Coca-Cola HBC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola HBC Bundle

Explore the strategic engine of Coca-Cola HBC with our comprehensive Business Model Canvas. Discover how they build strong customer relationships, leverage key resources, and maintain a competitive edge in the beverage industry. This detailed breakdown is your key to understanding their success.

Unlock the full strategic blueprint behind Coca-Cola HBC's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Coca-Cola HBC's fundamental partnership is with The Coca-Cola Company (TCCC), acting as a crucial bottling partner. This relationship is the bedrock of their operations, enabling Coca-Cola HBC to produce, market, and distribute TCCC's vast array of non-alcoholic beverages across its designated territories.

Under this agreement, TCCC supplies the essential beverage concentrates and dictates the overarching brand marketing strategies. Coca-Cola HBC then takes the lead in local execution, focusing on ensuring products are readily available to consumers and achieving strong market penetration within its operational regions.

In 2023, Coca-Cola HBC reported net sales revenue of €9.2 billion, a testament to the strength of its distribution network built upon this TCCC partnership. This collaboration allows for efficient scaling and market responsiveness, leveraging TCCC's global brand power with local operational expertise.

Coca-Cola HBC cultivates a robust network of local suppliers for essential raw materials such as sugar and fruit juices, alongside packaging components and vital operational services. This deep integration with local economies is a cornerstone of their strategy.

The company's commitment to local sourcing is substantial, with a target to procure over 95% of its addressable spending from local vendors. This focus not only bolsters the socio-economic fabric of the regions where it operates but also significantly enhances supply chain resilience and operational efficiency.

Coca-Cola HBC relies on third-party logistics (3PL) providers to manage its extensive distribution network across 29 countries. These partnerships are vital for streamlining transportation, warehousing, and market access. In 2024, Coca-Cola HBC continued to focus on optimizing these relationships to improve efficiency and sustainability, including exploring greener fuel options for its fleet.

Retail Customers and HoReCa Channel Partners

Coca-Cola HBC cultivates deep ties with a broad customer base, encompassing major supermarket chains, independent grocers, and the vital Hotels, Restaurants, and Cafes (HoReCa) segment. These collaborations are foundational for securing prominent product placement, optimal shelf visibility, and direct engagement with end consumers. The company prioritizes creating shared value and establishing itself as the go-to supplier for these varied retail and HoReCa partners.

In 2024, Coca-Cola HBC's extensive distribution network, built on these key partnerships, was instrumental in reaching millions of consumers daily across its diverse markets. For instance, its presence in over 1.5 million points of sale highlights the critical role of these retail and HoReCa relationships in driving sales volume and market penetration. The company's strategy revolves around supporting these partners through tailored marketing initiatives and efficient supply chain solutions.

- Retail Network Strength: Coca-Cola HBC's extensive reach is powered by its partnerships with thousands of supermarkets, convenience stores, and independent retailers, ensuring widespread product availability.

- HoReCa Sector Engagement: Strong relationships within the Hotels, Restaurants, and Cafes sector are crucial for capturing on-the-go consumption occasions and building brand loyalty in hospitality settings.

- Joint Value Creation: The company actively works with its partners to enhance sales through collaborative promotions, category management support, and data-driven insights, aiming for mutual growth.

- Preferred Supplier Status: Coca-Cola HBC's commitment to service excellence, product innovation, and reliable supply chain management underpins its objective to be the preferred beverage partner for its diverse customer base.

Technology and Digital Solution Providers

Coca-Cola HBC actively collaborates with technology and digital solution providers to drive its digital transformation and bolster commercial operations. These partnerships are crucial for implementing advanced capabilities, including artificial intelligence and sophisticated data analytics.

Key investments are directed towards enhancing customer engagement through platforms like WhatsApp chatbots, aiming to streamline interactions and personalize experiences. For instance, in 2024, the company continued to expand its use of digital tools to optimize supply chain management and improve direct-to-consumer delivery, a critical area for growth.

- AI and Data Analytics: Partnerships focus on leveraging AI for demand forecasting and personalized marketing campaigns, aiming for a significant uplift in sales efficiency.

- Customer Engagement Platforms: Investments in tools like WhatsApp chatbots facilitate direct communication, enabling quicker responses to customer inquiries and feedback collection.

- Digital Transformation Initiatives: Collaborations support the integration of new technologies to optimize internal processes, from production to distribution, enhancing overall operational agility.

- Innovation and New Technologies: These partnerships are vital for exploring and adopting emerging digital solutions that can create new revenue streams or improve existing business models.

Coca-Cola HBC's strategic partnerships extend to a diverse range of suppliers for essential raw materials and packaging, alongside vital third-party logistics providers. These collaborations are critical for maintaining supply chain resilience and operational efficiency across its extensive network. By prioritizing local sourcing, Coca-Cola HBC aims for over 95% of its addressable spending to be with local vendors, bolstering regional economies and ensuring consistent material availability.

In 2024, the company continued to optimize its relationships with third-party logistics (3PL) providers to enhance distribution efficiency and sustainability. These partnerships are fundamental to managing the complex transportation and warehousing needs across Coca-Cola HBC's 29 operating countries, ensuring products reach millions of consumers daily.

The company also actively engages with technology and digital solution providers to drive its digital transformation, integrating advanced capabilities like AI and data analytics. These collaborations are key to improving customer engagement, such as through WhatsApp chatbots, and optimizing supply chain management for direct-to-consumer delivery, a critical growth area.

What is included in the product

A comprehensive, pre-written business model tailored to Coca-Cola HBC's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

Coca-Cola HBC's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, allowing for rapid identification of inefficiencies and opportunities for optimization.

It streamlines strategic planning and problem-solving, transforming abstract challenges into actionable insights for improved performance and growth.

