CLP Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLP Holdings Bundle

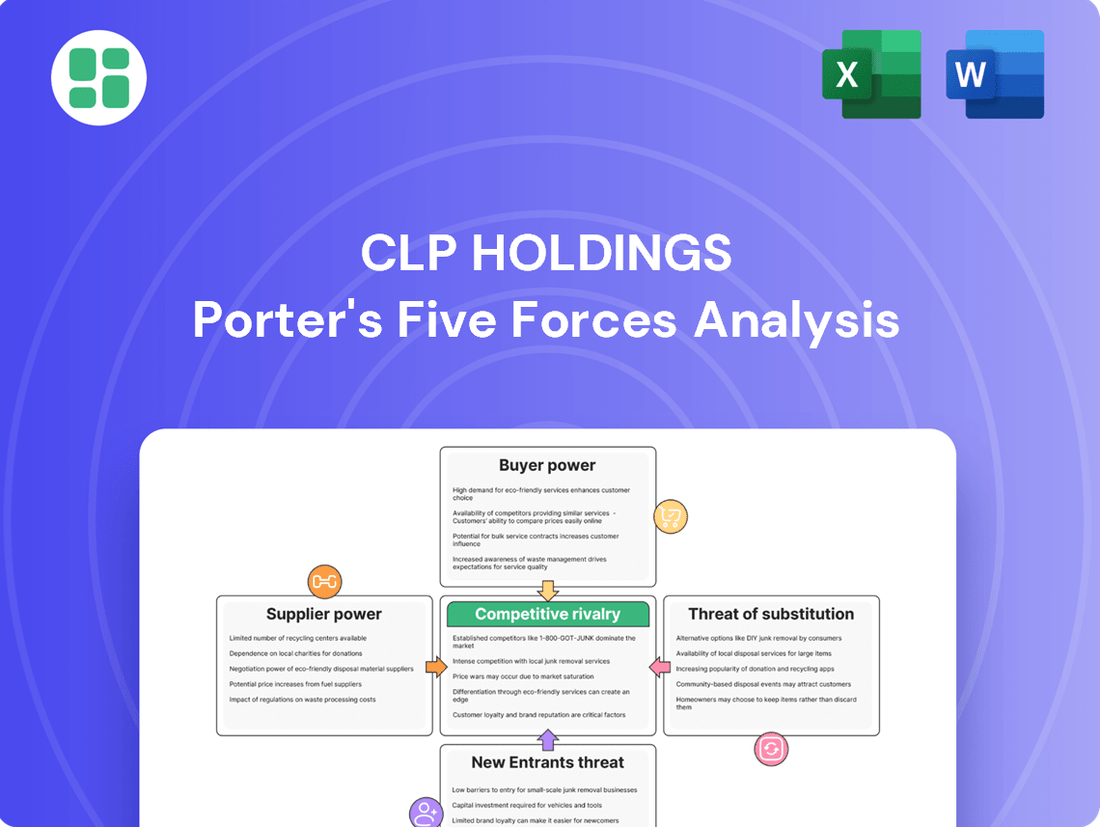

CLP Holdings operates in a dynamic energy sector where the threat of new entrants is moderate, balanced by high capital requirements. Buyer power is significant, particularly for large industrial clients, influencing pricing and service demands. The full Porter's Five Forces Analysis reveals the real forces shaping CLP Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CLP Holdings' reliance on concentrated fuel sources like coal and natural gas for its conventional power generation means suppliers of these commodities wield considerable influence. The global markets for these essential fuels can be tightly controlled by a few major producers, particularly for specific grades or origins.

This concentration translates into significant bargaining power for suppliers. For instance, the price volatility of natural gas, a key input for CLP, directly impacts operating expenses. In 2023, global natural gas prices experienced significant fluctuations, with benchmarks like TTF averaging around €40 per megawatt-hour, showcasing the direct cost implications for energy providers like CLP.

CLP Holdings, like many in the power industry, faces significant bargaining power from suppliers of specialized equipment. This includes essential components like turbines, generators, and advanced grid infrastructure. The high degree of technical expertise and capital investment required means there are only a handful of global manufacturers capable of producing these critical items.

