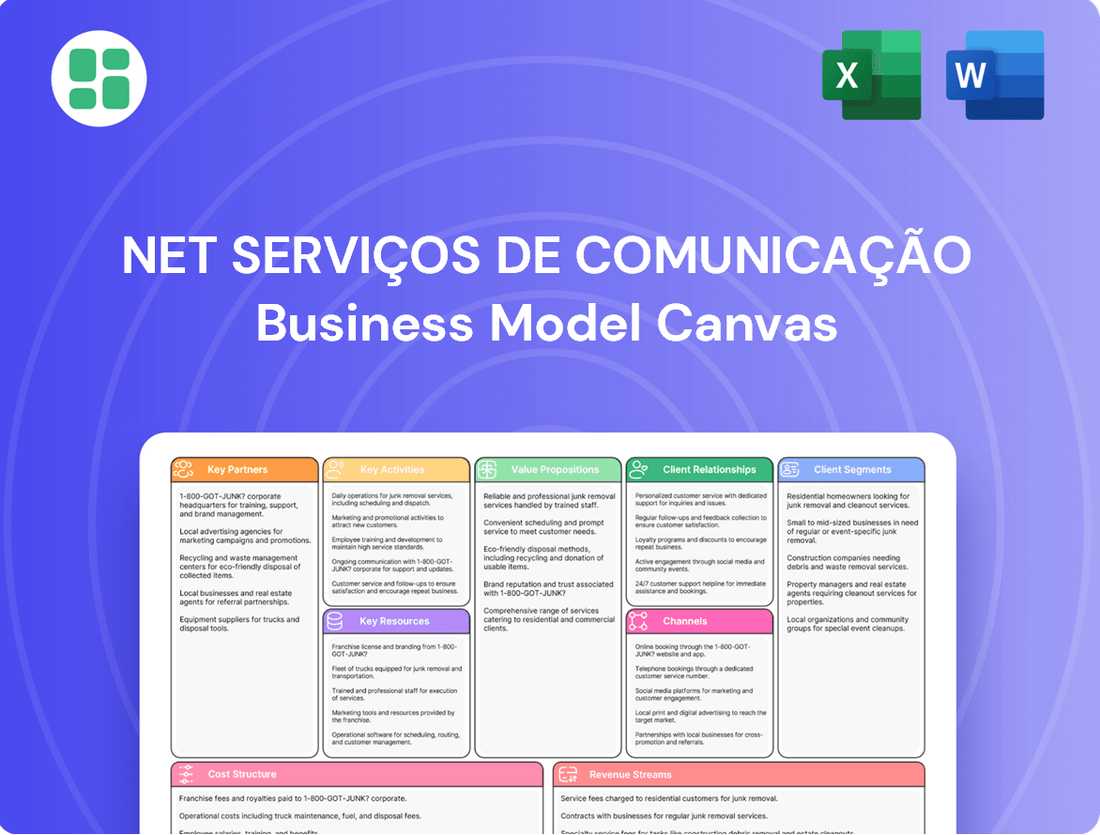

Net Serviços de Comunicação Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Net Serviços de Comunicação Bundle

Curious about how Net Serviços de Comunicação masters its market? This Business Model Canvas showcases their customer relationships, revenue streams, and key resources that drive their success. Discover the strategic framework that makes them a leader.

Partnerships

Claro Brasil's operations are deeply intertwined with technology and infrastructure providers. These partnerships are critical for sourcing advanced network equipment, software, and hardware necessary to build and maintain their telecommunications services. Companies providing 5G and fiber optic infrastructure are key collaborators.

The company's commitment to a cutting-edge network and expanded coverage hinges on these strategic alliances. For instance, Claro Brasil has been actively investing in the rollout of fiber optic networks and the deployment of 5G technology, directly benefiting from the innovations and capabilities of its technology partners. These investments are crucial for staying competitive in the rapidly evolving telecommunications landscape.

Claro, as part of Net Serviços de Comunicação, strategically partners with a wide array of content and media companies to build its comprehensive pay-TV and entertainment offerings. These collaborations are essential for curating a diverse and engaging content library, which is a primary driver for attracting and retaining subscribers in the competitive telecommunications market.

These partnerships are fundamental to Claro's strategy, enabling them to secure rights for popular movies, series, live sports, and exclusive programming. For instance, in 2024, the demand for high-quality, on-demand content continued to surge, making these content alliances more critical than ever for maintaining subscriber loyalty and attracting new customers seeking premium entertainment experiences.

Collaborations with governmental agencies, such as Brazil's National Telecommunications Agency (Anatel), are fundamental for Net Serviços de Comunicação. These partnerships are crucial for navigating regulatory compliance, securing essential spectrum licenses, and participating in significant national infrastructure development initiatives. For instance, Anatel's role in auctioning 5G spectrum directly impacts Claro's ability to expand its high-capacity network offerings.

These collaborations ensure that Claro operates within the established legal and operational frameworks, thereby fostering trust and stability. Furthermore, by aligning with national connectivity objectives, such as the expansion of high-capacity networks to underserved regions, Net Serviços de Comunicação demonstrates its commitment to contributing to Brazil's digital inclusion and economic growth.

Business-to-Business (B2B) Solution Partners

For its corporate clients, Net Serviços de Comunicação, through its Embratel and Claro brands, actively cultivates key partnerships with leading cloud service providers and IT solution firms. These collaborations are crucial for delivering comprehensive, integrated business services, allowing them to offer more than just connectivity.

These alliances extend to major public cloud players, including Amazon Web Services (AWS), Oracle, and Huawei. By integrating with these giants, Net Serviços enhances its portfolio, particularly in critical areas like Software-Defined Wide Area Networking (SD-WAN) and advanced security services, providing businesses with robust and flexible digital infrastructure solutions.

