CN Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CN Bundle

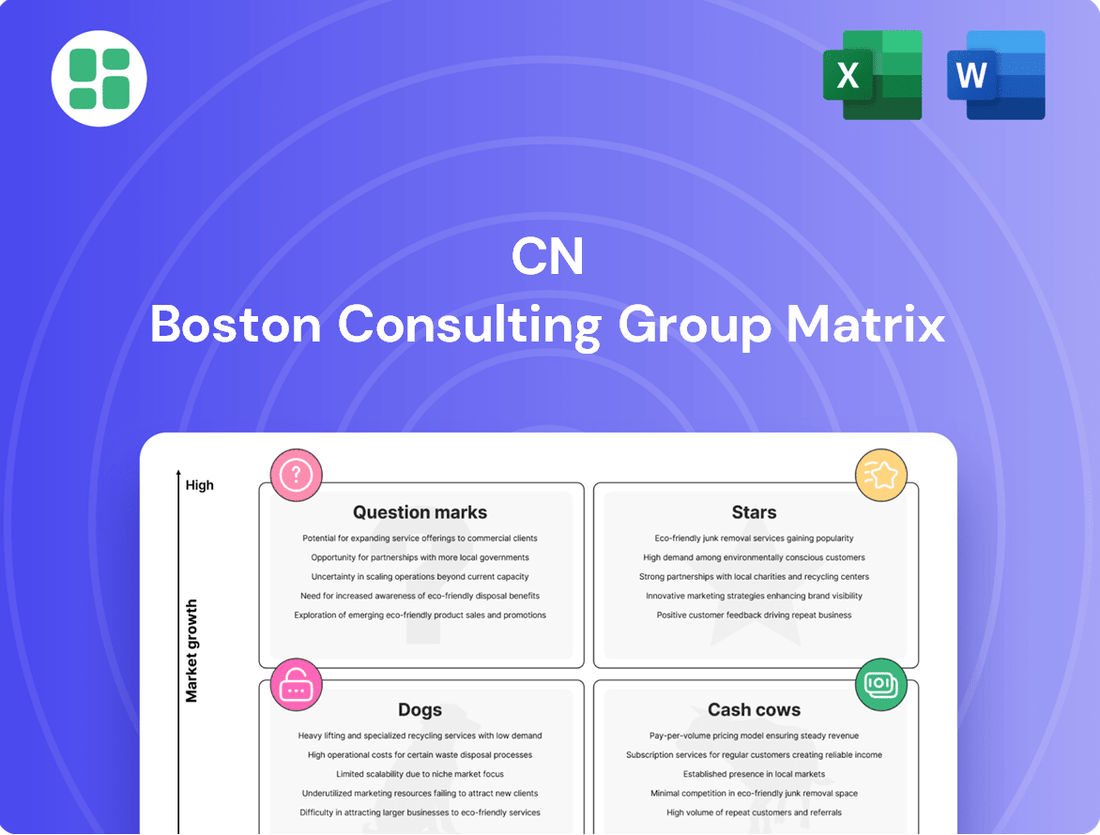

The BCG Matrix is a powerful tool that categorizes a company's products or business units based on market growth and market share. Understanding these placements—Stars, Cash Cows, Dogs, and Question Marks—is crucial for effective resource allocation and strategic planning. This snapshot offers a glimpse into your company's product portfolio, but the real value lies in the actionable insights and detailed analysis found in the complete report.

Unlock the full potential of your product strategy by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each product's position, enabling you to make informed decisions about investment, divestment, and development. Don't miss out on the opportunity to optimize your portfolio and drive sustainable growth—get the full report today!

Stars

Intermodal volume growth for CN has been robust, with year-over-year increases consistently observed, especially in the early months of 2025. This surge highlights intermodal as a high-growth area for the company.

Despite some challenges in international intermodal during the second quarter of 2025, largely attributed to trade disputes, the domestic intermodal segment has proven remarkably resilient. This resilience underscores the strength of intra-North American trade flows.

