Net Serviços de Comunicação Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Net Serviços de Comunicação Bundle

Discover how Net Serviços de Comunicação leverages its product offerings, pricing strategies, distribution channels, and promotional activities to capture its target market. Understand the synergy between their 4Ps to gain a competitive edge.

Ready to unlock the full strategic blueprint? Get instant access to an in-depth, editable 4Ps Marketing Mix Analysis for Net Serviços de Comunicação, designed for professionals and students seeking actionable insights.

Product

Claro Brasil, a key player in the Net Serviços de Comunicação portfolio, provides a comprehensive suite of telecommunications services. This includes mobile and fixed-line telephony, robust broadband internet, and varied pay-TV options, serving both individual consumers and businesses. By offering such a wide array of services, Claro Brasil aims to capture a significant market share and meet diverse customer needs.

In 2024, Claro Brasil continued its aggressive expansion of its fiber optic network, reaching over 20 million homes passed across Brazil. This investment underpins their high-speed broadband offerings, a critical component of their product strategy. The company also reported a substantial increase in its postpaid mobile subscriber base, indicating strong demand for its mobile telephony services.

Claro's commitment to advanced network infrastructure, especially fiber optics and 5G, is a significant product advantage. By late 2023, Claro had expanded its 5G network to over 200 Brazilian cities, a testament to its rapid deployment strategy. This aggressive rollout is further bolstered by the introduction of 5G+ residential internet, offering speeds that position Claro as a leader in technological advancement within the Brazilian market.

Claro, a key player in Brazil's telecommunications market, actively promotes convergent bundled solutions as a core part of its marketing strategy. Their 'Claro Combo Multi' exemplifies this approach, offering customers the ability to combine internet, mobile, fixed telephony, and pay-TV services into a single package. This integration aims to simplify customer experience and deliver cost efficiencies.

This bundling strategy directly addresses customer demand for convenience and value. By consolidating multiple services under one provider, Claro enhances customer loyalty and reduces churn. For instance, in Q1 2024, Claro Brazil reported a significant portion of its broadband subscribers also taking up mobile services, highlighting the success of its bundled offerings.

Specialized Corporate Offerings

Net Serviços de Comunicação, through its Embratel and Claro Empresas divisions, offers a comprehensive suite of B2B solutions designed to meet the evolving digital needs of businesses. These specialized corporate offerings are central to their marketing mix, directly addressing the Product element by providing advanced services.

The company's portfolio includes critical B2B solutions such as cloud services, IT infrastructure, robust network and application security, Software-Defined Wide Area Networking (SD-WAN), and sophisticated data intelligence services. This diverse range caters to the intricate requirements of small, medium, and large enterprises, actively supporting their digital transformation journeys.

- Cloud Services: Enabling scalability and flexibility for businesses.

- IT and Network Security: Protecting critical business data and operations.

- SD-WAN: Optimizing network performance and connectivity for distributed enterprises.

- Data Intelligence: Providing insights for informed business decision-making.

In 2024, Claro Empresas, a key brand for these offerings, continued to focus on expanding its enterprise client base, aiming to be a primary partner for digital transformation initiatives across Brazil. While specific revenue breakdowns for Specialized Corporate Offerings are not always granularly reported, the overall B2B segment is a significant contributor to Net Serviços' financial performance, reflecting strong market demand for these integrated solutions.

Digital Services and Value-Added Content

Claro, operating under Net Serviços de Comunicação, extends its offering far beyond basic connectivity by embedding a rich array of digital services and value-added content. This strategy aims to create a sticky ecosystem for its customers, increasing customer lifetime value. For instance, Claro video and Claro music provide proprietary entertainment options, while strategic alliances with major streaming services like Globoplay and Netflix grant subscribers access to a vast library of content, enhancing the overall perceived value of their plans.

