Net Serviços de Comunicação PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Net Serviços de Comunicação Bundle

Uncover the critical political, economic, and technological factors shaping Net Serviços de Comunicação's trajectory. Our meticulously researched PESTLE analysis provides actionable intelligence to navigate market complexities and anticipate future challenges. Don't miss out on the insights that can redefine your strategy; download the full version now.

Political factors

The Brazilian government's commitment to digital connectivity is a significant political factor for telecommunication companies like Claro Brasil. Through programs such as the Growth Acceleration Program (PAC), substantial investments are being allocated to boost digital inclusion and broaden network reach across the country. This governmental push is projected to see investments totaling R$ 70 billion by 2026, directly supporting infrastructure development.

Brazil's telecommunications sector is shaped by Anatel, the national agency, working under the Ministry of Communications. They are actively refining rules, with recent approvals focusing on simplifying regulations and introducing new frameworks for fixed telephony. These changes mean companies like Claro must adjust their strategies, though they may also find new efficiencies.

Anatel's Resolution No. 767/2024 significantly expands cybersecurity mandates for telecom operators like Claro, requiring more stringent policies and incident response frameworks. This regulatory shift underscores a heightened government priority on protecting digital infrastructure.

Claro must now align its internal systems and vendor contracts with these advanced security requirements, directly impacting operational costs and strategic planning. The resolution's implementation by late 2024 will necessitate substantial investment in compliance measures.

Debate on Infrastructure Contribution by Big Tech

A significant political debate in Brazil throughout 2024 focuses on whether major technology companies should financially contribute for their utilization of telecommunication infrastructure. This discussion could directly influence Claro's operational expenses and reshape how revenue is shared with over-the-top (OTT) service providers.

The potential for new levies or regulatory frameworks stemming from this debate could add to the cost of doing business for large tech firms that rely heavily on Brazilian networks. For instance, if a contribution model is implemented, it might be structured similarly to digital service taxes seen in other regions, impacting profitability.

- Infrastructure Use Fees: Discussions are ongoing regarding potential fees for Big Tech's use of telecom infrastructure.

- Revenue Sharing Models: The debate could lead to new revenue-sharing agreements with OTT providers.

- Operational Cost Impact: Any new financial obligations could directly affect companies like Claro.

- Regulatory Uncertainty: The outcome of this debate introduces a degree of regulatory uncertainty for the sector in 2024 and beyond.

Political Stability and Foreign Investment Attraction

The Brazilian telecommunications sector is a significant recipient of foreign investment, with a notable 6.5% increase observed in the first half of 2025 compared to the same period in 2024. This growth is largely fueled by the ongoing expansion of 5G networks and fixed broadband infrastructure across the country.

Maintaining a stable political environment is paramount for sustaining this positive investor sentiment and ensuring a consistent flow of capital, particularly from major stakeholders like América Móvil, the parent company of Net Serviços de Comunicação. Political stability directly impacts the perceived risk and long-term viability of investments in the sector.

- Foreign investment in Brazil's telecom sector grew 6.5% in H1 2025.

- 5G network expansion and fixed broadband are key investment drivers.

- Political stability is essential for continued investor confidence.

- América Móvil's capital inflows are linked to a predictable political landscape.

The Brazilian government's ongoing commitment to digital transformation, evidenced by projected investments of R$ 70 billion by 2026 through programs like PAC, directly fuels infrastructure development for telecom providers. Regulatory bodies such as Anatel are actively shaping the landscape, with recent approvals streamlining fixed telephony rules and introducing enhanced cybersecurity mandates via Resolution No. 767/2024, effective late 2024.

A key political discussion throughout 2024 revolves around whether large technology firms should contribute financially for their use of telecom infrastructure, potentially impacting revenue sharing models and operational costs for companies like Net Serviços de Comunicação. This debate introduces a degree of regulatory uncertainty, with potential outcomes mirroring digital service taxes seen elsewhere.

