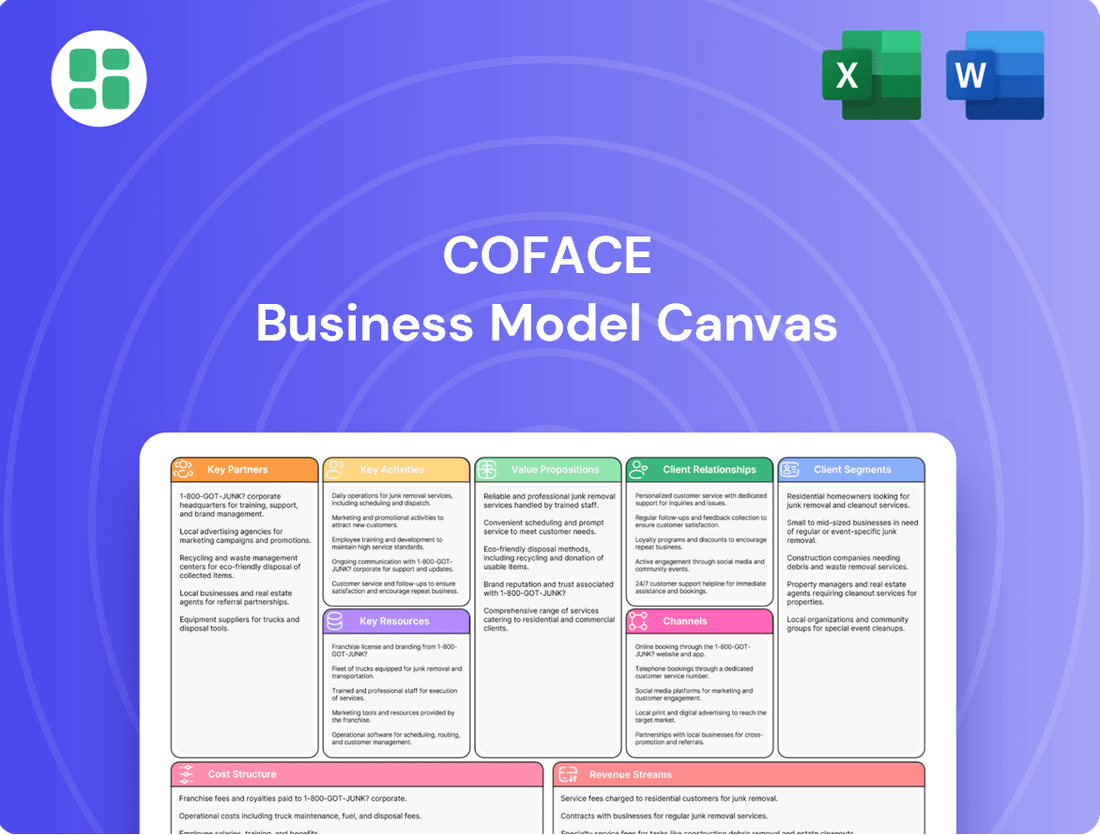

Coface Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coface Bundle

Curious about Coface's strategic framework? This Business Model Canvas offers a clear view of their customer relationships, revenue streams, and key resources. Discover how they navigate the credit insurance landscape and build lasting value.

Partnerships

Reinsurers are vital partners for Coface, enabling the company to offload a portion of the underwriting risk from its credit insurance policies. This risk transfer is essential for Coface to increase its capacity to underwrite new business, manage substantial financial exposures, and maintain stable earnings, particularly during periods of economic uncertainty. In 2023, the global reinsurance market saw significant activity, with major reinsurers like Munich Re and Swiss Re reporting strong results, underscoring the importance of these partnerships for managing large-scale risks in the insurance sector.

Insurance brokers and agents are crucial partners for Coface, acting as essential intermediaries that significantly expand our market reach, especially to small and medium-sized enterprises (SMEs) and mid-market businesses. They are instrumental in distributing our trade credit insurance and other risk management solutions, tapping into their established client networks and deep market understanding. In 2024, this channel continued to be a primary driver for acquiring new customers and fostering strong client loyalty, reflecting their effectiveness in connecting businesses with our offerings.

Coface collaborates with banks and financial institutions to provide businesses with integrated solutions, like guarantees supporting trade finance and factoring services. This synergy allows Coface to offer robust financial risk management tools that extend beyond standard credit insurance. For instance, in 2024, Coface's partnerships with major European banks facilitated access to over €5 billion in trade finance facilities for their clients.

Business Information Providers/Data Partners

Coface relies heavily on external business information and data providers to fuel its risk assessment and underwriting. These partnerships are fundamental to accurately evaluating the creditworthiness of businesses, a core function for Coface.

By integrating data from specialized partners, Coface significantly strengthens its proprietary risk models. This collaboration allows for the incorporation of advanced techniques in data science and artificial intelligence, leading to more sophisticated scoring and pricing mechanisms.

These data partnerships are crucial for ensuring more precise risk pricing and enabling better-informed decision-making across Coface's operations. For instance, in 2024, Coface continued to invest in enhancing its data analytics capabilities, leveraging partnerships to access a wider array of real-time economic and financial indicators.

- Data Integration: Access to diverse datasets from partners enriches Coface's understanding of market dynamics and individual company performance.

- Model Enhancement: Partnerships enable the incorporation of AI and machine learning, improving the predictive power of risk assessment tools.

- Accuracy in Pricing: Leveraging external data leads to more accurate credit risk pricing, benefiting both Coface and its clients.

- Competitive Edge: Continuous access to high-quality, up-to-date information provides a significant competitive advantage in the insurance market.

