CLP Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLP Holdings Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CLP Holdings's future. Our expertly crafted PESTLE analysis provides the deep-dive insights you need to navigate market complexities and anticipate industry shifts. Download the full version now to gain a strategic advantage and make informed decisions.

Political factors

CLP Holdings' operations are significantly shaped by government energy policies, notably the Scheme of Control Agreement (SCA) in Hong Kong. This agreement directly impacts CLP Power's investment decisions and its ability to adjust tariffs, ensuring alignment with broader energy objectives.

The Hong Kong government's approval of CLP Power's Development Plan for 2024-2028 provides a clear roadmap for capital expenditure and anticipated tariff adjustments. This plan is crucial for supporting Hong Kong's ambitious decarbonization targets and its strategic push towards becoming a smart city.

Hong Kong's energy security hinges on imported clean electricity, particularly from mainland China, with nuclear power a key component due to its consistent output. CLP Holdings is actively pursuing additional nuclear investments in mainland China, a move that requires robust government-to-government cooperation to facilitate. This cross-border energy dependency directly influences CLP's future generation portfolio and overall energy resilience.

CLP Holdings navigates a complex web of regulations across its global footprint, with mainland China, India, Southeast Asia, and Australia each presenting unique challenges and opportunities. These varying regulatory frameworks significantly shape operational strategies and investment decisions.

In Australia, the National Electricity Market (NEM) is actively undergoing substantial reforms aimed at fostering long-term investment in firm renewable energy and storage solutions to combat price volatility. These reforms, such as the introduction of the Capacity Investment Scheme, directly influence CLP's subsidiary, EnergyAustralia, impacting its operational planning and financial outlook.

Geopolitical Risks and Trade Policies

Geopolitical tensions and evolving trade policies present significant challenges for CLP Holdings. For instance, the ongoing trade friction between major economies can lead to increased tariffs on imported equipment, directly impacting CLP's capital expenditure for new projects and infrastructure upgrades. Changes in regulatory frameworks within its key operating regions, such as Hong Kong, mainland China, and Australia, can also introduce unforeseen compliance costs and operational complexities for utility providers.

China's dynamic approach to technology and green energy, particularly through initiatives like the Belt and Road Initiative (BRI), offers substantial investment avenues for CLP in renewable energy projects. However, these opportunities are often accompanied by compliance risks related to local regulations, environmental standards, and international trade agreements. Navigating these intricate international relations is crucial for CLP's sustained operational stability and strategic expansion efforts in the global energy market.

- Geopolitical Risks: Increased tensions can disrupt supply chains for critical infrastructure components, potentially delaying projects and increasing costs.

- Trade Policies: Shifting trade agreements and tariffs can impact the cost-effectiveness of importing advanced energy technologies and equipment.

- China's Green Energy Policies: While offering opportunities for renewable energy investment, these policies also necessitate careful adherence to evolving national standards and environmental regulations.

- Belt and Road Initiative: CLP's participation in BRI-related projects requires diligent management of political and economic risks in participating countries.

Government Support for Community and Green Initiatives

Governments across CLP Holdings' operational regions frequently introduce policies aimed at making energy more affordable and promoting environmental sustainability. For instance, in Hong Kong, the government has provided electricity charge relief, demonstrating a commitment to easing the financial burden on consumers, particularly during periods of economic strain. This aligns with CLP's role in providing essential services and its public image.

CLP actively participates in and benefits from these government-backed initiatives. The CLP Community Energy Saving Fund, for example, directly supports programs designed to encourage decarbonization efforts and provide assistance to households facing economic hardship. This collaborative approach between CLP and the government underscores a shared objective of promoting energy efficiency and social welfare.

These government-supported social programs are integral to CLP's broader community stewardship efforts. By engaging in these initiatives, CLP not only fulfills its corporate social responsibility but also positively influences public perception. For example, in 2023, CLP's contributions to community programs aimed at energy saving and poverty alleviation were highlighted, reinforcing its image as a responsible corporate citizen.

- Energy Affordability Measures: Government-led electricity charge relief programs in Hong Kong directly impact household energy expenditure and CLP's revenue streams.

- Decarbonization Support: Initiatives like the CLP Community Energy Saving Fund, backed by government policy, encourage investment in green technologies and energy efficiency.

- Community Engagement: CLP's participation in social programs, often co-funded or supported by government grants, enhances its brand reputation and stakeholder relations.

