CN Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CN Bundle

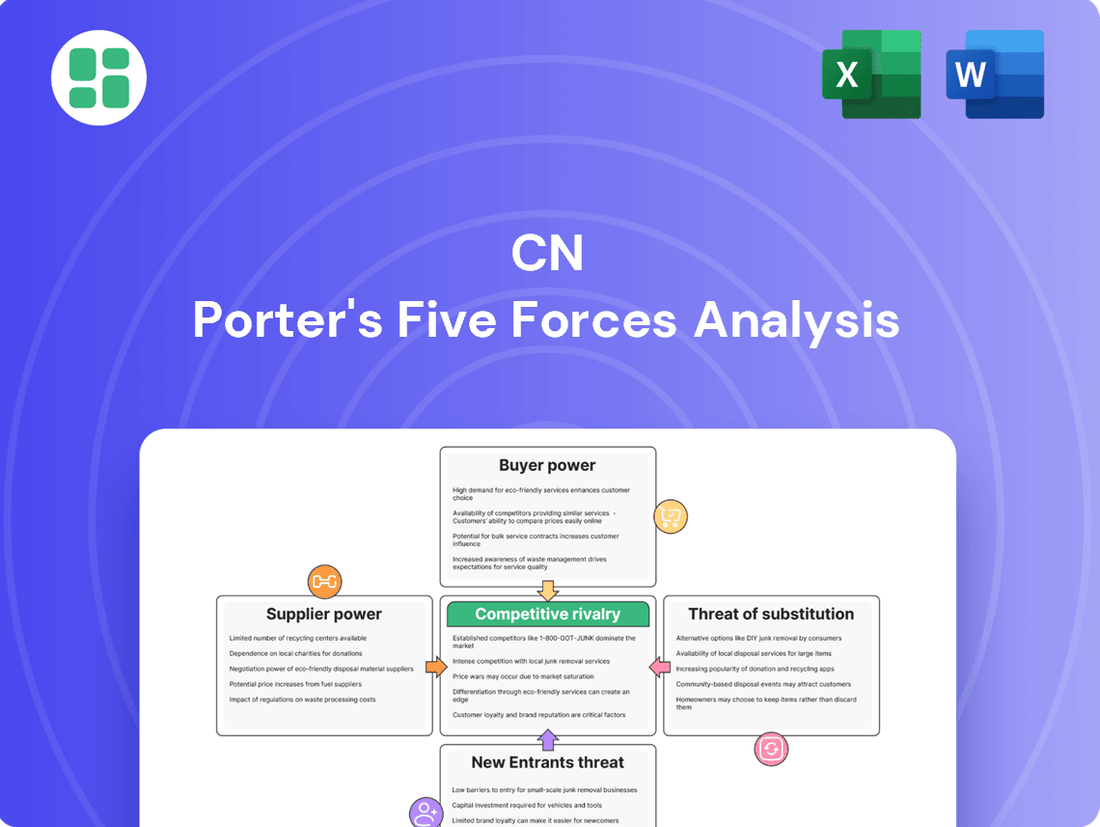

Porter's Five Forces Analysis provides a powerful lens to understand the competitive landscape of CN. It dissects the industry into five key forces: threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CN’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CN's reliance on a small group of specialized manufacturers for essential components like locomotives and advanced rail technology significantly bolsters supplier bargaining power. Key suppliers such as Wabtec Corporation, Progress Rail, and GE Transportation hold substantial sway, as CN has limited alternative sources for these critical parts.

The capital-intensive nature of railway operations inherently leads to high switching costs for companies like CN. Acquiring new locomotives, railcars, or sophisticated signaling systems requires substantial upfront investment and extensive integration processes.

For instance, a major overhaul of CN's signaling infrastructure, a critical component for safety and efficiency, could easily run into hundreds of millions of dollars. This significant financial commitment, coupled with the disruption to ongoing operations during a transition, makes it exceedingly difficult for CN to switch major suppliers readily, thereby enhancing the bargaining power of existing suppliers.

Fuel, especially diesel, is a major cost for CN, and its price swings directly affect the company's bottom line. This means suppliers of fuel wield significant indirect power because CN has to manage these cost changes. For instance, CN's Q2 2025 financial report highlighted that reduced fuel expenses were a key factor in lowering overall operating costs, demonstrating the immediate impact of fuel price volatility.

