Coface Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coface Bundle

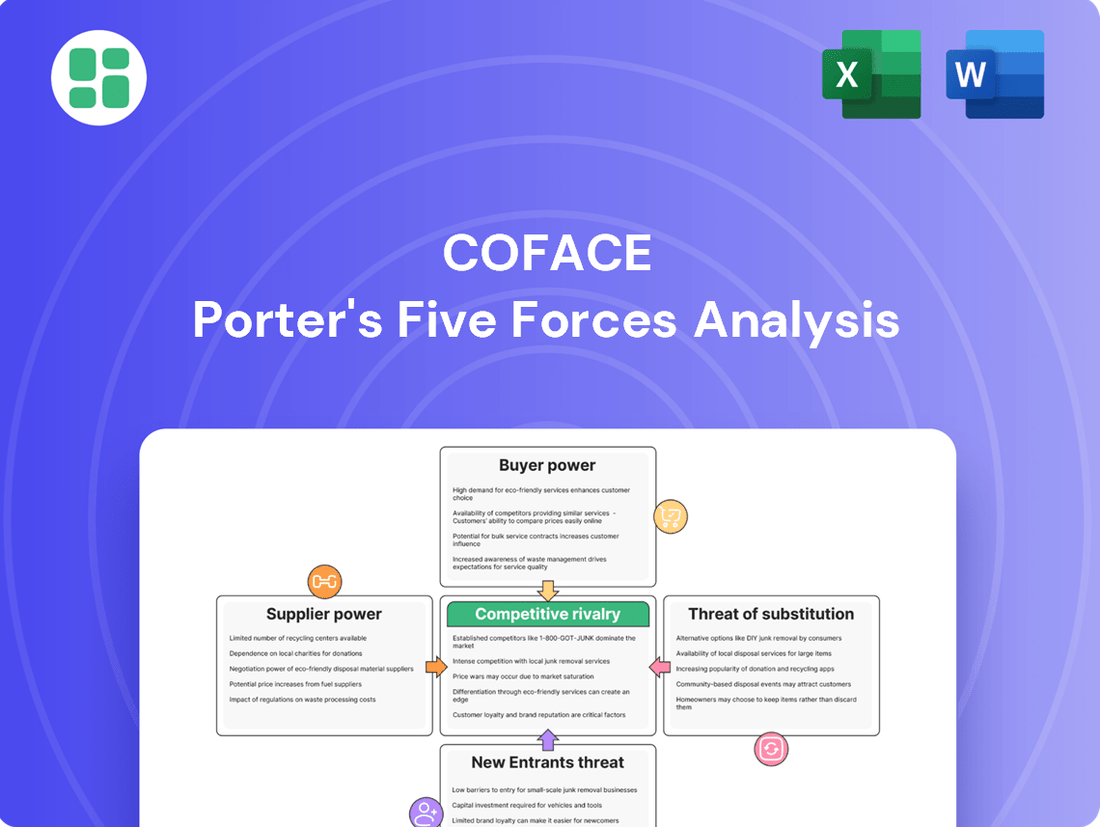

A Porter's Five Forces analysis of Coface reveals the intricate web of competitive pressures shaping its operating environment. Understanding the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry is crucial for strategic planning. This brief overview hints at the deeper insights available.

The complete report reveals the real forces shaping Coface’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Data and technology providers wield considerable influence over Coface. These suppliers offer essential business information, predictive analytics, and AI/ML tools crucial for Coface's risk assessment and underwriting. If their solutions are specialized or hard to find elsewhere, their bargaining power increases significantly.

Coface's strategic focus on technology, as highlighted in its 2024-2027 Power the Core plan, underscores the importance of these suppliers. The company is actively investing in data excellence and integrating advanced modeling, data science, and AI. This commitment means Coface is reliant on these partners to achieve its technological goals.

Reinsurance capacity providers hold significant bargaining power over insurers like Coface. As Coface offloads a portion of its risk, the terms and cost of this reinsurance directly affect its underwriting capabilities and profitability. A concentrated reinsurance market, with a limited number of reinsurers willing to take on credit and political risks, can lead to higher prices and stricter terms, impacting Coface's capacity for larger or more complex policies.

