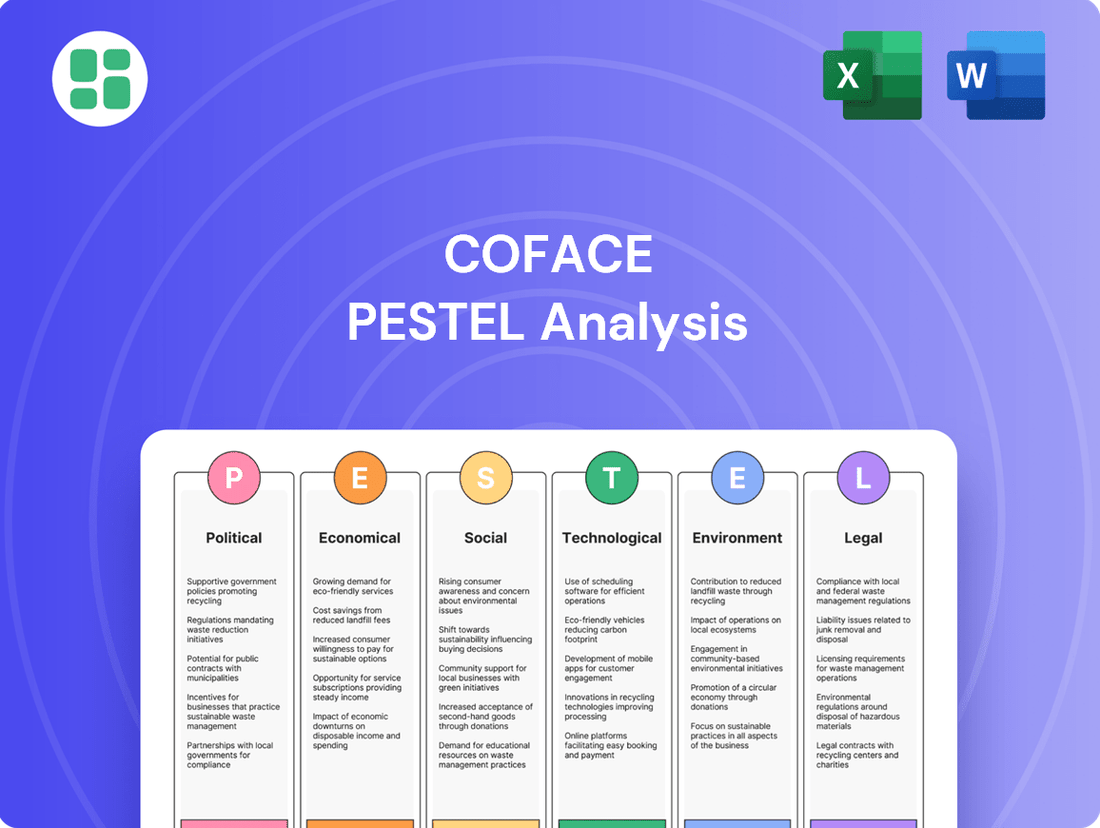

Coface PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coface Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Coface's trajectory. Our meticulously researched PESTLE analysis provides the essential intelligence to anticipate market shifts and identify strategic opportunities. Equip yourself with actionable insights; download the full report now and gain a decisive advantage.

Political factors

Geopolitical instability, including ongoing trade disputes between major global powers, significantly disrupts international supply chains. This disruption directly increases the risk of non-payment for commercial transactions, a core concern for credit insurers like Coface. For instance, the prolonged US-China trade war, which saw tariffs imposed on hundreds of billions of dollars worth of goods, created substantial uncertainty and increased costs for businesses globally throughout 2023 and into early 2024, impacting payment behaviors.

These tensions often result in unpredictable policy changes, directly affecting market access and the overall trading environment for Coface's clients. Businesses operating in regions experiencing heightened geopolitical risk may face higher operational costs due to tariffs or supply chain rerouting, alongside reduced revenue from market access restrictions. This financial strain can impair their ability to honor financial obligations, thereby increasing credit risk exposure for insurers.

Government support, like the US$2 trillion CARES Act enacted in 2020, directly impacts business solvency and thus Coface's risk. Conversely, tighter fiscal policies, such as anticipated interest rate hikes by central banks in 2024 to combat inflation, can strain businesses and increase default probabilities, influencing Coface's underwriting.

Regulatory stability is a cornerstone for Coface, as predictable government regulations and a straightforward business environment directly impact its operational stability and expansion. Sudden shifts in trade agreements or investment policies can introduce significant uncertainty, making it harder for Coface and its clients to accurately assess risks and plan market entries.

For instance, a country like Singapore consistently ranks high in the World Bank's Ease of Doing Business report, often within the top 5 globally, providing a secure environment for businesses like Coface. Conversely, countries experiencing frequent policy changes can deter investment and complicate cross-border transactions, impacting Coface's ability to offer reliable credit insurance.

