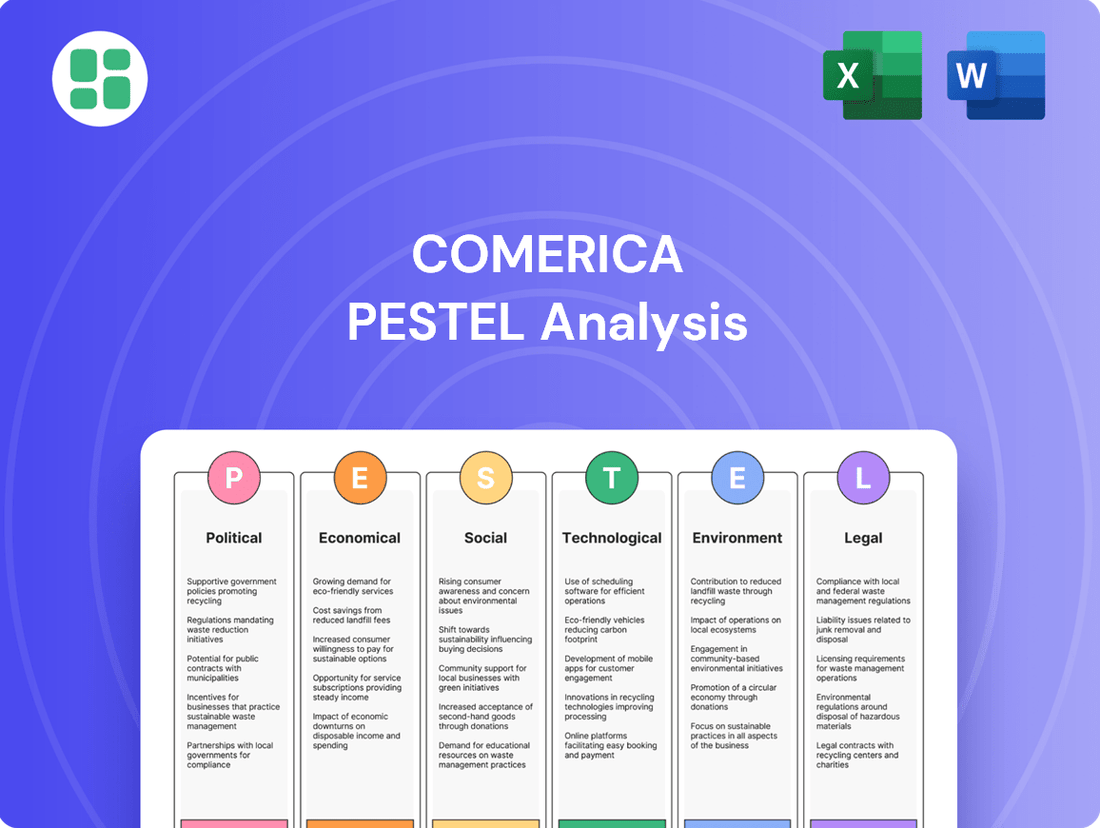

Comerica PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comerica Bundle

Navigate the complex external environment impacting Comerica with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its trajectory and uncover critical insights for your strategic planning. Download the full version to gain a competitive edge.

Political factors

Government policies and regulatory frameworks are pivotal to Comerica's operations, influencing everything from capital requirements to lending practices and compliance burdens. For instance, the Federal Reserve's ongoing review of capital adequacy rules, particularly in light of stress test results from early 2024, could necessitate adjustments to Comerica's balance sheet management. Changes in consumer protection laws, such as those potentially expanding disclosure requirements for loan products, may also increase operational costs and impact profitability.

Changes in government spending and taxation, alongside the Federal Reserve's monetary policy, significantly influence Comerica's financial performance. For instance, the Federal Reserve's decision to raise the federal funds rate by 525 basis points between March 2022 and July 2023 has demonstrably impacted net interest margins across the banking sector, including Comerica, by increasing the cost of funding and potentially moderating loan demand.

Economic stimulus packages, such as those implemented during the COVID-19 pandemic, can boost economic activity and loan growth, benefiting banks like Comerica. Conversely, austerity measures or shifts towards tighter fiscal policy could dampen consumer and business spending, leading to reduced credit demand and potentially higher loan loss provisions.

Comerica's operational landscape is significantly shaped by the political stability and policy frameworks within its key states: Texas, Michigan, California, Arizona, and Florida. These state-level decisions directly impact the economic climate, influencing factors like business incentives, tax rates, and infrastructure investments, which in turn affect Comerica's regional growth prospects and investment opportunities.

