Coca-Cola HBC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola HBC Bundle

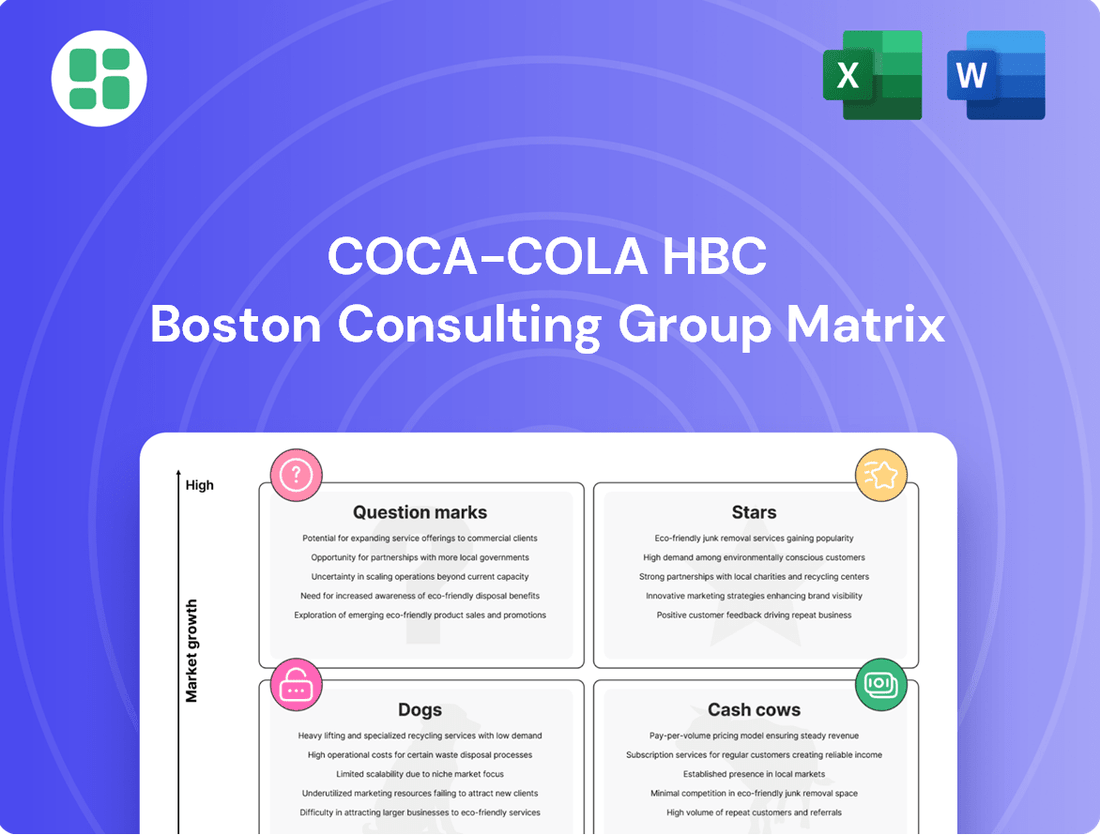

Coca-Cola HBC's BCG Matrix offers a fascinating glimpse into its diverse product portfolio, categorizing brands into Stars, Cash Cows, Dogs, and Question Marks. Understanding these placements is crucial for strategic decision-making and resource allocation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Coca-Cola HBC.

Stars

Coca-Cola HBC's energy drink segment, spearheaded by Monster, is a significant growth engine. In 2024, volumes for these beverages skyrocketed by an impressive 30.2%, continuing a remarkable nine-year streak of double-digit growth. This robust performance underscores the category's status as a star within Coca-Cola HBC's portfolio, contributing substantially to overall organic revenue and value share gains in the NARTD market.

The strategic expansion of products like Monster Energy Green Zero Sugar into 16 new markets highlights Coca-Cola HBC's commitment to capitalizing on the surging demand for functional beverages. Europe's energy drink market is booming, fueled by consumer interest in products offering enhanced benefits. Coca-Cola HBC's established distribution prowess and its strong alliance with Monster are key enablers, solidifying their leading position in this dynamic and expanding sector.

