Coca-Cola HBC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola HBC Bundle

Coca-Cola HBC navigates a dynamic beverage market, leveraging its strong distribution network and brand portfolio as key strengths. However, it faces challenges from evolving consumer preferences towards healthier options and increasing competition. Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

Want the full story behind Coca-Cola HBC's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Coca-Cola HBC boasts an impressive geographic reach, serving an estimated 740-750 million consumers across 29 countries spanning Europe, Africa, and Asia. This extensive footprint allows the company to tap into diverse market dynamics and seize growth opportunities, especially within rapidly expanding emerging economies.

Coca-Cola HBC's strength lies in its incredibly diverse brand portfolio, truly acting as a 24/7 beverage partner for consumers. This isn't just about sparkling drinks; it spans juices, water, sports and energy drinks, plant-based options, coffee, and even premium spirits.

This broad spectrum of offerings allows Coca-Cola HBC to capture value across numerous consumer occasions and preferences. In 2023, this comprehensive approach contributed to notable value share gains within the Non-Alcoholic Ready-To-Drink (NARTD) market, underscoring the effectiveness of their strategy.

The company consistently reinforces this strength through ongoing innovation and the introduction of new products. For example, their expansion into categories like premium spirits and plant-based beverages demonstrates a proactive approach to evolving consumer tastes.

Coca-Cola HBC demonstrates exceptional financial strength and operational flexibility. The company achieved a robust 13.8% organic revenue growth in 2024, further solidifying its market position.

This performance was driven by effective revenue growth management (RGM) strategies, leading to a significant 9.9% organic revenue increase in the first half of 2025. The company's commitment to profitability is evident in its double-digit organic EBIT growth and a remarkable surge in return on invested capital (ROIC) to 18.3% in 2024, highlighting efficient capital deployment.

Leading Position in Sustainability and ESG Initiatives

Coca-Cola HBC is a recognized leader in sustainability, frequently appearing at the top of ESG rankings, including the Dow Jones Sustainability Indices. This strong performance underscores their commitment to environmental, social, and governance principles.

The company has set ambitious targets, such as achieving NetZeroBy40, and actively invests in renewable energy sources and water stewardship initiatives. These actions demonstrate a proactive approach to environmental responsibility.

Coca-Cola HBC's focus on increasing the use of recycled PET (rPET) in its packaging is a key element of its sustainability strategy. For example, by the end of 2023, they reported that 43% of their PET bottles contained recycled content, a significant step towards their 2030 goal of 50%.

- Leading ESG Performance: Consistently ranked high in sustainability benchmarks like the Dow Jones Sustainability Indices.

- Ambitious Environmental Goals: Committed to NetZeroBy40 and significant investments in renewable energy.

- Water Stewardship: Implemented robust programs to manage and conserve water resources.

- Circular Economy Focus: Increasing the use of rPET, with 43% recycled content in PET bottles by end-2023.

Strategic Partnership with The Coca-Cola Company and Innovation Focus

Coca-Cola HBC's strategic partnership with The Coca-Cola Company is a significant strength, granting access to a portfolio of globally recognized brands and robust marketing support. This collaboration also provides a steady stream of innovation from the parent company, ensuring Coca-Cola HBC remains competitive. In 2023, The Coca-Cola Company's net revenue reached $45.8 billion, underscoring the brand power Coca-Cola HBC leverages.

Beyond the core partnership, Coca-Cola HBC demonstrates a strong commitment to its own product innovation. The company actively develops and adapts its beverage offerings to cater to diverse local tastes and preferences across its extensive geographical footprint. This localized approach is crucial for market penetration and consumer engagement.

Furthermore, Coca-Cola HBC is strategically investing in digital transformation. This focus aims to enhance customer experience through improved ordering platforms and delivery services, while also boosting operational efficiency across its bottling and distribution network. Digital initiatives are key to remaining agile in a rapidly evolving market.

- Brand Power: Leverages The Coca-Cola Company's iconic global brands, contributing to strong market presence.

- Innovation Access: Benefits from The Coca-Cola Company's innovation pipeline and marketing expertise.

- Local Adaptation: Drives growth through tailored product innovation that meets regional consumer demands.

- Digital Investment: Enhances customer experience and operational efficiency via digital transformation initiatives.

Coca-Cola HBC's extensive geographic reach, covering 29 countries and serving approximately 740-750 million consumers, provides a significant advantage in tapping into diverse markets and growth opportunities, particularly in emerging economies.

