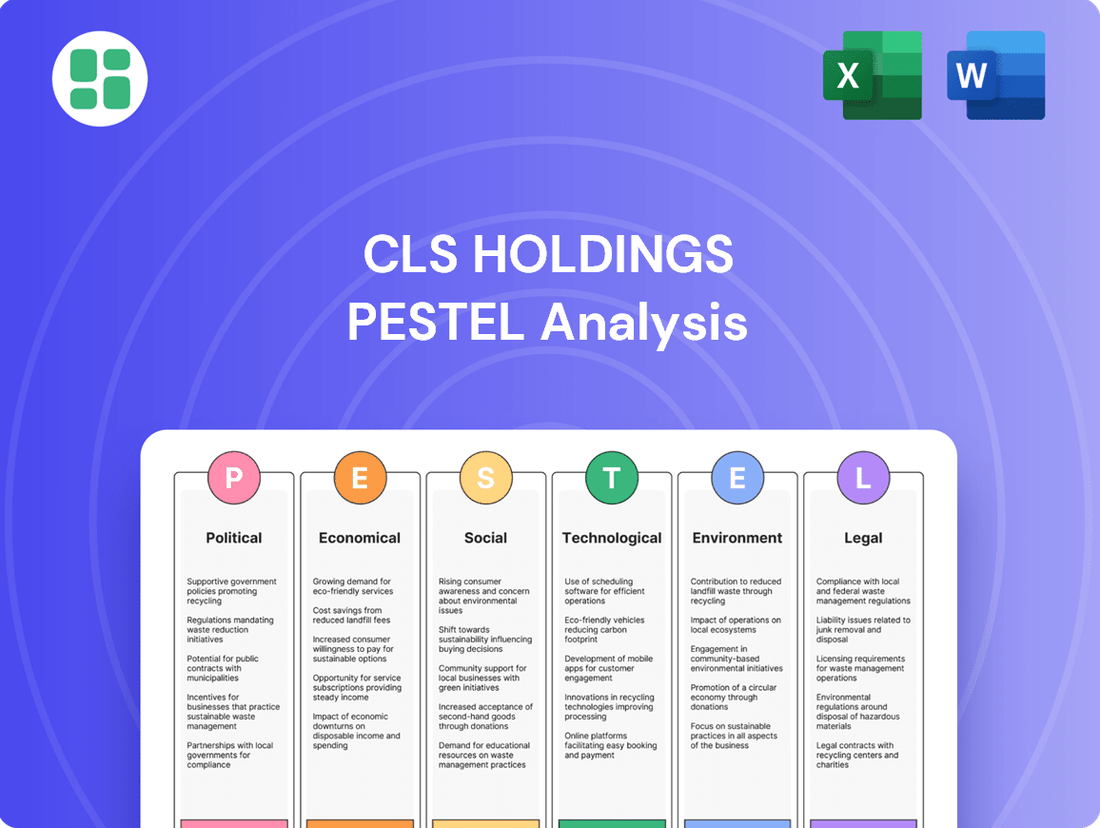

CLS Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLS Holdings Bundle

Uncover the hidden forces shaping CLS Holdings's future with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the external factors driving the company's performance and potential. Download the full version to gain actionable insights and sharpen your strategic edge.

Political factors

Political stability in the UK, Germany, and France is a cornerstone for CLS Holdings' strategic planning. For instance, the UK's general election scheduled for 2024 could introduce policy shifts impacting property markets. Germany's coalition government, while currently stable, faces ongoing discussions about economic stimulus measures that could indirectly affect real estate investment climates.

Taxation on commercial property, including stamp duty, property taxes, and capital gains tax, significantly impacts CLS Holdings' profitability and acquisition strategy. For instance, in the UK, Stamp Duty Land Tax (SDLT) rates on commercial property can range from 0% to 15% depending on the property value, directly affecting the cost of new acquisitions. In 2024, ongoing discussions around potential adjustments to these rates require close monitoring.

Government fiscal policies, such as incentives for certain types of development or disincentives for vacant properties, can directly influence the attractiveness and viability of CLS's portfolio assets. For example, some local authorities offer business rate reliefs for new constructions or refurbishments, which could boost rental income. Conversely, penalties for long-term vacant commercial spaces might encourage quicker leasing or disposal strategies.

Future changes to these tax regimes must be closely monitored to assess their financial implications. A shift towards higher property taxes or capital gains tax could reduce net returns on disposals, while targeted incentives for sustainable building retrofits, a growing focus in 2025, could enhance the value of CLS's existing portfolio.