While Coface possesses its own debt collection services, which saw a 14.8% increase in Q1 2025, the company may still engage external legal firms and specialized agencies for intricate or cross-border debt recovery. The specialized knowledge and established networks of these third-party providers, particularly within distinct legal frameworks, can afford them significant leverage.

IT Infrastructure and Software Vendors

The bargaining power of IT infrastructure and software vendors is a significant consideration for Coface, as these suppliers provide the backbone for its operations and digital transformation. Reliable core insurance platforms, robust cybersecurity solutions, and scalable cloud services are critical for Coface's efficiency and strategic goals. In 2024, the global IT services market was projected to reach over $1.3 trillion, underscoring the scale and importance of these vendors.

Coface's strategic imperative to simplify its operating model and reduce IT complexity could lead to increased reliance on a few key vendors or necessitate substantial investment in new systems. This concentration of need can amplify vendor leverage. For instance, a major provider of cloud infrastructure might have considerable sway if Coface aims to migrate a significant portion of its data and applications.

- Dependence on Core Platforms: Coface's reliance on specialized insurance software platforms means vendors in this niche can command higher prices or dictate terms due to limited alternatives.

- Cybersecurity Criticality: The essential nature of cybersecurity solutions grants vendors significant power, as any breach can have severe financial and reputational consequences for Coface.

- Cloud Service Providers: As Coface pursues digital transformation, its dependence on major cloud providers for scalability and flexibility strengthens the bargaining position of these tech giants.

- Vendor Consolidation: In the IT sector, mergers and acquisitions can reduce the number of viable suppliers, further concentrating power in the hands of remaining vendors.

Talent Pool for Specialized Skills

The availability of professionals with specialized skills, such as underwriting, data science, and digital transformation expertise, directly impacts Coface's operational efficiency and its capacity for innovation. A constrained supply of these critical roles within the insurance sector can significantly amplify the bargaining power of such employees.

This increased leverage for specialized talent can lead to higher recruitment expenses and greater challenges in retaining key personnel. For instance, in 2024, the demand for cybersecurity professionals, a subset of digital transformation skills, saw average salary increases of 10-15% in the financial services sector, reflecting this talent scarcity.

- Talent Scarcity: A limited pool of skilled underwriting and data science professionals puts upward pressure on wages and benefits.

- Recruitment Costs: Increased competition for top talent in areas like AI and machine learning for underwriting can drive up hiring expenses for Coface.

- Retention Challenges: High demand for digital transformation specialists means Coface must offer competitive packages to prevent attrition.

- Innovation Impact: The ability to attract and retain talent in these specialized fields is crucial for Coface's ability to develop new digital products and services.

The bargaining power of suppliers to Coface is a key factor in its operational costs and strategic execution. Critical suppliers include data and technology providers, reinsurance capacity providers, and specialized IT infrastructure vendors. The concentration of specialized skills in the workforce also grants significant leverage to employees in key roles.

Coface's reliance on advanced analytics and AI, as outlined in its 2024-2027 Power the Core strategy, makes data and technology suppliers particularly influential. Similarly, the need for reinsurance capacity, especially for larger risks, gives reinsurers considerable sway over terms and pricing. The IT sector's consolidation and the essential nature of cybersecurity solutions further bolster the power of these vendors.

The scarcity of specialized talent in areas like underwriting and data science, coupled with high demand for digital transformation expertise, drives up recruitment and retention costs for Coface. For instance, the financial services sector saw average salary increases of 10-15% for cybersecurity professionals in 2024, highlighting this trend.

| Supplier Category | Key Dependence for Coface | Impact on Bargaining Power | Example/Data Point (2024-2025) |

|---|---|---|---|

| Data & Technology Providers | Risk assessment, AI/ML integration, predictive analytics | High, due to specialized solutions and Coface's tech investment | Coface's 2024-2027 Power the Core plan emphasizes data excellence. |

| Reinsurance Capacity Providers | Risk transfer, underwriting capacity for large policies | Significant, especially in concentrated markets for credit/political risk | Terms and cost directly affect Coface's profitability. |

| IT Infrastructure & Software Vendors | Core insurance platforms, cybersecurity, cloud services | High, due to critical operational reliance and digital transformation needs | Global IT services market exceeded $1.3 trillion in 2024. |

| Specialized Talent (Employees) | Underwriting, data science, digital transformation expertise | High, due to talent scarcity and demand | 10-15% average salary increase for cybersecurity roles in financial services (2024). |

