Coca-Cola HBC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola HBC Bundle

Coca-Cola HBC navigates a competitive landscape shaped by moderate buyer power and significant rivalry among established players. Understanding the influence of suppliers and the threat of substitutes is crucial for strategic advantage.

The complete report reveals the real forces shaping Coca-Cola HBC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Coca-Cola HBC's reliance on The Coca-Cola Company (TCCC) for its proprietary concentrate is a significant factor in supplier bargaining power. This concentrate is the essential ingredient for its popular sparkling beverages, making Coca-Cola HBC fundamentally dependent on TCCC.

TCCC wields considerable power as the owner of the iconic brand and the secret concentrate formulas. This ownership allows TCCC to dictate crucial terms, including pricing, supply agreements, and the pace of new product development, directly impacting Coca-Cola HBC's operational flexibility and financial performance.

For instance, in 2023, Coca-Cola HBC reported that its revenue from TCCC brands constituted the vast majority of its total revenue, underscoring the depth of this dependency. This high degree of reliance grants TCCC substantial leverage, enabling it to exert significant influence over Coca-Cola HBC's business operations and profitability.

Suppliers of essential packaging materials like PET, glass bottles, and aluminum cans hold a moderate level of bargaining power over Coca-Cola HBC. This power is largely dictated by the fluctuating costs of raw materials, such as crude oil prices impacting PET production and global aluminum market dynamics. For instance, aluminum prices saw significant volatility throughout 2024, with fluctuations directly affecting the cost of can production.

While Coca-Cola HBC benefits from sourcing from a diverse range of vendors, the immense volume of packaging required for its operations, coupled with stringent quality standards, can empower larger, more established packaging suppliers. These suppliers, capable of meeting the scale and consistency demands, can leverage their position in negotiations. Coca-Cola HBC mitigates this by entering into long-term contracts and fostering strategic partnerships, which helps to stabilize supply and manage costs effectively.

Sugar and sweetener providers, while essential for Coca-Cola HBC's product line, generally possess limited individual bargaining power. This is largely due to the commodity nature of sugar and the availability of numerous global suppliers, which dilutes any single supplier's leverage. For instance, global sugar prices can fluctuate significantly, impacting input costs for Coca-Cola HBC, but the company's substantial purchasing volume allows for strong negotiation on favorable terms.

Logistics and Distribution Partners

Coca-Cola HBC utilizes a mix of its own extensive distribution network and third-party logistics (3PL) providers. The bargaining power of these 3PL partners is influenced by the specificity of their services and the prevailing regional market dynamics. For standard freight, their leverage is typically limited, but for specialized needs like cold chain management or intricate international shipping, select providers can exert greater influence.

The reliance on 3PLs for specific logistical functions, especially those requiring specialized equipment or expertise, can grant these suppliers a degree of bargaining power. For instance, companies needing advanced temperature-controlled transport for sensitive beverage products might face fewer options, thereby increasing the leverage of providers offering such capabilities. This is particularly relevant in markets where such specialized infrastructure is not widespread.

- Specialized Services: Providers offering cold chain logistics or complex cross-border transportation may hold more power due to limited alternatives.

- Regional Market Conditions: The availability and competition among logistics providers in specific operating regions directly impact their bargaining strength.

- Contractual Agreements: The terms and duration of contracts with 3PLs can either limit or enhance their bargaining power.

- Dependence: Coca-Cola HBC's reliance on these partners for critical delivery functions can shift the balance of power.

Equipment and Technology Providers

Suppliers of specialized bottling equipment, manufacturing technology, and IT solutions hold considerable sway over Coca-Cola HBC. Their proprietary technologies and the substantial costs associated with switching suppliers, which can involve significant capital investment and technical retraining, contribute to this leverage. For instance, a new, highly automated bottling line can cost millions of dollars, making Coca-Cola HBC's commitment to a particular supplier's technology a long-term one.