The company's diverse brand portfolio, encompassing everything from sparkling drinks and juices to energy drinks, coffee, and premium spirits, allows it to cater to a wide array of consumer preferences and occasions. This broad offering contributed to value share gains in the Non-Alcoholic Ready-To-Drink (NARTD) market in 2023.

Coca-Cola HBC demonstrates robust financial performance, achieving 13.8% organic revenue growth in 2024 and a 9.9% organic revenue increase in the first half of 2025, driven by effective revenue growth management strategies. Its commitment to profitability is further evidenced by double-digit organic EBIT growth and a notable 18.3% return on invested capital (ROIC) in 2024, indicating efficient capital deployment.

A key strength is Coca-Cola HBC's leading position in sustainability, consistently ranking high in ESG benchmarks like the Dow Jones Sustainability Indices and committing to ambitious goals such as NetZeroBy40. The company is actively increasing its use of recycled PET (rPET), with 43% of its PET bottles containing recycled content by the end of 2023, aligning with its 2030 target of 50%.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Geographic Reach | Extensive Market Coverage | Serves 740-750 million consumers across 29 countries. |

| Brand Portfolio | Diversified Offerings | Includes sparkling, juice, water, energy, coffee, and spirits. Contributed to 2023 NARTD value share gains. |

| Financial Performance | Strong Revenue Growth & Profitability | 13.8% organic revenue growth (2024); 9.9% organic revenue growth (H1 2025); 18.3% ROIC (2024). |

| Sustainability Leadership | ESG Commitment & Circularity | Top ESG rankings; NetZeroBy40 goal; 43% rPET in bottles (end-2023). |

What is included in the product

Offers a full breakdown of Coca-Cola HBC’s strategic business environment, detailing its internal capabilities and external market challenges.

Offers a clear, actionable roadmap by highlighting Coca-Cola HBC's competitive advantages and areas for improvement, simplifying strategic decision-making.

Weaknesses

Operating across 29 countries, Coca-Cola HBC faces substantial exposure to geopolitical and macroeconomic volatility. This broad geographic footprint, while a source of diversification, also means the company is susceptible to economic downturns, political instability, and fluctuating currency values in diverse markets.

Foreign exchange (FX) volatility, particularly in key emerging markets like Nigeria and Egypt, presents a significant challenge. For instance, in 2023, Nigeria's currency devaluation had a notable impact on Coca-Cola HBC's reported financials, illustrating how currency headwinds can directly affect revenue and profitability.

Managing these complex external factors is an ongoing and critical task for Coca-Cola HBC. The company must continuously adapt its strategies to mitigate the impact of these unpredictable global forces on its financial performance and operational stability.

Coca-Cola HBC's significant revenue stream from sparkling beverages presents a notable weakness. In 2023, sparkling beverages still accounted for a substantial majority of the company's sales volume, highlighting a continued dependence on this category despite growing health consciousness. This reliance makes the company susceptible to shifts in consumer demand away from sugary drinks and potential impacts from upcoming sugar taxes or stricter labeling regulations in various markets.

The non-alcoholic ready-to-drink beverage sector is intensely competitive, presenting a constant challenge for Coca-Cola HBC. This fierce rivalry, both on a global and local scale, puts continuous pressure on pricing strategies and the ability to maintain or grow market share.

In mature markets, Coca-Cola HBC must contend with significant marketing expenditures by its rivals. For instance, in 2023, the company saw a notable impact on its organic EBIT in certain segments, partly due to these aggressive competitor campaigns, highlighting the need for substantial investment to counter these efforts.

Sustaining and expanding its market presence necessitates ongoing, considerable investment in marketing initiatives and product innovation. This financial commitment is crucial for staying relevant and capturing consumer attention in a crowded marketplace.

Operational Cost Pressures and Supply Chain Vulnerabilities

Coca-Cola HBC, as a major bottler and distributor, faces substantial operational costs. These include expenses for raw materials, energy, transportation, and packaging. For instance, in 2023, the company reported a significant impact from inflation across these categories, particularly affecting sugar and aluminum prices, which are key inputs for their beverages.

The company's extensive supply chain makes it vulnerable to disruptions. Events like geopolitical instability or natural disasters can impact the availability and cost of essential resources. This susceptibility can directly affect their gross profit margins. For example, in early 2024, ongoing global shipping challenges continued to add to logistics costs, putting pressure on profitability.