What is included in the product

Analyzes the competitive intensity within Coface's operating environment, examining threats from new entrants, existing rivals, substitute services, buyer power, and supplier power to inform strategic decision-making.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Large corporate clients, particularly multinational corporations, wield considerable bargaining power. Their substantial trade volumes mean they represent significant premiums for insurers like Coface. This leverage allows them to negotiate more favorable terms, potentially demanding lower rates or broader coverage. In 2023, Coface reported that its largest clients contributed a significant portion of its premium income, underscoring their importance and influence.

Furthermore, these major clients often have the financial capacity and expertise to explore alternative risk management strategies, including self-insurance or bespoke solutions from other providers. This capability acts as a constant pressure point, encouraging Coface to offer competitive pricing and superior service to retain such valuable business. Coface's stated strategy to deepen and broaden its Trade Credit Insurance franchise indicates a focus on managing these relationships effectively.

Small and Medium-sized Enterprises (SMEs) are increasingly turning to trade credit insurance to shield themselves from payment defaults, a trend particularly pronounced during periods of economic instability. While individual SMEs may possess limited bargaining power, their collective and growing demand for such risk mitigation tools creates a substantial market opportunity for insurers like Coface.

Coface's strategic focus on expanding its reach within the SME and mid-market segments, evidenced by planned investments for growth in these areas, highlights the recognition of this customer base's volume potential. This strategic direction suggests Coface aims to capitalize on the aggregated demand from a segment that, while fragmented, represents significant revenue for the company.

Customers possess significant bargaining power when they have access to alternative methods for mitigating risks, reducing their reliance on a single supplier's credit terms. For instance, options like letters of credit or factoring provide customers with ways to secure their transactions without solely depending on the seller's creditworthiness.

The simplicity and cost-effectiveness of these alternatives directly impact customer leverage. If switching to or utilizing self-insurance is straightforward and less expensive, customers can more forcefully negotiate terms or seek out suppliers offering better conditions.

Furthermore, the increasing involvement of financial institutions in offering trade credit as part of broader financing packages amplifies customer options. This competitive landscape, where banks and other lenders provide attractive trade credit facilities, directly enhances the bargaining power of buyers by presenting them with more advantageous financing opportunities.

Information and Debt Collection Service Buyers

The bargaining power of customers in the business information and debt collection service sector is significant. Coface, a major player, has seen its business information and debt collection services achieve double-digit growth, reflecting robust market demand. This growth suggests that while demand is high, the ability of buyers to negotiate terms can still be substantial.

Buyers, encompassing a wide array of entities from small businesses to large financial institutions, scrutinize service providers based on critical factors such as data accuracy, the speed of information delivery, and the overall effectiveness of debt recovery efforts. Their ability to switch providers if these benchmarks are not met directly impacts supplier pricing and service level agreements.

- High Demand, Yet Price Sensitivity: Coface's double-digit growth in information and debt collection services highlights a strong market need. However, buyers, particularly larger ones, can leverage the presence of multiple providers to negotiate better rates and service terms.

- Key Evaluation Criteria: Customers prioritize accuracy, speed, and effectiveness. Providers who consistently deliver on these fronts can command better pricing, but failure to do so opens the door for competitors.

- Competitive Landscape: The market features numerous business information providers and debt collection agencies. This competitive environment empowers customers by offering them choices and increasing the pressure on service providers to remain competitive in both service quality and pricing.

Customer Retention Rates

Coface's robust customer retention, reaching 95.0% in Q1 2025 and 92.8% in H1 2024, demonstrates significant customer loyalty. This high retention rate implies that customers perceive substantial value in Coface's offerings, which inherently reduces their individual leverage to negotiate lower prices. When customers are satisfied and see ongoing benefits, they are less likely to seek alternatives, thereby diminishing their bargaining power.

