CLS Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLS Holdings Bundle

CLS Holdings demonstrates a compelling mix of market opportunities and potential challenges, with key strengths in its diversified portfolio and strategic acquisitions. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for informed decision-making.

Want the full story behind CLS Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CLS Holdings plc boasts a geographically diversified portfolio, with a significant presence in the United Kingdom, Germany, and France. This strategic spread across key European markets mitigates risks associated with any single economy, offering a more stable foundation for growth. By not being overly concentrated in one area, CLS can capitalize on diverse market dynamics.

The company's commitment to future-focused workspaces is evident in its substantial asset base, totaling over 603,870 square meters. This extensive footprint across its European holdings positions CLS to meet evolving demands for modern office environments, a key strength in the current real estate landscape.

CLS Holdings actively enhances its property portfolio through strategic refurbishments and re-lettings, directly aiming to boost both rental income and capital appreciation. This hands-on approach is a core strength, allowing the company to adapt to market demands and tenant needs.

In 2024, CLS demonstrated its value creation capabilities by making substantial progress on its strategic goals, even amidst a difficult economic environment. This resilience highlights the effectiveness of their active management strategy in optimizing portfolio performance and tenant attractiveness.

CLS Holdings has shown impressive operational strength through its consistent leasing efforts and excellent rent collection. This resilience is a significant advantage.

In 2024, the company achieved a substantial £16.6 million in contracted annual rent from 112 new lettings and renewals. Notably, these leases were secured at an average of 6.8% above their estimated rental values, showcasing strong demand and effective pricing strategies.

Furthermore, CLS Holdings maintained a remarkable rent collection rate of 99% throughout 2024 and into the first quarter of 2025. This high collection rate underscores the stability and reliability of its tenant portfolio.

Resilient Balance Sheet and Liquidity

CLS Holdings boasts a resilient balance sheet and substantial liquidity, a key strength that underpins its operational and strategic flexibility. This robust financial position is evidenced by its significant holdings in cash and cash equivalents, augmented by considerable undrawn revolving credit facilities.

As of December 31, 2024, the company reported total liquidity amounting to £120.5 million. This impressive liquidity acts as a crucial buffer, enabling CLS Holdings to pursue strategic investment opportunities, effectively manage its existing debt obligations, and confidently navigate potential market downturns or economic uncertainties.

- Strong Liquidity Position: £120.5 million in total liquidity as of December 31, 2024.

- Financial Flexibility: Ability to fund strategic investments and manage debt.

- Market Resilience: Capacity to withstand and adapt to market fluctuations.

Commitment to Sustainability (ESG)

CLS Holdings demonstrates a robust commitment to sustainability, evidenced by its Gold award in EPRA Sustainability Best Practices Recommendations and a GRESB award of 4 green stars. This dedication to Environmental, Social, and Governance (ESG) principles is not merely reputational; it translates into tangible business advantages by increasing asset appeal. The company's proactive stance on sustainability resonates with a growing market preference for eco-friendly properties.

The company is actively pursuing its 2030 Net Zero Carbon Pathway, a strategic initiative that involves substantial investment in sustainability projects. This forward-thinking approach positions CLS Holdings to meet evolving investor and tenant demands for environmentally responsible buildings, a trend that is accelerating in the 2024-2025 period.

Key strengths related to their ESG commitment include:

- Award-Winning ESG Practices: Recognition through EPRA Gold and GRESB 4-star awards validates their strong sustainability performance.

- Net Zero Carbon Pathway: A clear, actionable plan for achieving net-zero emissions by 2030 demonstrates long-term environmental commitment.

- Enhanced Asset Appeal: Investments in sustainability initiatives directly improve the attractiveness of their property portfolio to a wider range of investors and tenants.

- Alignment with Market Trends: Proactively addressing the increasing demand for green buildings ensures CLS Holdings remains competitive and relevant in the evolving real estate landscape.

CLS Holdings' diversified portfolio across the UK, Germany, and France provides a robust defense against single-market economic downturns. This geographical spread, coupled with a substantial 603,870 square meters of property, positions them well to capture varied European market dynamics. Their active asset management, including refurbishments and strategic re-lettings, consistently drives rental income and capital growth.

The company's financial health is a significant strength, underscored by strong liquidity. As of December 31, 2024, CLS Holdings reported total liquidity of £120.5 million, bolstered by cash reserves and undrawn credit facilities. This financial flexibility allows for strategic investments and effective debt management, ensuring operational resilience.