- Rising Input Costs: Coca-Cola HBC experienced a notable increase in commodity prices throughout 2023 and into 2024, impacting profitability.

- Supply Chain Fragility: Global logistics and raw material sourcing remain areas of concern, with potential for further disruptions affecting delivery and costs.

- Energy Price Volatility: Fluctuations in energy prices, critical for bottling and distribution operations, present an ongoing challenge to cost management.

- Packaging Material Costs: The price of aluminum and PET, key components of beverage packaging, has shown volatility, adding to production expenses.

Challenges in Established Markets' Profitability

Coca-Cola HBC faces profitability challenges in its established markets. While emerging markets are a growth engine, some mature segments saw a decline in organic EBIT in 2024. This is partly due to significant marketing investments and intense competition in these saturated regions.

Maintaining profitability in these developed markets requires careful strategy. The company must navigate price increases and optimize its promotional spending to offset these pressures. For instance, in 2024, the company noted that while net sales revenue increased, the impact of pricing actions was crucial in offsetting volume declines in certain mature European markets.

- Mature Market Headwinds: Established markets, particularly in Europe, experienced slower growth and in some cases, volume declines in 2024, impacting overall profitability.

- Aggressive Marketing Spend: Increased investments in marketing and promotions were necessary to maintain market share in competitive established markets, putting pressure on EBIT margins.

- Pricing Sensitivity: Consumers in mature markets can be more price-sensitive, limiting the ability to pass on cost increases through higher prices without impacting sales volumes.

- Segment-Specific Declines: Certain product categories or channels within established markets showed a decline in organic EBIT, signaling a need for targeted strategic adjustments rather than a blanket approach.

Coca-Cola HBC's significant reliance on sparkling beverages, which constituted a substantial portion of its sales volume in 2023, poses a risk. This dependence makes the company vulnerable to declining consumer preference for sugary drinks and potential regulatory actions like sugar taxes.

The company operates in a highly competitive non-alcoholic ready-to-drink beverage market. This intense rivalry, both globally and locally, exerts continuous pressure on pricing and market share maintenance.

Rising input costs, particularly for commodities like sugar and aluminum, significantly impacted Coca-Cola HBC's profitability in 2023 and continued to be a concern into early 2024, directly affecting gross profit margins.

Geopolitical instability and macroeconomic volatility across its 29 operating countries present a substantial weakness. Fluctuations in currency values, as seen with the Nigerian Naira devaluation in 2023, directly impact reported financials and profitability.

| Weakness | Impact | Supporting Data (2023/2024) |

| Sparkling Beverage Dependence | Vulnerability to changing consumer preferences and regulations | Sparkling beverages represented a majority of sales volume in 2023. |

| Intense Market Competition | Pressure on pricing and market share | Aggressive competitor marketing spend impacted organic EBIT in certain segments. |

| Rising Input Costs | Reduced profitability and gross margins | Notable increases in sugar and aluminum prices affected 2023 financials. |

| Geopolitical/Macroeconomic Volatility | Financial and operational instability | Nigerian Naira devaluation significantly impacted reported financials in 2023. |