- Cloud Integration: Partnerships with AWS, Oracle, and Huawei enable seamless integration of cloud services, offering businesses scalable and reliable IT resources.

- Enhanced Connectivity Solutions: Collaborations bolster offerings in SD-WAN, providing businesses with optimized and secure network management across multiple locations.

- IT Solution Providers: Aligning with IT solution companies allows for the delivery of specialized services like cybersecurity, data analytics, and managed IT, creating a one-stop shop for corporate digital transformation.

IoT and Digital Advertising Partners

Claro is actively forging partnerships in cutting-edge areas like the Internet of Things (IoT) and digital advertising. These collaborations are designed to unlock fresh revenue opportunities and significantly improve how customers interact with their services.

A prime illustration of this strategy is Claro's decade-long agreement with ICARO Media Group and RioVerde. This partnership focuses on generating revenue by leveraging digital advertising space across all of Claro's diverse platforms.

These strategic alliances are crucial for Claro's ongoing expansion and its commitment to offering innovative, digitally-driven solutions. By integrating with IoT and digital advertising ecosystems, Claro aims to stay ahead in a rapidly evolving telecommunications landscape.

- IoT and Digital Advertising Focus: Claro is expanding its partnerships in emerging technologies like IoT and digital advertising to create new revenue streams and enhance customer experiences.

- Key Partnership Example: A significant partnership involves a 10-year contract with ICARO Media Group and RioVerde to monetize digital advertising inventory across Claro's platforms.

- Strategic Objective: These collaborations are aimed at driving revenue growth and improving customer engagement through innovative digital solutions.

Net Serviços de Comunicação, operating as Claro Brasil, relies heavily on partnerships with technology and infrastructure providers to maintain its competitive edge. These alliances are vital for acquiring advanced network equipment and software, particularly for its ongoing 5G and fiber optic network expansions. In 2024, continued investment in these areas underscored the critical role of technology partners in delivering high-speed connectivity.

The company also strategically partners with a broad spectrum of content and media firms to enrich its pay-TV and entertainment services. These collaborations are essential for curating a diverse content library, which is a key differentiator in attracting and retaining subscribers. The demand for premium content, including exclusive sports and on-demand series, remained a significant driver for these partnerships throughout 2024.

Furthermore, Net Serviços engages with governmental bodies like Anatel for regulatory compliance and spectrum acquisition, crucial for its network development strategies. For its business clients, partnerships with major cloud providers such as AWS and Oracle, alongside IT solution firms, are integral to offering comprehensive digital transformation services, including advanced SD-WAN and cybersecurity solutions.

| Partner Type | Key Collaborators | Strategic Importance | 2024 Impact/Focus |

|---|---|---|---|

| Technology & Infrastructure | Network Equipment Suppliers, 5G/Fiber Providers | Network build-out and maintenance | Facilitated 5G spectrum deployment and fiber expansion |

| Content & Media | Movie studios, Sports broadcasters, Streaming services | Enriching pay-TV and entertainment offerings | Secured rights for popular content, driving subscriber retention |

| Cloud & IT Solutions | AWS, Oracle, Huawei, IT Service Firms | Delivering integrated business services (SD-WAN, security) | Enhanced corporate offerings with cloud integration and cybersecurity |

| Regulatory | Anatel (National Telecommunications Agency) | Navigating regulations, securing licenses | Enabled participation in 5G spectrum auctions |

What is included in the product

This Net Serviços de Comunicação Business Model Canvas outlines a strategy focused on delivering integrated telecommunications solutions, leveraging a multi-channel approach to reach diverse customer segments.

Net Serviços de Comunicação's Business Model Canvas offers a clear, structured approach to identifying and addressing customer pains in the telecommunications sector.

It provides a visual roadmap for understanding and alleviating customer frustrations, ensuring Net Serviços de Comunicação delivers effective solutions.

Activities

Net Serviços de Comunicação's key activities heavily revolve around the continuous development and upkeep of its network infrastructure. This includes significant, ongoing investments to expand its mobile capabilities, particularly with the rollout and enhancement of 4G and 5G technologies across Brazil. Simultaneously, the company prioritizes the growth of its fixed-line network, focusing on fiber optic deployment to offer high-speed broadband services.

A crucial aspect of this is building and maintaining extensive, high-capacity telecommunications transport networks. These are the backbone of their service delivery, ensuring data can move efficiently and reliably. Upgrading existing infrastructure is also paramount, guaranteeing that customers experience dependable connectivity, which is vital in today's data-driven world.

In 2024, Claro, a major player in the Brazilian telecom market and a relevant benchmark for Net Serviços, reported substantial capital expenditures aimed at network expansion and modernization. For instance, the company continued its 5G deployment, reaching numerous cities and increasing its spectrum availability. These investments are essential for maintaining a competitive edge and meeting the ever-growing demand for data and connectivity.

Claro's primary focus is on providing and managing its extensive range of telecommunications services, encompassing mobile and fixed telephony, high-speed broadband internet, and pay-television. This core activity is crucial for maintaining its market position and customer satisfaction.

Managing service quality and ensuring consistent uptime are paramount. Claro actively works on service activations, deactivations, and troubleshooting to guarantee a seamless experience for its millions of subscribers across Brazil.

In 2024, Claro continued to invest heavily in network infrastructure, aiming to enhance service delivery and expand coverage. The company reported a significant increase in broadband subscribers, underscoring the importance of reliable internet service provision.

Net Serviços de Comunicação, operating as Claro, actively pursues customer acquisition through targeted marketing and sales initiatives across multiple channels. This includes promotions designed to attract new postpaid subscribers, a key focus for growth.

Retention efforts are equally vital, employing loyalty programs and emphasizing service quality to minimize customer churn. In 2024, Claro continued to refine these strategies to maintain a strong subscriber base in a competitive telecommunications market.

