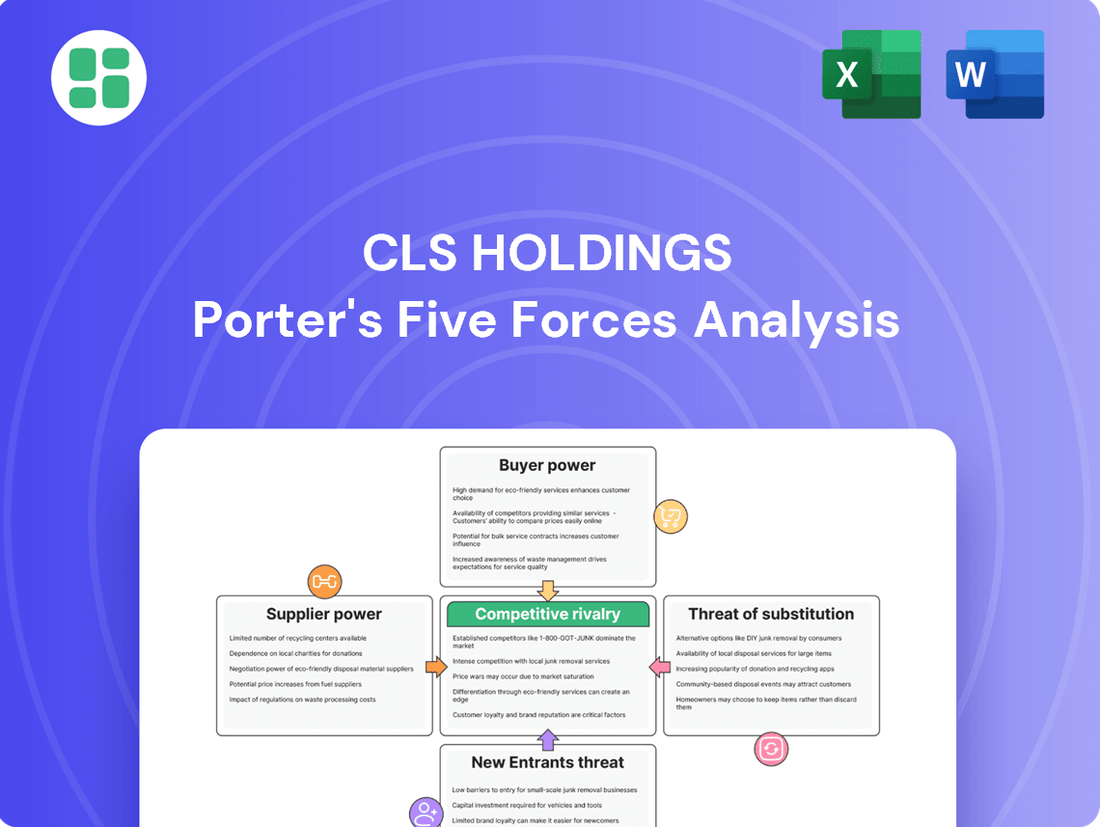

CLS Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLS Holdings Bundle

CLS Holdings operates in a dynamic market where understanding competitive forces is paramount. Our analysis reveals the intricate interplay of buyer power, supplier leverage, and the threat of substitutes, all of which significantly shape CLS Holdings's strategic landscape.

The complete report reveals the real forces shaping CLS Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for CLS Holdings, including land sellers and specialized construction companies, is significantly shaped by how concentrated these suppliers are and how unique their services or products are. In key city centers within the UK, Germany, and France, where CLS Holdings operates, developable land is often scarce, giving landowners considerable leverage. For instance, in 2024, prime London development sites continued to command premium prices, reflecting this limited supply.

Furthermore, the demand for contractors skilled in constructing modern, environmentally friendly office buildings, which align with ESG standards, is high. This specialized expertise, coupled with a limited pool of qualified firms, allows these contractors to negotiate higher fees. The increasing focus on sustainability in real estate development throughout Europe in 2024 has amplified this trend, placing more power in the hands of these specialized construction suppliers.

