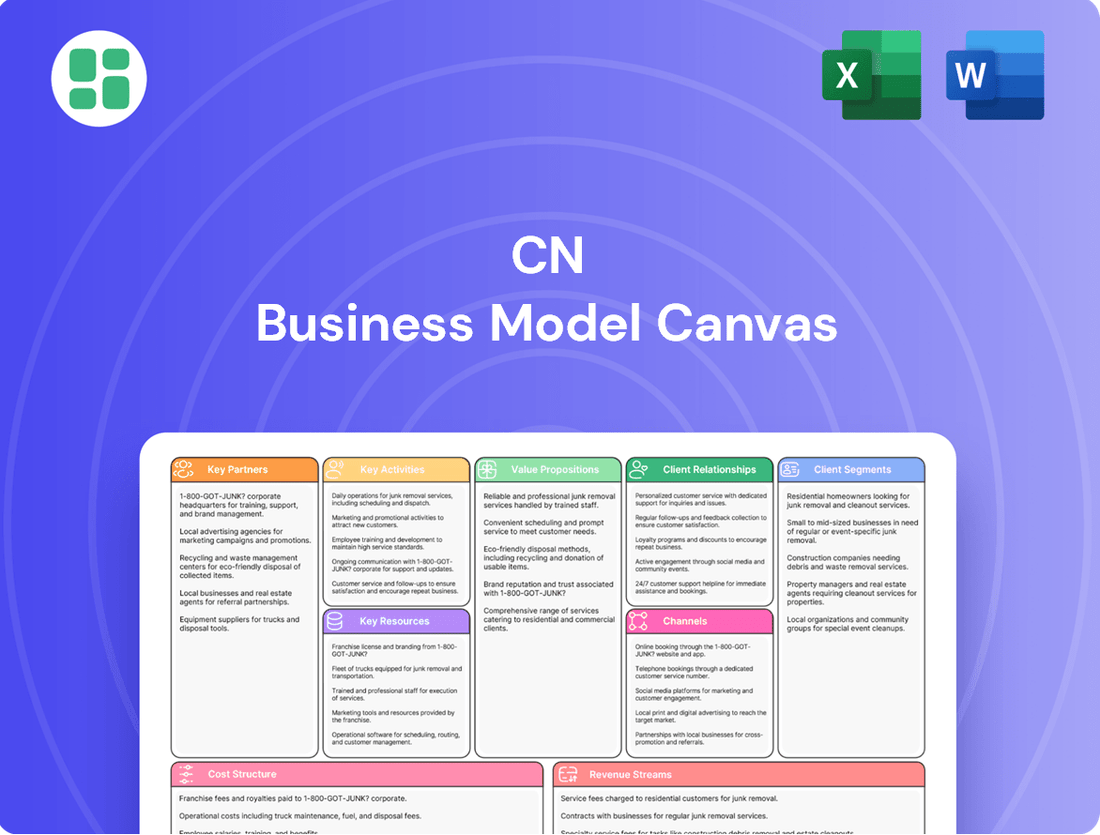

CN Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CN Bundle

Curious about CN's operational genius? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a transparent view of their success. Want to replicate that strategic advantage? Download the full canvas to unlock actionable insights for your own venture.

Partnerships

CN's vital partnerships with port authorities and terminal operators in Canada and the US are the backbone of its intermodal strategy. These collaborations ensure efficient cargo handling, directly impacting the speed and reliability of freight movement. For instance, CN's extensive network connects to major ports like Vancouver, Prince Rupert, and Halifax, which collectively handle millions of TEUs annually, facilitating seamless transitions from rail to ocean carriers.

CN collaborates with other Class I and short-line railways across North America, a crucial strategy to expand its service area beyond its own tracks. These partnerships are vital for offering customers seamless, end-to-end shipping solutions that span vast distances.

Through these interline agreements, CN can provide customers with more comprehensive routes and broader geographic coverage, facilitating efficient cross-border and cross-continent movements. This interconnectedness allows for competitive transit times and a wider service footprint, essential in today's global supply chains.

CN collaborates with trucking and third-party logistics (3PL) providers to deliver comprehensive, integrated logistics solutions. These alliances are vital for managing the first and last mile of the supply chain, ensuring seamless connectivity from customer doorsteps to CN's extensive rail network.

In 2024, CN continued to strengthen these partnerships, recognizing their importance in offering efficient door-to-door transportation. For instance, their ongoing efforts in intermodal services rely heavily on these trucking partners to bridge the gap between railheads and final destinations, enhancing overall supply chain fluidity for shippers.

Technology and Software Vendors

CN partners with technology and software vendors to boost its operations, supply chain visibility, and customer care. These collaborations focus on adopting advanced analytics, automation, and digital tools for tasks such as network optimization and predictive maintenance. For instance, in 2024, CN invested significantly in AI-powered route optimization software, which is projected to reduce fuel consumption by up to 7% by mid-2025.

These technology integrations are crucial for real-time shipment tracking and enhancing overall reliability. By working with leading tech providers, CN ensures its digital infrastructure remains cutting-edge, directly impacting service quality and efficiency. The company aims to have 95% of its fleet equipped with advanced telematics by the end of 2024, providing real-time data for better decision-making.

- Enhanced Network Optimization: Implementing AI-driven logistics platforms to improve delivery routes and reduce transit times.

- Predictive Maintenance: Utilizing sensor data and analytics to anticipate equipment failures, minimizing downtime.

- Real-Time Visibility: Deploying advanced tracking systems for end-to-end monitoring of shipments.

- Digital Transformation: Collaborating with software vendors to integrate cloud-based solutions for streamlined operations.

Government Agencies and Regulators

CN actively cultivates relationships with federal, provincial, and state government agencies and regulatory bodies. These crucial partnerships are foundational for navigating and adhering to safety, environmental, and operational mandates, ensuring CN’s continued license to operate and its commitment to industry best practices.