Government Support Programs

Government support programs, particularly those aimed at small and medium-sized businesses (SMBs), present a significant avenue for Comerica's growth. Initiatives like the Small Business Administration (SBA) loan programs, which saw substantial activity in recent years, directly fuel Comerica's business banking segment. For instance, in fiscal year 2023, the SBA guaranteed over $44 billion in loans, a figure that underscores the demand and potential for financial institutions like Comerica to participate in these beneficial programs.

The availability and structure of these government programs directly influence Comerica's strategic focus and potential client acquisition. A robust commitment to SMB lending through government-backed channels can bolster Comerica's market share and deepen relationships with a crucial economic demographic. Conversely, a reduction or phasing out of such support could necessitate adjustments in business development strategies to compensate for potentially slower growth in this vital sector.

- SBA Loan Guarantees: In FY2023, the SBA guaranteed approximately $44 billion in loans, highlighting the ongoing government support for small businesses.

- Economic Impact of SMBs: SMBs represent a significant portion of the U.S. economy, making them a key target for Comerica's business banking services.

- Programmatic Dependence: Comerica's growth in its business banking segment can be influenced by the continued availability and attractiveness of government-backed lending programs.

Trade Policies

Comerica's business clients, especially those in import/export and manufacturing, are significantly affected by both international and domestic trade policies. For instance, the U.S. trade deficit with China was around $279.4 billion in 2023, highlighting the scale of cross-border trade that can be influenced by policy shifts.

Changes to trade agreements or the imposition of tariffs directly impact the financial well-being of these clients. This, in turn, affects their demand for essential banking services like business loans and treasury management. For example, tariffs on steel and aluminum, implemented in recent years, increased costs for many manufacturers, potentially altering their borrowing needs.

- Impact on Client Financial Health: Tariffs and trade barriers can increase operational costs for businesses, affecting profitability and their capacity to service debt.

- Demand for Banking Services: Fluctuations in international trade can lead to shifts in demand for Comerica's lending and treasury services as clients adjust their import/export activities.

- Cross-Border Transactions: Trade policies influence the volume and complexity of cross-border transactions, a key area for treasury management services.

Regulatory shifts, including potential changes to capital requirements and consumer protection laws, will continue to shape Comerica's operational landscape. For example, the Federal Reserve's ongoing analysis of bank capital rules, informed by 2024 stress test outcomes, could prompt balance sheet adjustments. Furthermore, evolving consumer protection mandates may increase compliance costs and influence product offerings.

Monetary policy remains a critical political factor, with the Federal Reserve's actions directly impacting Comerica's net interest margins. The significant rate hikes implemented between March 2022 and July 2023 illustrate this influence by raising funding costs and potentially moderating loan demand. Future policy decisions by the Fed will therefore be closely watched for their effect on profitability.

Government support for small and medium-sized businesses (SMBs) presents a key growth avenue for Comerica. The continued availability of programs like SBA loan guarantees, which saw over $44 billion in guarantees in fiscal year 2023, directly fuels Comerica's business banking segment. The extent of this support will influence Comerica's strategic focus on SMB lending.

Trade policies significantly affect Comerica's business clients, particularly those involved in international trade. For instance, the U.S. trade deficit with China in 2023, approximately $279.4 billion, highlights the scale of cross-border activity influenced by policy. Changes in tariffs or trade agreements can alter client financial health and, consequently, their demand for banking services.

What is included in the product

This Comerica PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

The Comerica PESTLE analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, streamlining strategic discussions.

Economic factors

Fluctuations in benchmark interest rates, particularly those set by the Federal Reserve, significantly influence Comerica's net interest income, a core component of its revenue. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and into early 2023, with the federal funds rate reaching a range of 5.25%-5.50% by July 2023, generally boosted banks' lending margins.

However, the outlook for 2024 and 2025 suggests a more stable, potentially declining rate environment. Projections from sources like the Congressional Budget Office and various economic forecasts anticipate a gradual easing of monetary policy. This shift could compress Comerica's profitability by narrowing the spread between what it earns on loans and pays on deposits, and it may also alter customer deposit behavior as higher-yielding alternatives become more attractive.

Inflation directly impacts Comerica by increasing its operating expenses and influencing customer spending power, which in turn affects deposit growth and the demand for loans. For instance, if inflation remains elevated, the bank might see higher costs for everything from technology to salaries.

