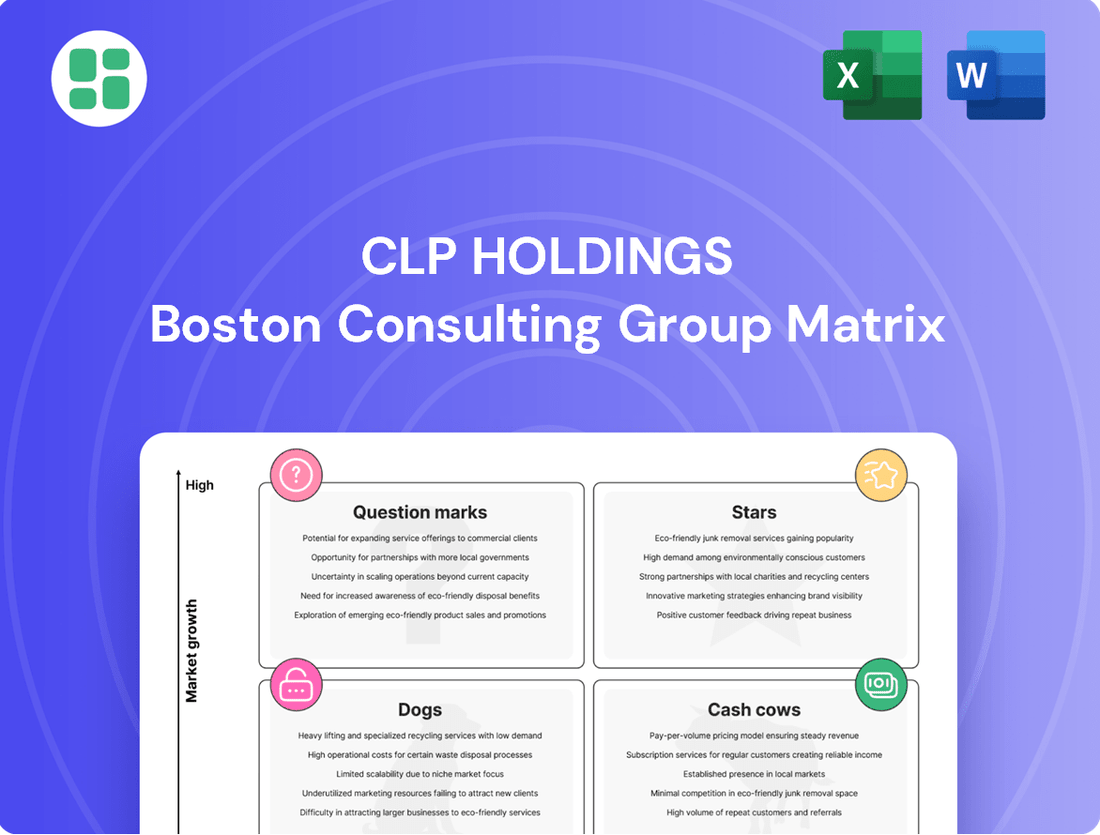

CLP Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLP Holdings Bundle

Curious about CLP Holdings' strategic product portfolio? Our BCG Matrix preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock actionable insights and a comprehensive understanding of their competitive landscape, dive into the full report.

Don't just guess where CLP Holdings' products stand in the market; know it with certainty. The complete BCG Matrix provides detailed quadrant placements and data-driven recommendations, empowering you to make informed investment and product development decisions. Purchase the full report for a strategic roadmap to success.

Stars

CLP Holdings is making a significant push into Mainland China's renewable energy sector, planning to double its assets there to 6 gigawatts by 2027. This strategic move is well-timed with China's ambitious decarbonization goals and evolving market-based pricing for renewables, creating a fertile ground for expansion.

The company is actively developing new wind and solar projects across China, demonstrating a clear intent to capture a larger share of this rapidly expanding market. In 2023, China's renewable energy capacity saw substantial growth, with solar PV installations alone adding over 216 gigawatts, highlighting the immense scale of opportunity CLP is targeting.