Labor Union Influence

Labor unions wield considerable influence over CN's operations. A substantial portion of CN's employees are unionized, which translates into significant bargaining power for these unions. This power is primarily exercised through wage negotiations, demands for enhanced benefits, and the potent threat of work stoppages or strikes. These factors can directly impact CN's operating expenses and the reliability of its services.

The impact of union negotiations on CN's financial performance is substantial. For instance, in 2024, wage settlements with major railway unions often included multi-year agreements with annual increases, directly affecting labor costs. The potential for strikes, while not always realized, necessitates contingency planning and can lead to significant revenue losses if disruptions occur. CN's ability to manage these labor relations effectively is a critical component of its overall cost structure and operational stability.

- Unionized Workforce: A large percentage of CN's employees are represented by unions, such as the Teamsters Canada Rail Conference and Unifor.

- Wage and Benefit Negotiations: Collective bargaining agreements dictate wages, healthcare, and pension benefits, directly impacting CN's operating costs.

- Strike Potential: The possibility of strikes or other job actions can disrupt operations and lead to significant financial losses, as seen in past labor disputes.

- Impact on Operating Costs: Union demands can increase labor expenses, affecting CN's profitability and competitiveness.

Technology and Maintenance Providers

Suppliers of advanced technologies for rail infrastructure, predictive maintenance, and signaling systems wield significant bargaining power. This is due to the highly specialized nature of their products and services, which are crucial for enhancing operational efficiency and safety. For instance, CN's investment in predictive maintenance solutions like CN Cognition highlights this reliance on specialized technology providers.

The increasing integration of sophisticated technologies means that rail operators often face limited alternatives for critical components and expertise. This dependence allows technology and maintenance providers to command premium pricing and favorable contract terms. In 2024, the demand for AI-driven predictive maintenance in the rail sector saw substantial growth, with companies reporting significant reductions in unplanned downtime, further solidifying the supplier's leverage.

- Specialized Offerings: Providers of advanced rail tech and predictive maintenance solutions have unique capabilities.

- High Reliance: CN and other rail operators increasingly depend on these innovations for efficiency and safety.

- Market Dynamics: The specialized nature of these technologies limits competitive alternatives, strengthening supplier power.

The bargaining power of suppliers for CN is amplified by the specialized nature of key components and the high costs associated with switching. This is particularly evident with manufacturers of locomotives and advanced rail technology, where limited alternative sources grant significant leverage to suppliers like Wabtec and Progress Rail.

Furthermore, the substantial capital investment required for railway operations, including new locomotives and signaling systems, creates high switching costs. For example, upgrading signaling infrastructure can cost hundreds of millions, making it difficult for CN to change suppliers readily, thus strengthening the position of current providers.

Fuel is another area where suppliers exert influence. Fluctuations in diesel prices directly impact CN's operating expenses, as highlighted by CN's Q2 2025 report where reduced fuel costs positively affected overall expenses. This price volatility gives fuel suppliers considerable indirect power.

Labor unions also represent a significant supplier of human capital for CN. With a large unionized workforce, unions like the Teamsters Canada Rail Conference and Unifor hold substantial bargaining power through wage negotiations and the potential for job actions. In 2024, multi-year wage agreements with unions directly increased CN's labor costs.

| Supplier Type | Key Factors Influencing Power | Examples of Suppliers | Impact on CN | Relevant Data/Events |

| Locomotives & Rail Technology | Specialization, Limited Alternatives, High Switching Costs | Wabtec Corporation, Progress Rail, GE Transportation | Higher component prices, favorable contract terms | CN's reliance on these specialized parts |

| Fuel (Diesel) | Price Volatility, Essential Input | Various Fuel Suppliers | Direct impact on operating expenses | Q2 2025 report noted reduced fuel expenses lowered operating costs |

| Labor | Unionization, Collective Bargaining, Strike Potential | Teamsters Canada Rail Conference, Unifor | Increased labor costs, operational disruption risk | 2024 wage settlements included annual increases; past strikes caused revenue loss |

| Advanced Technology & Maintenance | Specialized Offerings, High Reliance, Limited Competition | Predictive Maintenance Solution Providers (e.g., CN Cognition partners) | Premium pricing for critical systems | Growth in AI-driven predictive maintenance in 2024 led to downtime reduction for rail operators |

What is included in the product

CN Porter's Five Forces Analysis provides a framework to understand the competitive intensity and attractiveness of the transportation industry by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each force, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

CN's customer base is characterized by large industrial corporations, agricultural producers, and major shipping lines, all of whom typically move substantial volumes of freight. This concentration of high-volume shippers grants these customers significant bargaining power. For instance, in 2024, intermodal freight volumes handled by CN saw fluctuations, but the consistent presence of these large players means their business is crucial for CN's revenue streams.