Same Document Delivered

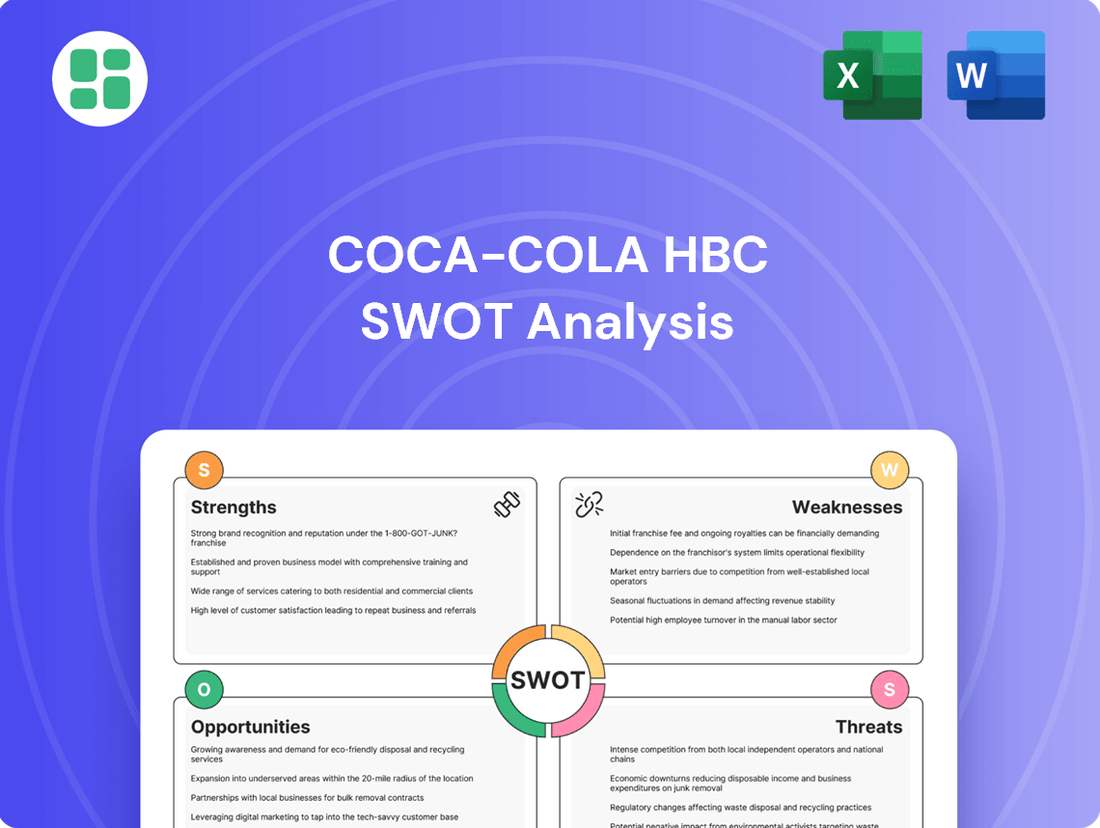

Coca-Cola HBC SWOT Analysis

This is the actual Coca-Cola HBC SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You'll gain a comprehensive understanding of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed report is ready for immediate use.

Opportunities

Coca-Cola HBC has a significant opportunity to capitalize on the booming demand for energy drinks, coffee, and healthier beverage options. Consumer preferences are clearly shifting towards low/no-sugar and plant-based alternatives, a trend the company is well-positioned to leverage.

The company's existing success in the energy drink and coffee segments, which saw strong growth in 2023, validates this strategic direction. This provides a clear roadmap for further portfolio diversification, aligning perfectly with the growing consumer focus on health and wellness.

Coca-Cola HBC is well-positioned to capitalize on the accelerated digital transformation trend. By continuing to invest in its digital capabilities and enhancing its e-commerce platforms, the company can significantly improve customer engagement and optimize its distribution networks.

Leveraging data analytics offers a powerful avenue to understand consumer behavior better and tailor offerings, directly driving online sales growth. This focus aligns with their stated goal of achieving higher digital engagement by 2025, indicating a strategic commitment to this opportunity.

For instance, Coca-Cola HBC reported a notable increase in online sales in recent periods, demonstrating the tangible impact of these digital initiatives. This momentum suggests that further investment in digital channels and data-driven strategies can be a key engine for future revenue expansion and operational efficiency.

Emerging markets within Coca-Cola HBC's territory present a compelling opportunity. Despite broader economic headwinds, these regions are characterized by favorable demographics, with a growing young population, and rising disposable incomes. For instance, countries like Nigeria and Russia, while facing their own unique challenges, have demonstrated resilience and potential for increased beverage consumption as their middle classes expand.

Strategic focus on these developing economies is key. Coca-Cola HBC's continued investment in localized product offerings and distribution networks in markets such as Poland and Romania has yielded strong organic growth. This approach, adapting to local tastes and economic realities, is crucial for unlocking the long-term value inherent in these expanding consumer bases, with per capita consumption still lagging behind more developed markets.

Leveraging Sustainability for Brand Enhancement and Consumer Loyalty

Coca-Cola HBC can significantly boost its brand image and consumer loyalty by deepening its commitment to sustainability. As of 2024, a growing segment of consumers actively seeks out brands with strong environmental and social governance (ESG) credentials, making this a prime opportunity. By further integrating practices like increasing recycled content in packaging and advancing decarbonization, Coca-Cola HBC can resonate more powerfully with this demographic.

This strategic focus not only appeals to consumers but also attracts investors prioritizing impact. For instance, companies demonstrating robust sustainability performance often see better access to capital and potentially lower borrowing costs. Coca-Cola HBC's ongoing efforts in water stewardship, a critical area for beverage companies, further solidify its position as a responsible operator, potentially preempting future regulatory challenges and enhancing long-term business resilience.