Activities

Coca-Cola HBC's core activity is the manufacturing and bottling of a wide array of non-alcoholic beverages. This involves the precise mixing of concentrates with water and other ingredients, followed by the efficient filling of bottles and cans, all while adhering to stringent quality control measures.

With a network of bottling plants spread across 29 markets, the company demonstrates a commitment to localized production. This adaptability allows Coca-Cola HBC to tailor its product offerings to specific regional preferences and dynamic market demands, ensuring relevance and consumer appeal.

Managing an extensive sales and distribution network is a cornerstone activity for Coca-Cola HBC, reaching an estimated 740 million consumers across Europe, Africa, and Asia. This intricate process involves the seamless movement of finished goods from production facilities to a network of warehouses and distribution centers.

The subsequent delivery to a diverse customer base, ranging from major supermarket chains to small, independent retailers, demands highly efficient logistics and precise route-to-market strategies. In 2024, Coca-Cola HBC's commitment to product availability is underscored by its vast operational footprint and sophisticated supply chain management.

Coca-Cola HBC's marketing and brand building are deeply intertwined with The Coca-Cola Company, focusing on localizing global campaigns to resonate with diverse markets. In 2024, this strategy continued to drive significant consumer engagement, with substantial investments in advertising and promotional activities aimed at boosting demand for their extensive beverage portfolio.

The company actively launches new products and refreshes existing brands, supported by data-driven category strategies developed using deep consumer insights. This approach is crucial for enhancing brand visibility and securing market share, as evidenced by their consistent performance in key markets across Europe and Africa.

Supply Chain Management and Sustainable Sourcing

Coca-Cola HBC's key activities heavily rely on robust supply chain management. This involves the intricate process of procuring raw materials, managing inventory efficiently, and ensuring all operations adhere to strict ethical and environmental standards. A significant focus is placed on sustainable sourcing, particularly for key agricultural ingredients and packaging materials.

The company actively works towards improving sustainability across its supply chain. This includes prioritizing local sourcing whenever feasible, which not only supports local economies but also reduces transportation-related emissions. Coca-Cola HBC has set ambitious targets, aiming for 100% of its key agricultural ingredients to be certified sustainable by 2025, demonstrating a commitment to responsible practices.

- Effective Supply Chain Management: Encompasses procurement, inventory control, and logistics.

- Sustainable Sourcing: Focuses on ethical and environmentally sound procurement of raw materials and packaging.

- Local Sourcing Priority: Supports local economies and reduces carbon footprint.

- 2025 Sustainability Goal: Aims for 100% certified key agricultural ingredients.

Product Innovation and Portfolio Diversification

Coca-Cola HBC's commitment to product innovation and portfolio diversification is a cornerstone of its strategy. This focus ensures the company remains relevant by constantly adapting to changing consumer tastes and market trends.

In 2024, Coca-Cola HBC continued to expand its offerings beyond traditional soft drinks. The company actively introduced new flavors and formats within its existing brands, alongside venturing into growth categories. This diversification strategy aims to capture a broader share of the beverage market, catering to a wider range of occasions and consumer needs throughout the day.

- Expanding Categories: In 2024, Coca-Cola HBC saw significant growth in its non-cola segments, with energy drinks and coffee showing particularly strong performance.

- Strategic Acquisitions: The company has strategically acquired or partnered with brands in premium spirits and other emerging beverage categories to broaden its appeal.

- Consumer-Centric Innovation: Efforts are focused on developing products that align with health-conscious trends and evolving lifestyle preferences, such as low-sugar options and plant-based beverages.

Coca-Cola HBC's key activities are centered on manufacturing, marketing, and distributing a vast portfolio of non-alcoholic beverages across its extensive geographic footprint. This involves sophisticated supply chain management, from sourcing raw materials to delivering finished products to millions of consumers.

The company's operational prowess is evident in its localized production capabilities and its commitment to sustainability, aiming for 100% of key agricultural ingredients to be certified sustainable by 2025. Innovation is also a critical activity, with a focus on expanding into new categories and refreshing existing brands to meet evolving consumer preferences.

In 2024, Coca-Cola HBC continued to drive growth through strategic marketing campaigns and product launches, reinforcing its strong market presence. Their distribution network, reaching approximately 740 million consumers, is a testament to their logistical expertise and deep market penetration.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Manufacturing & Bottling | Producing a wide range of beverages adhering to quality standards. | Operates numerous bottling plants across 29 markets. |

| Sales & Distribution | Managing an extensive network to reach consumers and customers. | Serves an estimated 740 million consumers. |

| Marketing & Brand Building | Localizing global campaigns and promoting beverage portfolio. | Significant investment in advertising and promotions. |

| Product Innovation | Launching new products and diversifying into growth categories. | Expansion into energy drinks and coffee categories showing strong performance. |

| Supply Chain Management | Procuring raw materials, managing inventory, and ensuring ethical operations. | Focus on sustainable sourcing with a 2025 goal for key agricultural ingredients. |