Sanctions and Export Controls

Sanctions and export controls, imposed by governments and international organizations, significantly disrupt global trade and can lead to unexpected payment defaults for companies operating in affected sectors or territories. Coface must stay vigilant, constantly tracking these evolving restrictions to maintain compliance and accurately gauge the increased risks in restricted commercial activities. For instance, the US Department of Commerce’s Bureau of Industry and Security (BIS) regularly updates its Entity List, impacting companies’ ability to export goods and technology to the United States. Failure to comply can result in substantial fines and reputational damage.

These measures can create substantial challenges for businesses, impacting supply chains and market access. For example, in 2023, the continued sanctions on Russia affected numerous international companies, leading to asset write-downs and operational restructuring. Coface’s risk assessment models must therefore incorporate the dynamic nature of these political factors to provide an accurate picture of the global business environment.

- Increased Compliance Burden: Businesses face heightened scrutiny and must invest in robust compliance programs to navigate complex sanction regimes.

- Supply Chain Disruptions: Export controls can sever critical links in global supply chains, forcing companies to find alternative suppliers or markets.

- Market Access Limitations: Sanctioned countries become inaccessible markets, reducing revenue opportunities for businesses.

- Financial Penalties: Non-compliance with sanctions can result in severe financial penalties, sometimes reaching billions of dollars, as seen in past cases involving major financial institutions.

International Trade Agreements and Blocs

The evolving landscape of international trade agreements and economic blocs is a critical political factor influencing Coface's operations. For instance, the European Union's single market, a prominent economic bloc, facilitates seamless trade among member states, reducing the complexity of cross-border transactions for businesses Coface insures. Conversely, the potential for new trade tensions or the renegotiation of existing pacts, such as those involving major economies like the United States and China, can introduce new risks and alter trade flows, impacting payment security and demand for credit insurance.

Changes in these agreements directly affect global trade volumes and the associated payment risks. For example, the World Trade Organization (WTO) reported that global trade in goods grew by an estimated 0.5% in 2023, a slowdown from previous years, partly influenced by geopolitical fragmentation and trade policy uncertainty. This slowdown means fewer transactions are being insured, but also potentially higher risks on the transactions that do occur due to increased protectionism.

Coface must continuously monitor and adapt to these shifts. Key considerations include:

- Impact of Regional Trade Deals: Analyzing how agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or the African Continental Free Trade Area (AfCFTA) create new opportunities and risks for businesses operating within those regions. The AfCFTA, for example, aims to boost intra-African trade significantly, potentially increasing demand for credit insurance in a continent where trade finance is often a bottleneck.

- Tariff and Non-Tariff Barriers: Assessing the effect of changes in tariffs and other trade barriers imposed by major economic powers. For instance, shifts in US trade policy towards certain countries could lead to increased import costs and payment delays for businesses involved in those supply chains.

- Geopolitical Instability and Trade Disruptions: Evaluating how political instability or conflicts in key trading regions can disrupt supply chains and payment flows, thereby increasing the need for robust credit risk management solutions. The ongoing conflict in Eastern Europe, for example, has had ripple effects on energy and commodity prices globally, impacting payment behavior.

Political stability and government policies profoundly shape the business environment, directly influencing credit risk. For instance, the World Bank's 2024 report highlights that regulatory reforms in emerging markets are gradually improving business conditions, potentially lowering default rates for insured companies. However, ongoing political tensions, such as those seen in parts of the Middle East in early 2024, continue to create localized economic instability and payment disruptions.

Government intervention, whether through subsidies or austerity measures, can significantly alter a company's financial health and its ability to meet obligations. In 2023, many governments provided targeted support to energy-intensive industries to mitigate inflation impacts, which indirectly bolstered their creditworthiness. Conversely, anticipated fiscal tightening in major economies during 2024 could strain businesses reliant on government spending or easy credit access.

Trade policies and international relations remain critical. The continued evolution of trade agreements, like the CPTPP, offers new market access but also introduces complex compliance requirements. For example, the USMCA (United States-Mexico-Canada Agreement) continues to shape North American trade, creating predictable frameworks but also specific rules of origin that impact supply chain financing and payment terms for businesses operating within that bloc.

The global political landscape, marked by shifting alliances and potential conflicts, directly impacts trade flows and payment security. The ongoing geopolitical fragmentation, evident in 2023 and projected for 2024, necessitates constant re-evaluation of country risk by credit insurers like Coface, as supply chain disruptions and payment delays become more prevalent in affected regions.

What is included in the product

This Coface PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operational landscape.

It provides a comprehensive overview of external forces, highlighting potential challenges and strategic advantages for Coface's global operations.