- Increased Recycled Content: Aiming for 100% recycled or renewable materials in packaging by 2030, as part of its broader sustainability goals, directly addresses consumer demand for eco-friendly products.

- Decarbonization Efforts: Investing in renewable energy for its operations, with targets to reduce absolute scope 1 and 2 greenhouse gas emissions, aligns with global climate action and appeals to environmentally aware stakeholders.

- Water Stewardship: Initiatives focused on replenishing water sources and improving water-use efficiency in water-stressed areas demonstrate responsible resource management, a key factor for brand trust.

- Investor Appeal: Strong ESG performance, as evidenced by sustainability reporting and ratings, can attract impact investors and improve the company's overall valuation and access to finance.

Strategic Partnerships and Potential Acquisitions for Portfolio Expansion

Coca-Cola HBC can strategically expand its portfolio by exploring new partnerships, joint ventures, or targeted acquisitions. This approach could facilitate entry into high-growth geographical markets or the acquisition of cutting-edge technologies, further diversifying its offerings. The company's successful collaboration with Costa Coffee in the out-of-home sector serves as a prime example of how such alliances can effectively broaden market reach and enhance its product range.

Specifically, Coca-Cola HBC could look to leverage its established distribution network to integrate new beverage categories or complementary consumer goods. For instance, a partnership in the rapidly growing non-alcoholic ready-to-drink coffee or functional beverage segments could capitalize on evolving consumer preferences. The company’s 2023 revenue reached €9.9 billion, demonstrating its capacity to absorb and integrate new ventures effectively.

- Diversification: Pursuing partnerships in emerging beverage categories like plant-based drinks or premium juices to align with health-conscious consumer trends.

- Geographic Expansion: Targeting acquisitions or joint ventures in underserved but high-potential markets in Africa or Eastern Europe, building on its existing presence.

- Technology Acquisition: Investing in or acquiring companies with innovative sustainable packaging solutions or advanced direct-to-consumer delivery platforms.

- Costa Coffee Success: Replicating the model of integrating acquired brands into its distribution system, as demonstrated by the Costa Coffee partnership which contributed to a 13.4% revenue growth in its key markets in 2023.

Coca-Cola HBC's strategic focus on expanding its digital capabilities and e-commerce platforms presents a significant opportunity. By leveraging data analytics to understand consumer behavior, the company can enhance customer engagement and optimize its distribution networks, driving online sales growth. This aligns with their 2025 digital engagement goals, building on the notable increase in online sales reported in recent periods.

Threats

Coca-Cola HBC faces a growing threat from escalating regulatory scrutiny and taxation worldwide. Many countries are implementing stricter rules concerning sugar content, plastic packaging, and overall environmental impact. For instance, the UK's sugar tax, introduced in 2018, has already influenced product formulations and pricing strategies for beverage companies.

These evolving regulations, including potential bans on single-use plastics and increased environmental levies, directly translate into higher operational costs for Coca-Cola HBC. This can affect everything from manufacturing processes to distribution networks, potentially impacting the company's bottom line and requiring significant investment in adapting to new standards.

Furthermore, such measures can dampen consumer demand for certain products, particularly those high in sugar, leading to a shift in purchasing habits. This regulatory pressure could force a re-evaluation of product portfolios and marketing strategies to align with public health and environmental concerns, ultimately influencing Coca-Cola HBC's profitability across its diverse markets.

Coca-Cola HBC faces significant competitive pressure in the beverage sector, with both global giants and nimble local bottlers vying for market share. This intense rivalry often escalates into price wars, directly impacting profit margins.

In many of Coca-Cola HBC's operating regions, the beverage market is highly saturated. This saturation makes it difficult to achieve substantial volume growth, necessitating significant marketing expenditure that can further squeeze profitability.

For instance, in 2023, the broader beverage market saw continued promotional activity, with key competitors like PepsiCo also investing heavily in marketing to defend their positions. This trend is expected to persist into 2024 and 2025, intensifying the challenge for Coca-Cola HBC to gain incremental market share without compromising pricing power.

Coca-Cola HBC faces a significant threat from ongoing currency fluctuations, especially in its emerging markets. For instance, in 2023, the company noted that adverse currency movements impacted its reported net sales. This volatility makes it challenging to predict revenue and can erode profits when translated back into reporting currencies.