Delivered as Displayed

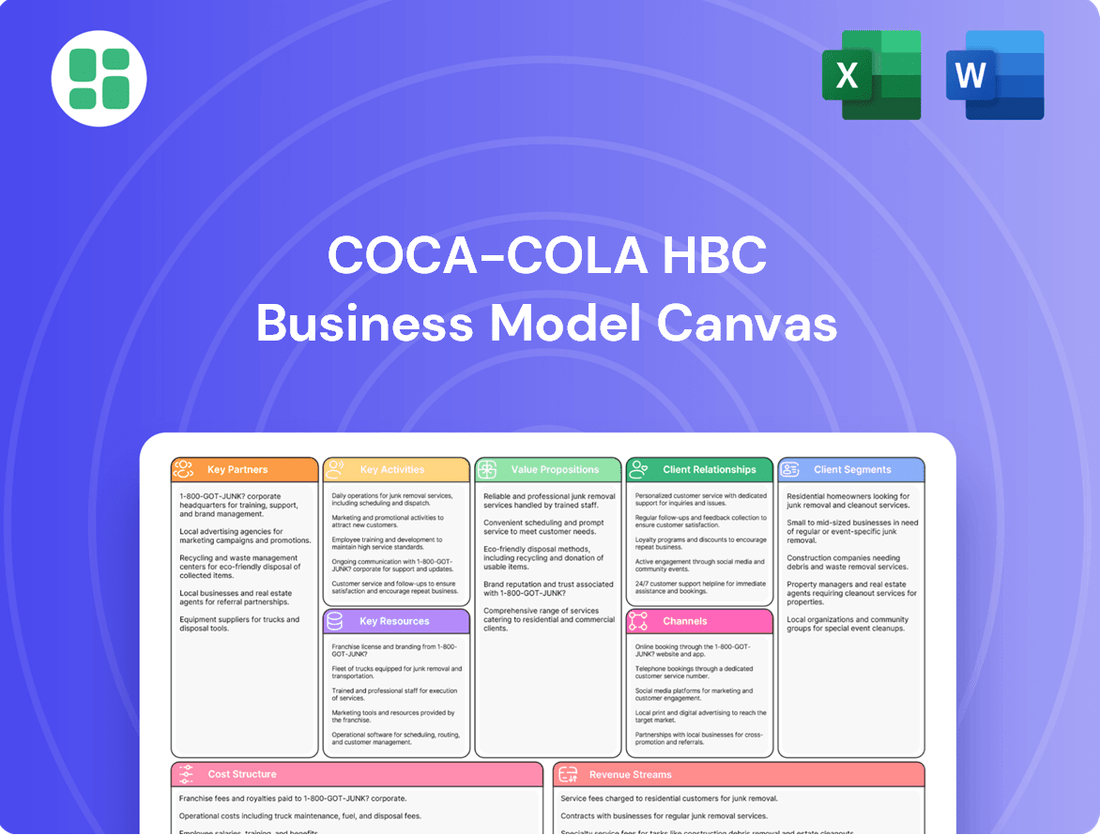

Business Model Canvas

The Coca-Cola HBC Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a mockup or sample; it's a direct representation of the comprehensive analysis that will be yours. Upon completion of your order, you'll gain full access to this same, detailed Business Model Canvas, ready for your strategic review and application.

Resources

Coca-Cola HBC's most vital intellectual asset is its vast collection of globally recognized brands, including Coca-Cola, Fanta, and Sprite. This strong foundation is further enhanced by a robust portfolio of local brands, juices, waters, sports drinks, energy drinks, and increasingly, plant-based beverages.

This extensive and varied product range is a key differentiator, enabling Coca-Cola HBC to effectively meet diverse consumer needs and preferences across its wide operational footprint. For instance, in 2023, the company reported net sales revenue of €9.2 billion, demonstrating the commercial success driven by this brand portfolio.

Coca-Cola HBC operates a vast manufacturing and logistics network, boasting numerous modern bottling plants, warehouses, and distribution centers strategically positioned throughout its 29 markets. This extensive infrastructure is the backbone of its operations, ensuring efficient production and delivery.

The company's commitment to maintaining and upgrading this physical asset base, including advanced machinery and a dedicated vehicle fleet, is crucial for its ability to reliably supply products. In 2023, Coca-Cola HBC continued its investment in these key resources, underscoring their importance to its business model.

Coca-Cola HBC's skilled workforce is a cornerstone of its operations, with a dedicated team across manufacturing, sales, marketing, logistics, and administration. This human capital is essential for executing intricate market strategies and maintaining efficient supply chains.

The company leverages decades of accumulated operational expertise in bottling and distribution. This deep knowledge is crucial for driving efficiency and successfully implementing complex market strategies, ensuring smooth execution from production to delivery.

Coca-Cola HBC places a strong emphasis on continuous talent development and fostering a performance-driven culture. This commitment to its employees ensures they possess the necessary skills and motivation to excel in their roles and contribute to the company's success.

Financial Capital and Strong Balance Sheet

Coca-Cola HBC leverages robust financial capital, secured from both equity and debt holders, alongside strong operational cash flow. This financial strength is fundamental, fueling investments in expansion, sustainability efforts, and enhancing operational efficiency. For instance, in 2023, Coca-Cola HBC reported a revenue of EUR 9.2 billion, demonstrating its substantial financial capacity.

A healthy financial position is maintained, enabling disciplined capital allocation and strategic acquisitions. This resilience allows the company to navigate economic downturns effectively. Coca-Cola HBC's commitment to a strong balance sheet underpins its ability to pursue growth opportunities and maintain shareholder value.

- Financial Capital Sources: Equity and debt financing, supplemented by strong operating cash flows.

- Investment Capabilities: Funds growth initiatives, sustainability projects, and operational enhancements.

- Financial Health: Maintains a strong balance sheet for disciplined capital allocation and strategic moves.

- Resilience: Ability to withstand economic fluctuations and pursue long-term objectives.

Advanced Supply Chain and Digital Capabilities

Coca-Cola HBC's advanced supply chain and digital capabilities are crucial. They utilize a vast network for procurement and distribution, enhanced by data analytics for better forecasting and inventory management. For instance, in 2023, the company reported a significant improvement in its supply chain efficiency, contributing to a 10.3% revenue growth.

Digital tools are increasingly integrated. This includes e-commerce platforms that expanded their direct-to-consumer reach and AI-driven tools for optimizing delivery routes and understanding consumer behavior. These investments support their goal of operational excellence and customer engagement.

Key digital and supply chain resources include:

- Sophisticated logistics and warehousing network

- Data analytics for demand forecasting and inventory optimization

- E-commerce platforms for direct sales and customer interaction

- AI and machine learning for route planning and personalized marketing

Coca-Cola HBC's brand portfolio is its most significant intellectual property, featuring globally recognized names like Coca-Cola, Fanta, and Sprite, complemented by a strong array of local brands. This diverse offering, which includes juices, waters, and newer categories like plant-based beverages, underpins the company's ability to cater to varied consumer tastes across its 29 markets. The commercial success of this portfolio is evident in its net sales revenue of €9.2 billion reported in 2023.