Provides a clear, actionable framework for understanding and mitigating external risks, turning complex market dynamics into manageable strategic insights.

Economic factors

The trajectory of global economic growth directly influences Coface's business, impacting both client solvency and the demand for trade credit insurance. A healthy global economy typically means businesses are performing well, leading to fewer defaults and greater demand for trade finance. For instance, the IMF projected global growth at 3.2% for both 2023 and 2024 in its October 2023 report, indicating a steady, albeit moderate, expansion.

Conversely, economic slowdowns or recessions present significant challenges. During these periods, businesses face tighter credit conditions, reduced consumer spending, and increased payment delays, all of which elevate credit risk and highlight the necessity of credit insurance. The World Bank's January 2024 Global Economic Prospects report anticipated global growth to slow to 2.4% in 2024, down from 2.6% in 2023, signaling a cautious outlook that Coface must monitor closely.

Therefore, Coface's ability to accurately forecast macroeconomic trends is crucial for anticipating shifts in its risk exposure and adapting its underwriting strategies. Understanding these global economic dynamics allows Coface to proactively manage its portfolio and offer relevant protection to businesses navigating uncertain market conditions.

Rising inflation, with global figures hovering around 5-6% in early 2024, directly impacts Coface by diminishing consumer and business purchasing power. This erodes profit margins for companies and can make debt repayment more challenging, increasing default risks that Coface must assess.

Simultaneously, central banks' efforts to curb inflation through interest rate hikes, such as the US Federal Reserve maintaining rates above 5% through mid-2024, significantly increase borrowing costs. For Coface, this means higher financing expenses for clients and a greater probability of financial distress, necessitating careful risk pricing adjustments.

Currency volatility significantly impacts international trade. For instance, in late 2024, the Euro experienced notable fluctuations against the US Dollar, impacting the cost of imported components for European manufacturers and the revenue generated from exports. This unpredictability directly affects Coface's clients by altering the value of cross-border transactions, potentially increasing the cost of raw materials or diminishing the returns from sales abroad.

These sharp exchange rate movements can create liquidity challenges for businesses. If a company has significant receivables denominated in a weakening foreign currency, the actual cash inflow upon conversion can be substantially lower than anticipated. This erosion of value can strain working capital and, in turn, heighten the risk of payment defaults, a key concern that Coface actively manages by assessing and adjusting its exposure to currency-related risks.

Sectoral Economic Performance

The economic performance of individual sectors is a critical lens through which Coface assesses credit risk. For instance, the automotive sector, a significant contributor to many economies, experienced a notable rebound in production in 2024, with global vehicle sales projected to reach approximately 90 million units, up from around 85 million in 2023, according to industry reports. However, this growth is not uniform, with some regions facing supply chain disruptions and fluctuating consumer demand.

Conversely, the retail sector’s performance is heavily influenced by consumer spending patterns and inflation rates. In 2024, while essential goods retail showed resilience, discretionary spending sectors faced headwinds due to persistent inflation, impacting disposable incomes. This divergence means Coface must analyze each sub-sector carefully, as a downturn in one, like luxury goods, might not reflect the stability in another, such as discount grocery chains.

The construction industry, often a bellwether for economic health, saw mixed results in 2024. While infrastructure spending provided a boost in some developed economies, rising material costs and interest rates in 2025 are expected to temper new residential and commercial project starts. This can lead to increased payment delays and potential insolvencies among construction firms and their suppliers.

- Automotive Sector: Global vehicle sales projected to reach ~90 million units in 2024, a rise from ~85 million in 2023, but regional variations persist.

- Retail Sector: Essential goods retail remains stable, while discretionary spending faces pressure from inflation in 2024-2025.

- Construction Sector: Infrastructure projects offer support, but rising costs and interest rates in 2025 may slow new residential and commercial development.

- Energy Sector: Volatility in energy prices continues to impact operational costs and investment decisions across various industries, with forecasts for 2025 suggesting a gradual stabilization but ongoing geopolitical influences.

Credit Cycles and Insolvency Rates

Understanding the current credit cycle and predicting corporate insolvency rates are absolutely central to Coface's business of trade credit insurance. When economies slow down, more companies struggle, leading to a rise in claims. This is a direct reflection of how economic health impacts business survival.

Conversely, during periods of economic growth, fewer businesses fail, and insolvency rates typically fall. Coface's entire approach to risk assessment and its underwriting strategies are built around anticipating and adapting to these predictable cyclical shifts in the economy.

For instance, global corporate insolvencies saw a notable increase in 2023, with estimates suggesting a rise of around 9% compared to 2022, reaching approximately 2.7 million cases. This trend is expected to continue into 2024, though perhaps at a slightly moderated pace.

- Global Insolvencies: Expected to remain elevated in 2024, following a significant rise in 2023.

- Economic Downturn Impact: Higher insolvency rates directly translate to increased claims for trade credit insurers like Coface.