CN's ongoing investments in expanding intermodal capacity, including new terminal facilities and equipment upgrades, clearly signal a strong commitment to capitalizing on this segment's future growth potential. For instance, in Q1 2025, CN reported a 7% increase in total intermodal volumes compared to the previous year.

CN is strategically investing approximately C$3.4 billion in 2025, with a significant portion earmarked for infrastructure upgrades. These investments are crucial for expanding capacity and enhancing operational efficiency throughout its extensive network.

The focus on Western Canada is particularly noteworthy, with these capital expenditures aimed at easing network congestion. This strategic move is intended to improve the flow of key Canadian exports, thereby bolstering the competitiveness of these vital trade corridors.

These infrastructure enhancements are positioned to drive growth by creating more efficient and reliable transportation routes. The increased throughput capacity will directly benefit Canadian producers and exporters, reinforcing CN's role as a critical enabler of economic activity.

Agricultural Goods Transport stands out as a strong performer for CN, particularly in the movement of grain. The company's strategic initiatives, including the 2024-2025 Grain Plan featuring new high-efficiency hopper cars and an emphasis on scheduled railroading, underscore its commitment to optimizing Canadian grain logistics.

This segment's robust growth is evident in the year-to-date grain volumes, which saw a 17% increase by July 2025 compared to the previous year. Furthermore, revenue from grain and fertilizer operations climbed by 12% in the second quarter of 2025, solidifying its position as a dominant and expanding area for CN.

Petroleum and Chemicals Segment

The petroleum and chemicals segment demonstrated a solid 4% revenue increase in the first quarter of 2024. This growth is bolstered by anticipated demand for frac sand and liquefied gas shipments, driven by increased drilling activities in Northeast British Columbia.

The segment holds a robust market position within its specialized area, suggesting a stable outlook for continued expansion.

- Revenue Growth: Q1 2024 saw a 4% revenue increase.

- Market Position: Strong in its specialized niche.

- Growth Drivers: Increased drilling in Northeast British Columbia for frac sand and liquefied gas.

- Outlook: Stable growth potential.

Technology and Automation Initiatives

CN's commitment to technology and automation is a key driver in its operational efficiency and market standing. Ongoing investments in areas like autonomous track inspection programs and mobile fire detection equipment are directly enhancing safety and streamlining operations. These initiatives, while not generating direct revenue as a product, are crucial for maintaining CN's competitive edge and paving the way for future expansion by improving service reliability.

These technological advancements are translating into tangible benefits. For instance, in 2024, CN reported significant progress in its autonomous track inspection programs, which are designed to identify potential issues before they escalate, thereby reducing downtime and maintenance costs. The company is also deploying advanced mobile fire detection systems across its network, a critical safety measure that bolsters operational resilience.

- Autonomous Track Inspection: CN is leveraging AI-powered systems to conduct track inspections, identifying defects with greater accuracy and speed than traditional methods.

- Mobile Fire Detection: Deployment of advanced sensors and real-time monitoring technology for early detection of fires along rail corridors.

- Operational Efficiency Gains: These technologies contribute to reduced operational disruptions and improved asset utilization.

- Market Leadership: By investing in cutting-edge solutions, CN reinforces its position as an industry leader in safety and innovation.

Stars in the BCG matrix represent business units with high market share in high-growth markets. For CN, intermodal and agricultural goods transport align with this profile. These segments demonstrate strong volume growth and revenue increases, indicating significant market demand and CN's dominant position.

CN's strategic investments in intermodal capacity and agricultural logistics, including new equipment and optimized scheduling, further solidify their Star status. These initiatives are designed to capture and sustain growth in these high-potential areas.

The company's consistent performance in these segments, evidenced by year-over-year volume increases and revenue growth, confirms their position as Stars. They are key drivers of CN's overall expansion and profitability.

| Segment | Market Growth | Market Share | 2025 Outlook |

|---|---|---|---|

| Intermodal | High | High | Continued strong growth, capacity expansion underway |

| Agricultural Goods Transport | High | High | Robust demand, optimized logistics driving volume increases |

What is included in the product

The CN BCG Matrix analyzes a company's portfolio, guiding investment decisions by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

The CN BCG Matrix provides a clear visual of your portfolio, simplifying complex strategic decisions and relieving the pain of uncertainty.

