance, in Texas, a significant market for Comerica, regional banks like Frost Bank and Prosperity Bank are formidable competitors, known for their deep roots and community-focused lending strategies. In Michigan, Fifth Third Bank and Huntington Bancshares are major players that actively vie for market share, leveraging their extensive branch networks and diverse product offerings.

The financial sector is experiencing a significant shift due to the rapid rise of fintech and neobanks. These digital-first entities are directly competing with traditional institutions like Comerica by offering streamlined, often cheaper, and highly personalized financial services. For instance, by mid-2024, global fintech investment continued to show resilience, with significant funding rounds bolstering the growth of companies focused on payments, lending, and wealth management, directly impacting customer acquisition for established banks.

Slow Industry Growth and Margin Pressures

The banking sector is experiencing a slowdown in growth. While interest rates are showing signs of stabilization, banks are still grappling with rising deposit costs and a return to more typical credit conditions. This economic climate naturally fuels more intense competition among financial institutions.

This intensified rivalry means banks are fighting harder for every customer and loan. They are looking for ways to differentiate themselves and capture a larger piece of the market, even as the overall pie grows more slowly. This can lead to tighter margins as banks may offer more favorable terms to attract business.

- Modest Industry Growth: The U.S. banking industry's loan growth, for instance, was projected to be in the low to mid-single digits for 2024, a notable deceleration from previous years.

- Deposit Cost Pressures: Banks faced increased costs for deposits in 2023 and into 2024, with average deposit rates rising significantly as customers sought higher yields.

- Normalizing Credit Cycle: Credit quality is expected to remain stable but with a gradual increase in non-performing loans as the economic cycle matures.

- Margin Compression: The combination of higher funding costs and competitive pricing pressures can lead to a compression of net interest margins for many banks.

High Exit Barriers in Banking

Competitive rivalry in banking, including institutions like Comerica, is intensified by high exit barriers. These barriers stem from substantial investments in physical infrastructure, such as bank branches, and robust IT systems, which are difficult and costly to divest. In 2023, the U.S. banking sector saw significant consolidation, yet many smaller or struggling banks remained operational due to these entrenched costs, continuing to exert competitive pressure.

Furthermore, the highly regulated nature of banking imposes complex compliance requirements and often necessitates lengthy wind-down procedures, making a swift exit impractical for many firms. This regulatory environment, coupled with the long-term commitment inherent in managing customer relationships and loan portfolios, discourages rapid market departures. Consequently, even underperforming banks may persist, maintaining a level of competition that impacts pricing and service offerings across the industry.

- Significant Fixed Assets: Banks maintain extensive branch networks and sophisticated IT infrastructure, representing substantial, illiquid investments.

- Regulatory Hurdles: Complex regulations and capital requirements make it challenging and time-consuming for banks to cease operations.

- Customer and Loan Portfolios: The long-term nature of customer loyalty and the lifecycle of loans create sticky relationships that are hard to break.

- Sustained Competitive Pressure: These factors combine to keep less profitable competitors in the market, thereby sustaining rivalry.

Comerica operates in a highly competitive banking environment, facing pressure from national giants, regional players, and agile fintech firms. The sheer scale of competitors like JPMorgan Chase, with over $3.9 trillion in assets as of Q1 2024, allows for significant cost advantages and broader product offerings, making it difficult for Comerica to gain market share.

Intense rivalry is further fueled by rising deposit costs and a normalizing credit cycle, leading to margin compression as banks compete for customers and loans. High exit barriers, including substantial investments in infrastructure and regulatory hurdles, mean even less profitable banks persist, sustaining competitive pressure across the sector.

| Competitor | Total Assets (Q1 2024, est.) | Key Competitive Factor |

|---|---|---|

| JPMorgan Chase | ~$3.9 trillion | Scale, Technology, Product Diversity |

| Bank of America | ~$3.2 trillion | Branch Network, Brand Recognition |

| Wells Fargo | ~$1.9 trillion | Customer Relationships, Regional Presence |

| Regional Banks (e.g., Frost Bank, Fifth Third Bank) | Varies (Significant in specific markets) | Local Relationships, Community Focus |

| Fintech Companies | Varies (Rapidly growing) | Digital Innovation, Lower Costs, Personalization |

SSubstitutes Threaten

Fintech lending platforms pose a significant threat by offering alternative funding avenues. Online lenders and peer-to-peer (P2P) platforms bypass traditional bank routes, providing personal, business, and mortgage loans. For instance, the P2P lending market, which saw substantial growth, facilitated billions in loans globally by 2024, offering quicker approvals and more adaptable terms than many conventional institutions.