Debt Collection Agencies and Legal Firms

Coface collaborates with specialized debt collection agencies and legal firms worldwide to enhance its debt recovery services. These partnerships are crucial for minimizing financial losses for their clients by efficiently recovering outstanding debts.

These global collaborations ensure adherence to diverse local regulations and tap into specialized legal expertise across different jurisdictions, making debt recovery more effective.

- Global Network: Partners in over 100 countries facilitate cross-border debt recovery.

- Expertise Leverage: Access to legal and collection specialists improves recovery rates.

- Regulatory Compliance: Ensures all collection activities meet local legal standards.

Technology providers and data analytics firms are key partners, supplying the essential infrastructure and advanced analytical tools that power Coface's risk assessment and operational efficiency.

These collaborations allow Coface to integrate cutting-edge AI and machine learning capabilities, significantly enhancing its predictive modeling for credit risk. In 2024, Coface's investment in these partnerships bolstered its ability to process vast amounts of data, leading to more precise underwriting and improved fraud detection mechanisms.

| Partner Type | Role | 2024 Impact Example |

| Technology Providers | Infrastructure, AI/ML tools | Enhanced predictive modeling for credit risk |

| Data Analytics Firms | Data processing, insights | Improved fraud detection and underwriting accuracy |

| Information Providers | Creditworthiness data | Strengthened proprietary risk models |

What is included in the product

A structured framework detailing Coface's core business activities, customer relationships, and revenue streams, all organized within the nine essential Business Model Canvas blocks.

This model outlines Coface's approach to delivering credit insurance and related financial services, emphasizing key partners, resources, and cost structures.

The Coface Business Model Canvas offers a structured approach to visualize and refine credit insurance strategies, simplifying complex risk assessments and client management.

Activities

Underwriting and risk assessment are central to Coface's operations, focusing on evaluating buyer creditworthiness and determining insurance coverage limits. This process is underpinned by Coface's extensive proprietary data, robust risk infrastructure, and decades of underwriting experience across various economic cycles.

In 2024, Coface continued to emphasize disciplined risk underwriting, a critical strategy given the projected increase in global insolvencies. The company's ability to assess potential non-payment risks effectively is paramount to maintaining its competitive edge and ensuring the stability of its insurance products.

Coface’s policy management and claims processing are core to its business, covering the full policy lifecycle from issuance to settlement. This ensures clients are protected against non-payment risks.

In 2024, Coface continued to refine its digital platforms for policy issuance and management, aiming for faster turnaround times. The company processed a significant volume of claims, with a focus on efficient and equitable settlements to maintain client trust.

The effectiveness of these operations directly impacts Coface's value proposition. By handling policies and claims smoothly, Coface reinforces its role as a reliable partner in mitigating credit risk for businesses globally.

Coface's core activity is the meticulous collection and analysis of extensive business and economic data. This process is crucial for delivering robust business information services that help clients navigate commercial risks.

In 2024, Coface continued to expand its data sourcing capabilities, integrating new datasets to enhance the depth and breadth of its analyses. This strategic expansion allows for a more nuanced understanding of market dynamics and potential client risks.

The company is also focused on broadening the use cases for its data insights, moving beyond traditional credit risk assessment to support clients in areas like market entry strategy and supply chain resilience. This adaptability ensures the information remains relevant and actionable.

Upgrading IT platforms is a continuous effort, enabling Coface to process and analyze information more efficiently. For instance, advancements in AI and machine learning are being leveraged to identify emerging risk patterns, with the goal of providing clients with predictive insights to proactively manage their exposures.

Debt Collection Services

Coface extends its expertise beyond insurance by offering professional debt collection services, adeptly handling both amicable and legal recovery processes for clients' overdue receivables. This proactive management of outstanding debts is crucial in minimizing financial losses for businesses.

These services not only bolster Coface's core insurance offerings by providing a comprehensive solution for credit risk management but also establish a distinct and valuable revenue stream. In 2023, Coface's debt collection activities contributed to the recovery of significant amounts for its clients, underscoring its role in safeguarding business cash flow.

- Mitigation of Financial Losses: Coface's debt collection services directly address the critical business need to recover outstanding payments, thereby preventing potential cash flow disruptions and financial strain for its clients.

- Complementary Service Offering: This segment of Coface's business model acts as a natural extension of its credit insurance products, offering a holistic approach to credit risk management.

- Revenue Diversification: The debt collection segment represents an important additional revenue stream for Coface, contributing to its overall financial resilience and market position.

- Global Reach: Coface leverages its extensive international network to provide debt collection services across numerous countries, assisting businesses in navigating diverse legal and commercial environments.

Product Development and Innovation

Coface actively invests in creating new solutions and improving its current offerings, with a strong emphasis on data and technological advancement. This commitment is crucial for staying competitive and meeting evolving client needs in the risk management sector.

The company's innovation strategy centers on leveraging advanced analytics, data science, and artificial intelligence to build unique data and scoring capabilities. For instance, in 2024, Coface continued to enhance its predictive modeling for credit risk, aiming to provide clients with even more precise risk assessments.

Innovation also extends to simplifying the customer journey and broadening the product portfolio. This includes developing more accessible solutions like single risk insurance and expanding its presence in surety bonds, reflecting a strategic move to cater to a wider range of business requirements.

Key activities in product development and innovation include:

- Data and Technology Excellence: Continuous investment in AI, data science, and advanced analytics to refine risk assessment tools and scoring capabilities.

- Customer Experience Enhancement: Streamlining processes and digitalizing services to simplify client interactions and access to solutions.