Apraava Energy, CLP's Indian joint venture, is aggressively pursuing non-carbon energy projects. This includes significant investments in wind, solar, and crucial transmission infrastructure, positioning it for substantial growth in a key market.

India's escalating power needs, coupled with a strong commitment to decarbonization, present a fertile ground for Apraava's expansion. The company is actively building its portfolio in this dynamic environment.

Currently, Apraava Energy has over two gigawatt-equivalent of non-carbon energy projects in its development pipeline. The company has set an ambitious target to more than triple this capacity in the medium term, reflecting strong confidence in India's energy transition.

CLP Power Hong Kong is making significant infrastructure investments to meet the escalating electricity needs of new data centers and the ambitious Northern Metropolis project. These developments are positioned as high-growth opportunities within Hong Kong's established market, where CLP is focused on solidifying its leading market position by serving these burgeoning high-demand sectors.

The company reported robust growth in electricity sales to data centers during the first half of 2025, underscoring the immediate impact of these strategic investments. This expansion directly addresses the increasing power requirements driven by digital transformation and urban development initiatives.

Large-Scale Battery Energy Storage Systems (BESS)

CLP Holdings is actively investing in large-scale Battery Energy Storage Systems (BESS), recognizing their pivotal role in the evolving energy landscape. A prime example is their involvement in the Wooreen Energy Storage System in Victoria, Australia, and a standalone BESS project in Shandong, China. These initiatives are critical for enhancing grid stability as the integration of renewable energy sources continues to grow.

These BESS projects are positioned within a high-growth segment of the energy transition, reflecting CLP's commitment to flexible capacity solutions. By undertaking such ventures, CLP is solidifying its standing as a key player in providing essential grid services. For instance, the Wooreen project, with a capacity of 100 MW/200 MWh, commenced operations in 2023, demonstrating tangible progress in this area.

- Investment in BESS: CLP is expanding its portfolio with significant investments in large-scale battery storage.

- Grid Stability: These systems are vital for managing the intermittency of renewable energy and ensuring grid reliability.

- Growth Potential: BESS represents a rapidly expanding market driven by global decarbonization efforts.

- Strategic Positioning: CLP's BESS projects aim to establish leadership in flexible energy solutions.

Strategic Partnerships in Clean Energy

CLP Holdings actively pursues strategic partnerships to bolster its clean energy initiatives. Collaborations with entities like Banpu Energy Australia and EDF Power Solutions Australia are key, focusing on areas such as battery storage and pumped hydro. These alliances are crucial for accelerating CLP's transition to cleaner energy sources and expanding its footprint in rapidly growing market segments.

These strategic alliances allow CLP to leverage external expertise and capital, thereby de-risking its expansion efforts. For instance, by partnering for battery storage projects, CLP can tap into specialized knowledge and shared investment burdens. This agile strategy is vital for capturing emerging opportunities in the clean energy sector efficiently.

- Accelerated Clean Energy Transition: Partnerships enable faster deployment of renewable energy projects.

- Market Expansion: Collaborations facilitate entry into new high-growth clean energy segments.

- Capital Efficiency: Sharing investment costs with partners reduces reliance on internal capital.

- Risk Mitigation: Strategic alliances help manage the financial and operational risks associated with new technologies and projects.

CLP Holdings' investments in Battery Energy Storage Systems (BESS) place them firmly in the "Stars" category of the BCG matrix. These BESS projects, like the one in Shandong, China, are in high-growth markets driven by the global shift towards renewables.

The company's commitment to BESS is evident in projects such as the Wooreen Energy Storage System in Victoria, Australia, which became operational in 2023 with a capacity of 100 MW/200 MWh. This positions CLP to capitalize on the increasing demand for grid stability solutions.

By investing in BESS, CLP is not only supporting the integration of renewable energy but also establishing a strong presence in a segment with significant future growth potential. This strategic focus on flexible capacity solutions is crucial for long-term value creation.

CLP's BESS ventures are characterized by high investment and high growth potential, aligning them with the "Stars" quadrant of the BCG matrix.