Cash Cows

CN's extensive North American rail network, spanning nearly 20,000 miles, is a prime example of a cash cow. This mature, high-market-share asset connects Canada's coasts to the U.S. Midwest and Gulf Coast, generating substantial and consistent cash flow.

This foundational infrastructure is crucial, enabling CN to transport over 300 million tons of diverse commodities annually. In 2024, CN reported operating revenue of approximately $17.1 billion, with its rail operations forming the bedrock of its financial performance.

CN's diversified core freight portfolio, encompassing industrial products, forest products, and metals and minerals, forms a stable revenue foundation. This broad commodity base taps into established markets, ensuring consistent cash generation.

The company's significant market share across various bulk and merchandise freight segments contributes to robust and predictable cash flows. Despite potential fluctuations in individual commodity markets, the overall diversification mitigates risk.

For instance, in 2024, CN reported a substantial portion of its revenue derived from these core segments, underscoring their role as cash cows. This stability allows for continued investment and operational efficiency.

CN's unwavering commitment to Precision Scheduled Railroading (PSR) has been a game-changer, dramatically enhancing its operating ratio and overall efficiency. This strategic focus translates directly into maximized cash flow from its existing rail network, a crucial element for any cash cow.

By meticulously managing costs and optimizing train schedules, CN has solidified its position as a leader in operational discipline within the mature rail industry. This tight cost control directly supports strong profit margins, reinforcing its cash cow status.

In 2024, CN reported an operating ratio of 57.3%, a testament to the sustained effectiveness of its PSR strategy. This figure highlights the company's ability to generate substantial cash from its operations, a hallmark of a strong cash cow.

Consistent Shareholder Returns

CN's status as a Cash Cow is clearly illustrated by its consistent and growing returns to shareholders. The company has a remarkable track record, boasting 29 consecutive years of increasing its quarterly cash dividends.

This sustained dividend growth, coupled with active share repurchase programs, underscores CN's robust and stable cash-generating capacity. These actions signal that the company's cash flow generation significantly surpasses its internal investment requirements, a defining characteristic of a Cash Cow.

- 29 Consecutive Years of Dividend Increases: Demonstrates a reliable and growing income stream for investors.

- Share Repurchase Programs: Indicates excess cash being returned to shareholders, boosting per-share value.

- Strong Cash Flow Generation: Exceeds internal investment needs, providing financial flexibility and stability.

- Financial Stability: A hallmark of a mature business unit generating more cash than it consumes.

Core Network Maintenance and Upgrades

Core Network Maintenance and Upgrades represent a critical Cash Cow for CN. A substantial C$2.08 billion is allocated in 2025 for these essential activities.

These investments are crucial for preserving the reliability and safety of CN's existing rail infrastructure, which forms the backbone of its operations.

- High Capital Allocation: Approximately C$2.08 billion in 2025 is dedicated to maintaining and upgrading the core rail network.

- Asset Longevity and Performance: These funds ensure the continued high performance and long-term viability of existing, high-market-share assets.

- Stable Cash Generation: The focus on maintaining established infrastructure supports consistent and reliable cash flow generation.

- Low Growth Environment: While essential, these upgrades are primarily for preservation rather than aggressive expansion, reflecting a low-growth characteristic typical of Cash Cows.

Cash Cows, like CN's established rail network, are mature business segments with high market share that generate more cash than they require for reinvestment. This surplus cash can then be deployed for other strategic purposes, such as funding growth initiatives or returning value to shareholders.

CN's core freight operations exemplify this. In 2024, the company's operating revenue reached approximately $17.1 billion, with its diversified freight portfolio providing a stable and predictable cash flow. This stability is a direct result of its dominant position in key commodity markets.

CN's commitment to Precision Scheduled Railroading (PSR) has further solidified its Cash Cow status by improving efficiency and reducing costs. This strategy directly translates into enhanced cash generation from its existing assets, as evidenced by its 2024 operating ratio of 57.3%.

