CLP Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLP Holdings Bundle

Unlock the strategic blueprint behind CLP Holdings's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they deliver value, manage key resources, and generate revenue in the dynamic energy sector. Perfect for anyone seeking to understand their competitive edge.

Partnerships

CLP Holdings maintains vital relationships with government and regulatory bodies, particularly in Hong Kong, where its operations are governed by the Scheme of Control Agreements. These partnerships are fundamental for securing necessary licenses, facilitating large-scale infrastructure projects, and ensuring alignment with evolving national energy strategies, including ambitious decarbonization targets and the development of new urban areas like the Northern Metropolis.

These collaborations are not merely procedural; they are strategic enablers that foster a stable and predictable operating environment for CLP. For instance, the Hong Kong government's commitment to renewable energy targets, as outlined in its Climate Change Action Plan 2023, directly influences CLP's investment decisions and infrastructure planning, underscoring the symbiotic nature of these governmental partnerships in achieving long-term sustainability and growth objectives.

CLP Holdings actively forms strategic joint ventures to share the significant capital investment required for major projects and to navigate regional markets effectively. A prime example is Apraava Energy in India, a joint venture with CDPQ, which allows CLP to leverage local knowledge and de-risk its expansion into the Indian renewable energy sector.

These collaborations are crucial for entering new territories and adopting advanced technologies, especially in the realm of non-carbon energy assets. For instance, CLP's involvement in nuclear power generation, such as the Daya Bay Nuclear Power Station, is undertaken in partnership with China General Nuclear Power Corporation (CGN), demonstrating a commitment to large-scale, capital-intensive, and technologically complex ventures.

CLP Holdings actively partners with technology providers to drive its digitalization efforts, focusing on smart grid solutions, battery energy storage systems, and advanced energy management. For instance, in 2024, CLP continued its investments in smart meter deployment, aiming to enhance grid efficiency and customer engagement through real-time data.

Collaborations with innovation accelerators and tech companies are crucial for CLP to boost operational efficiency and customer service. These partnerships are instrumental in exploring emerging areas such as electric vehicle charging infrastructure and the integration of artificial intelligence, as seen in their ongoing pilot projects for predictive maintenance of power assets.

Fuel and Energy Suppliers

CLP Holdings cultivates key partnerships with a diverse range of fuel and energy suppliers to ensure operational stability and strategic growth. These relationships are essential for sourcing both conventional fuels like natural gas and coal, and increasingly, renewable energy sources. For instance, in 2024, CLP continued to emphasize its commitment to cleaner energy, with renewable energy sources making up a growing portion of its generation portfolio.

These partnerships are critical for maintaining a reliable and cost-effective supply chain, directly impacting CLP's ability to generate power efficiently. Beyond traditional fuel procurement, CLP actively fosters collaborations for importing zero-carbon energy. A prime example is its ongoing development of cross-border clean energy systems with mainland China, a crucial element in its decarbonization strategy.

CLP's strategic approach to supplier relationships is evident in its efforts to secure long-term contracts and explore innovative energy solutions.

- Natural Gas and Coal Suppliers: Essential for maintaining baseload power generation, ensuring consistent energy output.

- Renewable Energy Providers: Partnerships with solar, wind, and other renewable energy developers are key to expanding CLP's clean energy capacity.

- Cross-Border Energy Import Partners: Collaborations, particularly with mainland China, are vital for accessing and importing zero-carbon energy sources to meet decarbonization targets.

Industrial and Commercial Clients for Energy Solutions

CLP Holdings cultivates key partnerships with major industrial and commercial clients, such as data centers and large property developers. These collaborations are designed to deliver bespoke energy solutions, comprehensive energy audits, and advanced smart energy services. This strategic approach moves beyond mere electricity provision.

These partnerships are instrumental in driving CLP’s growth by offering integrated services like energy efficiency initiatives, distributed energy resources, and electric vehicle charging infrastructure. For instance, CLP’s commitment to innovation in 2024 includes expanding its smart meter deployment, which directly benefits these large commercial clients by providing real-time energy usage data for better management and cost savings.

- Tailored Energy Solutions: Partnerships focus on customized energy plans and services for large industrial and commercial entities.

- Energy Efficiency Programs: Collaborations include implementing programs to reduce energy consumption and carbon footprint for clients.

- Smart Energy Services: Offering advanced technologies and data analytics to optimize energy usage and grid integration.

- Infrastructure Development: Joint ventures in areas like distributed generation and EV charging networks to support client sustainability goals.

CLP Holdings' key partnerships extend to financial institutions and investors, crucial for funding its capital-intensive projects and driving its expansion into new energy technologies. These relationships are vital for securing the necessary capital for infrastructure development, including renewable energy projects and grid modernization initiatives. For example, in 2024, CLP continued to leverage green financing options, underscoring the importance of these financial alliances in achieving its sustainability goals.

These financial collaborations are essential for managing the significant investment required in areas like battery energy storage systems and offshore wind farms. By working with banks and investment firms, CLP can access diverse funding streams, ensuring the financial viability of its long-term strategic objectives, such as its commitment to net-zero emissions by 2050.

CLP also engages in strategic alliances with research institutions and universities to foster innovation and stay at the forefront of energy technology. These partnerships are key to exploring cutting-edge solutions in areas like advanced materials for energy storage and smart grid analytics, ensuring CLP remains competitive in a rapidly evolving energy landscape.

| Partner Type | Purpose | Example/Focus Area | 2024 Relevance |

|---|---|---|---|

| Government & Regulators | Licenses, project facilitation, policy alignment | Scheme of Control Agreements (HK), Decarbonization targets | Ensuring operational stability and access to new development zones. |

| Joint Venture Partners | Capital sharing, market access, risk mitigation | Apraava Energy (India with CDPQ), Daya Bay Nuclear (with CGN) | Expanding renewable portfolio in emerging markets and complex energy projects. |

| Technology Providers | Digitalization, smart grid, energy storage | Smart meter deployment, AI for predictive maintenance | Enhancing grid efficiency and customer engagement through data. |

| Fuel & Energy Suppliers | Operational stability, supply chain security | Natural gas, coal, renewable energy sources, cross-border clean energy | Securing diverse energy inputs, increasing renewable mix. |

| Industrial & Commercial Clients | Bespoke solutions, energy efficiency, smart services | Data centers, property developers, EV charging infrastructure | Driving growth through integrated energy solutions and data insights. |

| Financial Institutions | Project funding, green financing | Green bonds, project finance for renewables | Accessing capital for large-scale infrastructure and sustainability initiatives. |

| Research Institutions | Innovation, technology development | Advanced materials, smart grid analytics | Staying at the forefront of energy technology and solutions. |