This limited supplier base directly translates into considerable leverage for these providers. For instance, the procurement of large power transformers, a vital piece of grid infrastructure, can have lead times stretching up to four years. This extended waiting period further solidifies the suppliers' strong negotiating position, as utility companies like CLP Holdings must plan far in advance and are often locked into specific suppliers due to compatibility and certification requirements.

As CLP Holdings expands its renewable energy portfolio, including solar and wind projects, its reliance on specialized component suppliers like those for solar panels, wind turbines, and battery storage systems increases. This creates a dynamic where supplier bargaining power can influence costs and project timelines.

While the global solar panel market has experienced significant price reductions due to oversupply, particularly for standard silicon panels, the bargaining power of suppliers for advanced or proprietary technologies, such as high-efficiency solar cells or specialized wind turbine components, can remain substantial. Similarly, the rapidly evolving battery storage sector may see suppliers of cutting-edge battery chemistries or integrated systems wielding considerable influence.

Geopolitical considerations and trade policies, including tariffs on imported components, can further concentrate bargaining power among a limited number of suppliers or regional manufacturers. For instance, in 2024, ongoing trade disputes and the imposition of tariffs on solar components from certain countries have demonstrably impacted the cost and availability for developers, underscoring the leverage suppliers in favored regions can exert.

Skilled Labor and Specialized Services

CLP Holdings relies heavily on skilled labor and specialized services for its complex operations. The scarcity of engineers and technicians experienced in areas like smart grid technology or large-scale renewable energy integration, crucial for infrastructure maintenance and development, grants these professionals significant leverage. This specialized expertise is a critical input that is difficult to substitute, impacting operational costs and project timelines.

- High Demand for Specialized Skills: The ongoing transition to cleaner energy sources and the modernization of existing grids necessitate expertise in fields such as advanced data analytics for grid management and specialized engineering for offshore wind farms.

- Limited Pool of Qualified Professionals: Globally, there's a recognized shortage of highly qualified engineers and technicians with experience in the power sector, particularly those with advanced certifications or specific project histories. For instance, reports in early 2024 highlighted a growing gap in the availability of skilled cybersecurity professionals for critical infrastructure, including power grids.

- Impact on Project Costs: The bargaining power of these specialized service providers can directly influence CLP Holdings' capital expenditure and operational expenses, particularly for new project development and the implementation of advanced technologies.

Financing Providers for Large-Scale Projects

CLP Holdings frequently engages in capital-intensive ventures, such as expanding its transmission and distribution networks or developing new power generation facilities, including renewable energy sources. For instance, in 2023, CLP's capital expenditure was HK$14.6 billion, with significant portions allocated to these areas.

The financing for these substantial projects typically originates from a select group of major financial institutions or through specialized government-backed programs. The sheer scale of these financial requirements means that fewer entities can provide the necessary capital.

The terms and the very availability of such large-scale financing can grant these lenders significant leverage. This bargaining power is amplified when project timelines are critical and alternative funding sources are scarce.

- Limited Funding Pool: Large-scale infrastructure projects require substantial capital, often exceeding the capacity of smaller lenders.

- Project Scale Dependency: The immense financial commitments needed for transmission, distribution, and new generation capacity give financiers considerable influence.

- Government Backing Influence: Government-backed financing schemes, while beneficial, can come with specific conditions that empower the backing entity.

CLP Holdings faces considerable supplier bargaining power due to its reliance on concentrated fuel sources like coal and natural gas. The global market for these commodities is often dominated by a few major producers, giving them significant leverage over pricing and supply. For example, in early 2024, fluctuations in the price of Brent crude oil, a benchmark for many energy commodities, hovered around $80-$85 per barrel, directly impacting CLP's fuel costs.

Furthermore, CLP's need for specialized equipment, such as advanced turbines and grid infrastructure, is met by a limited number of global manufacturers. These suppliers, due to high technical barriers and capital investment, possess strong negotiating power, as evidenced by lead times for critical components like large power transformers that can extend up to four years.

The growing renewable energy sector also presents supplier power dynamics. While prices for standard solar panels have fallen due to oversupply, suppliers of proprietary technologies or specialized components for wind turbines and battery storage can still command significant influence. Geopolitical factors and tariffs, such as those impacting solar components in 2024, further concentrate this power among favored regional suppliers.

CLP's demand for highly skilled labor, particularly in emerging areas like smart grid technology and renewable energy integration, grants these professionals considerable bargaining power. The scarcity of qualified engineers and technicians, with a noted shortage of cybersecurity experts for critical infrastructure in early 2024, directly impacts project costs and operational timelines.