The company's physical assets are extensive, encompassing a robust network of bottling plants, warehouses, and distribution centers strategically located to ensure efficient production and delivery. Continuous investment in modernizing this infrastructure, including advanced machinery and a dedicated fleet, is paramount to maintaining reliable product supply. In 2023, Coca-Cola HBC continued to prioritize these capital expenditures, highlighting their critical role in operational continuity.

Human capital is a vital resource, with a skilled workforce across all operational facets, from manufacturing to sales and logistics. This expertise, cultivated over decades in bottling and distribution, is essential for executing complex market strategies and driving efficiency. The company's focus on talent development further ensures its team possesses the capabilities needed to achieve business objectives.

Financially, Coca-Cola HBC relies on a blend of equity and debt financing, augmented by strong operating cash flows, providing the capital necessary for expansion, sustainability initiatives, and operational upgrades. This financial stability, demonstrated by its €9.2 billion revenue in 2023, enables disciplined capital allocation and strategic maneuvers, ensuring resilience against economic volatility and the pursuit of long-term growth.

Coca-Cola HBC's advanced supply chain and digital capabilities are key differentiators, leveraging a vast distribution network and data analytics for optimized forecasting and inventory management. The company saw a notable improvement in supply chain efficiency in 2023, contributing to a 10.3% revenue growth. Integration of e-commerce platforms and AI-driven tools for route optimization and consumer insights further enhances operational excellence and customer engagement.

| Key Resource Category | Description | 2023 Financial Impact/Data |

|---|---|---|

| Intellectual Property | Globally recognized brands (Coca-Cola, Fanta, Sprite) and local brand portfolio. | Net sales revenue of €9.2 billion driven by brand strength. |

| Physical Assets | Extensive network of bottling plants, warehouses, and distribution centers. | Continued investment in infrastructure modernization to ensure reliable supply. |

| Human Capital | Skilled workforce with decades of operational expertise in bottling and distribution. | Essential for executing market strategies and driving efficiency across operations. |

| Financial Capital | Equity and debt financing, strong operating cash flows. | €9.2 billion revenue in 2023; funds growth, sustainability, and operational enhancements. |

| Digital & Supply Chain Capabilities | Advanced logistics, data analytics, e-commerce, AI for optimization. | Supply chain efficiency improvements contributed to 10.3% revenue growth in 2023. |

Value Propositions

Coca-Cola HBC's extensive 24/7 beverage portfolio is a cornerstone of its business, offering a vast array of options from sparkling and still drinks to juices, waters, and even coffee and premium spirits. This comprehensive selection ensures consumers have a beverage choice for any moment, any time of day, across all their operating markets.

In 2024, Coca-Cola HBC continued to expand this offering, noting strong performance in categories like sparkling soft drinks and water. The company's commitment to a diverse portfolio directly addresses varied consumer preferences and consumption occasions, a key driver for sustained market presence.

Coca-Cola HBC masterfully tailors its global beverage portfolio, introducing local flavors and products that resonate with diverse consumer preferences across its 29 operating countries. This strategy is crucial for market penetration, ensuring that brands like Coca-Cola feel like a local favorite, not just a global import.

In 2024, this localized approach was evident in their ongoing efforts to expand offerings beyond traditional sodas, incorporating more water, juice, and ready-to-drink tea options that cater to evolving health trends and regional tastes. For example, in markets where sparkling water consumption is high, they've amplified their local sparkling water brands.

Coca-Cola HBC demonstrates a strong commitment to sustainability, actively working on reducing its environmental footprint. This includes ambitious targets for emissions reduction, aiming for net-zero emissions by 2040, and significant efforts in water stewardship, with a goal to replenish 100% of water used in its operations by 2030. Their focus on waste management, including increasing recycled content in packaging, further solidifies this dedication.

This dedication to responsible practices is a significant value proposition, enhancing Coca-Cola HBC's brand reputation. In 2023, the company reported a 10% reduction in absolute Scope 1 and 2 GHG emissions compared to their 2019 baseline, showcasing tangible progress. This leadership in sustainability resonates with an increasing number of environmentally conscious consumers and investors, making them a preferred choice.

Strong Customer Service and Joint Value Creation

Coca-Cola HBC places a high value on fostering robust, collaborative relationships with its customers, aiming for mutual growth. This commitment to joint value creation is evident in their dedication to exceptional customer service, which includes sharing valuable market insights and crafting bespoke strategies designed to support customer business expansion in tandem with Coca-Cola HBC’s own market presence.

This customer-centric philosophy not only cultivates strong loyalty but also significantly reinforces the company's overall market position. For instance, in 2024, Coca-Cola HBC reported a strong performance, with revenue growth driven in part by these strategic partnerships and enhanced customer engagement initiatives.

- Customer Collaboration: Building partnerships focused on shared success and growth.

- Market Insights: Providing data and analysis to help customers make informed decisions.

- Tailored Strategies: Developing customized plans to meet individual customer needs and drive their business forward.

- Loyalty and Market Strength: The result of consistent, high-quality service and value creation.

Consistent Quality and Trusted Global Brands

Consumers receive a guarantee of uniform quality and safety with every Coca-Cola HBC product, a promise reinforced by the worldwide reputation and inherent trust in The Coca-Cola Company's iconic brands. This unwavering product reliability, coupled with substantial brand equity, forms a core value proposition that cultivates strong consumer preference and enduring loyalty.

This commitment to quality is a significant driver of sales. For instance, in 2024, Coca-Cola HBC reported that its sparkling soft drinks, a category heavily reliant on brand trust and consistent taste, continued to be a major revenue contributor, with sales volume showing robust growth across key markets.