CLS Holdings' commitment to sustainability is a key differentiator, recognized by EPRA Gold and GRESB 4-star awards. Their active pursuit of a 2030 Net Zero Carbon Pathway enhances property appeal and aligns with growing market demand for environmentally conscious buildings, a trend gaining momentum through 2024 and into 2025.

| Metric | Value | As of |

|---|---|---|

| Total Liquidity | £120.5 million | December 31, 2024 |

| Property Portfolio Size | 603,870 sq m | 2024 |

| Rent Collection Rate | 99% | Q1 2025 |

| New Lettings Premium | 6.8% above ERV | 2024 |

What is included in the product

Provides a clear SWOT framework for analyzing CLS Holdings’s business strategy, highlighting its internal capabilities and market challenges.

Offers a clear, actionable SWOT analysis of CLS Holdings, simplifying complex strategic challenges into manageable insights for effective problem-solving.

Weaknesses

CLS Holdings faced a significant challenge with property valuations in 2024. The company reported a 5.8% decrease in its portfolio valuation when measured in local currency, and this figure rose to 8.3% when accounting for the strengthening of the British Pound.

The UK portfolio, in particular, experienced an 8.3% drop in value. This decline was influenced by factors such as a shortening lease term on a key asset, which impacted its attractiveness and therefore its valuation.

While there are indications that property valuations might be stabilizing, the recent downturn has had a direct effect on CLS Holdings' Net Tangible Assets (NTA) per share, reducing its overall asset backing.

CLS Holdings experienced an increase in its overall vacancy rate, rising to 12.7% in 2024 from 11.0% in 2023. This uptick is largely attributed to the availability of newly refurbished properties in the UK and France, ready for new tenants.

While the underlying vacancy rate saw a slight reduction, the higher overall figure signifies a transitional phase. The company is currently in the process of re-letting these newly completed or upgraded spaces, which can temporarily impact rental income streams.

CLS Holdings experienced a significant uplift in its financing expenses, which directly affected its financial performance. In 2024, this resulted in a 10.7% drop in EPRA Earnings Per Share (EPS).

The company's weighted average cost of debt climbed to 3.81% by the middle of 2024. This increase stems from the necessity to refinance existing debt at considerably higher interest rates, a common challenge in the current economic climate.

These escalating borrowing costs exert downward pressure on CLS Holdings' overall profitability. This is a key challenge the company must navigate, even as it works to manage its existing debt obligations.

Significant Loan Maturities in 2025

CLS Holdings faces a significant hurdle with approximately £372.3 million in loans maturing in 2025. This large volume of debt coming due in the near term, even with early refinancing efforts, creates ongoing challenges.

The current higher interest rate environment exacerbates this situation. CLS is exposed to the risk of higher borrowing costs as it seeks to refinance these substantial maturities.

- Loan Maturities: Approximately £372.3 million in loans due in 2025.

- Refinancing Pressure: Significant volume of debt requires refinancing.

- Interest Rate Risk: Higher borrowing costs are a concern in the current market.

Dividend Per Share Reduction

CLS Holdings’ decision in 2024 to reduce its dividend per share by 33.6% to 5.28 pence signals a challenging financial environment. While intended to bolster funds for future expansion and manage loan-to-value ratios, this move is likely to alienate investors prioritizing regular income streams.

The dividend cut directly impacts shareholder returns, potentially leading to a negative perception among a significant portion of the investor base. This can affect the company's valuation and its attractiveness to income-oriented funds.

- Dividend Reset: CLS Holdings decreased its dividend per share by 33.6% in 2024.

- New Dividend Rate: The dividend now stands at 5.28 pence per share.

- Strategic Rationale: The reduction aims to retain capital for growth and manage loan-to-value.

- Investor Impact: Income-focused investors may view this negatively, impacting share appeal.

CLS Holdings faces headwinds from declining property valuations, with its portfolio value dropping 5.8% in local currency during 2024. The UK segment saw an 8.3% decrease, partly due to a shorter lease on a key asset. This valuation dip directly reduced the company's Net Tangible Assets (NTA) per share.

The company's vacancy rate increased to 12.7% in 2024, up from 11.0% in 2023, primarily due to newly refurbished properties in the UK and France becoming available. This transitional phase, while preparing spaces for new tenants, temporarily impacts rental income.

Financing expenses significantly impacted CLS Holdings' financial performance, leading to a 10.7% drop in EPRA Earnings Per Share (EPS) in 2024. The weighted average cost of debt rose to 3.81% by mid-2024 due to refinancing at higher interest rates, putting pressure on profitability.