This dependence means that equipment providers can often dictate terms, especially for cutting-edge or highly customized machinery. The need for specialized maintenance and spare parts further solidifies these relationships, limiting Coca-Cola HBC's flexibility. In 2024, the global market for beverage packaging machinery saw continued growth, with advanced automation and digital integration being key trends, reinforcing the value and bargaining power of leading technology providers in these segments.

- Proprietary Technology: Suppliers offer unique equipment and software solutions.

- High Switching Costs: Significant capital and technical expertise are needed to change suppliers.

- Long-Term Relationships: Investments in new production lines foster enduring partnerships.

- Market Trends: Growth in advanced automation and digital integration in packaging machinery enhances supplier leverage.

The bargaining power of suppliers for Coca-Cola HBC is multifaceted, with The Coca-Cola Company (TCCC) holding the most significant leverage due to its exclusive ownership of concentrate formulas and brand rights. This dependency is evident as TCCC brands represented over 90% of Coca-Cola HBC's revenue in 2023, granting TCCC substantial control over pricing and operational terms.

Suppliers of essential packaging materials like PET, glass, and aluminum possess moderate bargaining power, influenced by volatile raw material costs and market dynamics. For instance, global aluminum prices experienced significant fluctuations throughout 2024, directly impacting can production expenses for Coca-Cola HBC.

While sugar and sweetener suppliers generally have limited individual power due to the commodity nature of these goods and a wide supplier base, Coca-Cola HBC's substantial purchasing volume enables strong negotiation. Specialized equipment and technology providers, however, wield considerable influence due to proprietary innovations and high switching costs, a trend reinforced by the 2024 growth in advanced automation within the beverage machinery sector.