- Regulatory Alignment: Government policies on energy transition and social welfare create a framework within which CLP must operate, influencing its strategic planning and operational focus.

Government energy policies, like Hong Kong's Scheme of Control Agreement, dictate CLP's investment and tariff strategies, aligning with decarbonization goals. The 2024-2028 Development Plan specifically guides capital expenditure and tariff adjustments to support smart city initiatives.

CLP's reliance on imported clean electricity, particularly from China's nuclear power, necessitates strong inter-governmental cooperation for future generation portfolios and energy security.

Global regulatory variations, from Australia's NEM reforms to China's green energy policies, significantly influence CLP's operational strategies and investment decisions, requiring careful navigation of compliance and standards.

Government initiatives promoting energy affordability, such as electricity charge relief in Hong Kong, directly impact CLP's revenue and public image, while community programs foster positive stakeholder relations.

What is included in the product

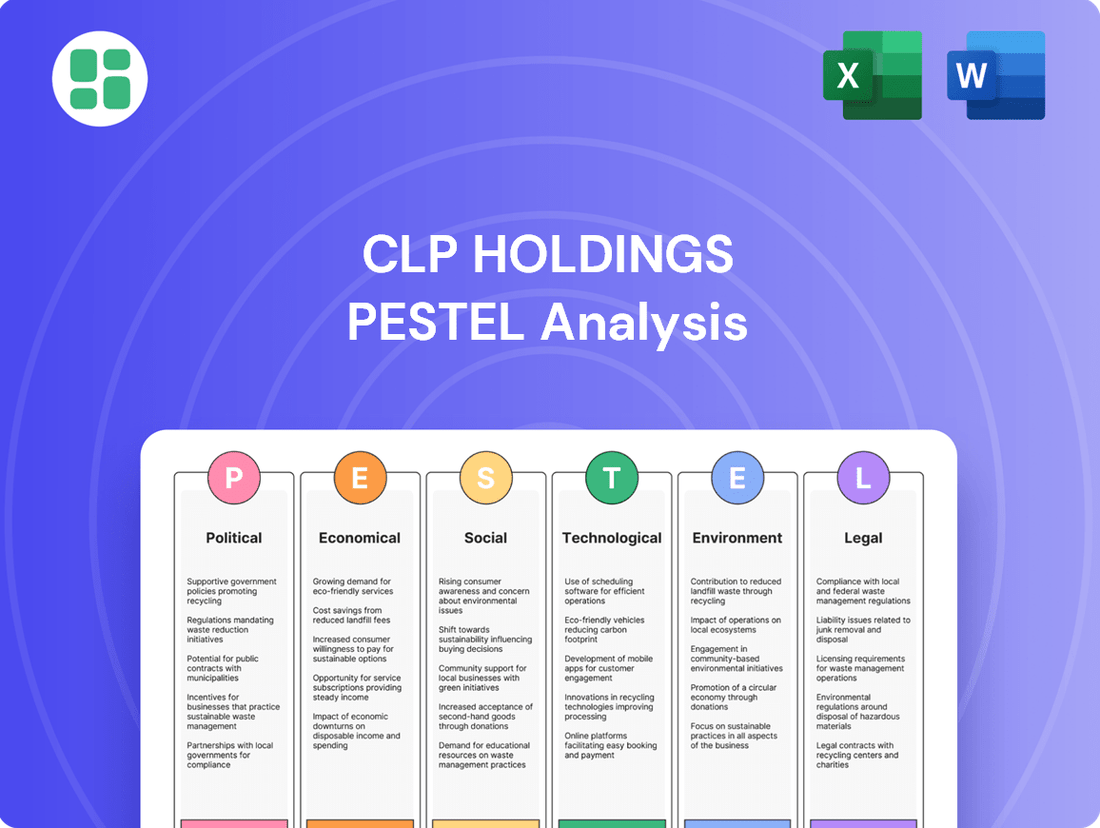

This PESTLE analysis examines the external macro-environmental factors influencing CLP Holdings across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these forces create both threats and opportunities for the company, offering actionable insights for strategic decision-making.

Provides a clear, actionable summary of external factors impacting CLP Holdings, enabling proactive strategic adjustments and mitigating potential risks.

Economic factors

Global electricity demand saw a robust 4% increase in 2024, marking the fastest growth in twenty years. This surge is largely attributed to a recovering global economy, the widespread adoption of new technologies, and a significant push towards electrification across various sectors.