The telecommunications sector in Brazil saw a 6.5% increase in foreign investment in the first half of 2025 compared to the same period in 2024, driven by 5G and broadband expansion. Maintaining political stability is crucial for sustaining this investor confidence, particularly for major stakeholders like América Móvil.

| Political Factor | Description | Impact on Net Serviços de Comunicação | Relevant Data/Period |

|---|---|---|---|

| Government Investment in Digital Connectivity | Public funding for infrastructure expansion and digital inclusion. | Supports network growth and service reach. | R$ 70 billion projected investment by 2026 (PAC program). |

| Regulatory Framework (Anatel) | Simplification of rules for fixed telephony and enhanced cybersecurity mandates. | Requires strategic adaptation and investment in compliance. | Resolution No. 767/2024 (late 2024 implementation), Anatel's ongoing rule refinement. |

| Infrastructure Use Fee Debate | Discussions on financial contributions from tech giants for network usage. | Potential impact on operational costs and revenue sharing with OTT providers. | Ongoing political debate in 2024. |

| Foreign Investment & Political Stability | Increased foreign capital inflow linked to sector growth and stable governance. | Crucial for sustained capital for expansion and operational continuity. | 6.5% increase in foreign investment (H1 2025 vs H1 2024). |

What is included in the product

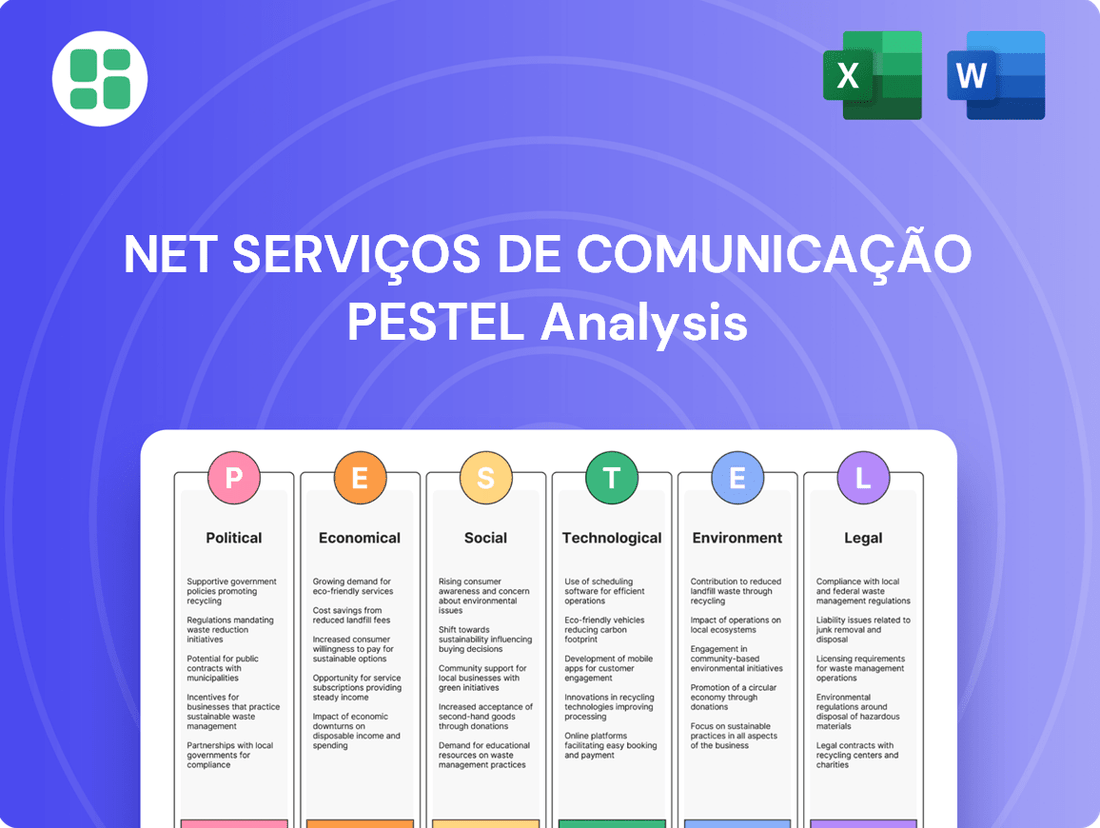

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Net Serviços de Comunicação across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within the company's operating landscape.