Billing and Revenue Management

Net Serviços de Comunicação's billing and revenue management is a core function, ensuring accurate invoicing for services rendered and timely collection of payments. This process directly impacts the company's cash flow and overall financial stability.

In 2024, telecommunication companies like Net Serviços often leverage sophisticated billing systems to handle the complexity of various service plans, data usage, and bundled offerings. For instance, a significant portion of revenue for such companies is derived from recurring monthly subscriptions, making efficient billing crucial.

- Accurate Invoicing: Generating precise bills based on service consumption and contracted plans.

- Payment Processing: Facilitating secure and convenient payment methods for customers.

- Revenue Collection: Implementing strategies to minimize outstanding accounts and maximize cash inflow.

- Financial Tracking: Maintaining detailed records of all transactions for reporting and analysis.

Research and Development (R&D) and Innovation

Net Serviços de Comunicação's key activities heavily rely on robust Research and Development (R&D) and a commitment to innovation to maintain its market edge. This involves significant investment in cutting-edge technologies, including the ongoing rollout of 5G infrastructure and the exploration of Generative AI applications. By focusing on these advancements, Net Serviços de Comunicação aims to create and deliver novel products and services that meet evolving customer demands and differentiate them from competitors.

Claro, a key player within the telecommunications sector and a relevant comparison point for Net Serviços de Comunicação's strategic direction, demonstrates this commitment through active participation in industry-shaping initiatives. For instance, Claro is involved in establishing an Engineering Research Center dedicated to pioneering advanced technologies. This strategic move underscores the importance of R&D in driving future growth and maintaining technological leadership.

- Investment in Future Technologies: Net Serviços de Comunicação prioritizes capital allocation towards emerging technologies like 5G and Generative AI to ensure its service portfolio remains state-of-the-art.

- Product and Service Innovation: The company's R&D efforts are geared towards developing and launching innovative offerings that enhance customer experience and create new revenue streams.

- Collaborative Research Initiatives: Participating in centers like the one Claro is involved with allows for shared expertise and accelerated development of advanced technological solutions.

- Competitive Advantage through R&D: Continuous innovation is essential for Net Serviços de Comunicação to stay ahead in the dynamic telecommunications market, fostering customer loyalty and attracting new subscribers.

Net Serviços de Comunicação's key activities center on managing and enhancing its extensive telecommunications network. This includes the continuous deployment of 5G and fiber optic technologies to expand coverage and improve service quality. The company also focuses on providing a comprehensive suite of services, from mobile and fixed telephony to high-speed broadband and pay-TV.

A significant portion of their efforts involves customer acquisition and retention, utilizing targeted marketing and loyalty programs to grow and maintain their subscriber base. Furthermore, efficient billing and revenue management are critical for financial health, ensuring accurate invoicing and timely payment collection.

The company actively invests in Research and Development, particularly in areas like 5G and Generative AI, to foster innovation and maintain a competitive edge. This commitment to technological advancement is crucial for developing new services and enhancing the overall customer experience in the dynamic telecom market.

What You See Is What You Get

Business Model Canvas

The Net Serviços de Comunicação Business Model Canvas you see here is the actual document you will receive upon purchase. This preview offers a direct glimpse into the comprehensive structure and content, ensuring you know exactly what you're getting. Once your order is complete, you'll gain full access to this identical, ready-to-use business model canvas.

Resources

Claro's extensive network infrastructure is its backbone, encompassing a vast array of physical assets like fiber optic cables, cellular base stations, satellites, and data centers. This robust foundation is crucial for delivering its wide range of telecommunication and entertainment services.

The company consistently invests in expanding and upgrading this infrastructure. For instance, in 2024, Claro continued its significant capital expenditures focused on enhancing its 5G capabilities and broadening its fiber optic network reach across its operating regions.

Spectrum licenses are the bedrock of Claro's mobile and broadband operations, granting essential access to radio frequencies for wireless communication. These licenses are not just permits; they are the conduits through which Claro delivers its core services to millions of customers.

Acquiring these vital rights involves participation in government-regulated auctions, a process that demands significant capital investment and strategic foresight. For instance, in 2024, Brazil's National Telecommunications Agency (Anatel) continued its spectrum allocation efforts, with operators like Claro actively participating to secure and expand their frequency holdings for 5G and future technologies.

The Claro brand, a flagship of Net Serviços de Comunicação, enjoys high recognition and strong customer trust in Brazil, a critical asset for market share. This established reputation directly translates into a significant competitive advantage.

Net Serviços de Comunicação's extensive customer base, spanning mobile, fixed-line, and pay-TV services, provides a robust foundation for ongoing revenue generation. In 2024, Claro Brazil reported approximately 80 million mobile subscribers, underscoring the scale of its reach and the potential for cross-selling and upselling opportunities.

Human Capital and Expertise

Human capital and expertise are the bedrock of Net Serviços de Comunicação's operations. A highly skilled workforce, encompassing engineers, technicians, sales, and customer service professionals, is crucial for navigating the intricate telecommunications landscape and driving innovation.

Claro, a significant player in the market, fosters a robust employee culture, connecting its over 33,000 individuals. This emphasis on people ensures the effective delivery of services and the development of new offerings.

- Skilled Workforce: Engineers, technicians, sales, and customer service personnel are essential for operational excellence and innovation in telecommunications.

- Employee Engagement: Claro's focus on a strong culture and employee connection across its more than 33,000 individuals underpins its service delivery and growth.

Data Centers and IT Systems

Data centers and IT systems are the backbone of Net Serviços de Comunicação's operations, enabling the seamless management of its extensive network, customer information, and billing processes. These sophisticated infrastructures are also vital for delivering digital services and supporting cloud offerings, which are increasingly important revenue streams.

Claro, a key player in the telecommunications sector, is actively investing in its local cloud platform. This strategic move aims to bolster its data center capabilities and IT systems, ensuring they can handle growing demands for data processing, storage, and advanced digital services. For instance, by mid-2024, Claro had announced significant upgrades to its cloud infrastructure, focusing on enhanced security and scalability to meet the evolving needs of its enterprise and consumer clients.