The availability of alternative transportation modes significantly influences customer bargaining power. While rail excels in long-haul, bulk movements, customers can leverage trucking for shorter hauls or specialized cargo. For instance, in 2024, the trucking industry continued to represent a substantial portion of freight movement, offering flexibility that rail often cannot match, thereby giving shippers leverage.

Furthermore, maritime shipping presents another viable alternative for certain commodities and international trade routes. This multi-modal landscape, where customers can switch between rail, truck, and sea, allows them to negotiate more favorable rates and service agreements. The ongoing competition between these modes ensures that no single option can dictate terms without considering customer alternatives.

For customers deeply integrated with rail, switching to another transport method or rail provider can be very expensive. Think about the costs of changing infrastructure or redesigning entire distribution systems. These significant switching costs can limit a customer's ability to bargain aggressively, particularly in long-standing partnerships.

Demand Sensitivity to Economic Conditions

Customer demand for freight services is closely tied to the health of the overall economy. When economic growth slows, businesses tend to ship less, which naturally gives customers more power in their negotiations with transportation providers like CN. This sensitivity means that during periods of economic downturn, customers can often demand better rates or terms.

Trade policies and commodity prices also play a significant role. For instance, changes in international trade agreements or fluctuations in the price of key commodities can directly impact the volume of goods that need to be transported. CN's Q2 2025 report highlighted how economic uncertainty and trade volatility can lead to reduced freight volumes. This reduction in demand inherently strengthens the bargaining position of customers, as carriers compete for fewer available loads.

- Economic Sensitivity: Freight volumes are directly impacted by GDP growth and industrial production.

- Trade Policy Impact: Tariffs and trade disputes can significantly alter cross-border shipping volumes, affecting customer demand.

- Commodity Price Influence: Fluctuations in energy, agriculture, and metal prices influence the quantity of goods requiring transportation.

- Customer Leverage: During economic slowdowns, reduced freight demand empowers customers to negotiate more favorable pricing and service agreements.

Service Quality Expectations

Customers today have very specific ideas about what they expect when they use a service. For transportation, this means they want things to be on time, work smoothly, and be handled efficiently. If a company like CN doesn't deliver on these fronts, customers have options.

These expectations mean customers can exert significant bargaining power. If CN's service quality falls short, customers might look elsewhere, even if it means paying a bit more or dealing with some initial hassle to switch. This is particularly true in 2024, where customer satisfaction is a key differentiator.

- High Service Quality Demands: Customers in 2024 are less tolerant of delays and inefficiencies in freight transportation.

- Competitive Landscape: The availability of alternative carriers and modes of transport gives customers leverage.

- Switching Costs vs. Service: While switching can have costs, poor service quality can outweigh these for many customers.

- Impact on CN: Failure to meet evolving service expectations can lead to customer attrition and reduced market share for CN.

The bargaining power of customers for CN is substantial, driven by the concentration of large shippers and the availability of alternative transportation methods like trucking and maritime shipping. Economic sensitivity and evolving service expectations further amplify this power, allowing customers to negotiate favorable terms, especially during economic downturns. In 2024, CN's ability to meet these demands directly impacts customer retention.

| Factor | Impact on CN | 2024/2025 Data/Trend |

|---|---|---|

| Concentration of Large Shippers | High leverage due to volume | Key industrial and agricultural clients consistently represent significant portions of freight volume. |

| Availability of Alternatives | Customers can switch modes (truck, sea) | Trucking remains a competitive alternative for flexibility and shorter hauls. |

| Switching Costs | Can limit aggressive bargaining | High infrastructure and system redesign costs can anchor some long-term relationships. |

| Economic Sensitivity | Reduced demand empowers customers | Economic slowdowns in 2024 led to reduced freight volumes, increasing customer negotiation power. |

| Service Expectations | Poor service leads to attrition | Customer satisfaction remains a critical differentiator in 2024, with a low tolerance for delays. |

What You See Is What You Get

CN Porter's Five Forces Analysis

This preview showcases the comprehensive CN Porter's Five Forces Analysis you will receive, detailing industry competitive intensity and profitability. You're looking at the actual document, which includes in-depth explanations of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for immediate strategic application.

Rivalry Among Competitors

The North American rail freight market operates as an oligopoly, dominated by a select few Class I railroads, most notably CN and CPKC. This limited number of major competitors means rivalry is fierce, with each player vying for market share and control over crucial transportation routes.

