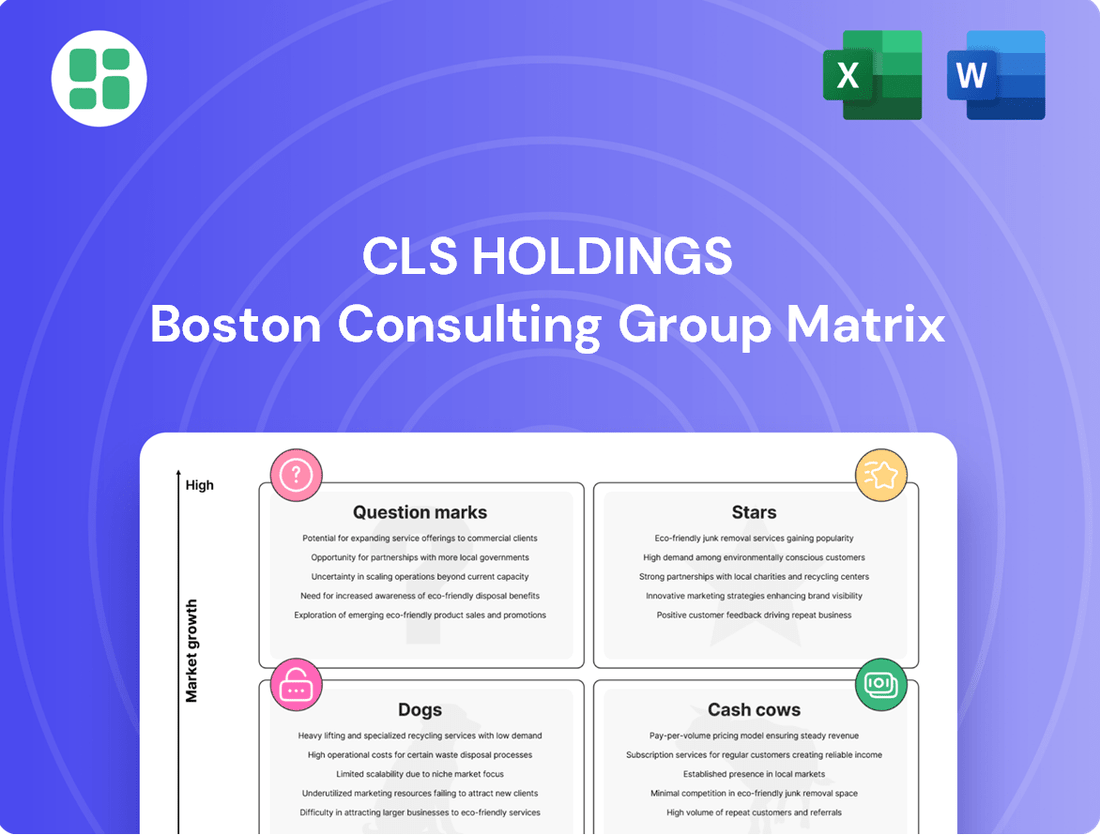

CLS Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLS Holdings Bundle

Curious about CLS Holdings' strategic product positioning? This glimpse into their BCG Matrix highlights key areas, but the real power lies in understanding the nuances of each quadrant.

Unlock the full potential of CLS Holdings' product portfolio by purchasing the complete BCG Matrix report. Gain actionable insights into their Stars, Cash Cows, Dogs, and Question Marks, and equip yourself with the strategic clarity needed to make informed investment decisions and drive future growth.

Stars

CLS Holdings' prime ESG-compliant office spaces in London, Paris, and major German cities are categorized as Stars within the BCG Matrix. These properties are situated in top-tier locations and meet rigorous environmental, social, and governance standards. The market is experiencing a significant flight to quality, with a pronounced demand for high-quality, sustainable office spaces. This trend is directly fueling prime rental growth in these sought-after European markets.

CLS Holdings' newly refurbished UK and French office properties are positioned as potential Stars in the BCG Matrix. These assets, recently made available for lease, represent opportunities for CLS to actively reduce vacancy. The company is focused on securing tenants for these prime locations.

