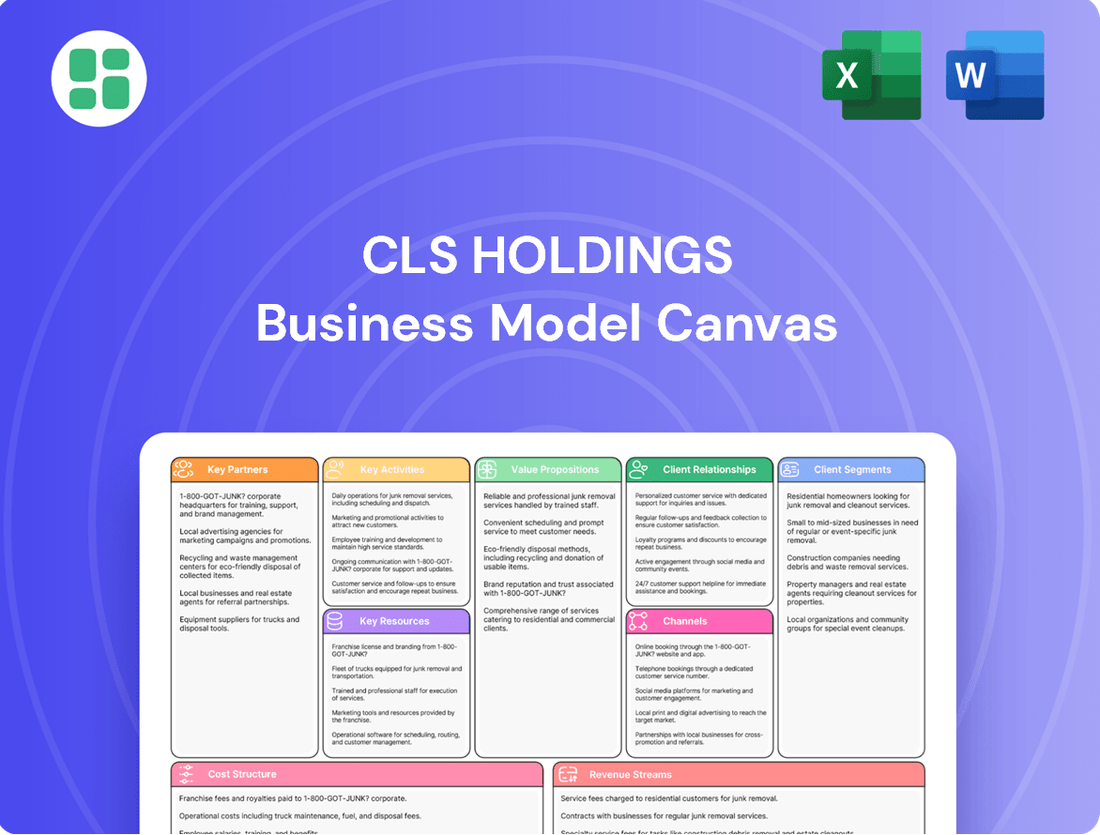

CLS Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLS Holdings Bundle

Discover the strategic engine behind CLS Holdings's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Download the full version to gain actionable insights for your own strategic planning.

Partnerships

CLS Holdings plc's ability to acquire properties, fund development, and manage its debt hinges on strong relationships with financial institutions and lenders. These partnerships are vital for securing the necessary capital to fuel its growth strategies and maintain operational flexibility.

The company actively pursues refinancing opportunities to optimize its debt structure and secure more advantageous terms. For instance, CLS Holdings plc reported significant progress in refinancing activities throughout 2024, aiming to secure favorable terms for its debt portfolio, including a substantial portion maturing in 2025.

CLS Holdings plc relies heavily on its partnerships with construction and development firms to bring its property enhancement vision to life. These collaborations are critical for transforming existing office spaces into modern, efficient, and attractive workplaces that meet evolving tenant demands.

These development partners are instrumental in ensuring CLS's portfolio remains competitive and valuable. For instance, in 2024, CLS continued its focus on refurbishment projects, aiming to boost energy efficiency and tenant amenity offerings, directly supported by the expertise of these construction entities.

CLS Holdings plc relies heavily on real estate agents and property brokers to drive its leasing and property sales. These professionals are instrumental in identifying and connecting CLS with prospective tenants, ranging from corporations to government bodies, ensuring a steady flow of rental income.

Furthermore, these partnerships are crucial for CLS's asset disposal strategies. In 2024, the company continued to leverage these relationships to efficiently sell off properties, aiming to optimize its portfolio and generate capital. The market insights provided by these agents help CLS negotiate advantageous leasing agreements and achieve optimal sale prices for its assets.

Local Authorities and Regulatory Bodies

CLS Holdings actively cultivates partnerships with local authorities and regulatory bodies across its operational regions, including the UK, Germany, and France. These collaborations are crucial for securing planning permissions and ensuring compliance with zoning laws, building codes, and environmental regulations. For instance, in 2024, CLS navigated numerous local planning applications, a process that often involves detailed consultations with municipal councils to align development projects with community needs and urban planning strategies.

These relationships are fundamental to CLS's ability to conduct its development and property management activities legally and responsibly. Adherence to these frameworks not only mitigates risk but also fosters positive community engagement, particularly concerning sustainability targets and urban regeneration efforts. CLS's commitment to these partnerships underscores its strategy to integrate its portfolio within the fabric of local economies and environments.

- Regulatory Compliance: Ensuring all properties meet stringent UK, German, and French building and environmental standards.

- Urban Development: Collaborating on projects that contribute to local economic growth and improved urban infrastructure.

- Sustainability Initiatives: Working with authorities on green building practices and energy efficiency targets, a growing focus in 2024 regulations.

- Community Engagement: Building trust and ensuring development plans align with local community interests and long-term vision.

Technology and Sustainability Solution Providers

CLS Holdings plc actively collaborates with technology and sustainability solution providers to drive its ambitious Net Zero Carbon Pathway by 2030. These partnerships are crucial for integrating advanced energy-saving measures throughout their property portfolio.