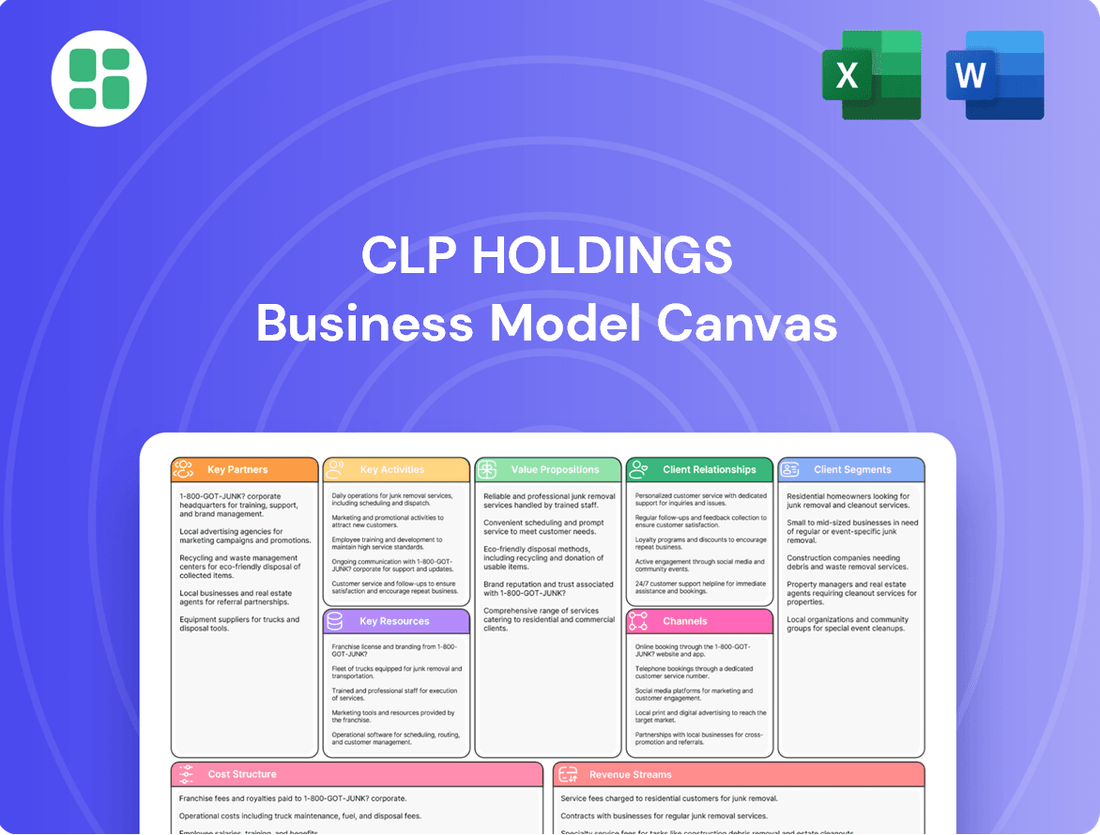

What is included in the product

A comprehensive, pre-written business model tailored to CLP Holdings' strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting real-world operations and plans for informed decision-making.

CLP Holdings' Business Model Canvas offers a clear, one-page snapshot to quickly identify and address operational inefficiencies and market challenges.

This structured approach allows for rapid diagnosis of pain points within CLP's value chain, enabling targeted solutions and strategic adjustments.

Activities

CLP Holdings' core activity revolves around generating electricity through a varied mix of power sources. This includes traditional fuels like coal and natural gas, alongside an increasing commitment to renewables such as wind and solar, and nuclear power.

The company actively manages and optimizes its power stations, while also investing in advanced generation technologies. For instance, in 2024, CLP continued its focus on expanding its gas-fired capacity with new combined-cycle gas turbines and integrating battery energy storage systems to enhance grid stability and support decarbonization efforts.

CLP Holdings' core activity involves the meticulous operation and upkeep of its extensive electricity transmission and distribution network. This ensures a consistent and dependable power supply to a vast customer base. The company consistently invests in modernizing its infrastructure and extending its grid, particularly to emerging growth areas such as the Northern Metropolis.

This commitment to network reliability is paramount, serving over 80% of Hong Kong's population. For instance, in 2023, CLP Holdings reported capital expenditure of HK$9.1 billion, with a significant portion allocated to network development and enhancement, underscoring their dedication to maintaining world-class service standards.

CLP Holdings' key activities in energy retail and customer management involve selling electricity to diverse customer groups and nurturing those relationships. This includes handling everything from billing and customer support to providing financial relief and promoting energy efficiency through dedicated funds.

In competitive markets like Australia, CLP actively adapts its strategies to attract and retain customers, often by developing innovative, customer-centric energy services and solutions. For instance, in 2024, CLP Power Hong Kong reported serving approximately 2.7 million customers, highlighting the scale of its retail operations.

Renewable Energy Development and Investment

CLP Holdings is heavily invested in growing its renewable energy assets throughout the Asia Pacific region. This includes building new wind and solar power facilities, as well as implementing battery energy storage solutions. These efforts are crucial to CLP's commitment to reducing its carbon footprint.

The company is dedicating substantial financial resources to achieve its decarbonization goals, aiming to double its renewable energy capacity. This expansion strategy often involves forming strategic alliances and collaborations to accelerate project development and secure necessary funding.

- Expanding Non-Carbon Energy Portfolio: CLP is actively developing new wind and solar farms across the Asia Pacific.

- Battery Energy Storage Systems: The company is also investing in battery storage technology to enhance grid stability and renewable energy integration.

- Decarbonization Strategy: These activities are fundamental to CLP's plan to significantly reduce its carbon emissions.

- Capital Expenditure and Partnerships: Doubling renewable energy capacity requires substantial investment and strategic collaborations.

Research, Development, and Digital Transformation

CLP Holdings actively invests in research and development (R&D) and digital transformation to bolster its operational capabilities. These efforts are geared towards enhancing efficiency, strengthening grid resilience, and pioneering novel energy solutions. For instance, CLP has been a proponent of integrating advanced technical solutions across its operations.