Costa Coffee's ready-to-drink (RTD) offerings are a significant driver for Coca-Cola HBC, showcasing impressive expansion. In 2024, coffee volumes surged by 23.9%, a testament to the growing consumer appetite for convenient, quality coffee beverages.

This remarkable growth isn't confined to a single region; it's a company-wide phenomenon across all operating segments. Coca-Cola HBC is strategically enhancing its presence in the out-of-home sector, a key lever for boosting revenue share in the coffee category.

The broader European beverage market further underscores coffee's prominence as a growth engine. Consumers are increasingly prioritizing variety and healthier choices, a trend that Costa Coffee's RTD portfolio is well-positioned to capitalize on.

Coca-Cola Zero Sugar is a shining star for Coca-Cola HBC, demonstrating robust mid-single digit volume growth in 2024. This success is fueled by the powerful Coca-Cola brand equity, maintaining a high market share while capitalizing on the increasing consumer demand for low-sugar options in the sparkling beverage market.

The company's strategic emphasis on reduced-calorie and no-calorie products, with 59% of its stock keeping units (SKUs) fitting this profile in 2024, highlights Coke Zero Sugar's pivotal role as a key growth engine. This performance underscores effective marketing initiatives and successful consumer acquisition within a competitive yet evolving sparkling beverage sector.

Adult Sparkling Beverages

Coca-Cola HBC is strategically investing in and expanding its Adult Sparkling beverages. This segment is a key driver for improvements in category mix and revenue per case, as seen in their 2024 performance. The company is tapping into a premiumization trend, offering consumers more sophisticated non-alcoholic choices.

This focus on mixability and premium adult sparkling drinks highlights a high-growth niche within the broader sparkling beverage market. It showcases Coca-Cola HBC's capacity for innovation, allowing them to capture new consumer occasions and diversify their offerings within established categories.

- Adult Sparkling Beverages contribute to improved category mix and revenue per case in 2024.

- This segment appeals to the premiumization trend in non-alcoholic options.

- The focus on mixability and premium offerings signifies a high-growth niche.

- Demonstrates company's innovation in capturing new consumer occasions.

Premium Spirits (e.g., Finlandia Vodka distribution)

Coca-Cola HBC's venture into premium spirits distribution, exemplified by the expansion of Finlandia Vodka across 19 new markets, signifies a strategic move into a high-growth, high-potential segment. This diversification capitalizes on their established distribution infrastructure and existing customer ties, broadening their offering beyond non-alcoholic beverages for a comprehensive 24/7 consumer engagement.

The integration of Finlandia is projected to have a substantial positive impact on comparable EBIT, underscoring its strategic value and future growth trajectory. This expansion into the premium alcohol market aligns with their strategy to capture value in a growing consumer category.

- Finlandia Vodka Distribution: Expanded into 19 new markets.

- Strategic Importance: Diversifies portfolio beyond non-alcoholic beverages.

- Financial Impact: Expected to significantly contribute to comparable EBIT.

- Market Position: Captures value in the growing premium alcohol segment.

Coca-Cola HBC's energy drink segment, led by Monster, is a standout star, achieving a remarkable 30.2% volume growth in 2024. This continues a nine-year trend of double-digit expansion, significantly boosting organic revenue. The strategic rollout of products like Monster Energy Green Zero Sugar into 16 new markets capitalizes on the increasing demand for functional beverages, solidifying Coca-Cola HBC's leading position.

Coca-Cola Zero Sugar also shines as a star, delivering robust mid-single digit volume growth in 2024. This success is driven by strong brand equity and the growing consumer preference for low-sugar options, with 59% of Coca-Cola HBC's SKUs being reduced or no-calorie in 2024. Effective marketing and consumer acquisition strategies are key to its dominance in the sparkling beverage sector.

