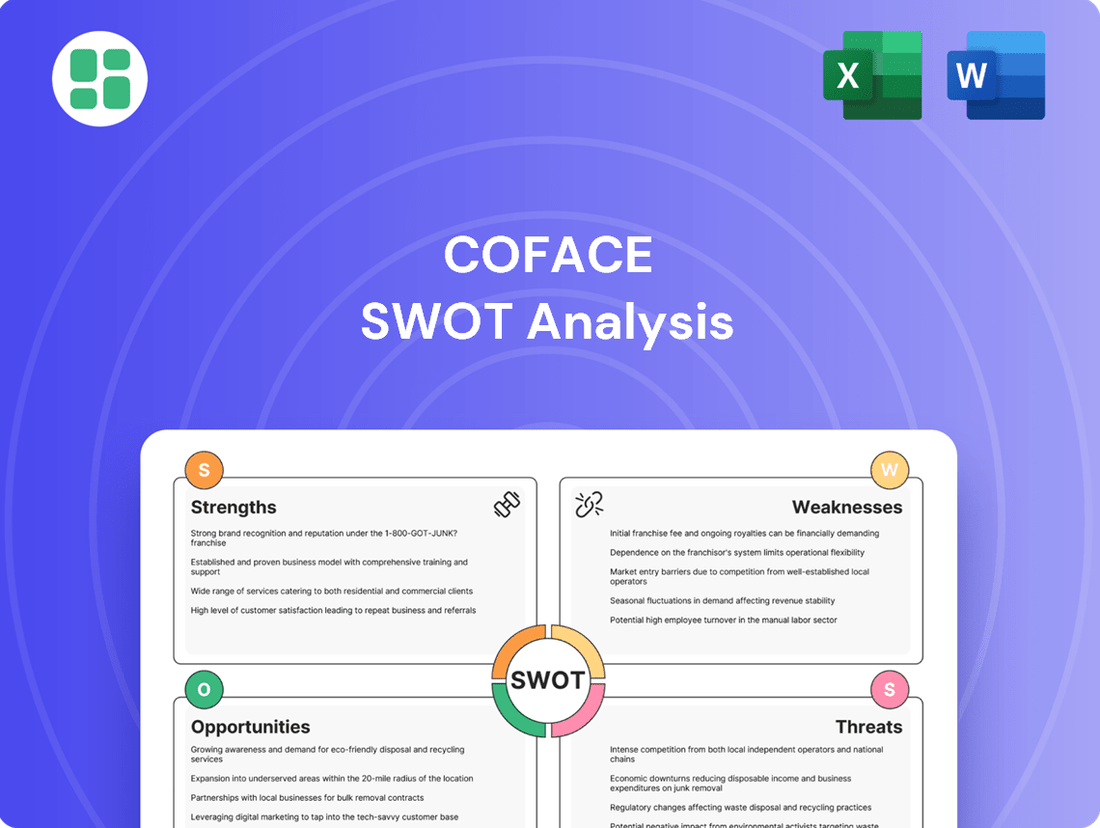

Coface SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coface Bundle

Coface, a global leader in credit insurance, demonstrates robust strengths in its extensive network and diversified product offering. However, understanding its potential weaknesses and the evolving market opportunities is crucial for strategic advantage.

Want to fully grasp Coface's competitive landscape and future trajectory? Purchase the complete SWOT analysis to uncover actionable insights, identify key growth drivers, and navigate potential threats effectively.

Strengths

Coface stands as a global frontrunner in trade credit insurance, boasting an expansive international network that underpins its leadership. This vast geographical footprint enables the company to provide robust solutions for securing accounts receivable across a multitude of diverse markets, both within countries and across borders. For instance, Coface operates in over 100 countries, a testament to its extensive reach.

Coface's strength lies in its comprehensive service portfolio, extending well beyond its core trade credit insurance. This includes vital complementary services such as business information, debt collection, and various guarantees. This diversified approach creates multiple revenue streams, positioning Coface as a holistic risk management partner for its clients.

The strategic expansion into non-insurance activities, notably in business information and debt collection, highlights the effectiveness of this broad service offering. For instance, Coface reported a significant increase in its business information segment, contributing to its overall revenue growth and solidifying its market position as a one-stop solution for businesses navigating complex commercial landscapes.

Coface boasts a best-in-industry risk management infrastructure, underpinned by its proprietary data and sophisticated scoring capabilities. This robust foundation allows for precise risk assessment, a crucial advantage in today's dynamic economic landscape.