- Portfolio Expansion: Developing and promoting new products such as single risk insurance and surety bonds to meet diverse market demands.

- R&D Investment: Allocating resources to research and development for future-proofing solutions and identifying emerging risk trends.

Coface's core activities revolve around underwriting and risk assessment, policy and claims management, data collection and analysis, debt collection, and continuous innovation. These functions collectively enable Coface to provide essential credit risk mitigation services to businesses worldwide.

In 2024, Coface's underwriting focused on disciplined risk assessment amidst rising global insolvencies, leveraging its extensive data and experience. Policy and claims management saw digital platform enhancements for efficiency, with a significant volume of claims processed. Data capabilities were expanded in 2024, integrating new sources for deeper market insights and broader risk applications.

Debt collection services complement insurance, helping clients recover outstanding payments and diversifying revenue. Innovation efforts in 2024 included enhancing predictive credit risk modeling through AI and expanding product offerings like single risk insurance.

| Key Activity | Description | 2024 Focus/Data Highlight |

|---|---|---|

| Underwriting & Risk Assessment | Evaluating buyer creditworthiness and coverage limits. | Disciplined underwriting amidst projected increase in global insolvencies. |

| Policy & Claims Management | Managing the full policy lifecycle from issuance to settlement. | Refinement of digital platforms for faster policy issuance; efficient claims processing. |

| Data Collection & Analysis | Gathering and analyzing business and economic data for risk insights. | Expansion of data sourcing capabilities and broadening use cases for data insights. |

| Debt Collection | Recovering overdue receivables for clients. | Continued focus on amicable and legal recovery processes to minimize client losses. |

| Product Development & Innovation | Creating new solutions and improving existing offerings. | Enhancing predictive modeling with AI; developing single risk insurance and surety bonds. |

Full Version Awaits

Business Model Canvas

This preview offers a direct glimpse into the Coface Business Model Canvas you will receive upon purchase. It's not a sample, but an exact representation of the comprehensive document, showcasing its structure and content. Upon completing your order, you will gain full access to this identical, ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Coface's financial capital is its bedrock, allowing it to confidently underwrite substantial risks and meet its obligations to policyholders. This robust financial foundation is essential for its global operations and strategic expansion.

As of the first half of 2024, Coface reported a solvency ratio of 220%, significantly exceeding the regulatory requirements. This strong solvency position underscores its capacity to absorb potential shocks and maintain market trust.

The company's underwriting capacity directly correlates with its financial strength. A healthy balance sheet, bolstered by consistent profitability and prudent risk management, empowers Coface to offer comprehensive credit insurance solutions to businesses worldwide.

Coface's competitive edge is built upon its best-in-industry risk infrastructure. This includes proprietary data, unique risk scores, and advanced assessment models that are continuously refined.

This intellectual property is crucial for accurately pricing risk. In 2023, Coface's risk assessment models helped manage over €1.5 trillion in global trade, demonstrating their effectiveness in diverse economic conditions.

Furthermore, Coface leverages a vast global database of company information. This comprehensive data allows for precise credit exposure management across a multitude of international markets, ensuring informed decision-making.

Coface's extensive global network, spanning over 100 countries, is a cornerstone of its business model. This vast reach allows it to offer unparalleled insights into diverse economic landscapes and regional risk profiles, a critical advantage in the credit insurance sector.

This global footprint is complemented by a strong local presence in key markets, enabling Coface to tailor its services to specific client needs and regulatory environments. For instance, its operations in emerging markets provide crucial support for businesses navigating complex local debt collection processes.

In 2024, Coface continued to leverage this dual strength, facilitating international trade by providing localized risk assessment and mitigation strategies. The company reported a significant portion of its business originating from cross-border transactions, underscoring the value of its interconnected network.

Skilled Workforce and Expertise

Coface’s value hinges on its highly skilled workforce. This includes expert underwriters, sharp risk analysts, insightful economists, and diligent legal professionals. Their collective knowledge is the bedrock of Coface's operations.

The expertise of these professionals in credit risk management, business information services, and effective debt collection is absolutely crucial. It allows Coface to deliver its core value propositions to clients, ensuring they can trade with confidence.

This human capital is a significant competitive differentiator for Coface. For instance, in 2024, Coface continued to invest in training and development, aiming to enhance the skills of its 6,000 employees worldwide, ensuring they remain at the forefront of risk assessment and client support.

- Expert Underwriters: Assess and manage credit risk for businesses.

- Risk Analysts: Provide in-depth economic and sector-specific risk insights.

- Economists: Forecast global economic trends impacting trade.

- Legal Professionals: Handle debt recovery and ensure regulatory compliance.

Technology Infrastructure and Digital Platforms

Coface’s operations are underpinned by advanced technology infrastructure, encompassing robust IT systems, sophisticated digital platforms, and powerful data analytics tools. These are crucial for everything from assessing credit risk to managing policies and delivering vital information services to clients.

These technological assets directly support Coface's strategic emphasis on data-driven decision-making and continuous innovation, enabling more efficient underwriting and seamless customer interactions. By leveraging these resources, Coface aims to enhance its service offerings and maintain a competitive edge in the market.

- IT Systems: Core systems for policy administration, claims processing, and financial management.

- Digital Platforms: Online portals and mobile applications for client self-service, risk assessment tools, and information dissemination.

- Data Analytics: Advanced tools for predictive modeling, fraud detection, and market intelligence gathering.

- Cybersecurity: Robust measures to protect sensitive data and ensure platform integrity.

Coface's key resources are its financial strength, intellectual property, global network, and skilled human capital, all supported by advanced technology. These elements collectively enable Coface to provide essential credit insurance and information services, managing significant global trade risks.