In Hong Kong, CLP Holdings experienced a notable uptick in power sales, directly correlating with the region's economic expansion. Key drivers for this growth included heightened demand stemming from digitalization initiatives and ongoing infrastructure development projects.

This escalating electricity demand across its operational regions presents substantial growth prospects for CLP. The company is well-positioned to capitalize on these trends, particularly as the global transition to cleaner energy sources accelerates.

CLP Holdings reported robust financial performance for 2024, with operating earnings before fair value movements climbing by 8.1%. This growth was significantly bolstered by its Australian subsidiary, EnergyAustralia, which demonstrated a notable improvement in its financial results, directly contributing to CLP's overall profit increase.

The company's strong earnings in 2024, particularly the surge attributed to EnergyAustralia, underscore effective operational management and shrewd strategic investments. These positive financial indicators suggest a healthy trajectory for CLP Holdings, potentially translating into attractive investment returns for stakeholders.

Tariff adjustments directly impact CLP Holdings' revenue and customer affordability. In Hong Kong, CLP Power saw its average net tariff decrease by 7.4% in 2024, largely driven by lower global fuel costs. However, a modest tariff increase is anticipated for 2025.

Looking ahead to the 2025-2028 period, the projected average annual basic tariff increase is around 2.2%. This rate is notably below expected inflation levels, suggesting CLP's efforts to manage costs effectively. The company's strategy includes a diversified fuel mix and the adoption of advanced technologies, which are crucial for maintaining competitive electricity prices for consumers and businesses.

Capital Investment in Energy Infrastructure

CLP Holdings is strategically allocating significant capital towards its energy infrastructure development plan for 2024-2028, earmarking approximately HK$52.9 billion. This investment signals a shift, with a greater emphasis on bolstering transmission and distribution networks rather than solely on generation projects. This focus is essential for ensuring grid stability and efficiently delivering power to meet rising demand.

The company's commitment to a cleaner energy future is evident in its continued investment in non-carbon initiatives. This includes the development of new gas-fired generation units in Hong Kong, a crucial step in reducing reliance on coal. Simultaneously, CLP is actively expanding its renewable energy portfolio through projects in mainland China and India, demonstrating a clear strategy to diversify its energy sources and contribute to global decarbonization efforts.

- Capital Expenditure: Approximately HK$52.9 billion planned for 2024-2028.

- Investment Focus: Increased allocation towards transmission and distribution systems.

- Non-Carbon Investments: Development of new gas-fired generation in Hong Kong.

- Renewable Energy Growth: Expansion of projects in mainland China and India.

Impact of Fuel Prices and Market Volatility

Fluctuations in global fuel prices are a significant factor for CLP Holdings, directly influencing its fuel cost adjustments and, consequently, electricity tariffs for consumers. For instance, in early 2024, Brent crude oil prices saw considerable swings, impacting the cost of natural gas and coal, key inputs for CLP's power generation.

The Australian energy market, a key operational area for CLP, is actively undergoing reforms aimed at mitigating price volatility and providing more predictable bills for customers. Initiatives like the Capacity Investment Scheme, introduced in 2023 and continuing through 2024, are designed to encourage investment in dispatchable renewable energy to stabilize the grid and prices.

CLP's strategic diversification of its fuel mix, which includes substantial investments in nuclear power and a growing portfolio of renewable energy sources like wind and solar, serves as a crucial buffer against the unpredictable nature of fossil fuel prices. This diversified approach helps to stabilize operating costs and protect profitability, even when global oil and gas markets experience significant turbulence.

- Fuel Cost Impact: Global oil price volatility in early 2024, with Brent crude fluctuating between $75 and $90 per barrel, directly affects CLP's fuel procurement costs.

- Australian Market Reforms: Australia's energy market is implementing reforms to enhance price stability, with a focus on increasing renewable energy and storage capacity.

- Diversification Strategy: CLP's reliance on nuclear (e.g., its stake in the Daya Bay Nuclear Power Plant) and renewables (e.g., significant wind farm investments in mainland China and Australia) mitigates exposure to fossil fuel price shocks.

Economic growth significantly influences CLP Holdings' performance, with global electricity demand rising by 4% in 2024. Hong Kong's economic expansion directly boosted CLP Power's sales, driven by digitalization and infrastructure projects. CLP's Australian subsidiary, EnergyAustralia, also contributed significantly to the company's 8.1% operating earnings growth in 2024.

