Coca-Cola HBC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola HBC Bundle

Discover how political stability, economic fluctuations, and evolving social trends are impacting Coca-Cola HBC's vast operations. Our PESTLE analysis dives deep into the technological advancements and environmental regulations shaping the beverage giant's future. Gain a competitive edge by understanding these critical external factors.

Ready to make informed decisions about Coca-Cola HBC? Our comprehensive PESTLE analysis provides actionable intelligence on the political, economic, social, technological, legal, and environmental forces at play. Unlock strategic insights to navigate market complexities and drive growth—download the full version now!

Political factors

Coca-Cola HBC navigates a complex political terrain, with regulatory shifts like the Corporate Sustainability Reporting Directive (CSRD) demanding significant investment in compliance. This new directive, effective from 2024 for many large companies, mandates enhanced transparency in environmental and social performance, requiring substantial resource allocation for data collection and reporting.

Governments globally are increasingly implementing sugar taxes, directly impacting beverage pricing and consumer purchasing habits. For instance, Italy's planned sugar tax, set to take effect in July 2025, is anticipated to raise prices by an estimated 8-11%, potentially dampening demand for high-sugar products.

These public health initiatives aim to curb sugar intake, prompting companies like Coca-Cola HBC to re-evaluate their product offerings and marketing approaches. Adapting to these evolving consumer preferences and regulatory landscapes is crucial for maintaining market share and profitability.

Coca-Cola HBC is navigating the rollout of new national Deposit Return Schemes (DRS) across several European markets in 2024. These initiatives, designed to increase the collection and recycling of beverage containers, present a dual challenge and opportunity for the company.

For instance, France's extended producer responsibility (EPR) regulations, which include DRS elements, are impacting packaging costs and collection logistics. Similarly, ongoing discussions and potential implementations in countries like Germany and Poland by late 2024 or early 2025 will necessitate significant adjustments to Coca-Cola HBC's operational framework and supply chain management.

While these schemes require capital investment in new infrastructure and updated logistics, they directly support Coca-Cola HBC's ambitious sustainability targets, such as increasing recycled content in packaging and reducing waste. Successfully integrating with these DRS will bolster the company's circular economy credentials and ensure compliance with evolving environmental legislation.

Geopolitical Instability and Trade Policies

Coca-Cola HBC AG (CCHBC) explicitly notes how geopolitical and economic shifts significantly influence its market growth. For instance, the company has navigated currency headwinds in key emerging markets such as Nigeria, Russia, and Egypt. These political and economic dynamics directly impact operational stability and profitability in these regions.

Political instability and evolving international trade policies pose substantial risks. These can lead to supply chain disruptions, fluctuating raw material costs, and altered market access for CCHBC's products. The company's broad geographical spread offers some resilience, but continuous monitoring of these volatile factors is essential for strategic planning.

- Currency Fluctuations: CCHBC reported that currency headwinds in markets like Nigeria and Egypt impacted its performance in the first half of 2024.

- Trade Policy Impact: Changes in import/export regulations or tariffs in countries where CCHBC operates could affect the cost of goods and market competitiveness.

- Geopolitical Risk Mitigation: The company's diversified operations across various countries help to spread risk, though specific regional conflicts can still present localized challenges.

- Emerging Market Exposure: A significant portion of CCHBC's revenue comes from emerging markets, which are often more susceptible to political and economic volatility.

Government Measures on Pricing and Competition

Governments in several key markets are implementing measures to address inflation and protect consumers, which directly impacts Coca-Cola HBC's operational strategies. For instance, in Greece, regulations have been introduced that include gross profit caps and restrictions on promotional activities. These policies necessitate careful navigation by Coca-Cola HBC to manage revenue and maintain competitiveness.

These pricing and competition regulations require the company to adapt its business model. Coca-Cola HBC must focus on operational efficiencies and innovative marketing approaches that comply with the new rules. For example, in 2023, the company reported a 10.1% increase in revenue to €9.2 billion, demonstrating its ability to grow even within challenging regulatory environments, though specific impacts of Greek regulations are ongoing.

The company's approach involves:

- Adapting pricing strategies: Implementing flexible pricing that balances profitability with regulatory limits.

- Optimizing promotional activities: Developing compliant offers that still drive consumer engagement.

- Enhancing operational efficiency: Focusing on cost management to offset potential margin pressures.

- Strengthening customer relationships: Building loyalty through product quality and service to mitigate the impact of price controls.

Political factors significantly shape Coca-Cola HBC's operating environment, from navigating new sustainability reporting mandates like the CSRD to adapting to government-imposed sugar taxes, such as Italy's planned July 2025 implementation. The company also faces evolving packaging regulations, including national Deposit Return Schemes (DRS) being rolled out across Europe in 2024, impacting operational costs and logistics but aligning with sustainability goals.