The company's consistent shareholder returns, including 29 consecutive years of dividend increases, are a clear indicator of its robust cash-generating capabilities, a defining trait of a Cash Cow.

| Metric | 2024 Data | Significance for Cash Cow Status |

|---|---|---|

| Operating Revenue | ~$17.1 billion | Indicates substantial revenue generation from mature operations. |

| Operating Ratio | 57.3% | Demonstrates high operational efficiency and strong profit margins. |

| Consecutive Years of Dividend Increases | 29 | Highlights consistent and growing cash returns to shareholders, exceeding reinvestment needs. |

| Core Network Maintenance & Upgrades (2025 Allocation) | C$2.08 billion | Represents essential reinvestment to preserve existing high-market-share assets, typical for cash cows. |

Preview = Final Product

CN BCG Matrix

The BCG Matrix preview you see is the exact, unedited document you'll receive after completing your purchase. This means you're getting a fully functional, professionally formatted strategic tool ready for immediate application in your business planning. No watermarks or demo limitations will be present in the final file, ensuring you have a pristine and actionable report. You can confidently evaluate this preview, knowing it represents the complete and high-quality BCG Matrix that will be yours to download and utilize.

Dogs

Segments like international intermodal and specific merchandise, including forest products, metals, and automotive traffic, have seen reduced volumes. This downturn is directly linked to ongoing trade and tariff uncertainties impacting major industries.

These segments are currently characterized by slow growth and potentially reduced profitability, positioning them as potential candidates for divestment if market conditions persist or worsen. For instance, in 2024, the automotive sector, heavily reliant on global supply chains, continued to grapple with tariff impacts and fluctuating demand, contributing to this segment's challenges.

Underperforming niche or legacy freight services represent a challenge for CN. These segments, often characterized by low volume and specialized demand, may not align with CN's primary, high-profitability routes. For instance, certain legacy contracts for less-trafficked industrial spurs could tie up valuable rolling stock and personnel.

These operations typically exhibit low market share and contribute minimally to CN's overall revenue growth or profitability. In 2024, while CN focused on optimizing its network for bulk commodities and intermodal traffic, these niche services might have absorbed a disproportionate amount of operational expenditure relative to their financial contribution, potentially impacting efficiency metrics.

Routes with intense trucking competition, particularly those experiencing depressed trucking rates, often fall into the 'Dogs' category within the CN BCG Matrix. These segments are characterized by low growth and low market share, making them challenging for intermodal services to compete effectively.

Shorter hauls or less efficient routes are especially vulnerable. For instance, if trucking rates for a specific lane drop significantly, say by 15% in 2024 due to overcapacity, intermodal providers on that same route might see their pricing power erode, impacting profitability.

These 'Dog' routes struggle to maintain market share because the lower cost structure of the competing trucking mode becomes more attractive to shippers. This dynamic can lead to a downward spiral in volumes and revenue for intermodal operators on these specific lanes.

Inefficient or Obsolete Infrastructure

Inefficient or obsolete infrastructure within a company, like CN, can be categorized as a 'Dog' in the BCG Matrix. These are assets or operational segments that consume resources but offer low returns and limited growth potential. For instance, older data centers or legacy communication systems might fall into this category.

These 'Dog' components demand significant capital for maintenance and upgrades, diverting funds that could be invested in more promising areas. In 2024, many large infrastructure-heavy companies are grappling with the cost of maintaining aging networks. For CN, this could translate to higher operational expenses without a corresponding boost in revenue or market share for those specific segments.

- High Maintenance Costs: Older infrastructure often requires more frequent repairs and specialized maintenance, increasing operational expenditure.

- Low Return on Investment: These assets typically generate minimal revenue and have little to no growth prospects, leading to poor ROI.

- Capital Tie-up: Significant capital is locked in these underperforming assets, hindering investment in growth opportunities or more modern technologies.

- Strategic Disadvantage: Obsolete infrastructure can lead to slower service delivery, reduced efficiency, and a competitive disadvantage compared to rivals with updated systems.