What is included in the product

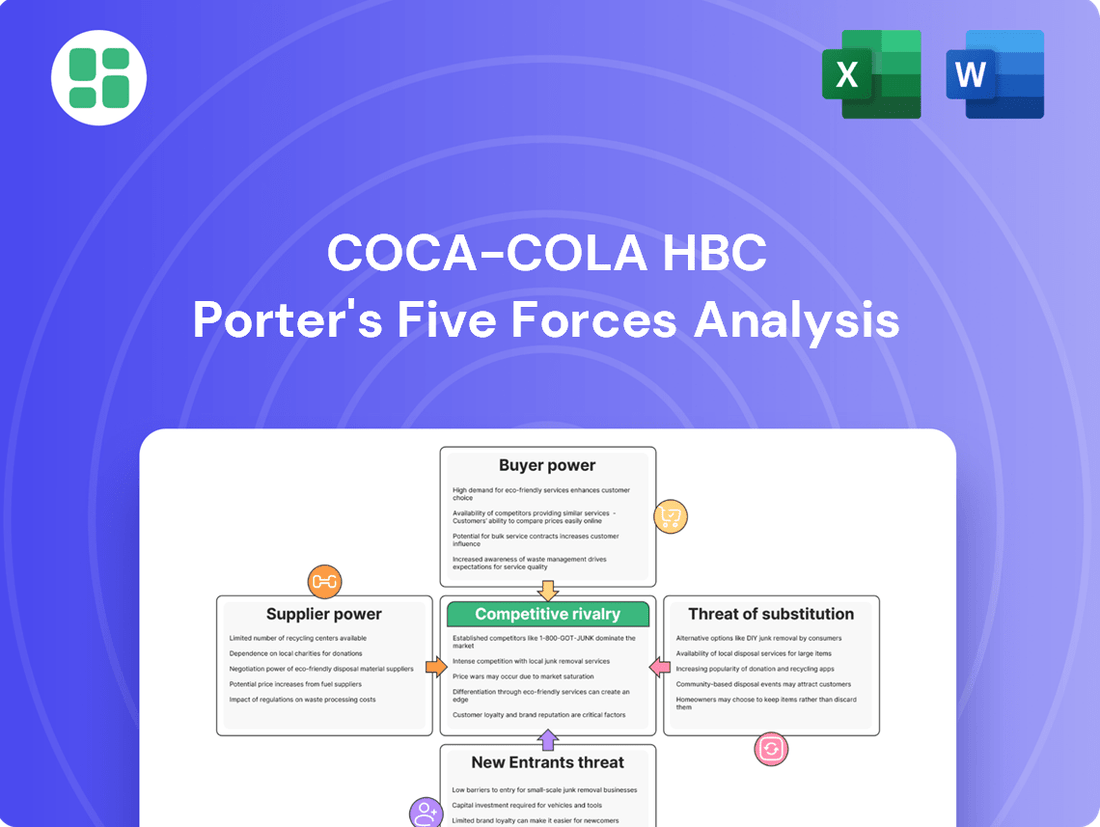

This analysis of Coca-Cola HBC's Porter's Five Forces reveals the intense rivalry within the beverage industry, the significant bargaining power of major bottlers and distributors, and the threat of new entrants, while also highlighting the company's strong brand loyalty and economies of scale.

Quickly identify and address competitive threats with a visual breakdown of Coca-Cola HBC's industry landscape.

Customers Bargaining Power

Major supermarket chains, hypermarkets, and discounters are crucial for Coca-Cola HBC, accounting for a substantial portion of its sales volume. For instance, in 2023, the top five retail customers in many of Coca-Cola HBC's operating countries represented over 50% of their respective market shares, giving them significant leverage.

These large customers can exert considerable bargaining power by demanding better pricing, promotional support, prime shelf placement, and extended payment terms. Their sheer purchasing scale and ability to influence consumer purchasing decisions within their vast retail networks make them formidable partners.

Coca-Cola HBC must therefore cultivate strategic relationships with these key retail players to ensure continued market access and favorable trading conditions. This involves ongoing negotiation and a deep understanding of the retailers' needs and market dynamics.

The HoReCa sector, encompassing hotels, restaurants, and cafes, is a crucial distribution channel for Coca-Cola HBC, driving sales for immediate consumption. While the sector is fragmented, major hospitality groups and large restaurant chains can wield significant bargaining power due to their substantial and aggregated purchasing volumes, enabling them to negotiate more favorable pricing and terms. For instance, a large hotel group might secure better deals than an independent cafe. Coca-Cola HBC's strong brand equity and the consistent consumer demand for its beverages serve as a key counter-balance, reducing the overall leverage individual customers within this segment can exert.

Wholesalers and independent distributors play a role in getting Coca-Cola HBC's products to smaller shops and less accessible locations. Their influence hinges on how widely they can distribute, how smoothly they operate, and how many other distributors are vying for business. For instance, in 2023, Coca-Cola HBC reported a significant portion of its sales volume was managed through its own extensive distribution network, particularly in its larger European markets, which inherently lessens the leverage of external wholesalers.

Vending Operators

Vending machine operators represent a specialized yet significant customer group for Coca-Cola HBC, catering to consumers seeking convenient, immediate beverage options. Their bargaining power is generally limited because their success hinges on stocking popular, recognizable brands to attract customers.

Coca-Cola HBC's robust brand portfolio, including the flagship Coca-Cola brand, makes its products a non-negotiable element for most vending machine operators aiming for consistent sales. This reliance on Coca-Cola HBC's product appeal grants the bottler considerable leverage in pricing and contract negotiations with these operators. For instance, in 2024, Coca-Cola HBC continued to maintain a dominant share in many markets, reinforcing its strong position with vending partners who depend on its high-demand beverages.

- Brand Dependency: Vending operators need established brands like Coca-Cola to ensure customer traffic and sales volume.

- Limited Alternatives: While other beverage options exist, the sheer market penetration of Coca-Cola HBC's products narrows viable alternatives for operators focused on maximizing revenue.

- Negotiating Leverage: Coca-Cola HBC's strong brand equity allows it to dictate terms more effectively, as operators are reluctant to risk losing access to its popular products.