CLS Holdings encounters significant switching costs when transitioning between suppliers, especially for critical, ongoing development projects or long-term service agreements. These costs can manifest as penalties for early contract termination, potential delays in project timelines, and the administrative burden and expense of establishing new relationships with alternative service providers.

For example, a substantial disruption and associated financial impact could arise if CLS Holdings were to change its primary construction partners mid-development. This scenario inherently strengthens the bargaining power of the existing supplier, as the cost and complexity of a changeover become a deterrent.

The criticality of a supplier's input for CLS Holdings' operations significantly shapes their bargaining power. When suppliers provide essential building materials, cutting-edge construction technologies, or specialized financing crucial for major acquisitions or property upgrades, their influence naturally increases.

For instance, the continued high construction costs observed across Europe in 2024, with some reports indicating year-over-year increases of 5-10% for key materials, directly bolster the leverage of material and labor suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into property ownership or development, known as forward integration, could significantly boost their leverage over companies like CLS Holdings. Imagine a major construction firm deciding to build and retain its own office spaces instead of just offering construction services. This shift could introduce direct competition, potentially forcing CLS to agree to less advantageous contract terms to secure essential services.

While not a frequent occurrence, this possibility remains a factor in supplier negotiations. For instance, in 2024, the UK construction sector saw a notable increase in investment in development projects by larger entities seeking to diversify revenue streams. This trend highlights the potential for suppliers to leverage their expertise and capital to enter property ownership, thereby altering the power dynamic.

- Forward Integration Threat: Suppliers developing and owning property rather than just providing services.

- Impact on CLS: Potential for less favorable contract terms due to increased supplier bargaining power.

- Market Trend: Increased investment in development by construction firms in 2024 indicates this threat's growing relevance.

Availability of Substitute Inputs

The bargaining power of suppliers for CLS Holdings is significantly influenced by the availability of substitute inputs. If CLS Holdings can readily find alternative sources for its operational needs, such as different financing options or diverse material suppliers, the power of any single supplier diminishes. For instance, exploring modular construction techniques or sourcing materials from varied geographic locations can provide leverage.

However, the market for premium real estate, particularly in high-demand urban centers, often presents challenges in finding perfect substitutes. The specific requirements for high-quality, ESG-compliant assets can restrict the pool of viable alternatives. This was evident in 2024, where the demand for green-certified buildings outstripped supply in many key European markets, giving landlords of such properties increased pricing power.

- Limited Substitutes for Premium Assets: The demand for high-quality, ESG-compliant properties in 2024 meant fewer direct substitutes were available, strengthening supplier (landlord) power.

- Diversification Strategy: CLS Holdings' ability to seek alternative financing or explore modular construction can mitigate supplier power by creating more options.

- Regional Sourcing: Sourcing materials or even properties from different regions can reduce dependence on a single supplier base.

- ESG Compliance Impact: The growing emphasis on Environmental, Social, and Governance (ESG) factors in 2024 and beyond limits the availability of truly equivalent substitutes for compliant assets.

The bargaining power of suppliers for CLS Holdings is elevated by the scarcity of developable land in prime European locations and the high demand for specialized construction expertise, particularly for ESG-compliant buildings. In 2024, this demand contributed to increased fees for skilled contractors, as evidenced by the continued premium pricing for prime London development sites. The limited availability of truly equivalent substitutes for high-quality, green-certified assets further strengthens the negotiating position of landowners and specialized service providers.

Furthermore, significant switching costs for CLS Holdings, including potential project delays and administrative burdens when changing suppliers, reinforce the leverage of existing partners. The threat of forward integration, where suppliers might enter property ownership themselves, as seen with increased investment in development by UK construction firms in 2024, also poses a risk of less favorable contract terms.

| Factor | Impact on CLS Holdings | 2024 Trend/Data Point |

|---|---|---|

| Supplier Concentration & Uniqueness | High leverage for scarce land and specialized construction skills. | Premium pricing for prime London sites; increased fees for ESG-compliant contractors. |

| Switching Costs | Reinforces power of existing suppliers due to disruption risks. | High costs associated with changing construction partners mid-project. |

| Criticality of Input | Increased leverage for suppliers of essential materials and technologies. | 5-10% year-over-year increase in key construction material costs in Europe. |

| Forward Integration Threat | Potential for less favorable contract terms if suppliers become competitors. | Increased investment in development by UK construction firms. |

| Availability of Substitutes | Limited substitutes for premium, ESG-compliant assets strengthens supplier power. | Demand for green-certified buildings outstripped supply in key European markets. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to CLS Holdings' unique position in the healthcare real estate sector.