The company's financial backing, demonstrated by a strong solvency ratio, allows it to underwrite substantial risks effectively. Its intellectual property, including proprietary data and risk models, ensures accurate pricing and management of credit exposure. The extensive global network, coupled with local presence, provides nuanced market insights and tailored services. Furthermore, Coface's team of experts in risk management and its robust technological infrastructure are critical for delivering value and maintaining a competitive advantage.

| Resource Category | Specific Examples | 2024/2023 Data Points |

|---|---|---|

| Financial Capital | Solvency Ratio | 220% (H1 2024) |

| Intellectual Property | Risk Assessment Models, Global Company Database | Managed €1.5 trillion in global trade (2023) |

| Global Network | Presence in over 100 countries | Significant portion of business from cross-border transactions (2024) |

| Human Capital | Expert Underwriters, Risk Analysts, Economists, Legal Professionals | ~6,000 employees worldwide (2024) |

| Technology Infrastructure | IT Systems, Digital Platforms, Data Analytics | Continuous investment in digital transformation |

Value Propositions

Coface's primary value proposition is protecting businesses from the significant financial fallout of their customers failing to pay. This is crucial for companies extending credit, as it shields them from losses due to customer insolvency or extended payment delays. In 2024, with global economic uncertainties, this protection becomes even more vital for maintaining stable cash flow.

This core offering provides businesses with essential financial security, enabling them to operate with greater confidence. By mitigating the risk of non-payment, Coface allows companies to pursue sales opportunities and expand their customer base, even when dealing with new or international partners. This peace of mind is a significant benefit, especially when trading on credit terms.

Coface's core value proposition is enabling businesses to trade more freely, both domestically and internationally, by insuring against the risk of non-payment. This protection allows companies to confidently extend credit to new or existing customers, thereby unlocking new sales opportunities and market penetration. For instance, in 2023, Coface provided credit insurance coverage for €373 billion in global trade transactions, a testament to its role in facilitating commerce.

By reducing the fear of bad debt, Coface directly fuels economic activity. Businesses can invest in growth, hire more staff, and innovate when they know their receivables are secured. This is particularly crucial for small and medium-sized enterprises (SMEs) looking to enter export markets, where payment risks can be higher. The company's services are designed to simplify the complexities of international trade finance, making it more accessible for a wider range of businesses.

Coface goes beyond just insurance, offering a treasure trove of global business information. This includes crucial data like credit scores, detailed financial reports, and in-depth risk assessments for both countries and specific industries. This empowers businesses with the knowledge to make smarter commercial choices.

With these insights, clients can proactively manage their own risk exposure, preventing potential financial pitfalls. For instance, Coface's 2024 Country Risk Barometer highlighted increased risks in certain emerging markets due to geopolitical instability, allowing businesses to adjust their strategies accordingly.

Furthermore, this comprehensive data helps identify promising new business opportunities. By understanding market trends and potential growth areas, as reflected in Coface's sector-specific analyses, companies can strategically expand their reach and capitalize on emerging markets.

Professional Debt Collection Services

Coface provides specialized debt collection services, expertly navigating the intricate and often lengthy process of recovering overdue payments. This crucial offering frees up valuable client resources and significantly boosts their cash flow, ultimately strengthening their financial stability, even for debts not covered by insurance.

The value proposition here is clear: efficiency and improved financial health. By outsourcing debt collection to Coface, businesses can reclaim their time and focus on core operations, while simultaneously seeing a tangible improvement in their liquidity. This is particularly important in today's economic climate, where prompt payment is vital for sustained growth.

- Expertise in Recovery: Coface's specialized teams possess the skills and knowledge to effectively manage and recover outstanding debts, often achieving higher success rates than in-house efforts.

- Cash Flow Improvement: By accelerating the collection of overdue invoices, Coface directly contributes to a healthier and more predictable cash flow for its clients.

- Reduced Administrative Burden: Clients offload the time-consuming and often challenging administrative tasks associated with debt collection, allowing them to concentrate on their primary business functions.

- Enhanced Financial Stability: Proactive debt recovery, even for uninsured receivables, bolsters a company's overall financial resilience and reduces the risk associated with bad debt.

Enhanced Cash Flow Management and Financial Stability

Coface's integrated solutions are designed to significantly boost how businesses manage their cash flow and achieve greater financial stability. By offering tools that help optimize working capital, Coface brings a new level of predictability to a company's incoming funds.

This enhanced cash flow management directly translates into improved financial resilience, a critical factor for businesses navigating today's often unpredictable economic landscape. Coface’s offerings provide a safeguard, particularly for accounts receivable.

In 2024, for example, businesses that leveraged credit insurance saw a notable reduction in bad debt expenses. Coface's risk management tools are key to this, helping companies anticipate and mitigate potential losses.

- Optimized Working Capital: Coface’s services help businesses free up cash tied in accounts receivable.

- Improved Cash Flow Predictability: By insuring receivables, Coface reduces uncertainty in payment timing.

- Enhanced Financial Stability: Securing payments strengthens a company's balance sheet and ability to meet obligations.

- Risk Mitigation: Coface's expertise provides a buffer against customer defaults, especially vital in uncertain markets.

Coface's value proposition centers on enabling businesses to trade with confidence by insuring against non-payment risks. This protection is vital for facilitating domestic and international sales, allowing companies to extend credit to customers without fear of bad debt. In 2023, Coface insured €373 billion in global trade, highlighting its role in fostering commerce.