- Economic Expansion Impact: Lower insolvency rates during growth periods reduce claims and improve insurer profitability.

- Coface's Strategy: Underwriting and modeling are heavily influenced by these cyclical credit patterns.

Economic factors are paramount for Coface, influencing everything from client solvency to the demand for trade credit insurance. Global growth forecasts, like the IMF's projection of 3.2% for 2024, provide a baseline, but the World Bank's more cautious 2.4% outlook for the same year highlights the need for constant vigilance. Rising inflation, hovering around 5-6% globally in early 2024, directly impacts businesses' purchasing power and debt repayment capabilities, increasing default risks. Furthermore, central banks' interest rate hikes, with the US Federal Reserve keeping rates above 5% through mid-2024, raise borrowing costs, potentially leading to financial distress for Coface's clients.

| Economic Factor | 2023 Data/Projection | 2024 Data/Projection | Impact on Coface |

|---|---|---|---|

| Global GDP Growth | 3.2% (IMF, Oct 2023) | 3.2% (IMF, Oct 2023) / 2.4% (World Bank, Jan 2024) | Influences client solvency and demand for insurance. |

| Global Inflation | ~6% (early 2024 estimate) | ~5-6% (early 2024 estimate) | Reduces purchasing power, increases default risk. |

| US Federal Funds Rate | ~5.25-5.50% (mid-2024) | Maintained above 5% (mid-2024) | Increases borrowing costs for clients. |

| Global Corporate Insolvencies | ~2.7 million cases (est. +9% vs 2022) | Expected to remain elevated | Directly correlates with increased claims. |

What You See Is What You Get

Coface PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Coface PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping Coface's strategic landscape.

Sociological factors

Global workforce demographics are undergoing significant shifts. Developed nations, like Japan and many European countries, are experiencing aging populations, leading to potential labor shortages and increased healthcare costs. For instance, Japan's working-age population (15-64) is projected to decline by over 10% between 2024 and 2030. This impacts operational capacity and innovation.

Conversely, emerging economies, particularly in Africa and parts of Asia, boast a youthful demographic. Nigeria, for example, has a median age of around 18 years in 2024, indicating a large pool of potential workers but also presenting challenges in job creation and education. These demographic divergences affect global labor availability, wage pressures, and consumer spending power, all of which are critical for businesses and their credit risk assessments.

Consumer preferences are shifting, with a growing emphasis on sustainability and ethical sourcing. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's environmental impact when making purchasing decisions. This trend directly impacts demand for certain goods and services, influencing the financial health and payment reliability of businesses that fail to adapt.

Spending habits are also evolving, particularly with the continued growth of e-commerce. By the end of 2025, online retail sales are projected to account for nearly 25% of total retail sales globally, a significant jump from previous years. This digital shift presents both opportunities and challenges for Coface clients, affecting their inventory management, supply chain logistics, and ultimately, their ability to meet payment obligations.

Societal expectations for businesses to act ethically and sustainably are growing. Consumers and investors alike are increasingly prioritizing companies that demonstrate strong Environmental, Social, and Governance (ESG) practices. For instance, a 2024 survey indicated that over 60% of consumers consider a company's sustainability efforts when making purchasing decisions.

This heightened ESG awareness directly impacts corporate financial performance and credit risk. Companies with robust ESG profiles, like those actively reducing their carbon footprint or ensuring fair labor practices, are more likely to attract investment and customer loyalty. In 2024, ESG-focused funds saw continued inflows, outperforming some traditional benchmarks, which suggests a tangible financial benefit to strong ESG credentials.

Conversely, businesses that neglect their social responsibility or environmental impact face significant risks. Reputational damage can lead to boycotts and reduced market access, directly affecting revenue streams and increasing credit risk. Coface, in its analysis, recognizes that a company's commitment to ESG principles is a key indicator of its long-term resilience and financial stability.

Rise of E-commerce and Digital Trade

The global e-commerce market is experiencing robust growth, with projections indicating continued expansion. For instance, global retail e-commerce sales were estimated to reach over $6.3 trillion in 2024, a significant increase from previous years. This surge fundamentally alters traditional trade, necessitating new approaches to risk management.

This digital transformation introduces novel risks, including sophisticated cyberattacks and evolving data privacy regulations. In 2023, the average cost of a data breach reached $4.45 million globally. Coface must integrate advanced cybersecurity measures and data protection protocols into its offerings to safeguard digital trade flows effectively.

- Global e-commerce sales are projected to exceed $6.3 trillion in 2024.

- The average cost of a data breach in 2023 was $4.45 million.

- E-commerce growth necessitates adaptation in risk assessment and mitigation strategies.