A substantial £372.3 million in loans mature in 2025, presenting a significant refinancing challenge in the current higher interest rate environment. The company also reduced its dividend per share by 33.6% to 5.28 pence in 2024, a move aimed at bolstering funds but potentially alienating income-focused investors.

| Metric | 2023 | 2024 | Change |

| Portfolio Valuation (Local Currency) | N/A | -5.8% | Decrease |

| UK Portfolio Valuation | N/A | -8.3% | Decrease |

| Overall Vacancy Rate | 11.0% | 12.7% | Increase |

| EPRA EPS | N/A | -10.7% | Decrease |

| Weighted Average Cost of Debt | N/A | 3.81% (mid-2024) | Increase |

| Dividend Per Share | N/A | 5.28 pence | -33.6% |

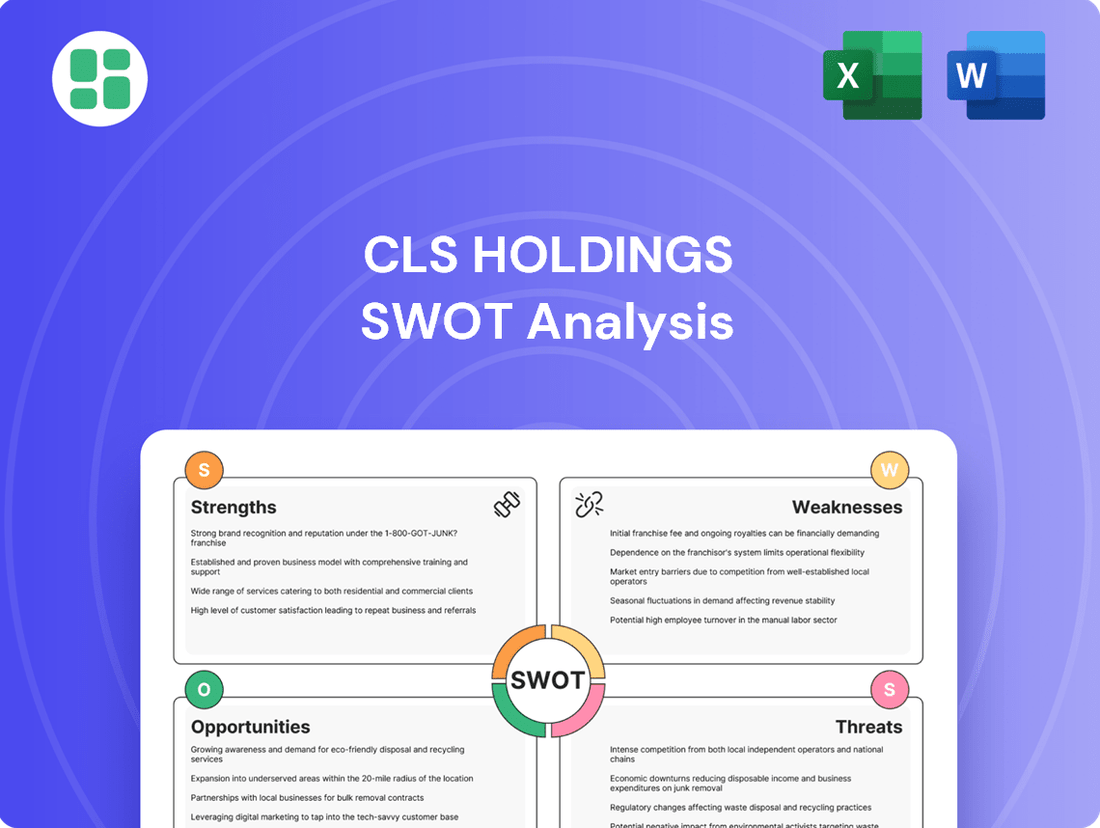

Preview Before You Purchase

CLS Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual CLS Holdings SWOT analysis, providing a clear overview of its strategic positioning. Upon purchase, you'll gain access to the complete, in-depth report.

Opportunities

The commercial property market in CLS Holdings' key regions, including the UK, Germany, and France, is exhibiting signs of stabilization, potentially reaching the nadir of the current economic cycle. Analysts are forecasting a cautious recovery for 2025, driven by improving market fundamentals.

Investment activity is showing signs of strengthening, and interest rates are expected to moderate, creating a more favorable environment for property acquisitions and potential value growth. For instance, European commercial real estate transaction volumes, while still below pre-pandemic levels, saw a modest uptick in late 2024, signaling renewed investor interest.