The company’s commitment to digital transformation is evident in its adoption of robust enterprise resource planning (ERP) systems, which streamline internal processes and improve data management. Furthermore, CLP is exploring cutting-edge technologies, including artificial intelligence (AI) for predictive maintenance and operational optimization, and the development of hydrogen-natural gas hybrid power solutions to support decarbonization goals.

- Investing in R&D and digital transformation enhances operational efficiency and grid resilience.

- Deployment of advanced technical solutions and ERP systems are key initiatives.

- Exploration of innovative technologies like AI and hydrogen-natural gas hybrid power is ongoing.

- CLP’s 2023 annual report highlighted significant capital expenditure allocated to network upgrades and digital initiatives, demonstrating a tangible commitment to these areas.

CLP Holdings' key activities are centered on generating and supplying electricity, managing its extensive transmission and distribution networks, and serving its retail customers. The company is also strategically expanding its renewable energy portfolio and investing heavily in research and development, including digital transformation initiatives.

| Key Activity | Description | Recent Data/Focus (2023-2024) |

| Electricity Generation | Producing power from diverse sources including gas, coal, nuclear, wind, and solar. | Continued expansion of gas-fired capacity and battery storage integration in 2024. |

| Network Management | Operating and maintaining transmission and distribution infrastructure. | HK$9.1 billion capital expenditure in 2023, with significant allocation to network enhancement and expansion, serving over 80% of Hong Kong's population. |

| Energy Retail | Selling electricity and managing customer relationships. | Serving approximately 2.7 million customers in Hong Kong in 2024, with adaptive strategies in competitive markets like Australia. |

| Renewable Energy Growth | Developing and expanding wind, solar, and battery storage assets in the Asia Pacific. | Commitment to doubling renewable energy capacity, requiring substantial investment and strategic partnerships. |

| R&D and Digital Transformation | Enhancing operations through advanced technologies and digital systems. | Exploration of AI for predictive maintenance and hydrogen-natural gas hybrid power solutions; adoption of robust ERP systems. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details CLP Holdings' strategic approach, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You'll gain full access to this ready-to-use, professionally formatted document, ensuring complete transparency and immediate utility.

Resources

CLP Holdings' power generation assets and infrastructure form the bedrock of its operations, encompassing a diverse range of power plants, including coal, gas, nuclear, wind, and solar facilities. This extensive network ensures a reliable supply of electricity across its key markets.

The company's infrastructure extends to critical transmission lines, substations, and distribution networks, vital for efficiently delivering power to customers in Hong Kong, mainland China, India, Southeast Asia, and Australia. These physical assets are the tangible representation of CLP's electricity generation and delivery capabilities.

As of the latest available data, CLP Holdings operates a significant installed capacity, contributing substantially to the energy needs of the regions it serves. For instance, in 2023, the company continued to invest in its generation portfolio, with a focus on diversifying its energy mix towards lower-carbon sources.

CLP Holdings absolutely depends on its highly skilled workforce. This includes engineers who design and maintain power plants, technicians who keep the grid running smoothly, and operational staff who manage the day-to-day energy supply. Their deep knowledge in areas like power generation, grid management, and developing new energy solutions is crucial for keeping the lights on reliably.

The collective experience of CLP's employees is a cornerstone of their success. This expertise is what allows them to manage incredibly complex energy systems efficiently and safely. For instance, in 2023, CLP reported a total workforce of over 18,000 employees globally, many of whom possess specialized technical skills essential for their operations.

This skilled workforce is also the engine driving innovation within CLP. Their understanding of emerging energy technologies and market trends enables the company to adapt and lead in the evolving energy landscape. This human capital is directly linked to CLP's ability to maintain high operational reliability and pursue advancements in sustainable energy.

CLP Holdings requires substantial financial capital for its extensive operations, including maintaining existing infrastructure and making significant investments in new power generation, renewable energy growth, and crucial grid upgrades. This financial muscle is fundamental to its business model.

The company's strong financial foundation and its proven ability to secure financing at competitive rates, notably through initiatives like green bonds and its medium-term note programs, are critical for funding these ongoing and future capital expenditures.

In 2023, CLP Holdings reported a capital expenditure of HK$13.9 billion, underscoring the significant financial resources deployed to support its strategic growth and infrastructure development plans.

Regulatory Licenses and Concessions

CLP Holdings operates within highly regulated environments, particularly in Hong Kong, necessitating a suite of essential regulatory licenses and concessions. These approvals are fundamental to its business, granting the company the exclusive right to provide electricity services across its designated territories. For instance, the Scheme of Control Agreements are critical intangible assets that underpin CLP's operational framework.

These licenses are not merely permissions but are actively managed and renewed, representing a significant barrier to entry for potential competitors. The stability and predictability afforded by these concessions are vital for long-term investment and infrastructure development. In 2023, CLP's regulated asset base in Hong Kong was HKD 114.2 billion, reflecting the substantial investment secured through these regulatory frameworks.

Key regulatory licenses and concessions for CLP Holdings include:

- Scheme of Control Agreements: These agreements with the Hong Kong government define the terms for electricity generation, transmission, and supply, including permitted rates of return.

- Environmental Permits: Licenses related to emissions, waste management, and environmental protection are crucial for operating power generation facilities.

- Land Use Leases and Easements: Agreements granting CLP the right to use land for infrastructure such as power lines and substations.

- Safety and Operational Certifications: Approvals ensuring the safe and reliable operation of its electrical network.

Brand Reputation and Customer Base

CLP Holdings benefits immensely from its deeply ingrained brand reputation for delivering dependable and sustainable power, a legacy built over decades, especially within Hong Kong. This strong standing acts as a significant intangible asset, fostering trust and loyalty among its stakeholders.

The company's vast customer base, exceeding 2.83 million accounts in Hong Kong as of 2024, provides a bedrock of stable demand. This extensive network also serves as a crucial platform for CLP to introduce and scale new, innovative energy solutions and services, further solidifying its market position.

- Established Brand Equity: CLP's long history translates into a trusted name in power provision.

- Extensive Customer Reach: Over 2.83 million customers in Hong Kong offer a significant and stable demand base.

- Platform for Innovation: The existing customer base facilitates the introduction of new energy services.

- Reputation for Reliability: A proven track record in delivering consistent power enhances customer retention.