Costa Coffee's ready-to-drink (RTD) offerings are another star performer, with volumes surging by 23.9% in 2024. This growth across all operating segments, particularly in the out-of-home sector, reflects the rising consumer demand for convenient and quality coffee beverages. The company's focus on premiumization and variety positions Costa Coffee RTD for continued success.

| Category | 2024 Volume Growth | Key Drivers | Strategic Focus |

|---|---|---|---|

| Energy Drinks (Monster) | 30.2% | Functional beverage demand, market expansion | Capitalizing on growth, distribution prowess |

| Coca-Cola Zero Sugar | Mid-single digit | Brand equity, low-sugar preference | Marketing, consumer acquisition |

| Costa Coffee RTD | 23.9% | Convenience, quality, out-of-home growth | Portfolio expansion, market presence |

What is included in the product

This BCG Matrix overview provides strategic insights into Coca-Cola HBC's portfolio, highlighting units for investment, holding, or divestment.

A clear Coca-Cola HBC BCG Matrix overview helps identify underperforming Stars, relieving the pain of inefficient resource allocation.

Cash Cows

Coca-Cola (Classic) is the undisputed cash cow for Coca-Cola HBC, holding a dominant market share within the mature sparkling beverage sector. In 2024, this iconic brand continued to be a bedrock of the company's performance, demonstrating resilience and consistent demand.

Despite the overall maturity of the sparkling drinks market, Trademark Coke consistently delivers low-single digit volume growth, a testament to its enduring appeal and robust distribution network. This steady performance translates directly into substantial contributions to Coca-Cola HBC's organic revenue streams.

With an exceptionally strong brand loyalty and availability across 29 diverse markets, Coca-Cola (Classic) reliably generates high cash flow and profitability. The company's ongoing strategic investments in marketing and distribution for this flagship product solidify its position as a consistent and predictable source of financial strength.

Fanta, a cornerstone of Coca-Cola HBC's beverage offerings, exemplifies a classic Cash Cow within their BCG matrix. Its established presence and broad consumer appeal across diverse European, African, and Asian markets translate into consistent, high-volume sales.

In 2024, while the overall sparkling beverage category saw modest growth of 1.5%, Fanta's performance underscored its role as a stable, cash-generating asset. This reliability stems from its mature market position, necessitating less aggressive marketing spend than emerging brands.

The brand's enduring popularity means it requires minimal investment to maintain its market share, allowing it to reliably funnel profits back into the Coca-Cola HBC business. Fanta's consistent contribution is a key factor in the company's robust financial performance.

Sprite stands as a significant sparkling beverage within Coca-Cola HBC's extensive portfolio, bolstering the company's overall market presence in the carbonated soft drink sector.

Operating in a well-established market, Sprite benefits from high brand recognition and enduring consumer demand, translating into reliable cash flow generation for Coca-Cola HBC.

Despite some fluctuations in the broader sparkling beverage category, Sprite demonstrated resilience, maintaining growth in key periods. For instance, in the first half of 2024, Coca-Cola HBC reported that sparkling beverages, including Sprite, saw a volume increase of 4.3%, underscoring its robust performance.

Its deeply entrenched distribution network and loyal customer base solidify Sprite's position as a consistent and valuable cash provider for the company.

Cappy Juices

Cappy juices stand as a cornerstone within Coca-Cola HBC's beverage offerings, firmly positioned in mature juice markets across its operational regions. The brand benefits from a long history and a wide appeal, securing a substantial market share even as the overall juice category sees moderate growth. For instance, in 2023, Coca-Cola HBC reported that its juice category, which includes Cappy, contributed significantly to its overall revenue, demonstrating the brand's consistent performance.

- Stable Market Share: Cappy maintains a strong position in established juice markets, benefiting from brand loyalty and widespread distribution.

- Consistent Cash Flow: The brand generates reliable income with minimal need for significant new investments to drive growth, characteristic of a cash cow.

- Portfolio Diversification: Cappy provides a stable revenue stream, balancing out more volatile segments within Coca-Cola HBC's diverse product lineup.

- Contribution to Revenue: In 2023, Coca-Cola HBC's juice segment was a key contributor to its financial results, underscoring Cappy's importance.