The success of these refurbished properties hinges on their ability to attract high occupancy and achieve rental growth in their respective expanding markets. For instance, in 2024, the London office market saw a vacancy rate of 6.5%, a decrease from previous years, indicating a strengthening demand for quality office space. Similarly, Paris experienced a positive net absorption in its office sector, suggesting favorable leasing conditions.

If these properties quickly achieve strong leasing performance and demonstrate significant rental income growth, they could transition into significant cash cows for CLS Holdings. This would solidify their position as key assets contributing substantially to the company's overall portfolio value and profitability.

CLS Holdings is strategically acquiring assets in emerging, high-growth urban sub-markets across the UK, Germany, and France. These targeted areas, often attracting burgeoning tech and life sciences sectors, represent significant potential for market share expansion. For instance, in 2024, CLS completed a significant acquisition in Berlin's Adlershof science city, a hub for innovation, aiming to capitalize on its robust growth trajectory.

Properties with Significant Rental Indexation Potential

Properties with a high proportion of their contracted rent linked to inflation indices, especially in robust economies, are prime candidates for significant rental indexation potential. This characteristic offers a predictable and escalating revenue stream, ensuring these assets maintain a strong market position as income grows.

For instance, in 2024, the UK's Consumer Price Index (CPI) averaged around 2.3% for the year, demonstrating a tangible inflation rate that directly impacts index-linked leases. CLS Holdings, a real estate investment trust, actively manages a portfolio where a substantial portion of its rent is tied to such indices. This strategy is particularly beneficial in markets with upward inflation trends, as it safeguards and enhances rental income.

- Assets with High Indexation: Properties where a large percentage of contracted rent is linked to inflation indices offer predictable revenue growth.

- Market Conditions: Strong economic fundamentals and inflationary environments amplify the benefits of index-linked leases.

- Revenue Stability: This built-in growth mechanism provides a stable and increasing income stream.

- Market Share in Income: Such properties are well-positioned for sustained high market share in terms of income generation.

Office Assets with Redevelopment Opportunities in Improving Markets

CLS Holdings has identified office properties with significant redevelopment potential in markets demonstrating positive economic trends. These assets represent a strategic focus for unlocking embedded value, aiming to position the company for leadership in revitalizing urban centers.

For instance, CLS's recent portfolio review highlighted several London office buildings where rezoning or modernization could significantly increase their value. In 2024, the London office market saw a notable uptick in leasing activity, with prime rents increasing by an estimated 5% year-over-year, indicating a strengthening demand for quality space.

- Redevelopment Potential: Targeting underutilized office spaces for conversion or modernization.

- Improving Market Fundamentals: Focusing on areas with increasing tenant demand and rental growth.

- Strategic Investment: Allocating capital to unlock embedded value and enhance market position.

- Example: London office assets showing a 5% year-over-year rent increase in prime locations during 2024.

CLS Holdings' prime ESG-compliant office spaces in London, Paris, and major German cities are categorized as Stars. These properties benefit from a strong flight to quality in the market, driving rental growth. For example, in 2024, prime London office rents saw an estimated 5% year-over-year increase.

Newly refurbished UK and French office properties are positioned as potential Stars, with active efforts to reduce vacancy. The company aims to secure tenants and achieve rental growth in these expanding markets. Paris's office sector, for instance, experienced positive net absorption in 2024, indicating favorable leasing conditions.

Assets with a high proportion of rent linked to inflation indices, particularly in strong economies, represent predictable and escalating revenue streams. In 2024, the UK's CPI averaged around 2.3%, directly impacting these index-linked leases and enhancing rental income for CLS Holdings.