Geopolitical instability and trade policy shifts introduce risks like supply chain disruptions and fluctuating raw material costs, particularly impacting emerging markets where Coca-Cola HBC has significant exposure. Currency headwinds in countries like Nigeria and Egypt were noted as impacting performance in the first half of 2024. Governments are also implementing inflation-control measures, such as gross profit caps in Greece, necessitating strategic adjustments in pricing and promotions.

Coca-Cola HBC's diversified operations provide some resilience against these political and economic volatilities. For instance, the company reported a 10.1% revenue increase in 2023 to €9.2 billion, showcasing adaptability within challenging regulatory landscapes. However, continued monitoring of political developments and trade policies remains critical for strategic planning and risk mitigation.

| Factor | Impact on Coca-Cola HBC | Example/Data Point (2024/2025) |

| Sustainability Regulations | Increased compliance costs, enhanced transparency | CSRD implementation from 2024; France's EPR impacting packaging costs. |

| Health-Related Taxes | Potential price increases, impact on consumer demand | Italy's planned sugar tax (July 2025) expected to raise prices by 8-11%. |

| Packaging & Recycling Schemes | Operational adjustments, investment in infrastructure | Rollout of national DRS across European markets in 2024. |

| Geopolitical & Economic Volatility | Supply chain risks, currency headwinds | Currency headwinds in Nigeria and Egypt impacted H1 2024 performance. |

| Pricing & Competition Regulations | Revenue management, adaptation of business models | Gross profit caps and promotional restrictions in Greece. |

What is included in the product

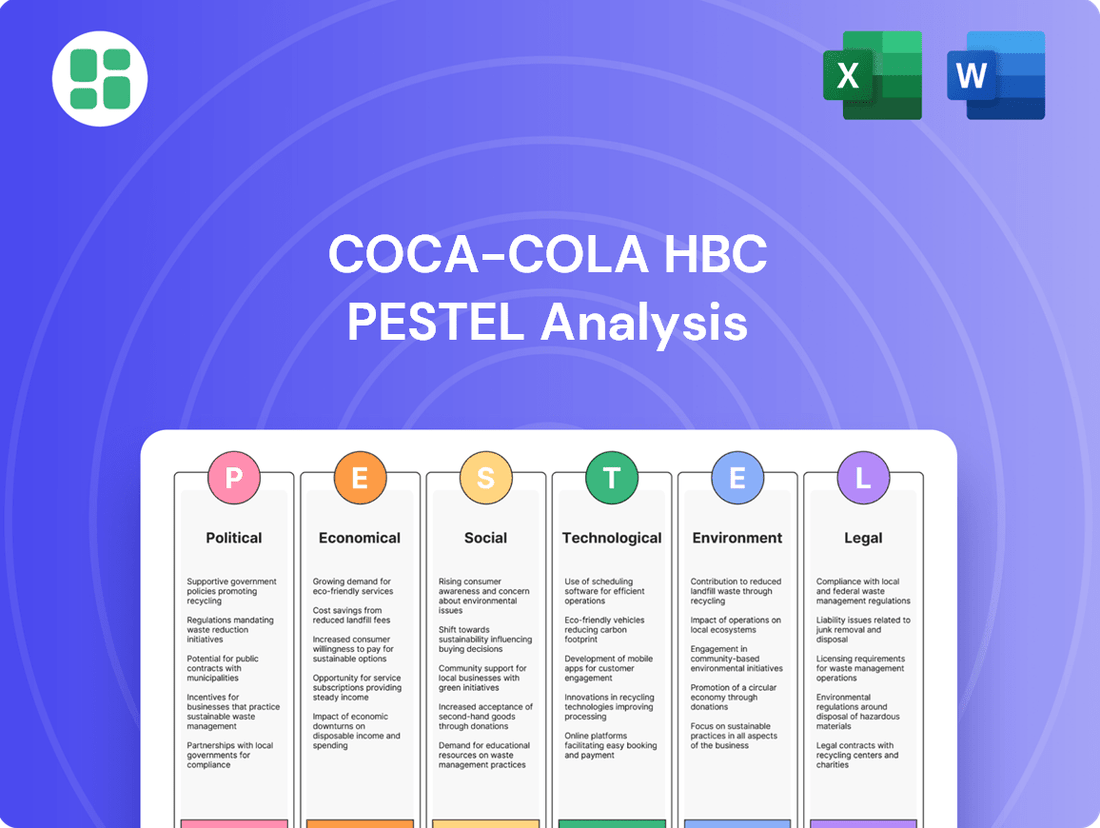

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Coca-Cola HBC, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends, threats, and opportunities relevant to Coca-Cola HBC's operating landscape.

