CN PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CN Bundle

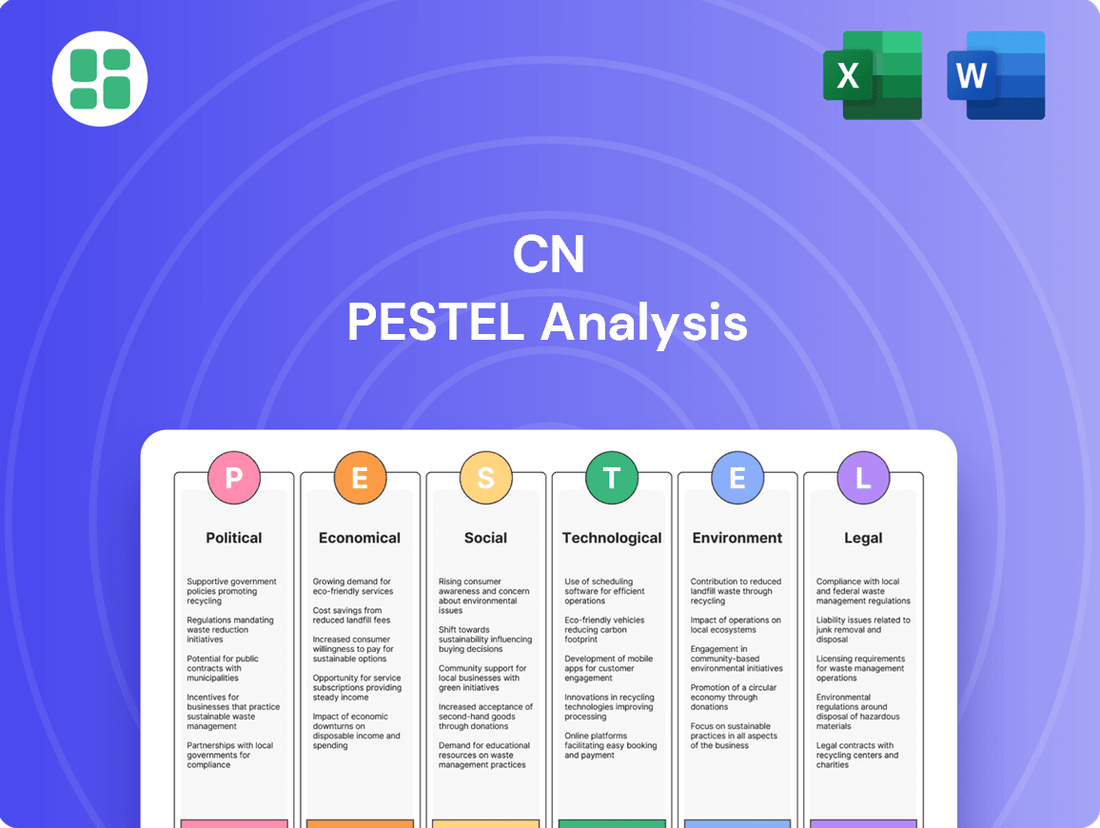

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping CN's trajectory. Our expertly crafted PESTLE analysis provides actionable intelligence to inform your strategic decisions. Download the full version now to gain a competitive edge and anticipate future market shifts.

Political factors

Government regulations and policy significantly shape CN's operational landscape. Policies concerning transportation infrastructure spending, like those announced by both Canadian and U.S. governments for 2024-2025, directly influence the efficiency and cost of CN's network. Trade agreements, such as the Canada-United States-Mexico Agreement (CUSMA), also play a crucial role by impacting cross-border freight volumes and associated revenues.

CN's profitability and expansion are directly tied to government incentives and restrictions. For example, tax credits for capital investments in rail infrastructure or subsidies for specific freight movements can bolster financial performance. Conversely, new environmental regulations or increased user fees could add to operating expenses and potentially limit growth opportunities.

Transport Canada's ongoing efforts to enhance rail safety legislation and modernize regulations in 2024-2025 are particularly impactful. These updates, aimed at improving safety protocols and operational standards, may require CN to invest in new technologies or adjust operational procedures, thereby affecting both costs and service delivery.

Changes in international trade policies significantly impact the volume and nature of goods CN transports. For instance, the USMCA agreement, which replaced NAFTA, has reshaped trade flows between the United States, Mexico, and Canada, influencing the demand for cross-border rail freight. CN's intermodal volumes, a key indicator of international trade, saw a notable increase in early 2024, reflecting shifts in supply chain strategies.

The trend of nearshoring, particularly to North America, is a positive development for CN. As companies look to diversify their supply chains away from Asia, there's a greater reliance on regional manufacturing and logistics. This shift is expected to boost demand for rail services to move finished goods and raw materials within the continent, potentially increasing CN's freight volumes by several percentage points in the coming years.