CLS Holdings is also strategically acquiring assets in emerging, high-growth urban sub-markets, such as Berlin's Adlershof science city, to expand market share. These areas, often attracting tech and life sciences sectors, show robust growth trajectories.

| Property Type | BCG Category | Key Characteristics | 2024 Market Data Example |

|---|---|---|---|

| Prime ESG Offices (London, Paris, Germany) | Stars | Top-tier locations, ESG compliant, high demand | London prime office rents +5% YoY |

| Refurbished Offices (UK, France) | Potential Stars | Recently upgraded, focus on vacancy reduction | Positive net absorption in Paris office market |

| Index-Linked Leases | Stars (potential) | Rent tied to inflation, predictable growth | UK CPI averaged 2.3% |

| Emerging Sub-Markets (Germany) | Stars (potential) | Acquisition in high-growth areas (e.g., Adlershof) | Targeting tech/life sciences hubs |

What is included in the product

This BCG Matrix overview offers strategic guidance on CLS Holdings' portfolio, identifying units for investment, holding, or divestment.

The CLS Holdings BCG Matrix offers a clear, actionable overview, simplifying complex portfolio decisions.

Cash Cows

CLS Holdings' mature, high-occupancy London office portfolio represents a classic Cash Cow. These are its well-established office properties situated in central or highly desirable, mature London sub-markets. They consistently boast high occupancy rates, ensuring stable and predictable rental income for the company.

These prime assets typically require minimal additional investment for ongoing maintenance, allowing them to generate significant, predictable cash flow. For instance, in 2024, CLS Holdings reported a strong performance from its London office segment, with occupancy rates often exceeding 90% in key locations, contributing substantially to the company's overall profitability and cash generation.

Stable German office properties with long-term leases and strong tenant covenants are prime examples of Cash Cows within the CLS Holdings BCG Matrix. These assets, even amidst fluctuating market conditions, offer predictable and substantial rental income, bolstering the company's overall financial stability and cash flow generation. For instance, in 2024, German office rents in prime locations like Frankfurt and Munich remained resilient, with vacancy rates in many established business districts staying below 5%, underscoring the dependable income stream these properties provide.

Prime French office assets in established business districts are prime examples of Cash Cows within the BCG Matrix. These properties, situated in sought-after Parisian arrondissements like the 8th or 9th, benefit from consistent demand from corporate tenants, leading to high occupancy rates and stable rental income. For instance, in 2024, the average prime office yield in Paris remained competitive, reflecting the enduring appeal and low risk associated with these well-located, fully leased assets.

Properties with Completed Refinancing and Reduced Debt Costs

Properties with completed refinancing and reduced debt costs serve as cash cows within the CLS Holdings BCG Matrix. These assets, having undergone successful refinancing at competitive rates, have seen their financing expenses decrease, which bolsters the company's balance sheet.

This financial optimization directly translates into increased net cash flow from these specific properties, granting CLS Holdings greater financial maneuverability. For instance, in 2024, CLS Holdings reported a significant reduction in its weighted average cost of debt following a series of successful refinancing initiatives across its portfolio.

- Reduced Interest Expenses: Lowered debt servicing costs directly boost profitability.

- Enhanced Cash Flow: More cash is available for reinvestment or distribution.

- Strengthened Balance Sheet: A healthier financial structure improves creditworthiness.

- Increased Financial Flexibility: Greater capacity to pursue new opportunities or manage economic downturns.

Diversified Portfolio Generating Consistent Rental Income

CLS Holdings' diversified portfolio of office properties across the UK, Germany, and France acts as a significant Cash Cow. This extensive property base across key European markets is the primary engine for the company's revenue, predominantly through consistent rental income.

The substantial and reliable cash flow generated from these assets provides the financial stability needed to support CLS Holdings' broader strategic objectives and investments in other areas of its business.

- Diversified Geographic Exposure: Operations span the UK, Germany, and France, mitigating single-market risks.

- Primary Revenue Driver: Rental income from office properties forms the bulk of CLS Holdings' earnings.

- Financial Resilience: The stable cash flow supports ongoing operations and strategic development.

- 2024 Performance Indicator: In 2024, CLS Holdings reported a robust rental income stream, underscoring the Cash Cow status of its diversified property portfolio.

CLS Holdings' mature, high-occupancy office properties in prime London locations are definitive Cash Cows. These assets consistently generate stable and predictable rental income, requiring minimal capital expenditure for upkeep. In 2024, CLS Holdings highlighted that its London office portfolio maintained occupancy rates above 90% in key areas, a testament to their reliable cash-generating capabilities.

Similarly, its stable German office properties, secured by long-term leases with strong tenants, function as Cash Cows. These investments offer dependable income streams, even during market volatility. For instance, prime German office markets like Frankfurt saw vacancy rates below 5% in established business districts in 2024, reinforcing the consistent returns from these holdings.

The company's prime French office assets, particularly in sought-after Parisian districts, also represent Cash Cows. These properties benefit from sustained corporate demand, leading to high occupancy and steady rental income. In 2024, prime office yields in Paris remained attractive, confirming the low-risk, high-return profile of these well-situated, fully leased assets.

| Asset Type | Market | Key Characteristic | 2024 Performance Indicator | BCG Classification |

|---|---|---|---|---|

| Office Properties | London (UK) | High Occupancy, Mature Market | >90% Occupancy in prime locations | Cash Cow |

| Office Properties | Germany (e.g., Frankfurt) | Long-term Leases, Strong Tenants | <5% Vacancy in established districts | Cash Cow |

| Office Properties | Paris (France) | Consistent Demand, Prime Locations | Competitive Prime Yields | Cash Cow |

Full Transparency, Always

CLS Holdings BCG Matrix

The CLS Holdings BCG Matrix preview you are viewing is precisely the document you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This comprehensive report is ready for immediate application, providing you with the full insights and professional formatting without any alterations. You can confidently use this preview as a direct representation of the final, downloadable BCG Matrix file, ensuring no surprises and immediate value for your business planning.

Dogs

CLS Holdings' portfolio includes UK office properties facing significant challenges. In 2024, these assets experienced an 8.3% valuation decline, a direct consequence of increasing vacancy rates. This downturn is particularly acute in properties with shorter lease terms or diminished tenant demand.

These underperforming assets represent potential Dogs within the BCG framework. They tie up capital and resources without yielding adequate returns, making them prime candidates for divestiture unless aggressive turnaround strategies prove successful. The current market conditions exacerbate the need for decisive action.

CLS Holdings has identified certain non-core or smaller assets for its disposal program. These are properties that may not be performing optimally or no longer align with the company's core strategic direction. The objective of this program is to streamline the portfolio and generate capital.

In 2024, CLS completed the sale of five properties as part of this initiative. Furthermore, additional disposals are currently in progress for 2025. These actions are designed to enhance financial flexibility and focus resources on more strategic investments.

Office properties situated in UK, German, or French regional markets grappling with sustained economic slowdown, subdued tenant interest, or an overabundance of available space fall into this category. These assets face significant hurdles in retaining their market position and achieving rental increases.

For instance, in 2024, certain secondary office markets in the UK reported vacancy rates exceeding 15%, a stark contrast to the sub-5% rates seen in prime London locations, illustrating the disparity in occupier demand and market health.

Such properties often require substantial capital expenditure for refurbishment to remain competitive, yet the potential for rental growth may not justify the investment, leading to a stagnant or declining valuation.

Assets Requiring Significant Capital Expenditure with Low ROI Prospects

Assets falling into the Dogs category of the CLS Holdings BCG Matrix are those demanding significant capital expenditure with a low return on investment (ROI) outlook. These are properties where substantial investment in upgrades, such as meeting Environmental, Social, and Governance (ESG) standards, is necessary, but the potential for increased rental income or capital appreciation remains minimal. For instance, older industrial buildings requiring extensive environmental remediation to comply with evolving regulations might fit this profile. In 2024, the cost of ESG compliance for commercial real estate has continued to rise, with some reports indicating that retrofitting older buildings can cost upwards of 30% of the property's current value, often without a commensurate increase in rental yields.

These assets can become cash traps, meaning further investment might not generate adequate returns to justify the outlay. Consider a portfolio of aging retail spaces in declining urban centers. While a capital injection for modernization might be considered, if foot traffic and consumer spending in that area are projected to remain stagnant or decline, the ROI on such an investment would likely be poor. For example, a study in late 2023 highlighted that retail vacancy rates in some secondary markets were exceeding 15%, making significant capital improvements a risky proposition.

- High Capital Outlay: Properties requiring substantial investment for refurbishment or compliance.

- Low ROI Prospects: Limited potential for improved rental income or capital value appreciation.

- Cash Trap Scenario: Investments may not yield adequate returns, draining resources.

- Strategic Divestment: Often considered for sale or disposition to reallocate capital to more promising assets.

Older, Non-ESG Compliant Buildings in Less Desirable Locations

Older, non-ESG compliant buildings in less desirable locations are often categorized as Dogs in the BCG Matrix. These properties, typically characterized by lower Energy Performance Certificate (EPC) ratings, face significant challenges in a market increasingly focused on sustainability. For instance, a substantial portion of the UK's commercial building stock predates modern energy efficiency standards, potentially requiring costly retrofits to meet future regulatory requirements.

The escalating cost and complexity of upgrading these older assets to comply with stricter environmental regulations, such as those anticipated by 2030, pose a considerable risk. This could render them unlettable or significantly reduce their market value. In 2024, the pressure on landlords to improve building energy performance is intensifying, with penalties for non-compliance becoming more stringent.

- Low EPC Ratings: Many of these buildings likely have EPC ratings of D, E, or lower, indicating poor energy efficiency.

- Location Disadvantage: Situated in peripheral or less sought-after areas, their rental demand and capital appreciation potential are limited.

- Retrofitting Costs: Upgrading to meet future ESG standards could cost tens of thousands, or even hundreds of thousands, per property.

- Regulatory Risk: Non-compliance with evolving energy efficiency mandates by 2030 could lead to void periods and devaluation.

Dogs within CLS Holdings' portfolio represent assets with low market share and low growth potential, often requiring significant investment without commensurate returns. These properties, such as older office buildings in declining UK regional markets, face challenges like high vacancy rates, which reached over 15% in some secondary UK markets in 2024. The need for substantial capital expenditure to meet ESG standards further compounds their status as potential Dogs, with retrofitting costs potentially exceeding 30% of a property's value in 2024.

These underperforming assets are prime candidates for divestment, as they can become cash traps, draining resources without generating adequate profit. CLS Holdings has actively pursued a disposal program, selling five properties in 2024 and planning further sales in 2025 to streamline its portfolio and improve financial flexibility. This strategic pruning aims to reallocate capital towards more promising investments.

| Asset Type | Market Growth | Market Share | CLS Holdings' Strategy | 2024 Data Point |

| UK Regional Offices | Low | Low | Divestment/Turnaround | 8.3% Valuation Decline |

| Older Industrial Buildings | Low | Low | Divestment/Refurbishment (if viable) | High ESG Compliance Costs |

| Aging Retail Spaces | Low | Low | Divestment | >15% Vacancy in Secondary Markets |

Question Marks

CLS Holdings' new development projects in emerging urban regeneration zones are classic examples of Question Marks in the BCG Matrix. These ventures target areas with high growth potential, but CLS's current market penetration is minimal, reflecting their nascent stage.

These initiatives demand substantial capital investment and carry inherent risks due to uncertain market acceptance and the long development cycles typical of urban renewal. For instance, a recent project in a revitalizing district of Manchester, UK, secured £50 million in funding, with construction expected to conclude in late 2025, aiming to capitalize on projected 8% annual growth in the local commercial property market.

CLS Holdings might consider expanding into burgeoning property segments like data centers or life sciences facilities. These sectors are experiencing robust growth, presenting a compelling opportunity for diversification beyond their established office portfolio. For instance, the global data center market was valued at approximately $275 billion in 2023 and is projected to reach over $500 billion by 2028, indicating substantial upside potential.

However, entering these specialized markets would mean CLS starting with a relatively low market share. Significant capital infusion would be necessary to build infrastructure, acquire expertise, and gain a foothold. For example, developing a single hyperscale data center can cost hundreds of millions of dollars, requiring a strategic and phased investment approach for CLS.

CLS Holdings actively seeks out smaller to medium-sized properties in German cities that present clear value-add opportunities. These assets often require hands-on management due to their current letting status or the age of their construction. The strategy involves significant investment and strategic input to improve occupancy, modernize facilities, and ultimately boost profitability.

In 2024, CLS continued to focus on these types of acquisitions within recovering German markets. For instance, the company acquired several office properties in secondary German cities, where rental growth is projected to accelerate. These acquisitions are categorized as Question Marks in the BCG matrix, as they require substantial capital and strategic repositioning to achieve their full market potential and increase CLS's market share in those specific locations.

Strategic Redevelopment of Underperforming Assets into Higher-Value Use

The strategic decision to redevelop an underperforming asset, often categorized as a 'Dog' in the BCG Matrix, into a higher-value use effectively transforms it into a 'Question Mark'. This repositioning requires substantial upfront capital and carries inherent risks, mirroring the uncertainty of a Question Mark's future market share and growth potential. For instance, consider a scenario where CLS Holdings identifies a property with low rental yields, a typical 'Dog' characteristic. Redeveloping this asset into a mixed-use commercial and residential space represents a significant investment with an unknown outcome, hence its classification as a Question Mark.

This strategic redeployment is akin to a Question Mark because it demands considerable investment to capture future growth. The success hinges on market reception, regulatory approvals, and construction efficiency. For example, a 2024 analysis of the UK property market might highlight a specific underperforming retail asset. The decision to convert it into modern office spaces or residential units would necessitate a detailed feasibility study, projecting future rental income and capital appreciation against the substantial redevelopment costs. The potential for high returns exists, but so does the risk of the project not meeting its financial projections.

The potential development site at Spring Gardens in the UK serves as a relevant illustration. If this site currently houses an underperforming asset, the decision to redevelop it into a higher-value use places it squarely in the Question Mark quadrant. This strategic move involves injecting significant capital for planning, demolition, and new construction. The anticipated future growth is high, but the path to achieving it is fraught with uncertainty, requiring careful management and market analysis to mitigate risks and maximize the potential for substantial returns.

- Strategic Redevelopment: Transforming an underperforming asset (Dog) into a higher-value use positions it as a Question Mark.

- Investment & Risk: This strategy requires significant upfront capital and carries inherent risks, similar to other Question Mark ventures.

- Future Potential: Success hinges on capturing future growth, with potential for substantial returns if the redevelopment is well-executed and market-aligned.

- Example: Redeveloping a low-yield property into mixed-use commercial and residential space exemplifies this strategic shift.

Early-Stage Ventures into New Geographical Markets

Early-stage ventures into new geographical markets, such as CLS Holdings expanding into untapped European countries or deepening its presence in less developed cities within its existing UK, German, and French markets, would be classified as Question Marks in the BCG Matrix.

These new geographical forays represent opportunities with potentially high growth rates but currently low market share, necessitating significant capital investment to establish a foothold and capture market share. For instance, a hypothetical expansion into Poland, a market projected to see a 5% compound annual growth rate in CLS's sector through 2028, would require substantial upfront funding for marketing, distribution, and local operations.

- High Growth Potential: New markets often exhibit robust economic growth and increasing demand for CLS's services.

- Low Market Share: CLS would be entering these markets as a new player, hence starting with a minimal share.

- Significant Investment Required: Capturing market share in competitive or nascent territories demands substantial capital outlay for market entry and brand building.

- Strategic Decision Point: CLS must carefully evaluate whether to invest further to turn these Question Marks into Stars or divest if the potential does not materialize.

Question Marks represent business units or products with low market share in high-growth industries. CLS Holdings' new urban regeneration projects and expansion into new geographical markets exemplify this category. These ventures require significant investment to gain traction and face uncertainty regarding future success.

| Category | Market Share | Market Growth | CLS Holdings Example | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Low | High | Urban regeneration projects, new geographical market entries | Requires significant investment to increase market share; potential to become a Star or a Dog. |

BCG Matrix Data Sources

Our CLS Holdings BCG Matrix is constructed using a blend of public financial disclosures, proprietary market research, and industry-specific performance metrics to provide a comprehensive view of our business units.