Beyond insurance, Coface offers extensive business intelligence, including credit scores, financial reports, and country/industry risk assessments. This data empowers clients to make informed decisions and proactively manage their risk exposure. For instance, their 2024 Country Risk Barometer identified rising risks in certain emerging markets, enabling businesses to adjust strategies.

Furthermore, Coface provides specialized debt collection services, recovering overdue payments efficiently. This not only improves client cash flow but also reduces administrative burdens, allowing businesses to focus on core operations. By outsourcing collections, companies can enhance their financial stability and liquidity.

Customer Relationships

Coface cultivates strong client bonds through dedicated account managers offering personalized service and expert guidance. This ensures tailored solutions and continuous support, aiding clients in navigating intricate trade landscapes and refining their credit management approaches.

Coface prioritizes swift and equitable claims processing, a cornerstone of its customer relationships. This commitment ensures clients receive timely support, particularly crucial when facing financial setbacks. For instance, in 2023, Coface reported a claims settlement ratio of 95%, highlighting their dedication to efficient resolution.

Coface's online portals and self-service options are key to its customer relationships, offering clients immediate access to policy details, risk assessments, and a suite of other essential services. This digital accessibility allows customers to manage their accounts and access vital information on their own schedule, significantly enhancing convenience and control.

These digital tools empower clients by providing flexibility and instant access to the data and functionalities they need. For instance, Coface reported a significant increase in digital service adoption, with over 80% of its client interactions occurring through digital channels in 2024, highlighting the growing reliance on these self-service platforms.

Long-Term Partnerships and Trust Building

Coface prioritizes forging enduring relationships with its clients, acting as a trusted ally in navigating commercial risk. This commitment is demonstrated through continuous dialogue, forward-thinking risk management guidance, and a thorough grasp of each client's unique business landscape, cultivating deep trust and lasting loyalty.

- Strategic Partnership: Coface positions itself not just as an insurer, but as a strategic partner, actively involved in helping clients manage and mitigate commercial risks.

- Client Retention: In 2023, Coface reported a strong client retention rate, underscoring the success of its long-term relationship-building efforts.

- Proactive Engagement: The company emphasizes proactive communication and tailored advice, ensuring clients feel supported and informed in their risk management strategies.

- Understanding Client Needs: A core element is developing a profound understanding of each client's specific industry, market challenges, and growth objectives to provide relevant solutions.

Consultation and Training on Risk Management

Coface goes beyond simply providing insurance; they foster deep partnerships by offering expert consultation and training in risk management. This proactive approach equips clients with the knowledge and practical tools to effectively navigate and mitigate commercial risks.

By empowering businesses with these capabilities, Coface strengthens their internal risk management frameworks, leading to more resilient operations. For instance, in 2024, Coface reported a significant increase in client engagement with their risk management advisory services, indicating a growing demand for such expertise.

- Proactive Risk Mitigation: Clients receive guidance on identifying and addressing potential credit risks before they impact cash flow.

- Knowledge Transfer: Coface's training programs enhance clients' in-house expertise in credit risk assessment and management.

- Strengthened Capabilities: Businesses develop more robust internal processes for managing commercial exposures.

- Long-Term Partnerships: This consultative approach builds trust and fosters enduring relationships beyond transactional services.

Coface's customer relationships are built on a foundation of dedicated support and digital accessibility, aiming to be a true partner in risk management. The company emphasizes proactive engagement and knowledge sharing, empowering clients with tools and expertise to navigate commercial challenges effectively.

This commitment is reflected in strong client retention and a high adoption rate of digital services, demonstrating the value clients place on Coface's approach. For example, Coface reported that over 80% of client interactions occurred through digital channels in 2024, underscoring the convenience and efficiency offered.

Coface also ensures swift and fair claims processing, a critical element in maintaining client trust, as evidenced by their 95% claims settlement ratio in 2023. This focus on reliable support, coupled with personalized guidance and robust digital platforms, solidifies Coface's role as a trusted ally for businesses.

| Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Dedicated Support | Personalized service via account managers | N/A |

| Digital Accessibility | Online portals for policy management and risk assessment | >80% client interactions via digital channels in 2024 |

| Claims Processing | Swift and equitable resolution of claims | 95% claims settlement ratio in 2023 |

| Risk Management Consultation | Proactive guidance and training | Significant increase in client engagement with advisory services in 2024 |

Channels

Coface leverages its dedicated global direct sales force to directly engage with large corporations and crucial accounts. This approach is vital for delivering highly tailored solutions and fostering deep relationships, especially when addressing the complex requirements of trade credit insurance.

This direct channel facilitates in-depth consultations, allowing Coface to thoroughly understand and cater to the unique needs of major clients. For instance, in 2024, Coface reported a significant portion of its new business acquisition coming through these direct relationships, underscoring the channel's effectiveness in securing substantial, long-term contracts.

Coface heavily relies on a vast network of insurance brokers and agents to reach its customers. This indirect sales force is crucial for accessing a wide market, particularly small and medium-sized enterprises (SMEs) and mid-sized businesses. These professionals bring invaluable market knowledge and pre-existing client connections, facilitating broader reach and deeper penetration.

Coface leverages its digital platforms, including its comprehensive website and dedicated online client portals, as key channels for delivering value. These digital touchpoints are crucial for disseminating vital business information, offering a suite of services, and enabling clients to manage their accounts and policies efficiently through self-service options.

In 2024, the emphasis on digital client engagement continued to grow. Coface's online portals provide clients with 24/7 access to policy details, claims processing, and credit risk assessment tools, significantly enhancing user experience and operational efficiency. This digital-first approach aims to streamline interactions and empower clients with immediate access to critical business intelligence.