Key collaborations focus on implementing smart building technologies and optimizing HVAC systems to significantly reduce energy consumption and greenhouse gas emissions. For instance, in 2024, CLS Holdings continued to roll out smart metering across its UK office portfolio, aiming for a 15% reduction in energy usage in retrofitted buildings.

- Partnerships for Net Zero: CLS Holdings collaborates with specialists to implement energy efficiency and sustainability solutions.

- Technology Integration: Smart building tech and efficient HVAC systems are key areas of focus to cut energy use.

- Environmental Targets: These collaborations directly support CLS Holdings' goal of achieving Net Zero Carbon by 2030.

- Portfolio Advancement: The aim is to create future-ready assets that are both environmentally responsible and attractive to tenants.

CLS Holdings plc's key partnerships are foundational to its operational success and strategic growth. These relationships span financial institutions for capital, development firms for property enhancement, and real estate agents for leasing and sales. Furthermore, collaborations with local authorities ensure regulatory compliance and community alignment, while partnerships with technology providers drive sustainability initiatives.

| Partnership Type | Key Role | 2024 Focus/Impact |

|---|---|---|

| Financial Institutions & Lenders | Capital acquisition, debt management | Securing favorable terms for debt portfolio, significant refinancing progress |

| Construction & Development Firms | Property refurbishment and modernization | Transforming spaces, boosting energy efficiency, enhancing tenant amenities |

| Real Estate Agents & Brokers | Leasing and property sales facilitation | Connecting with tenants, optimizing portfolio sales, negotiating agreements |

| Local Authorities & Regulators | Planning permission, regulatory compliance | Navigating planning applications, aligning projects with community needs |

| Technology & Sustainability Providers | Energy efficiency, Net Zero initiatives | Implementing smart building tech, reducing energy consumption (e.g., 15% target in UK offices) |

What is included in the product

A detailed CLS Holdings Business Model Canvas outlining its core operations, focusing on its role as a property investment company and its strategy for generating rental income and capital appreciation.

This model emphasizes CLS's customer segments (tenants), key resources (properties), and revenue streams (rent), providing a clear framework for understanding its investment and management approach.

The CLS Holdings Business Model Canvas offers a clear, one-page snapshot to quickly identify and address the core components of their operations, acting as a pain point reliever by simplifying complex strategies.

It provides a structured and digestible format for understanding CLS Holdings' business, making it ideal for brainstorming and internal use to pinpoint and resolve operational pain points.

Activities

CLS Holdings plc's property acquisition and investment strategy centers on securing commercial properties, particularly offices, within prime European locations. This involves a keen eye for assets that are either undervalued or possess substantial potential for growth through strategic improvements and redevelopment.

In 2024, CLS Holdings continued to execute this core activity, demonstrating a commitment to portfolio expansion and enhancement. For instance, their focus on urban regeneration projects in cities like Berlin and London underscores their approach to identifying and capitalizing on opportunities for value creation.

CLS Holdings plc actively manages its property portfolio to boost performance, focusing on optimizing existing assets. This includes undertaking refurbishment projects and improving energy efficiency to attract and retain tenants, thereby increasing rental income and property values. For instance, in 2023, CLS completed significant asset management initiatives across its European portfolio, contributing to a 4.7% like-for-like rental growth.

CLS Holdings actively engages in securing new leases and nurturing relationships with its extensive tenant base, which numbered over 744 in 2024. This core activity is crucial for maintaining high occupancy rates and ensuring consistent rental income.

The company's tenant portfolio includes prestigious blue-chip organizations and government departments, highlighting the quality and stability of its leasing operations. Effective property management and responsive service are paramount to tenant retention and satisfaction.

Negotiating lease terms and marketing available spaces are ongoing processes that directly impact rental revenue. Strong leasing performance is a fundamental driver of CLS Holdings' financial success.

Property Development and Refurbishment

CLS Holdings actively engages in property development and refurbishment, focusing on transforming existing office spaces into modern, adaptable environments. This strategic approach aims to meet the evolving demands of tenants and future-proof their portfolio.

Significant capital is allocated to these projects, ensuring buildings are upgraded for improved energy efficiency and enhanced functionality. For instance, in 2024, CLS Holdings continued to invest in its portfolio, with a focus on capital expenditure for refurbishments that add value and appeal to a discerning tenant base.

- Portfolio Enhancement: Projects are designed to increase the overall value and attractiveness of CLS Holdings' property assets.

- Tenant Focus: Refurbishments are tailored to meet contemporary tenant requirements for workspace design and amenities.

- Capital Investment: Substantial financial resources are committed to these development and refurbishment initiatives.

Financial Management and Capital Allocation

CLS Holdings plc's key financial activities revolve around robust financial management and strategic capital allocation. This includes diligently managing its debt, such as through refinancing efforts, to secure favorable terms and reduce interest expenses. For instance, in 2023, the company continued its focus on optimizing its debt profile, aiming to lower its overall cost of borrowing.

Effective capital allocation is paramount, with CLS Holdings plc actively working to strengthen its balance sheet. This involves a disciplined approach to managing its disposal program, which is designed to unlock capital. These funds are then strategically reinvested into areas that offer the greatest potential for growth and value creation, ensuring the company's long-term financial health and operational flexibility.

- Debt Refinancing: CLS Holdings plc actively pursues debt refinancing opportunities to optimize its cost of debt, contributing to improved profitability and financial stability.

- Capital Allocation: The company strategically allocates capital, prioritizing reinvestment in growth opportunities derived from its disposal program.

- Liquidity Management: Maintaining adequate liquidity is a core financial activity, ensuring CLS Holdings plc can meet its short-term obligations and capitalize on timely investment prospects.

- Balance Sheet Strengthening: Continuous efforts are made to enhance the company's balance sheet resilience through prudent financial management practices.