CLP Holdings' key resources include its extensive power generation assets and critical infrastructure, which are fundamental to its operations. These tangible assets are complemented by a highly skilled workforce, whose expertise is vital for maintaining reliable operations and driving innovation. The company also relies on substantial financial capital to fund its ongoing investments and strategic growth initiatives.

Furthermore, CLP's key intangible resources are its essential regulatory licenses and concessions, particularly in Hong Kong, which provide a stable operating framework and act as significant barriers to entry. Its strong brand reputation, built on decades of reliable service, and its vast customer base are also crucial assets that support stable demand and facilitate the introduction of new energy solutions.

| Key Resource Category | Description | 2023/2024 Data Point |

| Physical Assets | Power generation plants, transmission, and distribution networks. | HK$13.9 billion capital expenditure in 2023. |

| Human Capital | Skilled engineers, technicians, and operational staff. | Over 18,000 employees globally in 2023. |

| Financial Capital | Funds for operations, infrastructure, and growth. | HKD 114.2 billion regulated asset base in Hong Kong (2023). |

| Intangible Assets | Regulatory licenses, brand reputation, customer base. | Over 2.83 million customers in Hong Kong (2024). |

Value Propositions

CLP's core value proposition revolves around delivering an exceptionally reliable and stable electricity supply, a critical service for its customers in Hong Kong. This commitment translates into a world-class uptime of 99.999%, ensuring that homes, businesses, and industries experience virtually no power interruptions. Such consistent performance is fundamental to Hong Kong's status as a major international financial center and its overall economic vitality.

CLP Holdings is actively pursuing a net-zero emissions goal, demonstrating a strong commitment to decarbonization. This involves substantial investments in renewable energy sources like solar and wind power, aiming to significantly reduce their carbon footprint.

By prioritizing non-carbon energy, CLP is positioning itself as a leader in sustainable energy provision. This strategic focus directly appeals to a growing segment of customers, governments with climate targets, and investors who prioritize environmental, social, and governance (ESG) principles.

In 2024, CLP continued its significant capital expenditure in renewable energy projects, with a substantial portion of its investment portfolio allocated to these green initiatives. This commitment translates into tangible green energy solutions for its customers, further solidifying its value proposition in the sustainability space.

CLP Holdings is committed to offering electricity at prices that are both reasonable and competitive. They achieve this by carefully managing fuel costs and navigating market fluctuations, all while adhering to regulatory guidelines. For instance, in 2023, CLP’s average electricity tariff in Hong Kong was HK$1.29 per kilowatt-hour, reflecting their efforts to balance costs with affordability.

This dedication to affordability directly translates into economic value for their wide range of customers. Beyond just pricing, CLP actively promotes energy-saving programs and provides relief measures, further enhancing the financial benefits for households and businesses alike. These initiatives underscore their focus on delivering tangible economic advantages to their customer base.

Advanced Energy Solutions and Services

CLP Holdings goes beyond simply supplying electricity by offering a suite of advanced energy solutions and services. These include distributed energy generation, smart metering technology, electric vehicle charging infrastructure, and expert energy management consulting.

These offerings empower businesses and organizations to enhance their energy efficiency, significantly reduce their carbon emissions, and gain greater control over their energy usage patterns. For instance, CLP's smart meter deployment across Hong Kong is a key enabler for these advanced services, providing real-time data for optimized consumption.

CLP's commitment to innovation in this space is evident in their investments. In 2024, the company continued to expand its smart grid capabilities, aiming to integrate more renewable energy sources and provide greater flexibility for customers. They are actively exploring and implementing solutions that support the transition to a low-carbon economy.

- Distributed Energy Solutions: Enabling on-site generation and integration of renewables.

- Smart Metering: Providing granular data for better energy management and efficiency.

- EV Charging Infrastructure: Supporting the growth of electric mobility.

- Energy Management Consulting: Offering expertise to optimize energy consumption and reduce costs.

Support for Economic Growth and Infrastructure Development

CLP Holdings is a vital partner in driving economic growth and developing essential infrastructure across its operating regions. The company actively contributes to the expansion of new development areas, such as Hong Kong's Northern Metropolis, by ensuring a reliable supply of low-carbon power. This commitment also extends to powering the burgeoning data center sector, a critical component of modern economic activity.

CLP's role as a key enabler of regional growth is underscored by its strategic investments in power generation and distribution networks. For instance, in 2024, CLP continued its significant investment in renewable energy projects, aiming to bolster the low-carbon energy supply necessary for sustainable economic expansion. This forward-looking approach positions CLP as integral to innovation and development.

- Enabling New Development Areas: Providing essential, low-carbon power to support projects like the Northern Metropolis.

- Powering Innovation: Supplying energy for critical infrastructure such as data centers.

- Economic Contribution: Acting as a catalyst for regional economic advancement through reliable energy provision.

- Sustainable Infrastructure Investment: Committing to renewable energy to fuel future growth.

CLP Holdings offers a robust value proposition centered on dependable, high-quality electricity delivery with an exceptional 99.999% uptime, crucial for Hong Kong's economic stability. This reliability underpins its role as a foundational utility for businesses and households alike.

The company is strongly committed to sustainability, actively investing in renewable energy sources to achieve net-zero emissions. This focus on decarbonization appeals to environmentally conscious customers and investors prioritizing ESG factors.

CLP provides competitively priced electricity, managing costs effectively to offer affordability, further enhanced by energy-saving programs and customer relief measures. This economic value is a key differentiator.

Beyond basic supply, CLP delivers advanced energy solutions, including smart metering and EV charging infrastructure, empowering customers with greater energy efficiency and control.

CLP acts as a vital enabler of regional development, supplying low-carbon power to new areas and critical infrastructure like data centers, thereby contributing significantly to economic growth and innovation.

| Value Proposition Area | Key Features | Customer Benefit | 2024 Focus/Data Point |

|---|---|---|---|

| Reliable Energy Supply | 99.999% uptime | Uninterrupted operations for businesses and homes | Continued investment in grid modernization |

| Sustainability & Decarbonization | Net-zero commitment, renewable energy investment | Reduced environmental impact, alignment with ESG goals | Substantial capital expenditure in green projects |

| Affordability & Economic Value | Competitive tariffs, energy-saving programs | Lower energy costs, financial savings | 2023 average tariff: HK$1.29/kWh |

| Advanced Energy Solutions | Smart metering, EV charging, energy consulting | Enhanced efficiency, reduced emissions, greater control | Expansion of smart grid capabilities |

| Economic Development Enabler | Powering new developments, data centers | Facilitates growth and innovation in key sectors | Support for projects like the Northern Metropolis |

Customer Relationships

CLP Holdings, as a regulated service provider in Hong Kong, cultivates customer relationships by prioritizing reliability, safety, and stable electricity tariffs. This utility model necessitates consistent service delivery and transparent communication, fostering trust among its extensive customer base.