The company's substantial capital expenditure, which was HK$14.6 billion in 2023, often requires financing from a select group of major financial institutions. This limited pool of large-scale capital providers gives them significant leverage in setting terms, especially when project timelines are critical and alternative funding is scarce.

What is included in the product

Analyzes the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting CLP Holdings' utility operations.

Instantly identify and quantify the impact of each of Porter's Five Forces on CLP Holdings, enabling targeted strategies to alleviate competitive pressures.

Customers Bargaining Power

CLP Holdings operates under a Scheme of Control Agreement with the Hong Kong government, which sets electricity tariffs and limits the bargaining power of individual customers. This regulatory structure means prices are not subject to direct negotiation, as they are centrally determined. For instance, in 2023, CLP's revenue from electricity sales in Hong Kong was HKD 35.9 billion, with tariffs reflecting the regulated return on capital.

For the majority of CLP Holdings' customers, particularly in its core Hong Kong market, switching to alternative energy sources is practically impossible due to the absence of viable options beyond the established grid. This inherent lack of alternatives means customers face effectively infinite switching costs, severely limiting their bargaining power.

Customers are deeply reliant on CLP's extensive transmission and distribution infrastructure, a classic characteristic of a natural monopoly. This dependence on a single, essential service provider significantly curtails any ability for customers to negotiate terms or seek alternative providers, reinforcing CLP's strong position.

CLP Holdings benefits from a widely spread customer base, encompassing residential, commercial, and industrial users. This diversification spans across Hong Kong, mainland China, India, Southeast Asia, and Australia, significantly weakening the bargaining power of any individual customer or smaller group. For instance, in 2023, CLP's electricity customers numbered in the millions across these regions, making it difficult for any single entity to exert substantial influence on pricing or service terms, except in very specific, large-scale renewable energy contracts.

Government as a Major Customer/Influencer

Governments in CLP Holdings' operating regions are significant customers, particularly for infrastructure projects. For instance, in 2024, CLP continued to be involved in major infrastructure developments across Hong Kong and mainland China, often through government tenders or mandates. Their role extends beyond being a mere buyer; they are also powerful influencers of demand through policy, such as renewable energy targets.

These governmental policies can directly impact CLP's business strategy, pushing for investments in specific energy sources or operational standards. In mainland China, the influence of state-owned enterprises, often directed by government policy, means that government purchasing decisions can have a substantial indirect effect on CLP's market positioning and operational requirements.

- Government as a key customer for infrastructure projects.

- Policy mandates influencing energy procurement and operational standards.

- Significant indirect influence through state-owned enterprises in markets like mainland China.

Growing Energy Efficiency and Distributed Generation Awareness

While CLP Holdings' direct customer bargaining power might seem limited in its traditional utility model, a significant shift is underway due to increased customer awareness of energy efficiency and distributed generation. This growing consciousness, amplified by government support for self-generation technologies like rooftop solar, is beginning to indirectly shape demand. For instance, by 2024, solar photovoltaic installations globally continued to expand, with new capacity additions frequently exceeding previous years' records, indicating a tangible customer interest in alternative energy sources. This trend pressures utilities like CLP to innovate and offer a broader spectrum of energy solutions and services, moving beyond basic electricity supply.

This evolving customer landscape translates into an emerging form of influence. As more customers explore or adopt self-generation, their reliance on traditional utility grids may decrease, creating a subtle but growing bargaining leverage. CLP, like other energy providers, must therefore adapt by enhancing its service offerings and potentially integrating distributed energy resources into its portfolio to maintain customer loyalty and market share. The increasing adoption of smart home energy management systems, for example, further empowers consumers to optimize their energy consumption and potentially negotiate better terms or choose more flexible energy plans.

- Growing Awareness: Customers are increasingly informed about energy efficiency measures and the viability of distributed generation, such as rooftop solar installations.

- Government Incentives: Policies and subsidies encouraging self-generation are a key driver in this shift, making alternative energy solutions more accessible and attractive to consumers.

- Indirect Influence: This heightened awareness and adoption of self-generation indirectly influence customer demand patterns, prompting utilities to diversify their energy solutions and services.