Instantly identify and mitigate threats from competitors, suppliers, and new entrants with a clear, actionable framework.

Customers Bargaining Power

The bargaining power of CLS Holdings' customers, primarily office tenants, is significantly influenced by tenant concentration and the volume of space leased. In 2023, CLS Holdings reported that its top ten tenants accounted for approximately 30% of its total rental income, indicating a moderate level of concentration.

A few large tenants occupying substantial portions of CLS's portfolio can wield considerable leverage, particularly if the market for office space softens. This leverage might translate into demands for lower rents or more favorable lease terms.

Conversely, a more fragmented tenant base, where no single tenant represents an overwhelmingly large share of leased space, dilutes the individual bargaining power of any one customer. This diversification generally strengthens CLS Holdings' negotiating position.

The supply of alternative office spaces in CLS Holdings' core markets, the UK, Germany, and France, significantly influences tenant bargaining power. While top-tier office spaces continue to see robust demand, vacancy rates have been on the rise in several European urban centers, offering tenants a wider selection of properties.

This greater availability, particularly for non-premium office environments, allows tenants more leverage to negotiate favorable lease terms or explore alternative landlords. For instance, in late 2023, vacancy rates in some major German cities like Berlin and Munich saw an uptick, providing tenants with increased choice and thus stronger bargaining positions.

Tenant switching costs are a significant factor influencing their bargaining power with CLS Holdings. Relocating involves substantial expenses such as fitting out new premises, migrating IT systems, and the inevitable disruption to business operations. These financial and operational hurdles make tenants hesitant to move, thereby strengthening CLS Holdings' position.

For CLS Holdings, these high switching costs mean tenants are more inclined to renew their existing leases, even if marginally better deals are available elsewhere. This sticky nature of tenant relationships directly translates to reduced price sensitivity and increased lease renewal rates, a positive for the company's revenue stability. In 2023, the UK office market saw average fit-out costs range from £50 to £150 per square foot, illustrating the scale of these embedded expenses.

However, the evolving commercial real estate landscape presents a counter-trend. The increasing availability of flexible lease agreements and the proliferation of co-working spaces are actively working to lower these traditional barriers to entry and exit for tenants. This shift could gradually erode the leverage CLS Holdings currently enjoys due to tenant switching costs.

Tenant Price Sensitivity

Tenant price sensitivity is a key factor in the bargaining power of customers for CLS Holdings. This sensitivity is directly tied to prevailing economic conditions and how significant rent costs are within a tenant's overall operational expenses. For instance, during periods of economic uncertainty, businesses tend to scrutinize all expenditures more closely, making them more receptive to negotiating lower rental rates and thus increasing their bargaining leverage.

CLS Holdings' strategic positioning in prime locations with desirable amenities can serve to dampen tenant price sensitivity. Companies often view high-quality office space as a crucial element for attracting and retaining talent, especially in competitive markets. This focus on quality can mean that tenants are less likely to switch providers solely based on minor price differences, especially if the property offers significant advantages for employee well-being and productivity.

- Economic Outlook Impact: In 2024, many economies experienced persistent inflation and higher interest rates, leading businesses to adopt more cautious spending habits, potentially increasing their sensitivity to rent increases.

- Rent as a Cost Component: For many businesses, rent represents a substantial fixed cost. A rise in rent can significantly impact profitability, particularly for smaller or less established companies, amplifying their desire for favorable lease terms.

- CLS Holdings' Property Appeal: CLS Holdings' portfolio, often characterized by modern facilities and prime urban locations, aims to justify its rental pricing by offering benefits that contribute to tenant business success, such as enhanced employee satisfaction and corporate image.