Valser Water

Valser, a cornerstone of Coca-Cola HBC's portfolio, functions as a classic Cash Cow within the BCG Matrix. Its strength is particularly evident in the Swiss market, a mature yet consistently in-demand bottled water segment.

This high-quality water brand enjoys a substantial market share in its primary territories, translating into a predictable and robust stream of cash flow for Coca-Cola HBC. The bottled water category itself demonstrates resilience, with still water segments projected to see mid-single digit growth in 2024, underscoring Valser's role as a dependable revenue generator.

- Brand Strength: Valser is a well-established, high-quality water brand with a strong presence, particularly in Switzerland.

- Market Position: It holds a significant market share in its core regions, contributing reliably to Coca-Cola HBC's overall performance.

- Market Dynamics: The bottled water market is mature but essential, offering stable demand and consistent profitability.

- Financial Contribution: Valser generates significant and predictable cash flow, characteristic of a Cash Cow, supported by stable market growth, with the still water category expected to grow in the mid-single digits in 2024.

Schweppes, a prominent brand in Coca-Cola HBC's portfolio, operates as a significant Cash Cow. Its established presence in the mature mixer and adult beverage segment ensures consistent revenue generation with limited need for substantial investment. The brand benefits from strong brand equity and a loyal consumer base across its operating markets.

In 2024, the adult sparkling beverage category, where Schweppes is a key player, demonstrated steady performance. Coca-Cola HBC reported that its adult beverages segment contributed positively to overall growth, with brands like Schweppes showing resilience. This stability is driven by consistent demand for its core products, allowing it to be a reliable source of cash for the company.

Schweppes' ability to maintain its market position with moderate marketing expenditure highlights its Cash Cow status. Its consistent profitability and substantial cash flow generation are vital for funding other strategic initiatives within Coca-Cola HBC's broader business operations.

| Brand | Category | BCG Status | Key Characteristics | 2024 Relevance |

| Schweppes | Mixers/Adult Beverages | Cash Cow | Established brand, strong equity, loyal consumers, consistent demand. | Steady revenue contributor, moderate marketing needs, reliable cash flow. |

Full Transparency, Always

Coca-Cola HBC BCG Matrix

The Coca-Cola HBC BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive upon purchase. This analysis provides a comprehensive strategic overview of Coca-Cola HBC's product portfolio, categorizing each item into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth rate. You can confidently use this exact report for immediate strategic decision-making, competitive analysis, and internal presentations without any further modifications.

Dogs

Within Coca-Cola HBC's extensive beverage portfolio, certain less popular local juice brands, distinct from the prominent Cappy line, might find themselves in a challenging position. These brands often contend with a low market share, particularly in regions where established local competitors or evolving consumer tastes limit their appeal.

These niche juice offerings frequently operate within mature or even shrinking local juice markets. Consumer preferences have been observed to shift towards healthier alternatives or different beverage categories, impacting the demand for traditional juices. For instance, in 2024, the global juice market experienced moderate growth, but regional variations are significant, with some established markets showing stagnation.

Consequently, these struggling brands typically contribute little to profit and cash flow. Their limited returns may not justify the resources allocated, making them candidates for divestiture or a thorough strategic review to assess their long-term viability within the company's broader objectives.

Within Coca-Cola HBC's portfolio, certain niche still drinks, outside of major growth areas like energy or coffee, may exhibit characteristics of cash traps. These could be products like heritage ready-to-drink teas or less common flavored waters that have struggled to gain significant market traction in slow-growing segments.

These niche beverages often demand considerable marketing investment relative to their sales volume, yielding minimal returns. Their continued inclusion in the product lineup is more likely a reflection of historical presence than a strategic bet on future expansion.

Within Coca-Cola HBC's extensive portfolio, certain niche regional carbonated soft drink brands may exhibit characteristics of Dogs. These are brands that, despite operating in markets where core sparkling offerings like Coca-Cola, Fanta, and Sprite remain dominant, struggle to gain significant traction. They might be legacy products that have seen declining consumer interest or face formidable competition from agile local beverage producers in specific, slower-growing territories.