- Emerging Bargaining Power: The ability for customers to generate their own power represents a new avenue of customer influence, potentially leading to demands for more flexible and competitive energy offerings.

CLP Holdings' customer bargaining power is significantly constrained by its regulated monopoly status in Hong Kong, where tariffs are fixed by a Scheme of Control Agreement, limiting direct negotiation. While millions of customers across its diverse geographical spread, including Hong Kong, mainland China, India, Southeast Asia, and Australia, are served, their collective impact on pricing is minimal. For instance, in 2023, CLP's revenue from electricity sales in Hong Kong reached HKD 35.9 billion, reflecting these regulated tariffs.

However, growing customer awareness of energy efficiency and the increasing adoption of distributed generation, supported by government incentives for self-generation like rooftop solar, are beginning to exert indirect influence. By 2024, global solar PV installations continued to see record capacity additions, signaling a tangible shift in customer interest towards alternative energy sources and potentially pressuring utilities to innovate their service offerings.

| Metric | 2023 Value (HKD Billion) | Significance for Bargaining Power |

|---|---|---|

| Hong Kong Electricity Revenue | 35.9 | Indicates the scale of operations under regulated tariffs, limiting individual customer negotiation. |

| Number of Customers (Millions) | Millions across diverse regions | A large, diversified customer base weakens the influence of any single customer or small group. |

| Global Solar PV Capacity Additions | Record additions (ongoing trend in 2024) | Represents growing customer interest in self-generation, creating indirect pressure for utilities to adapt. |

Preview Before You Purchase

CLP Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for CLP Holdings, detailing the competitive landscape and strategic implications for the company. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, ensuring no surprises. This in-depth examination will equip you with valuable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within CLP Holdings' industry.

Rivalry Among Competitors

CLP Holdings faces limited direct competitive rivalry in Hong Kong due to its regulated duopoly with Hongkong Electric. The Scheme of Control Agreement, renewed through 2033, dictates pricing and operational frameworks, effectively capping direct price wars. This arrangement means competition is more focused on operational excellence and service delivery within their assigned territories rather than aggressive pricing strategies.

CLP Holdings faces significant competitive rivalry beyond its Hong Kong stronghold. In mainland China, India, Southeast Asia, and Australia, the company navigates markets characterized by fragmentation and a mix of state-owned enterprises, local private firms, and international competitors. This diverse player base means strategies must adapt to varying regulatory environments and market maturity levels.

The ongoing energy transition is a major catalyst for intensified rivalry, especially in the burgeoning renewable energy sector. Numerous developers are actively competing for solar, wind, and other clean energy projects across these regions. For instance, in 2024, Australia's renewable energy capacity saw substantial growth, with significant investment flowing into new projects, creating a dynamic and competitive environment for established players like CLP.

CLP Holdings' strategic pivot towards renewable energy places it in direct competition with a rapidly expanding field of specialized developers and established giants venturing into green power. This intensified rivalry is particularly evident in the fierce bidding for project tenders, securing prime land, gaining essential grid access, and negotiating long-term power purchase agreements.

The competitive landscape is further shaped by significant market developments, such as China's ambitious renewable energy expansion. In 2023, China added a record 216.9 gigawatts of renewable capacity, primarily from solar and wind, underscoring the sheer scale of investment and competition CLP faces in key growth regions.

Impact of Government Policies and State-Owned Enterprises

In key markets like mainland China and India, state-owned enterprises (SOEs) often dominate, enjoying preferential treatment and policy support. This can translate into an uneven competitive landscape for CLP, as these SOEs may not face the same market pressures or commercial constraints. For instance, in China's power sector, SOEs have historically received significant state investment and favorable regulatory treatment, impacting market access and pricing for private players.

- Government policies in China have historically favored SOEs in the energy sector, potentially limiting opportunities for private companies like CLP.

- In India, the presence of large SOEs in power generation and distribution can create competitive challenges due to their established infrastructure and government backing.

- CLP's ability to compete effectively may be influenced by the degree to which government policies create a level playing field across all market participants.

Strategic Partnerships and Acquisitions

CLP Holdings actively manages competitive rivalry and expands its market presence through strategic partnerships and acquisitions, particularly in the burgeoning renewable energy sector. These collaborations are crucial for navigating the dynamic energy landscape.

