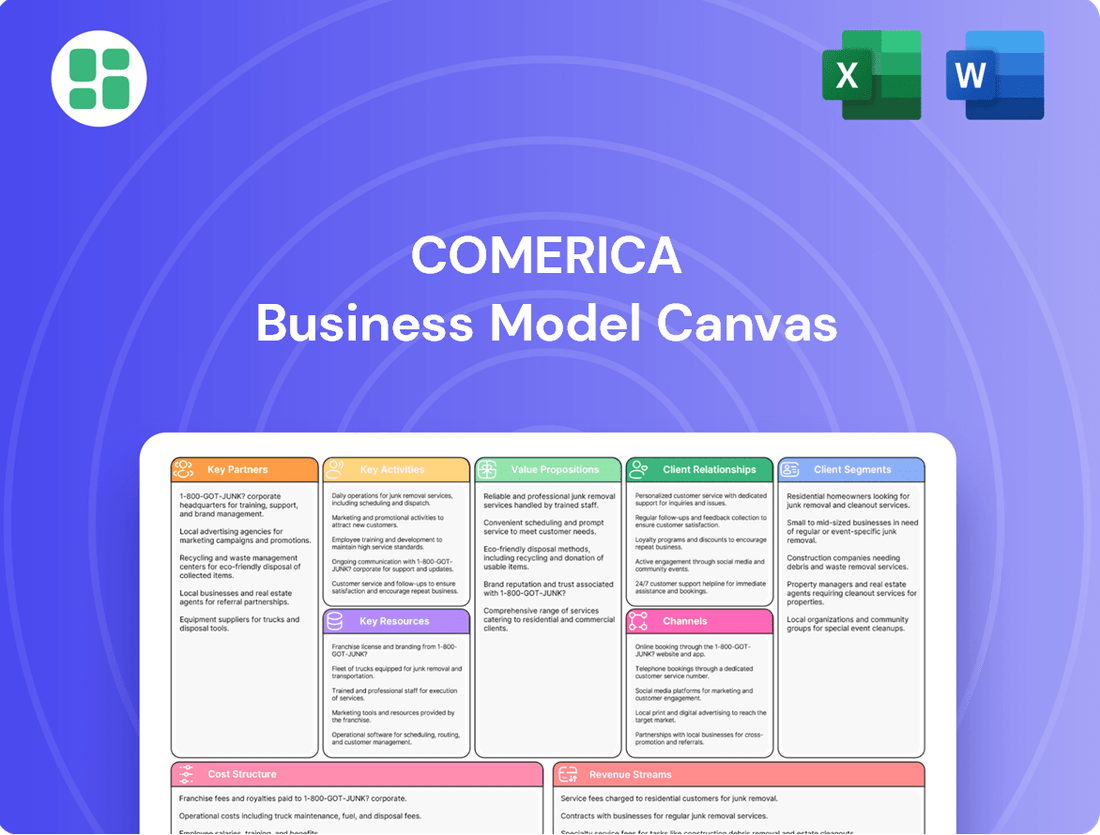

Comerica Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comerica Bundle

Unlock the strategic blueprint behind Comerica's business model. This comprehensive Business Model Canvas breaks down how they serve diverse customer segments and generate revenue. Discover their key resources and cost drivers in this insightful analysis.

Partnerships

Comerica actively collaborates with technology providers to bolster its digital banking services and fortify its cybersecurity defenses. These alliances are instrumental in delivering cutting-edge features and ensuring secure transactions for its clientele.

In 2023, Comerica invested $600 million in technology, a significant portion of which supports these crucial partnerships aimed at enhancing digital platforms and operational efficiency.

These strategic technology partnerships are vital for Comerica to maintain its competitive edge and operational resilience in the fast-paced digital financial environment.

Comerica actively partners with FinTech firms to embed cutting-edge solutions, enhancing its service offerings. These collaborations often focus on areas like real-time payment processing and sophisticated data analytics, crucial for staying competitive in 2024's rapidly digitizing financial landscape.

By integrating FinTech innovations, Comerica can better meet evolving customer demands for speed and convenience, while also unlocking new avenues for revenue generation through specialized digital lending or wealth management platforms.

Comerica leverages correspondent banking relationships to offer essential international services such as wire transfers and foreign exchange, particularly in areas where it lacks a physical footprint. These partnerships are crucial for extending its global reach and efficiently handling cross-border transactions for its clientele.

In 2024, Comerica's international services, supported by its correspondent network, likely saw continued demand as businesses engaged in global trade. While specific figures for correspondent banking revenue aren't always broken out, Comerica's overall Commercial Banking segment, which heavily utilizes these relationships, reported net interest income of $2.3 billion for the first nine months of 2024.

Real Estate Developers and Brokers

Comerica Bank actively cultivates relationships with real estate developers and brokers as a cornerstone of its commercial real estate lending strategy. These collaborations are vital for identifying promising development opportunities and securing a steady pipeline of potential borrowers, reflecting the bank's commitment to specialized lending. In 2023, Comerica's commercial real estate loan portfolio demonstrated resilience, with a focus on well-underwritten projects sourced through these established partnerships.

These partnerships extend to working with experienced appraisers, ensuring that all financed properties undergo rigorous valuation assessments. This due diligence process is critical for managing risk within Comerica's commercial real estate loan book. The bank's specialized expertise in this sector is directly bolstered by the insights and deal flow generated through these key relationships.