A concise PESTLE analysis for Coca-Cola HBC, presented in a visually segmented format by category, offers a quick and accessible overview of external factors impacting the business, thereby relieving the pain point of sifting through extensive data for strategic planning.

Economic factors

Coca-Cola HBC navigates a challenging economic landscape marked by ongoing inflation in several of its operating regions. This inflation directly impacts consumer purchasing power, making them more attuned to price changes across all product categories.

To counter this, the company is actively employing Revenue Growth Management (RGM) strategies. These include strategic price adjustments and the introduction of a wider array of pack sizes, designed to accommodate diverse consumer budgets and preferences. For instance, in 2023, Coca-Cola HBC reported a net sales increase of 10.1% to €9.03 billion, partly driven by effective pricing actions amidst inflationary headwinds.

The company's proactive portfolio management is key to its competitive edge. By offering a broad spectrum of brands and formats, Coca-Cola HBC can effectively cater to consumers across different price sensitivities, ensuring continued market presence even when economic conditions are less favorable.

Coca-Cola HBC has faced significant currency headwinds, notably from the depreciation of the Nigerian Naira, Russian Rouble, and Egyptian Pound. These fluctuations directly impacted the company's reported revenues and profitability, particularly in its emerging market operations.

Managing these foreign exchange impacts is an ongoing challenge, necessitating strategic financial hedging and operational adjustments. For instance, currency depreciation in key markets like Nigeria and Egypt can significantly erode the value of repatriated earnings.

Despite these currency-related challenges, Coca-Cola HBC has demonstrated resilience, achieving strong organic revenue growth in recent periods. This indicates the underlying strength of its business operations and brand appeal, even amidst adverse currency movements.

Consumer spending power across Coca-Cola HBC's 29 operating countries is a primary driver for demand. In 2024, economic forecasts suggest varying levels of disposable income across these diverse markets, influencing purchasing decisions for their wide range of beverages.

Coca-Cola HBC strategically tailors its product mix, offering everything from value-oriented options to premium selections. This approach allows them to effectively target different consumer segments and capture a broader share of household spending, adapting to economic conditions and consumer preferences.

The company's performance is often reflected in its volume growth and revenue per case. For instance, in the first quarter of 2024, Coca-Cola HBC reported a solid volume increase, demonstrating their ability to navigate market dynamics and meet consumer demand effectively, even amidst fluctuating economic landscapes.

Commodity Prices and Input Costs

While Coca-Cola HBC’s 2024 Integrated Annual Report noted a general easing of input cost inflation, commodity prices continue to be a significant influence on the cost of goods sold. Fluctuations in key raw materials such as sugar, aluminum for cans, and PET resin for bottles directly impact the company's profitability. For instance, the price of PET resin experienced volatility throughout 2024, influenced by crude oil prices and global supply chain dynamics.

These price swings in essential inputs can compress profit margins if not effectively managed. Coca-Cola HBC actively addresses this through strategic initiatives focused on operational efficiency and securing sustainable sourcing agreements. These measures aim to create a more stable and predictable cost base, mitigating the impact of market volatility.

- Sugar Prices: Global sugar prices saw an upward trend in early 2024, driven by supply concerns in major producing regions like Brazil and India, potentially increasing Coca-Cola HBC's raw material costs.

- PET Resin Costs: The cost of PET resin, a primary packaging material, remained sensitive to fluctuations in crude oil prices, which experienced considerable movement throughout the year.

- Energy Costs: Energy prices, crucial for manufacturing and logistics, continued to be a factor, with regional variations impacting operational expenses for Coca-Cola HBC's diverse markets.

Investment in Infrastructure and Growth Initiatives

Coca-Cola HBC is strategically boosting its capital expenditures for 2025, earmarking over 65 million euros. This significant investment is directed towards bolstering infrastructure, improving productivity, driving innovation, and advancing sustainability efforts across its operations.

These capital outlays are fundamental to the company's strategy to enhance operational efficiency and broaden its production capacities. By investing in these areas, Coca-Cola HBC aims to support its key growth pillars and maintain a competitive edge in the market.

Further underscoring its commitment to growth and sustainability, Coca-Cola HBC secured a substantial €1.2 billion sustainability-linked credit facility in August 2025. This financial backing is designated for general corporate purposes, providing flexibility to pursue its strategic objectives.

- Infrastructure Investment: Over 65 million euros allocated for 2025 to upgrade and expand operational facilities.

- Growth Initiatives: Funding for innovation and productivity enhancements to drive market expansion.

- Sustainability Focus: Capital expenditures also support the company's environmental and social governance goals.

- Financial Flexibility: A €1.2 billion credit facility enhances the company's capacity to fund its strategic plans.