CLS Holdings plc's key activities are centered on acquiring and enhancing commercial properties, primarily offices in prime European locations. They focus on identifying undervalued assets or those with significant redevelopment potential to drive value creation. A crucial aspect is active portfolio management, including refurbishments and energy efficiency upgrades, to boost rental income and property values. In 2023, this approach yielded a 4.7% like-for-like rental growth.

The company also prioritizes strong tenant relationships and leasing activities, managing a diverse tenant base of over 744 entities in 2024, including blue-chip organizations. This ensures high occupancy and stable rental revenue through effective property management and responsive service. Furthermore, CLS Holdings actively engages in property development and refurbishment, investing capital to modernize spaces and meet evolving tenant needs, as seen in their 2024 capital expenditure on value-adding refurbishments.

Financially, CLS Holdings focuses on robust management of debt through refinancing to reduce interest expenses and strategically allocates capital, often reinvesting proceeds from disposals into growth areas. This disciplined approach strengthens their balance sheet and maintains liquidity for timely investment opportunities.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Property Acquisition & Investment | Securing commercial properties in prime European locations with growth potential. | Continued focus on urban regeneration projects in cities like Berlin and London. |

| Portfolio Management | Optimizing existing assets through refurbishment and energy efficiency improvements. | Contributed to 4.7% like-for-like rental growth in 2023. |

| Leasing & Tenant Relations | Securing new leases and nurturing relationships with tenants. | Managed a tenant base of over 744 entities. |

| Property Development & Refurbishment | Transforming existing spaces into modern, adaptable environments. | Significant capital expenditure allocated to refurbishments enhancing property appeal. |

| Financial Management | Managing debt through refinancing and strategic capital allocation. | Ongoing efforts to optimize debt profile and strengthen the balance sheet. |

Full Document Unlocks After Purchase

Business Model Canvas

The CLS Holdings Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a sample; it's a direct representation of the comprehensive analysis you'll gain access to. You'll get the complete, ready-to-use Business Model Canvas, allowing you to understand CLS Holdings' strategic framework without any surprises.

Resources

CLS Holdings plc's core strength lies in its substantial and strategically positioned property portfolio. This collection of commercial real estate, primarily focused on office buildings, is a crucial asset, with its value standing at roughly £1.7 billion by the end of 2024. The geographical spread across the UK, Germany, and France further diversifies risk and opportunity.

This extensive physical asset base is the engine for generating rental income and pursuing capital growth. The inherent quality and prime locations of these properties are fundamental to CLS Holdings' entire business strategy, underpinning its revenue streams and long-term value creation.

CLS Holdings plc's access to significant financial capital is a cornerstone of its business model. This includes substantial cash reserves, undrawn credit facilities, and the capacity to secure new financing. For instance, as of December 31, 2023, CLS Holdings reported total assets of £2.9 billion, with a significant portion representing investment properties, underscoring the need for robust financial backing.

This financial firepower directly fuels CLS Holdings' strategic objectives, enabling the acquisition of new properties and the execution of development projects. It also covers ongoing operational expenses, ensuring smooth business continuity. The company's ability to manage its treasury effectively is paramount, directly impacting its capacity to pursue investment opportunities and drive growth.

CLS Holdings plc's experienced management team and skilled employees are a core asset, bringing deep expertise in property investment, development, and financial management. This human capital is vital for identifying lucrative opportunities and executing complex projects effectively.

The team's proficiency in asset management and tenant relations directly fuels the company's performance and guides its strategic direction. This includes a growing focus on specialists in sustainability and property technology, crucial for navigating evolving market demands.

Established Networks and Market Knowledge

CLS Holdings plc cultivates deep-seated relationships with key players in its operating regions, including real estate agents, legal experts, and financial institutions. These established networks are crucial for identifying attractive investment opportunities and facilitating smooth transactions.

The company's profound understanding of the UK, German, and French property markets is a significant asset. This market intelligence allows CLS Holdings to anticipate trends, assess risks accurately, and capitalize on emerging opportunities, giving them a distinct edge.

For example, CLS Holdings' 2024 portfolio performance, detailed in their recent financial reports, highlights the effectiveness of their market knowledge. Their ability to source off-market deals, often through these established networks, contributed to a robust pipeline and successful acquisitions throughout the year.

- Established Networks: Long-standing relationships with real estate agents, legal advisors, and financial partners.

- Market Knowledge: Deep understanding of UK, German, and French property markets.

- Competitive Advantage: Facilitates deal sourcing, trend analysis, and regulatory navigation.

- 2024 Impact: Networks and knowledge contributed to a strong deal pipeline and successful acquisitions.

Brand Reputation and Tenant Relationships

CLS Holdings' brand reputation as a dependable and forward-thinking commercial property investor and manager is a significant intangible asset. This established trust underpins their operations and market standing.

The company cultivates robust, enduring relationships with a broad tenant portfolio exceeding 744 entities. This diverse base includes prominent blue-chip organizations, which is crucial for generating consistent rental income and fostering repeat business.

- Brand Reputation: CLS Holdings benefits from a strong market perception as a reliable commercial property investor and manager.

- Tenant Base: The company serves over 744 tenants, a significant portion of which are blue-chip organizations.

- Relationship Value: Long-term tenant relationships contribute to stable rental income and encourage repeat business.

- Leasing Support: This reputation and tenant loyalty directly support ongoing leasing activities and tenant retention efforts.

CLS Holdings plc's key resources are its substantial property portfolio, valued at approximately £1.7 billion as of year-end 2024, and its strong financial standing, evidenced by total assets of £2.9 billion as of December 31, 2023. These are complemented by an experienced management team and deep market knowledge across the UK, Germany, and France. The company also benefits from established networks and a strong brand reputation, fostering long-term tenant relationships with over 744 entities, including blue-chip organizations.

Value Propositions

CLS Holdings plc provides premium, future-ready office environments that are meticulously maintained and equipped for modern business needs. These spaces are designed to foster growth and offer flexibility, ensuring tenants can adapt to evolving operational demands.