Segments with Persistent Volume Declines

Segments experiencing persistent volume declines, often termed Dogs in the BCG Matrix, are those commodity groups or traffic lanes where revenue ton miles (RTMs) consistently shrink. These areas typically lack a clear recovery strategy, often due to fundamental shifts in demand or intense competitive forces. For instance, in 2024, certain bulk commodity sectors, like thermal coal transport, continued to see RTMs fall as global energy markets pivot towards renewables.

These segments, while potentially breaking even, can divert valuable management focus and resources away from more promising growth areas. An example could be a specific rail corridor primarily serving a declining manufacturing industry, where RTMs have dropped by over 15% year-over-year through Q3 2024. Such segments represent a strategic challenge, requiring careful evaluation to determine if continued investment is warranted.

- Persistent RTM Decline: Segments showing consistent year-over-year drops in revenue ton miles.

- Lack of Recovery Path: No clear strategic initiatives or market trends indicating future growth.

- Resource Drain: Segments that consume management attention and capital without significant upside potential.

- Industry Shifts: Often impacted by long-term changes in consumer demand, technological advancements, or regulatory environments.

Dogs in the CN BCG Matrix represent business segments with low market share and low growth prospects. These are often underperforming freight services or routes facing intense competition, such as those with significant trucking competition. For example, in 2024, specific merchandise segments like forest products and metals experienced reduced volumes due to trade uncertainties, fitting the 'Dog' profile.

These segments require careful management as they can drain resources without offering substantial returns. Obsolete infrastructure or legacy systems can also fall into this category, demanding high maintenance costs and offering little ROI. In 2024, many companies, including those in the rail sector, were evaluating such assets to streamline operations.

Segments with persistent declines in revenue ton miles (RTMs) are classic 'Dogs.' For instance, certain bulk commodity sectors, like thermal coal, continued to see RTMs fall in 2024 due to shifts in global energy markets. These areas often lack a clear recovery path and can divert management focus from more profitable ventures.

The challenge with 'Dogs' is their potential to consume capital and management attention while contributing minimally to overall growth or profitability. Identifying and strategically managing these segments is crucial for optimizing resource allocation and enhancing overall business performance.

| BCG Category | Characteristics | CN Example (2024) | Strategic Implications |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Legacy freight services, specific merchandise (e.g., forest products), routes with intense trucking competition | Divest, harvest, or invest minimally; focus on efficiency |

| High Maintenance, Low ROI | Obsolete infrastructure, aging data centers | Upgrade or replace if critical; otherwise, consider divestment | |

| Persistent RTM Decline | Certain bulk commodities (e.g., thermal coal), declining manufacturing industry spurs | Evaluate for divestment or significant restructuring |

Question Marks

CN's emerging digital logistics and supply chain solutions are positioned as Stars within the BCG matrix. This segment operates in a high-growth market, with CN actively investing in new digital platforms and specialized services. While current market share is modest, the significant growth potential and disruptive capabilities of these offerings are clear indicators of future success.

Expanding into new geographic or niche commodity markets presents a strategic avenue for growth, even for a company with an established network like CN. These moves, however, demand significant capital outlay to build brand recognition and secure market share in unfamiliar territories or specialized sectors.

For instance, consider the burgeoning demand for rare earth minerals in Southeast Asia. While CN might have a general commodities presence, a focused expansion into this specific niche in countries like Vietnam, where mining operations are increasing, could yield substantial returns. In 2024, the global market for rare earth elements was projected to reach over $9 billion, with significant growth anticipated in emerging economies.

CN's foray into advanced predictive analytics and AI for network optimization positions it on the cusp of a significant technological leap. While its current market share in these cutting-edge applications might be nascent, the potential for high growth is substantial. This area is becoming increasingly critical for industries aiming for real-time efficiency and dynamic strategy adaptation.

The integration of AI for dynamic pricing, for instance, could revolutionize revenue streams. In 2024, the global AI market was valued at over $200 billion, with predictive analytics representing a significant and rapidly expanding segment. CN's ability to leverage these technologies for its network operations could unlock substantial competitive advantages and revenue growth, moving beyond traditional operational efficiencies.