The company’s strategic initiative, 'Power the Core,' signals a continued commitment to data and technology advancements, including significant investments in artificial intelligence. These enhancements are designed to sharpen risk assessment and underwriting, directly contributing to maintaining a healthy loss ratio, as evidenced by their consistent performance in challenging markets.

Strong Financial Health and Solvency

Coface consistently demonstrates robust financial health, evidenced by a strong balance sheet and solvency ratios that frequently surpass its internal targets. This financial fortitude acts as a crucial buffer against economic downturns, ensuring the company can effectively manage its risks and maintain its underwriting capabilities. For instance, the estimated solvency ratio for the period ending in 2024 was projected to be between 195% and 196%, significantly exceeding regulatory requirements and highlighting Coface's capacity to fulfill its financial commitments and invest in future growth.

This strong solvency position is a key competitive advantage, allowing Coface to:

- Maintain high credit ratings, which are essential for its business operations and client confidence.

- Underwrite larger and more complex risks, expanding its market reach and service offerings.

- Withstand unexpected financial stresses, ensuring business continuity and client protection.

- Support strategic initiatives and acquisitions, fostering long-term value creation.

Client-Centric Approach and High Retention

Coface's dedication to its clients is a significant strength, evident in its impressive client retention figures. In the first quarter of 2025, retention reached a near-record 95%, and for the first half of 2025, it stood strong at 94%. This high retention rate highlights the company's success in building lasting partnerships and consistently meeting client expectations.

The company's ability to provide customized solutions for a broad range of businesses, from small and medium-sized enterprises (SMEs) to large corporations, further solidifies this client-centric approach. By tailoring its offerings, Coface effectively addresses the diverse and evolving needs of its clientele, fostering loyalty and long-term engagement.

This focus on client satisfaction translates into tangible benefits:

- Exceptional client retention: Near-record rates of 95% in Q1 2025 and 94% in H1 2025 demonstrate strong client loyalty.

- Tailored solutions: Coface adapts its services to meet the specific needs of businesses of all sizes, from SMEs to large corporations.

- Long-term relationship building: The company prioritizes fostering enduring partnerships through its client-focused strategies.

Coface's extensive global presence, operating in over 100 countries, is a significant strength, allowing it to offer robust trade credit insurance and risk management solutions across diverse international markets. Its comprehensive service portfolio, including business information and debt collection, creates multiple revenue streams and positions it as a holistic risk management partner. The company's commitment to data and technology, particularly AI investments through its 'Power the Core' initiative, enhances its risk assessment capabilities and maintains healthy loss ratios.

Coface's financial health is a key differentiator, with strong solvency ratios consistently exceeding targets, projected between 195% and 196% for the period ending in 2024. This financial stability allows for high credit ratings, underwriting of larger risks, and support for strategic growth. Client-centricity is another major strength, reflected in exceptional retention rates, reaching 95% in Q1 2025 and 94% in H1 2025, alongside the provision of tailored solutions for businesses of all sizes.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Global Reach | International Network | Operates in over 100 countries |

| Service Diversification | Comprehensive Portfolio | Trade credit insurance, business information, debt collection |

| Risk Management | Data & Technology Investment | 'Power the Core' initiative, AI advancements |

| Financial Strength | Solvency Ratios | Projected 195%-196% for YE 2024 |

| Client Focus | Client Retention | 95% in Q1 2025, 94% in H1 2025 |

What is included in the product

Analyzes Coface’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Identifies critical risks and opportunities, allowing proactive mitigation and strategic advantage.

Weaknesses

Coface's core business as a trade credit insurer means it's directly tied to the health of the global economy. When economies slow down, businesses tend to struggle more, leading to a rise in bankruptcies and, consequently, more claims for Coface. This sensitivity to global economic cycles is a significant weakness.

For instance, early 2025 saw a noticeable uptick in Coface's loss ratio, a direct reflection of increased insolvencies and economic headwinds. This economic vulnerability can lead to unpredictable financial results, making consistent performance a challenge.

Coface operates in a highly competitive trade credit insurance sector, which consistently exerts downward pressure on pricing. This environment has led to a slight but noticeable decline in pricing for the company, impacting potential revenue growth in its primary insurance operations.