What is included in the product

CLP Holdings' BCG Matrix offers a strategic overview of its business units, categorizing them by market share and growth to guide investment decisions.

CLP Holdings BCG Matrix: Visualizes business unit performance, easing the pain of strategic uncertainty.

Cash Cows

CLP Power Hong Kong's regulated business is a quintessential Cash Cow for CLP Holdings, generating substantial and stable earnings. Its position is solidified by the Scheme of Control Agreement, which extends until 2033, ensuring predictable cash flows from its extensive asset base in a mature, regulated market.

Serving over 80% of Hong Kong's population, CLP Power Hong Kong boasts world-class reliability, a testament to its significant infrastructure investment. In 2024, the company continued to demonstrate its robust operational performance, contributing significantly to CLP Holdings' overall financial strength.

The Daya Bay Nuclear Power Station, a significant joint venture for CLP Holdings, stands as a prime example of a Cash Cow. It reliably supplies zero-carbon baseload electricity to both Hong Kong and Mainland China, underscoring its crucial role in the energy sector.

Nuclear power generation, particularly in established facilities like Daya Bay, offers a predictable and stable revenue stream. Its mature operational status and high efficiency contribute significantly to CLP's foundational profitability, reflecting its status as a low-risk, high-return asset.

In 2023, CLP Holdings reported that its energy business, which includes contributions from nuclear assets, maintained robust performance. While specific figures for Daya Bay are integrated within broader segment reporting, the consistent demand for reliable, carbon-free power ensures its ongoing contribution to CLP's financial stability.

CLP Holdings' existing conventional generation assets in Hong Kong, particularly its modern gas-fired units like the new addition at Black Point Power Station, function as significant cash cows. These facilities are crucial for providing a stable and reliable power supply to the city, a market with established demand and regulatory frameworks.

These assets generate consistent revenue streams due to their essential role in meeting Hong Kong's energy needs, contributing to CLP's overall financial strength. For instance, in 2023, CLP's generation segment in Hong Kong, heavily reliant on these assets, reported a substantial contribution to the group's earnings, underscoring their cash-generating capabilities.

Established Transmission and Distribution Networks

CLP Holdings' established transmission and distribution networks in Hong Kong function as a classic Cash Cow. These are mature, highly regulated assets with a dominant market share, providing predictable and stable revenue streams. The consistent demand for electricity ensures a reliable income, allowing CLP to generate significant cash flow from these operations.

These critical infrastructure assets require continuous, albeit predictable, investment for maintenance and upgrades to ensure reliability and meet regulatory standards. For instance, CLP Power Hong Kong Limited, a subsidiary of CLP Holdings, reported capital expenditure of approximately HK$5.2 billion in 2023, primarily directed towards maintaining and enhancing its network infrastructure.

- Stable Revenue Generation: The regulated nature of the Hong Kong electricity market provides a predictable revenue framework for CLP's transmission and distribution assets.

- High Market Share: CLP holds a near-monopoly position in its franchised areas, ensuring consistent customer demand and revenue.

- Predictable Investment Needs: While requiring ongoing investment, these capital expenditures are generally well-planned and manageable, supporting strong free cash flow generation.

- Mature Market: The Hong Kong market for electricity distribution is mature, with growth primarily driven by economic activity rather than new customer acquisition.

Apraava Energy's Existing Operational Assets in India

Apraava Energy's existing operational assets in India, encompassing wind, solar, and supercritical coal power plants, represent a significant cash-generating segment within CLP Holdings' portfolio. These established facilities benefit from a market with robust and consistent energy demand, contributing reliably to the overall financial health of the Indian operations.

The diversified nature of these assets, spanning multiple renewable and thermal technologies, mitigates risk and ensures a steady stream of income. For instance, in the fiscal year 2023, Apraava Energy's operational capacity in India was approximately 4,618 MW, with a substantial portion contributing to consistent cash flows.

- Diversified Portfolio: Includes wind, solar, and supercritical coal assets, ensuring a stable revenue base.

- Established Demand: Operates in a market with proven and ongoing energy consumption needs.

- Proven Reliability: Assets demonstrate consistent performance, anchoring the Indian business's financial contribution.

