CN SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CN Bundle

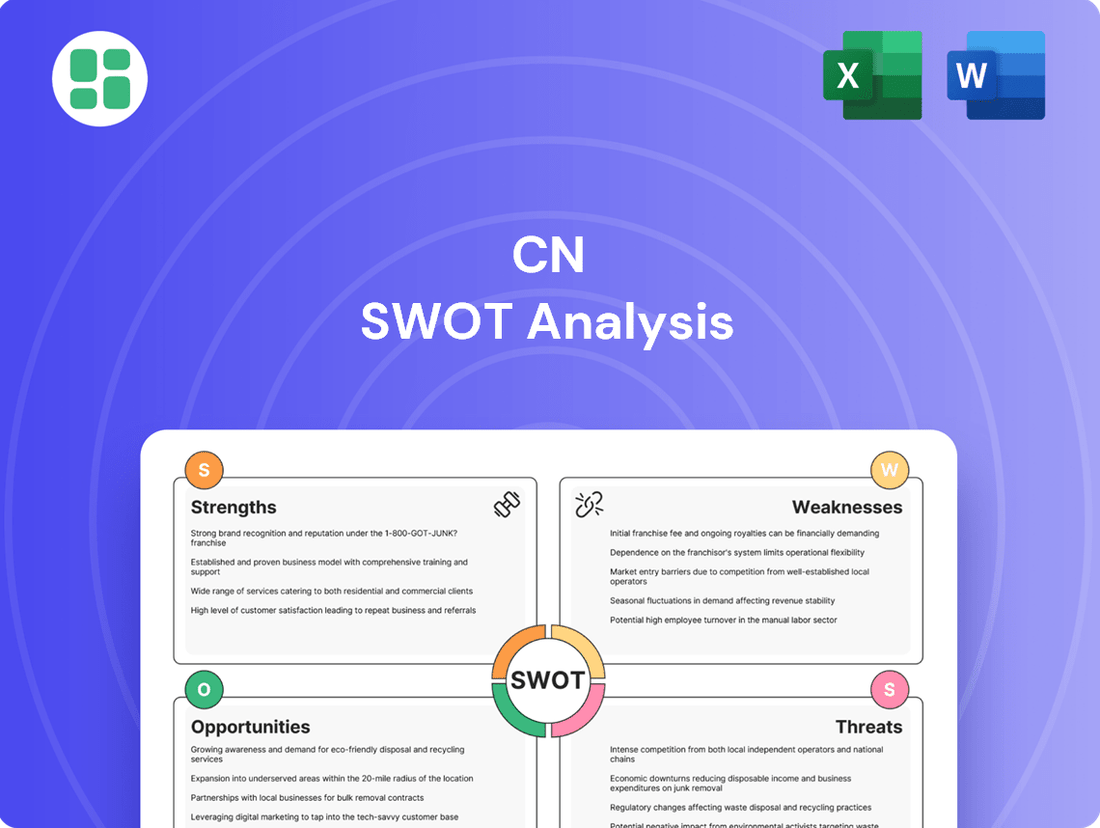

Explore the core strengths and potential challenges facing CN. Our analysis delves into key opportunities for growth and critical threats that could impact its market position.

Ready to uncover the full strategic picture? Purchase the complete CN SWOT analysis to gain detailed insights, actionable recommendations, and an editable format perfect for strategic planning and investor presentations.

Strengths

CN's extensive North American network is a cornerstone of its strength, covering over 32,000 route miles across Canada and the United States. This vast infrastructure connects vital ports on the Atlantic, Pacific, and Gulf coasts with major industrial hubs and agricultural heartlands, facilitating efficient cross-border and domestic freight movement.

This strategic reach provides a significant competitive edge, enabling CN to offer integrated logistics solutions. For instance, in 2024, CN reported a substantial portion of its revenue derived from intermodal and merchandise freight, highlighting the network's importance in diverse commodity transport.

CN's strength lies in its diverse commodity portfolio, encompassing industrial products, agricultural goods, energy, and intermodal containers. This broad mix significantly reduces the company's dependence on any single market segment, enhancing its overall resilience. For instance, in the first quarter of 2024, CN reported a 3% increase in revenue from petroleum and chemicals, while its grain and fertilizer segment saw a 2% rise, showcasing the benefit of this balanced approach.