Persistent inflationary pressures on crucial inputs like sugar, PET, and aluminum, alongside rising energy costs, also pose a considerable risk. While Coca-Cola HBC aims to mitigate these through pricing strategies, the sustained increase in the cost of goods sold can still compress operating margins, impacting overall financial performance, as seen in the increased cost of sales reported in its 2023 financial statements.

Evolving Consumer Preferences and Health Consciousness

The accelerating consumer shift towards healthier options, including functional beverages and water, presents a significant challenge. Coca-Cola HBC, like many in the beverage industry, faces potential market share erosion if it cannot swiftly innovate and adapt its portfolio to these evolving health and wellness trends. For instance, the global market for health and wellness beverages was projected to reach over $1 trillion by 2025, highlighting the scale of this consumer-driven transformation.

This evolving preference directly impacts Coca-Cola HBC's core carbonated soft drink categories. A sustained move away from sugary drinks could dampen demand, necessitating a strategic pivot. In 2024, many consumers are increasingly scrutinizing ingredient lists, seeking lower sugar content and natural sweeteners, a trend that directly pressures traditional soda sales.

- Growing demand for low-sugar and zero-sugar alternatives

- Increased consumer interest in functional beverages with added health benefits

- Potential for market share loss if product innovation lags behind consumer trends

- The global health and wellness beverage market's projected growth underscores this threat

Geopolitical Instability and Supply Chain Disruptions

Coca-Cola HBC’s extensive operations across numerous countries, including markets in Eastern Europe and Africa, leave it particularly vulnerable to geopolitical instability. For instance, ongoing conflicts and political shifts in regions where it operates can disrupt its production facilities and distribution channels. The company’s 2023 financial reports indicate significant exposure to markets that have experienced heightened geopolitical tensions, directly impacting operational costs and sales volumes in those areas.

Global supply chain disruptions, exacerbated by geopolitical events, pose a substantial threat. These disruptions can affect the availability and cost of key raw materials, packaging, and transportation, impacting Coca-Cola HBC’s ability to maintain consistent production and meet consumer demand. For example, a 2024 report highlighted increased logistics costs impacting beverage companies due to port congestion and regional conflicts, a challenge directly relevant to Coca-Cola HBC’s supply network.

- Geopolitical Risks: Exposure to political instability and conflicts in key markets like Russia and Ukraine, which together represented a significant portion of its revenue pre-2022, continues to pose a risk.

- Supply Chain Vulnerability: Reliance on global sourcing for ingredients and packaging materials makes the company susceptible to price volatility and availability issues stemming from international trade disputes or transit disruptions.

- Economic Downturns: Recessions or economic slowdowns in its diverse operating regions can dampen consumer spending on non-essential goods like beverages, impacting sales performance.

- Operational Continuity: Events such as natural disasters or civil unrest in its operating territories could lead to temporary or prolonged shutdowns of bottling plants and distribution centers, affecting revenue generation.

Intensifying competition from both established global players and agile local bottlers presents a significant threat, often leading to price wars that erode profit margins. Market saturation in many of Coca-Cola HBC's operating regions necessitates higher marketing spend to achieve modest volume growth, further squeezing profitability. For instance, in 2023, the beverage market saw sustained promotional activity, with competitors like PepsiCo investing heavily, a trend expected to continue into 2024 and 2025.

Currency fluctuations, particularly in emerging markets, pose a substantial risk, as adverse movements impacted Coca-Cola HBC's reported net sales in 2023. Persistent inflation on key inputs like sugar, PET, and aluminum, coupled with rising energy costs, also threatens to compress operating margins despite pricing strategies. This was evident in the increased cost of sales reported in its 2023 financial statements.

The accelerating consumer shift towards healthier options, including functional beverages and water, challenges Coca-Cola HBC’s core carbonated soft drink categories. The global health and wellness beverage market, projected to exceed $1 trillion by 2025, highlights the scale of this consumer-driven transformation, with consumers increasingly scrutinizing ingredients and seeking lower sugar content in 2024.

Geopolitical instability in regions like Eastern Europe and Africa exposes Coca-Cola HBC to disruptions in production and distribution, as noted in its 2023 reports. Global supply chain vulnerabilities, exacerbated by geopolitical events, can lead to price volatility and availability issues for raw materials and transportation, impacting operational continuity and increasing logistics costs, as highlighted in a 2024 report.

SWOT Analysis Data Sources

This Coca-Cola HBC SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded strategic overview.