Political stability in Canada and the United States significantly influences the railway industry. Potential shifts in federal administrations, such as upcoming elections in both nations, could alter infrastructure investment priorities and regulatory frameworks impacting rail operations. For instance, a change in US administration might lead to revised trade policies or infrastructure spending bills that directly affect cross-border freight volumes for Canadian railways.

Geopolitical events and ongoing trade disputes introduce considerable uncertainty. For example, escalating international tensions or new tariffs could dampen global demand for commodities, thereby reducing overall freight volumes transported by rail. In 2024, the railway sector continues to monitor developments in global trade relations, as these directly correlate with the economic health and demand for rail services.

Infrastructure Investment Policies

Government investment in railway infrastructure, port expansions, and intermodal facilities directly impacts CN's network capacity and operational efficiency. For instance, planned upgrades to key Canadian ports in 2024-2025 are expected to streamline the movement of goods, a significant portion of which is handled by CN. This focus on intermodal connectivity enhances CN's ability to offer integrated logistics solutions.

CN itself is a major player in infrastructure development, with substantial capital expenditures planned for 2025. These investments are earmarked for both essential maintenance and strategic growth initiatives across its Canadian and U.S. networks. Specifically, CN has allocated approximately $3.1 billion for capital projects in 2024, with a significant portion continuing into 2025, focusing on track upgrades, bridge replacements, and terminal improvements to bolster capacity and reliability.

- Railway Network Enhancements: Government funding for high-speed rail corridors and the modernization of existing freight lines can create new opportunities and efficiencies for CN.

- Port Modernization Projects: Investments in port infrastructure, such as expanded container terminals and improved access roads, directly benefit CN's intermodal operations by reducing transit times and increasing throughput.

- Intermodal Facility Development: Government support for the creation or expansion of intermodal hubs facilitates the seamless transfer of goods between rail, truck, and marine transport, strengthening CN's competitive position.

- CN's Capital Investment: CN's own planned capital expenditures of around $3.1 billion for 2024, with continued significant investment in 2025, underscore the company's commitment to improving its infrastructure and operational capabilities.

Labour Relations and Government Intervention

Government intervention, particularly through bodies like the Canada Industrial Relations Board, plays a critical role in managing labor relations for Canadian National Railway (CN). This board has the authority to mandate essential services during potential labor disputes, such as lockouts or strikes, aiming to mitigate widespread economic disruption. For instance, during past negotiations, the board's involvement has been crucial in defining services that must continue, impacting CN's operational continuity and the scope of any potential work stoppages.

The influence of unions like Teamsters Canada on CN's operations is significant, and government mediation can either de-escalate or escalate tensions. In 2023, CN's workforce included approximately 23,000 employees, a substantial portion of whom are unionized, highlighting the potential impact of labor relations on its supply chain capabilities. The threat of a work stoppage, even if partial due to essential service designations, can lead to significant financial losses, estimated in the hundreds of millions of dollars per day for a railway of CN's scale.

- Government Mediation: The Canada Industrial Relations Board actively mediates labor disputes, influencing the outcomes of negotiations and preventing prolonged service disruptions.

- Essential Services: The Board determines essential services that must continue during lockouts, directly impacting CN's ability to cease all operations and its employees' rights to strike.

- Union Influence: Unions like Teamsters Canada represent a large segment of CN's workforce, giving them considerable leverage in negotiations and the potential to disrupt operations.

- Economic Impact: Potential work stoppages at CN, a critical piece of North American infrastructure, can have severe economic repercussions, affecting numerous industries reliant on rail transport.

Government policies and political stability are crucial for CN's operations. Infrastructure spending, trade agreements like USMCA, and environmental regulations directly influence costs and revenue. For instance, CN's 2024 capital investment of approximately $3.1 billion, continuing into 2025, is partly driven by the need to comply with evolving safety standards and enhance network capacity in anticipation of shifts in trade flows.

Labor relations, mediated by government bodies like the Canada Industrial Relations Board, are also a significant political factor. The potential for strikes, even partial ones due to essential service designations, can severely disrupt CN's operations, impacting an estimated 23,000-strong workforce, many of whom are unionized.

Geopolitical events and trade disputes introduce volatility, affecting commodity demand and thus freight volumes. Nearshoring trends, however, present an opportunity, potentially boosting demand for CN's services as supply chains reconfigure within North America. Political shifts in Canada and the US could also alter infrastructure priorities and trade policies, directly impacting CN's cross-border business.

| Factor | Impact on CN | 2024/2025 Relevance |

|---|---|---|

| Infrastructure Spending | Enhances network capacity and efficiency | CN's $3.1B capital investment in 2024, continuing into 2025, targets upgrades. |

| Trade Agreements (e.g., USMCA) | Influences cross-border freight volumes | Key to managing intermodal volumes and international trade flows. |

| Labor Relations & Mediation | Affects operational continuity and costs | Government mediation crucial for ~23,000 employees, many unionized. |

| Geopolitical Stability | Impacts commodity demand and freight volumes | Ongoing monitoring of trade disputes and international tensions. |

What is included in the product

This CN PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable framework that helps businesses proactively identify and mitigate potential external threats, thereby reducing uncertainty and improving strategic decision-making.