- Tenant Retention vs. Price: While price is a consideration, the cost and disruption associated with relocating a business can often outweigh the savings from a slightly lower rent elsewhere, providing CLS Holdings with some degree of pricing power.

Threat of Tenant Backward Integration or Remote Work

The rise of remote and hybrid work models directly challenges CLS Holdings by presenting a significant substitute for traditional office spaces. This shift empowers tenants, allowing them to negotiate more favorable lease terms or reduce their overall space requirements. For instance, a 2024 survey indicated that 60% of companies were considering a permanent hybrid work policy, directly impacting the demand for physical office real estate.

Companies are actively re-evaluating their office footprints, often leading to downsizing or a preference for flexible workspace solutions. This strategic pivot by tenants diminishes the overall demand for CLS Holdings' primary offering, thereby increasing tenant bargaining power.

- Tenant Demand Shift: Increased adoption of hybrid work models creates a substitute for traditional office space.

- Footprint Re-evaluation: Companies are downsizing or seeking flexible office solutions.

- Reduced Demand: This trend directly lowers the overall demand for CLS Holdings' core product.

- Increased Bargaining Power: Tenants gain leverage in lease negotiations due to these market changes.

The bargaining power of CLS Holdings' customers, primarily office tenants, is moderately influenced by tenant concentration, with the top ten tenants representing around 30% of rental income in 2023. While a fragmented tenant base dilutes individual power, a few large tenants can exert leverage, especially in a softening market. The availability of alternative office spaces in CLS Holdings' key markets, coupled with rising vacancy rates in some European cities in late 2023, provides tenants with more options and thus greater negotiating strength.

Tenant switching costs, including fit-out expenses which averaged £50 to £150 per square foot in the UK office market in 2023, remain a significant barrier to relocation, bolstering CLS Holdings' position. However, the growth of flexible lease agreements and co-working spaces is gradually reducing these traditional switching costs.

Tenant price sensitivity is heightened by economic uncertainty and rent's significance as a cost component, with many businesses scrutinizing expenditures in 2024. CLS Holdings counters this by offering prime locations and desirable amenities, which tenants value for talent attraction and corporate image, potentially reducing their willingness to switch solely on price.

The increasing adoption of hybrid work models, with 60% of companies considering permanent policies in 2024, presents a direct substitute for traditional office space. This trend empowers tenants to negotiate better terms or reduce their office footprint, diminishing demand for CLS Holdings' core offering and increasing tenant bargaining power.

| Factor | Impact on CLS Holdings | 2023/2024 Data Point |

|---|---|---|

| Tenant Concentration | Moderate; top 10 tenants ~30% of rental income | Top 10 tenants accounted for approx. 30% of rental income in 2023. |

| Alternative Space Availability | Increases tenant power; rising vacancy rates in some European cities | Vacancy rates increased in some major German cities (e.g., Berlin, Munich) in late 2023. |

| Tenant Switching Costs | High; deters relocation, strengthens CLS Holdings' position | UK office fit-out costs ranged from £50-£150 per sq ft in 2023. |

| Hybrid Work Adoption | Increases tenant power; presents substitute for office space | 60% of companies surveyed in 2024 were considering permanent hybrid work policies. |

Full Version Awaits

CLS Holdings Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces analysis for CLS Holdings, detailing the competitive landscape and strategic implications for the company. The document you are viewing is the exact, fully formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. This analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the CLS Holdings market, providing actionable insights for your business strategy.

Rivalry Among Competitors

The European commercial property investment market is quite crowded, with many different types of players vying for the same assets. You'll find big institutional investors, publicly traded real estate investment trusts (REITs), and various private funds all actively participating. This sheer number and variety of competitors, particularly in major markets like the UK, Germany, and France, naturally fuels a highly competitive environment.

This intense rivalry means that securing desirable properties and attracting top-tier tenants becomes a significant challenge for companies like CLS Holdings. For instance, in 2023, the total investment volume in European commercial real estate reached approximately €250 billion, highlighting the substantial capital chasing opportunities and the need for differentiation.

To stand out and succeed in this fragmented landscape, CLS Holdings needs to focus on what makes it unique. This involves not just acquiring properties but actively managing them to enhance their value and pursuing strategic acquisitions that align with its long-term goals and market positioning.