Global Urbanization and Population Shifts

Global urbanization continues, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. This concentration of people fuels demand for housing, infrastructure, and consumer goods in cities, presenting both growth opportunities and logistical hurdles for businesses. For instance, emerging markets are seeing particularly rapid urban growth, with cities in Asia and Africa expected to absorb a significant portion of this expansion.

These population shifts directly impact business solvency by altering market dynamics and resource availability. Increased urban density can strain public services and infrastructure, potentially increasing operational costs for businesses or impacting their supply chains. Coface's risk assessments actively monitor these geographic population movements to understand their implications for business creditworthiness and market stability.

- Urban Population Growth: The UN estimates that urban areas will house 68% of the global population by 2050, up from 56% in 2021.

- Economic Concentration: Major urban centers often become hubs for economic activity, driving demand but also potentially leading to higher competition and operational costs.

- Infrastructure Strain: Rapid urbanization can outpace infrastructure development, impacting logistics and potentially increasing business operating risks.

- Regional Disparities: While urbanization is a global trend, its pace and impact vary significantly by region, creating diverse risk landscapes for businesses.

Societal expectations for businesses to act ethically and sustainably are growing, with consumers and investors increasingly prioritizing companies with strong ESG practices. For instance, a 2024 survey indicated that over 60% of consumers consider a company's sustainability efforts when purchasing. This heightened ESG awareness directly impacts corporate financial performance and credit risk, as companies with robust ESG profiles are more likely to attract investment and customer loyalty. In 2024, ESG-focused funds saw continued inflows, outperforming some traditional benchmarks, suggesting a tangible financial benefit to strong ESG credentials.

Conversely, businesses neglecting social responsibility or environmental impact face significant risks, including reputational damage, boycotts, and reduced market access, all of which affect revenue and increase credit risk. Coface's analysis recognizes a company's commitment to ESG principles as a key indicator of its long-term resilience and financial stability.

The global e-commerce market is experiencing robust growth, with projections indicating continued expansion. Global retail e-commerce sales were estimated to reach over $6.3 trillion in 2024. This surge fundamentally alters traditional trade, necessitating new approaches to risk management, especially considering that in 2023, the average cost of a data breach reached $4.45 million globally.

| Societal Factor | 2024 Data/Projection | Impact on Business | Credit Risk Implication |

|---|---|---|---|

| Consumer ESG Focus | 60%+ consumers consider sustainability | Influences demand, brand loyalty | Higher risk for non-compliant businesses |

| E-commerce Growth | >$6.3 trillion in global sales | Alters trade, supply chains | Cybersecurity & data privacy risks |

| Data Breach Costs | $4.45 million (average in 2023) | Operational disruption, financial loss | Increased financial strain, reduced solvency |

Technological factors

Advanced data analytics and AI are significantly enhancing Coface's credit risk assessment. By processing massive datasets, AI algorithms can detect subtle patterns and predict potential insolvencies with increased accuracy. This allows Coface to refine its underwriting decisions, optimize pricing strategies, and manage claims more effectively, ultimately bolstering its risk mitigation framework.

Blockchain technology is increasingly seen as a game-changer for international trade finance, promising greater transparency and security. Its ability to create immutable records for transactions and supply chain data can significantly enhance trust among parties. For instance, in 2024, several pilot programs demonstrated how blockchain could reduce settlement times in trade finance by up to 70%, a substantial improvement over traditional methods.

This technological advancement has the potential to curb certain types of fraud and operational risks inherent in cross-border commerce. By streamlining payment processes and providing verifiable proof of origin and ownership, blockchain could lessen the need for some traditional credit insurance services. The global trade finance market, valued at trillions of dollars annually, is a prime area where such efficiencies could lead to significant cost savings and reduced risk exposure for businesses.

Cybersecurity threats are a growing concern, impacting businesses worldwide. In 2024, the average cost of a data breach reached an all-time high of $4.95 million, according to IBM's 2024 Cost of a Data Breach Report. These escalating risks can cause significant operational disruptions, lead to sensitive data being compromised, and result in substantial financial losses, potentially even leading to business insolvencies.

For Coface, this means not only fortifying its own digital defenses but also critically evaluating the cybersecurity practices of its clients. A client's ability to protect their data is now a key indicator of their overall creditworthiness and risk profile. Companies with weak cybersecurity measures are inherently more vulnerable to events that could impact their financial stability and ability to meet obligations.

Digital Platforms for Service Delivery

Coface's strategic embrace of digital platforms is fundamentally reshaping how it delivers services. These online portals are not just for show; they are the engine for a better customer experience, making it easier to manage policies and process claims faster. By allowing clients to access vital business information and handle accounts receivable directly online, Coface is boosting its own operational efficiency and, crucially, client satisfaction.