Coca-Cola HBC operates in markets with varying economic growth trajectories, influencing consumer spending and demand for its products. The company's ability to adapt pricing and product offerings to different income levels is crucial for maintaining market share, as seen in its 2023 net sales growth of 10.1% to €9.03 billion, partly due to effective pricing strategies amidst inflation.

Currency fluctuations, particularly in emerging markets like Nigeria and Egypt, pose a consistent challenge, impacting reported revenues and profitability. Despite these headwinds, Coca-Cola HBC has shown resilience, with strong organic revenue growth in recent periods, indicating the underlying strength of its operations.

Input cost volatility, especially for sugar, aluminum, and PET resin, directly affects the cost of goods sold and profit margins. The company's strategic sourcing and operational efficiency initiatives are key to mitigating these impacts, ensuring a more stable cost base.

| Economic Factor | Impact on Coca-Cola HBC | 2024/2025 Data/Trend |

|---|---|---|

| Inflation | Reduces consumer purchasing power, necessitating price adjustments and varied pack sizes. | Ongoing in several operating regions, managed through Revenue Growth Management (RGM). |

| Currency Fluctuations | Affects reported revenues and profitability, especially in emerging markets. | Depreciation of Nigerian Naira, Russian Rouble, and Egyptian Pound noted as significant headwinds. |

| Consumer Spending Power | Directly drives demand for beverages across 29 operating countries. | Forecasts for 2024 indicate diverse disposable income levels across markets, influencing purchasing decisions. |

| Commodity Prices | Impacts cost of goods sold and profit margins for key raw materials like sugar and PET resin. | Upward trend in sugar prices in early 2024; PET resin costs sensitive to crude oil prices. |

What You See Is What You Get

Coca-Cola HBC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Coca-Cola HBC PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides critical insights for strategic planning and market understanding.

Sociological factors

Consumers are increasingly prioritizing their health, which directly impacts beverage choices. This growing health consciousness is fueling demand for low-sugar and zero-sugar alternatives, a trend clearly reflected in the high-single-digit growth observed for products like Coke Zero in recent years.

In response, Coca-Cola HBC is actively diversifying its product lineup to include a wider array of healthier options and plant-based beverages, demonstrating a commitment to meeting evolving consumer preferences and market demands.

This shift necessitates ongoing innovation in product development, focusing on new formulations and responsible ingredient sourcing to maintain a competitive edge and cater to the health-aware consumer.

Coca-Cola HBC's strategy centers on its diverse '24/7 portfolio,' effectively addressing evolving consumer lifestyles and a wider array of consumption occasions. This includes everything from traditional sparkling beverages to juices, waters, and the rapidly growing sports and energy drinks categories.

The company is actively expanding these consumption occasions, notably through initiatives like the 'Coke & Meals' campaign, which encourages beverage pairing with food throughout the day. This approach is further bolstered by a strategic move into the higher-margin out-of-home coffee market, tapping into the increasing demand for premium coffee experiences beyond the home.

Consumers increasingly favor brands that demonstrate a commitment to environmental and social responsibility. This shift in preference directly impacts purchasing decisions, with a growing segment willing to pay a premium for sustainable products.

Coca-Cola HBC's proactive stance on sustainability, evidenced by its ambitious net-zero emissions goal by 2040 and a significant increase in the use of recycled PET (rPET) in its packaging – reaching 30% across its portfolio in 2023 – resonates strongly with these evolving consumer values. This alignment is crucial for maintaining and growing market share.

By prioritizing environmental stewardship, such as reducing its carbon footprint and promoting circular economy principles, Coca-Cola HBC not only meets but anticipates consumer expectations. This commitment fosters stronger brand loyalty and enhances its overall market appeal, particularly among younger demographics who are highly attuned to corporate sustainability efforts.

Demographic Changes and Urbanization

Coca-Cola HBC's operations span diverse regions, necessitating an understanding of varying demographic profiles and urbanization trends. For instance, in 2024, many African nations within its operating territories, like Nigeria and Ethiopia, continue to experience robust population growth, projected to add millions of consumers. This demographic expansion, coupled with rising urbanization, creates significant demand for beverages.

Growth opportunities are particularly evident in areas with increasing populations and improving GDP per capita, which directly correlates with higher consumption rates. In 2023, several of Coca-Cola HBC's emerging markets saw GDP growth exceeding 5%, signaling increased disposable income and a greater capacity for consumer spending on products like Coca-Cola.

The company strategically adapts its product portfolio and distribution networks to meet these regional specificities. This includes tailoring product sizes and offerings to suit local purchasing power and investing in last-mile delivery solutions to reach expanding urban and peri-urban populations effectively.

- Population Growth: Nigeria's population is projected to reach over 230 million by 2025, a key consumer base for Coca-Cola HBC.