This intense competition among giants like CN and CPKC directly impacts pricing and service offerings across key corridors. For instance, in 2024, these railroads continue to invest heavily in network upgrades and capacity expansion to outmaneuver rivals, a trend that has been evident for years as they seek to capture more freight volume.

CN Porter's competitive rivalry is significantly shaped by other transportation modes, especially long-haul trucking. While rail excels in cost-effectiveness for bulk commodities and extensive distances, trucking often wins for flexibility and speed, directly competing for a substantial portion of freight. In 2024, the trucking industry continues to be a formidable force, with freight volumes remaining robust, underscoring the persistent need for rail to offer compelling value propositions beyond just cost.

Railroads face fierce competition due to their substantial fixed costs, which necessitate high capacity utilization. These costs, encompassing track maintenance, rolling stock, and signaling systems, create a strong incentive for carriers to fill every available car. For instance, in 2024, Class I railroads in the US reported operating ratios often hovering around 70-80%, indicating that a significant portion of revenue goes towards covering these fixed and variable operating expenses, pushing them to secure freight at almost any cost to spread these overheads.

This pressure to utilize capacity fully often translates into aggressive pricing tactics. Companies are willing to offer discounts and favorable terms to secure long-term contracts and consistent freight volumes, intensifying rivalry among carriers. The pursuit of market share can lead to price wars, particularly for bulk commodities where transportation costs are a major component of the final product price.

Service and Network Differentiation

Competitive rivalry in the rail industry, particularly for companies like CN, is intensely focused on service and network differentiation. This means that railroads compete not just on the cost of shipping, but on the quality, dependability, and scope of their services. They aim to offer integrated logistics solutions that go beyond simple transportation, bundling services to meet complex customer needs.

CN's significant investments in infrastructure and technology are a direct response to this competitive landscape. For instance, in 2023, CN reported capital expenditures of approximately $3.2 billion, a substantial portion of which is allocated to improving track, bridges, and terminals, as well as deploying advanced technologies for operational efficiency and safety. These upgrades are crucial for enhancing service reliability and expanding network reach, allowing CN to offer distinct advantages over competitors.

- Service Quality: Railroads differentiate by offering reliable transit times, specialized equipment, and dedicated customer support.

- Network Reach: Extensive route networks and intermodal capabilities provide customers with broader access and more efficient supply chain options.

- Integrated Logistics: Companies like CN are increasingly offering end-to-end logistics solutions, combining rail, trucking, and warehousing to simplify operations for shippers.

- Technological Advancement: Investments in areas like precision scheduled railroading (PSR) and advanced tracking systems improve efficiency and service predictability.

Intermodal Competition

Intermodal competition is a significant factor for CN, as it involves the seamless integration of rail and trucking services. CN's strength lies in its extensive network, connecting major ports with inland markets, directly challenging other intermodal providers and traditional long-haul trucking firms.

The efficiency and cost-effectiveness of CN's intermodal offerings are crucial in this competitive landscape. For instance, in 2024, the demand for efficient supply chain solutions continues to rise, pushing companies to optimize their logistics. CN's ability to provide reliable door-to-door service through its intermodal network is a key differentiator.

- Intermodal Network Reach: CN's extensive rail network provides a foundation for its intermodal services, connecting key North American economic centers and international gateways.

- Competition from Trucking: Long-haul trucking remains a primary competitor, especially for shorter routes or when flexibility is paramount, though it often faces higher fuel costs and driver shortages.

- Other Intermodal Operators: Direct competition comes from other Class I railroads with similar intermodal capabilities, as well as specialized intermodal marketing companies.

- Service Reliability and Cost: The competitive edge in intermodal hinges on consistent transit times, terminal efficiency, and competitive pricing structures.

Competitive rivalry within the North American rail freight market is intense, primarily due to the oligopolistic structure dominated by a few major players like CN and CPKC. This limited competition drives aggressive strategies focused on market share, pricing, and service differentiation.

Railroads like CN face significant pressure to maintain high capacity utilization because of their substantial fixed costs. This necessitates competitive pricing and service offerings to attract and retain freight volume, especially when competing against long-haul trucking for various cargo types.