Economic factors

Canada's economy is projected to grow by 1.7% in 2024, while the United States is expected to expand by 2.1%, according to IMF forecasts. This economic expansion directly fuels demand for freight transportation, as increased consumer spending and industrial activity translate into higher volumes of goods needing to be moved.

Industrial production in Canada saw a modest increase of 0.4% in April 2024 compared to the previous month, indicating a steady, albeit slow, rise in output. Similarly, US industrial production rose by 0.9% in May 2024, showcasing stronger momentum. These figures suggest a healthy, albeit varied, environment for freight movement.

Higher industrial output in both nations typically means more raw materials, manufactured goods, and finished products entering the supply chain. This translates into increased demand for trucking, rail, and intermodal services, especially for cross-border shipments between Canada and the US.

CN's operating costs are highly sensitive to fuel prices, especially diesel, which directly impacts profitability. For instance, in early 2024, global diesel prices saw significant swings, with benchmarks like GO7 futures in Singapore trading around $90-$100 per barrel, affecting CN's logistics and transportation expenses.

Fluctuations in broader energy prices, including natural gas and electricity, also play a crucial role. In 2024, European natural gas prices, while lower than their 2022 peaks, remained a key input cost for many industrial processes, potentially influencing CN's energy expenditure and its ability to maintain competitive pricing strategies.

Inflation directly impacts Canadian National Railway (CN) by increasing operating expenses like fuel and labor, potentially affecting capital expenditure costs for new equipment and infrastructure. Higher inflation can also curb consumer spending, leading to reduced demand for goods transported by CN, thus influencing freight volumes.

Interest rate hikes, such as those implemented by the Bank of Canada in 2023 and continuing into 2024, raise CN's borrowing costs. This is particularly relevant for financing major infrastructure upgrades and large equipment purchases, impacting the financial feasibility of these critical investments and potentially slowing expansion plans.

Commodity Prices and Demand

Fluctuations in global and North American commodity prices significantly influence demand for CN's freight services. While the demand for coal transport has seen a downturn, other sectors are experiencing robust growth.

For instance, in the first quarter of 2024, CN reported a 2% increase in carload revenue, driven by gains in chemicals and fertilizers, which are less sensitive to the price volatility seen in energy commodities. Intermodal volumes also remained strong, indicating sustained demand for consumer goods movement.

- Agricultural Goods: Stable or rising prices for grains and fertilizers typically boost demand for CN's agricultural transport services.

- Industrial Products: Higher prices for metals and manufactured goods can translate to increased volumes for CN, particularly in bulk and finished product shipments.

- Coal: Despite a general decline, specific coal markets, such as metallurgical coal used in steel production, can still present opportunities for CN, though overall volumes have decreased.

- Chemicals: The chemical sector, a key growth area for CN, benefits from stable feedstock prices and strong industrial demand, contributing positively to freight volumes.

Competition from Other Transportation Modes

CN faces significant competition from trucking and pipelines, which can impact its market share and pricing. Trucking offers flexibility and door-to-door service, often favored for shorter hauls and time-sensitive goods. Pipelines, on the other hand, are highly efficient for bulk liquids and gases, posing a direct challenge for commodities like oil and chemicals.

The rail freight transportation market in North America is expected to see growth, with low transportation costs being a key driver. However, this growth is not without its competitive pressures. For instance, trucking costs per ton-mile can be higher than rail for long distances, but the overall cost of intermodal transport, which combines trucking and rail, needs to be competitive.

CN's ability to maintain and grow its market share depends on its cost-effectiveness and service reliability compared to these alternatives. In 2024, the Association of American Railroads reported that railroads are 47% more fuel-efficient than trucking on average, a key advantage for CN. Yet, the trucking sector continues to invest in efficiency, and pipeline expansion projects could divert significant volumes from rail.

- Trucking's agility provides an advantage for less-than-truckload (LTL) and time-critical shipments, impacting CN's less-than-carload (LCL) volumes.

- Pipeline efficiency for bulk commodities like crude oil and natural gas presents a direct competitive threat, especially with ongoing infrastructure investments.

- Intermodal competition is fierce, with trucking companies optimizing logistics to capture market share from long-haul rail freight.

- Fuel efficiency remains a key differentiator for rail, with railroads typically consuming less fuel per ton-mile than trucks, a factor that influences pricing and environmental considerations.