Tariff adjustments are a key economic factor, with CLP Power's average net tariff decreasing by 7.4% in 2024 due to lower fuel costs, though a slight increase is expected for 2025. The projected average annual basic tariff increase of 2.2% for 2025-2028 is below anticipated inflation, indicating cost management efforts.

CLP is investing approximately HK$52.9 billion in its 2024-2028 development plan, prioritizing transmission and distribution networks. This capital expenditure supports the growing electricity demand and the transition to cleaner energy, including new gas-fired units in Hong Kong and renewable projects in China and India.

| Economic Indicator | CLP Holdings Impact | Data Point/Trend |

|---|---|---|

| Global Electricity Demand Growth | Increased power sales and revenue potential | 4% in 2024 |

| Hong Kong Economic Growth | Directly correlates with CLP Power's sales | Key driver for digitalization and infrastructure projects |

| Operating Earnings Growth | Positive financial performance | 8.1% in 2024, boosted by EnergyAustralia |

| Electricity Tariffs (Hong Kong) | Impacts revenue and customer affordability | 7.4% decrease in 2024, projected 2.2% annual increase (2025-2028) |

| Capital Expenditure | Investment in infrastructure and future growth | HK$52.9 billion (2024-2028) |

Full Version Awaits

CLP Holdings PESTLE Analysis

The preview shown here is the exact CLP Holdings PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CLP Holdings, providing valuable strategic insights.

Sociological factors

CLP Holdings demonstrates significant community engagement, investing over HK$200 million from its Community Energy Saving Fund in 2024-2025. This funding supports vital programs such as electricity subsidies for low-income households and initiatives promoting energy conservation.

These programs extend to enhancing home electrical safety for vulnerable populations, reflecting a commitment to social well-being. Additionally, CLP's Australian subsidiary, EnergyAustralia, actively contributes to local communities through its Community Grants program, supporting various non-profit endeavors.

CLP Holdings is actively addressing the growing demand for corporate social responsibility, recognizing its duty to exceed basic compliance and actively contribute to societal well-being. This includes a strong focus on decarbonization, with CLP aiming for a 75% reduction in its carbon intensity from 2018 levels by 2032, a significant step towards its net-zero ambitions by 2050.

The company is channeling substantial investment into renewable energy, with plans to invest HK$100 billion in the energy transition by 2030, focusing on areas like offshore wind and solar power. Transparency in Environmental, Social, and Governance (ESG) reporting is paramount, with CLP regularly publishing detailed reports on its performance and impact.

Furthermore, CLP is committed to upholding ethical human rights standards across its operations and supply chains, while also actively supporting communities affected by the energy transition through targeted initiatives and engagement programs. This commitment reflects a broader shift in stakeholder expectations, where businesses are increasingly judged on their positive societal contributions beyond financial returns.

The global shift towards renewable energy sources, often termed the energy transition, demands a workforce equipped with novel skills. CLP Holdings recognizes this, actively investing in training programs designed to equip its employees for the evolving demands of digitalization and the drive towards net-zero emissions. This proactive approach ensures CLP can leverage new technologies and operational paradigms.

In 2024, CLP continued its commitment to employee development, with significant investment allocated to upskilling programs focused on digital literacy and green technologies. For example, a substantial portion of their training budget was directed towards courses in data analytics and renewable energy system management, aiming to build a robust talent pipeline for the future. This focus on future-ready skills is crucial for maintaining operational efficiency and driving innovation in a rapidly changing energy landscape.

Consumer Attitudes Towards Energy and Sustainability

Consumer awareness regarding sustainable and affordable energy solutions is on the rise, influencing purchasing decisions and energy consumption habits. CLP's strategic focus on smart meter deployment, with a target of full rollout by 2025, directly addresses this trend by providing customers with real-time electricity usage data. This empowers individuals to better manage their consumption and actively participate in energy-saving initiatives.

CLP actively fosters energy conservation through various community engagement programs. For instance, in 2023, their "Energy Saving Championship" initiative saw participation from over 50,000 households, collectively reducing electricity consumption by an average of 8%. This demonstrates a tangible commitment to promoting sustainable energy practices beyond technological solutions.

- Growing Demand: Consumers increasingly prioritize eco-friendly and cost-effective energy options.

- Smart Meter Benefits: CLP's smart meter rollout (full by 2025) offers customers granular usage data for efficient management and savings.