- Critical Infrastructure: Sophisticated data centers and robust IT systems are essential for managing network operations, customer data, billing, and supporting digital and cloud services.

- Strategic Investment: Claro is expanding its local cloud platform to enhance these critical capabilities, underscoring the importance of IT infrastructure for future growth.

- Market Impact: Investments in data center expansion and IT system upgrades directly support the delivery of competitive digital services and cloud solutions in the telecommunications market.

Net Serviços de Comunicação's key resources include its extensive physical network infrastructure, such as fiber optic cables and cellular base stations, which are vital for service delivery. The company also relies on crucial spectrum licenses, obtained through strategic government auctions, to operate its wireless services. A strong brand reputation and a large, loyal customer base, numbering around 80 million mobile subscribers in Brazil as of 2024, are significant intangible assets.

Furthermore, Net Serviços de Comunicação leverages its highly skilled workforce of over 33,000 employees, whose expertise is critical for innovation and operational efficiency. Finally, its sophisticated data centers and IT systems, bolstered by ongoing investments in cloud platforms, form the technological backbone supporting all its digital and telecommunications offerings.

| Key Resource | Description | 2024 Data/Context |

|---|---|---|

| Network Infrastructure | Physical assets like fiber optics and base stations | Continued CAPEX for 5G and fiber expansion |

| Spectrum Licenses | Rights to radio frequencies for wireless communication | Active participation in Anatel spectrum auctions |

| Brand & Customer Base | High recognition, trust, and ~80M mobile subscribers | Foundation for revenue and cross-selling |

| Human Capital | Skilled workforce of over 33,000 employees | Essential for service delivery and innovation |

| Data Centers & IT Systems | Manage network, customer data, and digital services | Upgrades to cloud platform for security and scalability |

Value Propositions

Claro's comprehensive convergent services, a cornerstone of its business model, bundle mobile, fixed telephony, broadband internet, and pay-TV. This integration offers customers unparalleled convenience and the potential for significant cost savings by consolidating multiple essential services with a single provider.

In 2024, this strategy proved particularly effective as consumers increasingly sought streamlined digital experiences. Claro's bundled offerings directly address this demand, making it easier for households to manage their communication and entertainment needs efficiently.

Claro's investment in 5G technology and its expansive fiber optic network are central to its value proposition of high-speed and reliable connectivity. By deploying these advanced infrastructures, the company ensures customers receive fast and stable internet and mobile services.

This robust infrastructure directly translates to a superior user experience, especially for demanding activities like streaming, online gaming, and video conferencing. In 2024, Claro continued to expand its 5G coverage across Brazil, aiming to reach more urban and suburban areas, further solidifying its commitment to cutting-edge connectivity.

Claro, through its extensive pay-TV services and strategic content alliances, offers a rich tapestry of entertainment. This includes a vast selection of live channels, blockbuster movies, and a growing library of on-demand content, ensuring there's something for every taste and preference.

This diverse content portfolio significantly boosts the value proposition for Claro's residential customers. For instance, in 2024, the Brazilian pay-TV market saw continued demand for bundled entertainment packages, with operators like Claro leveraging their content libraries to retain subscribers amidst competition.

Tailored Corporate Solutions (Embratel)

Embratel, a key part of Claro's B2B strategy, provides businesses with highly customized connectivity, IT, and cloud services. These solutions are built to be scalable, ensuring they can grow with a company's evolving demands. For example, Embratel's focus on advanced networking like SD-WAN helps businesses optimize their wide area networks for better performance and cost efficiency.

The value proposition extends to a comprehensive suite of services catering to intricate corporate requirements. This includes robust satellite communication options for remote or challenging locations, alongside critical security services to protect sensitive business data. In 2024, Embratel continued to invest heavily in its fiber optic network, aiming to deliver higher bandwidth and lower latency for its enterprise clients, a crucial factor for digital transformation initiatives.

- Specialized Connectivity: Offering tailored solutions like SD-WAN and satellite to meet diverse business needs.

- Integrated IT & Cloud: Providing scalable IT infrastructure and cloud services designed for corporate environments.

- Security Focus: Delivering advanced security services to safeguard corporate assets and data.

- Network Enhancement: Continued investment in 2024 to expand fiber optic reach and improve service quality for businesses.

Competitive Pricing and Flexibility

Claro, a key player in Brazil's telecommunications sector, actively pursues competitive pricing strategies. This includes a diverse array of prepaid and postpaid mobile plans, alongside bundled service packages designed to cater to a wide spectrum of consumer financial capacities and communication habits. For instance, in the first quarter of 2024, Claro Brazil reported a significant increase in its customer base, partly attributed to its aggressive pricing and promotional offers across its mobile and broadband segments.

The company's approach emphasizes flexibility, aiming to capture a broad market share by offering value that aligns with customer needs. This strategy is evident in their tiered data plans and family sharing options, which allow users to customize their services. By balancing cost-effectiveness with the inclusion of premium features like higher data allowances and access to exclusive content, Claro seeks to differentiate itself in a highly competitive market. This focus on adaptable pricing models has been a cornerstone of their growth strategy throughout 2024.

- Competitive Pricing: Claro offers various prepaid and postpaid plans, including bundled packages.

- Market Segmentation: Plans are designed to suit different customer budgets and usage patterns.

- Flexibility Focus: The company aims to attract a broad market by balancing cost with premium features.

- 2024 Performance: Aggressive pricing contributed to customer base growth in early 2024.

Net Serviços de Comunicação's value proposition centers on delivering integrated telecommunications solutions. They offer a comprehensive bundle of mobile, fixed-line, broadband internet, and pay-TV services, providing customers with convenience and potential cost savings by consolidating multiple essential needs with a single provider.