There's a clear shift in tenant preferences towards modern, flexible, and environmentally responsible office spaces. This is a significant opportunity for CLS Holdings, as their strategy of upgrading and developing high-quality properties directly addresses this demand. For instance, in 2024, a significant portion of new office leases were for buildings with strong ESG credentials, indicating a premium is being placed on sustainability.

CLS Holdings is strategically divesting assets totaling £270 million. This move is designed to significantly lower the company's debt levels and free up capital for more promising investments. The company has already achieved substantial disposals at book value, with the remaining program slated for completion in 2025.

This proactive portfolio management allows CLS Holdings to shed underperforming assets and reallocate resources toward opportunities offering higher returns. By optimizing its property portfolio, the company aims to enhance overall portfolio yield and financial flexibility.

Potential for Moderating Interest Rates

Anticipated moderations or reductions in interest rates by central banks in 2025 could significantly lower borrowing costs for real estate firms like CLS Holdings. This potential shift would directly benefit CLS by decreasing their financing expenses, thereby enhancing profitability. Furthermore, such a climate could invigorate investment in the commercial property sector.

The prospect of declining interest rates in 2025 presents a notable opportunity. For instance, if the Bank of England were to lower its base rate from its current levels, CLS Holdings could see a tangible reduction in the cost of servicing its debt. This financial relief could then be reinvested into property acquisitions or development, potentially boosting the company's portfolio value and operational capacity.

- Lower Financing Costs: Reduced interest rates directly translate to cheaper debt for CLS Holdings, improving its bottom line.

- Stimulated Market Activity: A more favorable borrowing environment can encourage greater investment and transaction volume in commercial real estate.

- Enhanced Profitability: Savings on interest payments can be redirected to operational improvements or shareholder returns.

Redevelopment and Upside in Portfolio

CLS Holdings is actively pursuing redevelopment projects within its existing property portfolio, aiming to unlock significant value. A prime example is the Spring Gardens site in the UK, where redevelopment efforts are underway. These initiatives are strategically designed to boost both rental income and the overall market value of the properties once they are completed and leased.

The company anticipates that these redevelopments will lead to a substantial uplift in estimated rental values (ERVs) and capital values. For instance, CLS reported a 7.8% increase in ERV across its portfolio in the first half of 2024, partly driven by ongoing asset management and refurbishment projects. The successful execution of these projects is a key component of CLS's long-term strategy for value creation and portfolio enhancement.

CLS's approach to redevelopment focuses on transforming underutilized or outdated spaces into modern, desirable assets. This strategy is particularly relevant in the current market, where demand for high-quality, well-located commercial spaces remains strong. The potential for significant upside is a core driver of the company's investment in these redevelopment opportunities.

- Spring Gardens Redevelopment: CLS is actively progressing with the redevelopment of its Spring Gardens property in the UK.

- ERV Uplift Potential: Completed redevelopments are expected to significantly increase the estimated rental values of CLS assets.

- Capital Value Enhancement: The projects are designed to improve the capital value of the properties, contributing to long-term shareholder returns.

- Strategic Value Creation: Redevelopment is a key strategy for CLS to drive value creation within its existing portfolio.

The commercial property market in CLS Holdings' key regions is showing signs of stabilization, with cautious recovery forecasts for 2025. This improved market sentiment, coupled with moderating interest rate expectations, creates a more conducive environment for investment and potential asset value appreciation.

Tenant demand is increasingly focused on modern, flexible, and sustainable office spaces, aligning perfectly with CLS Holdings' strategy of upgrading its portfolio. The company's proactive asset disposals, totaling £270 million by 2025, are aimed at reducing debt and freeing up capital for higher-return opportunities.

Anticipated interest rate reductions in 2025 offer a significant advantage by lowering financing costs and potentially stimulating broader market activity. CLS is also actively pursuing value-enhancing redevelopment projects, such as Spring Gardens, which are projected to boost rental income and capital values, evidenced by a 7.8% ERV increase in H1 2024.

Threats

CLS Holdings faces significant headwinds from ongoing macroeconomic uncertainties. Inflation dynamics, particularly in the UK and Eurozone, continue to pressure operating costs and tenant affordability. For instance, UK inflation remained elevated at 2.3% in April 2024, impacting disposable incomes and potentially commercial rent growth.

Geopolitical factors add another layer of risk. Tensions in Eastern Europe and the potential for increased protectionist policies globally could dampen economic growth and investor sentiment across CLS Holdings' key European markets. This uncertainty can lead to delayed investment decisions in the commercial property sector, affecting leasing demand and overall investment volumes.