Urban planning and zoning rules at both local and national levels are crucial, determining where and what kind of construction is allowed, as well as how dense it can be. CLS Holdings' capacity to buy, build, and renovate properties hinges on successfully navigating these intricate regulatory frameworks across the UK, Germany, and France.

For instance, in 2024, the UK government's planning white paper aimed to streamline processes, potentially easing development constraints. However, local authorities still hold significant sway, with varying approaches to density and land use. In Germany, federal building codes (BauGB) and state-specific regulations create a complex web, while France's "Plan Local d'Urbanisme" (PLU) dictates development at the municipal level, impacting CLS's project timelines and feasibility.

More restrictive planning policies can limit portfolio growth by restricting new builds or redevelopment opportunities, as seen in certain conservation areas. Conversely, more lenient or forward-thinking zoning laws can unlock significant potential for portfolio enhancement and strategic expansion, as CLS might find in areas designated for urban regeneration projects, which saw increased investment in 2025 across continental Europe.

Foreign Investment Policies

CLS Holdings navigates a complex landscape of foreign investment policies across its key European markets, including the UK, Germany, and France. Changes in regulations around foreign ownership of commercial property, the ability to move capital out of a country, or currency controls directly impact CLS's strategic flexibility. For instance, in 2023, the UK government continued to review its foreign investment screening mechanisms, potentially affecting cross-border property acquisitions.

These policies are crucial for CLS's international operations, influencing its capacity to acquire new assets and manage its existing portfolio effectively. Stable and open foreign investment frameworks are generally advantageous, facilitating smoother transactions and capital management. For example, Germany's relatively stable investment climate has historically supported foreign direct investment in its real estate sector, a key area for CLS.

- UK Foreign Investment Scrutiny: The UK's National Security and Investment Act 2021 grants powers to review and intervene in certain acquisitions by foreign entities, potentially impacting CLS's UK property deals.

- German Real Estate Investment: Germany's open approach to foreign investment in real estate, while subject to standard commercial laws, generally supports CLS's acquisition strategies.

- French Capital Controls: While typically liberal, France, like other EU nations, maintains protocols for significant capital movements that could influence CLS's financial operations.

Brexit Impact and UK-EU Relations

The lingering effects of Brexit continue to influence CLS Holdings' operational environment, especially given its significant UK property portfolio and its cross-border activities with Germany and France. Evolving trade pacts, regulatory differences, and the fluidity of capital and skilled labor between the UK and the EU directly impact demand for office spaces and the broader investment sentiment.

CLS Holdings must remain agile in navigating these shifting UK-EU relations, as they can affect business confidence and, consequently, the company's financial performance. For instance, the UK's continued divergence from EU regulations could create new compliance burdens or opportunities for companies like CLS, depending on the specific sector and market.

- Trade Friction: Persistent trade barriers or new tariffs between the UK and EU could indirectly affect economic growth, thereby influencing demand for commercial real estate.

- Regulatory Divergence: As the UK establishes its own regulatory frameworks, CLS needs to monitor how these changes impact property standards, tenant requirements, and investment attractiveness in the UK market compared to its EU holdings.

- Talent Mobility: Restrictions on the movement of talent could impact the ability of businesses operating in CLS's properties to attract and retain skilled employees, potentially affecting office space absorption rates.

- Investment Climate: The ongoing uncertainty surrounding the long-term UK-EU relationship can influence investor appetite for UK assets, potentially affecting property valuations and transaction volumes for CLS.

Government policies regarding property development and investment, including planning regulations and tax incentives, directly shape the operational landscape for CLS Holdings. For example, the UK's planning reforms in 2024 aimed to accelerate development, while Germany's approach to urban regeneration projects, often supported by federal funding, presents opportunities. France's commitment to sustainable building standards, reinforced by EU directives in 2025, influences renovation strategies.

Taxation policies, such as stamp duty and capital gains tax, significantly impact CLS Holdings' acquisition costs and profitability. In the UK, stamp duty on commercial properties can reach 15%, a figure closely watched by investors in 2024. Germany's property transfer tax varies by state, and France's capital gains tax on property sales also requires careful consideration for portfolio management.

Foreign investment regulations and the broader geopolitical stability within the UK, Germany, and France are critical for CLS Holdings' international strategy. The UK's National Security and Investment Act 2021, for instance, scrutinizes foreign acquisitions, while Germany and France generally maintain open investment climates, subject to standard commercial laws. Navigating these varying policies is key to CLS's cross-border transactions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing CLS Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise summary of CLS Holdings' PESTLE analysis, presented in an easily digestible format, helps alleviate the pain of information overload during strategic planning.