This strategy proved particularly effective in 2024, as consumers increasingly sought streamlined digital experiences. Net Serviços de Comunicação's bundled offerings directly address this demand, simplifying how households manage their communication and entertainment.

Furthermore, the company's investment in advanced infrastructure, including 5G technology and an expansive fiber optic network, guarantees high-speed and reliable connectivity. This robust infrastructure ensures customers receive fast and stable internet and mobile services, enhancing their overall user experience.

For businesses, Net Serviços de Comunicação, through its specialized offerings, provides tailored connectivity, IT, and cloud services designed for scalability and corporate needs. This includes robust security features to protect sensitive data, making them a reliable partner for complex enterprise requirements.

Customer Relationships

Claro, a major player in Brazil's telecom sector, offers multi-channel customer support through its extensive network. This includes dedicated call centers, user-friendly online portals, and a widespread presence of physical retail stores across the country.

This multi-pronged approach ensures customers can easily reach out for inquiries, technical assistance, or to manage their services, catering to diverse preferences and accessibility needs. In 2023, Claro reported serving over 90 million active mobile lines in Brazil, highlighting the sheer volume of customer interactions managed through these channels.

Net Serviços de Comunicação prioritizes self-service digital platforms, investing in intuitive mobile apps and web portals. These tools empower customers to independently manage accounts, monitor usage, settle bills, and resolve common issues, significantly boosting convenience and operational efficiency.

Claro, a major player in the Brazilian telecommunications market, focuses on fostering customer loyalty through tailored offers and rewards. By analyzing individual usage data, they deliver personalized promotions and discounts, aiming to keep existing customers engaged and encourage them to explore higher-tier services. This approach is crucial in a competitive landscape where customer retention is key to sustained growth.

Community Engagement and Social Media Presence

Claro actively engages customers across social media and online forums, transforming these spaces into vital hubs for feedback, rapid issue resolution, and building a strong community. This direct interaction helps foster loyalty and a sense of belonging among users.

- Social Media Reach: As of early 2024, Claro maintained a significant presence on platforms like Facebook, Instagram, and X (formerly Twitter), with millions of followers across its regional operations, facilitating broad communication and engagement.

- Customer Support Efficiency: By leveraging social media for customer service, Claro aims to reduce response times, with many inquiries being addressed within hours, improving overall customer satisfaction.

- Information Dissemination: These digital channels are crucial for announcing new services, promotions, and network updates, ensuring customers are kept informed promptly and efficiently.

- Community Building: Initiatives like user groups and Q&A sessions hosted online help cultivate a loyal customer base and gather valuable insights for service improvement.

Dedicated Corporate Account Management

For its corporate clients, particularly those under the Embratel brand, Claro implements a strategy of dedicated corporate account management. This involves assigning specific account managers and specialized support teams to individual business clients.

This approach ensures that each corporate client receives tailored solutions designed to meet their unique operational needs and strategic objectives. The dedicated teams act as a single point of contact, streamlining communication and service delivery.

The focus is on proactive problem-solving, anticipating potential issues before they impact the client's business. This deep engagement fosters strong, long-term relationships built on trust and consistent performance. In 2024, Claro continued to invest in its account management infrastructure to enhance client retention and satisfaction within its B2B segment.

- Dedicated Account Managers: Assigned to each major corporate client for personalized service.

- Specialized Support Teams: Providing expertise in specific areas like network solutions or technical support.

- Tailored Solutions: Developing customized service packages based on client requirements.

- Proactive Problem-Solving: Addressing potential issues before they affect client operations.

Net Serviços de Comunicação, operating as Claro, employs a multifaceted approach to customer relationships, emphasizing both digital self-service and personalized support. The company invests heavily in intuitive mobile apps and web portals, allowing customers to manage accounts, billing, and service inquiries independently. This digital-first strategy is complemented by extensive multi-channel support, including call centers and retail stores, ensuring accessibility for all customer segments.

For its business clients, particularly under the Embratel brand, Net Serviços de Comunicação provides dedicated corporate account management. This involves assigning specialized teams and account managers to ensure tailored solutions and proactive support, fostering strong, long-term partnerships. As of early 2024, Claro's significant social media presence further enhances engagement, enabling rapid communication and community building.

| Customer Relationship Strategy | Key Channels/Methods | Focus Area |

|---|---|---|

| Digital Self-Service | Mobile Apps, Web Portals | Customer convenience, operational efficiency |

| Multi-Channel Support | Call Centers, Retail Stores | Accessibility, diverse customer preferences |

| Personalized Offers & Rewards | Data Analysis, Tailored Promotions | Customer loyalty, retention |

| Social Media Engagement | Facebook, Instagram, X | Feedback, issue resolution, community building |

| Dedicated Corporate Management | Account Managers, Specialized Teams | B2B client needs, tailored solutions, proactive support |

Channels

Claro maintains a substantial physical footprint with numerous retail stores throughout Brazil. These locations are crucial for direct customer engagement, offering sales, technical support, and device acquisition.

In 2024, Claro continued to leverage this extensive network of approximately 1,000 stores nationwide. This physical presence allows customers to experience services firsthand and receive personalized assistance, fostering stronger brand loyalty and facilitating service upgrades.

Net Serviços de Comunicação heavily relies on its official website and dedicated mobile applications for both selling its telecommunication services and products, and for enabling customers to manage their accounts independently. This digital-first approach is crucial for meeting modern consumer expectations for convenience and accessibility.

In 2024, the trend of digital customer engagement continued to accelerate. Companies like Net Serviços are seeing a significant portion of new customer acquisition and ongoing service management occur through these online platforms, reflecting a broader industry shift towards digital channels for efficiency and reach.

Customer service call centers are a vital touchpoint for Net Serviços de Comunicação, handling inquiries, providing technical assistance, and driving sales conversions. In 2024, telecommunication companies reported that call centers resolved approximately 75% of customer issues on the first contact, highlighting their efficiency.