The European office market has experienced a mixed bag recently. While there are indications of stabilization, economic uncertainties and evolving work habits have certainly put a strain on growth. This slower growth environment naturally makes the competition fiercer as companies battle for available business.

Despite the broader challenges, demand for premium office spaces that meet Environmental, Social, and Governance (ESG) standards remains strong. For instance, in 2023, prime office rents in major European cities like London and Paris held relatively firm, demonstrating this segment's resilience.

This focus on quality and sustainability creates a pocket of the market with more promising growth prospects. Companies are increasingly prioritizing well-located, modern, and energy-efficient buildings, which bodes well for landlords able to meet these evolving tenant needs.

CLS Holdings faces significant competitive rivalry, partly due to high exit barriers in the commercial property sector. The illiquidity of real estate assets, coupled with substantial capital investments and long-term debt, makes it difficult for companies to simply walk away from their properties. This means that even when market conditions sour, competitors are likely to stay put, continuing to exert competitive pressure rather than exiting the market and reducing supply.

Product Differentiation and Asset Quality

CLS Holdings' competitive rivalry is significantly shaped by product differentiation and asset quality in the office property sector. There's a clear market demand for Grade A, ESG-compliant buildings situated in prime urban areas. CLS Holdings actively manages its assets to enhance property income and capital values, a strategy designed to set its portfolio apart.

Properties that don't meet modern amenity standards or sustainability criteria are experiencing higher vacancy rates. For instance, in 2023, the vacancy rate for older, less desirable office stock in London's secondary market often exceeded 15%, compared to sub-5% for prime, ESG-certified buildings. This disparity intensifies competition for tenants, particularly for owners of secondary assets.

- Differentiation Focus: CLS Holdings targets differentiation through active asset management and portfolio enhancement.

- Market Preference: Strong demand exists for Grade A, ESG-compliant office spaces in prime locations.

- Secondary Market Pressure: Properties lacking modern features and sustainability face increased vacancy and slower rental growth, heightening competition.

- 2023 Data Insight: Secondary market vacancy rates for older office buildings in London reportedly surpassed 15%, contrasting sharply with prime properties.

Strategic Objectives of Competitors

Competitors in the European commercial property market exhibit a spectrum of strategic objectives. Some focus on maximizing immediate returns through opportunistic acquisitions, while others prioritize long-term capital preservation and steady income generation. This diversity in goals fuels varied competitive behaviors, influencing pricing and lease negotiations.

For instance, in 2024, while some institutional investors maintained a conservative stance, others actively sought value-add opportunities, leading to increased bidding activity on well-located assets. CLS Holdings must navigate these differing approaches to secure advantageous deals and maintain strong tenant relationships.

- Aggressive Bidding: Competitors seeking quick returns may engage in aggressive bidding wars for prime commercial properties.

- Long-Term Focus: Others prioritize stable, long-term income streams, leading to more measured acquisition strategies.

- Portfolio Diversification: Some players aim to diversify their holdings, potentially entering new sub-markets or property types.

- Value Creation: A notable trend in 2024 saw investors actively pursuing opportunities for value creation through refurbishment or repositioning of existing assets.

The competitive rivalry for CLS Holdings is intense due to the sheer volume of diverse players in the European commercial property market, from large institutions to private funds. This competition is further amplified by high exit barriers, meaning companies tend to remain invested even in challenging conditions, maintaining pressure on asset acquisition and tenant retention.

CLS Holdings differentiates itself by focusing on active asset management and enhancing property quality, particularly for Grade A, ESG-compliant buildings in prime locations, which remain in high demand. For example, in 2023, prime office rents in London and Paris remained stable, contrasting with higher vacancy rates exceeding 15% for secondary, older office stock in London during the same year.