- Community Engagement: CLP runs programs promoting energy conservation, evidenced by significant participation and savings in 2023 initiatives.

- Behavioral Shift: These efforts aim to cultivate a more conscious approach to energy usage among the general public.

Urbanization and Infrastructure Development Impact

Hong Kong's rapid urbanization, exemplified by the ambitious Northern Metropolis development, directly fuels a surge in electricity demand. This growth necessitates significant investment from CLP Holdings in its transmission and distribution networks to ensure a reliable power supply for these expanding urban centers.

CLP's strategic infrastructure upgrades are vital for accommodating the increased load from new residential and commercial developments. For instance, the company's ongoing investments in grid modernization are designed to support the projected population growth and economic activity in these evolving urban landscapes, directly impacting long-term energy planning and CLP's operational capacity.

- Northern Metropolis Target: Aims to house 2.5 million people by 2039, significantly increasing energy needs.

- CLP's Grid Investment: CLP Holdings has committed substantial capital to enhance its transmission and distribution infrastructure to meet future demand.

- Urban Density Impact: Higher population density in urban areas translates to concentrated electricity consumption, requiring robust grid resilience.

CLP Holdings' community investment, exceeding HK$200 million in 2024-2025 through its Community Energy Saving Fund, highlights a strong social commitment. This includes crucial support for low-income households and energy conservation programs, demonstrating a direct societal benefit.

The company's proactive approach to corporate social responsibility is evident in its ambitious decarbonization targets and substantial investments in renewable energy, aiming for a 75% carbon intensity reduction by 2032 and HK$100 billion in energy transition investments by 2030.

CLP's focus on employee development, with significant training investment in digital literacy and green technologies in 2024, addresses the evolving skill demands of the energy transition. This ensures a future-ready workforce capable of managing new operational paradigms.

Consumer demand for sustainable and affordable energy is growing, a trend CLP addresses through smart meter deployment, targeting full rollout by 2025 to empower customers with usage data for better energy management.

Technological factors

CLP Holdings is significantly boosting its renewable energy footprint, integrating cutting-edge solar and wind technologies. This strategic pivot is evident in its diversified portfolio, aiming to capture growth in sustainable energy markets.

India's renewable energy sector is experiencing robust expansion, with substantial solar and wind capacity additions projected for 2024-2025, fueled by supportive government policies and advancements in technology. CLP is strategically positioning itself to capitalize on these developments.

CLP's investment strategy specifically targets the expansion of its renewable energy assets in mainland China and India. This focus aligns with global trends and the increasing demand for cleaner energy sources in these key economic regions.

CLP Holdings is actively investing in smart grid technology to boost electricity supply reliability and efficiency. This initiative involves integrating advanced information and communication technologies across its operations.

A key part of this development is the ongoing replacement of traditional meters with advanced smart meters. CLP aims for full deployment of these smart meters across Hong Kong by 2025, a significant technological upgrade.

These smart grids facilitate bidirectional flow of electricity and data, which is crucial for effective demand management and seamless integration of renewable energy sources into the power network.

Digital innovation is a core focus for CLP, as evidenced by its 2024 Sustainability Report, where the company detailed its commitment to leveraging data for informed decision-making. This includes the strategic deployment of artificial intelligence across multiple operational areas, aiming to enhance efficiency and service delivery.

CLP is actively integrating advanced technologies to optimize its operations, with AI being a key enabler across various use cases. This digital transformation necessitates a parallel focus on robust cybersecurity measures to safeguard its expanding digital energy infrastructure against evolving threats.

Evolution of Energy Storage Solutions

The energy sector is experiencing a significant technological shift driven by advancements in energy storage. These innovations are key to integrating renewable energy sources like solar and wind, which can be intermittent. For instance, by the end of 2024, global battery energy storage capacity is projected to reach over 150 GW, a substantial increase from previous years, highlighting the rapid development in this area.

Australia's energy market reforms are a prime example of how governments are recognizing the importance of these technologies. The focus on firmed, renewable energy and storage underscores a strategic move towards ensuring grid reliability. This includes a growing emphasis on long-duration energy storage solutions, which are critical for maintaining a stable power supply when renewable generation is low.

The ongoing evolution of battery technology, including improvements in energy density, lifespan, and cost reduction, directly impacts grid stability. These advancements are essential for effectively balancing the variable output of renewable energy generation, a challenge that has historically limited their widespread adoption.