The push towards digitalization directly supports Coface's ability to scale its operations and react swiftly to market changes and client needs. For instance, in 2024, Coface reported a significant increase in digital interactions, with over 70% of new policy applications initiated through their online portal. This trend is expected to continue growing, with projections for 2025 indicating a further 15% rise in digital service utilization.

- Enhanced Customer Experience: Digital platforms provide clients with 24/7 access to policy details, risk assessments, and account management tools, simplifying interactions.

- Streamlined Operations: Online portals automate many manual processes, from policy issuance to claims submission, reducing turnaround times and operational costs.

- Improved Claims Processing: Digital submission and tracking of claims allow for faster assessment and payout, a critical factor in credit insurance.

- Data-Driven Insights: The increased use of digital platforms generates valuable data that Coface can leverage for better risk analysis and personalized service offerings.

Automation in Operations and Claims Processing

Automation is transforming how companies like Coface manage their operations. By automating tasks from issuing policies to processing claims and even collecting debts, significant improvements in efficiency and cost reduction are achievable. This acceleration in service delivery directly benefits clients.

Technologies like Robotic Process Automation (RPA) are key players here. They allow for the streamlining of repetitive, rule-based tasks. For instance, in 2024, many financial services firms reported efficiency gains of up to 25% through RPA implementation in claims processing, according to industry reports. This frees up valuable human capital.

The strategic advantage of this automation lies in redirecting human expertise. Employees can then focus on higher-value activities such as intricate risk assessment and building stronger client relationships. This shift enhances overall productivity and bolsters Coface's competitive edge in the market.

- Increased Operational Efficiency: Automation can reduce processing times for policies and claims by an estimated 20-30% in 2024-2025.

- Reduced Administrative Costs: Implementing RPA can lead to a decrease in operational expenses by up to 15% annually.

- Enhanced Focus on Core Competencies: Automation allows staff to dedicate more time to complex risk analysis and client engagement, improving service quality.

Technological advancements are a double-edged sword for credit insurers like Coface. While AI and advanced analytics enhance risk assessment and fraud detection, the increasing sophistication of cyber threats necessitates robust digital defenses and careful client vetting. The adoption of blockchain in trade finance, while promising greater transparency and efficiency, could also reduce reliance on certain traditional insurance products.

Coface's strategic investment in digitalization and automation is key to navigating this landscape. Digital platforms improve customer experience and operational efficiency, with over 70% of new policy applications initiated online in 2024. Automation, particularly through RPA, is projected to increase operational efficiency by 20-30% and reduce administrative costs by up to 15% annually, allowing staff to focus on complex risk analysis and client engagement.

| Technology | Impact on Coface | 2024/2025 Data/Projections |

|---|---|---|

| AI & Data Analytics | Enhanced credit risk assessment, fraud detection | AI algorithms improving insolvency prediction accuracy. |

| Blockchain | Increased transparency & security in trade finance; potential reduction in insurance needs | Pilot programs in 2024 reduced trade finance settlement times by up to 70%. |

| Cybersecurity | Increased operational risk, need for client data protection evaluation | Average cost of data breach reached $4.95 million in 2024 (IBM). |

| Digital Platforms | Improved customer experience, operational efficiency, scalability | Over 70% of new policy applications online in 2024; projected 15% rise in digital service utilization for 2025. |

| Automation (RPA) | Streamlined operations, cost reduction, focus on core competencies | Projected 20-30% increase in operational efficiency; up to 15% annual reduction in administrative costs. |

Legal factors

Modifications to insolvency and bankruptcy laws significantly influence Coface's debt recovery processes and the timeline for claims. Debtor-friendly legislation can extend recovery periods or decrease the amounts Coface can reclaim, whereas creditor-friendly reforms may lead to more favorable outcomes. For instance, as of late 2024, several European Union countries are implementing updated insolvency frameworks aimed at streamlining procedures for viable businesses while ensuring better creditor protection, a trend Coface actively tracks.

The increasing prevalence of data protection laws like Europe's GDPR and California's CCPA significantly impacts Coface. These regulations mandate careful handling of client and debtor data, covering collection, storage, processing, and sharing. Failure to comply can result in hefty penalties, with GDPR fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher.

Maintaining compliance necessitates strong data governance and secure information management systems throughout Coface's global operations. This includes investing in advanced cybersecurity measures and employee training to safeguard sensitive financial and personal data from breaches.

Coface must navigate increasingly stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, demanding rigorous client due diligence and transaction monitoring to thwart illicit financial flows. These regulations necessitate complex screening, reporting, and the implementation of robust compliance systems, thereby increasing operational expenses.

Failure to comply with these evolving legal frameworks can result in substantial financial penalties and severe reputational damage, underscoring the critical need for proactive and comprehensive adherence to AML/CTF mandates.

International Trade Law and Customs Regulations

Amendments to international trade laws and customs regulations directly impact Coface's clients involved in global commerce. For instance, the World Trade Organization (WTO) continues to monitor and facilitate trade agreements, with ongoing discussions around digital trade and supply chain resilience influencing future regulatory landscapes.