- Capacity Contribution: Approximately 4,618 MW of operational capacity as of FY2023, generating consistent cash flow.

CLP Power Hong Kong's transmission and distribution networks are a prime example of a Cash Cow. These mature, regulated assets with a dominant market share in Hong Kong ensure predictable and stable revenue streams due to consistent electricity demand. In 2023, CLP Power Hong Kong Limited reported capital expenditure of approximately HK$5.2 billion, largely for maintaining and enhancing this vital infrastructure, which underpins its strong cash-generating ability.

| Asset Type | Key Characteristics | Contribution to CLP Holdings | 2023 Data Point |

| Hong Kong Transmission & Distribution | Regulated, dominant market share, mature | Stable, predictable cash flows | HK$5.2 billion CAPEX for network maintenance/enhancement |

| Daya Bay Nuclear Power Station | Joint venture, zero-carbon baseload power | Reliable, foundational profitability | Consistent contribution to earnings (integrated into segment reporting) |

| Hong Kong Conventional Generation (e.g., Black Point) | Modern gas-fired units, essential for supply | Consistent revenue from meeting demand | Generation segment in Hong Kong contributed substantially to group earnings |

| Apraava Energy (India) Existing Assets | Wind, solar, supercritical coal; diversified | Steady income stream, mitigates risk | Approx. 4,618 MW operational capacity (FY2023) |

Preview = Final Product

CLP Holdings BCG Matrix

The CLP Holdings BCG Matrix preview you are viewing is the exact, fully-formatted report you will receive immediately after purchase. This comprehensive document, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis of CLP Holdings' business portfolio.

Dogs

EnergyAustralia's retail customer business, as part of CLP Holdings, is currently positioned as a Dog in the BCG Matrix. The intense competition in the Australian energy retail market has significantly impacted its performance.

In the first half of 2025, this segment experienced a substantial decline in operating profit, falling by 59% to $67 million. This downturn is attributed to reduced customer numbers and ongoing market pressures, leading to squeezed margins. The business operates in a highly competitive and challenging retail environment, reflecting a low market share and growth prospects.

CLP Holdings' aging coal-fired power stations in Australia, such as Yallourn scheduled for closure in mid-2028 and Mount Piper by 2040, represent a classic 'Dog' in the BCG Matrix. These assets are in a low-growth, declining market due to Australia's strong decarbonization push, which limits their future potential and profitability.

The ongoing capital expenditure required for maintaining these aging facilities, while their operational lifespan is clearly defined and limited, further solidifies their 'Dog' status. In 2023, Australia's coal power generation share continued its downward trend, falling to approximately 37% of the national electricity mix, a significant drop from previous years, underscoring the challenging market conditions for these assets.

CLP Holdings' minority interests in Taiwan and Thailand coal plants are positioned in the question mark category of the BCG matrix. These assets, including a coal-based generation plant in Taiwan and a solar project in Thailand, have historically contributed lower earnings to the group.

These operations are situated within government-controlled, low-growth electricity markets. CLP's market share in these regions is marginal, and the company faces challenges related to local regulatory environments and fluctuating fuel costs, impacting their profitability and growth potential.

Underperforming Legacy Assets in Mainland China

While CLP Holdings is actively expanding its renewable energy portfolio in Mainland China, certain legacy assets are presenting challenges. These older infrastructure, particularly those tied to evolving tariff structures, have seen their financial contributions decline. This is often due to operating in segments with less robust growth potential or facing specific market pressures that impact profitability.

For instance, in 2024, some of CLP's older coal-fired power plants in China, which are part of its legacy portfolio, have faced increased regulatory scrutiny and a downward trend in market electricity prices. This has led to a noticeable reduction in their earnings before interest and taxes (EBIT) compared to previous years.

- Legacy Assets Facing Tariff Pressure: Older power generation facilities in Mainland China, especially those with tariffs subject to downward revisions, are experiencing reduced revenue streams.

- Lower Growth Segment Exposure: These underperforming assets are often situated in markets with slower demand growth or are in sectors experiencing technological obsolescence.