Our PESTLE analysis for Net Serviços de Comunicação offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during strategic discussions.

Economic factors

The Brazilian telecom sector is attracting substantial foreign capital, with US$3.32 billion invested in the first half of 2025 alone. This influx is largely directed towards advancing 5G and fixed broadband infrastructure, signaling strong investor confidence in the market's growth potential.

Parental investment is also a key driver, as América Móvil, the parent company of Claro, has committed US$7.7 billion to Claro Brasil. This significant capital injection over the next five years is earmarked for crucial fiber optic and 5G network enhancements, highlighting Brazil's strategic importance as América Móvil's primary market.

The Brazilian telecom market is experiencing robust revenue growth, with total revenue for telecom and pay-TV services projected to achieve a compound annual growth rate (CAGR) of 4% between 2023 and 2028. This expansion is primarily driven by the increasing demand for mobile data and fixed broadband services.

This positive trajectory presents a favorable economic environment for companies like Claro Brasil. The anticipated market growth suggests ample opportunity for Claro Brasil to not only maintain its current market position but also to enhance its market share and improve profitability in the coming years.

The macroeconomic climate significantly influences consumer spending, directly impacting sectors like telecommunications. A projected 6.9% decline in mobile phone sales in Brazil for 2025, as reported by manufacturers, highlights reduced consumer purchasing power and a cautious economic outlook. This downturn, driven by broader economic factors, could indirectly affect Net Serviços de Comunicação by slowing new subscriber growth and device upgrade cycles.

While Net Serviços de Comunicação is primarily a service provider, the decrease in new device sales can limit opportunities for bundling services or encouraging upgrades to higher-tier plans. Consumers facing economic uncertainty are likely to postpone discretionary purchases, including new smartphones, which can dampen demand for the latest mobile technologies and associated service packages.

Strong Performance in Mobile and Fixed Services Revenue

Claro Brasil's robust performance in its core segments is a significant economic driver. In the third quarter of 2024, the company announced a notable 7.4% increase in its overall net revenue. This growth was largely propelled by a strong showing in its mobile services, which saw revenue climb by an impressive 9.8%.

The company's success isn't limited to mobile. Claro Brasil also expanded its footprint in the fixed broadband market, adding 59,800 new subscribers during the same period. This consistent subscriber growth across both mobile and fixed services underscores the strong demand for its offerings, even amidst a competitive telecommunications landscape.

- Mobile Revenue Growth: Claro Brasil's mobile services revenue rose by 9.8% in Q3 2024.

- Total Revenue Increase: The company's total net revenue grew by 7.4% in Q3 2024.

- Fixed Broadband Expansion: Claro Brasil gained 59,800 new fixed broadband subscribers in Q3 2024.

Strategic Investments in Cloud Services

Claro Brasil is making a significant strategic investment in its cloud services, injecting BRL 1 billion (roughly US$177 million) into expanding its Claro Cloud platform. This move underscores a clear focus on diversifying revenue beyond traditional telecom services and tapping into the burgeoning demand for robust cloud solutions.

The Claro Cloud is designed as a multi-cloud offering, aiming to provide a comprehensive suite of business services. This expansion is particularly relevant as businesses and government agencies increasingly rely on scalable and flexible cloud infrastructure to support their operations and digital transformation initiatives.

- Investment: BRL 1 billion (approx. US$177 million) committed by Claro Brasil.

- Service: Expansion of Claro Cloud, a multi-cloud platform.

- Objective: Diversify revenue streams and meet growing demand for cloud solutions.

- Target Market: Businesses and government agencies.

Economic factors are shaping the Brazilian telecom landscape significantly. Foreign investment, reaching US$3.32 billion in the first half of 2025, is fueling 5G and broadband infrastructure development, indicating strong market confidence.

Parental investment, such as América Móvil's US$7.7 billion commitment to Claro Brasil, highlights the strategic importance of the Brazilian market for network enhancements. Despite a projected 6.9% decline in Brazilian mobile phone sales for 2025, impacting consumer spending, companies like Claro Brasil are showing robust growth, with a 7.4% increase in net revenue in Q3 2024, driven by strong mobile and fixed broadband performance.