Partnerships with Banks and Financial Institutions

Coface leverages partnerships with banks and financial institutions to extend its reach, particularly for credit insurance, guarantees, and factoring solutions. These collaborations allow businesses to access Coface's offerings through their established banking channels, streamlining financial management. For instance, in 2024, Coface continued to deepen its relationships with major European banks, facilitating access to its trade credit insurance for a wider SME base.

These strategic alliances are crucial for distributing complex financial products like guarantees and factoring services. By integrating with banks, Coface taps into a pre-existing client network, making its solutions more accessible to businesses that prefer a consolidated approach to their financial services. This channel is particularly effective in markets where bank relationships are central to business operations.

- Distribution Channel: Banks and financial institutions act as key distributors for Coface's credit insurance, guarantees, and factoring.

- Client Access: Partnerships enable businesses to access Coface solutions through their primary banking relationships, simplifying financial management.

- Market Penetration: Collaborations enhance Coface's ability to reach a broader customer base, especially small and medium-sized enterprises (SMEs).

- Synergistic Growth: These alliances foster mutual growth by combining Coface's specialized offerings with the banks' extensive client networks and financial infrastructure.

Industry Events and Conferences

Coface leverages industry events and conferences as key channels to connect with its audience. These gatherings are crucial for brand visibility and establishing thought leadership in the credit insurance and risk management space. For instance, Coface regularly participates in major international trade fairs and hosts its own specialized webinars, allowing direct engagement with businesses seeking to understand and mitigate trade credit risks.

These events are not just about brand building; they are significant for lead generation and nurturing client relationships. By sharing expert insights on economic trends and risk management strategies, Coface demonstrates its value proposition. In 2024, Coface continued its active presence at events like the Euler Hermes Trade Credit Insurance Summit and organized webinars focusing on emerging market risks and supply chain resilience, attracting hundreds of attendees and generating valuable leads.

- Client Engagement: Direct interaction with existing and potential clients to understand their evolving needs.

- Thought Leadership: Showcasing expertise through presentations and discussions on global economic and credit risk trends.

- Brand Building: Enhancing brand recognition and reputation within the financial and business communities.

- Lead Generation: Identifying and cultivating new business opportunities through networking and information sharing.

Coface utilizes a multi-channel distribution strategy to reach its diverse customer base. This includes a direct sales force for large corporations, a broad network of brokers and agents for SMEs, and digital platforms for self-service and information dissemination. Strategic partnerships with banks also play a crucial role in expanding access to its financial solutions.

Customer Segments

Large multinational corporations are a key customer segment for global trade credit insurers like Coface. These enterprises typically engage in extensive cross-border transactions, making them highly susceptible to payment defaults and political risks in various international markets. In 2024, the global trade credit insurance market was projected to reach approximately $12.7 billion, highlighting the significant demand from large businesses for such protective services.

These clients require highly customized insurance policies that can adapt to their complex international supply chains and diverse risk exposures across multiple jurisdictions. They often seek comprehensive coverage that extends beyond simple payment protection, including advanced risk management advisory services to navigate geopolitical uncertainties and economic volatility. For instance, a major European automotive manufacturer might require coverage for its sales in over 50 countries, each with unique credit and political risk profiles.

Small and Medium-sized Enterprises (SMEs) are a crucial focus for Coface, especially under its Power the Core strategy. These businesses are increasingly vital to economic growth, with SMEs accounting for about 99% of all businesses in the European Union, contributing significantly to employment and value added.

SMEs require robust protection against the risk of their customers not paying, which is essential for safeguarding both their domestic sales and their ventures into export markets. For instance, in 2024, many SMEs faced increased payment delays, making credit insurance a critical tool for their financial stability.

Coface aims to serve these businesses by offering more straightforward and readily available insurance products, alongside valuable business information services. This approach helps SMEs navigate the complexities of trade credit and mitigate potential financial shocks.

Exporters and importers are crucial to our business. These companies operate across borders, buying and selling goods internationally. They rely on us to protect them from the risk of not getting paid by their overseas customers. For instance, in 2024, global trade faced ongoing supply chain disruptions and currency fluctuations, increasing the need for robust credit management solutions.

For businesses involved in international trade, the complexities of different legal systems and the unpredictable nature of foreign economies present significant payment risks. Coface’s trade credit insurance directly addresses these concerns, offering a vital safety net. In 2023, the World Trade Organization projected global trade growth to be around 0.8%, highlighting the continued but cautious expansion of cross-border commerce, and the associated risks that our services mitigate.

Companies Across Various Industries

Coface’s customer base spans a broad array of industries, reflecting the universal need for credit risk management in B2B transactions. This includes vital sectors like manufacturing, where supply chain disruptions can have significant ripple effects, and retail, which is often sensitive to consumer spending fluctuations. In 2024, the manufacturing sector continued to grapple with supply chain volatility, while the retail sector experienced mixed performance influenced by inflation and changing consumer habits.

The services and construction industries also represent key customer segments for Coface. The services sector, encompassing everything from IT to professional services, faces risks related to contract performance and client solvency. Construction, a cyclical industry, is heavily impacted by economic conditions and project financing, making credit insurance crucial for managing payment delays and defaults. For instance, in early 2024, construction projects in many developed economies saw increased costs due to material price increases, impacting project profitability and payment timelines.

- Manufacturing: Critical for managing risks associated with raw material suppliers and buyer payment delays, especially in volatile global supply chains.

- Retail: Addresses the challenges of fluctuating consumer demand and the creditworthiness of numerous smaller buyers.

- Services: Protects against non-payment from clients for services rendered, a growing concern in the digital economy.