The financial impact of these underperforming brands can be substantial if not managed. Their contribution to Coca-Cola HBC's overall volume and revenue is likely minimal, potentially even negative when factoring in the costs associated with their production, distribution, and marketing. For instance, if a brand's sales in a particular region barely cover its operational expenses, it becomes a drain on resources.

For example, if a small, regional cola brand in Eastern Europe only accounts for 0.1% of Coca-Cola HBC's total volume and has declining sales year-on-year, it fits the Dog profile. Such brands often represent a missed opportunity for investment in more promising segments of the business. They are prime candidates for a strategic review, which could lead to their discontinuation or a complete overhaul in their market approach to prevent them from becoming persistent cash drains.

Older, Less Innovative Packaging Formats

Older, less innovative packaging formats, particularly those that are less convenient or environmentally sustainable, can be categorized as 'Dogs' within Coca-Cola HBC's BCG Matrix. These formats might struggle to keep pace with evolving consumer demands for single-serve options or eco-friendly materials, directly impacting sales and market share. For instance, if a significant portion of Coca-Cola HBC's volume remains in multipacks that are difficult to recycle or in single-use plastics without clear recycling pathways, this segment could represent a 'Dog'.

The shift towards sustainable packaging is a key indicator of how Coca-Cola HBC is addressing these 'Dog' categories. By 2024, the company had set ambitious targets, aiming for 100% of its packaging to be recyclable, reusable, or compostable. Products still heavily reliant on packaging formats that do not meet these criteria, and which have not been updated to align with these sustainability goals, risk becoming 'Dogs'. This can lead to a decline in sales even for well-established brands, acting as a drain on resources and hindering overall efficiency and sustainability objectives.

- Packaging Sustainability Goals: Coca-Cola HBC aims for 100% of its packaging to be recyclable, reusable, or compostable by 2025. This 2024 progress report indicates that any packaging formats not meeting this standard are candidates for being classified as 'Dogs'.

- Consumer Preference Shift: In 2024, consumer demand for convenient, single-serve, and eco-friendly packaging continued to rise. Products predominantly offered in older, less adaptable formats may experience reduced sales velocity.

- Environmental Impact: Non-recyclable or difficult-to-recycle packaging formats contribute to environmental concerns, potentially leading to regulatory scrutiny and negative brand perception, further cementing their 'Dog' status.

Products with High Logistics Costs in Remote Markets

Certain products or brands distributed in very remote or challenging emerging markets, despite potential local demand, might incur disproportionately high logistics and distribution costs. If the sales volume and revenue generated from these specific products in such challenging regions are low, they can become Dogs due to unfavorable cost-to-revenue ratios.

The foreign exchange headwinds in emerging markets like Nigeria and Egypt, mentioned in 2024 reports, can exacerbate the unprofitability of such products. For instance, Coca-Cola HBC's operations in Nigeria faced significant currency devaluation challenges in 2024, impacting the cost of imported raw materials and the repatriation of profits, thereby increasing the effective cost of sales for products in that market.

- High Distribution Costs: Products in geographically dispersed or infrastructure-poor regions face elevated transportation expenses, potentially outweighing sales revenue.

- Low Sales Volume: Despite local presence, specific SKUs might not achieve sufficient sales velocity to offset these high operational costs.

- Currency Volatility: Fluctuations in exchange rates, as seen in markets like Egypt in 2024 where the Egyptian Pound experienced significant depreciation, directly inflate the cost of goods sold and reduce the local currency profitability of imported or dollar-denominated inputs.

- Profitability Assessment: These products require careful evaluation of market access strategies against their actual profitability, questioning continued investment if the cost-to-revenue ratio remains unfavorable.

Dogs within Coca-Cola HBC's portfolio represent brands or product lines with low market share in slow-growing or declining markets. These often require significant investment for minimal returns, acting as a drain on resources. For example, a niche regional carbonated soft drink with declining consumer interest in a specific territory would fit this category.

These underperformers contribute little to overall volume and revenue, and their continued existence may not align with strategic growth objectives. A prime example could be a legacy product facing strong competition from agile local players, resulting in a negative or negligible profit margin after accounting for operational costs.