The company's commitment to enhancing its portfolio is evident through continuous investment in refurbishments and upgrades. For instance, CLS Holdings reported a significant focus on capital expenditure in 2024 to modernize its properties, aiming to improve energy efficiency and incorporate advanced technological features that support tenant productivity and well-being.

This dedication to high-quality, adaptable office solutions attracts a broad spectrum of clients, from established corporations to government bodies. These organizations value environments that not only meet current operational standards but also anticipate future workplace trends, contributing to their long-term success and employee satisfaction.

CLS Holdings' strategic locations in key European cities, particularly in the UK, Germany, and France, focus on non-central but well-connected urban areas. This approach ensures tenants benefit from efficient transportation links, a crucial factor for business operations and employee commutes.

These carefully selected sites offer a compelling value proposition: cost-effective rental solutions that don't sacrifice accessibility. For instance, in 2024, CLS Holdings continued to optimize its portfolio by focusing on these types of locations, aiming to provide a strong balance between affordability and connectivity for its diverse tenant base.

The deliberate choice of these well-connected, non-central districts is designed to enhance tenant convenience and drive property value appreciation. By prioritizing accessibility and cost-efficiency, CLS Holdings positions its properties to attract and retain tenants, fostering long-term growth and maximizing returns.

CLS Holdings plc actively manages its property portfolio, aiming to boost both rental income and property worth. This proactive strategy includes regular upkeep, smart upgrades, and attentive tenant support, ensuring their assets remain appealing and profitable.

In 2024, CLS Holdings reported a strong performance, with its proactive asset management contributing significantly to its financial results. The company's focus on enhancing property values is a core element of its business model, driving sustainable growth.

Stable and Diversified Rental Income for Investors

CLS Holdings plc provides investors with a compelling value proposition centered on stable and diversified rental income. This is achieved through a broad tenant base spread across various geographies, mitigating single-market risks.

The company’s strategic focus on acquiring and managing high-yielding properties, coupled with robust rent collection processes, ensures a consistent and reliable return profile for its investors. This stability is a key draw for both individual and institutional investors looking for dependable income streams.

For example, in 2024, CLS Holdings reported a strong occupancy rate across its portfolio, demonstrating the resilience of its rental income. The company’s commitment to maintaining high occupancy levels directly translates into predictable cash flows for its shareholders.

- Diversified Geographic Exposure: CLS Holdings operates across the UK, Germany, and France, reducing reliance on any single market.

- High Occupancy Rates: The company consistently achieves high occupancy, ensuring steady rental income. For instance, in H1 2024, occupancy stood at 96.1%.

- Focus on Defensive Sectors: A significant portion of the portfolio is in sectors like healthcare and residential, which tend to be less cyclical.

- Strong Rent Collection: CLS Holdings has a proven track record of efficient rent collection, contributing to income stability.

Commitment to Sustainability and Modernization

CLS Holdings plc is actively pursuing a Net Zero Carbon Pathway by 2030, a commitment that directly enhances the value proposition for both tenants and investors by delivering properties with superior environmental performance.

This dedication to sustainability, evidenced by significant investments in energy efficiency upgrades and the pursuit of green certifications, translates into tangible long-term value. It not only slashes operational costs but also capitalizes on the escalating market demand for eco-conscious workspaces.

CLS Holdings' strategic focus on modernization and sustainability positions them as a forward-thinking and responsible entity in the real estate sector.

- Net Zero Carbon Pathway: Aiming for Net Zero by 2030.

- Environmental Performance: Offering tenants properties with improved energy efficiency and green credentials.

- Long-Term Value: Reducing operational costs and meeting demand for sustainable workspaces.

- Forward-Thinking Approach: Demonstrating responsible business practices and future-proofing assets.

CLS Holdings offers premium, adaptable office spaces in strategically chosen, well-connected urban locations across the UK, Germany, and France. These environments are designed to support business growth and tenant well-being, with a strong emphasis on continuous portfolio enhancement through refurbishment and technological integration.

The company's value proposition is built on providing cost-effective, accessible workspaces that anticipate future workplace trends. This focus on quality and convenience attracts a diverse tenant base, including corporations and government entities, who prioritize operational efficiency and employee satisfaction.

CLS Holdings actively manages its assets to enhance rental income and property value through consistent upkeep, strategic upgrades, and attentive tenant support. This proactive approach ensures properties remain desirable and profitable, contributing to sustainable growth and investor returns.

Investors benefit from stable, diversified rental income streams, supported by a broad tenant base and robust rent collection processes. The company's commitment to high occupancy rates, such as 96.1% in H1 2024, underscores the reliability of its cash flows.

CLS Holdings is committed to environmental responsibility, aiming for Net Zero Carbon by 2030. This focus on sustainability enhances property value by reducing operational costs and meeting the growing demand for eco-conscious workspaces, positioning the company as a forward-thinking leader.

| Value Proposition | Description | Key Supporting Facts (2024 Data) |

| Premium, Future-Ready Office Environments | Meticulously maintained, adaptable spaces equipped for modern business needs, fostering growth and flexibility. | Continuous investment in refurbishments and upgrades for energy efficiency and advanced technology. |

| Strategic Location & Accessibility | Well-connected, non-central urban areas in the UK, Germany, and France offering cost-effective solutions without sacrificing accessibility. | Focus on optimizing portfolio in these districts for balance between affordability and connectivity. |

| Proactive Asset Management | Boosting rental income and property worth through regular upkeep, smart upgrades, and attentive tenant support. | Strong performance in 2024 driven by asset management, enhancing property values and driving sustainable growth. |

| Stable & Diversified Rental Income for Investors | Consistent and reliable returns achieved through a broad tenant base across geographies, mitigating single-market risks. | High occupancy rates (96.1% in H1 2024) ensuring predictable cash flows and resilience of rental income. |

| Commitment to Sustainability | Achieving Net Zero Carbon by 2030, delivering properties with superior environmental performance and reduced operational costs. | Significant investments in energy efficiency upgrades and pursuit of green certifications to meet escalating market demand for eco-conscious workspaces. |

Customer Relationships

CLS Holdings plc cultivates robust customer relationships by assigning dedicated property management teams to its tenants. These teams offer direct, responsive support, managing daily operations and addressing maintenance promptly, thereby fostering tenant satisfaction and loyalty. For instance, in 2024, CLS reported a strong tenant retention rate, a testament to the effectiveness of this personalized approach.