Despite maintaining a strong client retention rate, these pricing challenges necessitate ongoing innovation and operational efficiencies to safeguard profitability. For instance, in 2023, while gross written premiums grew, the impact of pricing pressure was a factor influencing the overall margin performance.

While Coface operates globally, its performance can still be significantly impacted by downturns in specific geographic markets or industry sectors. For instance, the metal and traditional industrial sectors, including automotive and chemicals, have faced considerable headwinds.

Latin America, in particular, experienced elevated loss ratios in recent periods, highlighting the concentrated risk in certain regions. These sectoral and geographical concentrations can lead to disproportionate effects on Coface's overall financial results, even with its broad diversification.

Integration Challenges for Acquisitions

Coface's strategic acquisitions, like Cedar Rose and Novertur International, aimed at enhancing its data and service capabilities, introduce integration complexities. Successfully merging these entities is crucial for unlocking anticipated synergies and preventing disruptions to ongoing business activities. These integration efforts can strain resources and potentially affect near-term financial performance.

The process of integrating acquired companies, such as the 2023 acquisition of Cedar Rose, requires significant management attention and financial investment. Failure to achieve smooth integration could lead to:

- Operational Disruptions: Challenges in merging IT systems, processes, and cultures can lead to service interruptions or inefficiencies.

- Synergy Realization Delays: The anticipated cost savings and revenue enhancements from acquisitions may take longer to materialize if integration is not executed effectively.

- Resource Diversion: Management bandwidth and financial capital may be diverted from core business development to address integration issues.

- Cultural Clashes: Differences in corporate culture between Coface and acquired companies can hinder collaboration and employee retention, impacting overall productivity.

Cost Inflation and Investment Burden

Coface is contending with significant cost pressures stemming from broad inflationary trends. This is compounded by substantial investments required for its 'Power the Core' strategic plan, which focuses on enhancing technological capabilities and data infrastructure. These necessary expenditures, while crucial for future competitiveness, can negatively affect the net cost ratio and squeeze operating margins in the near term.

The company's commitment to its strategic digital transformation, including investments in areas like artificial intelligence and data analytics, presents a considerable financial undertaking. For instance, while specific 2024/2025 figures are still emerging, similar strategic investments in prior years have demonstrated a tendency to increase operating expenses before yielding efficiency gains. This creates a short-term drag on profitability.

- Rising Inflation: General economic inflation increases the cost of doing business, impacting everything from salaries to IT services.

- Technology Investment: The 'Power the Core' strategy necessitates heavy spending on digital platforms, data management, and cybersecurity.

- Net Cost Ratio Impact: Increased operational costs, without immediate corresponding revenue growth, can lead to a higher net cost ratio.

- Margin Pressure: The dual burden of inflation and investment weighs on operating margins, requiring careful cost management.

Coface's reliance on global economic health makes it vulnerable to downturns, as seen with rising loss ratios in early 2025 due to increased insolvencies. Competitive pricing pressures also impact revenue growth, necessitating continuous innovation to maintain profitability, as evidenced by margin performance in 2023 despite premium increases. Furthermore, concentration risks in specific sectors like traditional industries and regions such as Latin America can disproportionately affect financial results.

Full Version Awaits

Coface SWOT Analysis

The preview you see is the actual Coface SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of Coface's strategic position. Unlock the full, in-depth analysis by completing your purchase.

Opportunities

Emerging markets, particularly in Africa and Asia, present substantial growth opportunities for trade credit insurance. Despite inherent risks, these regions are experiencing economic development and a rise in international trade, creating demand for Coface's services. Coface's established global presence and specialized knowledge position it well to capitalize on this expansion, potentially increasing its market share and diversifying its risk exposure.

Coface's strategic focus on "Power the Core" directly addresses the opportunity presented by digitalization and AI. This plan prioritizes data and technology excellence, aiming to integrate advanced modeling, data science, and artificial intelligence. This investment is crucial for enhancing risk assessment capabilities.

By embracing digital transformation, Coface can streamline its operational processes, leading to greater efficiency. Furthermore, the integration of AI and modern data techniques is expected to significantly improve the customer experience, making interactions smoother and more personalized.

This technological push also opens doors for developing entirely new, innovative services. For instance, in 2023, Coface reported a 10% increase in its digital client service usage, indicating a growing demand for tech-enabled solutions in the credit insurance sector.

Coface has a significant opportunity to grow its non-insurance offerings, like business information and debt collection. These areas have seen impressive double-digit growth, signaling strong market demand.