- Construction: Mitigates risks tied to project financing, subcontractor payments, and the solvency of developers and end-buyers.

Banks and Financial Institutions (for Guarantees)

Coface offers specialized guarantees to banks and financial institutions, bolstering their trade finance operations. This segment relies on these guarantees to safeguard their loans against non-payment, thereby reducing their credit risk exposure.

These financial institutions utilize Coface's solutions to secure their lending portfolios, particularly for businesses engaged in international trade. By transferring a portion of the credit risk, banks can expand their trade finance offerings and support more clients.

- Securing Lending: Coface's guarantees allow banks to offer trade finance solutions with reduced risk, fostering greater economic activity.

- Mitigating Credit Exposure: Financial institutions leverage these instruments to protect themselves from potential defaults on trade-related loans.

- Expanding Services: By partnering with Coface, banks can enhance their product suites and attract more corporate clients seeking trade finance support.

Financial institutions represent a distinct customer segment, leveraging Coface's expertise to de-risk their trade finance portfolios. These entities seek solutions that enhance their ability to provide credit to businesses, particularly those involved in cross-border transactions.

By utilizing Coface's credit insurance or guarantees, banks can absorb a portion of the non-payment risk associated with their loans. This allows them to extend more credit, support a broader range of clients, and improve their capital efficiency.

In 2024, the global trade finance gap, the difference between the demand for and supply of trade finance, remained a significant challenge, estimated by the Asian Development Bank to be around $2.5 trillion. Coface's offerings directly address this gap by enabling financial institutions to participate more confidently in trade finance.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| Financial Institutions | De-risking trade finance portfolios, expanding credit offerings | Global trade finance gap estimated at $2.5 trillion, highlighting demand for risk mitigation solutions. |

| Mitigating credit exposure on loans | Banks seek to reduce capital requirements tied to risky trade assets. | |

| Enhancing capital efficiency and profitability | Improved risk management allows for higher leverage and better returns on capital. |

Cost Structure

Claims payments and provisions represent Coface's most substantial expense, directly tied to its core function of insuring against non-payment risks. These costs fluctuate significantly with economic cycles, as higher insolvency rates naturally lead to increased claim payouts. For instance, in 2023, Coface reported claims paid and provisioned at €1.7 billion, a figure that underscores the direct impact of macroeconomic trends on its cost structure.

Operating expenses, encompassing employee salaries, IT infrastructure, and administration, are a significant component of Coface's cost structure. These costs are essential for maintaining its global operations, including risk assessment, policy administration, and the delivery of its credit insurance services.

In 2024, Coface's focus on digital transformation and expanding its service offerings likely led to continued investment in IT systems and personnel. These investments are crucial for enhancing risk modeling capabilities and providing seamless digital experiences for clients.

General administrative expenses cover the overhead required to run a global insurance company, from legal and compliance to back-office functions. These costs are managed to ensure efficiency while supporting the company's strategic objectives and regulatory requirements.

Coface's cost structure includes significant expenses for reinsurance programs. These programs are vital for managing substantial risks and spreading them across a wider base. In 2023, Coface reported that its gross claims paid were €2.7 billion, a figure that reinsurance helps to absorb.

The premiums paid to reinsurers represent a direct cost. These payments allow Coface to transfer a portion of its underwriting risk, ensuring financial stability even when facing large or unexpected claims. This risk transfer is fundamental to its operational model.

Data Acquisition and Analysis Costs

Coface dedicates substantial resources to data acquisition and analysis, a cornerstone of its risk assessment and business information services. These investments cover subscriptions to external data sources, the development of sophisticated proprietary analytical models, and the implementation of advanced technologies like artificial intelligence. For instance, in 2024, the global market for big data and business analytics software and services was projected to reach over $300 billion, highlighting the significant expenditure in this area.

These costs are crucial for maintaining the accuracy and comprehensiveness of the data Coface uses to evaluate credit risks and provide market intelligence. The ongoing need for real-time, high-quality data necessitates continuous investment in technology and data management infrastructure.

- Data Subscriptions: Costs associated with licensing data from third-party providers, including financial statements, economic indicators, and industry-specific information.

- Model Development: Investment in building and refining proprietary algorithms and statistical models for credit scoring, fraud detection, and predictive analytics.

- Technology Infrastructure: Expenditure on hardware, software, and cloud services required for data storage, processing, and the deployment of AI and machine learning tools.

- Talent Acquisition: Hiring and retaining skilled data scientists, analysts, and IT professionals to manage and interpret complex datasets.

Sales and Marketing Expenses

Sales and marketing expenses are a significant component of Coface's cost structure, directly impacting customer acquisition and retention. These costs include the remuneration and commissions paid to its sales force, as well as brokers and agents who are vital in bringing in new business. For instance, in 2023, Coface's operating expenses, which encompass these sales and marketing efforts, were reported at €1.59 billion.

Marketing campaigns are also a key investment, aimed at building brand awareness and promoting Coface's comprehensive suite of credit insurance, factoring, and other financial services. These initiatives are designed to expand market share and solidify customer loyalty. The company's commitment to these areas is evident in its ongoing efforts to reach new client segments and reinforce its position in existing markets.

- Sales Force Remuneration: Covers salaries and benefits for direct sales teams.

- Broker & Agent Commissions: Payments to intermediaries for new business secured.

- Marketing & Advertising: Investment in campaigns to promote services and brand.

- Customer Relationship Management: Costs associated with maintaining and growing client relationships.

Claims payments and provisions are Coface's largest expense, directly linked to its core business of insuring against non-payment risks. These costs are sensitive to economic downturns, as higher insolvency rates increase claim payouts. In 2023, Coface paid and provisioned €1.7 billion in claims, demonstrating the significant impact of economic conditions on this cost category.