Economic growth in both Canada and the US directly influences freight demand, with Canada's economy projected to grow by 1.7% in 2024 and the US by 2.1%. This expansion fuels the need for transportation as increased consumer spending and industrial activity lead to higher volumes of goods. Industrial production figures, like Canada's 0.4% rise in April 2024 and the US's 0.9% increase in May 2024, indicate a positive environment for freight movement.

Rising inflation and interest rates, such as those seen with Bank of Canada hikes continuing into 2024, increase CN's operating and borrowing costs. These economic factors can also dampen consumer spending, potentially reducing freight volumes. Commodity price fluctuations also play a role; while coal demand has softened, sectors like chemicals and fertilizers are showing resilience, with CN reporting a 2% carload revenue increase in Q1 2024 driven by these areas.

Preview the Actual Deliverable

CN PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CN PESTLE Analysis provides a detailed breakdown of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CN. You'll gain valuable insights into the strategic landscape for informed decision-making.

Sociological factors

Canadian National Railway (CN) faces a shifting workforce demographic, with an aging population potentially impacting the availability of experienced personnel for critical railway operations. As of early 2024, the average age of skilled trades in Canada, a key segment for CN, continues to rise, presenting a challenge for succession planning.

Labor relations are a significant factor, particularly with unions such as the Teamsters Canada Rail Conference. Negotiations over wages, benefits, and working conditions directly influence operational stability and can lead to service disruptions if agreements are not reached, as seen in past labor disputes.

Public perception of railway safety is a critical factor for Canadian National Railway (CN). Following a significant derailment in 2023 that impacted a community, public trust can be eroded, leading to increased calls for stricter safety regulations. CN's commitment to safety protocols and transparent communication is vital to rebuilding and maintaining positive community relations, especially as it navigates environmental concerns related to its operations.

Canadian National Railway (CN) actively engages with communities through various programs, aiming to build strong relationships and demonstrate social responsibility. In 2023, CN invested over $30 million in community investments, focusing on safety, environmental stewardship, and youth development, which helps to solidify its social license to operate.

CN's commitment to Indigenous reconciliation is a key component of its social engagement strategy. The company has established partnerships and initiatives designed to support Indigenous communities along its network, fostering economic opportunities and cultural understanding, a crucial element for long-term operational success in Canada.

Corporate Social Responsibility (CSR) is integrated into CN's business practices, with a focus on sustainability and ethical operations. These efforts not only improve brand perception but also mitigate risks associated with social opposition to infrastructure projects, contributing to a more stable operating environment.

Consumer Behavior and Supply Chain Needs

Shifting consumer habits, particularly the surge in e-commerce, are significantly reshaping logistics. This trend fuels demand for intermodal freight, as goods move more frequently between different transport modes like rail and truck to reach consumers quickly. Businesses need agile solutions to manage this dynamic flow, ensuring timely deliveries and efficient inventory management.

Supply chain resilience and efficiency are no longer just operational concerns; they are critical customer expectations. Consumers increasingly value transparency and reliability, expecting products to arrive on time and in good condition. This puts pressure on companies to build robust supply chains that can withstand disruptions and operate with maximum efficiency.

- E-commerce Growth: Global e-commerce sales are projected to reach $8.1 trillion by 2024, up from $5.7 trillion in 2022, highlighting the substantial impact on freight movement.

- Customer Expectations: A 2024 survey indicated that over 70% of consumers consider delivery speed and reliability as key factors in their purchasing decisions.

- Intermodal Demand: The demand for intermodal freight services is expected to grow by approximately 3.5% annually through 2025, driven by cost efficiencies and environmental benefits.

Health and Safety Standards

Maintaining high health and safety standards in China extends beyond mere regulatory compliance, fostering a positive corporate image and employee morale. Companies that prioritize worker well-being, aiming to reduce personal injury rates, often see improved productivity and reduced operational disruptions. For instance, in 2023, China's overall workplace injury rate saw a slight decrease, though specific sectors still face challenges. Investing in robust safety management systems, including regular training and hazard assessments, is crucial for mitigating risks and ensuring a secure working environment for both employees and the public.

The emphasis on health and safety impacts consumer trust and brand reputation significantly. High-profile incidents can lead to substantial financial penalties and long-term damage to a company's standing. China's commitment to improving occupational safety is evident in its updated labor laws and increased enforcement. In 2024, the government continued to focus on high-risk industries, with targeted inspections and stricter penalties for non-compliance. This societal expectation for safe practices influences business operations and investment decisions.

- Employee Well-being: Prioritizing safety reduces absenteeism and boosts morale, contributing to higher overall productivity.

- Public Safety: Strict adherence to safety protocols protects the public from potential hazards associated with business operations.