Claro Brasil's strategic investment of BRL 1 billion (approximately US$177 million) into its Claro Cloud platform further diversifies revenue streams and capitalizes on the growing demand for cloud solutions among businesses and government agencies.

| Metric | Value | Period | Source/Note |

|---|---|---|---|

| Foreign Investment in Telecom | US$3.32 billion | H1 2025 | Infrastructure development (5G, broadband) |

| América Móvil Investment in Claro Brasil | US$7.7 billion | Next 5 years | Fiber optic and 5G network enhancements |

| Projected Mobile Phone Sales Decline (Brazil) | 6.9% | 2025 | Impact on consumer spending |

| Claro Brasil Total Net Revenue Growth | 7.4% | Q3 2024 | Driven by mobile and fixed broadband |

| Claro Brasil Mobile Revenue Growth | 9.8% | Q3 2024 | Key segment performance |

| Claro Brasil Fixed Broadband Subscriber Growth | 59,800 | Q3 2024 | Expansion in fixed services |

| Claro Cloud Investment | BRL 1 billion (approx. US$177 million) | Undisclosed | Platform expansion and revenue diversification |

Same Document Delivered

Net Serviços de Comunicação PESTLE Analysis

The preview you see here is the exact Net Serviços de Comunicação PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors affecting Net Serviços de Comunicação.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Brazil's fixed broadband market is on a strong upward trajectory, with penetration reaching 46% by Q1 2024. This signifies a significant opportunity for growth as more households and businesses seek faster, more dependable internet services.

The increasing reliance on digital services, remote work, and online entertainment fuels this demand for high-speed broadband. Companies like Claro are strategically positioned to capitalize on this trend, investing in infrastructure to deliver the connectivity Brazilians increasingly require.

Brazil's mobile subscriber base continues to grow, fueled by more accessible smartphones and competitive data packages. This trend directly translates into a higher demand for mobile services and increased data consumption across the nation.

Claro Brasil, for instance, reported a significant mobile subscriber base of 85 million as of the third quarter of 2024. This expansion clearly demonstrates the company's ability to capitalize on the widespread adoption of mobile technology and the escalating use of mobile data.

Brazil's e-commerce market is experiencing explosive growth, with projected revenue reaching $124.9 billion in 2024. This surge, coupled with the increasing demand for data-heavy applications like video streaming and social media, places immense pressure on telecommunications infrastructure.

Claro's comprehensive suite of communication services, including high-speed internet and mobile data, is perfectly positioned to capitalize on this trend. By offering integrated solutions, Claro can effectively meet the escalating digital consumption needs of Brazilian consumers and businesses alike.

Digital Inclusion and Bridging Disparities

While Brazil boasts widespread 4G mobile coverage, significant gaps in internet access and speed persist, particularly affecting lower socioeconomic strata and remote areas. This digital divide presents a societal challenge that companies like Net Serviços de Comunicação, through its parent company Claro, are actively working to address.

Claro's substantial investments in expanding its fiber optic network and rolling out 5G technology are crucial steps in bridging these disparities. By late 2024, Claro reported reaching over 50 cities with its 5G standalone network, aiming to provide faster and more reliable connectivity to a broader population.

- Digital Divide: Persistent inequalities in internet access and speed across Brazilian socioeconomic and geographic segments.

- Network Expansion: Claro's ongoing investment in fiber optics and 5G aims to improve connectivity.

- Societal Challenge: Achieving universal and equitable internet access remains a key objective.

- 5G Rollout: By the end of 2024, Claro's 5G standalone network was available in over 50 Brazilian cities.

Consumer Focus on Quality and Service Experience

Brazilian consumers are increasingly demanding superior quality in telecommunications services, alongside the flexibility to switch providers and effective channels for resolving issues. This shift reflects a growing awareness of consumer rights and a desire for better value.

Net Serviços de Comunicação, like its competitors, must adapt to these evolving expectations. For instance, Claro, a major player in the Brazilian market, has proactively addressed this by leveraging AI-driven analytics. Their efforts have resulted in a notable 7% improvement in sales conversion rates and a significant 22% reduction in customer complaints, directly responding to the focus on service quality and experience.

