Coface Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coface Bundle

Understand the strategic positioning of Coface's portfolio with our BCG Matrix analysis, revealing which segments are Stars, Cash Cows, Dogs, or Question Marks. This overview is just the tip of the iceberg, offering a glimpse into the critical insights needed for informed decision-making.

Unlock the full potential of Coface's strategic landscape by purchasing the complete BCG Matrix report. Gain access to detailed quadrant placements, actionable recommendations, and a clear roadmap to optimize resource allocation and drive future growth.

Stars

Coface is significantly boosting its trade credit insurance offerings for Small and Medium-sized Enterprises (SMEs) and mid-market companies. This strategic move is designed to tap into the growing demand for risk management tools from these businesses, especially as global economic conditions remain unpredictable. In 2023, Coface reported a 5.2% increase in its gross underwriting capacity, demonstrating a commitment to expanding its reach in these vital market segments.

The company's strategy involves making trade credit insurance simpler and more appealing to SMEs and mid-market firms. This accessibility is key, as these businesses often face substantial risks from non-payment by their customers. For instance, Coface’s 2024 outlook highlights that a significant portion of SMEs globally are concerned about rising insolvencies, making TCI a critical protective measure.

Coface's Business Information (BI) services are positioned as a star in the BCG matrix, experiencing profitable double-digit growth. This signifies a robust and expanding market for these essential services.

To capitalize on this high-growth potential, Coface is making substantial investments. These include expanding its sales force, enhancing data acquisition capabilities, and upgrading its IT infrastructure, all aimed at accelerating BI's trajectory.

These BI services are instrumental for businesses, offering critical insights into credit risk, supply chain resilience, and strategic planning. This makes them a vital component of Coface's portfolio, driving value and future opportunities.

Coface's 'Power the Core' strategy, launched in 2024 and extending to 2027, places significant emphasis on achieving data and technology excellence. This involves substantial investments aimed at developing unique data assets and advanced scoring capabilities.

The company is integrating cutting-edge modeling techniques, data science, and artificial intelligence to refine its offerings. This strategic push is designed to bolster its core credit risk management services and cultivate a premier global ecosystem in this domain, signaling a high-growth trajectory.

Global Expansion in Emerging Markets

Coface's strategic acquisitions, such as Cedar Rose in the Middle East and Africa, signal a clear intent to capitalize on high-growth emerging markets. This expansion aligns with the broader trend of emerging economies increasingly adopting trade credit insurance as they experience rising trade volumes and a more sophisticated approach to managing credit risk.

These emerging markets represent a fertile ground for Coface, offering substantial opportunities for growth. The increasing recognition of credit risk management's importance in these dynamic economies directly translates into demand for Coface's services.

- Expanding Reach: Coface's acquisition strategy targets regions with significant untapped potential for trade credit insurance.

- Market Adoption: Emerging markets are demonstrating a growing appetite for credit risk solutions due to increased trade activity.

- Growth Drivers: Higher trade velocities and a better understanding of credit risk in these economies fuel demand for insurance products.

New Digital Solutions and Connectivity

Coface is actively investing in technology and connectivity to boost its client offerings, especially for those navigating intricate global portfolios. This strategic move aims to streamline credit risk management.

The company is developing sophisticated APIs, allowing clients to access crucial insights across diverse companies, countries, and markets. This focus on high-growth digital solutions simplifies complex operations for multinational corporations, enhancing both efficiency and the overall customer experience.

- Increased Efficiency: APIs reduce manual data entry and reconciliation, saving valuable time for financial professionals.

- Enhanced Data Access: Real-time connectivity provides up-to-the-minute information for better decision-making.

- Global Portfolio Management: Seamless integration supports the complex needs of businesses operating across multiple geographies.

- Digital Transformation: Coface's investment in these areas positions them as a leader in digital credit risk solutions.

Coface's Business Information services are identified as Stars in the BCG matrix, showcasing robust, double-digit growth and a strong market position. This indicates a highly profitable and expanding segment for the company.

To further capitalize on this success, Coface is channeling significant investments into its BI offerings. These investments are focused on expanding the sales team, enhancing data acquisition, and upgrading IT infrastructure to accelerate growth.

These BI services are crucial for businesses, providing vital insights into credit risk and supply chain stability, making them a cornerstone of Coface's value proposition.