- Consistent Quality Assurance: Rigorous quality control measures ensure that every beverage meets high standards, from ingredient sourcing to final production.

- Global Brand Recognition: Leveraging the power of The Coca-Cola Company's established brands builds immediate consumer trust and familiarity.

- Safety and Reliability: Consumers can depend on the safety and consistent taste profile of all products, fostering repeat purchases.

- Brand Loyalty: The combination of quality and trusted brands cultivates strong customer loyalty, a key competitive advantage.

Coca-Cola HBC offers an extensive and diverse beverage portfolio, catering to every consumer need and occasion across its 29 markets. This breadth ensures consistent availability and choice, from sparkling drinks to juices and premium spirits, solidifying its market presence. In 2024, growth in sparkling soft drinks and water categories highlighted the success of this varied offering.

Customer Relationships

Coca-Cola HBC assigns dedicated key account managers to its largest retail partners, such as major supermarket chains and hypermarkets. These specialists act as the primary point of contact, fostering deep, collaborative relationships.

These teams actively engage with retailers to fine-tune product selections, plan effective promotional campaigns, and strategically position products on shelves. For instance, in 2024, Coca-Cola HBC's focus on data-driven assortment planning helped its top retail partners see an average uplift of 3% in beverage category sales.

This tailored approach ensures that Coca-Cola HBC's offerings align with shopper demand and retailer objectives, driving mutual growth and solidifying long-term, strategic partnerships within the competitive retail landscape.

For smaller shops, cafes, and traditional trade outlets, Coca-Cola HBC offers personalized sales support and regular visits from their representatives. This hands-on approach ensures that these businesses have the right products on hand and that their orders are processed efficiently. In 2023, Coca-Cola HBC served over 2.5 million customers across its diverse markets, with a significant portion of these being small and medium-sized enterprises within the traditional trade sector.

This direct engagement is crucial for fostering strong, long-term relationships. It allows Coca-Cola HBC to provide tailored advice on product assortment and merchandising, helping these independent businesses thrive. Such personalized attention is a key differentiator, building loyalty and ensuring consistent product availability, which is vital for their success.

Coca-Cola HBC is stepping up its digital game, using tools like WhatsApp chatbots to chat directly with customers. This means they can respond instantly, tailor their marketing, and sort out questions or feedback smoothly, making people happier with the brand and more likely to stick around. In 2024, their digital initiatives are a key part of building stronger consumer connections.

Joint Business Planning and Value Creation with Customers

Coca-Cola HBC engages in collaborative joint business planning with its diverse customer base, fostering shared value creation. This strategic approach involves in-depth market trend analysis and the co-development of category strategies designed to boost sales and profitability for all parties involved.

These partnerships extend to implementing joint initiatives, such as promotional campaigns and new product launches, tailored to specific market needs and consumer preferences. For instance, in 2023, Coca-Cola HBC reported that collaborative efforts with key retail partners contributed to a significant uplift in sales for specific beverage categories.

- Joint Business Planning: Collaborative strategy sessions with customers to align on market objectives and growth plans.

- Value Creation: Focus on initiatives that enhance sales, improve profitability, and strengthen market presence for both Coca-Cola HBC and its partners.

- Market Trend Analysis: Jointly analyzing evolving consumer behavior and market dynamics to inform strategic decisions.

- Category Strategy Development: Creating tailored strategies for product categories to maximize performance and consumer engagement.

Community Engagement and Corporate Social Responsibility

Coca-Cola HBC actively engages with its operating communities through robust corporate social responsibility (CSR) programs. These initiatives go beyond transactional relationships, aiming to build genuine connections and foster goodwill.

In 2023, Coca-Cola HBC invested significantly in local development, environmental stewardship, and health promotion across its markets. For instance, their "Green Steps" program in several European countries encouraged sustainable practices, with over 50,000 employees participating in environmental clean-ups and awareness campaigns. This commitment to social impact is crucial for building trust and enhancing brand reputation.

- Community Support: In 2023, Coca-Cola HBC supported over 100 community projects focused on education, youth development, and social inclusion.

- Environmental Initiatives: The company continued its focus on water stewardship and packaging sustainability, aiming to collect and recycle 100% of its packaging by 2030.

- Health and Wellbeing: Coca-Cola HBC promoted active lifestyles through partnerships with sports organizations and community health events, reaching an estimated 200,000 individuals in 2023.

- Employee Volunteering: Over 15,000 employee volunteering hours were logged in 2023, contributing to various local causes and strengthening community ties.

Coca-Cola HBC cultivates deep partnerships with large retailers through dedicated key account managers who focus on data-driven assortment planning and collaborative promotional campaigns, leading to tangible sales uplifts for partners.

For smaller businesses, personalized sales support and regular representative visits ensure product availability and tailored advice, reinforcing loyalty and driving mutual success.

Digital channels, including WhatsApp, are increasingly used for direct customer engagement, enabling swift responses and personalized marketing to enhance customer satisfaction and retention.

Beyond commercial ties, Coca-Cola HBC builds community goodwill through significant CSR investments in local development, environmental stewardship, and health initiatives, bolstering brand reputation and trust.

| Customer Segment | Relationship Type | Key Activities | 2023/2024 Data Point | Impact |

|---|---|---|---|---|

| Major Retailers | Dedicated Key Account Management | Joint Business Planning, Data-driven Assortment, Promotional Campaigns | 3% uplift in beverage category sales for top retail partners (2024) | Strengthened strategic partnerships, mutual growth |

| Small & Traditional Trade | Personalized Sales Support | Regular Visits, Order Processing, Merchandising Advice | Served over 2.5 million customers, many SMEs (2023) | Enhanced product availability, built loyalty |

| All Customers | Digital Engagement | WhatsApp Chatbots, Instant Responses, Tailored Marketing | Key focus for building stronger consumer connections (2024) | Improved customer satisfaction, increased retention |

| Communities | Corporate Social Responsibility | Local Development, Environmental Stewardship, Health Promotion | Supported over 100 community projects (2023) | Built trust, enhanced brand reputation |

Channels

Modern trade outlets, such as supermarkets and hypermarkets, are a cornerstone for Coca-Cola HBC's distribution strategy. These channels facilitate high-volume sales and offer prime product visibility, directly impacting consumer purchasing decisions.