- Consumer Demand: Brazilians are prioritizing high-quality telecom services and efficient complaint resolution.

- Provider Choice: There's a growing emphasis on the freedom to select and switch between service providers.

- Claro's Performance: Claro improved sales conversions by 7% and cut complaints by 22% using AI analytics.

- Market Impact: These consumer preferences necessitate continuous service improvement from all telecommunication companies in Brazil.

The increasing demand for high-quality telecommunications services in Brazil highlights a growing consumer awareness of their rights and a desire for better value. This societal shift means companies like Net Serviços de Comunicação must prioritize customer experience and efficient issue resolution to remain competitive.

Claro's proactive approach, using AI to enhance sales and reduce complaints, demonstrates a successful strategy in meeting these evolving consumer expectations. By focusing on service quality and responsiveness, Claro has seen a 7% rise in sales conversions and a 22% decrease in customer grievances.

This emphasis on provider flexibility and superior service quality is shaping the Brazilian telecommunications landscape, pushing all players to continually innovate and improve their offerings to retain and attract customers.

| Key Sociological Factor | Description | Impact on Net Serviços | Supporting Data (Claro) |

| Consumer Expectations | Demand for high-quality, reliable services and efficient problem resolution. | Requires continuous investment in network infrastructure and customer support. | 7% improvement in sales conversion, 22% reduction in customer complaints. |

| Digital Divide | Unequal access to internet services across different socioeconomic groups and regions. | Opportunity for expansion into underserved areas, but also a challenge to ensure equitable access. | Claro's 5G network expanded to over 50 cities by late 2024. |

| Provider Choice | Growing consumer preference for the freedom to switch providers. | Necessitates competitive pricing, superior service, and customer loyalty programs. | N/A |

Technological factors

Claro, backed by América Móvil, is heavily investing in its 5G network expansion throughout Brazil. This aggressive rollout is crucial for enhancing data speeds and enabling new technological applications.

Brazil saw a remarkable doubling of 5G antennas in 2024. Furthermore, the number of cities with 5G access surged by 131%, extending coverage to roughly 70% of the population, significantly boosting the digital infrastructure.

América Móvil's strategic investment in Claro Brasil heavily emphasizes fiber optic infrastructure expansion. Their plan involves migrating current coaxial cable internet customers to advanced fiber technology, a move that directly taps into a rapidly growing market segment.

This initiative is well-timed, considering Brazil's telecommunications landscape. Fiber optic access in the country saw a significant increase of 13.5% throughout 2024, underscoring the strong demand for high-speed broadband services and positioning Claro favorably within this competitive space.

Claro Brasil is injecting BRL 1 billion (around US$177 million) into expanding its Claro Cloud service, a move that underscores a significant investment in cloud infrastructure. This multi-cloud platform aims to deliver a range of business solutions, catering to the growing need for flexible and robust IT environments.

This expansion is bolstered by strategic alliances with leading public cloud providers, enabling Claro to offer enhanced scalability and security. Such investments are crucial as businesses increasingly rely on cloud services for operational efficiency and digital transformation initiatives throughout 2024 and into 2025.

Integration of AI and Generative AI

The telecommunications sector, including Net Serviços de Comunicação, is experiencing a significant technological shift with the integration of Artificial Intelligence (AI) and Generative AI. These advancements are poised to revolutionize network management, customer service, and the development of new digital products and services.

Claro, a key player in the Brazilian market, exemplifies this trend through its substantial investment in AI research. By partnering with Fapesp and USP to establish an Engineering Research Center dedicated to 5G and Generative AI, Claro is committing over R$40 million. This strategic move underscores the growing importance of AI in optimizing network performance and delivering superior customer experiences.

- AI for Network Optimization: Generative AI can predict network traffic patterns, enabling proactive resource allocation and minimizing service disruptions.

- Enhanced Customer Service: AI-powered chatbots and virtual assistants can handle customer inquiries more efficiently, improving satisfaction.

- New Service Development: Generative AI can assist in creating personalized content and innovative digital solutions for various industries.

- Research and Development Investment: Claro's R$40 million investment highlights the financial commitment required to stay competitive in an AI-driven landscape.