- Impact on Overall Performance: The reduced contributions from these legacy assets in 2024 have a dampening effect on the overall financial performance of CLP's Mainland China operations, despite growth in newer segments.

Certain Corporate and Development Expenses

Certain Corporate and Development Expenses, when viewed through the lens of CLP Holdings' BCG Matrix, often represent investments in potential future stars or question marks. These expenses, particularly those directed towards exploring new markets such as the Taiwan region and Vietnam, have demonstrably impacted CLP's earnings in the short term. For instance, in 2023, CLP Holdings reported that investments in new energy initiatives and market expansion contributed to a segment earnings decline in certain areas. This highlights the inherent trade-off: while these expenditures are vital for long-term growth and diversification, they can function as cash drains in their early stages, especially when immediate, substantial returns are not yet realized.

These strategic investments, though currently weighing on immediate profitability, are designed to build future revenue streams. The rationale is to establish a foothold in emerging markets and technologies that could become significant profit centers down the line. CLP's commitment to expanding its renewable energy portfolio, for example, involves substantial upfront capital expenditure. This aligns with the characteristics of question marks in the BCG matrix, where significant investment is required to determine if they will evolve into stars or revert to dogs.

- Exploration Costs: Higher corporate and development expenses, particularly for exploring new opportunities in nascent markets like the Taiwan region and Vietnam, have led to decreased earnings in those segments.

- Short-Term Impact: While crucial for future growth, these early-stage expenditures without immediate significant returns can act as cash traps in the short term.

- Strategic Investment: These costs are often associated with question mark businesses in the BCG matrix, requiring significant investment to gauge future potential.

- 2023 Context: CLP Holdings noted in its 2023 annual report that investments in new energy and market expansion contributed to segment earnings declines in specific regions, illustrating the immediate financial impact of such development activities.

CLP Holdings' EnergyAustralia retail business is firmly in the Dog category of the BCG Matrix. This segment experienced a 59% drop in operating profit to $67 million in the first half of 2025, driven by declining customer numbers and intense market competition that eroded margins. The Australian energy retail market is characterized by low growth and high competition, resulting in a low market share for this business.

Question Marks

CLP Holdings' early-stage renewable projects in Southeast Asia, particularly in markets like Taiwan and Vietnam, are currently positioned as Stars or Question Marks in the BCG matrix. These regions offer substantial growth potential for renewable energy, driven by increasing demand and supportive government policies. For instance, Vietnam aims to increase its renewable energy capacity significantly by 2030, creating a fertile ground for new ventures.

While CLP is investing in these markets, often securing long-term contractual agreements, its current market share and earnings from these nascent renewable ventures are minimal. This indicates a high investment requirement to capture market share and achieve profitability, characteristic of Question Marks. The company's strategic focus is on building a strong foundation for future growth in these dynamic emerging economies.

CLP Holdings is actively investing in new, large-scale battery energy storage and pumped hydro projects, exemplified by the significant Lake Lyell project in New South Wales, Australia. These initiatives represent a strategic move into a high-growth sector, aiming to bolster energy reliability and support renewable integration.

While these energy storage technologies are in a crucial development phase, their market share and profitability are still maturing. This necessitates considerable upfront capital investment and the creation of innovative business models to secure long-term viability and competitive advantage for CLP.

Apraava Energy, a key player in India's energy sector, is aggressively pursuing smart meter rollouts, aiming for millions of installations. This initiative positions them within a high-growth segment fueled by the broader digitalization trend across the utilities landscape.

While the long-term benefits of Advanced Metering Infrastructure (AMI) are substantial, the significant upfront capital expenditure for these deployments can temper immediate profitability. As of early 2024, the market penetration for smart meters in India, though growing, remains in its nascent stages, impacting the near-term financial returns for such large-scale projects.

Cooling-as-a-Service (CaaS) and EV Charging Solutions

CLPe's ventures into Cooling-as-a-Service (CaaS) and expanding EV charging infrastructure in Hong Kong represent strategic moves into burgeoning markets. These initiatives cater to a growing demand for sustainable and convenient solutions, positioning CLPe for future growth.