Customer interactions are primarily managed through robust customer service channels, including online portals, call centers, and physical service points, alongside comprehensive billing systems. These channels are crucial for addressing inquiries, managing accounts, and ensuring compliance with regulatory standards, reflecting a commitment to public service.

Community engagement programs and proactive communication about service improvements and tariff adjustments further solidify CLP's relationships. For instance, in 2023, CLP Power Hong Kong Limited invested HK$5.9 billion in network development and maintenance, underscoring its dedication to service quality and reliability for its over 2.6 million customers.

CLP Holdings utilizes dedicated key account management for its substantial commercial, industrial, and institutional clientele, including vital sectors like data centers and government entities. This strategic focus ensures these large customers receive highly customized energy solutions designed to address their unique operational demands and ambitious sustainability targets.

This tailored approach involves in-depth energy audits and the provision of specialized services, fostering strong, long-term partnerships. For instance, CLP’s commitment to innovation in 2024 saw significant investment in smart grid technologies, directly benefiting large industrial clients by enhancing energy efficiency and reliability, thereby supporting their operational continuity and cost management objectives.

CLP Holdings actively cultivates community relationships through a robust suite of social responsibility programs. These initiatives, which include dedicated energy-saving funds, comprehensive educational programs, and targeted support for underprivileged communities, are central to their customer relationship strategy.

These efforts are not merely philanthropic; they are designed to build significant goodwill and enhance CLP's brand reputation. By demonstrating a tangible commitment to the well-being of the communities it serves, CLP strengthens its social license to operate and fosters a more positive and supportive environment for its business operations.

In 2024, CLP continued its focus on community investment, with specific programs aimed at promoting energy efficiency and supporting local development. For instance, their community energy saving funds have empowered residents to reduce consumption, contributing to broader sustainability goals.

Digital Self-Service and Engagement Platforms

CLP Holdings is enhancing customer interactions through robust digital self-service and engagement platforms. The company is actively updating its mobile applications and online portals, making it easier for customers to manage their accounts, track energy usage, and access a range of services. This digital push is designed to boost convenience and deepen customer engagement in today's increasingly connected world.

- Digital Channels: CLP Holdings is investing in refreshed mobile apps and online portals to provide customers with seamless account management and service access.

- Customer Convenience: These platforms empower customers to monitor their consumption and manage their accounts efficiently, anytime and anywhere.

- Engagement Focus: The strategy aims to foster stronger customer relationships by offering intuitive digital tools that meet evolving expectations for service delivery.

Proactive Communication on Energy Transition

CLP Holdings actively engages its customers and stakeholders by proactively sharing updates on its decarbonization journey, highlighting progress in renewable energy projects, and explaining the evolving energy landscape. This open dialogue is crucial for fostering trust and encouraging participation in green energy programs.

- Proactive Information Sharing: CLP details its decarbonization strategies and renewable energy developments, such as investments in solar and wind power, to keep customers informed.

- Customer Engagement in Green Initiatives: The company promotes participation in schemes like Feed-in Tariffs and the purchase of renewable energy certificates, directly involving customers in the energy transition.

- Building Trust Through Transparency: By openly communicating its environmental efforts and future plans, CLP strengthens its relationship with customers, fostering a sense of shared responsibility.

- Data-Driven Engagement: In 2023, CLP reported a significant increase in renewable energy generation, contributing to its ambitious target of reducing carbon intensity, which it communicates to customers to demonstrate tangible progress.

CLP Holdings prioritizes customer relationships through a multi-faceted approach, blending reliable service with proactive engagement. This includes robust digital platforms for self-service, personalized support for key industrial clients, and extensive community outreach programs focused on sustainability and energy efficiency.

The company actively communicates its decarbonization efforts and renewable energy projects, fostering trust and encouraging customer participation in green initiatives. This transparency, coupled with investments in network development and smart grid technologies, underpins CLP's commitment to its diverse customer base.

In 2024, CLP continued to enhance customer convenience through updated mobile apps and online portals, facilitating easier account management and energy usage tracking. This digital focus aims to deepen engagement and meet evolving customer expectations for accessible service delivery.

Channels

CLP's transmission and distribution grid acts as the primary channel, delivering electricity to over 80% of Hong Kong's population. This robust physical infrastructure is the backbone, ensuring a consistent and reliable flow of power to homes, businesses, and essential public services across the territory.

In 2023, CLP invested approximately HK$5.1 billion in enhancing its electricity infrastructure, including upgrades to the transmission and distribution network. This commitment to modernization is crucial for maintaining the high reliability standards that customers depend on, supporting Hong Kong's dynamic economy.

CLP Holdings maintains a robust network of physical customer service centers and dedicated hotlines. These channels are crucial for direct customer engagement, handling inquiries, providing billing support, and resolving service-related issues. In 2024, CLP reported handling millions of customer interactions across these traditional touchpoints, underscoring their ongoing importance for accessible and personalized support, especially for their extensive residential customer base.

CLP Holdings leverages its corporate website and mobile applications to offer customers convenient self-service options, including online bill payment and account management. These platforms also serve as key channels for disseminating information about energy-saving tips and the company's sustainability efforts, reaching a growing tech-savvy demographic.

Social media presence further amplifies CLP's engagement, providing a dynamic space for customer interaction and sharing valuable content related to energy efficiency and environmental consciousness. In 2024, CLP reported a significant increase in digital engagement, with website traffic up 15% and mobile app usage growing by 10%, highlighting the effectiveness of these channels in reaching and serving a wider customer base.

Direct Sales and Business Development Teams

CLP Holdings leverages dedicated direct sales and business development teams to engage with large commercial and industrial customers, focusing on promoting innovative energy solutions. These teams act as the primary interface, building relationships and understanding specific client requirements to offer customized energy services and secure long-term contracts. This direct approach is crucial for driving adoption of advanced energy technologies and ensuring client satisfaction.