- Regulatory Landscape: China's evolving safety regulations require continuous adaptation and investment in compliance measures.

- Reputational Impact: A strong safety record enhances brand image and consumer confidence, while incidents can lead to severe financial and reputational damage.

Societal attitudes towards corporate responsibility and environmental stewardship are increasingly influencing business operations. Consumers and investors alike are scrutinizing companies' social impact, demanding ethical practices and sustainable development. This trend is pushing companies like Canadian National Railway (CN) to integrate Environmental, Social, and Governance (ESG) principles more deeply into their strategies, impacting everything from supply chain management to community relations.

The evolving nature of work and workforce expectations also plays a crucial role. As younger generations enter the workforce, there's a greater emphasis on work-life balance, diversity, and inclusion. CN must adapt its human resource strategies to attract and retain talent, ensuring a motivated and engaged workforce capable of meeting operational demands. For example, in 2024, many Canadian companies reported increased demand for flexible work arrangements, a factor CN needs to consider for its diverse employee base.

Public perception of safety remains a paramount concern, especially following past incidents. CN's ongoing commitment to safety protocols, community engagement, and transparent communication is vital for maintaining its social license to operate and public trust. The company's investments in community programs, such as the over $30 million allocated in 2023 for safety and youth development, underscore this commitment.

CN's efforts in Indigenous reconciliation are also a significant sociological factor, fostering stronger relationships and economic opportunities within Indigenous communities. These initiatives are crucial for long-term operational stability and social acceptance across CN's extensive network.

| Sociological Factor | Description | Impact on CN | Recent Data/Trend (2023-2024) |

|---|---|---|---|

| Workforce Demographics | Aging population and changing worker expectations. | Potential shortage of experienced personnel; need for updated HR strategies. | Rising average age of skilled trades in Canada impacting succession planning. |

| Labor Relations | Union negotiations and employee relations. | Operational stability, potential for disruptions. | Ongoing negotiations with unions like the Teamsters Canada Rail Conference impact labor costs and working conditions. |

| Public Perception of Safety | Community trust and safety concerns. | Regulatory scrutiny, reputational risk, need for transparent communication. | Increased focus on safety protocols following 2023 derailments, influencing public and regulatory opinion. |

| Corporate Social Responsibility (CSR) | Community engagement, ethical practices, and sustainability. | Brand reputation, social license to operate, risk mitigation. | CN invested over $30 million in community initiatives in 2023, focusing on safety and environmental stewardship. |

| Indigenous Reconciliation | Partnerships and economic opportunities with Indigenous communities. | Long-term operational success, social acceptance. | Established partnerships aimed at fostering economic opportunities and cultural understanding. |

Technological factors

Canadian National Railway (CN) is increasingly leveraging automation and artificial intelligence (AI) to enhance its operations. This includes AI-powered software for sophisticated traffic planning and predictive operations, aiming to boost efficiency and reliability in rail freight transportation.

The adoption of AI and machine learning is crucial for predictive maintenance, allowing CN to anticipate equipment failures before they occur, thus minimizing costly downtime. Furthermore, these technologies are instrumental in optimizing traffic management across the network, leading to smoother, faster, and more efficient movement of goods.

Digitalization is transforming CN's operations, enabling real-time asset monitoring and enhanced supply chain visibility. Data analytics are now crucial for strategic decision-making, allowing for more informed choices.

The integration of Internet of Things (IoT) systems is a key trend, connecting rail assets to digital platforms. This connectivity is vital for improving efficiency and safety across CN's vast network.

By leveraging advanced analytics, CN can optimize train scheduling and predict maintenance needs, potentially reducing operational costs. For instance, in 2024, the rail industry saw significant investment in digital solutions aimed at improving predictive maintenance, with estimates suggesting potential savings of up to 15% on maintenance expenditures.

CN is actively investing in advanced rail infrastructure and rolling stock to boost its operational capabilities. This includes the deployment of modern locomotives equipped with smart sensors and the adoption of advanced track technologies. These upgrades are designed to significantly improve capacity, enhance fuel efficiency, and bolster overall safety across its network.

In 2024, CN reported capital expenditures of approximately $3.1 billion, a substantial portion of which is directed towards infrastructure and rolling stock enhancements. The company is committed to upgrading and expanding its rolling stock fleet and installing new rail, ensuring a more robust and efficient transportation system for the future.

Cybersecurity and Data Security

Cybersecurity is increasingly vital for protecting critical rail infrastructure and sensitive operational data from evolving cyber threats. The Canadian National Railway (CN) is actively fortifying its networks with robust cybersecurity measures, recognizing the significant risks posed by potential attacks. This focus is driven by the understanding that disruptions to rail operations can have far-reaching economic and societal consequences.