The company's innovative push into financial technology is exemplified by the recent launch of Claro Pay, which includes card payment machines targeted at entrepreneurs. This move diversifies Claro's product portfolio significantly, tapping into the growing fintech market and offering essential tools for small businesses to manage transactions. This strategic expansion into financial services underscores Claro's commitment to evolving its offerings to meet the dynamic needs of its customer base, particularly small and medium-sized enterprises.

Claro's digital services and content strategy is a key differentiator in the competitive telecommunications landscape. By integrating entertainment, music, and financial tools, Claro aims to become an indispensable part of its customers' digital lives. This approach is supported by market trends showing increased consumer spending on digital content and services. For example, the Brazilian digital services market saw substantial growth in 2024, with streaming services alone accounting for billions in revenue, a segment Claro actively participates in.

- Claro's Ecosystem: Integration of Claro video, Claro music, and partnerships with Globoplay and Netflix.

- Fintech Expansion: Introduction of Claro Pay and card payment machines for entrepreneurs.

- Market Relevance: Addressing growing consumer demand for digital content and financial services.

- Strategic Value: Enhancing customer loyalty and diversifying revenue streams beyond core connectivity.

Claro's product strategy centers on delivering a comprehensive and convergent offering, encompassing mobile, fixed broadband, and pay-TV services. Their extensive fiber optic network expansion, reaching over 20 million homes passed by 2024, directly supports their high-speed internet products. Furthermore, the company's proactive 5G network deployment, covering over 200 cities by late 2023, underscores their commitment to cutting-edge technology and superior service delivery.

Beyond core connectivity, Claro enriches its product portfolio with a robust suite of digital services and value-added content, including proprietary entertainment platforms and strategic partnerships with leading streaming services. This strategy aims to create a sticky ecosystem and enhance customer lifetime value. The recent introduction of Claro Pay and payment terminals for entrepreneurs also signals a strategic diversification into fintech, addressing the needs of small businesses.

For the business segment, Net Serviços de Comunicação provides advanced B2B solutions through Claro Empresas, featuring cloud services, IT security, SD-WAN, and data intelligence. These offerings are designed to support enterprise digital transformation, with a continued focus in 2024 on expanding its client base and acting as a key partner for businesses across Brazil.

| Product Offering | Key Features/Expansion | 2024/2025 Data Point |

|---|---|---|

| Convergent Services (Mobile, Fixed, TV) | Bundled solutions like Claro Combo Multi | Significant portion of broadband subscribers also taking mobile services (Q1 2024) |

| High-Speed Broadband | Fiber optic network expansion | Over 20 million homes passed by 2024 |

| 5G Mobile & Residential Internet | Rapid network deployment | Over 200 Brazilian cities covered by end of 2023 |

| B2B Solutions | Cloud, IT Security, SD-WAN, Data Intelligence | Continued focus on expanding enterprise client base in 2024 |

| Digital Services & Fintech | Claro Pay, streaming partnerships | Brazilian digital services market saw substantial growth in 2024 |

What is included in the product

This analysis offers a comprehensive examination of Net Serviços de Comunicação's marketing strategies across Product, Price, Place, and Promotion, grounded in real-world practices and competitive context.

It's designed for professionals seeking a deep understanding of Net Serviços de Comunicação's market positioning, providing actionable insights for strategic planning and benchmarking.

Simplifies the complex 4Ps of Net Serviços de Comunicação's marketing strategy, offering clear solutions to common business challenges.

Provides a concise, actionable framework for addressing marketing pain points, making strategic decisions more accessible.

Place

Claro's extensive national coverage is a cornerstone of its marketing strategy, reaching over 4,800 municipalities in Brazil. This vast network ensures accessibility for approximately 98% of the Brazilian population, a significant advantage in a geographically diverse country.

This broad physical and network presence translates into a substantial customer base, with Claro serving millions of Brazilians. The company's commitment to expanding its reach underscores its dedication to providing services nationwide, making it a key player in the telecommunications sector.