Despite strong retention, a marginal decrease in pricing suggests that the market remains competitive. This indicates that while individual customers may have limited power due to satisfaction, the collective market dynamic still allows for some customer influence on pricing structures. The ability for prices to slightly decline points to a scenario where customers, as a group, can still exert pressure.

- Customer Retention: Coface achieved 95.0% retention in Q1 2025 and 92.8% in H1 2024.

- Value Perception: High retention suggests customers find significant value, limiting individual bargaining power.

- Pricing Trends: A slight decline in pricing indicates ongoing customer influence in a competitive landscape.

Customers wield significant bargaining power when they have readily available alternatives, such as other credit insurers or self-insurance options. For instance, a buyer can leverage access to competitive quotes from multiple insurers to negotiate better terms with their preferred provider. In 2024, the trade credit insurance market saw increased competition, providing buyers with more options and thus, enhanced bargaining power.

| Factor | Impact on Customer Bargaining Power | Example/Data Point |

| Availability of Alternatives | Increases power | Buyers can switch to other insurers if terms are unfavorable. |

| Switching Costs | Decreases power | High costs to change providers limit customer leverage. |

| Customer Concentration | Increases power | Large clients represent a significant portion of revenue, giving them more influence. |

Preview the Actual Deliverable

Coface Porter's Five Forces Analysis

This preview showcases the complete Coface Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. You are viewing the exact, professionally formatted document that will be available for immediate download upon purchase, ensuring no discrepancies or missing information. This comprehensive analysis is ready for your strategic planning needs without any further editing or setup.

Rivalry Among Competitors

The global trade credit insurance market is quite concentrated, with a few dominant companies holding a significant majority of the business. Coface, Allianz Trade (formerly Euler Hermes), and Atradius are the key players, collectively controlling more than 70% of the worldwide market. This means competition among these giants is fierce as they vie for market share and customer loyalty.

The trade credit insurance market is experiencing robust expansion, with a projected compound annual growth rate (CAGR) of 9.3% between 2024 and 2025. This growth is expected to propel the market to USD 25.27 billion by 2033.

While this expansion presents significant opportunities, it also has the potential to heighten competitive rivalry. As the market size increases, existing players and new entrants will likely intensify their efforts to capture market share, leading to more aggressive competition.

Competitors in the credit insurance market actively differentiate themselves through superior service quality, advanced risk assessment tools, extensive global networks, and innovative digital platforms. These elements are crucial for attracting and retaining clients in a competitive landscape.

Coface's strategic initiative, 'Power the Core,' directly addresses this by prioritizing data and technology advancements. This focus aims to enhance their risk assessment capabilities and digital service offerings, thereby strengthening their competitive position.

The company's commitment to deepening its Trade Credit Insurance (TCI) franchise further underscores its differentiation strategy. By concentrating on its core business and leveraging technology, Coface seeks to offer more tailored and efficient solutions to its clients, setting it apart from rivals.

Economic Uncertainty and Insolvency Trends

Rising global economic policy uncertainty is a significant factor impacting competitive rivalry. This uncertainty, coupled with an anticipated surge in business bankruptcies, creates a dynamic where demand for trade credit insurance escalates. However, this also means a higher frequency of claims, which can put pressure on insurer profitability and lead to adjustments in risk appetite and pricing strategies.

Insolvencies are projected to see a notable increase, with estimates suggesting a rise in 2024 and continuing into 2025. For instance, Coface's own forecasts indicated a global business insolvency increase of 8% in 2023, with a further 9% rise anticipated for 2024. This trend directly influences the competitive landscape among insurers.

- Increased Demand for Trade Credit Insurance: Economic volatility makes businesses more risk-averse, boosting demand for credit protection.

- Higher Claims Frequency: A rise in bankruptcies directly translates to more payouts for insurers, impacting their financial health.

- Pricing Adjustments: To manage increased risk and claims, insurers may raise premiums, altering the competitive pricing environment.