Expanding these services offers a strategic advantage, as they are less susceptible to economic downturns compared to core credit insurance. This diversification builds more stable and predictable revenue streams, bolstering Coface's financial resilience.

For instance, Coface's business information segment reported a notable increase in revenue, contributing positively to the group's overall performance in recent reporting periods, underscoring the viability of this growth avenue.

Increased Demand Due to Global Economic Volatility

The current global economic landscape, marked by significant policy uncertainty and a concerning rise in corporate insolvencies, is directly fueling demand for Coface's core offerings. Businesses worldwide are proactively seeking robust solutions to mitigate the growing risks associated with non-payment, creating a fertile ground for Coface's expansion.

This heightened awareness of counterparty risk presents a prime opportunity for Coface to both attract new clients and strengthen its ties with existing ones. As economic headwinds persist, the need for reliable credit insurance and related financial services becomes paramount for business continuity and growth.

- Increased Demand for Credit Insurance: Global economic volatility, with factors like inflation and geopolitical tensions, is driving businesses to seek protection against payment defaults.

- Rising Corporate Insolvencies: Reports indicate a significant uptick in business failures in key markets during 2024 and projected into 2025, underscoring the need for credit risk management. For instance, Coface's own analysis highlighted a notable increase in insolvencies in several European countries in late 2023 and early 2024.

- Opportunity for Market Share Growth: The heightened risk environment allows Coface to position its services as essential for businesses navigating economic uncertainty, potentially leading to expanded market share.

Strategic Partnerships and Ecosystem Development

Coface's strategic plan emphasizes building a leading global ecosystem for credit risk management. This involves forging new alliances with financial institutions, technology innovators, and other risk management specialists. These collaborations are designed to expand Coface's service portfolio and tap into previously unreached customer bases, enhancing its market position.

For instance, in 2024, Coface announced a significant partnership with a leading European fintech company specializing in data analytics. This collaboration is expected to bolster Coface's digital offerings and improve its real-time risk assessment capabilities. By integrating advanced AI-driven insights, Coface aims to provide clients with more predictive and actionable intelligence.

The development of this ecosystem is crucial for several reasons:

- Expanded Service Offerings: Partnerships allow Coface to integrate complementary services, such as supply chain finance solutions or specialized industry risk reports, creating a more comprehensive offering for clients.

- Enhanced Data Access: Collaborating with technology providers can grant Coface access to new data sources and analytical tools, improving the accuracy and speed of its credit risk assessments.

- Broader Market Reach: Aligning with financial institutions and other risk management firms can open doors to new client segments and geographical markets, accelerating growth.

- Innovation Acceleration: Ecosystem development fosters a culture of innovation, enabling Coface to co-develop new solutions and stay ahead of evolving market demands in credit risk management.

The increasing demand for credit insurance, fueled by global economic uncertainties and rising corporate insolvencies, presents a significant opportunity for Coface to expand its market share. For example, Coface's own analysis indicated a rise in insolvencies across several European nations in late 2023 and early 2024, directly increasing the need for its core services.

Coface can capitalize on the growing demand for its non-insurance offerings, such as business information and debt collection, which have demonstrated robust double-digit growth. This diversification not only strengthens Coface's financial resilience by providing more stable revenue streams, less impacted by economic downturns, but also enhances its overall value proposition to clients.

The company's strategic focus on digitalization and AI, encapsulated in its "Power the Core" initiative, is a key opportunity to improve risk assessment and operational efficiency. This investment in technology is crucial for staying competitive and enhancing customer experience, as evidenced by the 10% increase in digital client service usage reported by Coface in 2023.

Furthermore, building a global ecosystem through strategic alliances with financial institutions and technology innovators offers a pathway to expand service portfolios and reach new customer segments. A notable 2024 partnership with a European fintech firm specializing in data analytics aims to enhance Coface's digital offerings and real-time risk assessment capabilities.

Threats

The global landscape is increasingly fraught with geopolitical and trade uncertainties, posing a significant threat to businesses like Coface. Rising tensions between major economic powers and ongoing conflicts in regions such as the Middle East are creating a volatile environment for international commerce.

Trade protectionism, exemplified by measures like the US tariffs implemented in recent years, continues to disrupt established supply chains and increase the cost of doing business. This unpredictability directly impacts Coface’s operating environment, potentially leading to higher claims and a more challenging underwriting landscape as business insolvencies rise.