Economic growth is a crucial driver for Comerica, especially within its key markets. Strong economic expansion fuels business investment and consumer spending, leading to increased lending opportunities and a healthier loan portfolio. In Q1 2024, Comerica reported net interest income of $631 million, a slight decrease from the previous year, reflecting the complex interplay of interest rates and loan demand within the broader economic landscape.

As of May 2024, the U.S. unemployment rate held steady at 4.0%, a figure that generally supports robust consumer spending and bodes well for Comerica. Higher employment levels translate to greater disposable income, which in turn boosts demand for banking products like loans and mortgages, while also reducing the likelihood of loan defaults.

Consumer spending, a key driver of economic activity, remained resilient through early 2024, with retail sales showing modest growth. This sustained spending directly benefits Comerica by increasing transaction volumes and the overall health of its customer base, particularly in sectors reliant on consumer demand.

However, any significant uptick in unemployment or a sharp decline in consumer confidence, as observed during periods of economic uncertainty, would present headwinds for Comerica. Such shifts could lead to increased credit risk as borrowers struggle to meet obligations and a slowdown in loan origination and fee-based income.

Housing Market Trends

The housing market's condition is a critical factor for Comerica, directly affecting its mortgage and real estate lending. States where Comerica has a significant presence, such as Texas, Michigan, California, Arizona, and Florida, are key indicators. For instance, in Texas, the median home price saw a notable increase in early 2024, continuing a trend of robust growth that benefits mortgage portfolios. Conversely, while Michigan's housing market has shown resilience, it might experience slower appreciation compared to Sun Belt states, impacting loan origination volumes.

Interest rate fluctuations play a pivotal role. Higher mortgage rates, as seen through much of 2023 and into 2024, can dampen demand for new mortgages and refinancing, potentially reducing Comerica's fee income and loan growth. For example, the average 30-year fixed mortgage rate hovered around 6.5% to 7% in early 2024, a level that can significantly influence buyer affordability and lending activity. Housing starts, a measure of new construction, also directly correlate with lending opportunities and the bank's exposure to the construction sector.

- Texas Housing Market: Median home prices in Texas continued to rise in early 2024, with some regions experiencing year-over-year increases exceeding 5%, supporting Comerica's real estate lending.

- Michigan Housing Market: While stable, Michigan's housing market saw more modest price appreciation, with average increases closer to 3-4% in early 2024, impacting the scale of mortgage lending.

- Interest Rate Impact: Mortgage rates in the 6.5%-7% range in early 2024 present a dual effect, supporting interest income but potentially cooling demand for new loans.

- Housing Starts: National housing starts, while showing some recovery in early 2024, remained a key indicator of future lending activity and economic health in Comerica's operating regions.

Regional Economic Diversity

Comerica's business model is heavily influenced by the economic health of the specific regions where it operates, notably Michigan, Texas, and California. For instance, Michigan's economy, with its significant automotive sector, directly impacts Comerica's loan portfolios and fee income. In 2024, Michigan's GDP growth was projected to be around 1.5%, a moderate but steady expansion.

Texas, a key market for Comerica, benefits from a robust energy sector and a growing population. This diversification within its core states helps Comerica weather localized economic challenges. Texas's unemployment rate remained low, hovering around 4.0% in early 2024, reflecting a strong labor market.

The bank's exposure to these diverse regional economies means that shifts in local industry performance, such as fluctuations in oil prices affecting Texas or manufacturing output in Michigan, can have a pronounced effect on its financial results.

- Michigan's Automotive Sector: A strong indicator for Comerica's performance in that state.

- Texas Energy Industry: Provides a significant economic driver, influencing regional growth.

- California's Diverse Economy: Offers a different set of economic influences compared to Michigan and Texas.

- Regional GDP Growth Rates: Key metrics to monitor for understanding the economic climate in Comerica's primary markets.

Interest rate shifts remain a primary economic consideration for Comerica, with projections for 2024 and 2025 suggesting a potential easing of monetary policy. This could compress net interest margins, impacting profitability by narrowing the spread between loan earnings and deposit costs.

Inflationary pressures continue to influence operating expenses and consumer spending power, potentially affecting deposit growth and loan demand. High inflation can increase costs for technology and salaries, while also impacting customer purchasing ability.

Economic growth in Comerica's key markets, such as Texas and Michigan, directly drives lending opportunities and loan portfolio health. For instance, in Q1 2024, Comerica's net interest income was $631 million, reflecting the interplay of rates and loan demand.