- Urbanization Trends: By 2025, over 60% of Africa's population is expected to live in urban areas, concentrating consumer demand.

- Economic Indicators: Countries like Poland and Romania, part of Coca-Cola HBC's European segment, showed GDP growth of approximately 3-4% in 2023, supporting consistent beverage consumption.

- Market Adaptation: Introduction of smaller, more affordable pack sizes in markets like Egypt in 2024 to align with local income levels and consumption habits.

Community Engagement and Youth Development

Coca-Cola HBC places a strong emphasis on community engagement and youth development, recognizing its importance for social license and brand reputation. A prime example is their #YouthEmpowered program, which successfully trained over 1.1 million young individuals by the close of 2024.

This commitment extends beyond training, fostering socio-economic development and building trust within the communities where Coca-Cola HBC operates. Such initiatives are crucial for enhancing brand perception and ensuring sustained operational support.

- #YouthEmpowered Program Impact: Over 1.1 million young people trained by the end of 2024.

- Community Investment: Focus on socio-economic development and local talent cultivation.

- Social License: Initiatives strengthen brand reputation and community support.

Societal values are shifting, with consumers increasingly prioritizing health and wellness, driving demand for low-sugar and zero-sugar beverages. Coca-Cola HBC is responding by expanding its portfolio to include healthier options and plant-based drinks, a strategy supported by the high-single-digit growth of products like Coke Zero.

Sustainability is also a major societal concern, influencing purchasing decisions. Coca-Cola HBC's commitment to net-zero emissions by 2040 and its increased use of recycled PET (rPET), reaching 30% in 2023, aligns with these values and strengthens brand loyalty.

Demographic shifts and urbanization present significant growth opportunities, particularly in emerging markets within Coca-Cola HBC's operational territories. For example, countries like Nigeria are experiencing substantial population growth, with urbanization concentrating consumer demand.

Community engagement, especially youth development, is vital for Coca-Cola HBC's social license and brand reputation. The #YouthEmpowered program, which trained over 1.1 million young individuals by the end of 2024, exemplifies this commitment to socio-economic development.

| Sociological Factor | Impact on Coca-Cola HBC | Supporting Data/Initiative |

|---|---|---|

| Health Consciousness | Increased demand for healthier beverage options. | High-single-digit growth for Coke Zero; expansion of low-sugar/plant-based portfolio. |

| Sustainability Focus | Consumer preference for environmentally responsible brands. | Net-zero emissions goal by 2040; 30% rPET usage in packaging (2023). |

| Demographic Shifts & Urbanization | Growth opportunities in expanding urban centers. | Robust population growth in African markets; over 60% African urbanization projected by 2025. |

| Community Engagement | Enhanced brand reputation and social license. | #YouthEmpowered program trained over 1.1 million young people by end of 2024. |

Technological factors

Coca-Cola HBC's commitment to advanced bottling and production technologies is evident in its ongoing investments. For instance, in 2023, the company reported a significant portion of its capital expenditure was allocated to upgrading bottling lines and enhancing operational efficiency across its markets.

These technological advancements are designed to boost production throughput, minimize material waste, and maintain the high quality consumers expect. This focus on efficiency also supports their sustainability goals, as newer technologies often consume less energy and water per unit produced.

The implementation of robust environmental management systems, a key component of their advanced production, ensures compliance and drives continuous improvement in reducing the ecological footprint of their manufacturing operations.

Coca-Cola HBC heavily relies on data analytics to power its Revenue Growth Management (RGM) strategy. This allows them to analyze vast amounts of information to make smart decisions about pricing, product offerings, and how to reach consumers and businesses effectively in each of their diverse markets.

By using these advanced analytics, Coca-Cola HBC can develop highly specific RGM plans. For instance, they can tailor pricing strategies to local economic conditions and consumer purchasing power, optimize their product portfolio to meet specific market demands, and target marketing efforts with greater precision, which is crucial for navigating fluctuating inflation rates and varying economic climates across Europe and Africa.

In 2023, Coca-Cola HBC reported a revenue increase of 5.1% on a comparable basis, reaching €9.2 billion. This growth was partly attributed to their disciplined RGM execution, which included strategic price increases and a focus on higher-value packs, demonstrating the tangible impact of their data-driven approach on financial performance.

Coca-Cola HBC views digital commerce as a crucial strength, allowing for wider market access and more streamlined customer interactions. In 2023, their digital channels contributed significantly to sales growth, with e-commerce platforms seeing a 15% year-over-year increase in transactions.

The company is actively investing in digital tools to refine its route-to-market strategies, ensuring efficient product delivery across its 29 markets. This digital integration is vital for managing customer relationships and deepening market penetration, as evidenced by their digital sales platform adoption rate reaching 85% among key business clients by the end of 2024.