- Technological Advancement: Rapid improvements in battery and other energy storage technologies are enhancing grid stability.

- Renewable Integration: Storage solutions are crucial for integrating variable renewable energy sources, making them more reliable.

- Market Reforms: Australia's energy market reforms prioritize investment in firmed, renewable energy and storage, particularly long-duration solutions.

- Grid Balancing: Technological progress in storage is vital for managing the intermittent nature of renewable power generation.

Next-Generation Power Generation Technologies

CLP Holdings is actively investing in advanced power generation, notably commissioning new high-efficiency gas-fired units in Hong Kong. These units, like the Black Point Power Station's upgrades, are crucial for reducing the company's carbon footprint, with gas generation emitting significantly less CO2 per unit of energy compared to coal. For instance, the transition to cleaner fuels is a core part of CLP's strategy to meet Hong Kong's decarbonization targets, aiming for a substantial reduction in greenhouse gas emissions by 2030 and beyond.

The company also recognizes the potential of nuclear energy as a vital component of Hong Kong's long-term decarbonization strategy, although its direct role in CLP's generation portfolio is currently indirect through supply agreements. Furthermore, CLP is exploring the integration of hydrogen technologies. This includes pilot projects and research into hydrogen's role in the future energy mix, potentially for both power generation and industrial applications, aligning with global trends towards cleaner energy sources.

CLP's commitment to cleaner generation is reflected in its capital expenditure plans. In 2023, the company allocated significant investments towards new energy projects and asset upgrades focused on sustainability. This forward-looking approach positions CLP to adapt to evolving regulatory landscapes and increasing demand for low-carbon electricity solutions.

Technological advancements are reshaping CLP Holdings' operations, particularly in renewable energy integration and smart grid development. The company is actively deploying smart meters across Hong Kong, with a target for full deployment by 2025, enhancing grid efficiency and data management. CLP is also leveraging artificial intelligence and advanced data analytics to optimize its energy infrastructure, as detailed in its 2024 Sustainability Report.

The global surge in battery energy storage capacity, projected to exceed 150 GW by the end of 2024, is critical for balancing intermittent renewable sources. CLP's investment in high-efficiency gas-fired units in Hong Kong, like those at Black Point Power Station, also reflects a technological shift towards lower-carbon generation, aligning with decarbonization goals.

| Technology Area | CLP's Focus/Investment | Impact/Goal | Relevant Data/Target |

|---|---|---|---|

| Smart Grid & Metering | Smart meter deployment in Hong Kong | Enhanced grid reliability, data management | Full deployment by 2025 |

| Renewable Energy Integration | Investment in solar and wind technologies | Expanding renewable footprint | Strategic focus on China and India |

| Energy Storage | Adapting to advancements in battery technology | Grid stability, renewable integration | Global capacity > 150 GW by end of 2024 |

| Digital Transformation | AI and data analytics for operational optimization | Improved efficiency, service delivery | Detailed in 2024 Sustainability Report |

| Advanced Generation | High-efficiency gas-fired units | Reduced carbon footprint | Upgrades at Black Point Power Station |

Legal factors

CLP Power in Hong Kong operates under a strict Scheme of Control Agreement (SCA) with the government. This agreement legally defines its allowed rate of return and capital spending, ensuring public interest is protected. The recent 2023 interim review of this SCA, alongside the government's approval of CLP's 2024-2028 Development Plan, highlights the robust legal framework and ongoing regulatory scrutiny that governs electricity pricing and infrastructure development.

CLP Holdings is navigating a landscape of evolving legal mandates for ESG reporting. Their 2024 Annual Report and Sustainability Report, released in anticipation of new regulations, adhere to Hong Kong Financial Reporting Standards (HKFRS S1 and S2) and the Stock Exchange of Hong Kong's updated ESG Reporting Code, effective January 1, 2025. This proactive approach underscores the growing legal imperative for detailed sustainability disclosures and robust corporate governance.

CLP Holdings operates under stringent environmental regulations and national carbon emission targets across its diverse operational territories. These rules directly influence its energy generation and distribution strategies, necessitating significant investment in cleaner technologies.

The company has proactively enhanced its greenhouse gas emissions intensity target, aiming for a 2030 benchmark that aligns with the critical 1.5°C global warming trajectory. Furthermore, CLP is committed to a complete phase-out of coal power generation before 2040, a move that will reshape its asset portfolio.