By partnering with local entities or international investors, CLP effectively shares project risks, harnesses valuable local expertise, and secures crucial market access. This approach is a common and vital competitive strategy in rapidly evolving energy markets.

For instance, in 2024, CLP continued to explore opportunities to bolster its renewable portfolio. While specific acquisition figures are often proprietary until completion, the company has consistently highlighted its strategic intent to grow in areas like offshore wind and solar power. In 2023, CLP completed the acquisition of a 25% stake in the Jhimpir wind farm in Pakistan, demonstrating its ongoing commitment to expanding its renewable energy footprint through strategic investments.

- Strategic Partnerships: CLP collaborates with local and international players to share risks and gain market access, especially in renewable energy projects.

- Acquisitions: The company strategically acquires stakes in renewable energy assets to expand its operational footprint and technological capabilities.

- Market Expansion: These moves are designed to enhance CLP's competitive position in evolving energy markets, particularly in Asia.

- Risk Mitigation: Partnerships and acquisitions help CLP diversify its energy sources and reduce reliance on any single market or technology.

While CLP Holdings operates in a regulated duopoly in Hong Kong, its competitive rivalry intensifies significantly in its international markets, particularly in the rapidly expanding renewable energy sector. This competition comes from a diverse range of players, including specialized developers and established energy giants, all vying for project opportunities and market share. The company actively pursues strategic partnerships and acquisitions to navigate this dynamic landscape and bolster its renewable energy portfolio.

In 2023, CLP's acquisition of a 25% stake in Pakistan's Jhimpir wind farm exemplifies its strategy to grow its renewable footprint. The competitive pressure is further amplified by government policies in regions like China and India, which can favor state-owned enterprises, creating an uneven playing field for private companies. CLP's success hinges on its ability to adapt to these varied market conditions and leverage strategic alliances.

| Market | Key Competitors | Competitive Dynamics |

|---|---|---|

| Hong Kong | Hongkong Electric | Regulated duopoly, competition focused on operational excellence. |

| Mainland China | State-owned Enterprises (SOEs), local private firms | SOE dominance, policy support, fragmented market. |

| India | SOEs, local private firms, international players | SOE infrastructure and backing, evolving regulatory environment. |

| Australia | Renewable energy developers, established utilities | Growth in renewables, intense bidding for projects. |

| Southeast Asia | Local, regional, and international energy companies | Market fragmentation, varying regulatory maturity. |

SSubstitutes Threaten

The increasing affordability and efficiency of distributed generation technologies, such as rooftop solar and microgrids, present a significant threat to traditional utility models like CLP Holdings. In 2023, global solar PV capacity additions reached a record 307 GW, a 37% increase from 2022, indicating a rapid shift towards self-generation. This trend allows commercial, industrial, and residential customers to produce their own power, potentially reducing demand for grid electricity.

Government incentives and net metering policies further exacerbate this threat by making self-generation more economically viable and encouraging customers to feed surplus energy back into the grid. For instance, many regions offer attractive feed-in tariffs or tax credits for solar installations, directly impacting the revenue streams of established utilities. This growing customer autonomy can erode CLP Holdings' market share and profitability.

Improvements in energy efficiency are a significant threat to CLP Holdings. For instance, advancements in smart home technology and more efficient industrial equipment, as seen in the widespread adoption of LED lighting and improved insulation standards in new constructions, directly reduce the demand for electricity. This trend means fewer new power generation units are needed to meet overall energy requirements.

Demand-side management (DSM) programs also act as a substitute for traditional energy supply. Many utilities, including those in CLP's operating regions, actively encourage customers to reduce consumption during peak hours through incentives or smart grid technologies. In 2024, for example, various initiatives aimed at shifting energy usage away from peak times are in place, effectively lessening the need for CLP to invest in and operate peak-load power plants.

The threat of substitutes for CLP Holdings' energy storage solutions is growing, particularly from advancements in battery technology. Declining costs for these systems make them increasingly competitive for providing grid reliability and firming up renewable energy sources. For instance, by the end of 2023, the global average cost of lithium-ion battery packs had fallen to approximately $132 per kilowatt-hour, a significant decrease from previous years, making large-scale storage projects more economically feasible.

These battery energy storage systems can directly substitute for traditional peaking power plants, which are often more expensive to operate and maintain. Furthermore, behind-the-meter storage allows commercial and residential customers to reduce their reliance on grid electricity during peak price periods, effectively bypassing the need for CLP's grid services at those times.