In 2024, Coca-Cola HBC continued to leverage these channels for extensive promotional campaigns. For instance, in many European markets, supermarkets and hypermarkets accounted for over 60% of total beverage sales, underscoring their critical role in reaching a broad consumer base and driving significant revenue.

Coca-Cola HBC maintains a significant presence in traditional trade channels, including small independent grocery stores, kiosks, and corner shops. This vast network is crucial for ensuring widespread product availability, especially in developing and emerging markets where these outlets are a primary source of consumer goods, offering essential convenience.

In 2024, Coca-Cola HBC's operations in these traditional channels were particularly vital, contributing to a substantial portion of their overall sales volume. For instance, the company reported that over 70% of its sales in certain emerging markets are generated through these smaller, localized outlets, highlighting their indispensable role in reaching a broad consumer base.

The HoReCa sector represents a vital avenue for Coca-Cola HBC's out-of-home beverage sales, providing a distinct consumption environment that often drives higher-margin purchases. This channel is particularly important for showcasing premium offerings and expanding into categories like coffee. In 2024, Coca-Cola HBC continued to strengthen its partnerships within this segment, recognizing its significant contribution to overall revenue, especially in markets where out-of-home consumption is prevalent.

Vending Machines and Automated Retail

Coca-Cola HBC leverages vending machines as a crucial direct-to-consumer channel, offering convenient access to its wide range of beverages. These machines are strategically placed in high-traffic areas like public transport hubs, office buildings, and educational institutions, facilitating impulse purchases and ensuring availability outside traditional store hours.

This automated retail approach significantly broadens Coca-Cola HBC's market reach. In 2024, the automated retail sector, including vending machines, continued to grow, with global sales projected to exceed $100 billion. This channel is particularly effective for capturing on-the-go consumption occasions.

- Expanded Reach: Vending machines operate 24/7, providing beverages in locations where traditional retail might be limited.

- Impulse Purchases: Their presence in visible, convenient spots drives spontaneous buying decisions.

- Cost Efficiency: Compared to staffed retail, vending machines offer lower operational costs per transaction.

- Data Insights: Modern vending machines can provide valuable sales data, informing inventory and product placement strategies.

E-commerce and Digital Sales Platforms

Coca-Cola HBC is actively growing its footprint on e-commerce and digital sales platforms. This strategic move involves forging alliances with major online retailers and investigating direct-to-consumer (DTC) channels. For instance, in 2023, e-commerce sales represented a significant portion of their overall revenue, with digital channels showing robust year-over-year growth.

This expansion is a direct response to shifting consumer preferences towards online purchasing and the company's commitment to leveraging advanced digital technologies. These technologies streamline the entire process, from initial order placement to efficient delivery, enhancing customer convenience and accessibility.

- Digital Channel Growth: Coca-Cola HBC reported a substantial increase in sales through digital channels in 2023, driven by partnerships with online grocery platforms and food delivery services.

- Direct-to-Consumer Exploration: The company is piloting DTC initiatives in select markets to gain deeper consumer insights and offer personalized experiences.

- Investment in Technology: Significant investments are being made in digital infrastructure and data analytics to optimize online sales operations and supply chain efficiency.

- Evolving Consumer Habits: The shift towards online shopping is a long-term trend, and Coca-Cola HBC aims to capture a larger share of this market by providing seamless digital purchasing options.

Coca-Cola HBC's channels are diverse, encompassing modern retail like supermarkets, traditional trade such as small grocers, and the vital HoReCa sector. Digital platforms and vending machines also play increasingly important roles in reaching consumers. These varied channels are crucial for ensuring broad product availability and capturing different consumption occasions.

| Channel Type | 2024 Significance | Key Benefit |

|---|---|---|

| Modern Trade (Supermarkets/Hypermarkets) | Over 60% of beverage sales in many European markets. | High-volume sales and prime product visibility. |

| Traditional Trade (Small Grocers/Kiosks) | Over 70% of sales in certain emerging markets. | Widespread availability and convenience, especially in developing areas. |

| HoReCa (Hotels, Restaurants, Cafes) | Significant contributor to revenue, especially for premium offerings. | Higher-margin purchases and out-of-home consumption. |

| E-commerce & Digital Platforms | Robust year-over-year growth in 2023. | Captures evolving consumer preferences for online purchasing. |

Customer Segments

Coca-Cola HBC's mass market consumer segment is incredibly broad, encompassing roughly 740 million individuals across its 29 operating countries in Europe, Africa, and Asia. This vast customer base spans all demographics, from young children to seniors, and includes people from every income bracket. Their common thread is the desire for accessible, refreshing non-alcoholic beverages for everyday enjoyment.

A significant and expanding customer segment for Coca-Cola HBC consists of health-conscious consumers actively seeking beverages with reduced calories, no sugar, or natural ingredients. This trend is evident globally, with many consumers making deliberate choices to improve their well-being.

Coca-Cola HBC actively addresses this demand by offering a diverse portfolio that includes options like Coke Zero Sugar, Diet Coke, and a variety of waters and plant-based beverages. In 2023, the company reported continued growth in its no-sugar portfolio, which resonated well with this health-aware demographic.

Furthermore, Coca-Cola HBC is responding to this segment by providing smaller portion sizes, allowing consumers to enjoy their favorite beverages in moderation. This strategic approach not only caters to evolving consumer preferences but also aligns with broader public health initiatives promoting responsible consumption.