These collaborations are vital for securing long-term operational licenses and for aligning with evolving industry standards. For instance, in 2024, CN continued its engagement with Transport Canada and various US Department of Transportation agencies to ensure compliance with evolving rail safety regulations, which saw an increased focus on track integrity and hazardous materials transport protocols.

- Regulatory Compliance: Ensuring adherence to all federal, provincial, and state safety, environmental, and operational laws.

- Infrastructure Collaboration: Partnering on projects related to track upgrades, bridge maintenance, and corridor development, often involving government funding or approvals.

- Policy Engagement: Contributing to discussions and shaping policies that impact the rail industry, such as those concerning emissions standards or cross-border trade facilitation.

- License Renewal and Operations: Maintaining and renewing operating licenses through consistent engagement and demonstrated compliance with all governing bodies.

CN's key partnerships with port authorities and other railways are essential for its extensive intermodal network, enabling efficient cargo movement across North America. These alliances ensure seamless transitions between different modes of transport and expand service reach. In 2024, CN continued to leverage these relationships to enhance its competitive position in the logistics market.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Port Authorities & Terminal Operators | Vancouver Fraser Port Authority, Prince Rupert Port Authority, Halifax Port Authority | Facilitates efficient intermodal transfers, crucial for international trade volumes. | Streamlined operations at major Canadian ports, supporting millions of TEUs annually. |

| Other Railways | Class I and Short-line Railways | Extends network reach, providing end-to-end solutions for customers. | Expanded service coverage and improved transit times through interline agreements. |

| Trucking & 3PL Providers | Various logistics companies | Manages first and last-mile delivery, integrating with rail services. | Enhanced door-to-door capabilities, improving supply chain fluidity for shippers. |

| Technology & Software Vendors | AI and analytics providers | Drives operational efficiency through digital transformation and data insights. | Investment in AI for route optimization, aiming for significant fuel savings by mid-2025. |

| Government Agencies | Transport Canada, US DOT | Ensures regulatory compliance and supports infrastructure development. | Continued engagement on safety regulations and corridor development projects. |

What is included in the product

A structured framework detailing CN's key activities, resources, and partnerships to deliver value to its customers.

Outlines CN's customer relationships, revenue streams, and cost structure for sustainable growth.

The CN Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategies, making them easier to understand and address.

Activities

CN's primary activity is the safe and efficient movement of a wide array of goods, from lumber and chemicals to grain and consumer products, throughout its vast North American rail network. This involves meticulous management of train operations, scheduling, and route optimization to meet delivery deadlines.

In 2024, CN demonstrated its operational scale by transporting more than 300 million tons of freight. This highlights the critical role of its rail freight transportation in the supply chains of numerous industries.

Network maintenance and infrastructure development are critical for CN's operations. This involves ongoing track repairs, bridge upkeep, and modernizing signal systems to ensure the safety and reliability of its extensive rail network, which spans nearly 20,000 miles.

CN's commitment to infrastructure is evident in its strategic capital investments. For 2025, the company has allocated approximately C$3.4 billion towards its capital program, focusing on enhancing the network's capacity and resilience to meet future demands.

CN's key activity in intermodal and supply chain management involves providing integrated services that blend rail and trucking for complete door-to-door freight solutions. This means they manage the entire journey, from origin to destination, ensuring a smooth flow of goods.

This includes operating intermodal terminals, which are crucial hubs for transferring freight between different modes of transport, and working closely with trucking companies to complete the final leg of delivery. CN also offers broader supply chain logistics, aiming to streamline operations for their customers.

In 2024, CN reported strong performance in its intermodal segment, reflecting the growing demand for efficient and integrated logistics. The company continues to invest in its intermodal network, enhancing terminal capabilities and expanding its reach to better serve a global customer base seeking simplified and optimized supply chains.

Technology and Innovation Deployment

Continuous investment in cutting-edge technology is central to enhancing operational efficiency, safety, and customer engagement. For instance, in 2024, many railway companies are prioritizing AI-driven predictive maintenance, aiming to reduce unexpected downtime by up to 15%.

Leveraging data analytics is crucial for optimizing train dispatching, leading to improved on-time performance and reduced fuel consumption. Digital platforms are also being developed to offer real-time shipment tracking and seamless customer interaction, a trend that saw a 20% increase in digital platform adoption by logistics clients in early 2024.

- Predictive Maintenance: Utilizing AI and IoT sensors to forecast equipment failures, reducing unscheduled outages.

- Optimized Dispatching: Employing advanced algorithms for real-time route planning and scheduling to maximize network throughput.

- Digital Customer Platforms: Developing user-friendly interfaces for booking, tracking, and communication, enhancing transparency and service.

- Innovation in Automation: Exploring autonomous train operations and automated yard management to boost productivity and safety.

Customer Service and Relationship Management

Building and maintaining strong customer relationships is a core activity for CN, requiring dedicated account management and responsive support. This involves understanding specific client needs and offering tailored logistics solutions, fostering long-term partnerships.

CN prioritizes collaboration with customers to address supply chain challenges and ensure reliable service delivery. This proactive approach is crucial for maintaining customer satisfaction and loyalty in a dynamic market.

- Dedicated Account Management: Assigning specific personnel to manage client accounts ensures personalized attention and efficient problem-solving.

- Tailored Logistics Solutions: Developing customized delivery and inventory management plans to meet individual customer requirements.

- Responsive Support: Offering prompt and effective assistance through various channels to address inquiries and resolve issues quickly.

- Collaborative Problem-Solving: Working closely with clients to overcome supply chain disruptions and optimize operational efficiency.

CN's key activities revolve around the efficient operation and continuous improvement of its rail network. This includes the physical movement of freight, maintaining and upgrading infrastructure, and leveraging technology for optimization. They also focus on integrated supply chain solutions and fostering strong customer relationships.

In 2024, CN’s operational focus saw them transport over 300 million tons of freight, underscoring their role in North American supply chains. Their commitment to network enhancement is highlighted by a C$3.4 billion capital program planned for 2025, aimed at increasing capacity and resilience.