These teams are instrumental in identifying opportunities for energy efficiency upgrades, renewable energy integration, and smart grid technologies. Their efforts directly contribute to CLP’s revenue growth by securing significant contracts with major energy consumers. For instance, in 2024, CLP continued to expand its portfolio of energy solutions for businesses, with direct sales teams playing a pivotal role in securing new projects.

- Client Engagement: Direct interaction with large commercial and industrial clients to understand energy needs.

- Solution Development: Proposing tailored energy solutions, including efficiency and renewable options.

- Contract Acquisition: Securing contracts for advanced energy services and infrastructure projects.

- Revenue Generation: Directly contributing to revenue through the acquisition of key business accounts.

Community Outreach Programs and Events

CLP Holdings actively engages its community through various outreach programs and events. These channels, including educational workshops and public forums, are designed to connect with residential customers and the wider community, fostering a deeper understanding of energy efficiency and sustainable practices. For instance, in 2024, CLP Holdings continued its commitment to community education, with specific initiatives reaching over 50,000 households with energy-saving tips and resources.

These efforts are crucial for promoting energy literacy and encouraging sustainable living habits among the public. By participating in local events and hosting informative sessions, CLP Holdings aims to build stronger, more positive relationships with the communities it serves. A notable success in 2024 was their "Powering Tomorrow" campaign, which saw participation from over 10,000 individuals across multiple cities, directly contributing to increased awareness of renewable energy solutions.

Key community engagement activities include:

- Educational Workshops: Providing practical advice on reducing energy consumption at home.

- Energy-Saving Campaigns: Targeted initiatives to promote efficient energy use, often with measurable reduction targets.

- Public Events: Sponsoring and participating in community gatherings to enhance brand visibility and customer interaction.

- Partnerships: Collaborating with local schools and environmental groups to extend reach and impact.

CLP's channels encompass its extensive physical grid, direct customer service centers, and digital platforms like websites and mobile apps. These are complemented by specialized direct sales teams for large clients and broad community outreach programs. In 2024, digital engagement saw a notable surge, with website traffic up 15% and mobile app usage increasing by 10%, indicating a shift towards digital interactions for information and service.

| Channel Type | Description | 2024 Engagement Highlight | Key Function |

|---|---|---|---|

| Transmission & Distribution Grid | Physical infrastructure delivering electricity | HK$5.1 billion invested in infrastructure upgrades | Reliable power delivery |

| Customer Service Centers & Hotlines | Direct customer interaction points | Millions of customer interactions handled | Inquiries, billing, issue resolution |

| Digital Platforms (Website, Mobile App) | Self-service options and information dissemination | 15% website traffic increase, 10% mobile app usage growth | Online payments, account management, information sharing |

| Direct Sales & Business Development Teams | Engaging large commercial/industrial clients | Securing new energy solution projects | Customized solutions, contract acquisition |

| Community Outreach Programs | Educational workshops, public forums | Over 50,000 households reached with energy-saving tips | Promoting energy literacy, building community relations |

Customer Segments

Residential Customers in Hong Kong, comprising over 80% of the population across Kowloon, the New Territories, and outlying islands, are CLP Holdings' largest customer group. Their core requirement is consistent and cost-effective electricity to power their homes, making them receptive to initiatives like energy-saving rebates and community engagement programs designed to promote efficient energy use.

CLP Holdings serves a broad spectrum of commercial customers across Hong Kong and the wider region. This includes everything from small and medium enterprises (SMEs) to major players like large office buildings, extensive retail chains, and prominent hotel groups.

These businesses rely on CLP for a dependable and uninterrupted power supply, a critical factor in their day-to-day operations. In 2023, CLP's commercial customer base in Hong Kong represented a significant portion of its total electricity sales, underscoring their importance to the company's revenue streams.

Beyond basic power provision, CLP addresses evolving customer needs by offering energy efficiency solutions and increasingly, sustainable energy options. This focus on sustainability is driven by growing corporate environmental, social, and governance (ESG) goals among these commercial entities, as they seek to reduce their carbon footprint.

CLP Holdings serves industrial customers in Hong Kong and across the region, including manufacturing plants and data centers. These businesses are significant energy users, demanding a reliable and high-capacity power supply to maintain their operations. In 2023, industrial and commercial customers accounted for a substantial portion of CLP's electricity sales volume, highlighting their importance.

Government and Public Services

CLP Holdings serves a critical role in supporting government and public services, providing the essential electricity needed for everything from hospitals and schools to transportation networks and administrative buildings. In 2024, CLP's commitment to reliable power delivery is paramount for these entities, ensuring the continuity of vital community functions. They actively partner with governmental bodies on major urban development and infrastructure enhancement initiatives, contributing to the modernization and efficiency of public services.

This segment relies on CLP for consistent and stable power supply, which is fundamental for operational continuity. For instance, the continued investment in smart grid technologies by CLP aims to enhance the resilience and efficiency of power delivery to public sector clients, a key focus for 2024.

- Reliable Power for Essential Services: Governments and public institutions depend on CLP for uninterrupted electricity to operate critical infrastructure like healthcare facilities and emergency services.

- Support for Urban Development: CLP collaborates with government agencies on large-scale urban planning and infrastructure projects, ensuring power availability for new developments.

- Infrastructure Provider Partnerships: CLP works with various public infrastructure providers, such as water treatment plants and public transportation systems, to meet their specific energy demands.

- Commitment to Sustainability in Public Projects: CLP's focus on renewable energy integration supports government goals for greener public infrastructure and services.

Regional Energy Markets (Mainland China, Australia, India, Southeast Asia)

CLP Holdings extends its reach across key Asia Pacific regions, catering to a diverse customer base. In mainland China, CLP engages with industrial clients and utilities, navigating a dynamic market with significant investment in renewable energy. For instance, by the end of 2023, China's installed renewable energy capacity surpassed 1.3 billion kilowatts, a testament to the sector's growth.

Australia represents another critical market, where CLP, through its subsidiary EnergyAustralia, serves a broad spectrum of retail and industrial customers. EnergyAustralia is a major player in the Australian energy sector, managing a substantial generation portfolio and a large customer base. In 2023, EnergyAustralia continued its transition efforts, including investments in battery storage and renewable energy sources.

India's energy landscape presents opportunities for CLP, particularly with its growing industrial and utility sectors. The nation's ambitious renewable energy targets, aiming for 500 GW of non-fossil fuel energy capacity by 2030, create a favorable environment for energy providers like CLP. This focus on clean energy aligns with CLP's strategic objectives.