The company’s strategic direction, particularly its 2024-2027 'Power the Core' initiative, emphasizes data and technology excellence to reinforce its core credit risk management services.

| Coface Business Unit | BCG Matrix Classification | Growth Rate | Market Share |

|---|---|---|---|

| Business Information (BI) | Star | Double-digit | High |

| Trade Credit Insurance (SME/Mid-market) | Question Mark/Star (Emerging) | High | Growing |

| Global Solutions (Digital APIs) | Question Mark/Star (Emerging) | High | Growing |

What is included in the product

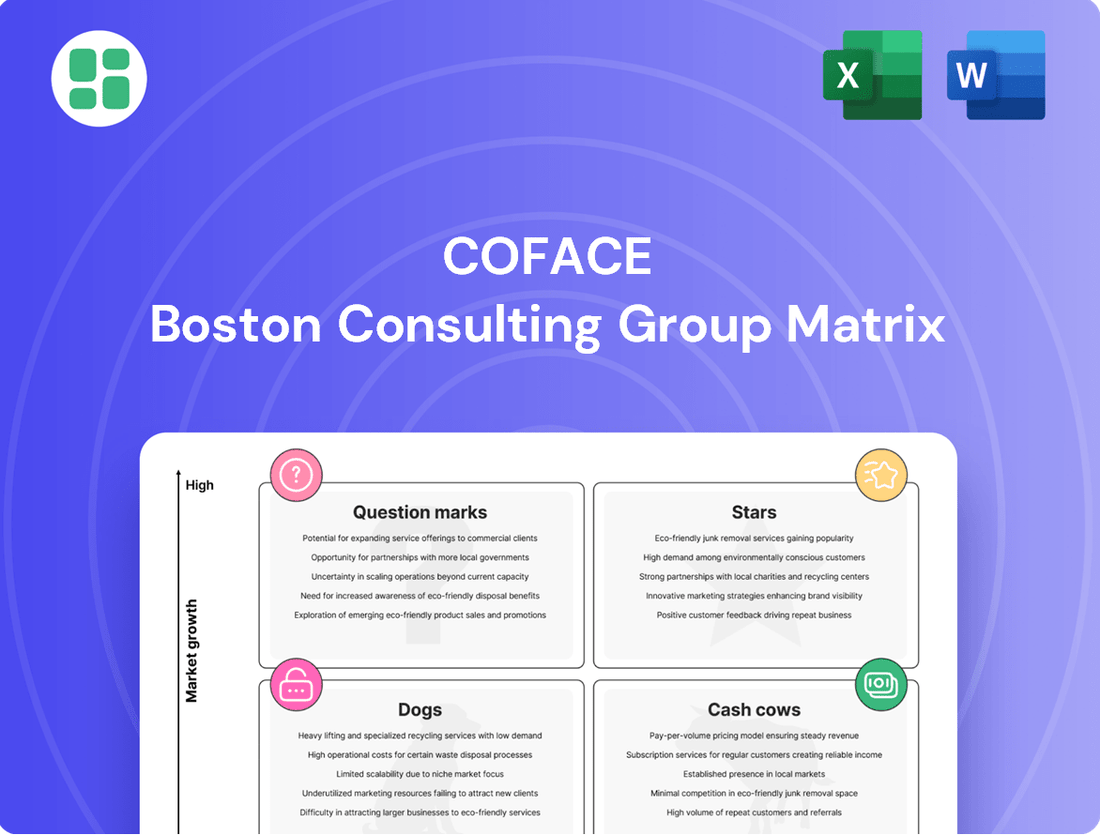

The Coface BCG Matrix categorizes business units by market share and growth rate to guide strategic decisions.

It helps identify Stars, Cash Cows, Question Marks, and Dogs to inform investment, divestment, or holding strategies.

The Coface BCG Matrix provides a clear, one-page overview of your portfolio, easing the pain of complex strategic analysis.

Cash Cows

Coface's core Trade Credit Insurance (TCI) business is its bedrock, holding a significant market share in a vital but established sector. This segment consistently delivers strong cash flows, even amidst market fluctuations and competitive pricing.

In 2024, Coface's TCI segment demonstrated resilience, with gross written premiums in this area contributing significantly to the group's overall revenue. The company's strategic focus on disciplined underwriting practices in 2024 has been key to maintaining profitability and ensuring stable returns from this foundational business.

Coface showcases exceptional client loyalty, with retention rates hovering around 95% in early 2025 and 94% by mid-2025. This robust customer base translates directly into dependable, recurring revenue streams, a hallmark of a true cash cow.