Packaging Innovation and Circular Economy Solutions

Technological advancements in packaging are pivotal for Coca-Cola HBC's commitment to sustainability. These innovations focus on increasing the adoption of recycled PET (rPET) and minimizing the use of virgin plastic. For instance, the company aims for 100% recycled or renewable content in its packaging by 2030.

Key technological developments include lightweighting initiatives for bottles and cans, which reduce material usage. Coca-Cola HBC is also eliminating plastic film from multi-packs, opting for more sustainable alternatives. Furthermore, the company actively engages in research and development, alongside strategic partnerships, to pioneer novel packaging solutions that align with circular economy principles.

Supporting these efforts, Coca-Cola HBC is investing in infrastructure for packaging collection and recycling. A notable example is the opening of new packaging collection hubs, such as the facility established in Nigeria, which directly contributes to enhancing circularity by facilitating the recovery and reprocessing of used materials. In 2023, Coca-Cola HBC reported that 31.5% of its PET packaging was made from recycled materials.

- Packaging Lightweighting: Reducing the amount of plastic used per unit.

- rPET Adoption: Increasing the percentage of recycled PET in bottles.

- Collection Hubs: Establishing infrastructure to support material recovery and recycling.

- Partnerships: Collaborating on R&D for next-generation sustainable packaging.

Product Innovation and Portfolio Diversification

Technological advancements are crucial for Coca-Cola HBC's product innovation and portfolio diversification. The company leverages technology in research and development to create new beverages that align with evolving consumer preferences. This includes utilizing data analytics to identify emerging trends and consumer demand.

Upcoming product launches in 2025 highlight this focus. Examples include Coca-Cola Orange Cream, Sprite + Tea, and POWERADE Xtra Sour. These innovations are designed to capture new market segments and refresh existing ones, ensuring the company's offerings remain competitive and appealing in a dynamic beverage market.

- Product Innovation: Technology enables the development of novel flavors and formulations, such as the upcoming Coca-Cola Orange Cream.

- Portfolio Diversification: Innovations like Sprite + Tea cater to growing consumer interest in healthier or alternative beverage options.

- Market Responsiveness: POWERADE Xtra Sour demonstrates the company's ability to adapt to specific consumer trends and demands in the sports drink category.

- Consumer Insights: Technological tools facilitate in-depth consumer research, informing the strategic direction of new product development for 2025 and beyond.

Coca-Cola HBC's technological investments are driving efficiency and sustainability. In 2023, capital expenditure focused on upgrading bottling lines, aiming for reduced waste and energy consumption. Their advanced environmental management systems ensure operational compliance and ecological footprint reduction.

Data analytics powers their Revenue Growth Management strategy, enabling tailored pricing and product strategies based on local economic conditions. This data-driven approach contributed to a 5.1% comparable revenue increase in 2023, reaching €9.2 billion, with digital channels showing a 15% transaction increase year-over-year.

Innovations in packaging, like lightweighting and increased rPET adoption, are central to their sustainability goals, targeting 100% recycled or renewable content by 2030. By the end of 2024, 85% of key business clients adopted their digital sales platform, enhancing route-to-market strategies.

Technological advancements also fuel product innovation, with new launches planned for 2025, such as Coca-Cola Orange Cream and Sprite + Tea, to meet evolving consumer preferences and diversify their portfolio.

| Key Technology Areas | Impact/Focus | 2023/2024 Data Points |

| Production & Bottling | Operational Efficiency, Waste Reduction | Capital expenditure on bottling line upgrades. |

| Data Analytics & RGM | Market Strategy, Pricing Optimization | 5.1% comparable revenue growth in 2023; 15% YoY increase in digital channel transactions. |

| Digital Commerce | Market Access, Customer Interaction | 85% digital sales platform adoption by key clients (end of 2024). |

| Sustainable Packaging | rPET Adoption, Lightweighting | 31.5% of PET packaging from recycled materials (2023); Target: 100% recycled/renewable by 2030. |

| Product Innovation | Portfolio Diversification, Consumer Trends | Upcoming launches include Coca-Cola Orange Cream, Sprite + Tea (2025). |

Legal factors

Coca-Cola HBC has proactively integrated a new Sustainability Statement into its 2024 Integrated Annual Report, specifically to meet the stringent requirements of the Corporate Sustainability Reporting Directive (CSRD). This move underscores the company's dedication to enhancing transparency and adhering to legal obligations concerning its environmental, social, and governance (ESG) performance within the European Union.