Brand Loyalty of End Consumers

The strong brand loyalty of end consumers is a significant factor in Coca-Cola HBC's market position. This loyalty acts as a powerful counterbalance against the bargaining power of its direct customers, such as supermarkets and restaurants.

When consumers consistently seek out Coca-Cola products, retailers have less leverage to negotiate prices or demand different terms. This consumer pull effectively compels retailers to stock Coca-Cola HBC's offerings, reducing their ability to switch to competing beverage suppliers or dictate terms. For example, in 2023, Coca-Cola HBC reported a revenue of €9.2 billion, demonstrating the sustained consumer demand for its diverse portfolio.

- End consumer preference directly influences retailer stocking decisions.

- High brand loyalty limits retailers' ability to negotiate pricing or switch suppliers.

- Coca-Cola HBC's 2023 revenue of €9.2 billion underscores strong consumer demand.

The bargaining power of customers for Coca-Cola HBC is significant, particularly from large supermarket chains and hypermarkets that account for a substantial portion of sales volume. These major retailers, often representing over 50% of market share in their respective regions as seen in 2023 data, can demand better pricing and promotional support due to their purchasing scale.

While the HoReCa sector is fragmented, large hospitality groups can negotiate favorable terms due to aggregated purchasing volumes. However, Coca-Cola HBC's strong brand equity and consistent consumer demand serve as a counter-balance to the leverage of individual customers in this segment.

Vending machine operators generally have limited bargaining power because their success relies on stocking popular brands like Coca-Cola, which have high consumer demand. Coca-Cola HBC's dominant market share in 2024 reinforces its strong position with these partners who depend on its high-demand beverages.

| Customer Segment | Bargaining Power Factor | Coca-Cola HBC Counterbalance |

|---|---|---|

| Major Supermarkets/Hypermarkets | High purchasing volume, market share concentration | Strong brand loyalty, consumer pull |

| HoReCa (Large Chains) | Aggregated purchasing volume | Brand equity, consistent consumer demand |

| Vending Machine Operators | Reliance on popular brands for sales | Dominant market share, high-demand products |

Preview Before You Purchase

Coca-Cola HBC Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Coca-Cola HBC, detailing the competitive landscape and strategic implications for the beverage giant. You're examining the exact document that will be delivered instantly upon purchase, offering actionable insights into the industry's dynamics. This professionally formatted analysis is ready for immediate use, providing a thorough understanding of the forces shaping Coca-Cola HBC's market position.

Rivalry Among Competitors

The non-alcoholic ready-to-drink (NARTD) sector is a battlefield, with Coca-Cola HBC contending fiercely against global titans like PepsiCo. This rivalry is particularly pronounced in the sparkling beverage segment, where both companies command substantial market presence and vie for consumer attention.

Both Coca-Cola HBC and PepsiCo boast expansive distribution networks, deeply entrenched brand loyalty, and considerable marketing war chests. This parity in resources fuels intense competition for prime shelf space, market share, and ultimately, consumer preference across all their operational geographies. In 2024, for instance, both companies continue to invest heavily in digital marketing and in-store promotions to capture consumer mindshare.

Pricing and promotional activities are key weapons in this ongoing competitive struggle. Companies frequently engage in price wars and offer aggressive promotional deals to attract and retain customers, making it challenging for any single player to gain a sustained, dominant advantage.

Beyond the giants, Coca-Cola HBC contends with a vibrant ecosystem of local and regional beverage makers. These companies often possess an intimate knowledge of local palates and can leverage lower cost bases or existing ties to regional distribution networks. For instance, in many European markets, smaller craft soda producers or regional water bottlers can carve out significant market share by catering to specific consumer preferences or offering more competitive pricing.

Competitive rivalry in the beverage sector, particularly for Coca-Cola HBC, is significantly fueled by relentless product innovation and diversification. Companies are constantly introducing new flavors, healthier options, and unique packaging to capture evolving consumer tastes. For instance, the rise of functional beverages and plant-based alternatives means that rivals are actively expanding their offerings in these areas, compelling Coca-Cola HBC to do the same to maintain market share.