The threat of substitutes for Comerica's wealth management and investment services is significant. Customers can easily turn to a wide array of non-bank alternatives, such as independent financial advisors, increasingly sophisticated robo-advisors, and user-friendly online brokerage platforms.

These substitutes often compete by offering specialized advice, lower fee structures, or highly automated investment management, which can be very appealing to clients seeking cost-effectiveness or convenience. For instance, the robo-advisor market has seen substantial growth, with assets under management projected to reach over $3 trillion globally by 2025, indicating a strong preference for these alternatives.

The rise of digital payment solutions and mobile wallets presents a significant threat of substitutes for traditional banking services. Apps like PayPal and Venmo, along with mobile payment systems such as Apple Pay and Google Pay, enable peer-to-peer transfers and point-of-sale transactions, bypassing the need for traditional bank accounts or cards for many everyday uses. For instance, in 2023, the global digital payments market was valued at over $9 trillion, with projections indicating continued strong growth, demonstrating how readily consumers and businesses are adopting these alternatives.

Credit Unions and Community Banks

Credit unions and community banks can serve as substitutes for Comerica's services, especially for customers prioritizing personalized relationships and local engagement. These institutions often offer tailored products and a community-centric approach, appealing to individuals and small businesses who may find large corporate banks less accommodating. For instance, in 2023, credit unions collectively held over $2.3 trillion in assets, demonstrating their significant presence and ability to attract a substantial customer base away from traditional banks.

- Customer Loyalty: Credit unions and community banks often foster strong customer loyalty through personalized service and local investment.

- Niche Offerings: They can provide specialized products or services that cater to specific community needs, acting as a substitute for broader offerings.

- Fee Structures: Different fee models can attract price-sensitive customers who might otherwise use larger institutions.

- Asset Growth: The continued asset growth of credit unions, exceeding $2.3 trillion in 2023, highlights their competitive capacity.

Embedded Finance Solutions

Embedded finance is rapidly growing, offering financial services directly within non-financial platforms. For example, e-commerce sites now frequently integrate financing options at the point of sale, creating a convenient alternative to traditional banking. This shift means customers can access financial tools when and where they need them, potentially bypassing direct interaction with institutions like Comerica for certain transactions.

This trend poses a significant threat of substitutes by offering integrated financial solutions that are more convenient and contextually relevant. As of 2024, the global embedded finance market is projected to reach hundreds of billions of dollars, demonstrating its substantial impact.

- Convenience: Financial services are seamlessly integrated into customer journeys on platforms they already use.

- Point-of-Need Access: Consumers can obtain financing or other services precisely when making a purchase or engaging in a relevant activity.

- Reduced Friction: The process of accessing financial services becomes simpler and faster, minimizing traditional banking hurdles.

- Market Growth: The embedded finance sector is experiencing exponential growth, indicating a strong consumer preference for these integrated solutions.

The threat of substitutes for Comerica is multifaceted, encompassing digital alternatives and community-focused institutions. Fintech lenders, robo-advisors, digital payment platforms, and embedded finance solutions all offer convenient, cost-effective, or integrated financial services that can draw customers away from traditional banking. Credit unions and community banks also present a substitute, particularly for those valuing personalized service and local ties.

| Substitute Category | Examples | Key Competitive Advantages | Market Data/Projections (Illustrative) |

|---|---|---|---|

| Fintech Lending | Online lenders, P2P platforms | Quicker approvals, adaptable terms | P2P lending facilitated billions in loans globally by 2024. |

| Wealth Management Alternatives | Independent advisors, robo-advisors, online brokerages | Specialized advice, lower fees, automation | Robo-advisor AUM projected over $3 trillion globally by 2025. |

| Digital Payments | PayPal, Venmo, Apple Pay, Google Pay | Convenience, peer-to-peer transfers, bypassing traditional accounts | Global digital payments market valued over $9 trillion in 2023. |

| Community Financial Institutions | Credit unions, community banks | Personalized service, community focus, tailored products | Credit unions held over $2.3 trillion in assets in 2023. |

| Embedded Finance | Point-of-sale financing on e-commerce | Integrated convenience, point-of-need access | Global embedded finance market projected in hundreds of billions by 2024. |

Entrants Threaten

The banking sector, including institutions like Comerica, faces substantial regulatory hurdles that significantly deter new entrants. For instance, in 2024, the U.S. banking industry continues to operate under frameworks like Basel III, which mandate rigorous capital adequacy ratios and liquidity requirements. These regulations demand substantial upfront investment and ongoing compliance, making it exceptionally challenging for new firms to establish a foothold.