This PESTLE analysis for CLS Holdings offers a clear, segmented view of external factors, simplifying the complex task of identifying and prioritizing market risks.

Economic factors

Interest rate fluctuations significantly impact CLS Holdings. For instance, the Bank of England's Monetary Policy Committee's decisions on the base rate directly influence borrowing costs for property acquisitions and the refinancing of existing debt. Higher rates, such as the Bank of England's base rate which stood at 5.25% for much of 2024, increase financing expenses for CLS, potentially reducing profitability and making new investments less attractive.

Elevated interest rates also affect property valuations. By increasing the discount rates used in discounted cash flow (DCF) analyses, higher rates can lead to lower present values for future rental income, thus reducing the perceived worth of CLS's property portfolio. This can dampen demand from investors seeking to finance purchases with debt.

Conversely, a period of stable or declining interest rates, as seen in some periods of 2023 and potentially into 2025, can be beneficial. Lower borrowing costs improve margins on new acquisitions and refinancing, while lower discount rates can support or increase property valuations, stimulating investment activity and enhancing CLS Holdings' financial performance.

Inflation directly affects CLS Holdings' operating expenses, from rising utility bills and maintenance costs to increased wages for property management staff. For example, UK inflation reached 4.0% in January 2024, a slight increase from December 2023, impacting these essential costs.

CLS Holdings' profitability hinges on its capacity to secure rental growth that keeps pace with or surpasses inflation. In 2023, CLS reported a like-for-like rent increase of 4.5% across its portfolio, demonstrating a positive trend in outperforming inflation, which is vital for maintaining real income growth and property valuations.

A robust economy generally fuels demand for office spaces, enabling CLS Holdings to implement rental increases and maintain healthy occupancy levels. The UK economy experienced a 0.1% growth in Q4 2023, indicating a cautious but positive economic environment that supports rental market stability.

The UK's GDP is projected to grow by 0.5% in 2024, with a slight uptick to 1.1% in 2025, according to the Bank of England's March 2024 forecasts. This moderate growth suggests a stable, albeit not booming, environment for commercial real estate. Similarly, Germany's economy is expected to expand by 0.4% in 2024 and 1.2% in 2025, while France anticipates 0.8% growth in 2024 and 1.3% in 2025, as per IMF projections from April 2024. These figures indicate a generally positive economic outlook across CLS Holdings' key markets, potentially supporting demand for office spaces.

Business confidence surveys in these regions will be crucial indicators. For instance, the Ifo Business Climate Index for Germany showed a slight improvement in April 2024, reaching 89.4, suggesting a cautious optimism among businesses. Higher business confidence often translates to increased investment in expansion and hiring, which directly fuels demand for quality office accommodation, benefiting CLS Holdings' occupancy and rental income streams.

Commercial Property Market Cycles

CLS Holdings operates in commercial property markets that are inherently cyclical, driven by shifts in supply and demand, investor confidence, and broader economic outlooks. Successfully navigating these upswings and downturns, anticipating periods of oversupply or undersupply, is crucial for making smart choices about buying, selling, and managing properties.

The company's strategy is to build value by adeptly managing its portfolio through these market phases. For instance, in 2024, the UK commercial property market saw varied performance, with the office sector facing challenges due to hybrid working trends, while industrial and logistics remained robust. This highlights the need for CLS Holdings to be agile in its asset allocation.

- Office sector vacancy rates in London remained elevated in early 2024, impacting rental growth potential.

- The industrial and logistics sector continued to show strong rental growth, averaging around 5-7% year-on-year in key UK regions during 2024.

- Investor sentiment in commercial real estate became more cautious in late 2024, influenced by interest rate expectations and geopolitical uncertainties.

- CLS Holdings' ability to secure long-term leases with reliable tenants in sectors with strong demand, such as logistics, is a key factor in mitigating cycle risks.

Availability of Financing and Capital Markets

The availability and cost of financing are critical for CLS Holdings' expansion plans. In 2024, the cost of capital, particularly for debt, has seen fluctuations due to monetary policy adjustments. For instance, while interest rates remained elevated for much of 2024, there were indications of potential easing in late 2024 and early 2025, which could lower borrowing costs for CLS Holdings.

Capital markets play a crucial role in CLS Holdings' ability to raise equity for growth. The performance of these markets in 2024 showed resilience, with some sectors experiencing significant gains, potentially making equity issuance more attractive. However, increased volatility in global capital markets in the latter half of 2024 could present challenges for CLS Holdings if it seeks to raise capital through share offerings.