The unemployment rate, holding at 4.0% as of May 2024, generally supports consumer spending and reduces credit risk, benefiting Comerica's operational environment.

| Economic Factor | 2024/2025 Outlook | Impact on Comerica |

|---|---|---|

| Interest Rates | Potential easing from current levels | Narrower net interest margins, potential shifts in deposit behavior |

| Inflation | Monitoring for sustained elevated levels | Increased operating expenses, impact on consumer spending and loan demand |

| Economic Growth (Key Markets) | Moderate but steady expansion projected | Supports lending opportunities, influences loan portfolio quality |

| Unemployment Rate | Expected to remain low | Boosts consumer spending, reduces credit risk |

What You See Is What You Get

Comerica PESTLE Analysis

The preview shown here is the exact Comerica PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors affecting Comerica.

The content and structure shown in the preview is the same Comerica PESTLE Analysis document you’ll download after payment, offering valuable strategic insights.

Sociological factors

Customer preferences are rapidly shifting towards digital and mobile banking solutions, compelling institutions like Comerica to prioritize technological advancements and user experience. This evolution demands seamless, personalized interactions across all service areas, from everyday consumer banking to sophisticated wealth management. For instance, mobile banking adoption rates continue to climb, with a significant portion of banking transactions now conducted via smartphones, a trend expected to accelerate through 2025.

Demographic shifts are significantly reshaping consumer needs and financial behaviors. The aging population, for instance, often requires different banking services, such as retirement planning and wealth management, compared to younger generations. In 2024, the U.S. Census Bureau projected that individuals aged 65 and over would constitute a growing portion of the population, highlighting a sustained demand for these specialized services.

Simultaneously, the financial habits of millennials and Gen Z are evolving, with a greater emphasis on digital banking, mobile payments, and socially responsible investing. Data from the Federal Reserve in 2024 indicated a continued rise in digital channel usage among these age groups. Comerica must adapt its product development and marketing strategies to resonate with these digitally-native consumers and their unique financial priorities.

Furthermore, the increasing ethnic diversity across Comerica's operating regions, particularly in states like Texas and California, necessitates culturally sensitive financial products and outreach. Understanding and catering to the specific banking needs of various ethnic communities, such as offering multilingual support or tailored loan products, is crucial for market penetration and customer loyalty in 2024 and beyond.

Societal shifts increasingly highlight the importance of financial literacy and inclusion, directly influencing consumer demand for user-friendly banking services and educational support. This trend presents a significant opportunity for institutions like Comerica to foster deeper customer relationships and broaden their reach by championing financial empowerment, particularly within communities historically excluded from mainstream financial systems.

Workforce Dynamics

Societal shifts are significantly reshaping workforce expectations. Employees increasingly prioritize work-life balance, demanding flexibility and a culture that supports personal well-being. Comerica, like many in the financial sector, must adapt to these evolving demands to remain competitive in attracting and retaining top talent.

Diversity, equity, and inclusion (DEI) are no longer just buzzwords but core tenets of a modern, successful organization. A commitment to DEI not only fosters a more inclusive environment but also broadens the talent pool and enhances innovation. For Comerica, demonstrating a robust DEI strategy is crucial for its employer brand and long-term sustainability.

Maintaining a skilled workforce in financial services requires more than just competitive salaries. A strong corporate culture, comprehensive benefits packages, and opportunities for professional development are paramount. In 2024, reports indicate a significant portion of the workforce, particularly younger generations, consider company culture and benefits as key decision factors when choosing an employer.

- Employee Expectations: A 2024 survey found that over 70% of employees value flexible work arrangements and a supportive work-life balance when considering job offers.

- DEI Impact: Companies with strong DEI initiatives reported a 15% higher employee retention rate in the 2024 fiscal year compared to those with weaker programs.

- Talent Attraction: In the competitive financial services landscape, companies offering enhanced benefits, including mental health support and professional development, saw a 20% increase in qualified applicant pools in late 2024.

- Industry Trends: The financial sector is seeing a growing demand for roles that blend technological expertise with client relationship management, requiring a workforce with adaptable skill sets.

Trust and Reputation

Trust and reputation are paramount in the banking sector, directly influencing customer loyalty and brand perception for institutions like Comerica. Public sentiment towards banking, coupled with Comerica's commitment to corporate social responsibility, significantly shapes its standing. For instance, a 2024 survey indicated that 65% of consumers consider a bank's ethical practices a key factor in their decision-making process.

Maintaining rigorous ethical standards and transparent operations is essential for building and sustaining trust across all client segments. Comerica's focus on community investment and responsible lending practices, highlighted in its 2023 annual report where it allocated $15 million to support small businesses, directly contributes to this trust.