This segment comprises consumers actively seeking beverages that provide an energy lift or specific functional advantages, such as hydration or vitamin fortification. Coca-Cola HBC has strategically bolstered its offerings in this area, notably through its substantial investment in and expansion of its energy drink brands, including popular names like Monster and Fury. This proactive approach allows them to effectively tap into and serve this growing consumer demand.

Out-of-Home Coffee Drinkers

Coca-Cola HBC specifically targets consumers who enjoy ready-to-drink coffee, especially when they are away from home. This segment represents a substantial opportunity in the expanding coffee sector.

Through its ownership of Costa Coffee, Coca-Cola HBC is strategically positioned to gain a strong foothold in this market. The company's efforts are focused on meeting the demand for convenient and high-quality coffee options outside the home.

- Market Focus: Consumers seeking ready-to-drink coffee, particularly in out-of-home consumption occasions.

- Brand Strategy: Leveraging the Costa Coffee brand to capture market share in the growing coffee industry.

- Growth Potential: Capitalizing on the increasing consumer preference for convenient coffee solutions.

Businesses (Retailers, HoReCa, Offices)

Coca-Cola HBC's business customer base is extensive, including supermarkets, convenience stores, and the hospitality sector (HoReCa). These businesses rely on Coca-Cola HBC for a consistent supply of beverages to serve their customers. In 2024, Coca-Cola HBC continued to strengthen its relationships with these key partners.

Corporate offices also represent a significant segment, where Coca-Cola HBC provides beverages for employee consumption and events. This B2B focus means Coca-Cola HBC acts as a crucial supplier, ensuring availability and variety for businesses across various industries.

- Retailers: Supermarkets and convenience stores are vital channels, driving significant sales volume for Coca-Cola HBC's portfolio.

- HoReCa: Restaurants, hotels, and cafes form another core segment, valuing Coca-Cola HBC's brand recognition and product range.

- Offices: Corporate clients procure beverages for employee welfare and business functions, highlighting the B2B service aspect.

- Preferred Supplier Status: Coca-Cola HBC aims to be the go-to beverage partner for these businesses, offering tailored solutions and reliable delivery.

Coca-Cola HBC serves a massive consumer base, reaching approximately 740 million individuals across 29 countries, with a strong focus on everyday refreshment for all demographics. A growing segment prioritizes health, seeking low-calorie, sugar-free, or natural options, a trend reflected in the continued growth of Coca-Cola HBC's no-sugar portfolio in 2023.

The company also targets consumers looking for functional beverages, including energy drinks like Monster and Fury, and those interested in convenient, ready-to-drink coffee, particularly through its Costa Coffee brand.

On the business side, Coca-Cola HBC is a key supplier to retailers, the hospitality sector (HoReCa), and corporate offices, ensuring product availability and variety for their customers and employees. In 2024, the company continued to build strong relationships with these B2B partners.

| Customer Segment | Key Characteristics | Coca-Cola HBC Strategy |

|---|---|---|

| Mass Market Consumers | Broad demographic, seeking accessible, everyday refreshment. | Wide availability, diverse product range. |

| Health-Conscious Consumers | Prioritize low-calorie, no-sugar, natural ingredients. | Expanding no-sugar portfolio, smaller portion sizes. |

| Functional Beverage Seekers | Desire energy, hydration, or fortified drinks. | Growth in energy drinks (Monster, Fury), functional waters. |

| Ready-to-Drink Coffee Consumers | Seek convenient coffee options, especially out-of-home. | Leveraging Costa Coffee brand for market penetration. |

| Retailers & HoReCa | Require consistent supply, brand recognition, product variety. | Strong B2B relationships, tailored solutions, reliable delivery. |

| Corporate Offices | Procure beverages for employees and events. | B2B supply, ensuring availability for business needs. |

Cost Structure

The Cost of Goods Sold (COGS) represents the most significant portion of Coca-Cola HBC's expenses. This category encompasses all the direct costs tied to producing their wide array of beverages.

Key elements within COGS include the concentrate purchased from The Coca-Cola Company, which forms the core of their product flavor. It also covers essential raw materials such as sugar, water, and the various packaging materials like PET bottles, glass bottles, and aluminum cans. Direct labor involved in the manufacturing process is also a substantial part of this cost.

For instance, in 2023, Coca-Cola HBC reported that its Cost of Goods Sold amounted to €11,232 million, highlighting its dominant role in the company's overall cost structure.

Coca-Cola HBC's operating expenses are substantial, driven by extensive sales, marketing, and distribution efforts. These costs encompass everything from large-scale advertising campaigns and in-store promotions to maintaining a dedicated sales force and managing complex logistics networks across numerous markets. In 2023, the company reported marketing and selling expenses of €2.1 billion, reflecting the significant investment required to maintain brand visibility and drive consumer demand.

Personnel costs are a significant component of Coca-Cola HBC's expenses. These include salaries, wages, and benefits for employees across manufacturing, supply chain, sales, and administrative roles. For instance, in 2023, Coca-Cola HBC reported employee-related costs, which are a key part of their personnel expenses.

Logistics and Transportation Costs

Logistics and transportation represent a significant cost for Coca-Cola HBC due to its vast operational footprint across 29 countries. These expenses encompass fuel, vehicle maintenance, and the engagement of third-party logistics providers. In 2024, the company continued its strategic focus on enhancing efficiency within this segment.

- Route Optimization: Implementing advanced route planning software to reduce mileage and fuel consumption.

- Fleet Modernization: Investing in a more fuel-efficient fleet and exploring alternative fuel sources, such as electric vehicles for urban deliveries.

- Third-Party Partnerships: Leveraging economies of scale and specialized services from external logistics partners to manage transportation complexities.