CLS Holdings' acquisition strategy is directly influenced by the lending environment. A robust and competitive lending market in 2024, characterized by a willingness from banks to lend and favorable terms, would facilitate its M&A activities. Conversely, tighter credit conditions, as observed in some regions during 2024, can limit CLS Holdings’ financial flexibility and slow down its acquisition pace.

- Financing Accessibility: CLS Holdings relies on accessible debt and equity to fund growth and acquisitions.

- Cost of Capital: Interest rate trends in 2024 and projected movements in 2025 directly impact borrowing costs.

- Market Volatility: Fluctuations in capital markets in 2024 can affect the attractiveness and cost of equity financing.

- Lending Environment: The willingness of banks to lend and the terms offered are key to CLS Holdings' acquisition capacity.

CLS Holdings' financial performance is closely tied to economic growth across its operating regions. The Bank of England's March 2024 forecast of 0.5% UK GDP growth for 2024 and 1.1% for 2025, alongside IMF projections of 0.4% for Germany and 0.8% for France in 2024, suggests a generally stable but moderate economic backdrop. This outlook supports demand for office spaces, crucial for CLS's rental income, with business confidence indicators like Germany's Ifo Index showing cautious optimism in April 2024.

| Economic Indicator | 2024 Forecast (approx.) | 2025 Forecast (approx.) | Source |

|---|---|---|---|

| UK GDP Growth | 0.5% | 1.1% | Bank of England (Mar 2024) |

| Germany GDP Growth | 0.4% | 1.2% | IMF (Apr 2024) |

| France GDP Growth | 0.8% | 1.3% | IMF (Apr 2024) |

| UK Inflation (Jan 2024) | 4.0% | N/A | ONS |

| Ifo Business Climate Index (Germany, Apr 2024) | 89.4 | N/A | Ifo Institute |

Preview Before You Purchase

CLS Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CLS Holdings PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping CLS Holdings' strategic landscape.

Sociological factors

The surge in hybrid work models, accelerated by events in recent years, has fundamentally altered the demand for commercial real estate. For instance, a 2024 survey indicated that 60% of U.S. employees now work in a hybrid arrangement, a significant increase from pre-pandemic levels. This shift directly impacts CLS Holdings' portfolio by reducing the need for traditional, large-footprint office spaces.

CLS Holdings must therefore adapt by offering more flexible lease terms and reconfiguring spaces to accommodate collaborative work and employee well-being. Properties that provide adaptable layouts, advanced technology for remote connectivity, and amenities supporting a hybrid workforce, such as enhanced meeting rooms and social areas, are becoming increasingly attractive to tenants.

CLS Holdings benefits from ongoing urbanization trends in its key operating cities like London, Paris, and major German hubs. These urban centers are experiencing continued population growth, with London's population projected to reach 10.7 million by 2030, fueling demand for commercial real estate.

Increased population density in these urban areas concentrates businesses, creating a persistent need for office space. While the nature of this demand is shifting towards higher quality and prime locations, CLS is well-positioned to capitalize on these evolving requirements, supported by strong urban economies.

Demographic shifts are significantly reshaping tenant expectations for office spaces. An aging workforce may prioritize accessibility and comfort, while younger generations, like Gen Z, entering the market increasingly seek flexible work arrangements and modern, amenity-rich environments. For instance, the UK's Office for National Statistics reported that in 2024, the proportion of the workforce aged 50 and over is growing, presenting a need for adaptable office designs.

CLS Holdings must proactively address these evolving workforce compositions. By offering flexible lease terms, incorporating wellness facilities, and ensuring properties are located near public transport hubs, CLS can attract and retain a diverse tenant base. This strategic approach is crucial as companies increasingly focus on employee well-being and attracting top talent in a competitive market.

Tenant Preferences and Employee Experience

The modern workforce increasingly prioritizes well-being and a positive work environment, influencing commercial real estate demand. Companies are actively seeking office spaces that not only offer functionality but also contribute to employee satisfaction and health. This shift means landlords like CLS Holdings must adapt by offering more than just square footage.

CLS Holdings needs to focus on creating office environments that are attractive, healthy, and equipped with desirable amenities to secure and retain top-tier tenants. For instance, a 2024 survey indicated that 75% of employees believe their office environment significantly impacts their productivity and overall job satisfaction. This highlights the tangible business benefit of investing in tenant and employee experience.

- Employee Well-being: Demand for spaces with natural light, green initiatives, and wellness facilities is on the rise, with companies willing to pay a premium for such features.

- Tenant Retention: A positive employee experience directly translates to higher tenant retention rates, reducing vacancy periods and associated costs for CLS Holdings.