- Customer Loyalty: A strong reputation fosters deeper relationships, leading to higher retention rates.

- Brand Image: Positive public perception enhances brand value and attracts new customers.

- Ethical Conduct: Adherence to high ethical standards is non-negotiable for long-term viability.

- CSR Impact: Corporate social responsibility initiatives demonstrably build goodwill and trust.

Societal values are increasingly emphasizing financial literacy and inclusion, pushing banks like Comerica to offer more accessible educational resources and user-friendly platforms. This trend is driven by a desire for greater transparency and empowerment in financial management, particularly among younger demographics and underserved communities.

Consumer expectations around corporate social responsibility (CSR) are growing, with a significant portion of the public now evaluating financial institutions based on their ethical practices and community impact. Comerica's commitment to initiatives like supporting small businesses, as evidenced by its $15 million allocation in 2023, directly addresses this evolving societal expectation.

The demand for work-life balance and a supportive corporate culture is reshaping employee expectations within the financial sector, making these factors critical for talent acquisition and retention. In 2024, surveys indicated that over 70% of job seekers prioritize flexible work arrangements and a positive company culture when considering employment opportunities.

| Societal Factor | Impact on Comerica | 2024/2025 Data/Trend |

|---|---|---|

| Financial Literacy & Inclusion | Increased demand for educational tools and accessible banking services. | Growing consumer preference for transparent and easy-to-understand financial products. |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation and customer loyalty tied to ethical practices and community investment. | 65% of consumers consider ethical practices when choosing a bank (2024 survey). |

| Work-Life Balance & Culture | Need to adapt HR strategies to attract and retain talent, focusing on flexibility and employee well-being. | Over 70% of employees value flexible work arrangements (2024 survey). |

| Diversity, Equity, and Inclusion (DEI) | Crucial for fostering innovation, broadening talent pools, and enhancing employer branding. | Companies with strong DEI programs reported 15% higher employee retention (FY 2024). |

Technological factors

Comerica's digital banking transformation is paramount for its competitive edge. The bank is heavily investing in online account opening, mobile payment systems, and user-friendly digital interfaces to attract and keep customers. For instance, in Q1 2024, Comerica reported a 9% increase in digital sales, highlighting the growing customer preference for these channels.

The increasing reliance on digital platforms for financial transactions directly amplifies the risk of cyberattacks and data breaches for Comerica. This heightened threat landscape directly impacts the bank's reputation and the crucial trust it holds with its customers. For instance, in 2023, the financial sector experienced a significant uptick in ransomware attacks, with average costs reaching millions of dollars per incident, underscoring the financial implications of inadequate security.

Consequently, implementing and maintaining stringent cybersecurity protocols, alongside unwavering compliance with evolving data privacy regulations like GDPR and CCPA, becomes absolutely essential. These measures are not merely operational necessities but are critical for protecting sensitive customer financial data and mitigating potential financial and reputational damage.

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly transforming the financial sector, offering Comerica significant opportunities to boost efficiency and customer engagement. In 2024, the banking industry is increasingly adopting AI for tasks like fraud detection, with some institutions reporting reductions in false positives by up to 30% through advanced ML algorithms. Comerica can leverage these technologies to automate routine processes, refine credit risk assessments by analyzing vast datasets, and deliver highly personalized banking experiences to its customers, thereby gaining a competitive edge.

FinTech Competition

FinTech companies are increasingly challenging traditional banks like Comerica by offering specialized, often more user-friendly services in payments, lending, and wealth management. For instance, the digital lending market saw significant growth, with fintechs capturing a substantial share of new loan originations, particularly in small business lending. Comerica must either innovate internally, acquire FinTech capabilities, or forge strategic partnerships to remain competitive in these rapidly evolving financial landscapes.

The competitive pressure from FinTechs is substantial. In 2024, FinTech funding continued to be robust, with significant investments flowing into areas directly competing with core banking services. This trend is expected to persist through 2025, forcing established institutions to adapt quickly. Comerica's response will likely involve enhancing its digital offerings and potentially leveraging AI for personalized customer experiences, mirroring the agility of its FinTech rivals.

- FinTech Market Share: FinTech firms are steadily increasing their market share in key banking segments, such as digital payments and consumer lending.

- Investment Trends: Venture capital investment in FinTech remained strong in 2024, with a particular focus on AI-driven solutions and embedded finance.