Such high retention signifies a solid market position and minimizes the costly process of acquiring new clients. It underscores Coface's ability to consistently satisfy its existing customers, ensuring a stable foundation for predictable cash flow.

Coface's robust solvency and capital management are key strengths, positioning it as a Cash Cow. Its estimated solvency ratio consistently surpasses the target range of 155%-175%, reaching an impressive 196% by the close of 2024 and maintaining 195% in the first half of 2025.

This strong capital buffer provides significant resilience, enabling Coface to effectively absorb market volatility and support its operational needs. The company's ability to maintain such high solvency ratios directly translates into its capacity to generate and retain substantial cash, underpinning its Cash Cow status.

Debt Collection Services

Coface's Debt Collection services are demonstrating strong performance, aligning with the characteristics of a Cash Cow within the BCG Matrix. This segment experienced a significant surge of 35% in the first half of 2025, following a nearly 15% increase in the first quarter of the same year.

This consistent, high growth indicates that the services are generating substantial revenue with relatively low investment needs. The services are leveraging established client bases and capitalizing on the ongoing demand for effective debt recovery solutions in the market.

- Robust Growth: Debt Collection services saw a 35% growth in H1 2025.

- Consistent Performance: Q1 2025 showed nearly 15% growth in the same segment.

- Cash Generation: High growth suggests it's a significant revenue generator for Coface.

- Market Position: Benefits from existing client relationships and market demand.

Established Global Network and Expertise

Coface's established global network and deep expertise are key to its position as a Cash Cow. With over 75 years in the business, they've cultivated a robust risk infrastructure spanning 100 countries. This extensive international presence and accumulated knowledge allow them to excel at managing credit risk, consistently generating profits from a loyal global customer base.

This significant competitive advantage translates into reliable earnings. Their ability to navigate diverse markets and understand local risk nuances is a core strength.

- Global Reach: Operations in 100 countries.

- Experience: Over 75 years of industry presence.

- Risk Infrastructure: Best-in-industry capabilities.

- Profit Generation: Consistent earnings from established clients.

Coface's Trade Credit Insurance (TCI) business is its prime Cash Cow, consistently generating substantial profits. In 2024, this segment, despite market pressures, maintained strong gross written premiums, underscoring its stable revenue generation capabilities.

The company's high client retention rate, around 95% in early 2025 and 94% by mid-2025, directly translates into dependable, recurring income streams. This loyalty minimizes acquisition costs and solidifies the predictable cash flow essential for a Cash Cow.

Coface's Debt Collection services also exhibit Cash Cow characteristics, with a notable 35% growth in the first half of 2025, building on a nearly 15% increase in Q1 2025. This robust performance indicates strong profitability with minimal new investment requirements.

The company's financial health, evidenced by a solvency ratio of 196% at the end of 2024 and 195% in H1 2025, further supports its Cash Cow status. This strong capital position allows for consistent cash generation and retention, reinforcing its stability and profitability.

| Business Segment | 2024 Performance | H1 2025 Performance | Cash Cow Indicators |

|---|---|---|---|

| Trade Credit Insurance (TCI) | Strong Gross Written Premiums | High Client Retention (approx. 94-95%) | Stable revenue, low investment needs, loyal customer base |

| Debt Collection | Significant Revenue Growth | 35% Growth (H1 2025), 15% Growth (Q1 2025) | High profitability, leveraging existing infrastructure |

| Capital Position | Solvency Ratio: 196% (End 2024) | Solvency Ratio: 195% (H1 2025) | Strong capital generation and retention capacity |

What You’re Viewing Is Included

Coface BCG Matrix

The Coface BCG Matrix preview you're examining is the identical, fully polished document you'll receive upon purchase, offering a clear strategic roadmap for your business units. This comprehensive analysis, ready for immediate application, will be delivered to you without any watermarks or demo content, ensuring a professional and actionable resource. You're seeing the actual, meticulously prepared Coface BCG Matrix that will empower your decision-making, providing the insights needed to optimize your portfolio. Once purchased, this expertly crafted matrix is yours to download, edit, and present, facilitating informed strategic planning and resource allocation.

Dogs

Coface's factoring turnover saw a minor dip of 1.5% in the first half of 2025. This slowdown is linked to decreased interest rates and subdued client activity, particularly in key markets such as Germany and Poland.

Within the context of Coface's Business Growth-Share Matrix, factoring services in these specific regions, like Germany and Poland, could be categorized as a 'Dog'. This designation arises from operating in a low-growth or declining market environment, potentially coupled with a less dominant market share.