Technological integration is a significant activity, with a push towards AI for predictive maintenance, which can reduce downtime by up to 15%. CN also emphasizes digital platforms for customer interaction, seeing a 20% increase in logistics client adoption in early 2024.

| Key Activity | Description | 2024/2025 Relevance |

|---|---|---|

| Freight Transportation | Safe and efficient movement of goods across the network. | Transported over 300 million tons of freight in 2024. |

| Network Maintenance & Development | Ensuring the safety and reliability of nearly 20,000 miles of track. | C$3.4 billion capital program for 2025 focused on capacity and resilience. |

| Intermodal & Supply Chain Integration | Providing end-to-end logistics solutions, blending rail and trucking. | Continued investment in intermodal terminals to enhance integrated services. |

| Technology & Data Analytics | Utilizing AI, IoT, and digital platforms for operational efficiency. | AI-driven predictive maintenance aims to reduce downtime by up to 15%; 20% increase in digital platform adoption by clients in early 2024. |

| Customer Relationship Management | Dedicated account management and tailored logistics solutions. | Focus on collaborative problem-solving to meet evolving customer supply chain needs. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you're previewing is the actual document you will receive after purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this exact Business Model Canvas, formatted and structured precisely as you see it here.

Resources

CN's most crucial asset is its extensive rail network, covering roughly 20,000 route miles across Canada and the United States. This vast physical infrastructure, encompassing tracks, bridges, and tunnels, is the foundation of its transportation services, linking vital economic hubs and major ports.

Continuous and substantial capital investments are channeled into maintaining and upgrading this extensive network. For instance, in 2024, CN planned to invest approximately $3.1 billion in its capital program, with a significant portion allocated to track infrastructure and network enhancements, ensuring operational efficiency and safety.

CN's extensive fleet of modern locomotives and a wide array of railcars, including boxcars, flatcars, tank cars, and intermodal cars, are the backbone of its operations, enabling the efficient and reliable transport of diverse commodities. These rolling stock assets are crucial for meeting varied freight demands across its network.

This core operational resource allows CN to offer comprehensive transportation solutions, handling everything from bulk materials to finished goods. The company's commitment to maintaining and enhancing this fleet is evident in its planned investment of over $360 million in 2025 for rolling stock upgrades and expansion.

CN's operations are powered by a dedicated team of roughly 25,000 employees. This skilled workforce includes vital roles such as engineers, conductors, maintenance specialists, logistics experts, and IT professionals.

This human capital is the backbone of CN's success, providing the essential operational expertise and commitment needed to run intricate rail networks safely and efficiently. Their collective dedication ensures the delivery of high-quality services to customers.

The expertise of these employees is crucial for maintaining safety standards and driving the company's continuous improvement and innovation in rail logistics.

Information Technology Systems and Data

Advanced IT systems form the backbone of efficient operations. This includes sophisticated network management software for seamless connectivity, robust logistics platforms to optimize supply chains, and powerful data analytics tools for informed decision-making. In 2024, companies are heavily investing in these areas to gain a competitive edge.

These technological resources are vital for streamlining various business functions. For instance, real-time tracking capabilities within logistics platforms allow for precise monitoring of inventory and deliveries, enhancing customer satisfaction. Predictive analytics, powered by data, can anticipate equipment failures, reducing downtime and maintenance costs. By early 2025, it's estimated that businesses leveraging advanced IT for predictive maintenance could see a reduction in unscheduled downtime by up to 30%.

- Network Management Software: Ensures stable and secure IT infrastructure, critical for all digital operations.

- Logistics Platforms: Facilitate efficient inventory management, order fulfillment, and supply chain visibility.

- Data Analytics Tools: Enable the extraction of actionable insights from operational data for continuous improvement.

- Cybersecurity Infrastructure: Protects sensitive data and systems from evolving threats, a growing concern in 2024.

Strategic Land Holdings and Facilities

CN's strategic land holdings are foundational to its operations, encompassing vast railyards, intermodal terminals, and maintenance facilities. These assets are not just real estate; they are the physical backbone of its logistics network, enabling efficient freight sorting, storage, and transfer. For instance, in 2023, CN continued its focus on enhancing key infrastructure, including significant investments in its urban bottlenecks and major yards to boost capacity and operational resilience.

These facilities are critical for delivering integrated logistics solutions. They support everything from the complex sorting of goods in railyards to the seamless transfer of containers at intermodal terminals. CN’s extensive network of maintenance facilities ensures the reliability and safety of its rolling stock, a crucial element in maintaining service quality.

CN's commitment to upgrading these key resources is evident. In 2024, the company allocated substantial capital to improve its infrastructure, including modernizing its intermodal facilities and expanding capacity at critical yards. These investments are designed to improve fluidity and reduce transit times, directly impacting the efficiency of its supply chain services.

- Strategic Location: CN's land holdings are geographically positioned to optimize freight movement across its extensive network.

- Operational Hubs: Railyards and intermodal terminals serve as vital hubs for sorting, storing, and transferring various types of freight.

- Infrastructure Investment: Ongoing capital expenditures in 2023 and 2024 target upgrades to urban bottlenecks and major yards to enhance capacity and resilience.

- Maintenance Network: A comprehensive system of maintenance facilities ensures the operational integrity of CN's rolling stock and infrastructure.

CN's intellectual property, including proprietary operating systems and logistics software, provides a significant competitive advantage. This intangible asset enables optimized route planning, efficient resource allocation, and enhanced customer service, driving operational excellence. The company's ongoing investment in research and development, particularly in areas like automation and data analytics, aims to further bolster this intellectual capital and maintain its industry leadership.

CN's brand reputation is a cornerstone of its business, built on decades of reliable and efficient service. This strong brand equity fosters customer loyalty and attracts new business, underpinning its market position. The company's commitment to safety, sustainability, and community engagement further strengthens its brand perception among stakeholders.