Establishing a new bank, like Comerica, demands significant upfront capital. This includes building physical branches, investing in robust IT systems, and meeting stringent regulatory reserve requirements, often in the billions of dollars. For instance, in 2024, regulatory capital ratios for large banks remained high, making it a substantial hurdle for newcomers.

These immense financial barriers effectively deter many potential entrants. Raising the billions needed to launch a new bank and compete with established players like Comerica, which already possess significant market share and brand recognition, is an exceptionally difficult undertaking.

Established brand loyalty and trust present a significant barrier to new entrants. Banks like Comerica have cultivated decades of recognition and customer confidence, often associated with stability and security. For instance, in 2024, major established banks continued to see strong customer retention rates, reflecting this deep-seated trust. Newcomers struggle to replicate this level of perceived reliability, making it challenging to attract a substantial customer base quickly.

Economies of Scale and Network Effects

Incumbent banks like Comerica benefit significantly from economies of scale. In 2024, major banks continued to leverage their size to reduce per-unit costs in areas like technology infrastructure and marketing campaigns. For instance, the massive IT investments made by large financial institutions allow them to spread those costs over a vast customer base, offering services at a lower price point than a startup could manage.

Network effects create substantial barriers for new entrants. In the banking sector, a wide-reaching branch network and established payment systems are crucial for customer convenience. By mid-2024, the density of physical branches and the integration of digital payment solutions by established players meant that new banks would need immense capital to replicate this reach and convenience, making it difficult to attract and retain customers.

- Economies of Scale: Large banks can spread fixed costs like technology and compliance over a broader customer base, leading to lower per-unit operating expenses.

- Network Effects: Established customer relationships and integrated payment networks create a valuable ecosystem that is difficult for newcomers to replicate quickly.

- Capital Requirements: Building the necessary infrastructure, technology, and brand recognition to compete with incumbents requires substantial upfront investment, acting as a deterrent.

Fintechs as Potential Entrants or Partners

The threat of new entrants in the banking sector, particularly concerning fintechs, presents a dynamic challenge for established institutions like Comerica. While traditional banking historically involves significant capital and regulatory hurdles, many new players emerge as specialized fintech firms rather than comprehensive banks.

These fintechs often target specific market segments, utilizing technology to bypass some of the stringent regulatory requirements and capital demands faced by incumbent banks. For instance, by focusing solely on digital payments or peer-to-peer lending, they can operate with leaner structures.

As these fintechs mature and expand their reach, they can evolve into direct competitors, offering services that overlap with traditional banking offerings. Alternatively, they may pursue strategic partnerships with established banks, creating new avenues for service delivery and potentially blurring the traditional lines of market entry. In 2024, the fintech sector continued its robust growth, with global fintech funding reaching tens of billions of dollars, indicating sustained innovation and potential competitive pressure.

- Niche Specialization: Fintechs often begin by focusing on specific, underserved areas of financial services.

- Technological Leverage: They use technology to reduce operational costs and circumvent traditional barriers.

- Regulatory Arbitrage: Some fintech models are designed to operate within less regulated spaces initially.

- Partnership or Competition: As they grow, fintechs can become direct rivals or collaborators with traditional banks.

The threat of new entrants for banks like Comerica remains moderate to low due to high capital requirements, stringent regulations, and established brand loyalty. For example, in 2024, launching a new bank still necessitates billions in capital for infrastructure, technology, and compliance with rules like Basel III, making it a significant deterrent.

Economies of scale and network effects further solidify the position of incumbents. Established banks leverage their size to offer services more cost-effectively, and their extensive customer relationships and integrated payment systems are difficult for newcomers to replicate. By mid-2024, the competitive landscape continued to favor institutions with significant operational scale and reach.

While fintechs present a dynamic challenge by targeting niche markets with technology, they often operate with leaner structures and can initially bypass some traditional banking barriers. However, their evolution into direct competitors or strategic partners means established players must remain agile. The robust growth and significant funding in the fintech sector in 2024, with global funding in the tens of billions, underscores this ongoing competitive pressure.

Porter's Five Forces Analysis Data Sources

Our Comerica Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Comerica's annual reports, investor presentations, and SEC filings. This primary data is supplemented by industry-specific market research reports and financial databases to provide a comprehensive view of the competitive landscape.