The CSRD mandates a comprehensive and standardized approach to sustainability reporting, requiring companies like Coca-Cola HBC to disclose detailed information on their impacts, risks, and opportunities related to sustainability matters. This legal framework is designed to ensure that stakeholders have access to reliable and comparable sustainability data, influencing investment decisions and corporate accountability.

The increasing adoption of Deposit Return Schemes (DRS) across European markets, with significant implementations in 2024, directly affects Coca-Cola HBC. These schemes are rooted in Extended Producer Responsibility (EPR), a legal framework that places the onus on producers for the entire lifecycle of their products, particularly packaging.

Coca-Cola HBC, like other beverage companies, faces direct compliance costs and operational adjustments due to these EPR regulations. For instance, the rollout of DRS in countries like France and Germany in 2024 necessitates substantial investment in collection and recycling infrastructure to meet mandated return rates and material recovery targets.

These legal factors compel Coca-Cola HBC to innovate in packaging design, prioritizing recyclability and incorporating higher percentages of recycled content. For example, by 2025, many EU countries aim for at least 30% recycled PET in beverage bottles, a target that requires significant upstream and downstream supply chain engagement.

Coca-Cola HBC, as a major beverage producer, must navigate a complex web of food safety and product quality regulations in each of its operating markets. These rules are designed to protect consumers and ensure the integrity of the products. While specific new legislation isn't always publicly highlighted, the company's commitment to standards like ISO 14001:2015 demonstrates a strong internal framework for managing product safety.

The company's proactive approach to compliance is underscored by actions like the precautionary recall in Austria in early 2024 due to a potential technical issue. This event, though minor, emphasizes the critical nature of adhering to these stringent legal requirements and the potential impact of even small deviations.

Taxation on Beverages (e.g., Sugar Tax)

Taxation on beverages, particularly the introduction or increase of sugar taxes, significantly impacts Coca-Cola HBC's financial performance. For instance, Italy implemented a sugar tax in 2024, which directly influences the company's pricing and product development strategies.

Coca-Cola HBC must adapt to these fiscal regulations by potentially raising prices, which could affect consumer demand, or by reformulating its products to reduce sugar content. This dynamic affects its market competitiveness and overall profitability.

- Impact on Pricing: Sugar taxes necessitate price adjustments, influencing consumer purchasing decisions and potentially reducing sales volume.

- Product Reformulation: Companies like Coca-Cola HBC may invest in R&D to lower sugar content, aiming to mitigate tax liabilities and meet evolving consumer preferences.

- Profitability Concerns: Absorbing the tax burden or facing reduced sales due to price increases can directly impact profit margins.

- Market Competitiveness: Differential tax treatments across regions or product categories can alter the competitive landscape for Coca-Cola HBC.

Competition Law and Market Practices

Coca-Cola HBC operates within stringent competition laws across its diverse markets, impacting its pricing strategies and promotional activities. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all players in the beverage industry. For instance, in 2024, Coca-Cola HBC continued to navigate varying national competition authorities' scrutiny regarding its market share and distribution agreements.

Adherence to these legal frameworks is crucial for maintaining market access and avoiding significant penalties. The company's efforts to grow its value share in the Non-Alcoholic Ready-To-Drink (NARTD) segment, a key focus area, are meticulously managed to comply with antitrust regulations. This involves careful consideration of how pricing, bundling, and exclusive arrangements might be perceived by regulators.

- Antitrust Compliance: Coca-Cola HBC must ensure its pricing and promotional activities do not stifle competition, a constant regulatory concern.

- Market Share Scrutiny: Regulators closely monitor market share gains to prevent dominance that could harm consumers or smaller competitors.

- Value Share Growth: The company's strategy to increase value share in the NARTD market is pursued within the boundaries of competition law.

- Regulatory Adaptability: Coca-Cola HBC must remain agile to adapt to evolving competition law interpretations and enforcement across its operating regions.

Coca-Cola HBC's commitment to sustainability is legally mandated, with the 2024 Integrated Annual Report reflecting adherence to the Corporate Sustainability Reporting Directive (CSRD). This directive ensures detailed and comparable ESG disclosures for stakeholders across the EU.

The increasing implementation of Deposit Return Schemes (DRS) across Europe in 2024, driven by Extended Producer Responsibility (EPR) laws, necessitates significant investment in packaging collection and recycling infrastructure. This legal framework directly impacts operational costs and packaging strategies, pushing for higher recycled content, such as the 2025 EU target of 30% recycled PET in beverage bottles.

Environmental factors

Climate change presents a significant environmental factor for Coca-Cola HBC, prompting ambitious sustainability goals. The company has committed to achieving net-zero emissions throughout its entire value chain by 2040, a target supported by a substantial €250 million investment in emissions reduction initiatives by 2025.