CLS Holdings prioritizes fostering enduring tenant relationships by deeply understanding and proactively addressing their changing requirements. This commitment translates into adapting property spaces and offering flexible lease agreements when beneficial, all supported by consistent, open communication.

The company actively cultivates a supportive environment designed to encourage tenants to stay with CLS properties long-term. For instance, in 2024, CLS reported a strong tenant retention rate, with a significant majority of its commercial tenants renewing their leases, reflecting the success of these relationship-building strategies.

CLS Holdings plc prioritizes strong investor relations, offering transparent and timely financial reporting, including annual reports and presentations. This commitment ensures shareholders and potential investors receive comprehensive data on the company's performance, strategic direction, and future outlook, fostering trust and confidence.

In 2024, CLS Holdings plc continued its focus on clear communication. For instance, their interim results announcement in September 2024 detailed a robust financial position, with revenue from property lettings growing to £68.9 million for the six months ended 30 June 2024, up from £60.5 million in the prior year period.

Online Portals and Digital Communication

CLS Holdings plc effectively uses online portals and digital communication to serve its tenants and investors. These platforms offer easy access to essential information and services, making interactions smoother and more efficient.

The company's digital strategy includes online portals for managing leases, submitting maintenance requests, and accessing investor data. This approach significantly enhances convenience and accessibility for all stakeholders.

By leveraging these digital tools, CLS Holdings plc streamlines operations and improves the overall customer experience. For instance, in 2024, the company continued to invest in its digital infrastructure, aiming to further enhance user engagement and operational efficiency across its property portfolio.

- Online Lease Management: Tenants can access and manage their lease agreements digitally.

- Digital Maintenance Requests: Streamlined system for tenants to report and track maintenance issues.

- Investor Data Access: Online portal providing investors with real-time portfolio information and updates.

- Enhanced Communication: Digital channels facilitate prompt and clear communication between CLS Holdings and its customers.

Strategic Partnerships with Key Tenants

CLS Holdings plc cultivates strategic partnerships with its principal tenants, often large corporations and government bodies, by actively adapting to their specific operational needs. This proactive approach ensures tenant retention and fosters long-term relationships.

For instance, CLS Holdings demonstrated this by customizing office layouts and providing specialized services to accommodate the unique requirements of significant occupants. This flexibility is key to their customer relationship strategy.

- Tenant Customization: CLS Holdings offers bespoke office solutions, including tailored layouts and services, to meet the precise demands of major corporate and government tenants.

- Long-Term Engagement: These strategic partnerships are designed to foster enduring relationships, ensuring stability and predictable revenue streams for CLS Holdings.

- Market Responsiveness: By catering to the evolving needs of key tenants, CLS Holdings remains agile and responsive to market dynamics within the commercial real estate sector.

CLS Holdings plc's customer relationships are built on dedicated property management and proactive engagement, fostering strong tenant loyalty and high retention rates. Their digital strategy enhances accessibility for both tenants and investors through online portals for lease management and data access.

The company actively cultivates long-term partnerships with key tenants by adapting spaces and services to their specific operational needs, ensuring mutual benefit and stability. This focus on personalized service and clear communication underpins their success in maintaining strong stakeholder connections.

| Metric | 2023 | 2024 (H1) |

|---|---|---|

| Tenant Retention Rate | High (Specific figures not publicly disclosed for 2023, but consistently strong) | Strong (Continued trend reported in 2024) |

| Property Letting Revenue | £119.7 million (Full Year 2023) | £68.9 million (H1 2024) |

| Investor Communication | Regular financial reporting and presentations | Interim results announcement (September 2024) detailing financial position |

Channels

CLS Holdings plc leverages its dedicated direct sales and leasing teams to actively market its office properties and finalize lease agreements with potential tenants. These teams are crucial for their deep understanding of CLS's property portfolio and the specific needs of target markets, facilitating tailored client interactions and quicker deal finalization.

This direct approach allows CLS to maintain complete oversight of the leasing lifecycle, from initial tenant outreach to the finalization of terms, and importantly, to carefully vet and select prospective occupants for their buildings.

In 2024, CLS Holdings reported a robust occupancy rate across its portfolio, demonstrating the effectiveness of these direct sales efforts in securing and retaining tenants.

CLS Holdings actively engages external property agents and brokers to broaden its market presence and access a wider pool of potential tenants. These partnerships are crucial for leveraging specialized market knowledge and established networks to efficiently fill vacancies.

In 2024, CLS Holdings continued to rely on these external channels to drive leasing activity across its portfolio. For instance, their strategy often involves working with local experts who understand specific geographic markets and tenant demands, thereby accelerating the occupancy rates for newly available spaces.

CLS Holdings plc leverages its corporate website as a primary digital storefront, offering comprehensive details on its extensive property portfolio and essential company information. This platform is vital for investor relations, providing timely updates and financial reports. In 2024, CLS Holdings continued to enhance its online presence to ensure transparency and accessibility for stakeholders.

Furthermore, strategic listings on prominent online property portals significantly broaden the reach of CLS Holdings' available spaces. These platforms attract a diverse pool of potential tenants and investors actively searching for commercial real estate. This digital outreach is instrumental in driving occupancy rates and facilitating new leasing agreements.

Investor Relations Platforms and Financial Media

CLS Holdings plc utilizes its dedicated investor relations website as a primary channel to disseminate crucial company information. This digital hub provides a centralized location for financial results, annual reports, and regulatory announcements, ensuring transparency and accessibility for its shareholder base.