CN's integrated logistics solutions extend far beyond its core rail operations, encompassing robust intermodal, trucking, and broader supply chain management services. This holistic offering allows CN to deliver seamless, end-to-end transportation, significantly boosting customer value and fostering long-term relationships. For instance, CN's intermodal volumes saw a notable increase in early 2024, reflecting the growing demand for its integrated services.

Strong Market Position and Brand Recognition

CN's robust market position as one of North America's largest railways is a significant strength. Its extensive network and established brand recognition create substantial barriers to entry, ensuring a consistent demand for its services. This dominance translates into pricing power and a stable revenue stream.

The company's market leadership is underscored by its vast operational footprint. In 2023, CN generated approximately $16.7 billion in revenue, reflecting its substantial market share across key commodity and intermodal sectors. Its integrated network, spanning Canada and the United States, allows for efficient and reliable transportation solutions.

- Dominant Market Share: CN is a leading carrier for key commodities like grain, coal, and automotive products.

- Extensive Network: Operates over 18,600 miles of track across North America.

- Brand Loyalty: Long-standing customer relationships foster repeat business and trust.

- Infrastructure Advantage: Significant investment in and ownership of critical rail infrastructure.

Operational Efficiency and Precision Scheduled Railroading (PSR)

CN has been a leader in adopting Precision Scheduled Railroading (PSR), a strategy that significantly boosts how efficiently its assets are used and makes services more dependable. This focus on optimizing train schedules, cutting down the time trains sit idle, and making operations smoother directly leads to reduced operating expenses and better on-time delivery rates.

The company's dedication to operational excellence, driven by PSR, has yielded tangible financial benefits. For instance, CN reported a notable improvement in its operating ratio, a key metric for efficiency, reaching approximately 57.6% in the first quarter of 2024, down from 60.7% in Q1 2023, demonstrating the impact of these streamlined processes.

- Maximized Asset Utilization: PSR enables CN to get more out of its locomotives and railcars, increasing throughput.

- Reduced Operating Costs: Streamlined operations and fewer empty miles contribute to lower fuel and maintenance expenses.

- Enhanced Service Reliability: Predictable schedules and reduced dwell times mean customers receive their goods more consistently and on time.

CN's extensive North American network, spanning over 18,600 miles, is a critical strength, connecting major economic centers and ports. This robust infrastructure underpins its ability to efficiently move diverse commodities, from grain to intermodal containers, as evidenced by its 2023 revenue of approximately $16.7 billion.

The company's market leadership is further solidified by its dominant share in key sectors like grain and automotive transport, fostering strong brand loyalty and pricing power. This established position creates significant barriers to entry for competitors.

CN's adoption of Precision Scheduled Railroading (PSR) has significantly boosted operational efficiency and service reliability. This strategy has led to tangible improvements, such as a reduced operating ratio, which improved to approximately 57.6% in Q1 2024 from 60.7% in Q1 2023.

| Key Strength | Description | Supporting Data (2023/Q1 2024) |

|---|---|---|

| Extensive Network | Over 18,600 miles across North America | Connects major ports and industrial hubs |

| Dominant Market Share | Leading carrier for grain, coal, automotive | Approx. $16.7 billion revenue in 2023 |

| Operational Efficiency (PSR) | Optimized schedules, reduced costs | Operating ratio improved to ~57.6% in Q1 2024 |

What is included in the product

Analyzes CN’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework to identify and address strategic weaknesses, turning potential obstacles into opportunities.

Weaknesses

Maintaining and expanding a vast rail network, like that operated by Canadian National Railway (CN), demands significant and continuous capital investment. In 2023, CN reported capital expenditures of $3.4 billion, a substantial sum dedicated to upgrading tracks, locomotives, and rolling stock to ensure operational efficiency and safety.

These substantial capital outlays can place a strain on free cash flow, potentially limiting financial flexibility, particularly during economic downturns. For instance, a significant portion of CN's 2024 capital plan, expected to be around $3.2 billion, is allocated to maintaining and enhancing its existing network, highlighting the persistent financial commitment required.