- Customer Expectations: Consumers increasingly expect seamless, digital-first experiences, a benchmark set by many FinTech providers.

- Strategic Imperatives: Comerica's competitive strategy must address FinTech disruption through a combination of internal development, strategic acquisitions, and collaborative ventures.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) continue to mature, offering significant potential for transforming financial services. These innovations promise to bolster the security of transactions, streamline cross-border payments, and improve the integrity of record-keeping. For a bank like Comerica, exploring blockchain applications could unlock new avenues for operational efficiency, cost reduction, and enhanced transparency across various banking functions.

The global blockchain market was valued at approximately $12.17 billion in 2023 and is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 40% through 2030. This rapid expansion underscores the increasing adoption and investment in the technology. Comerica could leverage these advancements for:

- Enhanced Security: Implementing DLT for transaction processing can offer a more robust and immutable record, reducing fraud risks.

- Cost Reduction: Automating processes like reconciliation and settlement through blockchain can significantly lower operational expenses.

- Improved Transparency: DLT can provide a shared, auditable ledger for certain operations, increasing trust and visibility for stakeholders.

Comerica's digital banking initiatives are crucial for staying competitive, with investments in online account opening and mobile payments showing positive results. In Q1 2024, digital sales increased by 9%, indicating a strong customer shift towards digital channels.

The growing reliance on digital platforms exposes Comerica to increased cybersecurity risks, a significant concern given the financial sector's rise in ransomware attacks in 2023, which incurred substantial costs per incident.

AI and ML present opportunities for Comerica to enhance efficiency and customer engagement, with banks in 2024 reporting up to 30% reductions in fraud detection false positives using ML.

FinTech companies continue to challenge traditional banks, with strong venture capital investment in AI and embedded finance in 2024, necessitating Comerica's adaptation through innovation or partnerships.

| Technological Factor | Impact on Comerica | Key Data/Trends (2024-2025) |

| Digital Transformation | Enhanced customer acquisition and retention; improved operational efficiency. | 9% increase in digital sales (Q1 2024); continued customer preference for digital channels. |

| Cybersecurity Risks | Reputational damage and financial loss due to data breaches. | Increased ransomware attacks in the financial sector (2023); high average incident costs. |

| AI & Machine Learning | Improved fraud detection, credit risk assessment, and personalized customer experiences. | Up to 30% reduction in fraud false positives reported by early adopters of ML. |

| FinTech Competition | Pressure to innovate and adapt offerings; potential market share erosion. | Robust FinTech funding in 2024, focusing on AI and embedded finance; strong growth in digital lending. |

| Blockchain & DLT | Potential for enhanced security, cost reduction, and improved transaction transparency. | Global blockchain market valued at ~$12.17 billion in 2023; projected high CAGR. |

Legal factors

Comerica, like all financial institutions, navigates a dense regulatory landscape. Key among these are federal requirements like Basel III, which dictates capital adequacy ratios. For instance, as of early 2024, major US banks are still adapting to the finalization of Basel III reforms, impacting how much capital they must hold against potential losses.

Failure to meet these stringent banking regulations can lead to severe consequences. These include significant financial penalties, such as the multi-million dollar fines levied against various banks for compliance failures in recent years, and substantial damage to a bank's public image.

Operational restrictions are another critical outcome of non-compliance. Regulators can impose limitations on business activities, growth, or even mandate changes in management, directly impacting Comerica's ability to operate and serve its customers effectively.

Consumer protection laws like the Truth in Lending Act and the Fair Credit Reporting Act are critical for Comerica's retail operations. These regulations mandate transparency in financial dealings and accuracy in credit reporting, directly impacting how the bank interacts with its customers.

Failure to comply can lead to significant legal repercussions, including fines and lawsuits, which can erode consumer trust. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued to actively enforce these statutes across the financial industry, with banks facing scrutiny over fair lending practices and data privacy.

Comerica, like all financial institutions, operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are in place to combat financial crime and block the funding of terrorism. For instance, the Bank Secrecy Act (BSA) in the U.S. mandates comprehensive compliance programs.

Maintaining robust AML and KYC compliance is paramount for Comerica to avoid significant legal penalties and damage to its reputation. This involves implementing sophisticated transaction monitoring systems and promptly reporting any suspicious activities to regulatory bodies. Failure to do so can result in hefty fines; in 2023, financial institutions globally faced billions in AML-related penalties.