For instance, the International Monetary Fund (IMF) has repeatedly cited geopolitical fragmentation as a drag on global growth. In its April 2024 World Economic Outlook, the IMF projected global growth to slow from 3.2% in 2023 to 3.0% in 2024, with geopolitical factors contributing to this slowdown and increasing the risk of economic shocks.

Despite hopes for a gentle economic adjustment, the global economy is showing signs of slowing down. Projections suggest growth could dip below 2% if existing geopolitical tensions and trade disputes worsen. This slowdown poses a significant threat to businesses across various sectors.

For Coface, a more pronounced economic downturn or a full-blown recession would translate directly into a sharp rise in corporate defaults and insurance claims. Such an event would put considerable pressure on the company's financial performance and its ability to maintain adequate capital reserves, potentially impacting profitability significantly.

The trade credit insurance sector is highly concentrated, with a few dominant companies. This intense competition can force price reductions or diminish Coface's market share. For instance, in 2023, the global trade credit insurance market was valued at approximately $12.5 billion, with major players like Euler Hermes, Atradius, and Coface holding significant portions.

Emerging FinTech firms pose a threat by introducing innovative technologies that could disrupt Coface's established business model. These new entrants might offer more agile or cost-effective solutions, necessitating ongoing adaptation and investment in new technologies from Coface to remain competitive.

Regulatory Changes and Compliance Burden

Coface navigates a financial services landscape defined by stringent regulations, with evolving solvency requirements like Solvency II presenting a constant challenge. These regulatory shifts can directly translate into higher compliance expenses and potentially alter capital needs, impacting Coface's operational agility.

The increasing complexity of global financial regulations means that staying compliant demands significant investment in systems and expertise. For instance, the ongoing implementation and adaptation to new data privacy laws across different jurisdictions add to this burden.

- Increased Compliance Costs: Evolving regulations necessitate ongoing investment in technology and personnel to ensure adherence, directly impacting operational expenditures.

- Capital Requirement Adjustments: Changes in solvency rules can lead to higher capital buffers, potentially affecting Coface's return on equity and strategic flexibility.

- Operational Restrictions: New regulatory frameworks may introduce limitations on product offerings, market access, or business practices, thereby constraining growth opportunities.

- Risk of Penalties: Non-compliance with financial regulations can result in substantial fines and reputational damage, underscoring the critical nature of rigorous oversight.

Cybersecurity Risks and Data Breaches

Coface's growing reliance on digital platforms and extensive data infrastructure inherently elevates its cybersecurity risks. A significant data breach or operational disruption could lead to the compromise of sensitive client information, impacting trust and potentially causing substantial financial and reputational damage. For instance, the global insurance industry saw an estimated increase in cyberattack frequency and sophistication throughout 2023 and into early 2024, with ransomware attacks remaining a primary concern.

The company's commitment to data excellence, while a strategic advantage, simultaneously expands its digital footprint. This increased online presence heightens the potential for cyber threats to exploit vulnerabilities. In 2024, cybercriminals are increasingly targeting financial services firms, leveraging advanced phishing techniques and exploiting cloud security gaps. The average cost of a data breach in the financial sector continued to climb, exceeding $5 million in many regions by late 2023.

- Increased Attack Surface: A larger digital footprint means more potential entry points for cyber threats.

- Reputational Damage: Data breaches can severely erode customer trust and brand image.

- Operational Disruption: System failures can halt critical business operations, leading to financial losses.

- Regulatory Penalties: Non-compliance with data protection regulations following a breach can result in significant fines.

Geopolitical instability and escalating trade protectionism present significant external threats, potentially increasing claims and impacting global economic growth. The IMF projected global growth to slow to 3.0% in 2024, with geopolitical factors contributing to this slowdown and increasing the risk of economic shocks.

Intensified competition within the concentrated trade credit insurance market, valued at approximately $12.5 billion in 2023, could lead to price pressures and market share erosion. Emerging FinTech firms also pose a disruptive threat with their innovative and potentially more cost-effective solutions.

Stringent and evolving financial regulations, such as Solvency II, necessitate ongoing investment in compliance, potentially increasing operational costs and impacting capital requirements. Cybersecurity risks are also a growing concern, with the financial sector experiencing increased sophisticated cyberattacks, leading to potential data breaches and reputational damage.

SWOT Analysis Data Sources

This Coface SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a well-rounded and accurate strategic perspective.