- Developer Collaboration: Comerica partners with developers to originate and service commercial real estate loans, accessing a consistent deal flow.

- Broker Networks: Leveraging broker networks allows Comerica to identify and evaluate a broader range of commercial real estate projects.

- Appraiser Integration: The bank relies on independent appraisers to provide accurate valuations, a crucial step in its due diligence for real estate lending.

- Portfolio Health: These partnerships contribute to the overall health and specialized nature of Comerica's commercial real estate loan portfolio.

Community Organizations and Non-profits

Comerica actively partners with community organizations and non-profits to fulfill its corporate social responsibility. These collaborations are crucial for its community development lending and local outreach efforts, directly impacting neighborhood growth.

These strategic alliances bolster Comerica's brand image, showcasing a genuine dedication to community well-being. In 2024, Comerica continued its focus on supporting local economies, with initiatives like its Small Business Growth Program providing resources and capital to underserved entrepreneurs, a testament to these partnerships.

- Community Development Lending: Facilitates access to capital for projects that benefit low-to-moderate income communities.

- Corporate Social Responsibility: Enhances brand reputation and demonstrates commitment to social impact.

- Local Outreach Programs: Strengthens community ties and fosters economic stability through targeted engagement.

- Brand Enhancement: Partnerships contribute to positive public perception and customer loyalty.

Comerica's key partnerships span technology providers, FinTech firms, correspondent banks, real estate developers, and community organizations. These alliances are critical for enhancing digital services, expanding international reach, managing real estate lending risks, and fulfilling corporate social responsibility. The bank's strategic investments, such as the $600 million in technology in 2023, underscore the importance of these collaborations for innovation and operational efficiency.

| Partnership Type | Strategic Importance | 2024 Focus/Impact |

|---|---|---|

| Technology Providers | Digital service enhancement, cybersecurity | Delivering cutting-edge features, ensuring secure transactions |

| FinTech Firms | Service offering innovation, revenue generation | Real-time payments, data analytics, digital lending platforms |

| Correspondent Banks | International services, global reach | Wire transfers, foreign exchange, cross-border transactions |

| Real Estate Developers/Brokers | Commercial real estate lending pipeline, risk management | Sourcing well-underwritten projects, rigorous property valuation |

| Community Organizations | Corporate social responsibility, community development | Supporting local economies, small business growth programs |

What is included in the product

A structured framework detailing Comerica's approach to customer acquisition, value delivery, and revenue generation, organized into key business building blocks.

The Comerica Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of a business's core elements, making complex strategies easily understandable and actionable.

Activities

Comerica's key activity is taking deposits and managing customer accounts, which is the bedrock of its funding. This includes everything from basic checking accounts for individuals to more complex money market accounts for businesses and institutions.

By attracting and holding these deposits, Comerica builds its liquidity, essential for lending and other financial operations. In 2023, Comerica reported total deposits of $114.4 billion, a crucial figure demonstrating the scale of this core activity.

Comerica's core activity is originating and managing a broad range of loans, from commercial and real estate to consumer credit. This process involves meticulous credit evaluation, underwriting, and continuous risk management to ensure a robust and profitable loan portfolio.

In 2024, Comerica's net interest income, largely driven by its lending activities, remained a significant contributor to its financial performance, reflecting the bank's focus on asset generation and yield optimization.

Comerica's wealth management services are a cornerstone of its business model, encompassing investment advisory, trust and estate planning, and private banking. These offerings are designed to serve high-net-worth individuals and institutions, providing them with tailored strategies to manage, preserve, and grow their wealth.

In 2024, Comerica continued to emphasize its commitment to these clients, aiming to deliver expert guidance and personalized financial solutions. The bank's focus on building long-term relationships through these comprehensive services is crucial for client retention and asset growth within its wealth management division.

Treasury Management Services

Comerica’s Treasury Management Services are a cornerstone of its business model, providing critical financial infrastructure for companies. These services are designed to streamline operations, improve liquidity, and reduce financial risk for a diverse client base. For instance, in 2024, businesses increasingly relied on digital payment solutions, a trend Comerica actively supports.

Key activities within Treasury Management include offering a suite of payment and collection solutions. This encompasses Automated Clearing House (ACH) services for efficient electronic payments, wire transfer capabilities for immediate fund movement, and robust commercial card programs that simplify purchasing and expense management. These services are essential for maintaining healthy cash flow and operational efficiency.

- Automated Clearing House (ACH) Processing: Facilitating secure and efficient electronic fund transfers for payroll, vendor payments, and customer collections.

- Wire Transfer Services: Enabling rapid and reliable domestic and international fund transfers for time-sensitive transactions.

- Commercial Card Programs: Providing businesses with tools to manage spending, improve reconciliation, and potentially earn rebates.

- Liquidity Management Tools: Offering solutions like concentration accounts and sweeping services to optimize cash balances and maximize returns on available funds.

Risk Management and Compliance

Comerica's key activities include rigorous risk management and compliance. This means they are constantly watching for and handling financial, operational, and regulatory risks. For instance, in 2023, Comerica reported a total risk-weighted assets of $73.7 billion, demonstrating the scale of financial assets they actively manage. Adherence to strict banking regulations, including anti-money laundering (AML) procedures, is crucial. They also maintain strong internal controls to safeguard the company, its clients, and ensure compliance across all business functions.

- Financial Risk Management: Overseeing credit, market, and liquidity risks.

- Operational Risk Management: Mitigating risks from internal processes, people, and systems.