The ongoing necessity for infrastructure upgrades represents a considerable financial burden. This continuous need for investment in rail lines, bridges, and signaling systems is critical for maintaining service reliability and capacity, but it directly impacts the company's ability to reinvest in other areas or return capital to shareholders.

CN's reliance on freight transportation makes it inherently vulnerable to economic downturns. For instance, during the COVID-19 pandemic's initial impact in 2020, global trade volumes contracted, directly affecting the demand for rail freight. This sensitivity to macroeconomic cycles can lead to unpredictable revenue streams and hinder long-term capital planning.

Despite its broad reach, Canadian National Railway (CN) exhibits a notable dependence on specific commodity sectors, particularly energy, agriculture, and automotive. For instance, in the first quarter of 2024, energy products represented a significant portion of CN's revenue, underscoring its sensitivity to fluctuations in oil and gas prices and production levels. Similarly, agricultural shipments, while a staple, can be heavily impacted by weather patterns and global demand shifts, as seen in the volatile grain markets of late 2023 and early 2024.

This concentrated exposure means that adverse events within these key industries, such as a sharp decline in crude oil demand or a widespread drought affecting crop yields, can disproportionately impact CN's freight volumes and overall financial health. For example, a slowdown in the automotive sector, driven by supply chain issues or reduced consumer spending, directly translates to fewer vehicle and parts shipments for CN. These vulnerabilities highlight how specific industry downturns can create concentrated risks for the company, even within its diversified network.

Labor Relations and Potential for Disruptions

CN's extensive reliance on a unionized workforce presents a significant weakness. Labor negotiations are inherently complex, and the potential for strikes or work stoppages remains a persistent risk. For instance, in 2019, a significant strike by the Teamsters Canada Rail Conference impacted CN's operations for nine days, leading to substantial financial losses and service disruptions across North America.

These labor disputes can severely curtail CN's operational capacity and undermine service reliability, directly affecting its financial performance. Managing these ongoing labor relations requires continuous attention and strategic foresight to mitigate the inherent risks associated with a unionized workforce.

- Unionized Workforce: A large portion of CN's employees are members of various unions, increasing the complexity of labor negotiations.

- Risk of Disruptions: Past events, like the 2019 strike, highlight the potential for significant operational and financial impacts from labor actions.

- Continuous Challenge: Effectively managing labor relations is an ongoing process that demands significant resources and strategic planning to minimize risk.

Regulatory Scrutiny and Environmental Compliance

CN, like all railways, operates under a heavy regulatory umbrella. This means significant investment is needed to meet evolving safety, operational, and environmental mandates. For instance, in 2024, the industry continued to grapple with the costs associated with implementing advanced safety technologies and adhering to stricter emissions standards, impacting capital expenditure plans.

The complexity of compliance can also divert resources and attention from core business activities. Any tightening of environmental regulations, particularly concerning emissions or hazardous material transport, could necessitate further costly upgrades or operational modifications, potentially affecting CN's financial performance and strategic flexibility.

Public and governmental scrutiny over environmental impact remains a key concern. CN has faced, and could continue to face, public pressure and potential legal challenges related to its environmental footprint, which can lead to reputational damage and unforeseen liabilities.

- Regulatory Burden: The railway sector's extensive regulatory framework necessitates continuous investment in compliance, impacting operational costs and capital allocation decisions.

- Environmental Compliance Costs: Adhering to increasingly stringent environmental standards, especially regarding emissions and hazardous materials, presents ongoing financial challenges.

- Potential for Stricter Regulations: Future regulatory changes could impose additional financial burdens or operational restrictions, requiring adaptive strategies.

- Public and Legal Scrutiny: Environmental performance is under constant public and governmental watch, posing risks of legal challenges and reputational damage.

CN's significant reliance on capital-intensive infrastructure means that maintaining its extensive rail network requires substantial and ongoing financial commitments. In 2023, the company invested $3.4 billion in capital expenditures, with a projected $3.2 billion planned for 2024, primarily for network upkeep and enhancements.