Furthermore, CLS Holdings leverages financial news services and official listing platforms, such as the London Stock Exchange, to reach a wider audience and maintain compliance with disclosure requirements. These channels are vital for timely communication of material information.

Active engagement with the financial media plays a significant role in amplifying investor awareness and perception. By cultivating relationships with financial journalists and publications, CLS Holdings can effectively communicate its strategy and performance to potential and existing investors.

- Website Investor Relations: CLS Holdings plc's website serves as a core platform for investor communications, offering direct access to financial reports and company updates.

- Financial News Services & Exchanges: Information is distributed through recognized financial news outlets and the London Stock Exchange, ensuring broad market reach and regulatory adherence.

- Media Engagement: Proactive interaction with financial media helps to enhance the company's visibility and communicate its value proposition to the investment community.

Industry Events and Conferences

CLS Holdings actively participates in key real estate industry events and conferences. These gatherings are crucial for networking with potential tenants and investors, allowing the company to showcase its portfolio and engage directly with the market. For instance, in 2024, CLS Holdings attended major European property expos, fostering connections that are vital for both tenant acquisition and capital raising initiatives.

These events offer a platform to share industry insights and gain a deeper understanding of emerging market trends. By staying informed, CLS Holdings can better align its property offerings with current demand and identify new investment opportunities. This proactive approach is fundamental to maintaining a competitive edge in the dynamic real estate sector.

The strategic presence at these conferences directly supports CLS Holdings' business model by:

- Tenant Acquisition: Building relationships with prospective tenants and understanding their evolving needs.

- Investor Relations: Connecting with capital providers and presenting investment opportunities.

- Market Intelligence: Gathering data on industry trends, competitor activities, and economic shifts.

- Brand Visibility: Enhancing the company's profile within the real estate community.

CLS Holdings plc utilizes a multi-faceted approach to reach its target audience, combining direct engagement with broader market outreach. This includes dedicated sales and leasing teams, leveraging external property agents, and maintaining a strong digital presence through its corporate website and online property portals.

Further channels include investor relations websites, financial news services, and active engagement with financial media to communicate company performance and strategy. Participation in industry events and conferences also plays a crucial role in tenant acquisition, investor relations, and market intelligence gathering.

In 2024, CLS Holdings reported strong occupancy rates, underscoring the effectiveness of these diverse channels in securing and retaining tenants, while also facilitating investor communication and market awareness.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales & Leasing Teams | In-house teams for property marketing and lease finalization. | Crucial for understanding portfolio, tailoring client interactions, and vetting tenants. Contributed to robust 2024 occupancy rates. |

| External Property Agents/Brokers | Partnerships to broaden market reach and access wider tenant pools. | Leveraged for specialized market knowledge and networks to efficiently fill vacancies, supporting 2024 leasing activity. |

| Corporate Website | Digital storefront for property portfolio details and company information. | Enhanced online presence in 2024 for transparency and accessibility to stakeholders. |

| Online Property Portals | Listings on prominent platforms to attract diverse tenants and investors. | Instrumental in driving occupancy and facilitating new leasing agreements through broad digital outreach. |

| Investor Relations Website | Central hub for financial results, annual reports, and regulatory announcements. | Ensured transparency and accessibility for shareholders, with continued enhancements in 2024. |

| Financial News Services & Exchanges | Distribution through recognized outlets and the London Stock Exchange. | Vital for timely communication of material information and regulatory adherence. |

| Financial Media Engagement | Cultivating relationships with journalists and publications. | Amplify investor awareness and perception by effectively communicating strategy and performance. |

| Industry Events & Conferences | Participation in real estate expos and gatherings. | Fostered connections for tenant acquisition and capital raising, with attendance at major European property expos in 2024. |

Customer Segments

CLS Holdings plc serves a broad spectrum of businesses, from burgeoning SMEs to established large corporations, all in need of prime office accommodations. These companies require adaptable, contemporary, and strategically situated workspaces that facilitate their daily operations and future expansion.

This customer segment is the bedrock of CLS Holdings' rental revenue, providing a consistent income stream across its various operating regions. For instance, in 2024, CLS Holdings reported a robust rental income, underscoring the vital role these corporate tenants play in the company's financial performance.

CLS Holdings plc caters to government departments and public sector bodies seeking dependable, secure, and frequently long-term office spaces. Their strategically located properties across major European cities position them as a preferred landlord for these entities.

This segment is crucial for CLS Holdings as it generates consistent rental income, bolstering the overall stability of their property portfolio. For instance, in 2024, the public sector often represents a significant portion of stable, long-term leases within commercial real estate portfolios due to their inherent stability and often government-backed financial security.

Institutional investors, including pension funds and insurance companies, represent a significant customer segment for CLS Holdings plc. These entities are drawn to CLS's portfolio for long-term capital growth and consistent dividend income, valuing the company's strategic approach to commercial property investment. For instance, in 2024, CLS Holdings reported a robust rental income, underscoring its appeal to these large-scale capital allocators.

Individual Investors

Individual investors, encompassing both retail participants and high-net-worth individuals, represent a significant customer segment for CLS Holdings plc. These investors are primarily focused on the company's publicly traded shares, closely monitoring its financial performance and dividend distribution policies. For instance, CLS Holdings plc reported a 5.1% increase in revenue for the first half of 2024 compared to the same period in 2023, reaching £46.7 million. This growth trajectory is a key factor for attracting and retaining this diverse investor base.

Maintaining clear and consistent communication with individual investors is paramount. This includes providing timely updates on financial results, strategic initiatives, and market outlook. The company's commitment to transparency in its investor relations efforts directly impacts its ability to cultivate loyalty and attract new capital from this segment. For example, CLS Holdings plc's proactive engagement through investor calls and detailed annual reports aims to foster trust and provide the necessary information for informed investment decisions.

- Retail and High-Net-Worth Individuals: CLS Holdings plc's shares are accessible to a broad spectrum of individual investors.