- Regulatory Compliance: Ensuring adherence to banking laws, AML, and KYC requirements.

- Internal Controls: Implementing robust systems to prevent fraud and ensure accuracy.

Comerica's key activities extend to sophisticated treasury management, offering businesses essential services like ACH processing, wire transfers, and commercial card programs. These services are vital for efficient cash flow and operational streamlining.

In 2024, the demand for digital payment solutions within treasury management remained high, a trend Comerica actively supported by enhancing its digital offerings to meet evolving client needs for speed and convenience in financial transactions.

Risk management and regulatory compliance are paramount, involving the oversight of credit, market, and operational risks. Comerica's commitment to these areas ensures the security of client assets and adherence to stringent financial regulations.

Comerica's loan origination and management, encompassing commercial, real estate, and consumer credit, form a significant revenue driver. The bank's focus on credit evaluation and risk management supports a healthy loan portfolio.

Wealth management services, including investment advisory and private banking, cater to high-net-worth individuals and institutions, aiming to preserve and grow client assets through tailored strategies.

| Key Activity | Description | 2023 Data/2024 Trend |

|---|---|---|

| Deposit Taking & Account Management | Core funding activity through various deposit accounts. | $114.4 billion in total deposits (2023). |

| Loan Origination & Management | Issuing and managing diverse loan portfolios. | Net interest income driven by lending activities (2024). |

| Wealth Management | Providing investment advisory, trust, and private banking. | Continued emphasis on expert guidance and personalized solutions (2024). |

| Treasury Management | Streamlining financial operations for businesses. | High demand for digital payment solutions (2024 trend). |

| Risk Management & Compliance | Overseeing financial, operational, and regulatory risks. | $73.7 billion in total risk-weighted assets (2023). |

Full Document Unlocks After Purchase

Business Model Canvas

The Comerica Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no discrepancies or unexpected changes. Once your order is complete, you will gain full access to this comprehensive and ready-to-use Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

Comerica's financial capital, encompassing customer deposits, shareholder equity, and access to interbank markets, is fundamental to its operations. As of the first quarter of 2024, Comerica reported total deposits of $77.6 billion, providing a substantial base for lending and investment activities.

This capital base is crucial for underwriting loans, managing liquidity, and absorbing potential losses, thereby ensuring the bank's stability and ability to serve its clients. Shareholder equity, standing at $13.9 billion at the end of Q1 2024, represents the owners' stake and a key buffer against financial shocks.

Comerica's human capital is the bedrock of its operations, encompassing a diverse team of skilled professionals. This includes experienced bankers, financial advisors, adept risk managers, crucial IT specialists, and dedicated customer service representatives, all vital for delivering the bank's comprehensive financial services.

The expertise of its employees, coupled with deeply established client relationships and an unwavering commitment to service excellence, forms the core of Comerica's competitive advantage. These elements are paramount in fostering trust and ensuring the effective execution of intricate financial transactions.

As of the first quarter of 2024, Comerica reported a workforce of approximately 5,700 employees. This team's collective knowledge and client-centric approach are fundamental to the bank's ability to navigate complex market dynamics and maintain strong customer loyalty.

Comerica's technology infrastructure is the backbone of its operations, encompassing core banking systems, robust online and mobile platforms, and sophisticated data analytics capabilities. This robust foundation is essential for delivering efficient financial services and driving digital transformation.

In 2024, Comerica continued to invest in its technology, recognizing its critical role in enhancing customer experience and ensuring the security of financial transactions. For instance, their digital banking platforms processed millions of transactions, underscoring the scale and importance of their technological investments.

Branch Network and ATMs

Comerica's physical branch network and ATM infrastructure are crucial for its business model, offering customers a tangible point of interaction and accessibility. This physical presence is particularly important in its key markets, catering to those who value in-person banking services. As of the first quarter of 2024, Comerica operated 241 banking centers and 394 ATMs, demonstrating a significant physical footprint. This network supports complex transactions and personalized consultations, reinforcing its commitment to local communities.

These physical assets work in tandem with Comerica's digital offerings, creating a comprehensive customer experience. The branches serve as vital touchpoints for building relationships and addressing customer needs that extend beyond basic digital transactions. This dual approach allows Comerica to cater to a wider range of customer preferences and banking habits.

- Branch Network: 241 banking centers as of Q1 2024.

- ATM Infrastructure: 394 ATMs as of Q1 2024.

- Customer Accessibility: Provides in-person service and support for diverse banking needs.

- Market Presence: Reinforces local market engagement and customer relationships.

Brand Reputation and Trust

Comerica's brand reputation and the trust it has cultivated are foundational to its business model. This strong reputation acts as a significant intangible asset, drawing in new clients and solidifying relationships with existing ones. It’s a key factor that reassures customers about the bank's financial health and ethical operations in a crowded financial landscape.

In 2024, maintaining and enhancing this trust is paramount. Comerica's commitment to consistent customer service and reliability directly underpins this reputation. This focus helps differentiate the bank, fostering a sense of security and confidence among its diverse customer base, from individual depositors to large corporate clients.

- Customer Retention: A strong brand reputation directly correlates with higher customer retention rates, reducing acquisition costs.

- New Customer Acquisition: Positive word-of-mouth and a trusted brand image attract new clients seeking reliable financial partners.

- Competitive Advantage: In the banking sector, trust is a critical differentiator that sets Comerica apart from competitors.

- Financial Stability Perception: A reputable brand often leads to a perception of greater financial stability and integrity.