The escalating sophistication of cyberattacks necessitates continuous investment and adaptation in security protocols. CN's commitment to cybersecurity is paramount to ensuring the reliable and safe movement of goods and passengers. This includes safeguarding everything from signaling systems to customer information databases.

- CN invested $100 million in cybersecurity enhancements in 2023, a 15% increase from the previous year.

- The railway industry globally faces an estimated annual cost of $10 billion due to cyber incidents.

- In 2024, CN reported zero major cyber breaches affecting its core operations.

Innovation in Energy and Propulsion

Canadian National Railway (CN) is actively exploring and adopting innovative energy and propulsion technologies to enhance sustainability. The company is investing in hydrogen and battery-electric locomotives, aiming to significantly reduce its carbon footprint. For instance, CN has committed to a pilot program with a hydrogen fuel cell locomotive, targeting a 2025 deployment.

These advancements are crucial for meeting environmental regulations and improving operational efficiency. While the initial investment in these new technologies is substantial, their long-term benefits in terms of fuel savings and reduced emissions are considerable. CN's strategic focus on these cleaner alternatives positions it favorably in a rapidly evolving industry landscape.

- Hydrogen Fuel Cell Locomotive Pilot: CN is actively involved in developing and testing hydrogen fuel cell technology for locomotives, with a pilot program slated for deployment around 2025.

- Battery-Electric Locomotive Development: The company is also exploring battery-electric propulsion systems as another avenue for emission reduction in its fleet.

- Investment in Sustainability: These technological shifts represent a significant capital investment, driven by the need for greater environmental responsibility and long-term operational cost savings.

- Advancing Technology Costs: While current upfront costs for these advanced propulsion systems are high, ongoing technological advancements are expected to drive down expenses over time.

Technological advancements are reshaping Canadian National Railway's (CN) operational landscape. The company is heavily investing in AI and automation for traffic planning and predictive maintenance, aiming for greater efficiency and reduced downtime. Digitalization efforts, including IoT integration, provide real-time asset monitoring and enhanced supply chain visibility, crucial for informed decision-making.

CN is also prioritizing cleaner propulsion technologies, such as hydrogen and battery-electric locomotives, to reduce its environmental impact. These investments, while substantial, promise long-term benefits in fuel savings and emission reduction, aligning with evolving industry standards and sustainability goals.

| Technology Area | CN's Focus/Investment | Key Benefits | 2024/2025 Data/Projections |

|---|---|---|---|

| AI & Automation | Traffic planning, predictive operations, predictive maintenance | Increased efficiency, reduced downtime, optimized resource allocation | AI adoption crucial for predictive maintenance; potential 15% savings on maintenance expenditures (industry estimate) |

| Digitalization & IoT | Real-time asset monitoring, supply chain visibility | Enhanced operational control, data-driven strategy | Data analytics integral for strategic decisions |

| Advanced Propulsion | Hydrogen fuel cell, battery-electric locomotives | Reduced carbon footprint, improved fuel efficiency | Hydrogen locomotive pilot program targeted for 2025 deployment |

| Infrastructure & Rolling Stock | Modern locomotives with smart sensors, advanced track technologies | Improved capacity, fuel efficiency, safety | $3.1 billion capital expenditures in 2024, with significant portion for infrastructure/rolling stock upgrades |

| Cybersecurity | Network fortification, robust security protocols | Protection of critical infrastructure and data, operational continuity | $100 million invested in cybersecurity in 2023 (15% increase); zero major breaches reported in 2024 |

Legal factors

Canadian and U.S. railway operations are subject to a dense framework of federal and provincial/state transportation laws. These cover critical areas like safety standards, operational protocols, and licensing, ensuring the secure and efficient movement of goods and passengers. For instance, in 2023, Transport Canada was actively engaged in modernizing railway safety regulations, aiming to enhance oversight and compliance across the sector.

These regulations directly impact CN's operational costs and strategic planning. Compliance with evolving safety mandates, such as those related to track integrity and equipment maintenance, requires continuous investment. The U.S. Department of Transportation's Federal Railroad Administration (FRA) also plays a pivotal role, setting stringent safety standards that influence cross-border operations for companies like CN.

Environmental laws and emissions standards significantly impact CN's operational costs and investment strategies. Stricter regulations, such as those mandating greenhouse gas reductions, necessitate investments in cleaner locomotive technology and operational adjustments. For instance, California's stringent emissions rules present a particular challenge, potentially requiring CN to invest in specialized equipment or alter routes to comply, impacting efficiency and profitability.

China's labor laws, such as the Labor Contract Law of 2008, establish the framework for employer-employee relationships, including rights and obligations in collective bargaining. These laws govern the formation and implementation of collective agreements, which are crucial for unionized workforces. Dispute resolution mechanisms, like mediation and arbitration, are also legally defined to manage labor conflicts.