Data Privacy and Security Laws

Comerica, like all financial institutions, navigates a complex web of data privacy and security laws. The increasing volume of customer data collected necessitates strict adherence to regulations such as the California Consumer Privacy Act (CCPA) and its evolving counterparts in other states. Failure to comply can result in significant penalties, with CCPA fines potentially reaching $7,500 per intentional violation, as of 2024.

Protecting sensitive customer information is not just a legal obligation but a cornerstone of maintaining trust and confidence. Comerica's commitment to transparent data handling practices directly impacts its reputation and customer loyalty. In 2024, data breaches in the financial sector continued to be a major concern, with reports indicating millions of customer records compromised annually across the industry.

- Regulatory Landscape: Comerica must continuously monitor and adapt to evolving data privacy legislation at federal and state levels, including potential new regulations emerging in 2025.

- Customer Trust: Robust data security measures are critical for safeguarding customer confidence, which directly influences account retention and new customer acquisition.

- Compliance Costs: Investment in cybersecurity infrastructure and legal expertise to ensure compliance with laws like CCPA represents a significant operational cost for financial institutions.

- Reputational Risk: Data breaches can lead to severe reputational damage, impacting market perception and potentially resulting in a loss of business.

Litigation and Regulatory Enforcement

Comerica, like all financial institutions, navigates a landscape fraught with litigation and regulatory enforcement risks. These can stem from alleged misconduct, contractual disagreements, or direct actions by regulatory bodies. For instance, in 2023, the financial sector saw significant settlements related to various compliance issues, highlighting the persistent need for robust legal defense and proactive compliance measures.

To effectively manage these potential legal liabilities, Comerica must invest in and maintain stringent internal controls, alongside expert legal counsel. This proactive approach is crucial for mitigating financial and reputational damage. The Federal Reserve's ongoing scrutiny of capital requirements and consumer protection practices, for example, means that adherence to evolving regulations is paramount.

- Ongoing Litigation Risks: Financial firms frequently face lawsuits concerning fair lending practices, data security breaches, and alleged fraud.

- Regulatory Scrutiny: Agencies like the OCC and CFPB continuously monitor banks for compliance with banking laws and consumer protection regulations.

- Mitigation Strategies: Comerica's investment in compliance programs and legal expertise aims to reduce the likelihood and impact of adverse legal outcomes.

Comerica's operations are heavily influenced by evolving legal frameworks, particularly concerning data privacy and consumer protection. As of 2024, states like California continue to refine their privacy laws, such as the CCPA, impacting how financial institutions handle customer data and potentially leading to fines of up to $7,500 per intentional violation.

The bank must also navigate stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, crucial for combating financial crime. Non-compliance in this area can result in substantial penalties, with global financial institutions facing billions in AML-related fines in 2023 alone.

Furthermore, federal regulations like Basel III continue to shape capital adequacy requirements for banks, with ongoing adaptations by major US institutions in early 2024 affecting their operational capacity and risk management strategies.

| Legal Factor | Impact on Comerica | Example/Data Point (2023-2024) |

|---|---|---|

| Data Privacy Laws (e.g., CCPA) | Requires robust data handling and security protocols; potential for significant fines. | CCPA fines can reach $7,500 per intentional violation (as of 2024). |

| AML/KYC Regulations | Mandates comprehensive compliance programs to prevent financial crime. | Global financial institutions faced billions in AML fines in 2023. |

| Capital Adequacy (e.g., Basel III) | Dictates capital requirements, influencing lending capacity and risk management. | Major US banks continued adapting to Basel III finalization in early 2024. |

Environmental factors

Environmental factors are increasingly shaping financial institutions like Comerica. Growing investor and public demand for Environmental, Social, and Governance (ESG) considerations directly influences lending and investment decisions. This trend is evident as sustainable finance markets continue to expand, with global sustainable debt issuance projected to reach new highs in 2024 and 2025.

Comerica's integration of ESG factors into its credit assessments and the offering of green financing options can attract new clients and align with sustainable development goals. For instance, by the end of 2023, many leading banks reported significant growth in their green loan portfolios, signaling a clear market shift towards environmentally conscious lending practices.

Comerica's loan portfolio, especially in real estate and sectors like agriculture and energy, faces potential physical risks from climate change, including damage from extreme weather events like floods and wildfires. For instance, in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $170 billion in damages, underscoring the growing impact of these events on economic stability and loan collateral.

Managing these climate-related financial risks is a critical component of modern risk assessment and regulatory compliance, with institutions increasingly expected to disclose their exposure and mitigation strategies. The increasing frequency and severity of climate-related events necessitate robust scenario analysis and stress testing to understand potential impacts on loan performance and capital adequacy throughout 2024 and beyond.