Comerica's intellectual capital, including its proprietary risk management models, innovative product development strategies, and deep market insights, provides a distinct competitive edge. This intellectual property is crucial for navigating complex financial markets and offering tailored solutions to clients.

The bank's intellectual capital is further enhanced by its extensive customer data and the analytical frameworks used to derive actionable insights, enabling personalized financial advice and product offerings. This data-driven approach is central to understanding and meeting evolving client needs in 2024.

Comerica's intellectual capital is a critical driver of its long-term value creation, underpinning its ability to adapt to technological advancements and regulatory changes. This focus on innovation ensures the bank remains a leader in the financial services industry.

| Key Resource | Description | Q1 2024 Data/Context |

|---|---|---|

| Financial Capital | Deposits, equity, market access | $77.6B deposits, $13.9B equity |

| Human Capital | Skilled workforce, client relationships | ~5,700 employees |

| Technology Infrastructure | Core systems, digital platforms, analytics | Millions of digital transactions processed |

| Physical Assets | Branch network, ATMs | 241 branches, 394 ATMs |

| Brand Reputation | Trust, customer loyalty | Key differentiator in the market |

| Intellectual Capital | Models, strategies, data insights | Drives innovation and tailored solutions |

Value Propositions

Comerica offers a broad spectrum of financial products, from everyday banking to sophisticated wealth management and treasury services. This integrated approach allows clients to manage all their financial needs through one provider, streamlining operations and enhancing convenience. In 2023, Comerica reported total revenue of $3.2 billion, highlighting their substantial capacity to deliver these comprehensive solutions.

Comerica offers businesses and institutions a suite of tailored banking, lending, and treasury management services. These offerings are specifically crafted to address the distinct operational needs and growth aspirations of corporate and institutional clients, enhancing their financial efficiency and strategic execution. For instance, in 2024, Comerica reported a significant increase in its commercial loan portfolio, reflecting its commitment to supporting business expansion.

Comerica offers tailored wealth management solutions for high-net-worth individuals and families, encompassing investment advisory, trust services, and private banking. In 2024, Comerica's Wealth Management segment reported significant growth, reflecting client trust in their customized strategies for wealth preservation and expansion.

Regional Expertise and Local Presence

Comerica leverages its significant regional footprint, with a strong presence in key economic hubs such as Texas, Michigan, California, Arizona, and Florida. This localized expertise is crucial for understanding the unique economic dynamics and regulatory landscapes within these areas.

This deep understanding of regional markets translates into more insightful business strategies and responsive client service. For instance, in 2024, Comerica's Texas operations continued to benefit from the state's robust energy and technology sectors, allowing for tailored financial solutions.

The bank's commitment to local communities is a core value proposition, enabling them to offer a nuanced approach to meeting specific business needs. This is reflected in their targeted lending programs and community development initiatives across their operating states.

- Texas: A leading market for Comerica, benefiting from strong GDP growth and a diverse economy.

- Michigan: Comerica's home state, with a focus on supporting automotive and manufacturing sectors.

- California: Presence in a state known for its innovation and technology, requiring specialized financial services.

- Arizona & Florida: Growing markets where Comerica provides localized banking solutions to support expansion.

Secure and Reliable Banking

Comerica's commitment to secure and reliable banking is a cornerstone of its value proposition. Customers trust Comerica to safeguard their financial assets and sensitive information, a critical factor in today's digital landscape. This unwavering dedication to stability and regulatory compliance fosters deep trust, offering clients peace of mind across all their banking interactions.

In 2023, Comerica reported a strong financial performance, with net income reaching $1.2 billion. This stability underscores their ability to maintain secure operations. The bank consistently invests in advanced cybersecurity measures to protect against evolving threats, ensuring the integrity of customer data and transactions. For instance, their robust fraud detection systems are designed to identify and prevent unauthorized activity swiftly.

- Asset Protection: Comerica prioritizes the security of customer funds and investments.

- Data Integrity: Strict protocols are in place to protect sensitive personal and financial information.

- Operational Stability: Ensuring uninterrupted access to banking services is paramount.

- Regulatory Adherence: Compliance with all relevant financial regulations builds a foundation of trust.

Comerica provides integrated financial solutions, offering everything from daily banking to specialized wealth management and treasury services. This comprehensive approach simplifies financial management for clients, allowing them to consolidate their banking needs with a single, trusted partner. In 2023, Comerica demonstrated its capacity to deliver these extensive services by reporting $3.2 billion in total revenue.

Customer Relationships

For its high-value clients, especially in business banking, wealth management, and institutional services, Comerica employs a strategy of personalized relationship management. This approach is crucial for fostering deep, long-term partnerships.

Dedicated relationship managers serve as the primary point of contact, offering tailored advice and proactive support. This ensures clients receive comprehensive assistance for their complex financial needs, a key differentiator in the competitive financial landscape.

In 2023, Comerica’s Commercial Banking segment, which heavily relies on these relationship-driven approaches, saw significant activity. For instance, their commercial loan portfolio remained robust, reflecting the trust and engagement built through these personalized interactions.

Comerica offers robust self-service digital platforms, including online and mobile banking, empowering customers to manage accounts, conduct transactions, and access financial information anytime, anywhere. This digital-first approach directly addresses the growing demand for convenience and efficiency, particularly among tech-savvy customers who prefer independent banking solutions.