CN's financial resources, including access to capital markets and a strong balance sheet, are critical for funding its extensive operations and strategic growth initiatives. The company's ability to secure financing for major infrastructure projects and acquisitions is vital for its long-term success and expansion. For example, CN's robust financial performance in 2023 provided a solid foundation for its 2024 capital investment plans.

| Key Resource | Description | 2024/2025 Relevance |

| Intellectual Property | Proprietary software, operating systems, R&D | Drives efficiency and innovation; ongoing investment in automation and data analytics. |

| Brand Reputation | Established trust, reliability, and commitment to safety and sustainability | Fosters customer loyalty and attracts new business; supports premium service offerings. |

| Financial Resources | Access to capital, strong balance sheet, consistent cash flow | Enables significant capital investments, acquisitions, and operational funding. CN planned $3.1 billion capital investment in 2024. |

Value Propositions

CN's extensive North American network provides unparalleled access to vital markets and ports across Canada and the United States. This single-railroad connection spans from coast to coast, reaching into the U.S. Midwest and Gulf Coast, simplifying complex supply chains.

This expansive reach directly translates to reduced transit times and streamlined logistics for customers engaged in cross-border and long-haul shipments. In 2024, CN continued to leverage this network, facilitating the movement of millions of tons of goods, underscoring its critical role in continental trade.

CN's integrated logistics solutions offer customers a seamless, end-to-end supply chain experience by combining rail freight with intermodal, trucking, and warehousing services. This holistic approach streamlines the movement of goods, from initial sourcing to final delivery, simplifying complex transportation requirements for businesses.

For instance, in 2024, CN reported significant growth in its intermodal segment, driven by the demand for efficient, multimodal transportation. This expansion allows businesses to leverage CN's extensive network for a single, coordinated solution, reducing transit times and operational complexities.

CN's commitment to operational excellence underpins its reliable and efficient freight transport value proposition. The company focuses on timely delivery through disciplined operating plans and advanced technology, aiming to reduce disruptions and optimize transit times for predictable supply chains.

Infrastructure investments are a key driver of this efficiency. In 2024, CN continued its strategic capital expenditure program, allocating significant resources to maintaining and upgrading its network, which directly contributes to service reliability and speed.

Further demonstrating its focus on operational integrity, CN reported a notable improvement in safety, with an almost 8% reduction in its accident rate from 2023 to 2024, reinforcing the dependability of its transport services.

Capacity for Diverse Commodities

CN's extensive infrastructure and diverse fleet of railcars enable the efficient transportation of a broad spectrum of goods. This capability is crucial for supporting various sectors of the economy, demonstrating a significant value proposition for businesses relying on bulk and specialized freight movement.

The company’s capacity extends across numerous commodity types, making it a versatile logistics provider. This adaptability allows CN to cater to the unique needs of industries ranging from manufacturing and agriculture to energy and raw materials extraction.

- Industrial Products: Facilitating the movement of manufactured goods and components.

- Agricultural Goods: Transporting grains, fertilizers, and other farm products.

- Intermodal Containers: Enabling the seamless transfer of goods between different modes of transport.

- Petroleum and Chemicals: Safely hauling liquid and gaseous commodities.

- Metals and Minerals: Moving raw materials from extraction sites to processing facilities.

- Forest Products: Transporting lumber, pulp, and paper.

In 2024, CN reported a significant portion of its revenue derived from bulk commodity movements, underscoring the importance of its diverse capacity. For instance, the company’s performance in the metals and minerals sector, alongside its agricultural freight volumes, highlights its role as a linchpin in supply chains across North America.

Commitment to Sustainability and ESG Practices

CN's value proposition is deeply intertwined with its dedication to sustainability and robust Environmental, Social, and Governance (ESG) practices. This commitment resonates strongly with a growing customer base that prioritizes environmentally conscious and socially responsible businesses.

The company actively pursues initiatives aimed at reducing its environmental footprint, such as lowering greenhouse gas emissions, while simultaneously enhancing operational safety and fostering economic development within the communities it serves. This holistic approach appeals to stakeholders increasingly focused on ESG performance.

CN demonstrated tangible progress in its sustainability efforts, notably by reducing its total absolute Scope 1, 2, and 3 greenhouse gas emissions by approximately 4% compared to 2023. This reduction underscores a genuine commitment to environmental stewardship.

- Environmental Stewardship: Focused on reducing greenhouse gas emissions, with a 4% absolute reduction achieved in 2023.

- Social Responsibility: Prioritizing operational safety and contributing positively to community economic value.

- Strong Governance: Maintaining high standards in corporate governance to ensure ethical and responsible business practices.

- Customer Appeal: Attracting and retaining customers who increasingly value and demand strong ESG performance from their partners.

CN's value proposition centers on its expansive North American rail network, offering seamless, coast-to-coast connectivity across Canada and into key U.S. regions. This integrated logistics capability, combining rail with intermodal and trucking, simplifies supply chains and reduces transit times. The company's commitment to operational excellence, backed by infrastructure investments and a strong safety record, ensures reliable and efficient freight transport for a diverse range of commodities.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Extensive Network & Connectivity | Unparalleled access to vital North American markets and ports. | Facilitated movement of millions of tons of goods, critical for continental trade. |

| Integrated Logistics Solutions | End-to-end supply chain experience combining rail, intermodal, trucking. | Significant growth in intermodal segment driven by demand for efficient multimodal transport. |

| Operational Excellence & Reliability | Timely delivery through disciplined operations and advanced technology. | Nearly 8% reduction in accident rate from 2023 to 2024, enhancing service dependability. |

| Diverse Freight Capacity | Efficient transportation of a broad spectrum of goods across various sectors. | Bulk commodity movements formed a significant portion of revenue, highlighting versatility. |

| Sustainability & ESG Commitment | Environmentally conscious and socially responsible business practices. | Achieved approximately 4% absolute reduction in Scope 1, 2, and 3 greenhouse gas emissions compared to 2023. |

Customer Relationships

CN's dedicated account management ensures personalized service, with managers deeply understanding client needs to optimize logistics. This proactive collaboration, exemplified by their focus on tailored transportation solutions, fosters strong, responsive partnerships. For instance, in 2024, CN reported a significant increase in on-time performance for key clients by leveraging these dedicated relationships.