This drive for novelty necessitates substantial investment in research and development. In 2023, Coca-Cola HBC's investment in marketing and brand support, which includes new product launches and promotions, played a crucial role in its performance. The company reported a net revenue increase of 10.1% in 2023, partly driven by its ability to adapt its portfolio to meet these dynamic consumer demands.

Marketing and Advertising Intensity

Competitive rivalry in the beverage industry, particularly for Coca-Cola HBC, is intense, largely fueled by aggressive marketing and advertising. Major players invest heavily to build brand recognition, grab consumer attention, and boost sales through a multi-channel approach encompassing traditional media, digital advertising, and sponsorships. For example, Coca-Cola's global advertising spend in 2023 was reported to be in the billions, a figure that sets the benchmark for the industry.

This high level of marketing expenditure is crucial for Coca-Cola HBC to maintain its market share and ensure its brands remain prominent in consumers' minds. The constant barrage of advertising from competitors means that any lapse in marketing effort can lead to a significant erosion of brand recall and, consequently, sales. In 2024, Coca-Cola HBC continued its robust marketing efforts, with a significant portion of its operating expenses dedicated to promotional activities to counter competitive pressures.

- Brand Equity: Massive marketing efforts by all major beverage companies are essential for building and sustaining strong brand equity.

- Consumer Attention: Companies allocate substantial budgets to capture and retain consumer attention in a crowded marketplace.

- Sales Drive: Advertising and promotional campaigns are directly linked to driving sales volumes and market penetration.

- Market Position: Continuous and significant marketing investment is required for Coca-Cola HBC to defend its established market position against rivals.

Distribution Network and Shelf Space

The competition for prime shelf space in retail stores is fierce, a constant battleground where visibility directly translates to sales. Companies like Coca-Cola HBC invest heavily in securing prominent placement, often through exclusive agreements and strong relationships with retailers. This strategic positioning is crucial for capturing consumer attention in a crowded marketplace.

Coca-Cola HBC's vast distribution network, spanning 29 countries, is a significant differentiator, ensuring product availability across diverse markets. However, competitors are not standing still; they are actively working to expand their own logistical capabilities and challenge Coca-Cola HBC's established reach. This ongoing effort to broaden distribution and secure new channels intensifies the rivalry.

- Shelf Space Dominance: Retailers often allocate limited shelf space, making it a valuable commodity that beverage companies aggressively compete for.

- Distribution Agreements: Exclusive deals with key retailers or distributors can lock out competitors, creating a significant barrier.

- Coca-Cola HBC's Network: In 2023, Coca-Cola HBC reported serving over 596,000 customer outlets, highlighting the scale of its distribution.

- Competitor Expansion: Rivals are continuously investing in their own supply chains and partnerships to match or surpass Coca-Cola HBC's market penetration.

Competitive rivalry is a defining characteristic for Coca-Cola HBC, primarily driven by the presence of global giants like PepsiCo and a multitude of local and regional players. This intense competition manifests in aggressive pricing, extensive marketing campaigns, and a constant push for product innovation to capture consumer loyalty and market share. In 2024, the battle for consumer attention remains fierce, with significant investments in digital and in-store promotions by all major participants.

The market is further segmented by the rise of niche beverage producers, including craft soda makers and those focusing on healthier or functional drinks, which challenge the established order. Coca-Cola HBC's substantial investments in marketing, such as its reported billions in global advertising spend in 2023, are critical to defending its market position against these diverse threats.