- Shifting Risk Appetites: Some insurers might reduce their exposure to certain sectors or regions, leading to market consolidation or new entrants focusing on underserved niches.

Global Footprint and Local Expertise

Trade credit insurance thrives on a delicate balance between a broad global reach and deep-seated local market understanding. Companies excelling in this space, like Coface, leverage their international presence to provide seamless solutions for clients operating across multiple countries. This global footprint is crucial for managing the intricate web of cross-border risks that businesses face today.

Coface's ability to offer comprehensive coverage worldwide, coupled with its localized expertise, directly impacts competitive rivalry. By having a strong presence in key markets, Coface can better assess and underwrite risks specific to those regions, offering tailored solutions that generic, less geographically diverse competitors might struggle to match. For instance, in 2023, Coface reported a significant increase in its global insured turnover, underscoring its expansive operational capabilities.

- Global Network Strength: Coface operates in over 100 countries, providing a significant advantage in serving multinational corporations.

- Local Risk Assessment: Local teams possess nuanced understanding of regional economic conditions and buyer behaviors, crucial for accurate risk pricing.

- Cross-Border Claims Handling: A unified global system facilitates smoother and more efficient claims processing for international transactions.

- Market Share in Key Regions: Coface's established presence in Europe, a major market for trade credit insurance, positions it strongly against rivals.

Competitive rivalry in the trade credit insurance market is intense, driven by a concentrated industry structure and a robust growth outlook. Coface, Allianz Trade, and Atradius dominate, collectively holding over 70% of the global market. This fierce competition is further fueled by a projected market CAGR of 9.3% from 2024 to 2025, with the market expected to reach USD 25.27 billion by 2033.

Differentiation strategies are key, with companies focusing on service quality, advanced risk assessment, global networks, and digital platforms. Coface's 'Power the Core' initiative, emphasizing data and technology, aims to enhance risk assessment and digital offerings, solidifying its competitive edge.

Economic policy uncertainty and rising insolvencies intensify rivalry. Coface's forecasts indicated a global business insolvency increase of 8% in 2023, with a further 9% rise anticipated for 2024, directly impacting insurers' risk appetite and pricing. This environment boosts demand for trade credit insurance but also increases claims frequency.

| Factor | Impact on Rivalry | Coface's Position |

|---|---|---|

| Market Concentration | High rivalry among few dominant players | One of the top 3 global players |

| Market Growth (2024-2025) | Intensified competition for market share | Actively expanding insured turnover |

| Differentiation | Service, technology, and global reach are key | Investing in data, technology, and global network |

| Economic Uncertainty & Insolvencies | Increased demand, but higher claims risk | Leveraging local expertise for risk assessment |

SSubstitutes Threaten

Businesses, especially those with robust financial health, can opt to self-insure their accounts receivable or handle credit risk internally. This internal capacity directly substitutes for external trade credit insurance, particularly when market risks appear subdued.

For instance, in 2024, companies with strong cash reserves might find it more cost-effective to absorb potential bad debts rather than paying premiums for external insurance, effectively bypassing the need for credit insurers.

Factoring and supply chain finance present significant threats of substitutes to traditional trade credit insurance. Factoring, where companies sell their outstanding invoices to a third party at a discount for immediate cash, offers a direct way to improve working capital and shift credit risk. For instance, the global factoring market was valued at approximately €3.4 trillion in 2023, indicating its substantial adoption.

Supply chain finance (SCF) solutions also provide viable alternatives by optimizing payment terms and mitigating buyer default risk, thereby reducing reliance on credit insurers. These financial tools allow businesses to access early payments against their approved invoices, strengthening their liquidity. The SCF market is projected to grow significantly, with estimates suggesting it could reach over $10 trillion globally in the coming years, underscoring its increasing role as a substitute.

Letters of credit and bank guarantees serve as traditional substitutes for trade credit insurance, particularly in international trade where payment security is paramount. These instruments offer a strong guarantee of payment, making them viable alternatives for businesses engaging in high-value or complex transactions.

While these traditional methods can be more administratively intensive and potentially costlier than trade credit insurance for everyday transactions, their robust security features make them attractive for managing significant risks. For instance, a significant portion of global trade still relies on these established banking instruments, underscoring their role as a viable substitute.