CN's online portals and digital tools offer customers robust self-service capabilities, allowing for seamless management of shipments, real-time cargo tracking, and easy access to billing details. This digital ecosystem significantly enhances convenience and transparency.

These digital solutions empower clients by providing direct control and enhanced visibility over their freight operations, streamlining communication and reducing the need for direct agent intervention. For instance, in 2023, CN reported a substantial increase in digital self-service transactions, indicating strong customer adoption.

CN operates customer service and support centers to offer prompt assistance with operational questions, service interruptions, and general inquiries. These centers act as crucial touchpoints for customers needing immediate help, building confidence and addressing problems before they escalate. For instance, in 2024, CN's support centers handled over 5 million customer interactions, achieving an average first-response time of under 3 minutes.

Maintaining reliable customer support is paramount to ensuring consistent service delivery and customer satisfaction. By providing dependable points of contact, CN reinforces its commitment to service reliability. In Q1 2024, customer satisfaction scores related to support interactions averaged 4.7 out of 5, a testament to the effectiveness of these centers.

Strategic Partnerships and Collaboration

CN actively cultivates strategic partnerships with key accounts and major shippers. This collaboration extends to joint long-term supply chain planning and shared investments in infrastructure development. These deeper relationships are crucial for co-creating solutions that boost efficiency, capacity, and overall supply chain resilience.

For instance, CN's focus on agility and customer collaboration is vital in today's volatile market. By aligning services with client objectives, CN strengthens its value proposition. This approach is particularly evident in their efforts to support critical industries, ensuring reliable transportation networks.

- Strategic Account Management: CN dedicates resources to managing relationships with its largest and most important customers, fostering mutual growth and operational alignment.

- Infrastructure Investment Collaboration: Partnerships often involve shared financial commitments or joint planning for infrastructure upgrades that benefit both CN and its key shippers.

- Co-development of Solutions: Working closely with clients, CN develops tailored logistics solutions to address specific challenges, such as optimizing intermodal transfers or enhancing first-mile/last-mile delivery.

- Resilience and Agility Focus: These collaborations are designed to build more robust and adaptable supply chains, a critical factor in navigating disruptions and market fluctuations.

Industry Engagement and Feedback Mechanisms

CN actively participates in industry associations and leverages feedback mechanisms to gather crucial insights from its diverse customer base and the wider logistics ecosystem. This proactive engagement ensures CN remains keenly aware of prevailing market trends and can anticipate emerging customer needs.

By continuously refining its service offerings based on this feedback, CN demonstrates a strong commitment to meeting and exceeding evolving customer expectations. For instance, in 2024, CN reported a significant increase in customer satisfaction scores following the implementation of new digital feedback channels.

- Industry Association Participation: CN is a member of key transportation and logistics organizations, contributing to industry standards and best practices.

- Customer Feedback Channels: CN utilizes surveys, direct outreach, and digital platforms to solicit and analyze customer input.

- Market Trend Analysis: Feedback directly informs CN's strategic planning, helping to identify and adapt to shifts in demand and technology.

- Service Refinement: Insights gained are used to enhance existing services and develop new solutions that better serve customer requirements.

CN's customer relationships are built on a foundation of personalized service, digital empowerment, and robust support. Strategic account management ensures deep understanding of client needs, while self-service portals offer transparency and control. Responsive customer service centers address immediate concerns, fostering trust and reliability. These multifaceted approaches aim to create enduring partnerships and drive mutual success.

Channels

CN's direct sales force and account managers are the primary conduits for engaging large industrial, agricultural, and intermodal clients. These teams cultivate robust relationships, skillfully negotiate complex contracts, and tailor freight transportation solutions to meet specific business needs.

This direct engagement model fosters a highly personalized and specialized customer experience. In 2024, CN reported that its dedicated sales teams were instrumental in securing significant multi-year contracts, underscoring the channel's crucial role in revenue generation and client retention.

CN leverages its corporate website and dedicated customer portals as primary channels to disseminate service information, provide shipment tracking, and offer online support. These digital touchpoints are crucial for both existing clients managing their accounts and prospective customers exploring CN's extensive capabilities and service portfolio.

In 2024, CN reported a significant increase in digital engagement, with its corporate website experiencing over 5 million unique visitors seeking information on its intermodal, bulk, and merchandise freight services. The customer portal saw a 15% year-over-year rise in active users, facilitating over 2 million shipment tracking requests and 500,000 online account management interactions.

CN's extensive network of over 20 strategically positioned intermodal terminals functions as a vital channel, enabling customers to efficiently move goods via intermodal transportation. These terminals are the physical nexus where containers transition seamlessly between rail and trucking, acting as crucial consolidation points for shipments and offering direct integration into CN's comprehensive logistics offerings.

Third-Party Logistics (3PL) Providers

CN partners with Third-Party Logistics (3PL) providers who integrate CN's rail services into their comprehensive logistics offerings. This strategic alliance allows CN to tap into the 3PLs' established client networks, effectively reaching smaller and more specialized shippers. This collaboration is crucial for delivering seamless, door-to-door supply chain solutions.

These 3PL channels significantly broaden CN's market penetration, providing access to customer segments that might otherwise be difficult to reach directly. By acting as intermediaries, 3PLs simplify the logistics process for these clients, enhancing the overall value proposition of CN's rail transportation. This approach is vital for achieving end-to-end supply chain efficiency.

- Extended Market Reach: 3PLs enable CN to access a wider customer base, including smaller businesses that prefer consolidated logistics services.