Such a classification suggests that these particular factoring operations may require a thorough strategic review. The focus would be on whether to divest, restructure, or find niche opportunities to improve performance, given the challenging market conditions.

While Coface's overall revenue remained stable, its Asia-Pacific region experienced a notable downturn in 2024, with turnover declining by 7.1% at constant foreign exchange rates. This performance was attributed to a general slowdown in client activity and a deliberate strategy to non-renew certain policies.

These underperforming regional insurance portfolios, particularly if this trend continues, can be categorized as Dogs within the Coface BCG Matrix. This classification stems from their low growth prospects and potentially limited market share, indicating a need for careful strategic evaluation.

Coface's strategic plan, "Power 2023," highlights a commitment to 'Reach data and technology excellence,' suggesting that some legacy IT systems and operational complexities persist. These older systems, while functional, may not be agile or cost-effective, potentially hindering innovation and efficiency. For example, in 2023, Coface continued investments in modernizing its IT infrastructure, aiming to streamline operations and improve data analytics capabilities to better serve its clients.

Non-Renewed or Selectively Exited Policies

Coface's 2024 financial disclosures highlighted a strategic approach to policy management, noting a 'selective non-renewal of certain policies' which contributed to a modest dip in insurance revenue. This action aligns with a BCG matrix categorization of 'Dogs' – business units or product lines with low market share and low growth potential, where continued investment is not justified.

These selectively exited or non-renewed policies likely represent segments where Coface faced significant competitive headwinds or where profitability margins were insufficient to warrant continued engagement. Such strategic divestments are crucial for resource allocation, allowing the company to focus on more promising growth areas.

- Selective Non-Renewal Impact: Coface's 2024 results indicated that the non-renewal of certain policies contributed to a slight decrease in insurance revenue, demonstrating a deliberate pruning of less profitable or strategically misaligned business lines.

- BCG Matrix Alignment: These exited policies can be viewed as 'Dogs' in the BCG matrix, representing areas with low market share and potentially low growth, where divesting or minimizing exposure is a sound strategic move.

- Resource Optimization: By exiting these underperforming segments, Coface frees up capital and management attention to invest in and nurture its 'Stars' and 'Cash Cows', thereby optimizing its overall portfolio performance.

Segments Highly Vulnerable to Economic Downturns without Differentiation

Segments highly vulnerable to economic downturns without differentiation are essentially the ‘Pets’ in the Coface BCG Matrix context. These are business areas or product lines that are in a low-growth market and have a low market share. In a challenging economic climate, characterized by increasing insolvencies, these segments are particularly at risk. They struggle to gain traction or market share, especially when the overall economic growth is sluggish. Consequently, their profitability is often marginal, with many breaking even at best.

Consider the retail sector, specifically non-essential goods retailers with undifferentiated offerings. During economic slowdowns, consumer spending on discretionary items typically falls sharply. For example, in early 2024, reports indicated a slowdown in consumer spending growth in several major economies, directly impacting retailers without unique selling propositions. These businesses often face intense price competition and find it difficult to pass on rising costs, leading to squeezed margins. Their inability to stand out means they are often the first to suffer when consumers tighten their belts.

- Low Market Share: These segments typically command a small portion of their respective markets.

- Low Market Growth: They operate in industries or niches that are not expanding significantly.

- Vulnerability to Economic Shocks: Downturns disproportionately affect these areas due to lack of competitive advantage.

- Marginal Profitability: Often, they only manage to cover their costs, with little to no profit.

Dogs in the Coface BCG Matrix represent business units or market segments with low growth and low market share. These are areas where Coface might have exited certain policies in 2024, such as those in the Asia-Pacific region which saw a 7.1% turnover decline. Such segments require careful strategic review, potentially leading to divestment or restructuring to optimize resource allocation.

For instance, factoring operations in markets like Germany and Poland, experiencing subdued client activity and interest rate impacts, could be classified as Dogs. These areas might be candidates for divestment or a focus on niche opportunities to improve performance. The company's "Power 2023" plan also points to ongoing modernization of legacy IT systems, which can be seen as areas needing strategic attention, similar to Dogs, due to potential inefficiencies compared to newer technologies.

The selective non-renewal of certain insurance policies in 2024, contributing to a slight revenue dip, exemplifies Coface's approach to managing its 'Dog' segments. By pruning these underperforming lines, Coface frees up capital and focus for more promising growth areas, ensuring a more efficient and profitable business portfolio.