Navigating and adhering to these increasingly rigorous environmental legal frameworks is paramount for CLP's ongoing operations and its long-term investment planning. Failure to comply could result in substantial penalties and reputational damage, impacting its ability to secure future financing and maintain stakeholder confidence.

Market Reform Legislation and Competition Laws

Australia's National Electricity Market (NEM) is undergoing substantial reforms, driven by legislative changes aimed at fostering long-term investment in firm renewable energy and storage solutions. An independent review panel has put forth recommendations for these legislative shifts, which will directly influence market operations, investment incentives, and the competitive landscape within the Australian energy sector, impacting CLP Holdings' Australian business units.

These reforms are designed to address the evolving energy mix and ensure grid stability and reliability. For CLP, this means adapting to new market rules and potentially identifying new investment opportunities in renewable generation and storage technologies. The Australian Competition and Consumer Commission (ACCC) also plays a crucial role in overseeing competition within the energy market, ensuring fair practices and preventing anti-competitive behavior as these reforms are implemented.

Key aspects of the reforms include:

- Market Mechanism Adjustments: Changes to how energy is priced and dispatched, potentially impacting revenue streams for generation assets.

- Investment Signals: New incentives or frameworks designed to attract capital into specific types of energy infrastructure, such as firming capacity.

- Competition Oversight: Continued scrutiny by regulatory bodies like the ACCC to ensure a level playing field for all market participants.

Foreign Investment and Data Regulations in China

CLP Holdings' significant investments in mainland China are directly shaped by the nation's evolving foreign investment laws and stringent data regulations. While China has been progressively opening its financial sector, regulatory uncertainties remain, particularly concerning transactions in strategically important industries like energy infrastructure.

Navigating these legal complexities is paramount for CLP's ongoing growth and operational stability within the Chinese market. For instance, China's Cybersecurity Law, enacted in 2017 and further elaborated through subsequent regulations, imposes strict requirements on data localization and cross-border data transfers for critical information infrastructure operators, which could impact CLP's data management practices.

- Foreign Investment Law: China's Foreign Investment Law, effective from January 1, 2020, aims to create a more predictable and transparent environment for foreign investors, but retains provisions for national security reviews and restrictions in certain sectors.

- Data Localization Requirements: Regulations like the Personal Information Protection Law (PIPL) and the Data Security Law (DSL) mandate specific procedures for handling and transferring data generated within China, potentially increasing compliance costs for CLP.

- Regulatory Scrutiny: Transactions involving energy and utilities, critical infrastructure sectors, often face heightened scrutiny from Chinese regulators, requiring careful attention to compliance and potential approval processes.

CLP Holdings must navigate a complex web of international and national legal frameworks that govern its operations. In Hong Kong, the Scheme of Control Agreement (SCA) dictates its allowed rate of return, with the 2023 interim review and 2024-2028 Development Plan approval underscoring its legal foundation. Furthermore, CLP is adapting to new ESG reporting mandates, with its 2024 reporting aligning with HKFRS S1 and S2 and the Stock Exchange of Hong Kong's updated ESG Reporting Code effective January 1, 2025, demonstrating a commitment to enhanced transparency and governance.

Australia's energy market reforms, driven by legislative changes to boost renewable investment and storage, will directly impact CLP's operations there. The Australian Competition and Consumer Commission (ACCC) continues to oversee market competition. In mainland China, CLP faces evolving foreign investment laws and stringent data regulations, including the Cybersecurity Law and PIPL, which necessitate careful compliance for data management and cross-border transfers.

| Jurisdiction | Key Legal Factor | Impact on CLP | Relevant Legislation/Agreement | Effective Date/Period |

|---|---|---|---|---|

| Hong Kong | Scheme of Control Agreement (SCA) | Defines allowed rate of return and capital spending. | SCA | Ongoing (2023 interim review, 2024-2028 Development Plan approval) |

| Hong Kong | ESG Reporting Mandates | Requires enhanced sustainability disclosures and corporate governance. | HKFRS S1 & S2, HKEX ESG Reporting Code | Effective January 1, 2025 |

| Australia | Energy Market Reforms | Influences investment in renewables and storage, market operations. | Legislative changes | Ongoing |

| Mainland China | Foreign Investment Laws & Data Regulations | Affects investment, data localization, and cross-border transfers. | Cybersecurity Law, PIPL, DSL | Effective 2017 onwards (with ongoing updates) |

Environmental factors

CLP Holdings is actively pursuing its Climate Vision 2050, a comprehensive plan aimed at achieving net-zero greenhouse gas emissions by 2050. This strategy is central to its business operations, driving the accelerated retirement of coal-fired power plants and a strategic shift towards cleaner energy sources.