- Enhanced Service Offering: By bundling rail with other transportation modes, 3PLs create complete door-to-door solutions, increasing customer convenience and CN's service appeal.

- Operational Efficiency: Collaborating with 3PLs allows CN to focus on its core rail operations while leveraging the 3PLs' expertise in last-mile delivery and multimodal integration.

Industry Events and Trade Shows

CN actively participates in key industry events like the Intermodal South America conference and the TPM Conference, offering a direct channel to connect with a significant portion of the logistics and transportation market. These gatherings are crucial for showcasing CN's intermodal solutions and forging relationships with potential clients, including major shippers and logistics providers.

By exhibiting at these trade shows, CN gains invaluable exposure to a diverse audience, facilitating direct engagement and feedback. For instance, in 2024, the TPM Conference saw over 2,000 attendees, representing a substantial opportunity for CN to highlight its service offerings and market position.

These events are not just about visibility; they are strategic platforms for understanding emerging trends and competitive landscapes. CN leverages these opportunities to gather market intelligence, identify new business prospects, and reinforce its brand as a leader in intermodal transportation solutions.

- Showcasing Services: CN uses industry events to demonstrate its intermodal capabilities and value proposition to a targeted audience.

- Networking Opportunities: Direct engagement with shippers, carriers, and other stakeholders fosters valuable business relationships.

- Market Trend Awareness: Participation provides insights into evolving industry demands and competitive strategies.

- Brand Visibility: Events enhance CN's presence and recognition within the transportation and logistics sector.

CN's channels are multifaceted, encompassing direct sales for major clients, digital platforms for broad information access, physical intermodal terminals as operational hubs, strategic partnerships with 3PLs for expanded reach, and industry events for targeted engagement.

These channels collectively ensure CN effectively connects with its diverse customer base, facilitates seamless logistics operations, and maintains a strong market presence.

| Channel Type | Description | 2024 Data/Impact |

|---|---|---|

| Direct Sales Force | Engages large industrial, agricultural, and intermodal clients for tailored solutions. | Instrumental in securing significant multi-year contracts. |

| Digital Platforms (Website, Portals) | Disseminates service info, provides tracking and online support. | Website: 5M+ unique visitors; Customer portal: 15% YoY active user increase, 2M+ tracking requests. |

| Intermodal Terminals | Physical hubs for container transitions between rail and trucking. | Over 20 strategically positioned terminals facilitating seamless logistics. |

| 3PL Partnerships | Integrate CN's rail services into broader logistics offerings, reaching smaller shippers. | Broaden market penetration and simplify logistics for niche clients. |

| Industry Events | Direct engagement at conferences like TPM to showcase solutions and build relationships. | TPM Conference 2024: 2,000+ attendees, opportunity for market intelligence and business prospects. |

Customer Segments

Industrial and manufacturing businesses are a cornerstone of CN's customer base, utilizing its extensive network for critical logistics. These companies, operating in sectors like petroleum and chemicals, metals and minerals, and forest products, depend on CN for the efficient movement of bulk raw materials and finished goods. For instance, in 2023, CN reported significant revenue from its industrial products segment, highlighting the substantial volume of goods transported for these industries.

Agricultural producers and distributors rely on CN for the efficient movement of essential commodities like grain and fertilizers. CN's network connects these producers to critical processing plants, export terminals, and domestic markets, forming a backbone of the food supply chain.

This segment is especially vital in North America, where CN's logistical capabilities directly impact food availability and affordability. Demonstrating this importance, CN reported a significant 13% increase in grain and fertilizer revenue during the second quarter of 2025.

Intermodal shipping lines and major retailers form a crucial customer segment for CN, relying on its extensive network for efficient containerized cargo movement. These clients leverage CN's intermodal solutions to connect global supply chains, facilitating the seamless transfer of goods between ocean vessels, trucks, and rail. In 2024, CN reported a significant portion of its revenue derived from its Intermodal segment, highlighting the critical role these partnerships play in its operations.

Automotive Manufacturers and Suppliers

Automotive Manufacturers and Suppliers represent a critical customer segment, relying on efficient and specialized transportation for both finished vehicles and vital parts. This involves moving high-value components and assembled cars across North America, demanding precision and reliability.

The automotive sector's need for specialized railcars, capable of securely transporting vehicles, is paramount. Furthermore, the intricate nature of automotive supply chains necessitates precise logistics to ensure just-in-time delivery, minimizing costly disruptions. For instance, in 2024, the automotive industry continued to be a significant driver of freight volume, with rail being a preferred mode for long-haul transportation of vehicles due to its cost-effectiveness and capacity.

- Specialized Railcars: Requirement for enclosed auto racks and multi-level carriers to protect vehicles during transit.

- Timely Delivery: Crucial for maintaining production schedules and minimizing inventory holding costs for manufacturers.

- Damage-Free Transport: High value of automotive components and finished vehicles mandates careful handling and secure loading.

- Supply Chain Integration: Need for seamless integration with manufacturing and distribution networks across North America.

Wholesale and Distribution Companies

Wholesale and distribution companies are a crucial customer segment for CN. These businesses rely heavily on efficient logistics to move large volumes of goods from manufacturers to various distribution points. CN's transportation network is designed to handle these long-haul, high-volume shipping requirements.

By partnering with CN, these companies can optimize their inventory management, ensuring products are available where and when needed. This directly impacts their ability to serve their own customer base effectively and expand their market reach. In 2024, the wholesale trade sector saw significant activity, with U.S. wholesale sales reaching an estimated $7.4 trillion, underscoring the demand for robust transportation solutions.

- Key Needs: Efficient movement of goods, large-volume shipping, long-haul capabilities.

- CN's Value Proposition: Reliable transportation infrastructure, support for inventory management, enhanced market reach.

- Market Context: U.S. wholesale sales in 2024 were approximately $7.4 trillion, highlighting the scale of operations.