Question Marks

Coface's strategic acquisitions of Cedar Rose and Novertur International significantly bolster its information services, especially within the Middle East and Africa. These moves are classic examples of Stars in the BCG matrix, representing areas with high growth potential but requiring substantial investment to fully capitalize on their market share and integration success.

Coface's strategic vision emphasizes expanding its business information services into new application areas. This move is crucial for maintaining its position as a 'Star' in the BCG matrix, as it taps into the high-growth potential of data analytics.

While the broader business information sector is a star, the specific new use cases Coface is targeting are still emerging. These are high-growth opportunities, but their market penetration and Coface's current share within these specific niches are still being established, necessitating further investment.

Coface's establishment of a new Lloyd's syndicate for AA solutions is a prime example of a 'Question Mark' within the BCG matrix. This strategic move targets a high-growth segment for advanced, higher-grade solutions, aiming to capture new market share.

While the potential for these AA solutions is significant, their current market penetration and profitability are in the early stages. Coface will need to invest substantially to build a robust presence and prove the viability of this new venture.

Digitalization and AI-driven Product Innovation

Coface's strategic investment in new technology divisions, particularly those centered on data, connectivity, and product innovation, highlights a commitment to leveraging data science and artificial intelligence. This focus is crucial for developing advanced digital and AI-driven products.

These emerging offerings are positioned as question marks within the Coface BCG Matrix. They represent significant potential in future high-growth markets, but their current market share is minimal due to their early development or adoption stages. Consequently, substantial investment is required to achieve scalability and market penetration.

- Data Science and AI Investment: Coface is channeling resources into advanced analytics and AI to create innovative insurance products and services.

- Future Growth Potential: These digital and AI-driven products are designed to tap into rapidly expanding market segments.

- Early Stage Development: Currently, these products have low market share, reflecting their nascent phase in the product lifecycle.

- Investment Requirement: Significant capital outlay is necessary for research, development, and market entry to foster growth and adoption.

Targeted Growth in New Geographic Markets

Targeted growth in new geographic markets for Coface, within the context of the BCG Matrix, focuses on areas where the company sees significant upside despite a currently modest footprint. For instance, Coface might identify emerging economies in Southeast Asia or specific regions within Latin America as prime candidates for expansion. These markets often exhibit robust economic growth and a rising demand for trade credit insurance, a core Coface offering.

The strategy here involves substantial investment to build brand awareness and establish a strong local presence. This could include setting up new offices, hiring local sales and underwriting teams, and developing tailored product offerings to meet the specific needs of businesses in these regions. The goal is to transition these markets from question marks to stars in Coface's portfolio.

For example, Coface's 2024 strategic initiatives might include a dedicated push into countries like Vietnam or Colombia, where business activity is expanding rapidly. In 2023, Vietnam's GDP grew by approximately 5.05%, signaling a fertile ground for business services. Coface's approach would likely involve partnerships with local financial institutions and chambers of commerce to accelerate client acquisition.

- Expansion Focus: Coface is likely targeting high-growth emerging markets in regions such as Southeast Asia and Latin America for its next phase of development.

- Investment Strategy: Significant capital allocation will be directed towards sales, marketing, and establishing local infrastructure to penetrate these new territories effectively.

- Market Potential: These markets present substantial opportunities due to their increasing economic activity and growing need for trade credit solutions.

- Objective: The aim is to transform these nascent markets into significant revenue generators and establish a strong competitive position.

Question Marks represent new ventures or markets where Coface has a small market share but operates in a high-growth industry. These require careful consideration regarding investment. Coface's exploration of new digital product lines, leveraging AI and data analytics, fits this category. These initiatives, while promising, are in their infancy and demand significant funding to establish market presence and prove their commercial viability.

Coface's foray into new geographic markets, such as Vietnam with its projected 2024 GDP growth of around 6.0-6.5%, also exemplifies a Question Mark. The company is investing to build its presence in these high-potential regions, aiming to convert them into Stars.

The establishment of a new Lloyd's syndicate for AA solutions is another clear Question Mark. This venture targets a growing market for advanced solutions, but its success hinges on substantial investment to gain traction and build a strong client base.

| Coface Initiative | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| New Digital/AI Products | Question Mark | High | Low | High |

| Expansion into Vietnam | Question Mark | High (est. 6.0-6.5% GDP growth 2024) | Low | High |

| New Lloyd's Syndicate (AA Solutions) | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust blend of financial statements, industry growth forecasts, and competitor performance data to provide a clear strategic overview.