The company's focus on sustainability, with a goal for 100% recyclable packaging by 2025, means older, less eco-friendly packaging formats also risk becoming Dogs. Products heavily reliant on these outdated formats, which do not meet evolving consumer demands for convenience and environmental responsibility, are likely to see reduced sales and become resource drains.

Furthermore, products distributed in remote or challenging emerging markets with high logistics costs and low sales volumes can also fall into the Dog category. Currency volatility, as experienced in markets like Nigeria in 2024, can further inflate costs and reduce profitability, making these products candidates for divestiture or a strategic overhaul.

| Category | Characteristics | Coca-Cola HBC Example (Illustrative) | Financial Impact |

|---|---|---|---|

| Dogs | Low market share, low growth market | Niche regional carbonated soft drink, legacy juice brand in a mature market | Minimal revenue, high cost-to-serve, potential cash drain |

| Packaging | Outdated, non-sustainable formats | Products primarily in non-recyclable single-use plastics | Reduced consumer appeal, potential regulatory risk, brand image impact |

| Distribution | High logistics cost, low sales volume in challenging markets | Specific SKUs in remote emerging markets with currency headwinds | Unfavorable cost-to-revenue ratio, reduced profitability |

Question Marks

Coca-Cola HBC's new plant-based beverages are entering a rapidly expanding European market fueled by consumer demand for healthier and more sustainable options. This segment is experiencing robust growth, with the plant-based milk market alone projected to reach over $15 billion in Europe by 2027, according to recent market analyses.

As a relatively new player in this dynamic category, these products likely represent question marks in the BCG matrix. While they tap into a high-growth area, their current market share may be modest compared to established brands, meaning they require substantial investment in marketing and distribution to build brand awareness and capture a significant portion of the market. For instance, initial marketing campaigns for new beverage lines often involve significant upfront costs for advertising and promotional activities to educate consumers about product benefits and differentiate them from competitors.

These plant-based offerings have the potential to evolve into Stars, but they currently demand considerable capital expenditure without a guaranteed immediate return. The investment is necessary to scale production, develop innovative product formulations, and establish a strong distribution network across diverse European markets. This investment phase is critical for building the foundation for future market leadership in this promising sector.

The functional beverage market, encompassing enhanced waters and innovative sports drinks, is a burgeoning sector driven by heightened consumer focus on wellness. Coca-Cola HBC's strategic expansion into its 24/7 portfolio, which includes these dynamic product lines, reflects a commitment to capturing this growth. While these beverages offer substantial potential, their market penetration in these specific niches is still evolving, necessitating ongoing investment in research, development, and marketing to establish a strong competitive presence.

Beyond the established Costa RTD range, Coca-Cola HBC is exploring innovative ready-to-drink coffee formats and unique flavor profiles. These emerging products are designed to tap into the dynamic and rapidly expanding RTD coffee market, which is showing significant growth potential. For instance, the global RTD coffee market was valued at approximately $36.7 billion in 2023 and is projected to reach $91.5 billion by 2032, exhibiting a CAGR of 10.7% during the forecast period.

These new offerings are currently in their nascent stages of market introduction, characterized by a low initial market share. Consequently, they necessitate substantial investment in marketing and consumer education to build awareness and drive adoption. The strategic objective is for these ventures to mature into Stars within the BCG matrix, mirroring Costa's success, though they carry the inherent risk of becoming Dogs if market acceptance falters.

Premiumisation of Water Portfolio (e.g., new sparkling water variants)

The global bottled water market, while mature, is experiencing a significant premiumization trend, particularly with the introduction of new sparkling water variants and functional waters. This segment offers substantial growth potential, with projections indicating continued expansion driven by evolving consumer preferences for healthier and more sophisticated beverage options. For instance, the global sparkling water market alone was valued at over $30 billion in 2023 and is expected to grow at a CAGR of approximately 6% through 2030, demonstrating the appeal of these premium offerings.