This constant need for infrastructure renewal, including tracks, bridges, and signaling systems, directly impacts free cash flow and can limit financial flexibility, especially during economic downturns. The sheer scale of these investments underscores the persistent financial burden associated with operating and upgrading such a vast network.

Same Document Delivered

CN SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The booming e-commerce sector is a significant tailwind for intermodal transportation. As online shopping continues its upward trajectory, the need for swift and dependable movement of goods across vast distances intensifies. CN's extensive rail infrastructure and strategically located intermodal hubs place it in an advantageous position to capture this growing demand.

CN's ability to efficiently connect major consumption centers and production facilities through its rail network is key. For instance, in 2024, CN reported a substantial increase in intermodal volumes, reflecting the direct impact of e-commerce growth on its operations. Further investments in intermodal capacity, including terminal enhancements and modern equipment, are projected to unlock even greater growth potential in the coming years.

The global shift towards nearshoring and reshoring is a major opportunity for CN. As companies move production closer to home, particularly within North America, the demand for efficient, reliable transportation of raw materials, components, and finished products is set to surge. This trend directly benefits CN's extensive rail network, which is ideally positioned to capitalize on increased cross-border manufacturing and trade.

In 2024, we're seeing this play out with significant investments in manufacturing capacity in the US and Canada. For instance, the automotive sector is a key driver, with new battery plants and assembly operations being established. This translates into more freight for CN to move, supporting the entire supply chain from initial material sourcing to final delivery. The reshoring trend is expected to continue, further solidifying rail as a critical logistics partner.

CN's adoption of advanced technologies like AI and predictive analytics is a significant opportunity. For instance, in 2024, CN continued to invest in digital transformation, aiming to boost operational efficiency by an estimated 5% through better network fluidity and predictive maintenance, reducing costly downtime.

Autonomous rail operations and enhanced digital platforms offer further avenues for improvement. By 2025, CN plans to pilot autonomous technology in specific yards, projecting a potential 10% increase in asset utilization and a reduction in operational errors, directly impacting cost savings and service reliability.

These technological investments are expected to yield substantial cost reductions and optimize asset utilization. CN's commitment to data-driven insights for network fluidity, as seen in their 2024 capital expenditure plan which allocated over $200 million to technology upgrades, positions them for a more competitive service offering.

Sustainability Initiatives and ESG Focus

The increasing global focus on environmental, social, and governance (ESG) criteria offers a significant opportunity for CN. By highlighting its commitment to sustainability, CN can attract a growing pool of investors and customers prioritizing these factors. CN's rail operations are inherently more eco-friendly than trucking, with studies showing rail can be up to four times more fuel-efficient, emitting significantly less greenhouse gas per ton-mile. This positions CN as a key player in the shift towards greener logistics solutions.

CN can leverage this by investing in and promoting cleaner technologies and sustainable operational practices. For instance, continued investment in modernizing its locomotive fleet for better fuel efficiency and exploring alternative fuels can further solidify its green credentials. Such initiatives not only enhance reputation but also contribute to long-term operational cost savings and value creation.

Key opportunities include:

- Enhanced Brand Reputation: Aligning with ESG principles can improve CN's public image and attract environmentally conscious clients.

- Access to Sustainable Finance: Companies with strong ESG performance often find it easier to secure capital through green bonds and sustainability-linked loans. In 2023, the global green bond market saw continued growth, indicating strong investor appetite for sustainable projects.

- Competitive Advantage: Differentiating itself as a sustainable logistics provider can attract new business and retain existing customers seeking to reduce their own carbon footprints.

Strategic Acquisitions and Partnerships

CN has significant opportunities to pursue strategic acquisitions or form partnerships within the logistics sector. Collaborating with other logistics providers, trucking companies, or port authorities could dramatically expand CN's network reach and diversify its service portfolio. For instance, a partnership with a specialized last-mile delivery firm could enhance CN's e-commerce fulfillment capabilities, a rapidly growing market segment.

These strategic alliances can also bolster CN's market share in critical geographic areas. By integrating with regional trucking networks, CN could offer more comprehensive intermodal solutions, capturing greater freight volume. Such moves are projected to unlock substantial operational synergies and pave the way for new, diversified revenue streams, especially as global supply chains continue to evolve and demand greater integration.