This proactive stance is particularly relevant as 2024 has been recognized as the warmest year on record, with a notable increase in the frequency and intensity of extreme weather events. These climatic shifts directly impact supply chains, resource availability, and operational costs for beverage companies like Coca-Cola HBC.

Coca-Cola HBC is deeply invested in environmental sustainability, with a primary focus on circular packaging solutions and reducing its carbon footprint. A key objective is to significantly increase the use of recycled PET (rPET) across its product portfolio.

By 2025, the company aims for 35% rPET content in all its markets. This target escalates to 50% rPET in European Union markets and Switzerland by the same year, with an ambitious projection to surpass 60% in these specific regions by the end of 2025.

Furthermore, Coca-Cola HBC is committed to reducing virgin plastic usage. The company plans to eliminate at least 350,000 metric tonnes of virgin plastic by 2025 through initiatives like product light-weighting and expanding the availability of reusable packaging options.

Water is absolutely essential for making beverages, and Coca-Cola HBC really focuses on taking care of it. They've set a goal to be net positive for biodiversity by 2040, which includes making sure water is secure in places where it's hard to come by.

To achieve this, the company works on using water more efficiently in its factories and also puts water back into the environment and local communities. For instance, in 2023, Coca-Cola HBC reported returning 172% of the water used in its finished products back to nature and communities, exceeding their 2020 goal of 100%.

Waste Management and Recycling Infrastructure

Coca-Cola HBC is actively investing in and supporting recycling infrastructure to improve waste management. A key example is their new packaging collection hub in Nigeria, designed to process up to 13,000 metric tonnes of PET annually.

These initiatives are crucial for increasing collection rates and diverting packaging from landfills. This focus on recycling directly supports Coca-Cola HBC's ambitious target of recovering 75% of its primary packaging by 2025.

- Investment in Nigeria: The new collection hub in Nigeria is a significant step, aiming to process 13,000 metric tonnes of PET annually.

- Collection Rate Improvement: Such infrastructure development is vital for boosting the collection of used packaging materials.

- Circular Economy Goals: The company's commitment to recycling aligns with its broader sustainability objective of recovering 75% of primary packaging by 2025.

Energy Efficiency and Renewable Energy Transition

Coca-Cola HBC is actively pursuing a transition to 100% renewable electricity across its operations, a key component of its ambitious emissions reduction targets. This strategic shift is supported by significant investments in enhancing energy efficiency throughout its manufacturing and distribution processes.

The company’s commitment extends to its customer base, with initiatives focused on providing energy-efficient coolers. These efforts are crucial in minimizing its overall carbon footprint and aligning with global sustainability goals.

- Renewable Electricity Target: Coca-Cola HBC aims for 100% renewable electricity sourcing for its operations.

- Energy Efficiency Investments: The company is investing in improving energy efficiency across its value chain.

- Cooler Efficiency Program: Providing energy-efficient coolers to customers contributes to Scope 3 emissions reduction.

- Emissions Reduction Strategy: These actions are integral to Coca-Cola HBC's broader strategy for cutting greenhouse gas emissions.

Coca-Cola HBC is actively addressing climate change, aiming for net-zero emissions by 2040 with a €250 million investment by 2025. The company is also prioritizing circular packaging, targeting 35% recycled PET (rPET) content across its portfolio by 2025, and aims to eliminate 350,000 metric tonnes of virgin plastic by the same year.

Water stewardship is paramount, with a goal of being net positive for biodiversity by 2040, including securing water resources in water-scarce areas. In 2023, Coca-Cola HBC returned 172% of water used in finished products back to nature and communities, surpassing their 2020 goal.

The company is enhancing waste management through investments in recycling infrastructure, such as a Nigerian PET collection hub processing 13,000 metric tonnes annually, supporting their 2025 target of recovering 75% of primary packaging.

Coca-Cola HBC is transitioning to 100% renewable electricity and investing in energy efficiency across its operations and customer-facing coolers to reduce its carbon footprint.

| Environmental Focus | Target/Action | Year | Key Metric/Investment |

|---|---|---|---|

| Climate Change | Net-zero emissions | 2040 | €250 million investment by 2025 |

| Packaging | Recycled PET (rPET) content | 2025 | 35% across portfolio (50% in EU/Switzerland) |

| Packaging | Reduce virgin plastic | 2025 | Eliminate 350,000 metric tonnes |

| Water Stewardship | Net positive for biodiversity | 2040 | Returned 172% water in 2023 |

| Waste Management | Recover primary packaging | 2025 | 75% recovery rate |

| Energy | Renewable electricity | Ongoing | Investment in energy efficiency |

PESTLE Analysis Data Sources

Our Coca-Cola HBC PESTLE Analysis is built on a robust foundation of data from official government publications, leading economic institutions like the IMF and World Bank, and reputable industry-specific market research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.