Telemarketing remains a key strategy for Net Serviços de Comunicação to proactively engage potential customers and promote new service bundles or upgrades. Industry data from 2024 indicates that well-executed telemarketing campaigns can achieve conversion rates of up to 5% for targeted offers, contributing significantly to customer acquisition.

Direct Sales and Corporate Sales Teams

For its corporate and large business clients, Claro leverages specialized direct sales teams. These teams are tasked with deeply understanding the unique requirements of each client to craft bespoke telecommunication and technology solutions. This personalized approach ensures that businesses receive services precisely aligned with their operational needs and strategic goals.

The Embratel brand within Net Serviços de Comunicação is particularly instrumental in serving this business-to-business (B2B) segment. Embratel's focus is on providing robust connectivity, cloud services, and integrated IT solutions designed for the complexities of enterprise operations. In 2024, Claro Brasil, which includes Embratel, continued to invest heavily in its fiber optic network, aiming to expand its reach and capacity for corporate clients. For instance, Claro's investments in infrastructure in 2023 alone were reported to be in the billions of Reais, directly supporting the expansion of services to the corporate sector.

The effectiveness of these direct sales channels is crucial for Net Serviços de Comunicação's revenue generation. These teams not only acquire new clients but also foster long-term relationships, driving upsell and cross-sell opportunities. Their expertise in navigating the specific demands of enterprise clients, from data security to scalable network solutions, positions Claro as a key partner for businesses seeking digital transformation.

Key aspects of these channels include:

- Dedicated Account Management: Sales teams are structured to provide continuous support and relationship building with key corporate accounts.

- Tailored Solution Development: Focus on understanding business challenges to offer customized product and service bundles.

- Embratel's B2B Specialization: Leveraging the Embratel brand's established reputation and expertise in enterprise-level telecommunications and IT services.

- Network Infrastructure Investment: Ongoing capital expenditure to ensure high-capacity, reliable connectivity essential for corporate clients.

Third-Party Distributors and Retailers

Claro leverages a vast network of third-party distributors and independent retailers to expand its market presence, especially for mobile prepaid services and device sales. This strategy significantly enhances accessibility and customer reach across diverse geographic areas.

These partnerships are crucial for driving sales volume and ensuring that Claro's offerings are readily available to a wider consumer base. In 2024, for instance, the prepaid mobile segment continued to be a significant contributor to telecom revenue in Brazil, with third-party channels playing a vital role in this segment's success.

- Expanded Reach: Third-party channels allow Claro to penetrate markets that might be difficult to reach directly, increasing brand visibility and customer acquisition.

- Sales Channels: Key channels include authorized dealers, electronics stores, supermarkets, and convenience stores, offering a variety of prepaid plans and handset options.

- Market Penetration: In 2024, the Brazilian telecommunications market saw continued growth in prepaid subscriptions, with these distributors being instrumental in onboarding new users.

- Device Sales: Retail partners are essential for the sale of mobile devices, bundled with Claro's services, driving both hardware and service revenue.

Net Serviços de Comunicação utilizes a multi-channel approach to reach its diverse customer base. This includes a significant physical retail presence, robust digital platforms like its website and mobile apps, and extensive customer service call centers.

The company also employs targeted telemarketing for customer acquisition and leverages specialized direct sales teams, particularly through its Embratel brand, to serve corporate clients with tailored solutions.

Furthermore, Net Serviços expands its reach through a wide network of third-party distributors and independent retailers, which are crucial for selling prepaid services and mobile devices across Brazil.

In 2024, these channels collectively drove significant customer engagement and revenue. For example, digital channels saw accelerated customer acquisition, while third-party distributors were vital for the prepaid market's continued growth.

| Channel Type | Key Activities | 2024 Relevance |

|---|---|---|

| Physical Stores | Sales, Technical Support, Device Acquisition | ~1,000 stores nationwide for direct customer engagement |

| Digital Platforms (Website/App) | Sales, Account Management, Customer Service | Accelerated customer acquisition and service management |

| Call Centers | Inquiries, Technical Assistance, Sales | Resolved ~75% of customer issues on first contact |

| Telemarketing | Proactive Engagement, Promotions | Achieved up to 5% conversion rates for targeted offers |

| Direct Sales (B2B) | Tailored Solutions, Account Management (Embratel) | Supported by billions in infrastructure investment |

| Third-Party Distributors | Prepaid Sales, Device Sales | Instrumental in onboarding new users in the prepaid segment |

Customer Segments

Residential consumers represent a core customer base for Net Serviços de Comunicação, encompassing individual households that require a suite of integrated telecommunication services. These services typically include mobile connectivity, high-speed fixed broadband internet, and pay-TV packages, all bundled for personal and family entertainment and communication needs. Claro actively targets this segment by offering solutions tailored to diverse user requirements and financial capacities.

In 2024, the demand for reliable broadband and integrated digital services continued to surge among Brazilian households. For instance, data from Anatel (Brazil's National Telecommunications Agency) indicated that fixed broadband subscriptions in Brazil reached approximately 45 million by the end of 2023, with a significant portion attributed to residential users. Claro, as a major player, consistently aims to capture a substantial share of this market by providing competitive pricing and advanced technology, such as fiber optic networks, to enhance the customer experience.

Small and Medium-Sized Enterprises (SMEs) are a cornerstone of the economy, and their need for robust digital infrastructure is paramount. In 2024, SMEs continue to be a primary focus for communication providers like Claro, as they represent a vast market seeking dependable internet, voice, and cloud services to drive their growth and efficiency.

Claro actively caters to this segment by providing specialized digital solutions and connectivity tailored to the unique demands of smaller businesses. This includes offering scalable packages that can adapt as these companies expand, ensuring they have the necessary tools to compete in an increasingly digital landscape.