Southeast Asia, encompassing markets like Malaysia and Thailand, sees CLP serving industrial clients and contributing to the development of regional energy infrastructure. These markets are characterized by increasing energy demand driven by economic growth and a rising emphasis on sustainable energy solutions. CLP's presence in these diverse regions underscores its commitment to powering economic progress while supporting the transition to cleaner energy.

- Mainland China: Serves industrial clients and utilities, with a strong focus on renewable energy integration. China's renewable energy capacity reached over 1.3 billion kW by the end of 2023.

- Australia: EnergyAustralia serves a large retail and industrial customer base, actively investing in battery storage and renewables.

- India: CLP targets the growing industrial and utility sectors, aligning with India's goal of 500 GW non-fossil fuel capacity by 2030.

- Southeast Asia: Engages industrial clients and supports energy infrastructure development in countries like Malaysia and Thailand, driven by economic growth and sustainability trends.

CLP Holdings' customer segments are diverse, ranging from the foundational residential base to specialized industrial and governmental entities across various Asia Pacific markets. This broad reach allows CLP to cater to distinct energy needs and leverage growth opportunities in different economic landscapes. The company's strategy involves adapting its service offerings to meet the unique demands of each segment, from ensuring reliable power for public services to facilitating renewable energy integration for industrial clients.

| Customer Segment | Key Characteristics | 2023/2024 Focus/Data |

|---|---|---|

| Residential | Over 80% of Hong Kong population; seeks cost-effective, consistent electricity. | Receptive to energy-saving initiatives. |

| Commercial | SMEs to large enterprises (offices, retail, hotels); requires dependable, uninterrupted power. | Increasing demand for sustainable energy solutions due to ESG goals. |

| Industrial | Manufacturing, data centers; high energy users needing reliable, high-capacity supply. | Substantial portion of electricity sales volume in 2023. |

| Government & Public Services | Hospitals, schools, transport; relies on continuity of essential services. | 2024 focus on smart grid tech for resilience; partnerships in urban development. |

| International (China, Australia, India, SEA) | Industrial clients, utilities, retail customers; diverse needs driven by economic growth and sustainability. | China: Renewable energy capacity >1.3 billion kW (end 2023). India: targets 500 GW non-fossil fuel by 2030. Australia: EnergyAustralia invests in battery storage and renewables. |

Cost Structure

Fuel and energy purchase costs represent a substantial component of CLP Holdings' operational expenses. This category primarily includes the acquisition of natural gas and coal for its thermal power generation facilities, as well as the purchase of electricity from external sources to meet demand.

The financial performance of CLP is significantly influenced by the fluctuating prices of these global commodities. For instance, in 2023, the average price of Brent crude oil, a key indicator for energy markets, saw considerable volatility, impacting the cost of natural gas procurement.

CLP Holdings dedicates significant capital expenditure to its infrastructure, a cornerstone of its business model. This involves substantial investments in constructing new power generation facilities, enhancing existing transmission networks, and maintaining its distribution systems to ensure consistent service delivery. For instance, CLP's 2023 capital expenditure was HK$11.3 billion, with a considerable portion allocated to these infrastructure development and maintenance activities, underscoring its commitment to a robust and reliable energy supply.

These capital outlays are crucial for modernizing the grid and expanding capacity, particularly in areas like renewable energy integration. CLP's ongoing projects, such as those aimed at increasing the share of renewables in its energy mix, require substantial upfront investment in new technologies and infrastructure upgrades. This forward-looking approach is vital for meeting future energy demands and environmental targets, as evidenced by their planned investments in offshore wind projects and grid enhancements to support cleaner energy sources.

CLP Holdings' operational and administrative expenses encompass significant costs related to its extensive workforce, including salaries and benefits for thousands of employees across its diverse energy and utility operations. These expenses also cover essential administrative overheads, the maintenance and upgrade of sophisticated IT systems, and various other day-to-day operational costs inherent in managing a large, geographically dispersed business. For instance, in 2023, CLP Holdings reported employee-related costs and administrative expenses as a substantial portion of its overall expenditure, highlighting the critical need for efficient management to maintain profitability.

Regulatory Compliance and Environmental Costs

CLP Holdings faces significant costs related to adhering to stringent environmental regulations and safety standards across its operations. These expenses are crucial for maintaining its license to operate and ensuring sustainable business practices. For instance, in 2023, the company continued to invest in upgrading its facilities to meet evolving emissions standards, a key component of its decarbonization strategy.

These regulatory compliance and environmental costs are multifaceted, encompassing:

- Environmental Monitoring and Reporting: Costs associated with tracking emissions, waste management, and biodiversity impact, as well as preparing detailed compliance reports for regulatory bodies.

- Safety Regulations: Investments in safety training, equipment upgrades, and operational procedures to comply with occupational health and safety standards in all jurisdictions.

- Decarbonization Investments: Capital expenditure on cleaner energy technologies, carbon capture solutions, and energy efficiency improvements to meet climate targets. For example, CLP's commitment to net-zero by 2050 necessitates ongoing investment in renewable energy projects and the phasing out of higher-emission assets.

- Permitting and Licensing: Fees and administrative costs related to obtaining and maintaining operating permits and licenses, which are often tied to environmental performance.

Financing Costs and Debt Servicing

CLP Holdings, given its capital-intensive operations, faces substantial financing costs. These stem from the significant debt CLP utilizes to fund its extensive infrastructure projects and ongoing business activities. Managing these interest expenses is a critical component of its overall cost structure. For instance, in 2023, CLP's finance costs amounted to HKD 4,853 million, reflecting the considerable borrowing required to support its global energy network.

Maintaining a strong credit rating is paramount for CLP to access capital at favorable rates, thereby minimizing its financing costs. A robust credit profile translates to lower interest payments on its debt obligations. The company's commitment to prudent financial management and operational efficiency directly impacts its ability to secure and retain these favorable credit ratings.

- Financing Costs: CLP incurred HKD 4,853 million in finance costs in 2023.

- Debt Servicing: Interest payments on significant debt are a major expense.

- Credit Rating Importance: A strong credit rating is vital for cost-effective capital raising.

- Capital Intensity: The energy sector's nature necessitates substantial investment, driving financing needs.

CLP Holdings’ cost structure is heavily influenced by fuel and energy purchases, significant capital expenditure on infrastructure, and operational and administrative expenses including employee costs.