Securing prime shelf space and maintaining a robust distribution network are ongoing strategic imperatives, with Coca-Cola HBC serving over 596,000 customer outlets in 2023. Competitors are actively expanding their own logistical capabilities to challenge this reach, intensifying the rivalry across all operational geographies.

| Key Competitor | Market Focus | Key Competitive Tactics |

|---|---|---|

| PepsiCo | Sparkling beverages, snacks | Extensive distribution, brand loyalty, aggressive marketing, product innovation |

| Local/Regional Players | Specific geographic markets, niche segments | Intimate knowledge of local tastes, lower cost bases, regional distribution ties |

| Craft/Functional Beverage Brands | Health-conscious consumers, unique flavors | Product differentiation, catering to evolving consumer preferences, agile innovation |

SSubstitutes Threaten

The threat of plain and tap water as substitutes for Coca-Cola HBC's beverages is substantial, particularly with growing health awareness. In 2024, global bottled water sales are projected to reach over $300 billion, highlighting a significant shift in consumer preference towards healthier, calorie-free options. This trend directly pressures sales of Coca-Cola HBC's traditional carbonated soft drinks.

Coca-Cola HBC has responded by significantly expanding its water portfolio, investing in brands like Kinley and Cappy. The company's 2023 financial reports indicated a notable increase in revenue from its non-soda segments, underscoring the strategic importance of diversifying beyond sugary drinks to counter the substitute threat.

Coffee and tea are significant substitutes for Coca-Cola HBC's products, especially during traditional beverage consumption times like mornings and afternoons. Their availability both at home and when dining out means they directly vie for consumer budgets across Coca-Cola HBC's diverse markets.

The cultural importance of coffee and tea in many of Coca-Cola HBC's operating regions, such as Eastern Europe and Nigeria, makes them deeply ingrained choices for consumers. For instance, in 2024, coffee consumption in Europe continued its upward trend, with per capita consumption in some markets exceeding 5 kilograms annually, presenting a constant competitive pressure.

The expanding landscape of specialty coffee shops and the increasing variety of premium tea products further amplify this threat. This trend offers consumers more sophisticated and appealing alternatives, potentially diverting spending away from traditional carbonated soft drinks and juices offered by Coca-Cola HBC.

Milk and plant-based alternatives like almond, oat, and soy milk pose a threat as substitutes, particularly for health-conscious consumers or those with dietary restrictions. While not directly competing with Coca-Cola's core sparkling beverages, these alternatives vie for consumer spending in the broader non-alcoholic beverage sector, especially during breakfast or snack times. The market for plant-based milk, for instance, saw significant growth; in 2023, the global plant-based milk market was valued at approximately $15.3 billion, with projections indicating continued expansion, underscoring a notable shift in consumer preferences that Coca-Cola HBC needs to actively track.

Homemade Beverages and Fresh Juices

The rise of consumers making their own drinks at home, like fresh juices, smoothies, and infused water, presents a challenge to pre-packaged beverages. This DIY approach is often seen as healthier and more budget-friendly. For instance, a 2023 survey indicated that over 40% of consumers are increasing their consumption of homemade beverages due to perceived health benefits and cost savings.

While these homemade options aren't typically produced on a massive scale, this growing trend can gradually reduce the demand for bottled and canned drinks, especially among consumers prioritizing wellness. This segment is crucial, as health-conscious choices are increasingly influencing purchasing decisions across the beverage market.

- Growing DIY Beverage Trend: Consumers are increasingly opting for homemade drinks, impacting ready-to-drink sales.

- Health and Cost Perceptions: Homemade beverages are often viewed as healthier and more economical alternatives.

- Market Share Erosion: While not a mass-market substitute, this trend can chip away at demand, particularly from health-focused consumers.

- 2023 Data: Over 40% of consumers reported an increase in homemade beverage consumption in 2023, citing health and cost as key drivers.

Emerging Functional Beverages

The emergence of innovative functional beverages like kombucha, specialized health drinks, and fortified waters poses a significant threat of substitutes to Coca-Cola HBC's traditional offerings. These products directly target consumers seeking specific wellness benefits, often appealing to a desire for healthier alternatives to sugary soft drinks. For instance, the global functional beverage market was valued at approximately $125 billion in 2023 and is projected to grow substantially, highlighting the increasing consumer preference for these categories.