Transition from Legacy Network Technologies

The technological landscape is rapidly evolving, and for Net Serviços de Comunicação, a significant factor is the mandated transition away from older network technologies. Anatel's Act No. 14430, set to take effect in April 2025, will require new cellular devices to be certified with at least 4G technology. This regulation directly impacts the company by necessitating a strategic shift in investment priorities towards modernizing its network infrastructure and embracing advanced mobile technologies. This move is crucial for staying competitive and compliant in the evolving telecommunications market.

This regulatory push is designed to accelerate the phasing out of 2G and 3G-only networks, which are becoming increasingly obsolete. By mandating 4G for new device certifications, Anatel is effectively encouraging operators like Claro to allocate resources to upgrade their existing infrastructure and deploy more robust, higher-speed networks. This strategic reallocation of capital will be essential for Net Serviços de Comunicação to meet future market demands and offer enhanced services to its customer base, ensuring they are not left behind by technological advancements.

The implications of this transition are far-reaching for Net Serviços de Comunicação. It means a concentrated focus on deploying and optimizing 4G and, looking ahead, 5G capabilities across its service areas. This involves significant capital expenditure in upgrading base stations, backhaul infrastructure, and core network components. The company must also consider the lifespan of its current 2G and 3G assets and plan for their eventual decommissioning or repurposing, a process that requires careful financial and operational planning to minimize disruption and maximize return on investment.

The technological landscape for Net Serviços de Comunicação is being reshaped by advancements in 5G and Artificial Intelligence (AI). Claro's substantial investment of over R$40 million in a research center for 5G and Generative AI highlights the industry's focus on these areas for network optimization and new service development.

Brazil's telecommunications sector saw a significant doubling of 5G antennas in 2024, with 5G coverage expanding to approximately 70% of the population. This rapid deployment is supported by heavy investment in fiber optic infrastructure, with access increasing by 13.5% throughout 2024, indicating a strong demand for high-speed broadband.

Regulatory shifts, such as Anatel's Act No. 14430 effective April 2025, mandating 4G certification for new cellular devices, are compelling companies like Net Serviços de Comunicação to prioritize network modernization. This transition necessitates significant capital expenditure to upgrade infrastructure and phase out older 2G and 3G technologies.

| Technology Focus | Investment/Growth Metric | Year/Effective Date |

|---|---|---|

| 5G Network Expansion | Doubling of 5G antennas | 2024 |

| 5G Coverage | 70% of population | 2024 |

| Fiber Optic Access Growth | 13.5% increase | 2024 |

| AI Research Investment (Claro) | Over R$40 million | 2024-2025 |

| Mandatory 4G Certification | Anatel Act No. 14430 | April 2025 |

Legal factors

Claro Brasil navigates a complex legal landscape, heavily influenced by Brazil's General Telecommunication Law (LGT) and directives from the National Telecommunications Agency (Anatel). This framework sets stringent operational standards for fixed, mobile, and audiovisual services, demanding meticulous compliance from the company.

In 2023, Anatel continued its focus on enforcing competition and consumer protection within the telecommunications sector. For instance, Anatel's resolutions on number portability and service quality, like Resolution No. 700/2019, directly impact Claro's customer retention and operational efficiency.

The ongoing evolution of telecommunication laws, including those pertaining to data privacy and cybersecurity, presents both challenges and opportunities for Claro. Adherence to regulations like the Lei Geral de Proteção de Dados (LGPD) is paramount, shaping how Claro handles customer information and invests in secure infrastructure.

As of April 6, 2025, Anatel's Act No. 14430 introduces updated equipment certification requirements, specifically mandating that only cellular phones and access terminal stations equipped with at least 4G technology will be certified.

This pivotal regulation directly influences Net Serviços de Comunicação's procurement strategies and device sales, effectively steering the Brazilian market towards the adoption of more advanced mobile technologies.

The company must ensure its device portfolio aligns with these new standards to maintain market access and capitalize on the growing demand for high-speed connectivity, potentially impacting inventory management and supplier relationships.