- Expanded Network Reach: Acquiring or partnering with regional trucking firms can extend CN's service footprint into underserved markets.

- Service Diversification: Collaborations can introduce new services like specialized cold-chain logistics or last-mile delivery, tapping into growing market demands.

- Enhanced Market Share: Strategic integration with port authorities or other rail operators can solidify CN's position in high-volume trade corridors.

- Synergy Realization: Merging operations or sharing infrastructure can lead to cost efficiencies and improved asset utilization, boosting profitability.

CN can capitalize on the growing e-commerce demand by further expanding its intermodal capacity and leveraging its extensive rail network to connect key consumption and production hubs. The company's 2024 performance, marked by increased intermodal volumes, demonstrates this trend. Continued investment in terminal upgrades and equipment is poised to unlock further growth in this sector.

The reshoring and nearshoring trend presents a significant opportunity for CN to benefit from increased North American manufacturing and trade, particularly in sectors like automotive. As new production facilities, such as battery plants, come online, CN is well-positioned to transport raw materials and finished goods, supporting these evolving supply chains.

CN's strategic adoption of advanced technologies, including AI and predictive analytics, offers substantial gains in operational efficiency and cost reduction. Projections for 2025 indicate potential improvements in asset utilization and service reliability through initiatives like autonomous technology pilots and digital platform enhancements, supported by significant capital allocation to technology upgrades.

The company's focus on ESG principles provides a competitive edge, attracting environmentally conscious investors and customers. CN's inherently lower emissions compared to trucking, with studies showing up to four times better fuel efficiency, positions it as a sustainable logistics provider, further enhanced by investments in cleaner locomotive fleets and alternative fuels.

Strategic acquisitions and partnerships within the logistics sector can expand CN's network reach and service offerings, such as last-mile delivery or cold-chain logistics. These collaborations are expected to create operational synergies, improve asset utilization, and unlock new revenue streams by integrating with regional networks and port authorities.

| Opportunity Area | Description | 2024/2025 Data/Projections |

|---|---|---|

| E-commerce Growth | Leveraging increased online shopping for intermodal transport. | CN reported substantial intermodal volume increases in 2024 due to e-commerce. |

| Nearshoring/Reshoring | Benefiting from increased North American manufacturing and trade. | Investments in US and Canadian manufacturing, particularly automotive battery plants, are driving freight demand. |

| Technology Adoption | Improving efficiency and reliability through AI, predictive analytics, and autonomous operations. | CN aims for 5% efficiency gains via digital transformation; pilot programs for autonomous tech by 2025 target 10% asset utilization increase. Over $200 million allocated to tech in 2024. |

| ESG Focus | Attracting investors and customers through sustainability initiatives. | Rail is up to 4x more fuel-efficient than trucking, emitting less GHGs per ton-mile. Global green bond market saw continued growth in 2023. |

| Strategic Partnerships/Acquisitions | Expanding network reach and service diversification. | Potential for enhanced last-mile delivery capabilities and integration with regional trucking networks. |

Threats

A potential economic recession in North America presents a significant threat to CN, as it could drastically reduce freight volumes across all commodity types. This downturn directly impacts CN's revenue streams and overall profitability. For instance, a prolonged economic slowdown could see a decline in industrial production, a key driver of rail freight, as seen in historical downturns where freight ton-miles have contracted by over 10%.

Furthermore, persistent inflationary pressures are a substantial concern, driving up operating costs for CN. Expenses related to fuel, labor, and essential materials are all susceptible to increases. If CN cannot pass these rising costs onto customers or find efficiencies, profit margins will inevitably shrink. The average annual inflation rate in Canada and the US remained elevated through late 2023 and into 2024, impacting operating expenditures.

Canadian National Railway (CN) faces significant competitive pressures from the trucking sector, which provides agility and direct delivery for many goods. This flexibility allows truckers to serve niche markets and offer more customized solutions that railways often cannot match. For instance, in 2024, the trucking industry continued to handle a substantial portion of North American freight, particularly for shorter hauls and time-sensitive deliveries, directly impacting the volume of goods available for rail transport.