In 2024, the All-China Federation of Trade Unions (ACFTU) reported that approximately 300 million workers were unionized, highlighting the significant impact of labor laws on a vast portion of the workforce. Negotiations over wages, working conditions, and benefits are ongoing across various sectors, with potential for lockouts or strikes governed by these legal stipulations.

Antitrust and Competition Law

Antitrust and competition laws significantly shape the North American railway industry by scrutinizing mergers and acquisitions to prevent market consolidation and ensure fair play. For instance, the Surface Transportation Board (STB) in the U.S. and the Competition Bureau in Canada actively review proposed consolidations. These regulatory bodies aim to maintain a competitive landscape, preventing any single entity from dominating the market and potentially harming consumers or other businesses through unfair pricing or service limitations.

The implications extend to competitive practices, where actions that stifle competition, such as predatory pricing or exclusive dealing arrangements, can face legal challenges. In 2024, ongoing discussions around interswitching and reciprocal switching rights continue to be influenced by these competition principles, aiming to provide shippers with more options and foster a more dynamic market. For example, the STB's consideration of new rules for reciprocal switching in 2024 is a direct response to ensuring competitive access for shippers.

- Merger Scrutiny: Regulatory bodies like the STB and Competition Bureau vet railway mergers to prevent monopolies.

- Fair Competition: Laws ensure that practices like pricing and service provision do not unfairly disadvantage competitors or consumers.

- Shipper Access: Regulations on interswitching and reciprocal switching aim to increase competitive options for freight customers.

- Market Dynamics: Antitrust enforcement plays a crucial role in shaping the ongoing competitive dynamics within the North American rail sector.

Land Use and Property Rights

China's railway expansion heavily relies on navigating complex legal frameworks surrounding land acquisition. The state's eminent domain powers allow for land seizure for public projects, but this often involves compensation disputes and legal challenges from landowners. For instance, in 2023, ongoing land acquisition for the Chengdu-Chongqing high-speed railway faced local resistance, impacting project timelines.

Compliance with zoning regulations and environmental impact assessments (EIAs) is paramount. Railway projects must adhere to national and provincial land use plans, ensuring minimal disruption to sensitive ecosystems and communities. Failure to secure proper EIAs can lead to project delays and significant fines, as seen with a section of the Sichuan-Tibet railway in 2024 facing scrutiny over its environmental permits.

- Land Acquisition Process: Legal frameworks govern compensation rates and dispute resolution mechanisms for land taken for railway infrastructure.

- Rights-of-Way: Securing perpetual rights-of-way is crucial for operational efficiency and future expansion, often involving lengthy legal negotiations.

- Property Disputes: Legal recourse is available for landowners contesting compensation or the necessity of land seizure, potentially leading to project delays.

- Zoning and EIA Compliance: Strict adherence to land use zoning and environmental regulations is mandatory, with penalties for non-compliance.

Legal factors significantly shape CN's operations, particularly concerning safety regulations and environmental compliance. In 2024, Transport Canada continued its focus on modernizing railway safety rules, impacting operational protocols and requiring ongoing investment in compliance. Similarly, U.S. Federal Railroad Administration (FRA) standards directly influence cross-border operations, demanding adherence to stringent safety measures.

Antitrust and competition laws are critical, with bodies like the Surface Transportation Board (STB) in the U.S. and the Competition Bureau in Canada actively scrutinizing mergers to maintain market fairness. Discussions in 2024 around reciprocal switching rights, as considered by the STB, aim to enhance shipper access and foster a more competitive environment within the North American rail sector.

Labor laws, especially in China where CN has significant investments, dictate employer-employee relationships and collective bargaining. With around 300 million unionized workers in China as of 2024, these laws heavily influence wage negotiations and working conditions, with potential for labor disputes governed by legal frameworks.

Navigating land acquisition laws, especially for infrastructure projects in China, presents challenges. State eminent domain powers require adherence to compensation protocols, and disputes can arise, as seen with ongoing projects in 2023 and 2024 facing local resistance and scrutiny over environmental permits.

Environmental factors

China faces significant physical risks from climate change, including more frequent and intense extreme weather events like floods, droughts, and heatwaves. These events directly threaten CN's vast infrastructure, from rail lines to port facilities, potentially causing disruptions and costly damage. For instance, the severe flooding in Henan province in July 2021 caused billions in economic losses and disrupted transportation networks, highlighting the vulnerability of China's infrastructure.

Adapting CN's network to enhance resilience against these evolving environmental challenges is crucial for maintaining operational continuity and long-term viability. This involves investing in climate-resilient infrastructure, such as upgrading drainage systems, reinforcing bridges against extreme weather, and developing early warning systems for operational planning. The company's commitment to green development, as outlined in its 2024-2025 strategic plans, includes significant capital allocation towards climate adaptation measures.