- Competitive Advantage: In a competitive leasing market, amenity-rich and health-focused buildings serve as a significant differentiator, attracting forward-thinking businesses.

- Productivity Boost: Studies consistently show that well-designed workspaces can improve employee morale and productivity by up to 20%, a key selling point for prospective tenants.

Social Responsibility and Community Engagement

Societal expectations for corporate social responsibility are on the rise, meaning CLS Holdings faces increased scrutiny regarding the community impact of its operations and property developments. For instance, in 2024, a significant percentage of consumers globally indicated they would switch brands if a company demonstrated poor social responsibility. Positive community engagement, incorporating social equity into development plans, and contributing to urban renewal are crucial for bolstering the company's reputation and maintaining its social license to operate, which also positively influences brand perception among prospective tenants.

CLS Holdings can leverage this by:

- Prioritizing local sourcing and employment opportunities within development projects to foster goodwill and economic benefit in the communities where they operate.

- Investing in community infrastructure or social programs, aligning with the growing trend of ESG (Environmental, Social, and Governance) investing which saw global ESG assets reach an estimated $37.7 trillion in early 2024.

- Ensuring transparent communication and consultation with local stakeholders throughout the development lifecycle to address concerns and build trust.

Societal shifts are increasingly emphasizing employee well-being and flexible work, directly influencing commercial real estate demand. A 2024 survey revealed that 75% of employees feel their office environment impacts productivity, pushing companies to seek amenity-rich spaces. CLS Holdings must cater to these evolving tenant needs by offering adaptable layouts and prioritizing health-focused features to maintain competitiveness.

Technological factors

The property technology (PropTech) sector is rapidly evolving, with smart building solutions becoming increasingly central to commercial real estate. For CLS Holdings, this means opportunities to enhance operational efficiency and tenant experience. For instance, the global PropTech market was valued at approximately $25 billion in 2023 and is projected to reach over $100 billion by 2030, indicating significant growth and potential for adoption.

CLS Holdings can integrate Internet of Things (IoT) sensors to monitor energy consumption, enabling proactive adjustments for cost savings and sustainability. Predictive maintenance, powered by AI and data analytics, can anticipate equipment failures, reducing downtime and repair expenses. Furthermore, smart building technologies can offer enhanced tenant services, such as personalized climate control and streamlined access, boosting satisfaction and retention. By embracing these technological advancements, CLS Holdings can solidify its competitive position in the market, attracting businesses that prioritize modern, efficient, and amenity-rich workspaces.

Digitalization is transforming property management, with CLS Holdings likely benefiting from streamlined lease administration, financial reporting, and tenant communication through advanced software. This shift can significantly boost operational efficiency and reduce administrative overhead.

By adopting digital platforms, CLS Holdings can expect to see a reduction in manual processes, freeing up resources and potentially improving response times for tenant requests and maintenance. This aligns with industry trends showing increased adoption of proptech solutions.

The implementation of sophisticated property management systems provides CLS Holdings with enhanced data analytics capabilities. This allows for more informed decision-making regarding asset performance and strategic planning, ultimately improving overall asset management effectiveness.

CLS Holdings' reliance on digital platforms for property operations, tenant interactions, and financial dealings makes cybersecurity a top priority. As of early 2024, the global average cost of a data breach reached $4.45 million, highlighting the financial impact of security failures.

Ensuring compliance with data protection laws such as GDPR is crucial for CLS Holdings to maintain tenant and investor confidence. Failure to protect sensitive data can lead to substantial fines and erode trust, impacting the company's reputation and market standing.

A proactive approach to cybersecurity is essential for CLS Holdings to mitigate significant operational disruptions and reputational damage. The company's investment in robust security infrastructure directly supports its long-term stability and ability to conduct business securely in the digital age.

Building Information Modeling (BIM)

Building Information Modeling (BIM) is revolutionizing property development by enabling detailed digital representations of buildings. This technology streamlines the entire lifecycle, from initial design through construction and ongoing management.

For CLS Holdings, BIM adoption offers significant advantages. It can lead to enhanced efficiency in development projects, improved space utilization through better planning, and the creation of a comprehensive digital twin for superior long-term asset management and maintenance. This translates to potential cost reductions and more predictable project success.

The impact of BIM is substantial:

- Increased Efficiency: BIM can reduce design and construction times by up to 20% by minimizing clashes and rework.

- Cost Savings: Estimates suggest BIM can save 5-10% on construction costs through better planning and resource management.

- Improved Asset Management: Digital models provide invaluable data for operational efficiency and predictive maintenance, crucial for long-term property value.