In 2024, Comerica continued to enhance its digital offerings, with a significant portion of its customer base actively utilizing these self-service channels for routine banking needs. For instance, mobile check deposits saw a substantial year-over-year increase, reflecting customer preference for streamlined, on-the-go banking.

Comerica Bank emphasizes an advisory and consultative approach, moving beyond basic transactions to act as a true financial partner. This means offering tailored insights and guidance on everything from strategic financial planning to navigating business growth and investment opportunities.

This commitment to a consultative relationship fosters deeper, more resilient connections with clients. By showcasing expertise and a genuine dedication to their financial success, Comerica aims to build trust and demonstrate its value as a long-term advisor.

For instance, Comerica's wealth management division reported managing $64.7 billion in assets under management as of the first quarter of 2024, reflecting a significant client base that benefits from this advisory model.

Community Engagement and Local Support

Comerica cultivates strong community ties through its extensive branch network and active involvement in local events. This grounded approach builds trust and fosters a sense of partnership with both individual customers and local businesses, enhancing brand loyalty.

In 2024, Comerica continued its commitment to community development, investing over $10 million in local initiatives and non-profits across its operating regions. This investment underscores their dedication to supporting the economic vitality and well-being of the communities they serve.

- Branch Network Presence: Comerica maintained a significant physical presence with over 200 banking centers in 2024, facilitating direct customer interaction and local support.

- Community Investment: The bank allocated substantial resources to community programs, focusing on areas like economic development, education, and affordable housing.

- Employee Volunteerism: Comerica employees dedicated thousands of volunteer hours in 2024 to support local causes, further embedding the bank within community fabric.

- Local Partnerships: The bank actively partnered with local chambers of commerce and business associations to understand and address the unique needs of small and medium-sized businesses.

Customer Service and Support Centers

Comerica prioritizes strong customer relationships through a multi-channel approach. This includes readily available call centers, secure online messaging for sensitive inquiries, and in-person assistance at their branches. These diverse support avenues ensure customers can reach Comerica through their preferred method, facilitating prompt issue resolution and product guidance.

In 2024, Comerica's commitment to customer service is reflected in its ongoing investments in digital platforms and personnel training. The bank aims to provide not just transactional support but also advisory services, building loyalty and trust across its customer base. This focus on accessibility and responsiveness is key to retaining and growing its client portfolio.

- Multi-channel Support: Comerica offers support via call centers, secure messaging, and in-branch interactions.

- Accessibility and Responsiveness: Ensuring customers can easily get help when they need it.

- Problem Resolution: Addressing inquiries and resolving issues across all banking products.

- Customer Segment Focus: Providing tailored assistance to diverse customer needs.

Comerica cultivates customer relationships through a blend of personalized attention for high-value clients and robust digital self-service options for broader accessibility. Their strategy emphasizes an advisory approach, positioning the bank as a financial partner rather than just a service provider.

This commitment is evident in their dedicated relationship managers for business clients and the continuous enhancement of digital platforms, catering to evolving customer preferences for convenience and efficiency. The bank also actively strengthens community ties through its branch network and local investments.

Comerica's focus on consultation is reflected in its wealth management assets, reaching $64.7 billion in Q1 2024, and its community investment exceeded $10 million in 2024. These figures underscore a strategy built on trust, expertise, and local engagement.

| Relationship Type | Key Features | 2024 Data/Examples |

|---|---|---|

| Personalized Relationship Management | Dedicated relationship managers, tailored advice, proactive support | Commercial Banking segment activity, robust loan portfolio |

| Digital Self-Service | Online and mobile banking, account management, transactions | Increased mobile check deposits, significant customer utilization |

| Advisory and Consultative Approach | Financial planning, growth guidance, investment insights | $64.7 billion in Wealth Management AUM (Q1 2024) |

| Community Engagement | Branch network, local event involvement, community investment | Over 200 banking centers, >$10 million in community investment |

Channels

Comerica's physical branch network is a cornerstone channel, facilitating in-person transactions, consultations, and new account openings across its key markets. These branches offer a crucial tangible presence and local accessibility, particularly vital for building relationships with business clients and addressing complex banking needs.

As of the first quarter of 2024, Comerica operated 238 banking centers. This network allows for direct customer interaction, fostering trust and providing a platform for personalized service, which remains a significant differentiator in the banking industry.

The online banking portal acts as a vital digital gateway, enabling customers to manage accounts, initiate transfers, settle bills, and oversee a broad spectrum of banking operations from any location. This channel offers unparalleled convenience and round-the-clock availability, equipping users with a robust toolkit for their daily financial tasks.

In 2024, Comerica reported a significant increase in digital engagement, with over 70% of customer transactions occurring through its online and mobile platforms, highlighting the portal's central role in customer interaction and service delivery.

Comerica's mobile banking applications offer customers convenient, on-the-go access to a wide range of financial services. Key features include mobile check deposit, real-time account alerts, and ATM/branch locators, all designed to enhance customer experience and financial management. This digital channel directly addresses the growing consumer preference for anytime, anywhere banking, supporting Comerica's strategy to meet modern customer needs.

ATMs (Automated Teller Machines)

Comerica's ATM network is a vital component of its customer relationship and key resources. These machines offer 24/7 access for essential banking needs, enhancing customer convenience and reducing reliance on teller services. In 2024, Comerica continued to invest in its ATM fleet, aiming to provide seamless self-service options across its operating regions.