Alternative Fuels and Direct Energy Use

The threat of substitutes for CLP Holdings, particularly concerning alternative fuels and direct energy use, presents a nuanced challenge. While grid electricity remains a dominant energy source, advancements in alternative fuels like hydrogen for industrial processes and transportation could gradually erode demand in specific sectors. For instance, the growing adoption of hydrogen fuel cells in heavy-duty trucking, projected to capture a significant market share by 2030, directly competes with electric vehicle charging infrastructure that relies on grid power.

Furthermore, the increasing efficiency and accessibility of direct heat generation technologies, such as solar thermal systems for water and space heating, offer a viable alternative to electric heating solutions. In 2024, the global solar thermal market is expected to see continued growth, driven by government incentives and a desire for energy independence, directly impacting the residential and commercial electricity consumption patterns that CLP serves.

- Hydrogen Fuel Cells: Potential to displace electricity demand in sectors like heavy-duty transport.

- Solar Thermal Systems: Direct substitution for electric heating in residential and commercial buildings.

- Market Trends: Growth in alternative fuel adoption and solar thermal installations indicates a rising substitute threat.

Technological Advancements and Innovation

Technological advancements are a significant threat of substitutes for CLP Holdings. Rapid innovation in energy technologies, such as advanced smart grid solutions and peer-to-peer energy trading platforms, can disrupt the traditional utility model. These innovations allow for new ways of supplying and consuming energy, potentially reducing reliance on established, centralized electricity networks.

For instance, the growth of distributed generation, like rooftop solar, presents a direct substitute for grid-supplied electricity. In 2023, renewable energy sources accounted for approximately 30% of global electricity generation, a figure projected to rise, indicating a growing market share for these substitutes.

- Smart Grid Technologies: Enable more efficient energy distribution and consumption, potentially reducing overall demand from traditional sources.

- Peer-to-Peer Energy Trading: Platforms allow consumers to sell excess energy directly to each other, bypassing utility companies.

- Localized Energy Solutions: Microgrids and battery storage systems offer greater energy independence, reducing reliance on the main grid.

- Renewable Energy Adoption: Increased use of solar, wind, and other renewables as direct substitutes for fossil fuel-based power generation.

The threat of substitutes for CLP Holdings is amplified by the increasing viability of distributed generation and energy efficiency measures. Technologies like rooftop solar and advancements in energy storage, such as battery systems, directly reduce reliance on grid electricity. In 2024, the continued decline in battery costs, with lithium-ion pack prices falling below $130/kWh, makes these alternatives more economically attractive for both consumers and businesses, impacting CLP's traditional revenue streams.

| Substitute Technology | Impact on CLP Holdings | Key Data Point (2023/2024) |

|---|---|---|

| Distributed Generation (e.g., Rooftop Solar) | Reduces demand for grid electricity, erodes market share. | Global solar PV capacity additions reached 307 GW in 2023. |

| Energy Storage Systems (e.g., Batteries) | Can replace peaking power plants and reduce peak demand charges. | Lithium-ion battery pack costs fell to approx. $132/kWh by end of 2023. |

| Energy Efficiency Improvements | Lowers overall electricity consumption, reducing the need for new generation. | Widespread adoption of LED lighting and improved building insulation standards. |

| Alternative Fuels (e.g., Hydrogen) | Displaces electricity demand in specific sectors like heavy transport. | Projected significant market share for hydrogen fuel cells in heavy-duty trucking by 2030. |

Entrants Threaten

The electricity sector, particularly for integrated utilities like CLP Holdings, presents a formidable barrier to new entrants due to its exceptionally high capital intensity. Establishing power generation facilities, extensive transmission networks, and distribution grids demands billions in upfront investment. For instance, in 2024, major infrastructure projects in the energy sector often require capital expenditures exceeding several billion dollars, making it exceedingly difficult for smaller or less capitalized firms to compete.

Stringent regulatory hurdles significantly deter new entrants in the power sector. In Hong Kong, CLP Holdings operates under a Scheme of Control Agreement, effectively creating a near-monopoly that makes market entry exceptionally difficult. For instance, securing the necessary generation, transmission, and distribution licenses, along with environmental permits, involves extensive time and substantial capital investment, often running into hundreds of millions of dollars, creating a formidable barrier.