Financing costs are also substantial due to the capital-intensive nature of the business and the debt used to fund its global operations. Furthermore, regulatory compliance and environmental investments represent ongoing expenditures critical for sustainable operations.

| Cost Category | 2023 (HK$ million) | Key Drivers |

|---|---|---|

| Fuel and Energy Purchases | Not explicitly detailed, but significant | Natural gas, coal prices; electricity purchases |

| Capital Expenditure | 11,300 | New generation facilities, transmission networks, grid modernization |

| Finance Costs | 4,853 | Debt servicing for infrastructure investments |

| Operational & Administrative Expenses | Not explicitly detailed, but substantial | Employee costs, IT systems, general overheads |

| Environmental Compliance & Safety | Not explicitly detailed, but ongoing | Emissions standards, safety training, decarbonization investments |

Revenue Streams

CLP Holdings' primary revenue source in Hong Kong comes from selling electricity to homes, businesses, and factories. This is all governed by Scheme of Control Agreements, which means their profits are tied to a set return on the assets they use to generate and distribute power. For 2024, this regulated electricity sales segment is expected to remain the bedrock of their financial performance, offering a consistent and dependable income stream.

CLP Holdings generates revenue from electricity sales in markets beyond Hong Kong, including Australia and mainland China. These sales are primarily driven by market-based pricing, meaning revenue can fluctuate based on supply and demand dynamics and competitive pressures within those regions.

This market-based approach, while potentially more volatile than regulated tariffs, allows for the possibility of higher profit margins, particularly for CLP's investments in renewable energy projects. For instance, in Australia, CLP operates under a deregulated market where wholesale electricity prices can vary significantly, impacting revenue streams from its wind and solar farms.

CLP Holdings generates revenue through capacity charges, ensuring adequate power generation, and transmission fees for using its extensive network. These charges are crucial for recouping significant infrastructure investments, especially in markets where regulations allow for such cost recovery.

In 2024, the energy sector continued to see evolving regulatory frameworks impacting these revenue streams. For instance, in Hong Kong, CLP Power’s tariff structure is subject to the Scheme of Control, which allows for a regulated rate of return on its asset base, directly influencing the transmission and distribution fees it can charge customers.

Smart Energy Solutions and Services Fees

CLP Holdings is expanding its revenue streams beyond traditional electricity supply by offering smart energy solutions and services. This diversification strategy focuses on providing value-added services to businesses and organizations looking to optimize their energy consumption and embrace sustainable practices.

These services include the installation of solar energy systems, expert energy management consulting, the provision of electric vehicle charging infrastructure, and the deployment of battery energy storage systems. For example, in 2024, CLP continued to invest in and expand its portfolio of distributed generation and energy storage projects, aiming to capture a larger share of the growing market for clean energy solutions.

- Solar Energy Installations: Revenue generated from designing, installing, and maintaining solar photovoltaic systems for commercial and industrial clients.

- Energy Management Consulting: Fees earned from providing expert advice and solutions to businesses to improve energy efficiency and reduce costs.

- Electric Vehicle Charging Services: Income derived from the installation, operation, and maintenance of EV charging stations for corporate fleets and public use.

- Battery Energy Storage Systems: Revenue from the deployment and management of battery storage solutions that enhance grid stability and provide peak shaving capabilities for clients.

Dividends from Joint Ventures and Associates

CLP Holdings benefits from dividends and profit contributions stemming from its strategic investments in joint ventures and associated companies. These partnerships, including Apraava Energy in India and significant nuclear assets in mainland China, represent key components of its diversified revenue. For instance, in 2024, CLP's share of profits from its associates and joint ventures remained a crucial element of its overall financial performance, reflecting the ongoing contributions from these strategically important regional ventures. This income stream directly supports the company's financial stability and provides a valuable link to growth opportunities across different markets.

These income streams are particularly vital as they offer a degree of insulation from direct operational risks while still capturing the upside from regional economic expansion. The dividends received are a tangible return on CLP's equity stakes in these entities, bolstering its cash flow and contributing to its ability to fund future growth initiatives or return value to shareholders. The performance of these associated companies is closely monitored, as their profitability directly impacts CLP's consolidated results, underscoring the importance of these revenue streams.

- Diversified Income: Dividends from joint ventures and associates provide a stable, diversified income stream for CLP Holdings.

- Regional Growth Capture: Investments like Apraava Energy in India and mainland China nuclear assets allow CLP to capitalize on regional growth opportunities.

- Financial Contribution: These contributions are a significant part of CLP's overall financial performance, supporting cash flow and investment capacity.

- Strategic Importance: The success of these ventures directly impacts CLP's consolidated results, highlighting their strategic value.

CLP Holdings' revenue is primarily driven by electricity sales, both regulated in Hong Kong and market-based in Australia and mainland China. In 2024, these sales formed the core of its income, with regulated sales providing stability and market-based sales offering growth potential, particularly from renewable assets. Beyond direct sales, CLP also earns from capacity charges and transmission fees, essential for infrastructure investment recovery, with Hong Kong's Scheme of Control influencing these tariffs.

The company is actively diversifying revenue through smart energy solutions like solar installations, energy management consulting, EV charging, and battery storage, aiming to capture the growing clean energy market. Furthermore, dividends and profit contributions from strategic joint ventures and associates, such as Apraava Energy in India and mainland Chinese nuclear assets, provide a significant and stable income stream, contributing substantially to CLP's overall financial performance and strategic growth.

| Revenue Stream | Key Markets | 2024 Focus/Notes |

|---|---|---|

| Regulated Electricity Sales | Hong Kong | Bedrock of financial performance, tied to Scheme of Control Agreements. |

| Market-Based Electricity Sales | Australia, Mainland China | Revenue fluctuates with supply/demand; higher potential margins from renewables. |

| Capacity Charges & Transmission Fees | Various Markets | Recoup infrastructure investments; Hong Kong tariffs influenced by Scheme of Control. |

| Smart Energy Solutions & Services | Global Expansion | Growth area including solar, energy management, EV charging, battery storage. |

| Dividends & Profit Contributions from JVs/Associates | India, Mainland China, etc. | Significant, stable income from strategic partnerships like Apraava Energy. |

Business Model Canvas Data Sources

The CLP Holdings Business Model Canvas is informed by a robust combination of financial reports, regulatory filings, and extensive market research. These sources provide a comprehensive understanding of CLP's operational landscape and strategic positioning.