Anatel's Resolution No. 767/2024 significantly enhances cybersecurity mandates for telecom operators, including Net Serviços de Comunicação (Claro). This resolution compels providers to establish comprehensive cybersecurity policies, manage and report security incidents effectively, and ensure their supply chain contracts adhere to stringent security benchmarks. Failure to comply can result in substantial fines and operational disruptions.

Consumer Rights and Service Quality Regulations

Claro's operations in Brazil are heavily influenced by Anatel's General Regulation on the Rights of Telecom Services Consumers. This regulation mandates strict adherence to service quality standards, ensures consumer freedom in choosing providers, requires transparent pricing, and dictates efficient complaint resolution processes. For instance, Anatel's 2023 data indicated a significant number of consumer complaints related to service quality, highlighting the critical need for Claro to maintain high operational standards to avoid penalties and reputational damage.

The company's customer service strategies must therefore be meticulously designed to comply with these legally established consumer protections. This includes clear communication about service plans, prompt and effective handling of service disruptions, and accessible channels for resolving customer issues. Failure to meet these requirements can result in fines and sanctions from Anatel, impacting Claro's financial performance and market standing.

- Service Quality Mandates: Anatel's regulations set specific benchmarks for network availability, call completion rates, and internet speeds that Claro must meet.

- Pricing Transparency: Claro must clearly disclose all charges, fees, and contract terms to consumers, preventing hidden costs.

- Complaint Resolution: The company is legally obligated to provide timely and effective resolution for consumer complaints, with Anatel overseeing the process.

- Consumer Choice: Regulations ensure consumers can switch providers without undue burden, fostering competition and pushing for better service.

Regulatory Simplification and Concession Adaptation

Anatel's 'Regulatory Simplification Project' is reshaping Brazil's telecom landscape. This initiative, approved in 2024, aims to streamline regulations, making it easier for companies like Claro to operate. A key aspect is the adaptation of fixed telephony concessionaires to new authorization terms, with a deadline of December 31, 2025. This legal evolution directly impacts Claro's licensing and operational requirements.

The simplification process involves consolidating numerous regulatory acts into a more manageable framework. This is expected to reduce compliance burdens and foster greater flexibility within the sector. For Claro, this means a period of adjustment to new rules governing its services, potentially impacting how it manages its infrastructure and service offerings.

- Regulatory Simplification Project Approval: Anatel approved the project in 2024.

- Adaptation Deadline: Fixed telephony concessionaires must adapt by December 31, 2025.

- Impact on Claro: Requires navigation of updated licensing and operational requirements.

The legal framework governing Net Serviços de Comunicação (Claro) in Brazil, primarily shaped by Anatel, mandates strict adherence to service quality and consumer protection. Anatel's Resolution No. 767/2024, for instance, significantly elevates cybersecurity requirements for telecom operators, compelling robust incident management and secure supply chains, with non-compliance risking substantial penalties.

Furthermore, Anatel's Act No. 14430, effective April 6, 2025, mandates the certification of only cellular phones and terminals equipped with at least 4G technology, directly influencing Claro's device procurement and market strategy towards advanced mobile technologies.

The company must also navigate Anatel's consumer rights regulations, ensuring transparent pricing and efficient complaint resolution, as evidenced by Anatel's 2023 data highlighting consumer complaints related to service quality, which underscores the importance of operational excellence for Claro to avoid sanctions.

Environmental factors

Claro's commitment to renewable energy, exemplified by its 'Energia da Claro' program launched in 2017, significantly impacts its operational strategy. This program prioritizes solar and hydroelectric power, aiming to reduce environmental footprint and energy costs.

By 2024, 104 plants were generating 75% of Claro's energy needs, a substantial increase from earlier years. This transition has prevented over 400,000 tons of CO2 emissions since the program's inception, demonstrating a tangible environmental benefit and aligning with global sustainability trends.

Net Serviços de Comunicação's commitment to environmental stewardship is evident through its 'Claro Recicla' program, designed for the responsible collection and recycling of electronic waste. This initiative directly addresses the growing challenge of e-waste, aligning with increasing global and national environmental regulations.