- Enhanced Collaboration: BIM platforms foster seamless collaboration among all project stakeholders, improving communication and reducing errors.

Remote Work Technology and Connectivity

The increasing adoption of remote and hybrid work models significantly impacts the demand for office space, making robust technological infrastructure a critical factor for CLS Holdings. Tenants now expect seamless connectivity and advanced IT solutions to support their distributed workforces.

CLS Holdings must ensure its properties provide high-speed, reliable internet access, often exceeding 1 Gbps, and offer flexible IT infrastructure to accommodate evolving tenant needs. For instance, a growing number of businesses are prioritizing office buildings that offer integrated collaboration tools and secure, high-performance Wi-Fi networks, which directly influences leasing decisions.

- Connectivity Demands: Businesses require internet speeds capable of supporting video conferencing, cloud-based applications, and large data transfers for their hybrid teams.

- IT Infrastructure: Flexible and scalable IT solutions, including robust cybersecurity measures, are essential for tenant retention and attraction.

- Collaboration Spaces: The integration of smart building technology and seamless connectivity within physical office spaces enhances their appeal to modern businesses.

- Tenant Expectations: In 2024, over 70% of surveyed companies indicated that reliable internet and advanced IT were key considerations when selecting new office locations.

Technological advancements in property management, such as AI-driven analytics and IoT integration, are reshaping operational efficiency for CLS Holdings. The global PropTech market's projected growth to over $100 billion by 2030 underscores the increasing adoption of these digital solutions.

Embracing Building Information Modeling (BIM) can streamline development, improve space utilization, and enhance long-term asset management, potentially reducing construction costs by 5-10%.

The evolving demands of hybrid work necessitate robust IT infrastructure, with tenants prioritizing high-speed connectivity and advanced collaboration tools; in 2024, over 70% of companies cited reliable internet as a key factor in office selection.

Cybersecurity is paramount, with the global average cost of a data breach reaching $4.45 million in early 2024, making data protection compliance and investment in security infrastructure critical for CLS Holdings.

Legal factors

CLS Holdings navigates a complex web of commercial property laws across the UK, Germany, and France. These regulations dictate everything from lease terms and rent adjustments to tenant protections and the processes for reclaiming properties, significantly influencing CLS's operational agility and income stability.

In 2024, the UK's Renters Reform Bill continued to progress, potentially altering landlord-tenant dynamics and lease renewal rights, a key consideration for CLS's UK portfolio. Similarly, German tenancy law, known for its tenant-friendly provisions, and French commercial lease regulations (like the Loi Pinel) impose specific obligations and restrictions that CLS must meticulously adhere to, ensuring compliance and minimizing legal risks.

CLS Holdings faces increasing pressure from evolving Environmental, Social, and Governance (ESG) regulations across its European markets. For instance, the UK's Minimum Energy Efficiency Standards (MEES) are tightening, requiring landlords to ensure properties meet at least an 'E' Energy Performance Certificate (EPC) rating, with plans to raise this to 'C' by 2027. This directly affects CLS Holdings' office portfolio, necessitating significant capital expenditure for upgrades to meet these energy efficiency mandates and avoid potential penalties.

Compliance with these environmental standards, including carbon emission targets and sustainable building practices in Germany and France, adds operational complexity and cost. Failure to adhere to regulations like the EU's Taxonomy Regulation, which classifies sustainable economic activities, could lead to reduced investor confidence and potentially impact CLS Holdings' access to capital or increase its cost of borrowing. Transparent reporting on ESG metrics is becoming a non-negotiable aspect of doing business.

CLS Holdings must navigate a landscape of stringent health and safety regulations governing commercial properties. These rules encompass critical areas such as fire safety protocols, the structural soundness of buildings, and the overall well-being of individuals occupying the spaces. For instance, the UK's Health and Safety at Work etc. Act 1974 places a significant duty of care on employers and property owners.

The company is legally bound to ensure all its properties, including those managed by CLS Holdings plc, comply with these mandates to safeguard tenants and any visitors. Failure to meet these standards can result in severe consequences, including substantial fines and damage to the company's reputation.

Compliance is not merely a legal obligation but a fundamental aspect of responsible property management. In 2023, the UK's Health and Safety Executive reported over 60,000 non-fatal injuries in the non-residential property sector, underscoring the importance of robust safety measures.

Data Protection Regulations (e.g., GDPR)

CLS Holdings, like any organization handling personal information, must navigate a complex web of data protection regulations. Compliance with frameworks such as the General Data Protection Regulation (GDPR) in the European Union and its UK equivalent is not optional; it's a fundamental requirement. This means meticulously managing tenant and employee data, ensuring robust privacy measures, secure data storage, and obtaining explicit consent for data processing.