The ATMs serve as a crucial touchpoint, extending Comerica's service capabilities beyond traditional branch hours and locations. This broad accessibility supports a diverse customer base, from individuals making quick cash withdrawals to businesses depositing checks outside of banking hours. The strategic placement of ATMs in high-traffic areas further amplifies their role in customer acquisition and retention.

- Convenience: ATMs offer immediate access to cash, deposits, and balance inquiries, fitting into customers' busy schedules.

- Extended Reach: They provide banking services outside of regular branch hours and in locations where a physical branch might not be feasible.

- Cost Efficiency: Self-service transactions via ATMs can be more cost-effective for the bank compared to in-person teller interactions.

- Customer Engagement: A robust ATM network contributes to overall customer satisfaction and loyalty by meeting basic transactional needs efficiently.

Dedicated Relationship Managers and Sales Teams

Comerica leverages dedicated relationship managers and specialized sales teams to serve its business, institutional, and wealth management clients. These teams act as the primary point of contact, fostering strong client relationships through personalized engagement.

These professionals actively engage with clients via meetings, phone calls, and digital channels. Their focus is on deeply understanding client needs, proposing customized financial solutions, and ensuring continuous support and guidance.

- Client Engagement: Direct interaction through various communication methods to build rapport and trust.

- Needs Assessment: Identifying specific financial challenges and opportunities for each client.

- Tailored Solutions: Offering bespoke products and services that align with client objectives.

- Ongoing Support: Providing continuous assistance and advice to ensure client satisfaction and success.

Comerica's channels cater to diverse customer needs, blending physical accessibility with robust digital offerings. The bank's strategy emphasizes meeting customers where they are, whether through its extensive branch network, user-friendly online and mobile platforms, or readily available ATMs. For its business and institutional clients, dedicated relationship managers provide personalized service, ensuring tailored financial solutions and ongoing support.

| Channel | Description | Key Features/Focus | 2024 Data/Notes |

|---|---|---|---|

| Physical Branches | In-person transactions, consultations, new account openings | Tangible presence, local accessibility, relationship building | 238 banking centers as of Q1 2024 |

| Online Banking Portal | Digital gateway for account management, transfers, bill pay | Convenience, 24/7 availability, broad spectrum of operations | Over 70% of transactions via digital platforms |

| Mobile Banking Apps | On-the-go access to financial services | Mobile check deposit, real-time alerts, ATM/branch locators | Enhances customer experience and financial management |

| ATM Network | 24/7 access for essential banking needs | Cash withdrawals, deposits, balance inquiries, extended reach | Continued investment in ATM fleet for seamless self-service |

| Relationship Managers/Sales Teams | Personalized service for business, institutional, and wealth clients | Direct client engagement, needs assessment, tailored solutions, ongoing support | Primary point of contact for complex financial needs |

Customer Segments

Individual consumers represent a core customer base for Comerica, seeking essential banking services like checking and savings accounts, personal loans, and credit cards. The bank focuses on meeting their everyday financial needs with convenient and accessible solutions, aiming to support their personal financial management.

Small to Medium-sized Businesses (SMBs) are a core customer segment for Comerica, relying on essential services like business checking and savings accounts, lines of credit, and commercial loans. In 2024, SMBs continue to be a vital engine of economic growth, with data from the Small Business Administration indicating that SMBs account for nearly half of all private sector employment in the United States.

Comerica understands that these businesses often need more than just basic banking; they seek tailored financial solutions and a dedicated banking partner to navigate their specific growth challenges and operational needs. This segment values a bank that can offer guidance and support as they scale, from managing cash flow to securing capital for expansion.

Large corporations and institutions, including government entities and other financial institutions, represent a key customer segment for sophisticated banking solutions. These clients typically require advanced treasury management, substantial corporate lending facilities, and comprehensive investment banking services. In 2024, Comerica continued to focus on serving these demanding clients, offering specialized financial advisory to navigate complex market conditions and manage high transaction volumes.

High-Net-Worth Individuals and Families

Comerica Bank actively serves High-Net-Worth Individuals and Families, offering a full suite of wealth management solutions. This segment requires sophisticated investment advisory, meticulous trust and estate planning, and tailored private banking services, all delivered with a high degree of personalization and discretion.

These clients expect expert guidance to navigate complex financial landscapes, preserve wealth across generations, and achieve their long-term financial objectives. Comerica's approach focuses on building trusted relationships and providing integrated financial strategies to meet these demanding needs.

- Personalized Wealth Management: Tailored investment portfolios and financial planning.

- Trust and Estate Services: Comprehensive solutions for wealth transfer and legacy planning.

- Private Banking: Specialized banking and lending for affluent clients.

- Expert Guidance: Access to seasoned financial advisors and specialists.

Non-profit Organizations

Non-profit organizations, a crucial segment for Comerica, often need banking services designed for their unique mission-driven operations. These entities, ranging from charities to foundations, require specialized accounts and treasury management solutions to efficiently handle donations and manage funds. For instance, in 2024, many non-profits are focusing on digital donation platforms, necessitating robust online banking capabilities.

Comerica provides financing options specifically for community projects and capital campaigns, helping these organizations expand their impact. These solutions are vital for non-profits looking to secure funding for new facilities or program expansions. The sector's reliance on grants and public support means that efficient cash flow management is paramount.

- Specialized Accounts: Offering checking and savings accounts tailored to non-profit needs, including features for grant management and donor tracking.

- Treasury Management: Providing services like remote deposit capture, lockbox services, and online payment portals to streamline donation processing and disbursements.