The shift towards hybrid and remote work continues to fuel high office vacancy rates across the commercial real estate sector, with national averages hovering around 18.5% by mid-2025. This persistent oversupply of office space presents a significant challenge, potentially leading to downward pressure on rental income and asset valuations for companies like CLS Holdings.

The cost of financing remains a significant concern. While interest rates have shown some moderation, they are still considerably higher than in recent years, and lenders have become more stringent with their underwriting. This environment poses a direct threat to CLS Holdings.

CLS Holdings faces considerable refinancing risks as its existing loans mature. The elevated interest rate environment means that refinancing these obligations will likely come with higher debt service costs. This could put a strain on the company's profitability and its ability to manage liquidity effectively, especially if securing favorable new terms proves difficult.

Increased Scrutiny on Operational Costs and ESG Compliance

CLS Holdings, like other commercial property managers, is facing heightened pressure from tenants to justify and reduce service charges, demanding greater transparency in operational costs. This trend intensified in 2024 as inflation continued to impact building maintenance and utility expenses.

Moreover, the company must navigate increasingly stringent environmental, social, and governance (ESG) regulations. Meeting these evolving compliance standards, particularly regarding energy efficiency in its portfolio, necessitates substantial capital investment, potentially driving up both capital expenditure and ongoing operating expenses. For instance, upgrades to HVAC systems and building insulation, critical for ESG compliance, could represent significant upfront costs.

- Tenant Demand for Cost Efficiency: Pressure to reduce service charges is a growing concern for property managers.

- ESG Compliance Investment: Significant capital is required for energy efficiency and sustainability upgrades.

- Increased Operating Expenses: Meeting ESG standards can lead to higher ongoing operational costs.

Market Competition and Shifting Investor Focus

The commercial real estate sector is intensely competitive, with a notable pivot towards asset classes like logistics, multifamily housing, and data centers. CLS Holdings, primarily focused on office properties, faces significant challenges in this environment. The intense competition for premium assets, coupled with a potential investor preference shift away from traditional office spaces, could hinder CLS's capacity to secure new acquisitions or attract necessary capital. For instance, in Q1 2024, office vacancy rates in major US markets remained elevated, with some cities experiencing rates above 15%, underscoring the pressure on traditional office portfolios.

This dynamic presents a threat as investor sentiment increasingly favors sectors with perceived stronger growth prospects and resilience. The ongoing demand for modern, well-located office spaces is still present, but the overall market appetite may be narrowing, impacting valuations and transaction volumes for properties not aligning with current trends. For example, a report from Q4 2023 indicated that while logistics and data center investments saw substantial year-over-year growth, office sector investment volumes experienced a notable contraction.

- Intensified Competition: CLS competes with a broad range of investors for prime office assets, including institutional funds and private equity firms.

- Shifting Investor Preferences: A growing number of investors are reallocating capital away from traditional office buildings towards sectors perceived as more stable or growth-oriented.

- Acquisition Hurdles: The combination of high competition and evolving investor sentiment can make it more difficult and expensive for CLS to acquire desirable new properties.

- Capital Attraction Challenges: Demonstrating consistent returns and adapting to market shifts will be crucial for CLS to continue attracting investment capital in the face of these market pressures.

The ongoing pressure from tenants to reduce service charges, driven by inflation in 2024, directly impacts CLS Holdings' revenue streams. Simultaneously, the substantial capital investments required for ESG compliance, such as upgrading building efficiency, will likely increase operating expenses and capital expenditure. These combined factors create a challenging environment for maintaining profitability and managing costs effectively.

CLS Holdings faces intense competition from investors favoring logistics and data centers over traditional offices, potentially hindering acquisitions and capital attraction. This shift in investor sentiment, evident in Q4 2023 data showing office sector investment contraction versus growth in other asset classes, poses a threat to CLS's portfolio strategy and valuation.

| Threat Category | Specific Threat | Impact on CLS Holdings | Relevant Data/Context |

|---|---|---|---|

| Tenant Relations | Tenant demand for lower service charges | Reduced revenue, pressure on margins | Inflation in building maintenance costs in 2024 |

| Regulatory & Compliance | ESG compliance costs | Increased CAPEX and OPEX | Need for energy efficiency upgrades |

| Market Competition | Shift in investor preference to logistics/data centers | Difficulty in acquisitions, capital attraction challenges | Office sector investment contraction (Q4 2023) vs. growth in other sectors |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from CLS Holdings' official financial filings, comprehensive market research reports, and insights from industry experts to provide a well-rounded perspective.