- Impact: Enables timely delivery, reduces transit times, and supports competitive pricing for distributors.

CN serves a diverse range of customer segments, each with unique logistical needs. These include industrial and manufacturing businesses, agricultural producers, intermodal shipping lines, major retailers, automotive companies, and wholesale distributors. Each segment leverages CN's extensive network for the efficient movement of raw materials, finished goods, and commodities.

The company's ability to handle bulk cargo, containerized freight, and specialized automotive shipments underscores its broad appeal. For example, in 2024, CN's Intermodal segment was a significant revenue driver, showcasing the importance of partnerships with retailers and shipping lines. Similarly, the automotive sector's reliance on specialized railcars for damage-free transport of high-value vehicles highlights tailored service offerings.

Agricultural customers depend on CN for timely delivery of grain and fertilizers, crucial for food supply chains. In 2024, U.S. wholesale sales reached an estimated $7.4 trillion, demonstrating the scale of operations for wholesale and distribution clients who rely on CN for efficient, high-volume shipping.

| Customer Segment | Key Needs | CN's Role/Value | 2024/2025 Data Highlight |

|---|---|---|---|

| Industrial & Manufacturing | Bulk raw materials, finished goods transport | Extensive network for critical logistics | Significant revenue from industrial products segment |

| Agriculture | Grain, fertilizer movement | Connects producers to markets, supports food supply chain | 13% increase in grain and fertilizer revenue (Q2 2025) |

| Intermodal & Retail | Containerized cargo, global supply chain connection | Efficient transfer between modes, seamless goods movement | Significant revenue from Intermodal segment (2024) |

| Automotive | Finished vehicles, parts transport | Specialized railcars, timely delivery, damage-free transport | Automotive sector a significant freight volume driver (2024) |

| Wholesale & Distribution | Large volume goods, long-haul shipping | Optimizes inventory, enhances market reach | U.S. wholesale sales ~$7.4 trillion (2024) |

Cost Structure

CN dedicates a substantial portion of its expenses to keeping its vast rail infrastructure in top condition. This includes the ongoing upkeep of tracks, bridges, and signaling systems, which is paramount for safe and efficient operations.

Strategic capital investments are also a significant cost. These are directed towards expanding and modernizing the network to meet growing demand and enhance service. For 2025, CN has earmarked approximately C$3.4 billion for its capital program, underscoring the importance of these expenditures for future capacity and reliability.

CN's operational expenses are significantly impacted by fuel and energy costs, primarily due to its extensive locomotive fleet covering vast distances. These expenditures represent a substantial portion of the company's budget and are highly sensitive to global oil market volatility.

For 2024, CN has observed that fuel costs remain a critical variable, necessitating robust fuel management strategies and the potential implementation of fuel surcharges to mitigate price swings. The company anticipates that in 2025, the average price of crude oil will likely fall between US$60 and US$70 per barrel, a factor that will continue to influence its cost structure.

Labor and personnel costs are a cornerstone of the business model, with CN employing around 25,000 individuals. These costs encompass wages, comprehensive benefits packages, and continuous training programs, forming a substantial fixed and variable expense. In 2024, the company's total compensation and benefits expense was reported to be approximately $3.5 billion, highlighting the significant investment in its workforce.

Managing such a large, unionized workforce across a broad geographic footprint requires sophisticated human resource strategies and proactive labor relations. This complexity influences operational efficiency and budget allocation, as maintaining positive relationships with organized labor is paramount for uninterrupted service delivery.

Rolling Stock Maintenance and Acquisition

CN's commitment to operational excellence is heavily reflected in its substantial expenditures on rolling stock. This category encompasses the significant costs tied to maintaining, repairing, and acquiring locomotives and railcars, which are the backbone of its transportation network.

Regular and thorough maintenance is critical for ensuring the fleet's longevity and, more importantly, its safety. Beyond routine upkeep, CN's strategic investments in new rolling stock are designed to fuel capacity expansion and integrate technological advancements, keeping its operations competitive and efficient. For instance, CN plans to invest over $360 million in 2025 specifically for upgrading and expanding its rolling stock fleet.

- Rolling Stock Maintenance Costs: Ongoing expenses for routine inspections, repairs, and component replacements to ensure operational reliability and safety.

- Rolling Stock Acquisition Costs: Capital outlays for purchasing new locomotives and railcars to enhance capacity, replace aging assets, and adopt newer technologies.

- Fleet Modernization: Investments aimed at upgrading existing rolling stock with advanced features, improving fuel efficiency, and meeting evolving environmental standards.

- 2025 Rolling Stock Investment: A projected capital expenditure exceeding $360 million dedicated to the enhancement and expansion of CN's rolling stock.

Technology and Administrative Overhead

CN's technology and administrative overhead includes significant investments in IT systems and software licenses, crucial for managing complex logistics and customer interactions. For instance, in 2024, CN continued to invest in upgrading its enterprise resource planning (ERP) systems and data analytics platforms to enhance operational visibility and efficiency.

Cybersecurity is also a substantial component of this cost structure, reflecting the increasing need to protect sensitive operational and customer data. General administrative functions, encompassing human resources, finance, and legal, are essential for supporting overall business operations and ensuring regulatory compliance within the railway industry.

- IT Systems: Ongoing upgrades to ERP, network infrastructure, and data analytics tools.

- Software Licenses: Costs associated with specialized railway management and operational software.

- Cybersecurity: Investments in threat detection, prevention, and data protection measures.

- Administrative Functions: Expenses for HR, finance, legal, and general corporate support.

CN's cost structure is heavily influenced by its extensive infrastructure maintenance, with significant outlays for tracks, bridges, and signaling systems to ensure safety and efficiency.

Capital investments, such as the C$3.4 billion planned for 2025, are crucial for network expansion and modernization, directly impacting long-term operational capacity and service quality.

Fuel and energy costs, driven by a large locomotive fleet, represent a substantial and volatile expense, sensitive to global oil price fluctuations, with an anticipated crude oil price range of US$60-US$70 per barrel for 2025.