Changes in customs duties and import/export rules can significantly alter the cost structure and market access for businesses. For example, the European Union's Carbon Border Adjustment Mechanism (CBAM), phased in during 2023 and expanding in 2024, imposes costs on carbon-intensive imports, affecting sectors like steel and cement and potentially influencing credit risk for companies in these industries.

These evolving regulations can affect payment terms and the overall creditworthiness of Coface's clients. Businesses facing increased tariffs or new trade barriers may experience cash flow challenges, thereby elevating the demand for trade credit insurance to mitigate these risks.

- WTO's ongoing work on digital trade rules could reshape cross-border e-commerce regulations by 2025, impacting online sellers.

- The EU's CBAM, implemented in October 2023, is set to cover more goods by 2025, increasing compliance costs for exporters to the EU.

- Shifts in preferential trade agreements, like potential renegotiations of existing pacts, can alter tariff structures and impact import/export costs for businesses.

- Increased focus on supply chain security and origin verification by customs authorities globally may lead to more stringent documentation requirements, affecting trade efficiency.

Contract Law and Dispute Resolution Mechanisms

Coface's operations are heavily influenced by contract law and the effectiveness of dispute resolution. The strength and speed of legal frameworks in various countries directly affect Coface's capacity to secure payments and enforce agreements. For instance, differing judicial processes and the enforceability of judgments across jurisdictions can significantly slow down or complicate debt recovery, impacting Coface's financial performance.

Navigating these legal complexities is paramount for risk management. Variations in how contracts are interpreted and disputes are settled require Coface to adapt its strategies. A robust legal system can reduce the time and cost associated with claim recovery, making markets with well-established contract enforcement more attractive.

Consider the impact of legal efficiency on Coface's bottom line. In 2024, the World Bank's Doing Business report, though discontinued, historically highlighted significant disparities in contract enforcement timelines. For example, resolving a commercial dispute could take over 600 days in some emerging markets, versus under 200 days in more developed economies, directly affecting Coface's operational costs and recovery rates.

- Contractual Certainty: The clarity and enforceability of contracts are vital for Coface's credit insurance and factoring services.

- Dispute Resolution Efficiency: Faster and more predictable legal processes reduce the cost and risk associated with unpaid debts.

- Jurisdictional Differences: Coface must account for varying legal systems, from common law to civil law, impacting claim resolution.

- Enforcement of Judgments: The ability to enforce foreign judgments is critical for cross-border transactions and recoveries.

Legal frameworks surrounding insolvency and bankruptcy directly influence Coface's debt recovery efficiency. For instance, as of late 2024, the EU is updating insolvency laws to expedite procedures for viable businesses while strengthening creditor protections, a development Coface closely monitors to adapt its claims management.

Data protection regulations like GDPR, with potential fines up to 4% of global annual turnover, necessitate robust data governance and cybersecurity investments for Coface. Similarly, stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws require enhanced due diligence and compliance systems, increasing operational costs but mitigating significant legal and reputational risks.

International trade laws and customs regulations, such as the EU's Carbon Border Adjustment Mechanism (CBAM) expanding in 2024, directly impact Coface's clients by altering import costs and market access. These shifts can affect client cash flow and creditworthiness, potentially increasing demand for trade credit insurance.

Contract law and dispute resolution efficiency are critical for Coface's operations. In 2024, disparities in contract enforcement timelines, historically noted as over 600 days in some emerging markets versus under 200 in developed economies, directly impact Coface's recovery costs and success rates.

Environmental factors

Climate change is increasingly disrupting global supply chains. Extreme weather events, such as floods and droughts, are becoming more frequent and intense, leading to significant operational interruptions. For example, in 2023, severe flooding in Thailand caused widespread damage to manufacturing facilities and logistics networks, impacting automotive and electronics production.

These disruptions directly affect Coface's clients. Delays in receiving raw materials or shipping finished goods can hinder their ability to operate and meet payment obligations, thus increasing the risk of default. Coface actively analyzes these climate vulnerabilities across different geographies and sectors to better understand and manage these emerging risks for its insured businesses.

The increasing focus on Environmental, Social, and Governance (ESG) criteria is reshaping business landscapes. New regulations, like the EU's Corporate Sustainability Reporting Directive (CSRD), which came into full effect for many companies in 2024, mandate detailed ESG disclosures, impacting how businesses are viewed by investors and lenders.

Companies with weaker ESG profiles may encounter higher borrowing costs and diminished access to capital markets. For instance, a 2024 study by S&P Global found that companies with higher ESG scores generally have lower costs of debt. This can translate to increased credit risk for entities like Coface, as poor ESG performance can signal underlying operational or reputational vulnerabilities.