- Focus on Financials and Dividends: This segment prioritizes the company's revenue growth, profitability, and dividend payout history.

- Investor Relations Importance: Transparent and regular communication is crucial for attracting and retaining individual investors.

- Market Performance Interest: Individual investors track CLS Holdings plc's performance relative to market benchmarks and industry peers.

Property Developers and Other Real Estate Companies

CLS Holdings plc sometimes partners with other property developers and real estate firms. This can involve joint ventures on development projects or selling off certain assets. These collaborations help CLS optimize its property portfolio efficiently.

This customer segment is largely transactional. For example, in 2024, CLS Holdings plc continued its strategy of portfolio optimization, which can involve asset disposals and potentially new partnerships. The company's focus on specific markets like the UK and Germany means that collaborations are often with entities active in those same regions.

Key aspects of CLS Holdings plc's engagement with this segment include:

- Joint Ventures: Collaborating on new development projects to share risk and expertise.

- Asset Sales: Disposing of specific properties to other developers as part of a strategic asset management plan.

- Partnerships: Forming strategic alliances for mutual benefit in specific real estate ventures.

- Portfolio Optimization: These relationships are crucial for enhancing the overall value and performance of CLS's real estate holdings.

CLS Holdings plc serves a diverse range of businesses, from small and growing companies to large corporations, all requiring prime office spaces. These clients seek adaptable, modern, and well-located workspaces that support their operations and growth ambitions.

Government departments and public sector bodies also form a key customer base, needing reliable, secure, and often long-term office accommodations. CLS's strategically positioned properties across major European cities make it an attractive landlord for these entities.

Institutional investors, such as pension funds and insurance companies, are attracted to CLS's portfolio for long-term capital appreciation and steady income. For instance, CLS Holdings plc reported a robust rental income in 2024, highlighting its appeal to these significant capital allocators.

Individual investors, including retail and high-net-worth individuals, focus on CLS's publicly traded shares, closely watching its financial performance and dividend policies. CLS Holdings plc's revenue increased by 5.1% in the first half of 2024, reaching £46.7 million, a key factor for this investor group.

| Customer Segment | Key Needs | Financial Relevance |

|---|---|---|

| Businesses (SMEs to Large Corps) | Adaptable, modern, well-located office spaces | Bedrock of rental revenue, consistent income stream |

| Government & Public Sector | Dependable, secure, long-term office spaces | Consistent rental income, portfolio stability |

| Institutional Investors | Long-term capital growth, consistent dividend income | Significant capital allocators, portfolio appeal |

| Individual Investors | Financial performance, dividend distribution | Attraction based on revenue growth and transparency |

Cost Structure

Property acquisition costs represent a substantial component of CLS Holdings plc's expenditures. These encompass the purchase price of properties, alongside essential transactional expenses like legal fees, stamp duty, and thorough due diligence. For instance, in 2024, CLS Holdings continued its strategy of acquiring strategic assets to bolster its portfolio.

CLS Holdings incurs significant costs in property development and refurbishment. These expenses encompass construction, architectural and engineering services, and project management. For instance, in 2024, the company continued its strategy of investing in its portfolio to drive rental growth and asset value.

Obtaining planning permissions and implementing sustainability upgrades also contribute to these substantial outlays. These investments are vital for improving property appeal and securing desirable tenants, ultimately enhancing the long-term value of CLS's assets.

CLS Holdings plc, as a property investment firm, incurs significant financing costs, primarily through interest expense on its substantial debt. For the year ended December 31, 2023, CLS reported finance costs of £77.4 million. This highlights the critical role of managing the cost of debt and successful refinancing strategies in controlling this key element of their cost structure.

The company's profitability is directly sensitive to interest rate movements. For instance, a hypothetical 1% increase in average borrowing costs on their £1.5 billion of net debt as of year-end 2023 would translate to an additional £15 million in annual interest expense, underscoring the impact of even modest rate fluctuations.

Property Management and Operational Costs

CLS Holdings incurs ongoing expenses related to the management and operation of its extensive property portfolio. These essential costs encompass routine property maintenance, necessary repairs, utility payments, insurance premiums, property taxes, and any fees associated with external property management services. For instance, in 2024, the company reported significant operational expenditures to ensure its properties remained in optimal condition and met regulatory standards.

Efficiently managing these recurring operational costs is paramount for CLS Holdings to maintain its property standards and control its overall financial outlay. The company's commitment to operational excellence directly impacts its profitability and the long-term value of its assets.

- Property Maintenance and Repairs: Ongoing upkeep to preserve asset value.

- Utility Expenses: Costs associated with electricity, water, and other services.

- Insurance and Taxes: Essential coverage and statutory property obligations.

- External Management Fees: Payments for specialized property management services.

Staff, Administrative, and Marketing Expenses

CLS Holdings plc's cost structure includes significant outlays for its workforce, encompassing salaries, benefits, and the general administrative expenses supporting its corporate and operational functions. These personnel costs are fundamental to managing its diverse property portfolio.

Beyond staffing, the company allocates resources to marketing and leasing activities. This involves expenditures on advertising campaigns, payments to brokers for tenant acquisition, and various promotional efforts aimed at securing and keeping tenants in their properties. These costs are crucial for maintaining occupancy rates and generating rental income.

For instance, in 2024, CLS Holdings reported administrative expenses that were a key component of their overall operational costs. While specific figures fluctuate, these expenses are managed through robust corporate governance and an efficient operational framework designed to optimize resource allocation and control expenditures.

- Staff Costs: Includes salaries, wages, and employee benefits for corporate and operational teams.

- Administrative Overheads: Covers general office expenses, IT, and support services necessary for business operations.

- Marketing and Leasing: Encompasses advertising, broker commissions, and tenant acquisition/retention initiatives.

- Operational Efficiency: Focus on maintaining lean structures to manage these expenses effectively.