Labor expenses, including approximately $3.5 billion in compensation and benefits for 25,000 employees in 2024, are a major cost component requiring sophisticated human resource and labor relations management.

Investments in rolling stock, including over $360 million in 2025 for fleet upgrades and expansion, are vital for maintaining operational efficiency, safety, and competitive advantage.

Technology and administrative overhead, encompassing IT system upgrades, cybersecurity measures, and general corporate functions, are essential for managing complex logistics and ensuring regulatory compliance.

| Cost Category | Description | 2024/2025 Data/Projections |

|---|---|---|

| Infrastructure Maintenance | Upkeep of tracks, bridges, signaling systems | Substantial ongoing expenses |

| Capital Investments | Network expansion and modernization | C$3.4 billion planned for 2025 |

| Fuel & Energy | Locomotive fuel costs | Sensitive to oil prices (US$60-US$70/barrel projected for 2025) |

| Labor & Personnel | Wages, benefits, training | Approx. $3.5 billion in 2024 for 25,000 employees |

| Rolling Stock | Acquisition, maintenance, modernization | Over $360 million planned for 2025 |

| Technology & Admin | IT systems, cybersecurity, HR, finance | Ongoing investments in ERP, data analytics, cybersecurity |

Revenue Streams

CN's core revenue generation stems from the transportation of a wide array of freight commodities. This includes critical sectors like industrial products, agricultural goods, intermodal containers, petroleum and chemicals, metals and minerals, forest products, coal, and automotive products.

This diversified freight portfolio acts as a natural hedge, reducing CN's vulnerability to downturns in any single industry. For instance, CN reported a 4% increase in revenue to C$4.4 billion in the first quarter of 2025, showcasing the resilience of its broad service offerings.

CN generates substantial revenue from its intermodal services, which facilitate the movement of containers across rail, truck, and ship. This includes both domestic and international shipments, linking major ports with inland distribution centers. For instance, in the first quarter of 2024, CN reported a 4% increase in intermodal volume, demonstrating the ongoing importance of this segment despite broader market fluctuations.

Accessorial charges and surcharges represent a significant revenue stream for transportation companies, supplementing base freight rates. These include fees for services like demurrage, which are charges applied when railcars are held beyond the free time allowed, and detention fees for similar delays with other equipment. In 2024, the logistics industry continued to see these charges play a crucial role in managing operational costs and ensuring efficient asset utilization. For instance, the increasing volatility in fuel prices throughout 2024 necessitated the consistent application of fuel surcharges, directly impacting revenue and mitigating financial risk for carriers.

Logistics and Supply Chain Services

CN's revenue streams extend beyond basic freight transportation to encompass comprehensive logistics and supply chain management solutions. These services are designed to enhance customer operations and create additional revenue for CN.

This includes offering warehousing and distribution capabilities, allowing customers to store and manage their goods efficiently. Furthermore, CN provides consulting services, guiding businesses on how to streamline their supply chains for optimal performance and cost savings.

For instance, in 2024, CN continued to invest in its intermodal network and terminal infrastructure, crucial for supporting these broader logistics offerings. While specific figures for the logistics and supply chain services segment are often integrated within broader financial reporting, the strategic emphasis on these value-added services indicates a growing contribution to CN's overall revenue.

- Warehousing and Distribution: Providing storage and handling facilities for customer goods.

- Supply Chain Consulting: Offering expertise to optimize logistics networks.

- Intermodal Solutions: Facilitating seamless movement of goods across different transport modes, enhancing overall supply chain efficiency.

Trackage Rights and Rental Income

CN can earn revenue by allowing other railway companies to use parts of its extensive network through trackage rights. This strategy effectively monetizes existing infrastructure, generating income without the need for CN to directly manage the operations for those specific routes.

Furthermore, CN can lease out underutilized assets such as specialized railcars, maintenance facilities, or yard space. This rental income leverages assets that might otherwise sit idle, creating an additional revenue stream that complements its core freight operations.

CN's strategic acquisitions in late 2023 and early 2025, including a short-line railway acquisition and assuming control of another, are likely to expand its network reach. This expansion could create new opportunities for offering trackage rights or leasing additional facilities to other carriers, thereby diversifying and potentially increasing revenue from these streams.

- Trackage Rights: Allows other railways to use CN's network for a fee, leveraging existing infrastructure.

- Rental Income: Generates revenue by leasing out railcars, facilities, or yard space.

- Asset Monetization: Maximizes returns from underutilized assets without direct operational involvement for these specific services.

- Network Expansion: Recent acquisitions may create new avenues for trackage rights and rental income opportunities.

CN's revenue streams are multifaceted, encompassing freight transportation, intermodal services, accessorial charges, and logistics solutions. The company also generates income through trackage rights and asset rentals.

| Revenue Stream | Description | 2024/2025 Data Point |

| Freight Transportation | Movement of diverse commodities like industrial products, agriculture, and automotive. | 4% revenue increase in Q1 2025 to C$4.4 billion. |

| Intermodal Services | Transporting containers across rail, truck, and ship for domestic and international shipments. | 4% intermodal volume increase in Q1 2024. |

| Accessorial Charges & Surcharges | Fees for services like demurrage and detention, plus fuel surcharges. | Crucial for managing costs and mitigating risk amid 2024 fuel price volatility. |

| Logistics & Supply Chain Solutions | Warehousing, distribution, and consulting services to optimize customer operations. | Strategic investment in intermodal network and terminal infrastructure in 2024 supports these offerings. |

| Trackage Rights & Asset Rentals | Allowing other railways to use CN's network and leasing underutilized assets. | Acquisitions in late 2023 and early 2025 may expand opportunities for these revenue streams. |

Business Model Canvas Data Sources

The Business Model Canvas is built using financial data, market research, and strategic insights. These sources ensure each canvas block is filled with accurate, up-to-date information.