The varied strategic objectives of competitors, ranging from opportunistic acquisitions to long-term capital preservation, create a dynamic competitive landscape. In 2024, a notable trend involved investors actively pursuing value-creation opportunities through asset refurbishment, intensifying the battle for desirable properties.

| Competitive Factor | CLS Holdings Strategy | Market Trend (2023-2024) |

|---|---|---|

| Market Saturation | Focus on niche markets and active asset management | High volume of institutional and private investors |

| Asset Quality Demand | Emphasis on Grade A, ESG-compliant properties | Strong demand for premium, sustainable buildings |

| Exit Barriers | Long-term investment and value enhancement | Illiquidity keeps competitors in the market |

| Tenant Acquisition | Targeting tenants seeking modern, well-located spaces | Higher vacancy for secondary assets vs. prime properties |

SSubstitutes Threaten

The most significant substitute for traditional office space is the widespread adoption of remote and hybrid work models. This trend directly reduces the demand for physical office footprints.

Companies are increasingly downsizing their office spaces or opting for flexible work arrangements, which directly impacts the demand for and value of conventional office properties, like those held by CLS Holdings. For instance, in 2024, many businesses reported maintaining hybrid models, with some indicating a permanent reduction in their leased square footage.

The burgeoning co-working and flexible office sector, particularly strong in EMEA, directly challenges traditional office leases. In 2024, the global flexible office market was projected to reach over $100 billion, indicating a significant shift in how businesses approach workspace needs. This trend offers a compelling alternative for companies seeking agility and reduced overhead, potentially diverting demand from CLS Holdings' long-term lease offerings.

Ongoing advancements in virtual collaboration tools are making remote work increasingly viable, directly impacting CLS Holdings. Technologies like advanced video conferencing, VR meeting spaces, and sophisticated cloud platforms are reducing the need for physical presence. This trend intensifies the threat of substitutes by offering compelling alternatives to traditional office environments and in-person interactions.

Conversion of Office Space to Other Uses

The threat of substitutes for office space is amplified by the increasing conversion of underutilized office buildings into other property types. This trend, seen across major urban centers, directly impacts the demand for traditional office environments. For instance, in the UK, the government has been actively encouraging office-to-residential conversions, with over 17,000 homes created through this route in the year to March 2023 alone, according to government data. This shift can devalue CLS Holdings' office portfolio if its assets are less adaptable to changing market needs.

This conversion trend poses a significant substitute threat by fundamentally altering the supply and demand dynamics for office space. As more buildings are repurposed, the overall availability of offices decreases, but more importantly, it signals a potential decline in the long-term desirability of traditional office-centric models. This is particularly relevant for older or less flexible office stock, which may struggle to compete with newer, mixed-use developments that cater to evolving urban living and working patterns.

- Office-to-residential conversions are a growing substitute for traditional office space.

- Over 17,000 homes were created via office conversions in the UK in the year to March 2023.

- This trend can negatively impact the valuation of less adaptable office assets.

- The shift signifies a broader move away from pure office demand towards mixed-use urban environments.

Relocation to Lower-Cost Regions or Decentralization

Companies are increasingly exploring relocation to lower-cost regions or adopting decentralized office models to curb expenses. This trend presents a significant substitute for traditional, high-cost office spaces, particularly in major European hubs where CLS Holdings has substantial holdings.

For instance, the cost of office space in London's prime West End can exceed €100 per square foot annually, a stark contrast to emerging business districts in Eastern Europe where similar spaces might cost under €30 per square foot. This economic advantage makes alternative locations a compelling substitute for businesses prioritizing cost efficiency.

This strategic shift impacts CLS Holdings by potentially reducing demand for its premium urban properties as companies opt for more budget-friendly operational bases. The availability of cheaper, well-equipped office facilities elsewhere directly challenges the value proposition of CLS Holdings' existing portfolio.

Key considerations for CLS Holdings include:

- Cost Savings: Businesses can achieve substantial reductions in overhead by moving operations away from expensive city centers.

- Talent Access: Decentralization can open access to wider talent pools outside of saturated metropolitan areas.

- Operational Flexibility: A hub-and-spoke model can offer greater agility in managing distributed workforces and diverse business needs.

- Market Dynamics: The growing acceptance of remote and hybrid work models further bolsters the viability of these substitute strategies.

The rise of remote and hybrid work models presents a significant substitute for traditional office spaces, directly impacting companies like CLS Holdings. In 2024, many businesses continued to embrace these flexible arrangements, leading to a sustained reduction in demand for physical office footprints. This shift means companies are actively downsizing leased square footage, directly affecting the need for conventional office properties.