Diversification of Customer Base

Diversifying a customer base is a powerful strategy to reduce reliance on any single buyer, inherently lowering overall credit risk exposure. This approach acts as a fundamental risk mitigation substitute, much like an insurance product, by spreading the potential impact of a customer default across a wider group. For instance, in 2024, many businesses focused on expanding into new geographic markets or industry verticals to buffer against sector-specific downturns or individual client financial distress.

This diversification directly impacts a company's bargaining power with its customers. When a company has many clients, the loss of one or even a few is less detrimental, diminishing the leverage any single customer holds. Consider the automotive sector in 2024; manufacturers actively sought to increase their sales to fleet operators and government agencies alongside individual consumers to stabilize demand and reduce dependence on any one sales channel.

Key benefits of a diversified customer base include:

- Reduced Dependence: Lessens the impact of losing a major client.

- Improved Bargaining Power: Weakens the leverage of individual customers.

- Enhanced Stability: Creates a more resilient revenue stream against market fluctuations.

- Lower Credit Risk: Spreads the risk of non-payment across a broader client portfolio.

Government Export Credit Agencies (ECAs)

Government Export Credit Agencies (ECAs) can act as a significant substitute for private credit insurers, especially in high-risk or strategically important markets. By offering government-backed guarantees and insurance, ECAs can absorb risks that private insurers might deem too substantial, thereby undercutting the need for private sector solutions.

These agencies often provide more competitive pricing and terms, particularly when promoting exports for national economic development. For instance, ECAs might offer longer repayment periods or cover political risks that private insurers shy away from, making them a compelling alternative for businesses operating in challenging environments. In 2024, many ECAs continued to play a crucial role in facilitating international trade, with some reporting increased activity in supporting green energy and infrastructure projects.

- ECA Support: ECAs provide credit insurance and guarantees, acting as a substitute for private insurers.

- Competitive Terms: They often offer more favorable pricing and coverage, especially in emerging markets.

- Strategic Importance: ECAs are particularly relevant in regions where governments actively promote exports and national industries.

The threat of substitutes for trade credit insurance is substantial, encompassing various financial instruments and strategic approaches. Companies can leverage internal capabilities, such as self-insuring accounts receivable, especially when market risks are perceived as low. For example, in 2024, firms with strong liquidity might opt for this to avoid premium costs.

Factoring and supply chain finance offer direct alternatives by improving working capital and mitigating buyer default risk. The global factoring market’s significant size, around €3.4 trillion in 2023, highlights its prevalence. Similarly, supply chain finance is poised for considerable growth, potentially exceeding $10 trillion globally.

Traditional methods like letters of credit and bank guarantees remain viable substitutes, particularly for securing international transactions. While potentially more complex, their inherent security makes them attractive for high-value deals. Furthermore, diversifying a customer base acts as a fundamental risk mitigation substitute, reducing overall credit exposure and enhancing stability.

Government Export Credit Agencies (ECAs) also pose a threat by offering government-backed guarantees, often at more competitive terms than private insurers, especially in emerging or high-risk markets. Their role in facilitating trade, including support for green projects in 2024, underscores their function as a substitute.

Entrants Threaten

The trade credit insurance sector demands substantial initial investment due to high capital adequacy requirements mandated by regulators. For instance, Solvency II regulations in Europe, which came into full effect in 2016 and continue to shape capital management, necessitate significant reserves to cover potential claims.

Navigating the complex web of licensing and compliance across various countries presents another formidable barrier for potential new entrants. These regulatory hurdles, which require ongoing adaptation to evolving financial frameworks, can deter new players from entering the market.

In 2024, the global insurance market continues to grapple with these capital and regulatory demands, making it challenging for new companies to establish a foothold. The sheer scale of investment needed to operate competitively and compliantly remains a significant deterrent.

The trade credit insurance market demands significant upfront investment in data infrastructure and risk assessment capabilities. New entrants must acquire and process extensive historical data on debtor performance, industry-specific vulnerabilities, and global economic shifts. This data-intensive nature, coupled with the need for specialized risk expertise, creates a substantial barrier to entry.