Renewable Fuels and Green Energy Transport Solutions

Renewable fuels and green energy transport solutions for CN represent a promising, albeit developing, area. As CN enhances its capabilities to move biofuels and hydrogen, it taps into a high-growth sector driven by decarbonization efforts. For instance, in 2024, the demand for sustainable aviation fuel (SAF) is projected to grow significantly, creating new logistics opportunities for rail carriers.

CN's strategic focus on this segment aligns with broader industry trends. The company is investing in specialized equipment and expertise to handle these new energy products. This includes the transport of components for renewable energy infrastructure, such as large wind turbine blades and solar panels, which are increasingly being moved via rail to support the expansion of clean energy projects across North America.

- High Growth Potential: The market for transporting renewable fuels and green energy components is expanding rapidly, driven by global sustainability targets.

- Capability Development: CN is actively building specialized infrastructure and operational expertise to effectively serve this emerging market.

- Infrastructure Support: Rail transport is crucial for delivering components needed for the construction of wind farms and solar installations, a sector seeing substantial investment.

- Market Share Expansion: As capabilities mature, CN has a significant opportunity to capture a larger share of this evolving logistics landscape.

Strategic Partnerships for Intermodal Corridor Development

Canadian National Railway (CN) is actively pursuing strategic partnerships to bolster its intermodal corridor development, particularly in high-growth areas. These alliances are crucial for navigating the evolving competitive landscape and securing future market share. For instance, CN's investment in expanding its network to new port connections or developing cross-border routes signifies a proactive approach to capturing emerging intermodal demand.

These partnerships often involve collaboration with terminal operators, trucking companies, and even government entities to streamline logistics and enhance efficiency. A prime example is the ongoing development of intermodal hubs that integrate various transportation modes, aiming to reduce transit times and costs for shippers. By fostering these relationships, CN positions itself to capitalize on increased trade volumes and the growing demand for seamless, end-to-end supply chain solutions.

- Focus on High-Growth Corridors: CN's strategy prioritizes intermodal corridors with significant projected growth, often driven by new trade agreements or shifts in global supply chains.

- New Port Connections and Cross-Border Routes: Investments are directed towards expanding access to key ports and establishing efficient cross-border transit points, enhancing CN's reach and service offering.

- Evolving Competitive Landscape: Partnerships are formed in areas where the competitive dynamics are still taking shape, allowing CN to establish a strong presence and influence market development.

- Investment for Future Market Share: CN's capital allocation in these partnerships is a strategic move to secure a dominant position in anticipated future intermodal freight volumes.

Question Marks represent new ventures or business areas where CN has a low market share but operates in a high-growth industry. These segments require significant investment to gain traction and could potentially become Stars or Dogs. The challenge lies in accurately assessing their future potential and deciding whether to invest further or divest.

CN's exploration into autonomous rail technology and advanced drone-based inspection services are classic examples of Question Marks. While these innovations are in their early stages with limited current adoption, the underlying markets for automation and AI-driven infrastructure monitoring are experiencing explosive growth.

For instance, the global market for autonomous vehicles, which includes rail applications, was projected to reach over $100 billion by 2025, indicating a substantial future opportunity. Similarly, the drone services market, particularly for industrial inspections, was expected to grow by over 20% annually in the early 2020s, highlighting the rapid expansion of this sector.

CN's investment in securing rights-of-way for potential high-speed rail corridors or developing specialized cold chain logistics for perishable goods in emerging markets also fits the Question Mark profile. These initiatives are capital-intensive and their market success is not yet guaranteed, but they tap into sectors with strong long-term growth potential driven by changing consumer demands and infrastructure needs.

| Business Area | Market Growth | Current Market Share | Strategic Consideration |

| Autonomous Rail Technology | High | Low | Invest for future leadership or divest if potential is uncertain |

| Drone Inspection Services | High | Low | Develop capabilities to capture growing demand for infrastructure monitoring |

| High-Speed Rail Corridors | High (potential) | Very Low | Long-term strategic investment, requires significant capital and regulatory support |

| Specialized Cold Chain Logistics | High | Low | Target niche markets with growing demand for temperature-controlled transport |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.