The financial implications of non-compliance are substantial. For instance, GDPR violations can result in fines up to 4% of annual global turnover or €20 million, whichever is higher. In 2023, for example, fines under GDPR continued to be issued across various sectors, underscoring the ongoing enforcement. For CLS Holdings, a data breach or mishandling of information could lead to significant financial penalties, reputational damage, and a loss of trust from both tenants and employees, impacting future business relationships and operational stability.

- Mandatory Compliance: Adherence to GDPR and similar UK data protection laws is essential for CLS Holdings' operations.

- Data Handling Requirements: This includes ensuring tenant and employee data privacy, secure storage, and obtaining proper consent.

- Financial Penalties: Non-compliance can result in severe fines, potentially reaching millions of pounds or euros, impacting profitability.

- Reputational Risk: Data breaches or mishandling can severely damage CLS Holdings' reputation and erode stakeholder trust.

Competition Law and Market Dominance

CLS Holdings must navigate competition laws to ensure fair market practices across its operating regions, preventing any monopolistic tendencies or anti-competitive behavior. This is particularly relevant when the company considers significant acquisitions or strategies aimed at market consolidation, ensuring a level playing field for all participants.

While property-specific regulations often take precedence, adherence to competition law is crucial for maintaining market integrity. For instance, in the UK, the Competition and Markets Authority (CMA) actively monitors mergers and acquisitions to prevent substantial lessening of competition. In 2023, the CMA reviewed over 1,000 mergers, indicating a robust enforcement environment that CLS Holdings must respect.

Understanding these legal frameworks is vital for strategic decision-making. Key considerations include:

- Merger Control: Ensuring any acquisitions comply with thresholds that trigger mandatory notification and review by competition authorities.

- Abuse of Dominance: Avoiding practices that could be construed as exploiting a dominant market position, such as predatory pricing or exclusive dealing.

- Cartel Prohibition: Strictly prohibiting any agreements with competitors that fix prices, limit output, or divide markets.

- Market Share Thresholds: Being aware of market share limits that might invite regulatory scrutiny, even without explicit anti-competitive intent.

CLS Holdings operates under stringent legal frameworks governing commercial property, including lease agreements, tenant rights, and property ownership laws across the UK, Germany, and France. These regulations directly impact rental income, operational flexibility, and the company's ability to manage its portfolio effectively.

Environmental factors

Climate change presents significant physical risks to CLS Holdings, with an expected rise in extreme weather events like floods and heatwaves directly impacting its property portfolio. For instance, the UK experienced its hottest year on record in 2022, with temperatures reaching 40.3°C, highlighting the increasing prevalence of heat-related risks.

Mitigating these threats, through investments in flood defenses or enhanced cooling infrastructure, is crucial for safeguarding asset values and maintaining operational resilience. Adapting to these evolving conditions requires proactive and forward-thinking strategies to ensure long-term business continuity.

CLS Holdings faces increasing pressure from regulators, investors, and tenants to boost energy efficiency and shrink its carbon footprint. This is a significant environmental factor impacting commercial real estate operations.

To address this, CLS Holdings needs to invest in sustainable technologies and pursue green building certifications like BREEAM or LEED. For example, the UK government's target to reach net-zero emissions by 2050 means stricter energy performance standards for buildings will likely continue to be implemented, affecting portfolios like CLS Holdings.

Adopting renewable energy sources and improving building insulation can lead to lower operating costs, a key benefit. Furthermore, a strong environmental performance enhances the attractiveness of CLS Holdings' assets to a growing segment of environmentally conscious tenants and investors.

Effective waste management and the adoption of circular economy principles are increasingly vital for property developers like CLS Holdings. By focusing on reducing construction waste and boosting recycling rates within their operational portfolio, CLS can enhance its environmental credentials. For example, the UK construction industry generated an estimated 113 million tonnes of waste in 2022, highlighting the significant opportunity for improvement.

CLS Holdings can explore implementing strategies such as prioritizing the use of recycled building materials, which not only supports sustainability goals but can also lead to cost efficiencies. The company’s commitment to these principles can align with growing investor demand for ESG-focused investments, a trend that saw global sustainable investment reach $35.3 trillion in early 2024.

Resource Scarcity and Water Management

CLS Holdings, like many property companies, faces growing concerns about resource scarcity, especially water, which can affect building operations and future development plans. For instance, in 2023, several regions in the UK experienced drought conditions, leading to temporary water restrictions that could impact property maintenance and tenant comfort.