Established grid infrastructure and significant network effects present a substantial threat to new entrants in the electricity utility sector. CLP Holdings, for instance, benefits from decades of investment in its extensive transmission and distribution networks, which function as natural monopolies.

The sheer cost and complexity of building a parallel grid or securing access to the existing one create formidable barriers. For example, in 2024, the capital expenditure required for new transmission infrastructure alone can run into billions of dollars, making it prohibitively expensive for newcomers to compete in the distribution segment.

Furthermore, the established customer base and the inherent advantages of scale enjoyed by incumbents like CLP create powerful network effects. These effects make it challenging for new entrants to achieve the necessary market penetration and cost efficiencies to be competitive.

Economies of Scale and Experience Curve

Incumbent utilities like CLP Holdings benefit from substantial economies of scale, particularly in generation, procurement, and operational efficiencies. For instance, CLP's extensive network and large-scale power purchase agreements in 2023 allowed for lower per-unit costs compared to a hypothetical new entrant trying to establish similar infrastructure and supply chains from scratch.

New entrants would face a significant hurdle in matching these cost advantages. The experience curve also plays a crucial role; CLP's decades of operational experience translate into optimized processes and reduced waste, further lowering their cost base. A new entrant would lack this accumulated learning, leading to higher initial operating expenses.

- Economies of Scale: CLP's vast infrastructure and purchasing power in 2023 enabled cost efficiencies unavailable to new, smaller-scale operations.

- Experience Curve: Decades of operational learning for CLP translate to optimized processes and lower costs, a significant barrier for new market entrants.

- Capital Intensity: The immense capital required to build new utility infrastructure makes it difficult for potential entrants to compete on cost with established players like CLP.

Access to Fuel and Land Resources

New companies entering the energy sector face significant hurdles in securing essential fuel and land resources. For instance, obtaining long-term, cost-effective natural gas contracts or identifying suitable land for major power generation or renewable energy installations can be a complex and expensive undertaking. Established companies like CLP Holdings often benefit from existing relationships and preferential access to these critical inputs, creating a barrier for newcomers.

The challenge is amplified by the capital-intensive nature of the industry. New entrants may struggle to compete with the financial clout of incumbents who have already made substantial investments in resource acquisition and infrastructure. This disparity in resource access and financial capacity directly impacts the threat of new entrants, making it a considerable force within the energy market.

- Resource Acquisition Costs: New entrants must contend with potentially higher upfront costs for securing fuel supplies and land compared to established players with existing contracts and land banks.

- Established Relationships: Incumbents often possess long-standing relationships with resource suppliers and landowners, granting them priority and better terms.

- Capital Intensity: The significant capital required for resource acquisition and infrastructure development acts as a substantial barrier to entry for less capitalized new firms.

The threat of new entrants for CLP Holdings is considerably low due to the immense capital required to establish power generation and distribution networks, often running into billions of dollars for major projects in 2024.

Stringent regulatory frameworks, such as Hong Kong's Scheme of Control Agreement, create a near-monopoly, demanding extensive licensing and permits that cost hundreds of millions, effectively blocking new players.

CLP's established grid infrastructure, built over decades, represents a significant barrier, as replicating such extensive networks would cost billions in 2024, while securing access is also challenging.

Economies of scale, evident in CLP's 2023 large-scale power purchase agreements, provide cost advantages that new entrants, lacking similar purchasing power and operational experience, cannot easily match.

| Barrier Type | Description | Example Impact for CLP |

|---|---|---|

| Capital Intensity | Requires billions in upfront investment for infrastructure. | New entrants face prohibitive costs to build generation and distribution networks. |

| Regulatory Hurdles | Complex licensing and permits, like Hong Kong's Scheme of Control. | Creates a near-monopoly, making market entry exceptionally difficult. |

| Network Effects & Infrastructure | Established, extensive transmission and distribution grids. | New entrants struggle to achieve scale and cost efficiencies against incumbent infrastructure. |

| Economies of Scale | Lower per-unit costs due to large-scale operations and procurement. | New entrants cannot match the cost advantages of established players like CLP. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CLP Holdings is built upon a foundation of publicly available financial reports, including annual statements and investor presentations. We also incorporate data from industry-specific market research reports and reputable business news outlets to gain a comprehensive understanding of the competitive landscape.