The co-working and flexible office sector, a growing substitute, offers businesses agility and reduced overhead. By 2024, the global flexible office market was projected to exceed $100 billion, highlighting a substantial move towards alternative workspace solutions that can divert demand from traditional lease offerings.

Advancements in virtual collaboration tools further bolster the threat of substitutes by making remote work increasingly viable. Sophisticated video conferencing and cloud platforms reduce the necessity for physical office presence, intensifying the challenge to traditional office environments.

The conversion of underutilized office buildings into other property types, such as residential units, also acts as a substitute. For example, the UK saw over 17,000 homes created through office-to-residential conversions in the year to March 2023, indicating a trend that can devalue less adaptable office assets.

Companies are also relocating to lower-cost regions or adopting decentralized models to manage expenses. Prime London office space, for instance, can cost over €100 per square foot annually, compared to under €30 per square foot in emerging Eastern European business districts, making these locations a compelling substitute for cost-conscious businesses.

| Substitute Type | Impact on Traditional Office Demand | Key Drivers | 2024 Market Insight |

| Remote/Hybrid Work | Reduced Footprint Demand | Flexibility, Cost Savings | Continued adoption by businesses |

| Co-working/Flexible Offices | Diversion of Demand | Agility, Lower Overhead | Global market projected over $100 billion |

| Virtual Collaboration Tools | Decreased Need for Physical Presence | Technological Advancements | Enhanced remote work capabilities |

| Property Conversions | Altered Supply/Demand Dynamics | Urban Redevelopment, Policy Support | 17,000+ UK homes via office conversion (yr to Mar 2023) |

| Decentralization/Relocation | Shift to Lower-Cost Locations | Cost Efficiency, Talent Access | Significant cost differentials between prime and emerging markets |

Entrants Threaten

Entering the commercial property investment arena, particularly in sought-after European urban centers, necessitates considerable financial outlay. This includes the costs associated with acquiring properties, undertaking development projects, and managing them effectively over time.

These substantial financial prerequisites act as a significant deterrent for many prospective new participants. For instance, in 2024, the average acquisition cost for prime office space in London exceeded £10,000 per square meter, highlighting the immense capital needed.

Consequently, this high barrier to entry creates a protective advantage for established companies like CLS Holdings. It effectively shields them from a flood of new competitors, allowing them to maintain their market position.

CLS Holdings, like many established real estate firms, leverages its deep-rooted relationships with brokers, local authorities, and a robust existing tenant base. These established networks are invaluable, providing preferential access to opportunities and streamlining operational processes. For instance, in 2024, the UK commercial property market saw continued demand for well-located assets, making it harder for newcomers to secure prime sites without these established connections.

New entrants attempting to penetrate the market face significant hurdles in replicating these vital industry connections and acquiring desirable, well-positioned properties. The cost and time required to build trust and secure prime locations can be prohibitive. In 2023, the average time to complete a commercial property acquisition in London remained substantial, often exceeding six months, a period during which established players can solidify their existing advantages.

CLS Holdings benefits from significant economies of scale in property management and financing, reducing its cost per unit. In 2024, the company's diversified portfolio across various geographies and property types allows for more efficient resource allocation compared to a new entrant with a smaller footprint.

The experience curve is a substantial barrier. CLS Holdings' long history in active asset management translates into optimized operational strategies and financing terms, which are difficult for newcomers to replicate quickly. This accumulated know-how in navigating market cycles and tenant relations is a key differentiator.

Regulatory Hurdles and Planning Permissions

The commercial real estate sector across the UK, Germany, and France presents a formidable barrier to new entrants due to intricate and time-consuming regulatory processes. These include navigating complex zoning laws, stringent building codes, and the necessity of obtaining multiple planning permissions. For instance, in 2024, the average time to secure planning permission for a significant commercial development in London could extend beyond 12-18 months, significantly increasing upfront costs and project timelines.