In 2023, CLP continued to advance its decarbonisation efforts, with renewable energy sources accounting for approximately 40% of its electricity generation portfolio. The company has committed to investing billions in renewable projects and grid infrastructure upgrades through 2030 to support this transition.

CLP Holdings is heavily investing in renewable energy, with significant projects in wind and solar in mainland China and India. This aligns with strong regional mandates pushing for cleaner energy sources.

India's commitment is particularly noteworthy, reaching 49% of its installed electricity capacity from non-fossil fuel sources by July 2025, showcasing a rapid transition that CLP is actively participating in.

This global shift towards renewables is a core driver for CLP's strategic direction, influencing its project pipeline and investment priorities for the coming years.

CLP Holdings has demonstrated concrete progress in reducing its carbon footprint, notably through the commissioning of new gas-fired generation units and the decommissioning of coal-fired units in Hong Kong. This strategic shift is directly contributing to a lower greenhouse gas emissions intensity for the company.

The company's commitment is underscored by its active pursuit of 2030 decarbonization targets, reflecting a clear pathway towards more sustainable operations. These initiatives are vital for aligning with both CLP's internal environmental performance benchmarks and the increasing external expectations from stakeholders and regulators.

Nature Conservation and Biodiversity Initiatives

CLP Holdings is increasingly focusing on nature conservation and biodiversity, as evidenced by its 2024 Sustainability Report. This report features a dedicated chapter on nature-related topics, directly reflecting the company's adoption of the Task Force on Nature-related Financial Disclosures (TNFD) recommendations.

This strategic shift signifies CLP's commitment to managing its broader environmental footprint, moving beyond carbon emissions to encompass biodiversity and the preservation of natural resources. The company is actively working to understand and mitigate its dependencies and impacts on ecosystems.

- TNFD Alignment: CLP's 2024 Sustainability Report includes a specific chapter on nature, aligning with TNFD recommendations.

- Expanded Environmental Focus: The company is broadening its environmental stewardship to include biodiversity and natural resource preservation, not just carbon emissions.

- Impact Management: CLP is actively managing its dependencies and impacts on nature, demonstrating a comprehensive approach to environmental responsibility.

Impact of Extreme Weather and Climate Risks

Climate impacts, such as extreme weather and rising temperatures, directly influence electricity demand and create operational hurdles for power utilities like CLP Holdings. For example, Hong Kong's record high temperatures in 2023, reaching peaks of 35.1°C in July, fueled increased air conditioning usage, contributing to CLP's power sales growth.

CLP's proactive climate strategy involves rigorous scenario analysis to pinpoint both long-term climate-related risks and emerging opportunities. This forward-thinking approach is crucial for navigating the evolving energy landscape.

- Record Temperatures Drive Demand: Hong Kong's average temperature in 2023 was 23.6°C, the second warmest year on record, boosting electricity consumption for cooling.

- Operational Resilience: CLP invests in infrastructure upgrades to withstand more frequent and intense weather events, ensuring service reliability.

- Climate Risk Assessment: The company actively identifies and plans for physical risks like flooding and heat stress, as well as transition risks associated with decarbonization policies.

CLP Holdings is actively transitioning its energy portfolio, with renewable sources forming approximately 40% of its generation mix in 2023. The company is strategically investing billions in renewables and grid upgrades through 2030 to support its net-zero ambitions by 2050.

CLP's environmental focus extends beyond carbon, with a new emphasis on nature conservation and biodiversity, as highlighted in its 2024 Sustainability Report which incorporates TNFD recommendations. This signifies a broader commitment to managing its ecological impact.

Physical climate impacts, such as the record 2023 temperatures in Hong Kong (average 23.6°C, second warmest on record), directly influence energy demand, increasing consumption for cooling. CLP is enhancing operational resilience to manage these increasingly volatile weather patterns.

PESTLE Analysis Data Sources

Our PESTLE Analysis for CLP Holdings is built upon a robust foundation of data sourced from official government publications, reputable financial institutions like the IMF and World Bank, and leading industry-specific research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting CLP.