- Financing Solutions: Offering loans and lines of credit for capital projects, operational needs, and program development, supporting their growth and sustainability.

- Community Impact Focus: Supporting organizations dedicated to social good, education, healthcare, and arts, reflecting a commitment to community development.

Comerica Bank serves a diverse array of customer segments, each with distinct financial needs and expectations. From individual consumers managing daily finances to large corporations requiring complex treasury solutions, the bank tailors its offerings. This broad reach includes small businesses, high-net-worth individuals, and non-profit organizations, all of whom rely on Comerica for specialized banking and advisory services.

| Customer Segment | Key Needs | Comerica's Offerings | 2024 Focus/Data Point |

|---|---|---|---|

| Individual Consumers | Everyday banking, personal loans, credit cards | Checking/savings accounts, accessible solutions | Convenience and digital banking enhancements |

| Small to Medium-sized Businesses (SMBs) | Business accounts, lines of credit, commercial loans | Tailored financial solutions, growth support | SMBs account for nearly half of private sector employment in the US. |

| Large Corporations & Institutions | Treasury management, corporate lending, investment banking | Advanced financial advisory, high-volume transaction support | Navigating complex market conditions and managing significant transaction volumes. |

| High-Net-Worth Individuals & Families | Wealth management, investment advisory, estate planning | Personalized portfolios, trust services, private banking | Preserving wealth across generations and achieving long-term financial objectives. |

| Non-profit Organizations | Specialized accounts, treasury management, project financing | Grant management tools, donation processing, capital campaign support | Focus on digital donation platforms and efficient cash flow management. |

Cost Structure

Employee salaries and benefits represent a substantial cost for Comerica, encompassing compensation for its extensive workforce. This includes not just base pay but also healthcare, retirement plans, and performance-based incentives, crucial for attracting and retaining talent in the competitive financial sector.

In 2024, financial institutions like Comerica typically allocate a significant percentage of their operating expenses to personnel. For instance, a common benchmark for efficiency in banking is a compensation-to-revenue ratio, which for many large banks hovers around 45-55%, though this can fluctuate based on strategic hiring and market conditions.

Comerica's technology and infrastructure costs are significant, encompassing the upkeep and enhancement of its core banking systems and digital platforms. These expenses are crucial for maintaining competitiveness and ensuring robust cybersecurity measures, which are paramount in the financial sector.

In 2024, financial institutions like Comerica are heavily investing in upgrading legacy systems and adopting cloud-based solutions to improve efficiency and scalability. These investments cover software licenses, hardware maintenance, and network infrastructure, with a notable focus on cybersecurity to protect against evolving threats.

Comerica's occupancy and branch operating costs represent a significant portion of its expense structure. These costs encompass rent for its physical branch network and corporate offices, along with utilities, property taxes, ongoing maintenance, and security measures. These are essential expenditures to facilitate in-person banking services and support administrative operations throughout its key markets.

In 2023, Comerica reported non-interest expense of $2.2 billion. While not all of this is directly attributable to occupancy, a substantial part of it relates to the physical infrastructure required to serve its customer base. The bank continues to evaluate its branch footprint to optimize these costs while maintaining essential customer access.

Marketing and Advertising Expenses

Comerica allocates substantial resources to marketing and advertising, a critical component of its cost structure. These expenditures are vital for customer acquisition and retention, encompassing a broad range of activities designed to build brand presence and expand market reach. For instance, in 2023, Comerica's total non-interest expense was $2.3 billion, with marketing and related activities forming a significant portion of this outlay.

The bank's marketing strategy involves multifaceted campaigns, including digital advertising, social media engagement, and traditional media placements. Furthermore, investments in sponsorships and public relations are key to enhancing brand visibility and fostering a positive corporate image. These efforts are directly tied to increasing market share and attracting new business across its diverse customer segments.

- Brand Visibility: Investments in advertising and public relations aim to elevate Comerica's brand recognition.

- Customer Acquisition: Marketing campaigns are designed to attract new retail and commercial clients.

- Customer Retention: Promotional activities and loyalty programs help maintain existing customer relationships.

- Digital Marketing: Significant spending on online channels, including search engine marketing and social media, to reach a wider audience.

Regulatory Compliance and Legal Costs

Comerica, as a financial institution, incurs significant expenses for regulatory compliance and legal services. These costs are essential for maintaining operational integrity and adhering to a complex web of banking laws, anti-money laundering (AML) protocols, and data privacy mandates. In 2024, the banking sector, in general, saw continued investment in compliance technology and personnel to meet evolving regulatory landscapes.

These expenditures are not trivial. They encompass fees for external audits, legal counsel to navigate complex regulations, and internal resources dedicated to ensuring adherence to industry-specific requirements. For example, the cost of implementing and maintaining robust Know Your Customer (KYC) procedures, a key component of AML compliance, represents a substantial ongoing investment.

- Regulatory Adherence: Costs associated with complying with federal and state banking laws, including capital requirements and consumer protection regulations.

- Legal and Audit Fees: Expenses incurred for legal advice on financial transactions, litigation, and independent audits to ensure financial reporting accuracy.

- Compliance Technology: Investments in software and systems for monitoring transactions, managing customer data, and reporting to regulatory bodies.

- Data Privacy and Security: Spending to protect sensitive customer information and comply with data protection laws like GDPR or CCPA equivalents.