In 2024, differentiation through service quality, network reach, integrated logistics, and technological advancements is paramount for CN to stand out. Investments in infrastructure and efficiency are key to offering superior value compared to rivals.

| Competitor | Key Differentiators | 2023 Capital Expenditures (Approx.) |

|---|---|---|

| CN | Extensive network, intermodal strength, integrated logistics | $3.2 billion |

| CPKC | Network integration, focus on efficiency | $1.7 billion (combined CP and KCS pre-merger) |

| Union Pacific | Vast US network, intermodal and automotive | $3.3 billion |

| BNSF | Extensive US network, strong intermodal and energy sectors | $4.0 billion |

SSubstitutes Threaten

Trucking stands as a primary substitute for long-haul rail freight, offering distinct advantages. Its ability to provide door-to-door delivery, coupled with enhanced flexibility and often quicker transit for shorter to medium hauls, makes it a compelling alternative. In 2024, the trucking industry continued to be a major player, with freight volumes remaining robust, underscoring its competitive threat to rail.

For bulk commodities and certain heavy goods, especially those located near navigable waterways, inland maritime shipping presents a cost-effective substitute to other transportation methods. However, its inherent geographic limitations and generally slower transit times mean it’s best suited for specific, less time-sensitive niches.

In 2024, the U.S. Army Corps of Engineers reported that inland waterways move approximately 60% of agricultural exports and 40% of U.S. coal, highlighting its importance for bulk goods. Despite its efficiency for these specific cargo types, the capital investment required for port infrastructure and the environmental regulations can act as barriers, limiting its widespread adoption as a substitute across all industries.

Air freight acts as a substitute for CN Porter's core business, particularly for exceptionally high-value, time-sensitive, or perishable items where speed trumps cost. This niche segment, while not directly impacting the bulk of CN's operations, highlights the premium placed on rapid delivery for specific cargo types.

Pipelines

Pipelines represent a significant threat to CN Porter's business, particularly for the transportation of liquid and gaseous commodities. They offer a highly efficient and cost-effective alternative for moving bulk materials like crude oil, natural gas, and refined petroleum products directly from source to destination.

While CN does transport some petroleum and chemical products, the inherent cost and efficiency advantages of pipelines for these specific types of cargo make them a formidable substitute. For instance, the cost per ton-mile for pipeline transport is often substantially lower than rail, especially for large volumes over long distances.

- Pipeline transport offers lower operating costs per unit for bulk liquids and gases compared to rail.

- Pipelines provide a direct, dedicated route, minimizing handling and transit time for commodities.

- The capital investment for new pipeline infrastructure can be substantial, but for established routes, operational costs are very competitive.

Shipper-Owned Fleets and Private Logistics

Large corporations, particularly those with significant shipping volumes, may establish their own private logistics operations, including trucking fleets. This creates a direct substitute for services offered by third-party rail providers like CN. For instance, a major retailer might invest in its own fleet to control delivery schedules and costs, bypassing traditional rail transport for certain routes.

This internal capability offers a degree of self-sufficiency, allowing companies to manage their supply chains more directly. Such private logistics can be particularly attractive for businesses that require specialized handling or just-in-time delivery, which might be more challenging to guarantee with external providers. In 2024, the trend of large enterprises enhancing their private fleet capabilities continued, driven by a desire for greater operational control and resilience in their supply chains.

- Reduced Reliance: Shipper-owned fleets directly substitute for rail services, lessening demand for CN's offerings.

- Cost Control: Companies may find owning logistics more cost-effective for high-volume, predictable shipping needs.

- Supply Chain Integration: Private fleets allow for tighter integration and control over the entire supply chain process.

The threat of substitutes for rail freight is multifaceted, encompassing trucking, inland waterways, air cargo, and pipelines. Each offers distinct advantages for specific types of goods and delivery requirements.

Trucking remains a primary substitute, particularly for door-to-door service and shorter to medium hauls, with freight volumes staying strong in 2024. Inland maritime shipping is a cost-effective alternative for bulk commodities near waterways, though its reach is geographically limited. Air freight serves a niche for high-value, time-sensitive goods, where speed is paramount.

Pipelines offer a highly efficient and cost-effective substitute for liquid and gaseous commodities, often boasting lower per-ton-mile costs than rail for large volumes. Additionally, large corporations increasingly utilize private logistics operations, such as their own trucking fleets, to gain greater control and potentially reduce costs for predictable shipping needs, a trend that continued in 2024.

Entrants Threaten

The sheer cost of building a new Class I railway in North America is a massive hurdle. We're talking about billions of dollars just for land, laying tracks, constructing bridges and tunnels, and acquiring locomotives and freight cars. For instance, estimates for building a new transcontinental railway line could easily exceed $100 billion, making it virtually impossible for newcomers to compete.