For instance, Coface's strategic 'Power the Core' initiative underscores the critical role of data and technology in maintaining a competitive edge. Developing the sophisticated models and analytical talent required to effectively underwrite credit risk is a costly and time-consuming endeavor, making it difficult for newcomers to compete with established players who have already built these capabilities.

Established players like Coface leverage deep-seated client relationships and robust global distribution networks. These established connections are not easily replicated, as building trust and a comprehensive sales and service infrastructure requires substantial time and capital investment for newcomers.

Coface's high client retention rate, often exceeding 90% for its core services, underscores the strength of these existing relationships. This loyalty acts as a significant deterrent, making it challenging for new entrants to gain market share without offering a demonstrably superior value proposition or a disruptive business model.

Brand Recognition and Reputation

In financial services, brand recognition and a reputation for reliability are paramount. New entrants face a significant hurdle in building trust and credibility against established players like Coface, who boast a long history and a solidified market position. For instance, in 2023, Coface reported a gross combined ratio of 84.1%, indicating strong operational efficiency that underpins its reputation.

Newcomers must invest heavily in marketing and customer service to even begin to rival the established trust associated with firms that have a proven track record. This is particularly true in sectors like credit insurance, where policyholders depend on the insurer's stability and responsiveness during critical financial events.

Consider the impact of customer loyalty programs and established client relationships. A 2024 survey indicated that over 60% of businesses prioritize long-term partnerships and proven reliability when selecting financial service providers, making it difficult for new entrants to gain initial traction.

The threat of new entrants is therefore moderated by the substantial time and capital required to cultivate brand loyalty and a reputation for dependability in the financial services industry.

Technological Advancements (Insurtech)

While established players might see technology as a barrier, agile Insurtech startups are leveraging AI, machine learning, and blockchain to significantly lower entry barriers. These innovations streamline underwriting, risk assessment, and claims processing, creating more efficient operational models.

These technological advancements enable new entrants to challenge traditional insurance models. For instance, the short-term credit insurance market has seen a notable increase in new players, with over 20 private insurers operating in 2025, partly driven by these technological capabilities.

- Insurtechs utilize AI and machine learning for enhanced underwriting and risk assessment.

- Blockchain technology improves transparency and efficiency in claims processing.

- Over 20 private short-term credit insurers were active in 2025, indicating market entry facilitated by technology.

- Scaling and effective integration of new technologies remain key challenges for new entrants.

The trade credit insurance market presents significant barriers to new entrants, primarily stemming from high capital requirements and stringent regulatory compliance across diverse jurisdictions. These factors necessitate substantial upfront investment, making it difficult for newcomers to compete with established entities that have already navigated these complexities.

Furthermore, the need for sophisticated data infrastructure, advanced risk assessment capabilities, and specialized talent creates a steep learning curve and considerable cost for any new player. Building the necessary expertise and data analytics platforms to effectively underwrite credit risk is a major hurdle.

Established players benefit from strong brand recognition, deep-rooted client relationships, and extensive distribution networks, which are difficult and time-consuming for new entrants to replicate. Customer loyalty, often driven by a reputation for reliability, further solidifies the position of incumbents, demanding significant investment in marketing and trust-building from potential new market participants.

Insurtech innovations are beginning to lower some of these barriers by leveraging AI and blockchain for more efficient operations, though scaling these technologies effectively remains a challenge.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High initial investment due to solvency regulations and reserves. | Deters entry without substantial funding. |

| Regulatory Compliance | Complex licensing and adherence to evolving financial frameworks. | Requires significant legal and administrative resources. |

| Data & Technology | Need for extensive data infrastructure and risk assessment expertise. | Costly to acquire and develop, demanding specialized talent. |

| Brand & Relationships | Established trust, client loyalty, and distribution networks. | Difficult to penetrate without a proven track record or superior offering. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data sources, including industry-specific market research reports, company financial statements, and expert interviews. This multi-faceted approach ensures a robust understanding of competitive intensity, supplier and buyer power, and the threat of new entrants and substitutes.