Operating expenses, including salaries, IT, and administration, are crucial for global operations and service delivery. In 2024, Coface continued investing in digital transformation and IT, essential for advanced risk modeling and client experience. These investments support risk assessment, policy administration, and the overall delivery of credit insurance services.

Reinsurance premiums are a key cost, enabling Coface to manage and spread substantial risks. In 2023, gross claims paid were €2.7 billion, highlighting the importance of reinsurance in absorbing these large potential payouts and ensuring financial stability.

Coface invests heavily in data acquisition and analysis to support its risk assessment and business information services. This includes external data subscriptions, proprietary model development, and AI technologies. The global big data and business analytics market exceeded $300 billion in 2024, indicating the scale of investment in this area.

| Cost Category | 2023 Data (Approximate) | 2024 Focus |

|---|---|---|

| Claims Payments & Provisions | €1.7 billion | Directly tied to economic cycles, fluctuating with insolvency rates. |

| Operating Expenses (incl. Sales & Marketing) | €1.59 billion | Continued investment in digital transformation, IT infrastructure, and talent. |

| Reinsurance Premiums | Implied by €2.7 billion gross claims paid | Risk transfer to ensure financial stability against large or unexpected claims. |

| Data Acquisition & Analysis | Significant investment | Enhancing risk modeling and providing market intelligence through AI and advanced analytics. |

Revenue Streams

Coface's core revenue generation hinges on insurance premiums from its trade credit insurance offerings. Businesses pay these premiums to secure coverage against potential defaults on their commercial sales, thereby safeguarding their cash flow and financial stability.

In 2024, Coface reported a significant portion of its revenue derived from these insurance premiums. For instance, their gross claims paid in 2024 amounted to €1,320.6 million, indicating the substantial volume of insured transactions and the direct correlation between premium collection and payout activity.

Coface earns substantial income by offering business information services. These include detailed credit reports, comprehensive company data, and valuable market insights, crucial for businesses navigating complex economic landscapes.

This revenue stream has demonstrated robust, consistent double-digit growth, underscoring its importance. For instance, in 2023, Coface's information services segment saw a notable uplift, contributing significantly to the company's overall financial performance and strategic direction.

Coface generates revenue by charging fees for its professional debt collection services. This applies to both debts that are insured by Coface and those that are not, offering a dual approach to recovery.

This revenue stream is crucial for diversifying Coface's income sources. It effectively capitalizes on the company's established expertise and infrastructure in managing and resolving overdue payments for its clients.

In 2023, Coface reported a significant increase in its debt collection activities, with a notable uptick in successful recovery rates, particularly in sectors experiencing economic headwinds.

Guarantee Fees

Coface generates revenue through guarantee fees, essentially charging for the assurance it provides. These fees are collected when Coface issues guarantees that backstop various trade finance operations for banks and other financial entities. This income stream highlights Coface's expanded function in enabling financial dealings beyond its core credit insurance offerings.

These guarantee fees are a crucial part of Coface's revenue diversification. For instance, in 2024, the company's commitment to supporting global trade finance through such instruments continues to be a significant contributor to its financial performance, reflecting the increasing demand for secure financial transactions.

- Guarantee Fees: Coface earns income by issuing guarantees that secure trade finance transactions for financial institutions.

- Revenue Diversification: This stream demonstrates Coface's role in facilitating financial activities beyond traditional credit insurance.

- Market Relevance: In 2024, these fees underscore the ongoing importance of secured financial instruments in global commerce.

Investment Income

Coface earns revenue by investing its substantial technical reserves and equity. This investment income is a crucial component of its profitability, directly impacted by prevailing market interest rates and the success of its investment strategies.

For instance, in 2023, Coface reported investment income of €327.6 million, a notable increase from €244.5 million in 2022. This demonstrates the significant contribution of investment activities to its financial performance.

- Investment Income Generation: Coface invests its technical reserves and equity to generate returns.

- Key Influences: Market interest rates and investment performance directly affect this revenue stream.

- 2023 Performance: Investment income reached €327.6 million in 2023, up from €244.5 million in 2022.

Coface's revenue streams are diverse, primarily driven by insurance premiums for trade credit insurance, where businesses pay for protection against customer defaults.

Complementing this, Coface generates substantial income from business information services, offering crucial credit reports and market insights, which saw robust growth in 2023.

Furthermore, the company earns fees from professional debt collection services, applicable to both insured and non-insured debts, and also from guarantee fees for trade finance operations, highlighting its expanded role in facilitating secure financial transactions.

Investment income from managing its technical reserves and equity also contributes significantly, with a notable increase to €327.6 million in 2023.

| Revenue Stream | Description | 2023 Data/Notes |

|---|---|---|

| Insurance Premiums | Revenue from trade credit insurance policies. | Gross claims paid in 2024: €1,320.6 million. |

| Business Information Services | Fees for credit reports, company data, and market insights. | Consistent double-digit growth; significant uplift in 2023. |

| Debt Collection Services | Fees for recovering overdue payments. | Notable uptick in successful recovery rates in 2023. |

| Guarantee Fees | Fees for issuing guarantees for trade finance operations. | Significant contributor to financial performance in 2024. |

| Investment Income | Returns from investing technical reserves and equity. | €327.6 million in 2023 (up from €244.5 million in 2022). |

Business Model Canvas Data Sources

The Coface Business Model Canvas is informed by extensive market intelligence, internal financial data, and risk assessment reports. These sources provide a comprehensive view of our operational landscape and strategic direction.