Policies designed to address climate change, like carbon taxes and mandates for green energy, create transition risks for businesses. These measures can raise operating expenses and require substantial investment in new technologies, potentially affecting the financial stability of Coface's clients, especially those in high-emission industries.

For instance, the EU's Carbon Border Adjustment Mechanism (CBAM), fully phased in from 2026, will impose costs on imports based on their embedded carbon emissions. This directly impacts sectors like steel and cement, potentially increasing their input costs by an estimated 10-20% depending on the carbon intensity of their production, thereby influencing their creditworthiness.

Natural Disaster Frequency and Severity

The increasing frequency and severity of natural disasters like floods, droughts, and wildfires pose a significant threat to businesses. These events can directly damage physical assets, disrupt operations, and destabilize financial health in affected areas. For instance, the World Meteorological Organization reported that extreme weather events in 2023 caused over $100 billion in damages globally, highlighting the tangible economic impact.

These disruptions can lead to prolonged business interruptions, costly property repairs, and substantial financial losses, which in turn can strain a company's ability to meet its financial obligations. This heightened risk environment can also lead to an increased demand for trade credit insurance as businesses seek to mitigate the financial fallout from supply chain disruptions and customer defaults stemming from these events.

- Increased operational costs: Businesses face higher expenses for repairs, business continuity planning, and potentially relocation.

- Supply chain vulnerability: Disasters can cripple key suppliers, leading to shortages and production delays.

- Insurance premium hikes: As the risk of claims rises, insurance providers may increase premiums, impacting profitability.

- Investor confidence erosion: Companies in disaster-prone regions may see reduced investor interest due to perceived instability.

Resource Scarcity and Water Stress

Growing concerns over resource scarcity, particularly water stress, are increasingly impacting industries reliant on these essential inputs. Agriculture, manufacturing, and energy sectors face significant challenges as critical natural resources become more limited.

This scarcity translates directly into rising input costs and operational constraints, potentially reducing productivity across affected businesses. For instance, by 2025, projections indicate that over two-thirds of the global population may face water shortages, a stark reality for water-intensive industries.

The financial viability and creditworthiness of companies in these sectors are directly threatened by these environmental trends. Coface actively monitors these long-term environmental shifts to assess their impact on business risk.

- Water Stress Impact: By 2025, an estimated 5.2 billion people could live in cities experiencing water scarcity.

- Agricultural Vulnerability: Agriculture accounts for approximately 70% of global freshwater withdrawals, making it highly susceptible to water stress.

- Manufacturing Costs: Increased water prices or restricted access can significantly raise production costs for industries like textiles and electronics.

- Energy Sector Challenges: Many energy production methods, including thermal power plants, are water-intensive, facing operational risks due to scarcity.

Environmental factors are increasingly shaping the business landscape, with climate change and resource scarcity posing significant risks. Extreme weather events, predicted to intensify, caused an estimated $100 billion in global damages in 2023 alone, directly impacting supply chains and business continuity. Growing water stress, with projections suggesting over two-thirds of the world's population could face shortages by 2025, threatens water-intensive industries like agriculture and manufacturing, driving up operational costs and impacting creditworthiness.

The global push for sustainability, underscored by regulations like the EU's CSRD effective in 2024, means companies with poor ESG performance face higher borrowing costs and reduced market access. For instance, S&P Global data from 2024 indicates a correlation between higher ESG scores and lower debt costs. Additionally, climate policies such as the EU's CBAM, fully implemented from 2026, will add costs to carbon-intensive imports, potentially increasing prices for sectors like steel and cement by 10-20% and affecting their financial stability.

| Factor | Impact on Businesses | Examples/Data (2023-2025) |

|---|---|---|

| Extreme Weather Events | Supply chain disruption, operational interruptions, increased repair costs, potential defaults. | $100 billion+ in global damages in 2023 (WMO). Flooding in Thailand in 2023 disrupted automotive and electronics production. |

| Resource Scarcity (Water Stress) | Rising input costs, operational constraints, reduced productivity, threats to financial viability. | By 2025, 5.2 billion people could live in water-scarce cities. Agriculture uses ~70% of global freshwater. |

| ESG Regulations & Investor Pressure | Higher borrowing costs for poor ESG performers, reduced market access, need for detailed disclosures (e.g., EU CSRD from 2024). | Companies with higher ESG scores generally have lower costs of debt (S&P Global, 2024). |

| Climate Policies (e.g., Carbon Taxes) | Increased operating expenses, need for technological investment, transition risks. | EU CBAM (phased in from 2026) may increase costs for steel/cement imports by 10-20%. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from leading international organizations like the IMF and World Bank, alongside national government statistics and reputable industry-specific reports. This comprehensive approach ensures all political, economic, social, technological, legal, and environmental insights are well-supported and current.