Coca-Cola HBC actively addresses this threat by expanding its own portfolio to include these growing segments, aiming to capture a share of this evolving market. However, the continuous influx of new entrants with novel formulations and targeted marketing strategies in the functional beverage space remains a persistent challenge, requiring ongoing adaptation and innovation from Coca-Cola HBC.

- Growing Market Share: Functional beverages are capturing an increasing share of the beverage market, with some categories experiencing double-digit annual growth rates.

- Consumer Health Consciousness: A heightened focus on health and wellness drives consumers towards beverages perceived as beneficial, creating a direct substitute for traditional soft drinks.

- Innovation Pipeline: New entrants frequently introduce innovative products with unique ingredients and health claims, constantly reshaping consumer preferences.

- Portfolio Diversification: Coca-Cola HBC's strategy to acquire or develop brands in these functional categories is crucial for mitigating the substitute threat.

The threat of substitutes for Coca-Cola HBC's beverages is multifaceted, with plain water and tap water emerging as significant challengers due to rising health consciousness. In 2024, the global bottled water market is expected to exceed $300 billion, reflecting a clear consumer shift towards healthier, calorie-free options. This trend directly impacts the sales of Coca-Cola HBC's traditional carbonated soft drinks.

Coffee and tea also present a substantial substitute threat, particularly during common beverage consumption times. Their widespread availability, both at home and when dining out, means they compete directly for consumer spending. For example, in 2024, European coffee consumption continued its upward trajectory, with per capita intake in some regions surpassing 5 kilograms annually, indicating persistent competitive pressure.

The increasing popularity of homemade beverages like fresh juices and smoothies, often perceived as healthier and more cost-effective, further erodes demand for pre-packaged drinks. A 2023 survey revealed that over 40% of consumers were increasing their homemade beverage consumption, citing health benefits and cost savings as primary drivers.

Functional beverages, including kombucha and fortified waters, represent another growing substitute category, appealing to consumers seeking specific wellness benefits. The global functional beverage market was valued at approximately $125 billion in 2023, with strong projected growth, underscoring a significant consumer preference for these alternatives.

| Substitute Category | 2024 Market Projection/Trend | Impact on Coca-Cola HBC | Coca-Cola HBC's Response |

| Water (Bottled & Tap) | Global bottled water sales > $300 billion | Directly pressures traditional soft drink sales | Portfolio expansion in water brands |

| Coffee & Tea | High per capita consumption in key markets (e.g., Europe > 5kg/year) | Competes for consumption occasions and budget | Focus on diversifying beverage offerings |

| Homemade Beverages | 40%+ consumers increased consumption (2023) | Reduces demand for pre-packaged drinks | Monitoring consumer trends in health and cost |

| Functional Beverages | Global market ~$125 billion (2023) | Appeals to health-conscious consumers | Developing and acquiring brands in this segment |

Entrants Threaten

The threat of new entrants in the non-alcoholic ready-to-drink beverage sector, particularly for bottling and distribution, is significantly dampened by the substantial capital investment needed. Coca-Cola HBC, operating across 29 countries, necessitates enormous outlays for state-of-the-art bottling facilities, securing high-quality raw materials, and establishing a vast, efficient distribution network. This high capital intensity acts as a formidable barrier, effectively deterring most new players from entering the market.

Coca-Cola HBC benefits immensely from the established brand loyalty and recognition of The Coca-Cola Company. This deep-seated consumer preference, built over decades, makes it incredibly challenging for newcomers to gain traction solely on brand appeal. For instance, in 2023, Coca-Cola’s global brand value was estimated at over $97 billion, demonstrating the sheer scale of this advantage.

Coca-Cola HBC's extensive distribution network, reaching an estimated 740 million consumers across Europe, Africa, and Asia, presents a formidable barrier to new entrants. Securing comparable shelf space in key retail outlets and replicating their efficient last-mile delivery infrastructure across such diverse territories is an exceptionally challenging and costly endeavor for any aspiring competitor. This established logistical might and ingrained market presence significantly deter potential new players.