Extensive regulatory hurdles present a formidable threat of new entrants in the railway industry. Companies must secure numerous permits, undergo rigorous environmental assessments, and obtain critical safety certifications. Compliance with complex operational standards, often varying by region and type of service, adds further layers of difficulty. For instance, in 2024, the U.S. Department of Transportation continued to emphasize stringent safety regulations for freight and passenger rail operations, requiring significant upfront investment in compliance and ongoing monitoring.

Established network and infrastructure pose a significant barrier to new entrants in the railway industry. Companies like CN have spent over a century building extensive networks, rights-of-way, and operational hubs. Replicating this vast and interconnected infrastructure is practically impossible for a new player.

Economies of Scale and Scope

Incumbent railways leverage significant economies of scale, benefiting from massive cost advantages in operations, maintenance, and bulk purchasing. For instance, in 2024, major Class I railroads in North America continued to operate vast networks, with Union Pacific reporting over 32,000 route miles and BNSF operating more than 32,500 route miles. This scale allows them to spread fixed costs over a much larger volume of freight, making it exceedingly difficult for new entrants to match their per-unit costs.

Furthermore, railways achieve economies of scope by transporting a diverse range of commodities, from agricultural products to manufactured goods, across extensive geographic areas. This broad service offering enhances network utilization and provides a more comprehensive service package. The ability to offer integrated solutions for various industries, as seen with the extensive intermodal networks developed by established players, creates a substantial barrier to entry for smaller, less diversified competitors who cannot replicate this breadth of service or operational efficiency.

- Economies of Scale: Railways benefit from lower per-unit costs due to high fixed investments in infrastructure and rolling stock spread over large volumes.

- Economies of Scope: The ability to transport diverse goods across wide networks enhances efficiency and customer appeal, creating a competitive advantage.

- Capital Intensity: Building and maintaining a railway network requires immense capital, a significant deterrent for potential new entrants.

- Network Effects: Larger, more established networks offer greater connectivity and efficiency, attracting more shippers and further solidifying their market position.

Access to Key Markets and Ports

CN's exclusive access to key North American markets and ports presents a formidable barrier to entry. For instance, CN's extensive network includes vital intermodal facilities in Chicago, a major North American logistics hub. New entrants would need to replicate this extensive infrastructure or secure complex, costly agreements to achieve comparable reach.

The sheer capital required to establish a similar network of ports, rail lines, and industrial connections is astronomical. Consider the significant investments needed for new port development or acquiring rights-of-way; these are often in the billions of dollars. This financial hurdle severely limits the ability of new competitors to challenge CN's established market position.

Furthermore, securing critical cross-border access points between Canada and the United States, such as those managed by CN, involves intricate regulatory approvals and established relationships. New entrants would face lengthy timelines and substantial legal and political challenges to gain equivalent transit rights. For example, in 2024, the average time for securing new cross-border freight permits can extend over several months, adding to initial operational costs and delays.

- Strategic Port Access: CN's control over key ports, like Prince Rupert and Vancouver, offers a significant advantage.

- Industrial Center Connectivity: Direct links to major industrial hubs reduce drayage costs and transit times for shippers.

- Cross-Border Efficiency: Streamlined operations at border crossings facilitate faster movement of goods between Canada and the US.

- High Infrastructure Costs: The immense capital investment required to build or acquire comparable rail and terminal infrastructure deters new entrants.

The threat of new entrants in the railway industry is exceptionally low due to immense capital requirements, extensive regulatory hurdles, and the need for vast, established infrastructure. New players face billions in costs for track, rolling stock, and rights-of-way, coupled with complex safety and environmental approvals. Established networks and economies of scale enjoyed by incumbents like CN further solidify these barriers, making it nearly impossible for newcomers to compete effectively.

| Barrier | Description | Estimated Cost/Impact (Illustrative) |

|---|---|---|

| Capital Intensity | Building new rail lines, acquiring locomotives, and freight cars requires massive upfront investment. | $100+ billion for a new transcontinental line. |

| Regulatory Hurdles | Securing permits, environmental assessments, and safety certifications is time-consuming and costly. | Months to years for approvals; significant compliance costs. |

| Existing Infrastructure | Replicating the extensive, century-old networks of established players is practically unfeasible. | Billions to acquire or build comparable rights-of-way and terminals. |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to high-volume operations. | Union Pacific (32,000+ miles) and BNSF (32,500+ miles) operate at significantly lower unit costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data, including industry-specific market research reports, company financial statements, and public domain competitor disclosures.