While these services are in nascent stages with low current market share, their potential within rapidly expanding sectors is significant. For instance, Hong Kong's EV market saw a substantial increase in registrations, with new electric vehicle registrations accounting for approximately 15% of all new vehicle registrations in the first half of 2024, highlighting the market's upward trajectory.

- Cooling-as-a-Service (CaaS): CLPe is exploring innovative models for providing cooling solutions, targeting sectors with significant energy consumption for climate control. This service aims to offer predictable costs and enhanced efficiency for customers.

- EV Charging Solutions: The company is actively expanding its network of electric vehicle charging stations across Hong Kong. This aligns with the government's push for greater EV adoption and aims to address charging accessibility concerns.

- Market Position: Both CaaS and EV charging are considered new products for CLPe, operating in markets characterized by high growth potential but currently low penetration for the company.

- Investment and Profitability: Significant capital investment is required to scale these operations, build out infrastructure, and achieve widespread customer adoption, with profitability expected to materialize over the medium to long term.

Digital Transformation and AI Integration Initiatives

CLP Holdings is actively pursuing digital transformation and AI integration, recognizing their critical role in enhancing operational efficiency and maintaining competitiveness. These forward-looking investments, while promising substantial long-term benefits, are currently in a growth phase with potential not yet fully translated into immediate market share gains or direct financial returns.

The company's commitment to deploying AI across its operations is a strategic move to optimize processes, improve predictive maintenance, and enhance customer service. For instance, CLP has been piloting AI-powered solutions for grid management, aiming to reduce downtime and improve energy distribution reliability. These initiatives are designed to unlock significant operational improvements, positioning CLP to capitalize on the evolving energy sector.

- Digital Innovation Investment: CLP is allocating resources to explore and implement new digital technologies, including AI, across its diverse business units.

- AI Deployment for Efficiency: The integration of AI is targeted at improving operational performance, such as predictive maintenance and grid optimization, leading to potential cost savings and enhanced service delivery.

- Future Competitiveness: These digital and AI initiatives are crucial for CLP to remain competitive in a rapidly changing energy market characterized by technological advancements and evolving customer expectations.

- Growth Potential vs. Current Returns: While these investments offer high growth potential for operational enhancements, their direct impact on immediate market share and realized financial returns is still developing.

CLP's investments in new ventures like Cooling-as-a-Service and EV charging infrastructure in Hong Kong are categorized as Question Marks. These sectors exhibit high growth potential, evidenced by the increasing adoption of electric vehicles, with new EV registrations making up approximately 15% of all new vehicle registrations in Hong Kong during the first half of 2024.

However, CLP's current market share in these areas is minimal, requiring substantial capital investment to build out infrastructure and customer bases. Profitability is anticipated in the medium to long term as these markets mature and CLP scales its operations.

Similarly, CLP's digital transformation and AI integration efforts, aimed at enhancing operational efficiency, are also considered Question Marks. While these initiatives promise significant long-term benefits and are critical for future competitiveness, their immediate impact on market share and direct financial returns is still developing.

The company is actively piloting AI solutions for grid management, seeking to improve reliability and reduce downtime, reflecting the strategic importance of these investments in a rapidly evolving energy landscape.

| Venture | Market Growth Potential | CLP Market Share | Investment Requirement | Profitability Outlook |

|---|---|---|---|---|

| Cooling-as-a-Service (Hong Kong) | High (driven by demand for sustainable solutions) | Low (nascent stage) | High (infrastructure build-out) | Medium to Long Term |

| EV Charging Solutions (Hong Kong) | High (supported by government EV adoption push) | Low (nascent stage) | High (network expansion) | Medium to Long Term |

| Digital Transformation & AI Integration | High (operational efficiency, predictive maintenance) | Low (development phase) | High (technology implementation) | Long Term (enhancement of existing operations) |

BCG Matrix Data Sources

Our BCG Matrix is constructed using CLP Holdings' official annual reports, investor presentations, and publicly available financial disclosures, supplemented by reputable industry research and market growth data.