Economies of Scale and Cost Advantages

Coca-Cola HBC, like other established beverage giants, benefits from substantial economies of scale. This means they can produce and distribute their products at a significantly lower cost per unit compared to smaller, newer companies. For instance, their massive purchasing power allows them to secure better prices on raw materials like sugar and packaging, and their extensive distribution networks reduce per-bottle delivery costs.

These cost advantages create a formidable barrier for potential new entrants. A newcomer would find it exceptionally challenging to replicate the efficiency and cost-effectiveness of Coca-Cola HBC's operations. To compete, they would likely need to accept lower profit margins or invest heavily in infrastructure, making it difficult to gain market share without substantial capital and time.

- Economies of Scale: Coca-Cola HBC's vast production volumes lead to lower per-unit manufacturing costs.

- Procurement Power: Significant buying power enables negotiation of favorable terms with suppliers for ingredients and packaging.

- Logistical Efficiency: Established distribution networks minimize transportation costs per unit.

- Cost Disadvantage for Newcomers: New entrants face higher initial operating costs, hindering price competitiveness.

Regulatory Hurdles and Compliance

The beverage industry is heavily regulated, with rules covering everything from food safety and accurate labeling to environmental impact and advertising. For instance, in 2024, the European Union continued to enforce strict food additive regulations and updated its packaging and recycling directives, impacting production and distribution. Coca-Cola HBC, operating across 29 countries, must navigate these diverse and often evolving legal frameworks.

Ensuring compliance across multiple nations demands significant investment in legal expertise, quality control systems, and specialized personnel. This complexity acts as a substantial barrier, making it challenging and costly for potential new entrants to establish a foothold and compete effectively. The need for continuous adaptation to varying national standards, such as differing sugar tax implementations or ingredient disclosure requirements in 2024, further elevates the cost of entry.

These regulatory challenges mean that new companies must not only develop competitive products but also build robust compliance infrastructure from the outset. This includes understanding and adhering to:

- Food safety standards: Ensuring products meet rigorous health and safety requirements in each market.

- Labeling regulations: Providing accurate nutritional information, allergen warnings, and country-specific claims.

- Environmental compliance: Meeting standards for water usage, waste management, and packaging recyclability.

- Marketing and advertising restrictions: Adhering to rules about product promotion, especially concerning children.

The threat of new entrants for Coca-Cola HBC remains relatively low, primarily due to the immense capital required for bottling, distribution, and brand building. Established brand loyalty, as evidenced by Coca-Cola's global brand value exceeding $97 billion in 2023, presents a significant hurdle for newcomers. Furthermore, Coca-Cola HBC's extensive distribution network, reaching approximately 740 million consumers, and considerable economies of scale in procurement and production create substantial cost advantages that are difficult for new players to overcome.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for bottling plants, supply chains, and marketing. | Deters smaller companies; requires significant funding. |

| Brand Loyalty & Recognition | Decades of consumer preference for established brands like Coca-Cola. | Makes it hard for new brands to gain market share based on appeal alone. |

| Distribution Network Scale | Extensive reach across 29 countries, serving millions of consumers. | New entrants struggle to secure shelf space and replicate logistical efficiency. |

| Economies of Scale | Lower per-unit costs due to high production and purchasing volumes. | New entrants face higher initial operating costs, impacting price competitiveness. |

| Regulatory Compliance | Navigating diverse and evolving food safety, environmental, and marketing laws across multiple countries. | Increases operational complexity and cost for new businesses. |

Porter's Five Forces Analysis Data Sources

Our Coca-Cola HBC Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from the company's annual reports, investor presentations, and industry-specific market research from firms like Euromonitor and Statista.

We also leverage publicly available data from regulatory bodies, financial news outlets, and competitor disclosures to provide a comprehensive view of the competitive landscape affecting Coca-Cola HBC.