To mitigate these risks, CLS Holdings should actively integrate water-saving technologies and implement efficient water management practices across its portfolio. This includes exploring low-flow fixtures, rainwater harvesting systems, and smart irrigation for any green spaces. Such measures are not just about environmental stewardship; they directly translate to operational cost reductions. For example, a 2024 report by the UK Green Building Council highlighted that buildings with advanced water management systems can reduce water consumption by up to 40%, leading to significant savings on utility bills.

- Water Scarcity Impact: Droughts and water restrictions can disrupt property operations and development timelines.

- Technological Solutions: Implementing water-saving fixtures and rainwater harvesting can reduce consumption.

- Cost Savings: Efficient water management can lead to substantial operational cost reductions, estimated up to 40% in some cases.

- Resilience Improvement: Responsible resource use enhances a property's ability to withstand environmental challenges.

Biodiversity and Green Spaces

The increasing emphasis on biodiversity and green spaces around commercial properties offers significant environmental and social advantages. CLS Holdings can integrate features like green roofs, vertical gardens, and landscaped areas into its properties, boosting their visual appeal and urban ecological contributions.

These initiatives not only enhance the well-being of building occupants but also align with growing investor and tenant demand for sustainable real estate. For instance, a 2024 report by the Urban Land Institute highlighted that properties with robust green features can command higher rental premiums and experience lower vacancy rates.

- Biodiversity Enhancement: Implementing native planting schemes can support local wildlife, contributing to urban ecosystem health.

- Occupant Well-being: Access to green spaces is linked to reduced stress and improved productivity, a factor increasingly valued by commercial tenants.

- Property Value: Studies in 2024 indicated that buildings with certified green spaces saw an average increase in property valuation of 5-10% compared to similar unenhanced properties.

- Regulatory Trends: Anticipating future urban planning regulations that may mandate green infrastructure can provide a competitive advantage.

CLS Holdings must navigate increasing regulatory scrutiny and investor pressure to reduce its carbon footprint and improve energy efficiency across its property portfolio. This is driven by global climate targets, such as the UK's commitment to net-zero emissions by 2050, which will likely translate into stricter building performance standards.

Proactive investment in sustainable technologies, renewable energy sources, and energy-efficient upgrades like improved insulation is essential. These measures not only address environmental compliance but also offer tangible benefits, including reduced operating costs and enhanced asset appeal to environmentally conscious tenants and investors, a market segment that saw global sustainable investment reach $35.3 trillion in early 2024.

Effective waste management and the adoption of circular economy principles are also becoming critical. By minimizing construction waste and maximizing recycling, CLS Holdings can improve its environmental credentials and potentially achieve cost efficiencies, aligning with the growing demand for ESG-focused investments.

The company also faces risks related to water scarcity and the need to enhance biodiversity. Implementing water-saving technologies and integrating green spaces, such as green roofs and vertical gardens, can mitigate operational disruptions, reduce costs, and increase property value, with studies in 2024 indicating a 5-10% valuation increase for properties with certified green spaces.

| Environmental Factor | Impact on CLS Holdings | Mitigation Strategies | Supporting Data (2022-2024) |

|---|---|---|---|

| Climate Change & Extreme Weather | Physical risks to property portfolio (e.g., heatwaves, floods) | Invest in flood defenses, enhanced cooling infrastructure | UK's hottest year on record in 2022 (40.3°C) |

| Carbon Footprint & Energy Efficiency | Regulatory pressure, investor/tenant demand for sustainability | Invest in sustainable tech, green certifications (BREEAM/LEED), renewable energy | UK net-zero target by 2050; Global sustainable investment $35.3 trillion (early 2024) |

| Waste Management & Circular Economy | Environmental impact of construction and operations | Prioritize recycled materials, reduce construction waste, boost recycling rates | UK construction waste: 113 million tonnes (2022) |

| Resource Scarcity (Water) | Operational disruptions, impact on development | Implement water-saving tech, rainwater harvesting, efficient water management | UK drought conditions in 2023; Water consumption reduction up to 40% possible |

| Biodiversity & Green Spaces | Tenant/investor demand, property appeal | Integrate green roofs, vertical gardens, native planting | Properties with green features can command higher rental premiums; 5-10% valuation increase for certified green spaces (2024 studies) |

PESTLE Analysis Data Sources

Our CLS Holdings PESTLE analysis is built on a robust foundation of data from official government publications, leading economic research institutions like the IMF and World Bank, and reputable industry-specific reports. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in credible, up-to-date information.