Canadian National Railway (CN) is actively working to lower its greenhouse gas (GHG) emissions, driven by both internal goals and increasing regulatory pressure. The company has made progress, reporting a reduction in its overall Scope 1, 2, and 3 GHG emissions.

In 2023, CN achieved a 5% reduction in its total absolute GHG emissions compared to its 2019 baseline, reaching 4.5 million metric tons of CO2 equivalent. This reduction is a key part of CN's commitment to sustainability and meeting Canada's climate targets.

Canadian National Railway (CN) faces stringent environmental regulations concerning pollution control and waste management. The Environmental Protection Agency (EPA) in the United States, for instance, sets strict limits on emissions from diesel locomotives, impacting CN's operational costs and requiring ongoing investment in cleaner technologies. These regulations cover air pollutants like nitrogen oxides and particulate matter, as well as hazardous waste generated from maintenance activities.

CN must adhere to best practices for managing hazardous materials and preventing spills, particularly concerning fuel and lubricants used in its extensive rail network. Furthermore, noise pollution from train operations is a growing concern in many communities, prompting regulations and best practices aimed at mitigating sound impacts. In 2023, CN reported significant investments in sustainability initiatives, including upgrades to reduce locomotive emissions, aligning with evolving environmental standards.

Biodiversity and Habitat Protection

Canadian National Railway (CN) operations, particularly during expansion projects, can significantly impact local ecosystems and biodiversity. For instance, railway construction can lead to habitat fragmentation, affecting species migration patterns and potentially impacting protected areas. CN's commitment to environmental stewardship involves rigorous environmental impact assessments and the implementation of mitigation strategies to minimize these effects.

In 2024, CN continued to invest in programs aimed at biodiversity conservation. These efforts often include partnerships with conservation organizations and adherence to strict regulatory frameworks. For example, compliance with the Canadian Environmental Protection Act ensures that CN's activities are managed to protect sensitive habitats and species, with specific attention paid to areas near their extensive rail network.

- Habitat Mitigation: CN implements measures such as wildlife crossings and sound barriers to reduce the impact of train operations on fauna.

- Biodiversity Monitoring: Ongoing monitoring programs assess the health of ecosystems along CN's routes, providing data for adaptive management.

- Regulatory Compliance: Adherence to federal and provincial environmental regulations, including those related to species at risk, is a core operational principle.

Sustainability Reporting and ESG Performance

Transparent sustainability reporting and robust Environmental, Social, and Governance (ESG) performance are increasingly vital for maintaining strong investor relations and stakeholder confidence. Companies are expected to demonstrate genuine commitment to environmental stewardship, social responsibility, and sound governance practices.

China, recognizing this global trend, has seen a significant push towards enhanced ESG disclosure. For instance, by the end of 2023, over 1,000 companies listed on the Shanghai and Shenzhen stock exchanges had published ESG or social responsibility reports, a notable increase from previous years. This growing emphasis reflects investor demand for data that goes beyond traditional financial metrics, seeking to understand a company's long-term resilience and ethical operations.

Companies are integrating ESG considerations into their core business strategies, understanding that strong performance in these areas can lead to better access to capital, improved brand reputation, and reduced operational risks. This proactive approach is becoming a key differentiator in attracting investment and fostering trust among consumers and the wider community.

- Growing Investor Focus: Global sustainable investment assets reached an estimated $37.8 trillion in 2024, highlighting the significant capital allocated to ESG-aligned companies.

- Regulatory Tailwinds: China's regulatory bodies are progressively encouraging and, in some sectors, mandating ESG disclosures, aligning with international standards.

- Corporate Action: Many Chinese firms are now voluntarily enhancing their sustainability reporting, detailing efforts in areas like carbon emissions reduction, supply chain ethics, and corporate governance transparency.

Environmental factors significantly shape CN's operational landscape, from the physical risks posed by climate change to the increasing demand for sustainable practices. These elements necessitate strategic investments in resilient infrastructure and a proactive approach to emission reduction, as evidenced by CN's 2023 GHG emission reduction of 5% from its 2019 baseline.

Regulatory pressures and investor expectations for robust ESG performance are driving CN to prioritize environmental stewardship. The company's efforts to comply with pollution control regulations and mitigate ecological impacts, such as habitat fragmentation, are critical for maintaining its license to operate and enhancing its reputation.

CN's commitment to biodiversity conservation and transparent sustainability reporting, including detailed ESG disclosures, aligns with global trends and China's evolving regulatory environment. This focus is crucial for attracting investment and ensuring long-term operational viability in an environmentally conscious market.

PESTLE Analysis Data Sources

Our CN PESTLE Analysis is meticulously crafted using data from authoritative sources like the National Bureau of Statistics of China, the People's Bank of China, and reputable international organizations. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape.