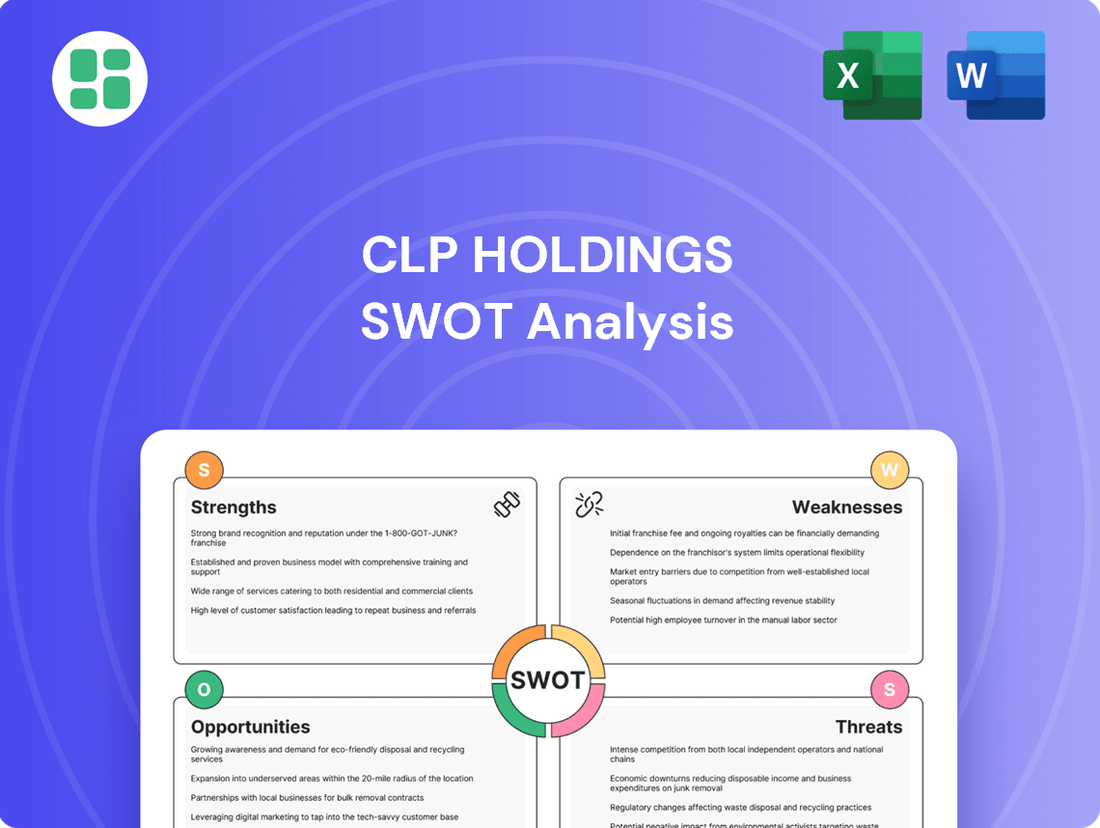

CLP Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLP Holdings Bundle

CLP Holdings demonstrates robust strengths in its diversified energy portfolio and significant market presence, yet faces challenges from evolving regulatory landscapes and emerging competition. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind CLP Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CLP Power Hong Kong holds a commanding position, serving more than 80% of the population with a remarkably reliable power supply, boasting 99.999% world-class reliability. This extensive reach is solidified by a stable Scheme of Control Agreement, valid until 2033, which guarantees predictable regulatory returns and ensures consistent cash flow for CLP Holdings.

CLP Holdings boasts a strong geographical diversification, with significant investments spanning mainland China, India, Southeast Asia (including Thailand and Taiwan), and Australia. This wide reach across key Asia Pacific markets is a core strength, as it significantly reduces the risk of being overly dependent on any single economic region. For instance, in 2023, CLP's Hong Kong operations contributed a substantial portion of its earnings, but its international assets are increasingly important for stability and growth.

CLP Holdings is making a significant strategic move towards decarbonization, actively growing its renewable energy portfolio. This includes substantial investments in wind, solar, and even nuclear power projects, demonstrating a clear commitment to transitioning away from carbon-intensive assets.

This energy transition strategy is particularly evident in key markets like mainland China and India, where CLP is expanding its non-carbon asset base. For instance, as of late 2024, CLP's renewable energy capacity continues to grow, with a stated ambition to increase its share of renewables in its generation mix significantly by 2030.

By aligning with global decarbonization trends, CLP is positioning itself for long-term sustainable growth. This proactive approach in the evolving energy landscape is crucial for maintaining competitiveness and meeting increasing stakeholder demands for environmentally responsible operations.

Strong Financial Performance and Shareholder Returns

CLP Holdings showcased robust financial health in 2024, achieving total earnings of HK$11.7 billion. This represents a significant 76% surge compared to the previous year, largely attributed to enhanced performance in its Australian operations.

The company's commitment to shareholder value is evident in its consistent history of stable or growing dividend payouts. This reliable return underscores CLP's strong financial footing and its dedication to rewarding investors.

- 2024 Earnings: HK$11.7 billion, a 76% year-on-year increase.

- Key Driver: Improved performance in Australian business segment.

- Shareholder Returns: Consistent track record of stable or increasing dividend payments.

Established Infrastructure and Operational Excellence

CLP Holdings boasts an established infrastructure, a testament to over a century of operational experience. This extensive and well-maintained network covers power generation, transmission, and distribution, underpinning its market presence.

The company’s operations in Hong Kong are recognized for their world-class reliability, a key strength that customers value. CLP consistently invests in upgrading its energy infrastructure and operational capabilities across all its markets.

- Extensive Infrastructure: Over 100 years of experience in developing and maintaining power generation, transmission, and distribution networks.

- Operational Excellence: Renowned for world-class reliability, particularly in its Hong Kong operations.

- Ongoing Enhancements: Continuous investment in infrastructure upgrades, including the commissioning of new gas generation units and smart metering projects to improve efficiency and service.

CLP Holdings' strengths lie in its dominant market position in Hong Kong, serving over 80% of the population with exceptional 99.999% reliability, secured by a Scheme of Control Agreement extending to 2033. This provides predictable returns and stable cash flow. The company also benefits from significant geographical diversification across Asia Pacific and Australia, mitigating single-market risks. Furthermore, CLP is actively pursuing decarbonization, expanding its renewable energy portfolio, which is crucial for long-term sustainable growth and meeting evolving stakeholder expectations.

| Strength | Description | Supporting Data/Fact |

| Market Dominance & Reliability | Commanding presence in Hong Kong with a highly reliable supply. | Serves over 80% of Hong Kong population; 99.999% reliability. Scheme of Control Agreement valid until 2033. |

| Geographical Diversification | Reduced reliance on any single market through investments across Asia Pacific and Australia. | Significant operations in Mainland China, India, Southeast Asia, and Australia. |

| Renewable Energy Growth | Strategic shift towards decarbonization and expanding renewable energy assets. | Actively investing in wind, solar, and nuclear projects; increasing non-carbon asset base in China and India. |

| Financial Performance & Shareholder Returns | Robust financial health with strong earnings growth and consistent dividend payouts. | 2024 earnings of HK$11.7 billion (76% YoY increase); consistent history of stable or growing dividends. |

| Established Infrastructure | Over a century of experience in developing and maintaining extensive power networks. | Well-maintained generation, transmission, and distribution networks; continuous infrastructure upgrades. |

What is included in the product

Delivers a strategic overview of CLP Holdings’s internal and external business factors, highlighting its strengths in regulated markets and opportunities in renewable energy, while also addressing weaknesses in capital intensity and threats from regulatory changes.

Offers a clear, actionable framework to identify and address CLP Holdings' strategic challenges and opportunities.

Weaknesses

CLP Holdings operates across diverse markets, including Australia and mainland China, making it vulnerable to evolving regulatory landscapes and government policies. These shifts can directly influence operational costs and revenue streams. For example, recent regulatory adjustments in Australia are projected to affect the profitability of its EnergyAustralia division, underscoring this significant risk.

CLP Holdings faces significant hurdles in its overseas ventures. For instance, the first half of 2025 saw its Australian operations grappling with profit declines, largely a consequence of fierce competition in the retail energy sector and a higher rate of customer departures. This highlights a key weakness in adapting to dynamic and competitive international markets.

Further compounding these challenges, contributions from some nuclear and renewable energy assets in mainland China have also decreased, negatively affecting the group's overall financial results. This dip in performance from key international segments underscores a vulnerability in diversifying and maintaining consistent earnings across different geographical and energy sectors.

CLP Holdings still relies significantly on coal and gas-fired power plants, making up a notable percentage of its installed capacity across its operational regions. This dependence on fossil fuels presents ongoing environmental and operational risks, particularly as global mandates push for a more rapid shift away from carbon-intensive energy sources.

Capital-Intensive Business Model

The energy industry, by its very nature, demands substantial investment. CLP Holdings, like its peers, faces continuous capital expenditure needs to keep its existing infrastructure running smoothly and to fund new generation and transmission projects. This is a significant hurdle.

While CLP's operations in Hong Kong generate strong, reliable cash flows, the sheer scale of capital required across its entire global portfolio can put a strain on its financial resources. This ongoing need for investment can impact its ability to manage debt levels effectively.

For instance, CLP Holdings reported capital expenditure of HK$12.5 billion in 2023, a substantial outlay reflecting the ongoing investment in its diverse energy assets. This highlights the capital-intensive reality of the business.

- High Capital Expenditure: The energy sector necessitates significant ongoing investment in infrastructure maintenance and development.

- Financial Strain Potential: While Hong Kong operations are strong, extensive global capital needs can pressure financial resources and debt management.

- 2023 CAPEX: CLP Holdings invested HK$12.5 billion in capital expenditure in 2023, underscoring the sector's demands.

Market Volatility and Fuel Price Fluctuations

CLP Holdings' reliance on various energy markets means it's susceptible to swings in fuel prices, particularly for coal and natural gas. These fluctuations directly affect the cost of generating electricity.

While lower fuel costs can translate to lower tariffs in regulated areas like Hong Kong, the overall unpredictability of these prices poses a challenge to consistent profitability, especially for CLP's operations outside of regulated frameworks. For instance, global natural gas prices saw significant volatility in late 2023 and early 2024, impacting operational expenses for utilities worldwide.

- Exposure to Commodity Price Swings: CLP's diverse energy portfolio inherently links its profitability to the volatile global commodity markets for fuels like coal and natural gas.

- Impact on Cost of Generation: Fluctuations in fuel prices directly alter the primary cost component for power generation, affecting margins.

- Profitability Uncertainty: While regulated markets may offer some buffer, non-regulated assets face direct impacts on profitability from unpredictable fuel cost changes.

CLP Holdings' significant reliance on fossil fuels, particularly coal and gas, exposes it to considerable environmental and regulatory risks as global decarbonization efforts intensify. This dependence on carbon-intensive energy sources could lead to future stranded assets and increased compliance costs.

The company's international operations, notably in Australia, have shown vulnerability to competitive pressures and customer retention issues, impacting profitability. For example, the first half of 2025 saw profit declines in its Australian segment due to these market dynamics.

Furthermore, underperformance in certain mainland China renewable and nuclear energy assets has negatively affected overall financial results, indicating challenges in achieving consistent returns across its diversified international portfolio.

CLP Holdings faces substantial capital expenditure requirements for infrastructure maintenance and new projects, with HK$12.5 billion invested in 2023 alone. This ongoing need for investment can strain financial resources and debt management, despite strong cash flows from Hong Kong.

Preview Before You Purchase

CLP Holdings SWOT Analysis

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the CLP Holdings SWOT analysis, providing a comprehensive overview of its Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The Asia Pacific region is a powerhouse of economic expansion and urbanization, fueling a consistent rise in electricity demand. CLP Holdings is well-positioned to capitalize on this trend, with the International Energy Agency projecting a substantial increase in electricity consumption across the region through 2025 and beyond.

This sustained demand growth offers CLP a prime opportunity to invest in and expand its generation, transmission, and distribution infrastructure. Meeting these evolving energy needs will be crucial for regional development and presents a significant avenue for revenue growth and market share expansion for CLP.

The global push for decarbonization is a significant tailwind for CLP Holdings. As countries worldwide accelerate their adoption of renewable energy, CLP is well-positioned to capitalize on this shift. For instance, in 2024, the company continued to expand its renewable energy portfolio, with a notable increase in its operational wind and solar capacity, contributing to its ambitious climate targets.

CLP can further leverage this opportunity by increasing investments in large-scale wind and solar farms, alongside crucial battery energy storage systems. By utilizing its established expertise and fostering strategic alliances, CLP can effectively grow its non-carbon energy generation, meeting rising demand for cleaner power sources.

CLP Holdings can capitalize on the growing smart grid and energy solutions market. Advancements in smart grid technologies, digitalization, and integrated energy solutions offer opportunities to boost operational efficiency and customer satisfaction. For instance, CLP's investment in digital transformation initiatives is expected to yield significant improvements in grid reliability and customer service by 2025.

Expanding its electric vehicle charging network and offering comprehensive energy management services to businesses are key growth avenues. This aligns with global trends towards electrification and sustainability, potentially opening up new revenue streams for CLP.

Strategic Partnerships and Acquisitions

CLP Holdings can leverage strategic partnerships and acquisitions to expand its reach and capabilities. For instance, its existing joint venture, Apraava Energy in India, demonstrates a successful model for market entry and operational synergy.

The company's continued focus on collaborations for nuclear power development in mainland China further highlights its strategy to diversify its asset base and acquire critical expertise. These moves are crucial for navigating the evolving energy landscape and securing future growth opportunities.

CLP Holdings' 2024-2025 strategic outlook likely includes identifying and executing further partnerships and acquisitions to bolster its position in key markets and emerging technologies.

- Market Expansion: Partnerships and acquisitions provide a faster route to enter new geographical markets and energy sectors, as seen with Apraava Energy in India.

- Technology Transfer: Collaborations, such as those in nuclear power development, facilitate the acquisition of advanced technologies and operational know-how.

- Accelerated Growth: Targeted M&A activities can significantly speed up growth by integrating new assets, customer bases, and revenue streams.

- Diversification: These strategic moves help diversify CLP's energy portfolio and reduce reliance on specific markets or technologies, enhancing overall resilience.

Expansion into Emerging Markets and Services

CLP Holdings can strategically expand its operations into emerging markets, particularly those experiencing robust growth in energy consumption and developing renewable energy infrastructure. This geographic diversification offers a pathway to tap into new customer bases and secure long-term growth opportunities. For instance, the Asia-Pacific region, excluding China, is projected to see significant energy demand increases in the coming years, presenting fertile ground for expansion.

Beyond geographical reach, CLP has a clear opportunity to diversify its service portfolio by offering value-added energy solutions. This includes focusing on energy efficiency programs for commercial and industrial clients, which can lead to substantial cost savings for customers and recurring revenue streams for CLP. The global market for energy efficiency services was valued at over $40 billion in 2024 and is expected to grow steadily.

Furthermore, investing in and deploying advanced metering infrastructure (AMI) presents another avenue for service diversification. AMI enhances grid management, improves billing accuracy, and provides customers with real-time energy usage data, fostering engagement and potential demand-side management programs. The global AMI market is anticipated to reach approximately $30 billion by 2025, indicating substantial market potential.

- Geographic Expansion: Targeting high-growth emerging markets with increasing energy needs and nascent renewable sectors.

- Service Diversification: Offering energy efficiency solutions to commercial and industrial clients, projected to grow significantly.

- Advanced Metering Infrastructure: Implementing AMI to enhance grid operations and customer engagement, with a market size expected to reach $30 billion by 2025.

CLP Holdings is strategically positioned to benefit from the ongoing global transition to cleaner energy sources. The company's commitment to expanding its renewable energy portfolio, which saw a notable increase in operational wind and solar capacity in 2024, aligns perfectly with this trend. By further investing in large-scale wind and solar projects, complemented by essential battery energy storage systems, CLP can solidify its position as a leader in low-carbon power generation.

The company can also capitalize on the burgeoning smart grid and integrated energy solutions market. CLP's ongoing investments in digital transformation are expected to enhance grid reliability and customer service by 2025, creating new revenue streams through services like electric vehicle charging networks and comprehensive energy management for businesses.

Furthermore, strategic partnerships and acquisitions represent a significant opportunity for CLP. Its successful joint venture, Apraava Energy in India, exemplifies this approach. Continued collaborations, such as those in mainland China's nuclear power development, will allow CLP to diversify its asset base and acquire critical expertise, ensuring its adaptability in the evolving energy landscape.

CLP's expansion into high-growth emerging markets, particularly in the Asia-Pacific region, offers substantial potential for new customer acquisition and long-term revenue growth. Simultaneously, diversifying its service offerings with energy efficiency programs for commercial clients and implementing advanced metering infrastructure (AMI) will tap into growing markets projected to reach significant valuations by 2025.

Threats

CLP Holdings' retail energy operations, notably EnergyAustralia, are navigating a fiercely competitive landscape. Deregulated markets mean constant price wars and a significant challenge in retaining customers, with high churn rates a persistent concern. This intensified rivalry, amplified by economic pressures on consumers, directly threatens profit margins and customer base stability.

For instance, in Australia's retail energy sector, competition has driven down average retail electricity prices for residential customers. While specific CLP figures for 2024/2025 are still emerging, industry-wide trends show that companies are increasingly relying on value-added services and customer loyalty programs to offset the impact of price-driven churn. The ongoing cost of living crisis further intensifies this, as consumers actively seek cheaper energy plans, putting direct pressure on CLP's profitability in these segments.

CLP Holdings faces increasing pressure from evolving and more stringent environmental regulations, particularly those targeting carbon emission reductions. Meeting these evolving standards necessitates substantial capital outlays for upgrading to cleaner technologies, potentially impacting profitability and operational flexibility. For instance, in 2023, CLP committed to investing HK$100 billion in renewable energy and grid infrastructure by 2030, reflecting the scale of investment required to align with decarbonization goals.

Beyond regulatory compliance, the physical manifestations of climate change present a significant operational threat. Extreme weather events, such as typhoons and heatwaves, could disrupt CLP's extensive infrastructure, including power generation facilities and transmission networks. Such disruptions can lead to service interruptions, repair costs, and potential revenue losses, as seen in past instances where severe weather impacted grid stability across its operating regions.

CLP Holdings faces significant threats from technological disruption. The rise of distributed generation, like rooftop solar, and advanced energy storage solutions are fundamentally altering the energy landscape, potentially undermining traditional utility revenue streams. For instance, by the end of 2023, renewable energy capacity additions globally reached record levels, a trend that will likely accelerate, impacting established players.

Furthermore, CLP's increasing reliance on digital infrastructure makes it a prime target for escalating cybersecurity threats. A successful cyberattack could cripple operational integrity, leading to widespread power outages, and compromise sensitive customer data, resulting in substantial financial and reputational damage. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the pervasive nature of this risk.

Geopolitical and Economic Instability

CLP Holdings' extensive operations across the Asia Pacific region mean it's susceptible to a range of geopolitical and economic risks. For instance, ongoing trade tensions between major economies could disrupt supply chains and impact the cost of capital investments, a critical factor for infrastructure projects. The company's exposure to markets like mainland China, which experienced a 5.2% GDP growth in 2023, also means it's subject to policy shifts and regulatory changes that could affect its business environment.

Economic downturns in key operating territories can directly impact CLP's financial performance. Fluctuations in currency exchange rates, particularly against the Hong Kong dollar, can also create headwinds for earnings reported in other currencies. For example, a significant depreciation of the Australian dollar, where CLP has substantial investments, could negatively affect its consolidated financial results.

- Geopolitical Tensions: Increased risk of trade disputes and regional conflicts impacting investment and operational stability.

- Economic Volatility: Exposure to economic slowdowns in diverse Asian markets, affecting demand for energy services.

- Currency Fluctuations: Adverse movements in exchange rates can diminish the value of foreign earnings when translated back to the reporting currency.

Fluctuating Commodity Prices

CLP Holdings faces a significant threat from the volatility in global commodity markets, especially for essential fuels like coal and natural gas. This fluctuation directly impacts operational costs and profitability, particularly for its generation assets that aren't subject to strict regulatory cost pass-through mechanisms.

For instance, the price of Newcastle thermal coal, a key fuel for many power plants, saw considerable swings in 2024. While specific figures for CLP's direct exposure are proprietary, broader market trends indicate that a sharp increase in coal prices, such as those experienced in early 2024 where prices briefly touched over $130 per tonne, can significantly squeeze margins on non-regulated assets. Even in regulated markets, while costs are often passed on, substantial price swings necessitate constant financial adaptation and can create short-term cash flow pressures.

- Global commodity prices, particularly for coal and natural gas, are inherently volatile.

- This volatility directly impacts CLP's operational costs and profitability for non-regulated generation assets.

- Significant price swings can strain financial stability and necessitate continuous strategic adaptation.

- Even in regulated markets, price volatility requires careful financial management and can affect short-term cash flows.

CLP Holdings faces intense competition in its retail energy markets, leading to price wars and customer churn, especially with the ongoing cost of living crisis impacting consumer spending. For example, the Australian retail energy sector has seen downward pressure on prices, with companies increasingly relying on loyalty programs to retain customers. This competitive environment directly threatens CLP's profitability and customer base stability.

SWOT Analysis Data Sources

This CLP Holdings SWOT analysis is built upon a foundation of robust data, including official financial statements, comprehensive market research reports, and expert industry analyses, ensuring a well-rounded and accurate strategic perspective.