Coca-Cola HBC is actively participating in this premiumization drive by enhancing its water portfolio, focusing on mixability and introducing higher-value products. This strategic move aims to capture a larger share of the growing premium beverage segment. The company's investment in brands like Topo Chico, a premium sparkling mineral water, exemplifies this commitment. Topo Chico, in particular, has seen strong growth in key markets, contributing to the overall premiumization of Coca-Cola HBC's beverage offerings.

- Growth Potential: The premium water segment, including sparkling and functional variants, presents a high-growth avenue within a mature overall water market.

- Strategic Focus: Coca-Cola HBC is investing in brand building and distribution for these premium water offerings to capture higher price points and specific consumer niches.

- Market Penetration: New premium water variants typically start with a low initial market share but have the potential to gain traction if they resonate with consumers seeking enhanced beverage experiences.

- Investment Needs: Significant marketing and distribution investments are crucial for these products to establish a strong brand presence and achieve sustained growth in the competitive premium beverage landscape.

Digital and E-commerce Exclusive Product Lines

Coca-Cola HBC is actively expanding its digital and e-commerce presence, a move that includes exploring exclusive product lines tailored for these channels. This strategy aims to tap into the rapid growth of online sales, a segment that saw significant acceleration in 2024. For instance, many beverage companies reported double-digit growth in their e-commerce segments during the first half of 2024, underscoring the channel's importance.

These digitally-focused offerings, while promising high growth potential, might initially exhibit lower market share as they establish their online footprint and build consumer confidence. The investment required for these ventures is substantial, covering everything from sophisticated e-commerce platform development to specialized logistics for direct-to-consumer delivery and targeted digital marketing campaigns. For example, in 2024, major FMCG players increased their digital marketing spend by an average of 15% to support such initiatives.

- Digital Investment: Coca-Cola HBC is channeling resources into building robust e-commerce infrastructure and digital marketing capabilities.

- Market Entry Dynamics: New, online-exclusive products may start with a smaller market share, focusing on building digital presence and trust.

- Cost Considerations: Significant investment is necessary for platform development, specialized logistics, and online customer acquisition.

- Scalability Imperative: The success of these digital-first products hinges on rapid scaling within the online ecosystem to ensure profitability.

Coca-Cola HBC's emerging plant-based beverages are positioned as question marks due to their entry into a high-growth, yet competitive, European market. While consumer demand for these products is robust, with the plant-based milk sector alone projected to exceed $15 billion in Europe by 2027, these new offerings likely have a modest market share. Consequently, they require significant investment in marketing and distribution to build brand recognition and capture market share.

These products represent a strategic bet on future market trends, demanding substantial capital expenditure for scaling production and developing innovative formulations. The success of these question marks hinges on effectively converting initial investments into market leadership, similar to how established brands have grown. Failure to gain traction could result in them becoming Dogs, but the potential upside in a rapidly expanding market makes the investment compelling.

The company's expansion into functional beverages and innovative RTD coffee formats also places these product lines in the question mark category. For instance, the global RTD coffee market was valued at approximately $36.7 billion in 2023 and is projected to reach $91.5 billion by 2032. While these areas offer significant growth potential, their market penetration is still developing, necessitating ongoing investment in R&D and marketing to establish a strong competitive presence and potentially evolve into Stars.

Similarly, new digital-exclusive product lines face the question mark classification. The e-commerce segment saw significant acceleration in 2024, with many beverage companies reporting double-digit growth. These ventures require substantial investment in platform development, specialized logistics, and digital marketing to build online presence and consumer trust. The imperative is to scale rapidly within the online ecosystem to ensure profitability.

| Product Category | Market Growth | Current Market Share | Investment Needs | BCG Classification |

| Plant-Based Beverages | High | Low | High | Question Mark |

| Functional Beverages | High | Low | High | Question Mark |

| Innovative RTD Coffee | High | Low | High | Question Mark |

| Digital/E-commerce Exclusive Lines | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our Coca-Cola HBC BCG Matrix is constructed using a blend of internal financial disclosures, detailed market research reports, and competitor performance data to provide a comprehensive view.