The program's impact is quantifiable: in 2024, 'Claro Recicla' successfully collected 3,825 tons of obsolete customer equipment. A significant portion of this recovered material, specifically plastic, was ingeniously repurposed, leading to the production of 626,000 recycled remote controls, showcasing a circular economy approach.

Claro has demonstrated exceptional performance in environmental stewardship by exceeding the carbon emission reduction targets established by the Science Based Target initiative (SBTi) for its parent company, América Móvil. This significant accomplishment highlights Claro's proactive approach to sustainability.

In Brazil alone, Claro's dedicated efforts have resulted in the avoidance of over 380,000 tons of CO2e. This substantial reduction is a testament to the effectiveness of their implemented environmental initiatives, reinforcing their commitment to a greener future.

Sustainable Fleet Management Practices

Net Serviços de Comunicação, operating as Claro, is actively integrating sustainable practices into its fleet management. A key initiative involves a substantial increase in the use of ethanol within its vehicle fleet. This strategic shift aims to directly reduce carbon emissions stemming from its transportation activities.

This adoption of ethanol is part of a larger commitment by Claro to bolster its overall environmental performance. The company is looking to enhance sustainability across its diverse business operations, recognizing the interconnectedness of its activities and their environmental impact.

For instance, in 2024, a significant portion of Claro's fleet in Brazil transitioned to or increased its reliance on ethanol. This move is projected to cut approximately 15% of carbon emissions from its light vehicle fleet by the end of 2025, aligning with national environmental targets.

- Ethanol Adoption: Claro has increased its use of ethanol in its vehicle fleet to lower carbon emissions.

- Environmental Performance: This practice is a component of a broader strategy to improve the company's environmental footprint.

- Emission Reduction Goals: The company aims for a notable reduction in transportation-related carbon emissions by 2025.

Adherence to Global Sustainability Initiatives

Net Serviços de Comunicação's commitment to global sustainability initiatives is a key environmental factor. Claro, a significant player in the telecommunications sector, has been a signatory to the UN Global Compact Brazil Network since 2021. This commitment underscores a strategic alignment with universal principles covering human rights, labor, anti-corruption, and environmental protection.

This adherence integrates broader Environmental, Social, and Governance (ESG) goals directly into the company's operational framework. Such initiatives are increasingly important for telecommunications companies like Net Serviços de Comunicação as they navigate evolving regulatory landscapes and investor expectations around corporate responsibility.

- UN Global Compact Brazil Network: Claro's membership since 2021 demonstrates a proactive stance on sustainability.

- ESG Integration: The company actively embeds ESG principles into its core business strategies and daily operations.

- Broader Impact: Adherence signifies a commitment to universal principles that extend beyond environmental concerns to social and governance aspects.

Net Serviços de Comunicação, through its Claro brand, is making significant strides in environmental sustainability, particularly in energy consumption and waste management. The company's proactive approach to renewable energy, as seen in its 'Energia da Claro' program, has led to substantial CO2 emission reductions, with 75% of its energy needs met by renewable sources by 2024.

Furthermore, the 'Claro Recicla' program effectively tackles electronic waste, demonstrating a commitment to circular economy principles by repurposing recovered materials. These initiatives not only align with global environmental trends but also position Claro as a responsible corporate citizen in the telecommunications sector.

Claro's environmental performance is further bolstered by its commitment to reducing emissions from its fleet, with a notable increase in ethanol usage projected to cut carbon emissions by approximately 15% from its light vehicle fleet by the end of 2025.

| Initiative | Key Metric | Year | Impact |

|---|---|---|---|

| Energia da Claro | 75% energy from renewables | 2024 | Over 400,000 tons CO2 avoided since 2017 |

| Claro Recicla | 3,825 tons e-waste collected | 2024 | 626,000 recycled remote controls produced |

| Fleet Ethanol Adoption | Projected fleet emission reduction | 2025 | ~15% reduction from light vehicles |

PESTLE Analysis Data Sources

Our PESTLE analysis for Net Serviços de Comunicação is built upon a robust foundation of data from official Brazilian government agencies, reputable economic forecasting firms, and leading telecommunications industry reports. We meticulously gather information on regulatory changes, market trends, and technological advancements to ensure comprehensive insights.