Through its Embratel brand, Claro actively targets large corporations and government entities, offering sophisticated telecommunications and IT infrastructure. These clients often have complex, high-demand needs for data, cloud computing, and robust security solutions.

In 2024, Embratel continued its focus on providing these critical services, supporting digital transformation initiatives for major enterprises and public sector organizations across Brazil. The company’s investments in network expansion and advanced technology are designed to meet the evolving demands of this segment.

High-Value/Postpaid Subscribers

Claro prioritizes attracting and retaining high-value postpaid subscribers. These customers typically exhibit higher average revenue per user (ARPU) due to their greater service utilization and the adoption of bundled offerings.

Brazil's telecommunications market experienced robust expansion in postpaid mobile subscriber additions during the first quarter of 2025, indicating a strong demand for these premium services.

- High ARPU: Postpaid subscribers generally contribute more revenue per user than prepaid customers.

- Bundled Services: This segment often takes advantage of service bundles, increasing customer loyalty and revenue.

- Q1 2025 Growth: Recent data shows a positive trend in postpaid subscriber acquisition in Brazil.

Prepaid Mobile Users

Prepaid mobile users represent a significant portion of the Brazilian telecommunications market, valuing the flexibility and control offered by pay-as-you-go plans. Claro acknowledges this by providing competitive prepaid offerings, though a strategic focus has emerged to attract and retain higher-value customers within this segment.

In 2024, prepaid services continued to be a dominant force in Brazil, with a substantial percentage of the subscriber base opting for these plans due to their cost-effectiveness and absence of long-term contracts. This segment often prioritizes affordability and the ability to manage spending directly.

- Market Dominance: Prepaid plans remain a cornerstone of mobile adoption in Brazil, particularly among price-sensitive consumers.

- Flexibility & Control: Users appreciate the pay-as-you-go model, allowing for precise budget management and avoiding unexpected bills.

- Claro's Strategy: While serving the broad prepaid base, Claro is increasingly targeting prepaid users who demonstrate potential for higher ARPU (Average Revenue Per User) through targeted promotions and value-added services.

- Competitive Landscape: The prepaid market is highly competitive, with operators like Claro constantly innovating to offer attractive data bundles and calling rates to capture market share.

Claro's customer segments are diverse, ranging from individual residential users seeking bundled entertainment and communication to large enterprises and government bodies requiring sophisticated IT infrastructure. The company also actively targets Small and Medium-Sized Enterprises (SMEs) with scalable connectivity solutions and focuses on both high-ARPU postpaid mobile subscribers and the vast prepaid market in Brazil.

Cost Structure

Net Serviços de Comunicação, operating as Claro, faces substantial costs for its network infrastructure. This includes ongoing investments in expanding and upgrading its 5G mobile and fiber optic fixed networks, alongside essential maintenance to ensure service quality and reliability.

In 2024, telecommunications companies like Claro are heavily investing in 5G deployment, with global capital expenditures for network infrastructure projected to reach hundreds of billions of dollars. For Claro specifically, these expenditures are critical for maintaining a competitive edge and meeting increasing data demands.

Personnel and operational expenses are a significant component of Net Serviços de Comunicação's cost structure. These include substantial outlays for employee salaries, comprehensive benefits packages, and various administrative costs associated with its extensive workforce.

A large portion of these costs is dedicated to customer service, technical support, and sales teams, reflecting the labor-intensive nature of providing communication services. For instance, as of the first quarter of 2024, Net Serviços de Comunicação reported significant personnel-related expenses that directly impact its operational budget.

Content acquisition and licensing fees represent a significant portion of Net Serviços de Comunicação's cost structure. These expenses are directly tied to securing the rights to broadcast a wide array of television channels, films, and various digital entertainment content for their pay-TV and streaming services. In 2024, the competitive landscape for premium content rights continued to drive up these costs, impacting profitability for many media companies.

Marketing and Sales Expenses

Net Serviços de Comunicação invests heavily in marketing and sales to drive customer acquisition and build brand recognition. These expenditures encompass a range of activities designed to reach and convert target audiences.

Key outlays include advertising campaigns across various media, direct marketing efforts, and the costs associated with maintaining a strong retail presence. Sales commissions are also a significant component, directly incentivizing the sales team to generate revenue.

In 2024, telecommunications companies globally saw marketing budgets fluctuate, with a notable focus on digital channels. For instance, industry reports indicated that digital advertising spend within the sector grew by an estimated 15% year-over-year, reflecting a strategic shift towards online engagement.

- Advertising Campaigns: Significant investment in digital and traditional media to enhance brand visibility.

- Promotional Activities: Costs associated with special offers, discounts, and loyalty programs to attract and retain customers.

- Sales Commissions: Performance-based incentives paid to sales representatives for closing deals.

- Retail Channel Maintenance: Expenses related to operating and supporting physical stores or distribution partners.

Regulatory Fees and Spectrum Costs

Net Serviços de Comunicação incurs significant costs related to regulatory fees and spectrum. These are not optional expenses but rather fundamental requirements for operating legally and expanding its telecommunications services within Brazil.

Payments for spectrum licenses are a major component, allowing Net to utilize specific radio frequencies essential for mobile and broadband services. Beyond initial acquisition, ongoing fees and taxes imposed by regulatory bodies like Anatel (Agência Nacional de Telecomunicações) directly impact the cost structure. These fees ensure compliance with national telecommunications laws and standards, which is critical for maintaining operational licenses and avoiding penalties.

- Spectrum License Payments: These are substantial, often acquired through government auctions, representing a significant upfront and recurring cost for frequency usage rights.

- Regulatory Compliance Fees: Anatel levies various fees for operational permits, service authorizations, and adherence to technical and service quality regulations.

- Telecommunications Taxes: Specific taxes on telecommunications services and infrastructure contribute to the overall financial burden, impacting profitability and investment capacity.