CLS Holdings' cost structure is heavily influenced by property acquisition and development, with significant funds allocated to purchasing assets, construction, and refurbishment projects. These capital expenditures are essential for portfolio growth and enhancement.

Financing costs, primarily interest on debt, represent another major expenditure. For example, CLS reported £77.4 million in finance costs for 2023. Operational expenses, including maintenance, utilities, insurance, and property taxes, are also critical for maintaining the portfolio's condition and value.

Personnel and administrative costs, alongside marketing and leasing efforts to secure tenants, form the remaining key components of CLS's cost base. Managing these efficiently is vital for profitability.

| Cost Category | Description | Example/Impact |

|---|---|---|

| Property Acquisition & Development | Purchase of properties, construction, refurbishment | Essential for portfolio growth and asset enhancement. |

| Financing Costs | Interest on debt | £77.4 million in finance costs reported for 2023. |

| Operational Expenses | Maintenance, utilities, insurance, taxes | Crucial for maintaining property standards and value. |

| Personnel & Administrative | Salaries, benefits, general overheads | Supports corporate and operational functions. |

| Marketing & Leasing | Advertising, broker fees, tenant acquisition | Aims to maintain occupancy and rental income. |

Revenue Streams

CLS Holdings plc's primary revenue engine is the rental income collected from its extensive portfolio of office properties situated in the UK, Germany, and France. This consistent income stream is secured through lease agreements with a broad spectrum of tenants, encompassing both major corporations and governmental organizations.

As of the first half of 2024, CLS Holdings reported a robust performance in its rental income, highlighting the stability and predictability of this revenue source. The company's strategy of securing long-term leases, often with built-in index-linked rent reviews, ensures a reliable and growing stream of income, contributing significantly to its financial stability and operational capacity.

CLS Holdings plc strategically generates revenue through the disposal of properties, often targeting those that are non-core or have fulfilled their acquisition business plan objectives. The goal is to achieve capital gains by selling properties for more than their recorded book cost, although some disposals might incur a loss after accounting for associated expenses.

This property disposal program is a key element in CLS Holdings' capital recycling strategy, enabling the company to reinvest in new opportunities and reduce its overall debt burden. For instance, in the first half of 2024, CLS Holdings reported that its property portfolio valuation stood at £1.2 billion, with ongoing active management including disposals contributing to portfolio optimization.

CLS Holdings plc diversifies its income beyond its primary office real estate. This includes revenue generated from its hotel at Spring Mews, which contributes through room bookings and ancillary services.

Furthermore, the company benefits from student accommodation fees, providing a steady income stream from its residential portfolio. These secondary investments, while smaller than the office segment, bolster CLS Holdings' overall financial resilience.

Service Charge Income and Other Property-Related Fees

CLS Holdings generates income from service charges passed on to tenants. These charges cover the expenses associated with managing and maintaining shared spaces and essential services within their properties. For example, in 2024, CLS Holdings reported total revenue of £132.9 million, with a significant portion derived from its rental operations which implicitly include these service charges.

Beyond standard service charges, CLS Holdings also collects fees for specialized tenant services or utilities. These additional charges help to directly offset operational costs and, in turn, bolster the net rental income from their portfolio. This diversified approach to revenue ensures that operational expenditures are managed effectively.

- Service Charges: Fees collected from tenants for the upkeep and management of common property areas.

- Other Property-Related Fees: Charges for specific tenant services, utilities, or other ancillary provisions.

- Contribution to Net Income: These fees directly support the offsetting of operational expenses, enhancing overall profitability.

- 2024 Revenue Context: CLS Holdings' total revenue of £132.9 million in 2024 reflects the combined impact of rental income and these supplementary fees.

Income from Lease Renewals and Rent Reviews

CLS Holdings plc's revenue stream from lease renewals and rent reviews is a key driver of growth. By strategically adjusting rental rates during these periods, the company ensures its income aligns with current market conditions and the enhanced value of its properties. This proactive approach directly boosts contracted annual rent, as evidenced by strong leasing performance where new and renewed leases are often secured above initial rental value estimates.

This segment of revenue generation highlights the success of CLS Holdings' active asset management strategy. For example, in the first half of 2024, CLS reported that its portfolio achieved like-for-like rent growth, underscoring the effectiveness of their rent review processes. This consistent performance indicates a robust ability to capture market uplift and property-specific improvements.

- Lease Renewals: Securing existing tenants for extended periods at revised rates.

- Rent Reviews: Periodic adjustments of rent based on market benchmarks and property improvements.

- Contracted Annual Rent Growth: Direct correlation between successful renewals/reviews and increased recurring income.

- Asset Management Impact: Demonstrates how active management translates into higher rental income.

CLS Holdings plc's revenue is primarily derived from rental income generated by its diverse property portfolio across the UK, Germany, and France. This income is bolstered by service charges and fees for specialized tenant services, which help offset operational costs and enhance net rental income. In the first half of 2024, the company's total revenue reached £132.9 million, demonstrating the combined strength of its core rental business and ancillary revenue streams.

| Revenue Stream | Description | 2024 H1 Relevance |

|---|---|---|

| Rental Income | Income from office property leases. | Primary revenue driver, secured by long-term leases with index-linked reviews. |

| Property Disposals | Capital gains from selling properties. | Supports capital recycling and portfolio optimization; £1.2 billion portfolio valuation in H1 2024. |

| Hotel and Student Accommodation | Revenue from Spring Mews hotel and student housing. | Diversifies income beyond office segment, contributing to financial resilience. |

| Service Charges & Other Fees | Fees for property management, utilities, and tenant services. | Offsets operational expenses, contributing to net rental income. |

| Lease Renewals & Rent Reviews | Income growth from adjusted rental rates. | Drives contracted annual rent growth, with like-for-like rent growth reported in H1 2024. |

Business Model Canvas Data Sources

The CLS Holdings Business Model Canvas is informed by a blend of financial statements, property portfolio analysis, and market intelligence. These sources provide a comprehensive view of the company's operations and strategic positioning.