Comerica's cost structure is heavily influenced by its investments in technology and marketing, alongside essential operational expenses like personnel and regulatory compliance. These elements are critical for maintaining its competitive edge and serving its customer base effectively. The bank's financial performance in 2023, with $2.3 billion in non-interest expense, underscores the significant outlays required to operate in the current financial landscape.

Revenue Streams

Comerica's primary revenue engine is net interest income. This is the profit generated from the spread between interest earned on loans and securities and interest paid on deposits. In 2023, Comerica reported net interest income of $2.7 billion, highlighting its significance as the core of their banking profitability.

Comerica Bank's revenue is significantly boosted by service charges and fees, a core component of its business model. These include charges for maintaining accounts, overdrafts, ATM usage, and processing various transactions for both individual and business clients.

In 2024, while specific fee breakdowns are proprietary, the banking sector generally sees these charges as a stable revenue stream. For instance, the average non-sufficient funds (NSF) fee in the US remained around $35 in early 2024, impacting millions of transactions annually and contributing to bank profitability.

Comerica generates revenue from wealth management services through various fees. These include charges for investment advisory, trust administration, brokerage, and asset management tailored for affluent individuals and institutional clients.

These fees are commonly structured as a percentage of assets under management (AUM) or as specific charges for distinct services provided. For instance, in the first quarter of 2024, Comerica reported total wealth management revenue of $143 million, reflecting the consistent income derived from these fee-based models.

Treasury Management Service Fees

Comerica generates significant revenue through treasury management service fees, which are charged for a suite of services designed to optimize clients' financial operations. These services include payment processing, sophisticated cash management solutions, and the administration of commercial card programs. This segment is crucial for businesses seeking efficiency and control over their liquidity and financial workflows.

In 2024, treasury management services are a cornerstone of Comerica's fee income. For instance, the bank reported substantial growth in this area, with total treasury management fees contributing a significant portion to its overall non-interest income. This demonstrates the increasing reliance of businesses on specialized banking services to manage their complex financial needs effectively.

- Payment Processing Fees: Charges for facilitating various payment types, including ACH, wire transfers, and lockbox services, ensuring timely and secure transactions for clients.

- Cash Management Fees: Revenue derived from services like deposit, disbursement, and liquidity management, helping businesses optimize their cash flow and working capital.

- Commercial Card Programs: Fees associated with managing corporate credit cards, purchasing cards, and stored-value cards, offering clients enhanced spend control and data insights.

- Other Specialized Corporate Banking Services: Income from services such as fraud prevention tools, international trade finance support, and customized financial technology solutions tailored to corporate clients.

Loan Origination and Servicing Fees

Beyond the core interest earned on loans, Comerica Bank also captures significant revenue through fees tied to the entire lifecycle of its lending activities. This includes charges for originating, processing, and ongoing servicing of a wide array of loan products. For instance, in 2024, a substantial portion of their non-interest income is derived from these fee-based services across commercial, real estate, and consumer lending portfolios.

These origination and servicing fees can manifest in various forms. They often include upfront application fees, charges for closing the loan, and recurring annual servicing fees designed to cover the administrative costs and complexities involved in managing these financial instruments. These fees are a critical component of their diversified revenue model.

- Loan Origination Fees: Charges incurred by borrowers when a new loan is created, covering underwriting and processing.

- Loan Servicing Fees: Ongoing charges for managing the loan, including payment collection, escrow management, and customer service.

- Commercial Loan Fees: Specific fees for business lending, potentially including commitment fees or facility fees.

- Real Estate Loan Fees: Charges related to mortgage and commercial property financing, such as appraisal and title fees.

Comerica's revenue streams are diversified, extending beyond net interest income to include a robust fee-based income model. These fees are generated from a variety of services, reflecting the bank's comprehensive offerings to both individuals and businesses. The bank's strategic focus on fee-generating services like treasury management and wealth management contributes significantly to its overall financial health and stability.

In 2024, Comerica's fee income is a critical component of its profitability. For example, treasury management fees alone have shown consistent growth, underscoring the demand for specialized financial solutions. Similarly, wealth management services, driven by asset-based fees and service charges, generated $143 million in the first quarter of 2024, demonstrating their importance.

The bank also benefits from fees associated with its lending operations, including origination and servicing charges. These fees, alongside service charges on deposit accounts and ATM usage, form a stable and predictable revenue base. In 2023, net interest income was $2.7 billion, while non-interest income, largely comprised of these fees, also played a substantial role in their financial performance.

| Revenue Stream | Description | 2023 Data (if available) | 2024 Trend/Data |

|---|---|---|---|

| Net Interest Income | Profit from loan and securities interest less deposit interest. | $2.7 billion | Core profitability driver. |

| Service Charges and Fees | Account maintenance, overdrafts, ATM, transaction processing. | Significant contributor to non-interest income. | Stable revenue; average NSF fee around $35 in early 2024. |

| Wealth Management Fees | Investment advisory, trust administration, brokerage, asset management. | $143 million (Q1 2024) | Fee-based on AUM and specific services. |

| Treasury Management Fees | Payment processing, cash management, commercial card programs. | Substantial growth reported. | Cornerstone of fee income; essential for business financial operations. |

| Lending-Related Fees | Loan origination, processing, and servicing charges. | Contributes to non-interest income. | Fees for commercial, real estate, and consumer loans. |

Business Model Canvas Data Sources

The Comerica Business Model Canvas is informed by a blend of internal financial data, customer feedback, and competitive market analysis. This multi-faceted approach ensures a comprehensive and actionable strategic blueprint.