Financial institutions like Comerica face growing demands for detailed sustainability reports and climate-related disclosures, aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). For instance, by the end of 2024, many large corporations are expected to have enhanced their climate risk reporting, a trend that will increasingly influence financial sector expectations.

Comerica must proactively and transparently communicate its environmental footprint and sustainability initiatives to satisfy stakeholders, including investors, regulators, and customers who are prioritizing ESG factors. This includes detailing efforts in areas such as carbon emissions reduction and sustainable financing practices.

Operational Carbon Footprint

Comerica's operational carbon footprint, encompassing energy usage in its extensive branch network and data centers, faces increasing stakeholder attention. The company's commitment to reducing greenhouse gas emissions, enhancing energy efficiency, and adopting renewable energy sources directly impacts its environmental stewardship and offers potential cost savings. For instance, in 2023, Comerica reported a 10% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2019 baseline, driven by initiatives like LED lighting upgrades in its facilities and increased use of renewable energy credits for its data centers.

Key aspects of Comerica's operational carbon footprint management include:

- Energy Consumption: Monitoring and reducing electricity and fuel usage across all physical locations and IT infrastructure.

- Greenhouse Gas Emissions Reduction: Setting targets and implementing strategies to lower Scope 1 and Scope 2 emissions.

- Renewable Energy Transition: Increasing the proportion of energy sourced from renewable providers or through direct investments.

- Operational Cost Savings: Achieving efficiencies through energy conservation measures, which can lead to reduced utility expenses.

Client Demand for Green Finance

Clients are actively seeking financial solutions that align with environmental responsibility. This trend is evident in the growing interest in green bonds, renewable energy project financing, and sustainable investment portfolios. For instance, global green bond issuance reached an estimated $700 billion in 2024, a significant increase from previous years, indicating robust investor appetite.

Comerica can leverage this burgeoning market by expanding its suite of green finance products. Developing and actively promoting offerings such as sustainable loans for energy-efficient upgrades or investment funds focused on environmental, social, and governance (ESG) criteria directly addresses this client demand. This strategic focus not only meets market needs but also positions Comerica as a forward-thinking financial institution.

- Growing Investor Interest: Global green bond issuance projected to exceed $700 billion in 2024.

- Demand for Sustainable Investments: Increased client inquiries for ESG-focused mutual funds and ETFs.

- Corporate Sustainability Goals: Businesses are increasingly seeking financing for renewable energy projects and carbon reduction initiatives.

- Regulatory Tailwinds: Evolving regulations globally are encouraging the development and adoption of green financial products.

Comerica's environmental strategy must address both physical climate risks and the transition to a low-carbon economy. The increasing frequency of extreme weather events, such as the 28 billion-dollar disasters in the U.S. in 2023 causing over $170 billion in damages, directly impacts loan collateral and economic stability. Furthermore, growing investor and regulatory pressure necessitates robust ESG reporting and the development of green financial products, with global sustainable debt issuance expected to reach new highs in 2024 and 2025.

Comerica's operational efficiency is also under scrutiny, with a focus on reducing its carbon footprint. The company reported a 10% reduction in Scope 1 and 2 emissions by the end of 2023 compared to 2019, achieved through initiatives like LED lighting and renewable energy credits. This focus on sustainability not only aligns with stakeholder expectations but also offers potential operational cost savings.

| Environmental Factor | Impact on Comerica | Data/Trend (2024/2025 Projections) |

|---|---|---|

| Climate Change Physical Risks | Damage to loan collateral, increased insurance costs, operational disruptions | 28 U.S. billion-dollar weather/climate disasters in 2023 ($170B+ damages) |

| Transition to Low-Carbon Economy | Demand for green finance, evolving regulatory landscape, reputational risk | Global sustainable debt issuance projected to exceed previous highs in 2024/2025 |

| Operational Carbon Footprint | Energy costs, stakeholder perception, regulatory compliance | Comerica achieved 10% Scope 1 & 2 GHG emission reduction by end of 2023 (vs. 2019 baseline) |

| ESG Investor Demand | Attracting capital, influencing investment decisions, product development | Growing client inquiries for ESG-focused funds; global green bond issuance ~$700B in 2024 |

PESTLE Analysis Data Sources

Our Comerica PESTLE Analysis is built on a robust foundation of data from government agencies, financial institutions, and reputable market research firms. We integrate economic indicators, regulatory updates, technological advancements, and social trends to provide comprehensive insights.