Net Serviços de Comunicação's cost structure is heavily influenced by network infrastructure, including significant investments in 5G and fiber optics, alongside essential maintenance. Personnel and operational expenses, covering salaries, benefits, and customer service, also represent a substantial outlay. Furthermore, content acquisition, marketing, sales, and regulatory fees, particularly for spectrum licenses, are critical cost drivers for the company.

| Cost Category | Description | 2024 Estimated Impact/Focus |

|---|---|---|

| Network Infrastructure | 5G/Fiber expansion, upgrades, and maintenance | Hundreds of billions globally in telecom CAPEX; critical for Claro's competitiveness. |

| Personnel & Operations | Salaries, benefits, administrative costs, customer service | Significant portion of operational budget, reflecting labor-intensive services. |

| Content Acquisition | Licensing fees for TV channels, films, digital content | Rising costs due to competitive landscape for premium content rights. |

| Marketing & Sales | Advertising, promotions, sales commissions, retail maintenance | Estimated 15% year-over-year growth in digital ad spend within the sector. |

| Regulatory & Spectrum | Spectrum license payments, Anatel fees, telecommunications taxes | Substantial upfront and recurring costs for frequency usage and operational compliance. |

Revenue Streams

Mobile service subscriptions and usage fees are the bedrock of Net Serviços de Comunicação's income. This includes the predictable monthly charges from postpaid customers, along with the flexible top-ups made by prepaid users. Revenue is also generated from the actual consumption of services like voice calls, data usage, and text messages.

In 2024, this core revenue stream demonstrated robust performance, with mobile service revenue experiencing notable growth. This indicates a strong demand for Net Serviços de Comunicação's mobile offerings and effective customer retention strategies.

Revenue streams from fixed broadband internet subscriptions are primarily generated through monthly fees paid by both residential and corporate customers. These services are typically delivered via advanced fiber optic and cable networks, offering high-speed internet access. Claro, a major player in this market, has experienced steady increases in its fixed broadband subscriber base.

Pay-TV Subscriptions represent a core revenue stream for Net Serviços de Comunicação, primarily through monthly fees collected from subscribers to Claro's comprehensive pay-TV offerings. These packages include a diverse range of channels and convenient on-demand content, catering to varied viewer preferences.

Claro consistently holds a dominant position in the Brazilian pay-TV landscape, underscoring the robustness of this revenue channel. As of the first quarter of 2024, Claro Brasil reported a significant subscriber base, contributing substantially to the company's overall financial performance and market leadership.

Corporate Services (Embratel)

Embratel's corporate services generate revenue by offering tailored telecommunications and IT solutions to businesses. This includes a suite of offerings like data center services, cloud solutions, Software-Defined Wide Area Networking (SD-WAN), and satellite connectivity.

This business-to-business segment is experiencing notable expansion, particularly in areas demanding advanced digital infrastructure. For instance, in 2023, Embratel saw significant demand for its cloud and data center services, reflecting the ongoing digital transformation across industries.

- Data Center Services: Revenue from secure and scalable data storage and processing facilities.

- Cloud Solutions: Income generated from providing access to computing resources and software over the internet.

- SD-WAN: Earnings from optimizing network traffic and connectivity for enterprises.

- Satellite Services: Revenue from providing internet and communication services in areas with limited terrestrial infrastructure.

Equipment Sales and Other Digital Services

Net Serviços de Comunicação generates revenue through the sale of essential hardware. This includes mobile handsets, internet modems, and set-top boxes for television services, directly supporting their core connectivity offerings.

Beyond hardware, the company is expanding its digital service portfolio. This diversification includes revenue from burgeoning areas like Internet of Things (IoT) solutions, leveraging their network infrastructure.

Monetizing digital advertising presents another significant avenue for income. Furthermore, the introduction of financial services, such as the Claro Pay platform, adds a new dimension to their revenue streams, catering to evolving consumer needs.

- Equipment Sales: Revenue from mobile phones, modems, and set-top boxes.

- IoT Solutions: Income generated from connected device services.

- Digital Advertising: Revenue from ad placements and monetization.

- Financial Services: Earnings from platforms like Claro Pay.

Net Serviços de Comunicação's revenue is multifaceted, encompassing core telecommunications services and expanding into digital and financial offerings. The company's robust mobile and fixed broadband segments continue to be significant income drivers, complemented by pay-TV subscriptions.

In 2024, the company saw strong performance in its mobile segment, with revenue growth reflecting effective customer acquisition and retention. Similarly, fixed broadband subscriptions have shown consistent increases, indicating sustained demand for high-speed internet access.

Embratel's corporate solutions, including data center and cloud services, are experiencing substantial growth, driven by the increasing need for advanced digital infrastructure among businesses. This B2B segment is a key area of expansion for Net Serviços de Comunicação.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Mobile Services | Subscription and usage fees for mobile voice and data. | Notable growth in mobile service revenue. |

| Fixed Broadband | Monthly fees for high-speed internet access. | Steady increase in subscriber base. |

| Pay-TV | Monthly fees for television channel packages. | Dominant market position with substantial subscriber contribution. |

| Corporate Services (Embratel) | IT and telecommunications solutions for businesses. | Significant demand for cloud and data center services in 2023. |

| Equipment Sales | Sale of mobile handsets, modems, and set-top boxes. | Supports core connectivity offerings. |

| Digital Services (IoT, Advertising) | Revenue from connected devices and ad placements. | Expanding portfolio with growing IoT solutions and digital advertising monetization. |

| Financial Services | Earnings from platforms like Claro Pay. | New dimension of revenue catering to evolving consumer needs. |

Business Model Canvas Data Sources

The Net Serviços de Comunicação Business Model Canvas is informed by a blend of internal financial data, customer feedback, and market research reports. This comprehensive approach ensures each component of the canvas is grounded in actionable insights.