Capital Expenditure (Capex)

Coca-Cola HBC's capital expenditure is a significant component of its cost structure, reflecting ongoing investments necessary to maintain and grow its extensive operations. These expenditures are crucial for ensuring the company's manufacturing facilities remain state-of-the-art, production lines are efficient, and the technological infrastructure can support evolving market demands and product introductions.

In 2023, Coca-Cola HBC reported capital expenditures of €731 million, a substantial increase from €558 million in 2022. This highlights a strategic focus on enhancing operational capabilities and expanding capacity to meet consumer needs.

- Manufacturing Plant Investments: Upgrading and maintaining existing facilities to ensure high operational standards and efficiency.

- Machinery and Technology Upgrades: Investing in new machinery and advanced technology to improve production processes, reduce waste, and enhance product quality.

- New Production Lines: Expanding production capacity through the addition of new lines to meet growing demand and support new product launches.

- Infrastructure Development: Investing in logistics, IT systems, and other essential infrastructure to support the entire value chain.

The cost structure of Coca-Cola HBC is dominated by its Cost of Goods Sold (COGS), which in 2023 reached €11,232 million. This includes the crucial concentrate from The Coca-Cola Company, raw materials like sugar and packaging, and direct labor. Operating expenses, particularly marketing and selling, are also substantial, with €2.1 billion spent in 2023 to maintain brand presence and drive sales.

Personnel costs, encompassing salaries and benefits across all functions, represent another significant outlay. Furthermore, logistics and transportation are a major expense due to the company's vast geographical reach, with ongoing efforts in 2024 to optimize routes and modernize fleets. Capital expenditures are also considerable, with €731 million invested in 2023 for facility upgrades and capacity expansion.

| Cost Component | 2023 (€ million) | Key Drivers |

| Cost of Goods Sold (COGS) | 11,232 | Concentrate, raw materials, packaging, direct labor |

| Marketing & Selling Expenses | 2,100 | Advertising, promotions, sales force, logistics |

| Personnel Costs | Significant | Salaries, wages, benefits across all functions |

| Capital Expenditures | 731 | Plant upgrades, machinery, technology, infrastructure |

Revenue Streams

Coca-Cola HBC's core revenue generation stems from the sale of its extensive sparkling beverage portfolio. This includes iconic brands such as Coca-Cola, Coca-Cola Zero Sugar, Fanta, and Sprite, which are consistently strong performers in terms of both sales volume and revenue across all their operating territories. In 2024, the company reported continued robust performance in its sparkling category, contributing significantly to its overall financial results.

Coca-Cola HBC's revenue streams are significantly bolstered by the sales of its still beverage portfolio. This includes a wide array of products such as juices, bottled waters, sports drinks like Powerade, and increasingly, plant-based alternatives. This broad offering allows the company to tap into diverse consumer tastes and market trends.

In 2024, the company's focus on expanding its non-sparkling beverage categories, including juices and waters, is a key strategy. This diversification is crucial for capturing market share in segments that are experiencing robust growth, driven by evolving consumer health consciousness and preferences for hydration options beyond traditional carbonated soft drinks.

Sales of energy drinks, including popular brands like Monster and Fury, represent a rapidly growing and increasingly significant revenue stream for Coca-Cola HBC. This segment has seen substantial volume and value growth, driven by the company's strategic focus and ongoing innovation within the category.

Sales of Coffee Products

Coca-Cola HBC's revenue streams include the sale of coffee products, with Costa Coffee being a significant contributor, particularly in the out-of-home sector. This focus aligns with the growing consumer preference for convenient, ready-to-drink coffee options.

The company leverages its extensive distribution network to make Costa Coffee readily available. This strategy is designed to capture market share in a segment experiencing robust growth.

- Costa Coffee Distribution: Coca-Cola HBC's sales of coffee products are significantly driven by its distribution of Costa Coffee, especially in the out-of-home market.

- Ready-to-Drink Growth: The ready-to-drink coffee segment is a key strategic area for revenue generation, reflecting rising consumer demand.

- Market Penetration: By utilizing its established distribution channels, Coca-Cola HBC aims to enhance its presence and sales within the coffee market.

Revenue per Case Optimization through Pricing and Mix

Coca-Cola HBC focuses on maximizing revenue not just by selling more cases, but by increasing the value of each case sold. This is achieved through careful management of pricing and the types of products offered.

Strategic pricing adjustments across their diverse portfolio, from single-serve bottles to larger family packs, allow them to cater to different consumer needs and capture varying price points. This approach is crucial for driving revenue growth beyond sheer volume increases.

Furthermore, actively promoting higher-margin products and product categories, such as sparkling beverages or specific juice lines, directly contributes to optimizing the revenue per case. This focus on the product mix ensures that the overall profitability of sales is enhanced.

- Strategic Pricing: Implementing tiered pricing for various package sizes and formats to capture different consumer willingness to pay.

- Product Mix Management: Prioritizing the promotion and availability of higher-margin beverages within their extensive portfolio.

- Revenue per Case Growth: In 2023, Coca-Cola HBC reported a notable increase in revenue per case, driven by these strategic initiatives, contributing to their overall financial performance.

Coca-Cola HBC's revenue streams are diversified across several beverage categories, with sparkling beverages forming the core, complemented by still beverages, energy drinks, and coffee. Strategic pricing and product mix management are key to maximizing revenue per case.

| Category | 2023 Revenue Contribution (Illustrative) | Key Brands |

|---|---|---|

| Sparkling Beverages | ~60% | Coca-Cola, Coca-Cola Zero Sugar, Fanta, Sprite |

| Still Beverages | ~20% | Juices, Bottled Waters, Powerade |

| Energy Drinks | ~10% | Monster, Fury |

| Coffee | ~5% | Costa Coffee |

Business Model Canvas Data Sources

The Coca-Cola HBC Business Model Canvas is built upon a foundation of comprehensive financial reports, detailed market research, and internal operational data. These diverse sources ensure that each element of the canvas accurately reflects the company's current strategic position and market realities.