These bureaucratic complexities act as a substantial deterrent, effectively raising the cost and time investment required for new players to enter the market. Successfully managing these requirements demands specialized knowledge and dedicated resources, which can be a significant hurdle for smaller or less experienced firms. The sheer volume of paperwork and the potential for delays mean that only well-resourced and experienced entities can realistically contend with these entry barriers.

- Regulatory Complexity: UK, German, and French commercial real estate markets are characterized by extensive zoning, building codes, and planning permission requirements.

- Time and Cost Implications: Navigating these regulations can add 12-18 months or more to project timelines, substantially increasing development costs.

- Deterrent to New Entrants: The bureaucratic burden favors established players with existing expertise and resources, acting as a significant barrier to entry for newcomers.

- Impact on Market Entry: For example, in 2024, obtaining necessary permits for large-scale commercial projects in major European cities often involved multi-stage approvals, making market entry challenging.

Brand Reputation and Tenant Relationships

CLS Holdings, as a well-established commercial property firm, benefits significantly from its strong brand reputation and deep-rooted tenant relationships. This established trust makes it challenging for newcomers to attract and retain tenants, as they need to invest considerable resources to build credibility and demonstrate reliable property management. For instance, in 2024, the average time for a new commercial property to reach full occupancy in London, a key market for CLS, was reported to be around 18-24 months, highlighting the significant hurdle new entrants face in building a tenant base.

New entrants must overcome the incumbent advantage of CLS Holdings, which has cultivated a loyal tenant base through consistent service and a proven track record. Building this level of trust and commitment typically requires substantial upfront investment in marketing, tenant acquisition, and service infrastructure. This barrier is further amplified by the fact that in 2023, CLS Holdings reported a high tenant retention rate of over 85% across its portfolio, demonstrating the stickiness of its existing relationships.

- Brand strength: CLS Holdings benefits from decades of operation, fostering a recognizable and trusted brand in the commercial real estate sector.

- Tenant loyalty: Existing relationships with tenants, built on consistent service and reliability, create a significant barrier to entry for new competitors.

- High acquisition costs: New entrants face substantial costs in marketing, tenant outreach, and establishing a track record to compete with established players like CLS Holdings.

- Market saturation: In prime urban markets, the presence of established, reputable landlords like CLS Holdings limits opportunities for new entrants to gain significant market share quickly.

The threat of new entrants for CLS Holdings in the commercial property sector is generally low. High capital requirements, estimated in the millions for prime European locations, present a substantial financial hurdle. For instance, in 2024, acquiring even a mid-sized commercial building in a key city like Berlin could easily surpass €50 million.

Established networks and brand reputation further solidify this barrier. Newcomers struggle to replicate CLS Holdings' long-standing relationships with brokers, local authorities, and a loyal tenant base, which are crucial for securing prime assets and favorable terms. In 2023, CLS Holdings maintained an average tenant retention rate exceeding 85%, underscoring the difficulty for new entrants to attract and keep tenants.

Regulatory complexities in markets like the UK and Germany add significant time and cost, often extending planning permission processes to over a year, as seen with major London developments in 2024. This bureaucratic landscape favors established entities with the expertise and resources to navigate it effectively.

| Barrier Type | Description | 2024 Impact Example | CLS Holdings Advantage |

|---|---|---|---|

| Capital Requirements | High initial investment for property acquisition and development. | Acquiring prime London office space exceeded £10,000/sqm. | Established financial strength and access to capital. |

| Established Networks | Deep relationships with brokers, authorities, and tenants. | Securing prime sites in demand markets requires established connections. | Strong existing relationships and preferential access. |

| Regulatory Hurdles | Complex zoning, building codes, and planning permissions. | London planning permission for commercial development can take 12-18 months. | Expertise in navigating complex legal and bureaucratic processes. |

| Brand Reputation & Tenant Loyalty | Trust and consistent service attract and retain tenants. | New properties in London averaged 18-24 months to reach full occupancy. | High tenant retention rates (e.g., >85% for CLS in 2023). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CLS Holdings is built upon a foundation of comprehensive data, including detailed company annual reports, regulatory filings, and industry-specific market research from reputable firms. We also incorporate insights from financial news outlets and macroeconomic indicators to provide a robust understanding of the competitive landscape.