Beyond trucking, CN also contends with intense rivalry from other major North American railways. These competitors, operating on overlapping routes, vie for the same freight contracts, leading to price sensitivity and a constant need for operational efficiency. In 2024, intermodal freight volumes remained a key battleground, with railways and trucking companies alike investing in capacity and service improvements to capture market share. This ongoing competition can constrain CN's pricing power and necessitate substantial capital expenditures to maintain its competitive edge.

Global supply chain vulnerabilities, including port congestion and labor disputes, directly impact CN's operational efficiency. For instance, the lingering effects of the 2021-2022 supply chain crisis, which saw average container shipping costs surge by over 80%, continue to present challenges, although rates have stabilized considerably by early 2024.

Geopolitical conflicts and trade policy shifts can create unpredictable demand fluctuations and operational hurdles. The ongoing conflict in Eastern Europe, for example, has influenced energy prices and trade routes, potentially affecting commodity volumes transported by CN. CN's revenue in Q1 2024 was C$3.67 billion, showing resilience despite these external pressures.

Regulatory Changes and Increased Environmental Policies

New or tougher government rules on railway safety, emissions, or how trains operate could mean higher costs and limits for CN. For instance, stricter emissions standards, like those being discussed for 2025, might require significant investments in cleaner locomotives. This could directly impact CN's operating expenses and profitability.

A growing emphasis on environmental policies, such as potential carbon pricing mechanisms or more rigorous emission limits, could force CN to invest heavily in modernizing its fleet and infrastructure. In 2024, rail companies are already facing increased scrutiny on their environmental footprint, with some analysts projecting that compliance costs could rise by 5-10% annually if new regulations are implemented.

- Increased Compliance Costs: New safety and environmental regulations can lead to higher operational expenses for CN.

- Capital Expenditures for Upgrades: Investments in cleaner technology and infrastructure to meet environmental standards are anticipated.

- Operational Restrictions: Stricter rules may limit train speeds, routes, or cargo types, affecting efficiency.

- Regulatory Uncertainty: The evolving nature of environmental and safety policies creates a challenging planning environment.

Cybersecurity Risks and Data Breaches

As a major player in critical infrastructure, CN faces significant cybersecurity risks. Cyberattacks could target its operational technology, potentially disrupting freight movement and impacting its ability to manage operations. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of the threat to all industries, including transportation.

A substantial data breach or an operational technology shutdown stemming from a cyber incident could result in considerable financial losses for CN. Beyond direct costs, the company could suffer severe reputational damage and face hefty regulatory penalties. In 2024, the average cost of a data breach reached $4.73 million globally, emphasizing the financial ramifications of such events.

- Cyberattack Impact: Disruption of operational technology systems and freight movement.

- Data Breach Consequences: Compromise of sensitive customer data, leading to financial and reputational damage.

- Financial Exposure: Potential for significant financial losses due to operational downtime and recovery costs.

- Regulatory Penalties: Risk of fines and sanctions for failing to protect data and systems.

The threat of a North American economic recession looms large, potentially slashing freight volumes across all sectors and directly impacting CN's revenue and profitability. Persistent inflation also poses a significant challenge, escalating operating costs for fuel, labor, and materials, which could squeeze profit margins if not effectively managed or passed on to customers. CN also contends with intense competition from the trucking industry for shorter, time-sensitive hauls and from other major railways vying for freight contracts, potentially limiting pricing power and necessitating ongoing capital investment.

Additionally, global supply chain disruptions, such as port congestion and labor issues, can hinder CN's operational efficiency, a challenge that persisted in various forms through early 2024. Geopolitical events and shifting trade policies introduce uncertainty in demand and operational pathways, while new or more stringent government regulations concerning safety, emissions, or operational procedures could impose higher costs and restrictions. Finally, cybersecurity risks represent a critical threat, with potential cyberattacks capable of disrupting operations and leading to substantial financial and reputational damage, as evidenced by the rising global costs of cybercrime projected to reach $10.5 trillion annually by 2025.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and expert industry analysis to provide a clear and actionable strategic overview.