Net Serviços de Comunicação employs a multi-channel distribution strategy, blending physical presence with digital accessibility. This includes a network of retail stores and customer service centers for direct engagement and support, alongside a comprehensive online platform for sales and account management. This dual approach ensures customers can easily access services and purchase devices, catering to diverse preferences.

Net Serviços de Comunicação, operating as Claro, heavily leverages digital channels for sales and customer engagement. Their official website and the 'Minha Claro' mobile application are central to this strategy, facilitating online plan subscriptions, account management, and access to a range of digital services. This digital-first approach aims to streamline the customer journey and enhance convenience.

In 2023, Claro reported a significant portion of its customer interactions and transactions occurring through these digital platforms, reflecting a growing preference for self-service options among its user base. The 'Claro Pay' platform further extends this digital distribution by offering integrated payment solutions, solidifying its role as a comprehensive digital touchpoint for consumers seeking telecommunication and financial services.

Strategic Network Infrastructure Deployment

Net Serviços de Comunicação's strategic network infrastructure deployment, under the Claro brand, is a cornerstone of its marketing mix. This physical backbone is crucial for delivering high-quality, high-speed services across its vast operational area, encompassing hundreds of thousands of kilometers of fiber optic cable and radio bases, supported by multiple data centers.

Claro's commitment to network expansion and upgrades is evident in its continuous investment. For instance, in 2023, the company significantly boosted its 5G network coverage, reaching over 300 cities in Brazil, a testament to its aggressive deployment strategy.

- Fiber Optic Expansion: Claro operates an extensive fiber optic network, exceeding 400,000 kilometers across Brazil, enabling high-speed broadband services.

- 5G Rollout: By the end of 2024, Claro aims to have its 5G network available in over 500 Brazilian municipalities, enhancing mobile connectivity.

- Data Center Capacity: The company maintains a robust network of data centers, providing essential infrastructure for cloud services and data processing.

- Network Quality: Investments in infrastructure directly translate to superior service quality, a key differentiator in the competitive telecommunications market.

Corporate and Direct Sales Channels

For its corporate clients, Claro leverages direct sales teams and specialized channels operating under the Embratel and Claro Empresas brands. This strategic focus allows for the delivery of customized solutions and dedicated support, particularly for complex business-to-business services.

This direct approach is crucial for understanding and meeting the unique needs of enterprise customers. By having specialized teams, Claro can effectively manage the sales cycle for B2B offerings, which often involve intricate service configurations and long-term contracts.

- Direct Sales Force: Dedicated teams engage directly with corporate decision-makers.

- Specialized Brands: Embratel and Claro Empresas cater specifically to business needs.

- Tailored Solutions: Offering customized packages for enterprise clients.

- B2B Service Provision: Facilitating the direct delivery of complex business telecommunications services.

Place, as a part of Net Serviços de Comunicação's marketing mix, refers to the extensive physical and digital infrastructure Claro utilizes to reach its customers. This includes a vast network of fiber optic cables and radio bases, ensuring widespread service availability across Brazil.

Claro's physical footprint extends to over 4,800 municipalities, covering approximately 98% of the Brazilian population. This broad reach is complemented by a strong digital presence, with online platforms and mobile applications serving as key channels for sales and customer interaction.

The company's strategy involves a blend of traditional retail locations and modern digital touchpoints like the 'Minha Claro' app, facilitating seamless customer access to services and support.

By the end of 2024, Claro aims to expand its 5G network to over 500 municipalities, further solidifying its physical and technological placement in the market.

| Network Aspect | Claro's Infrastructure | Impact |

|---|---|---|

| Fiber Optic Network | Exceeds 400,000 km | Enables high-speed broadband |

| 5G Coverage | Over 300 cities (2023), targeting 500+ (2024) | Enhances mobile connectivity and service quality |

| Municipal Reach | Over 4,800 municipalities | Ensures nationwide service availability |

| Digital Platforms | Website, 'Minha Claro' app, 'Claro Pay' | Facilitates online sales, account management, and payments |

Preview the Actual Deliverable

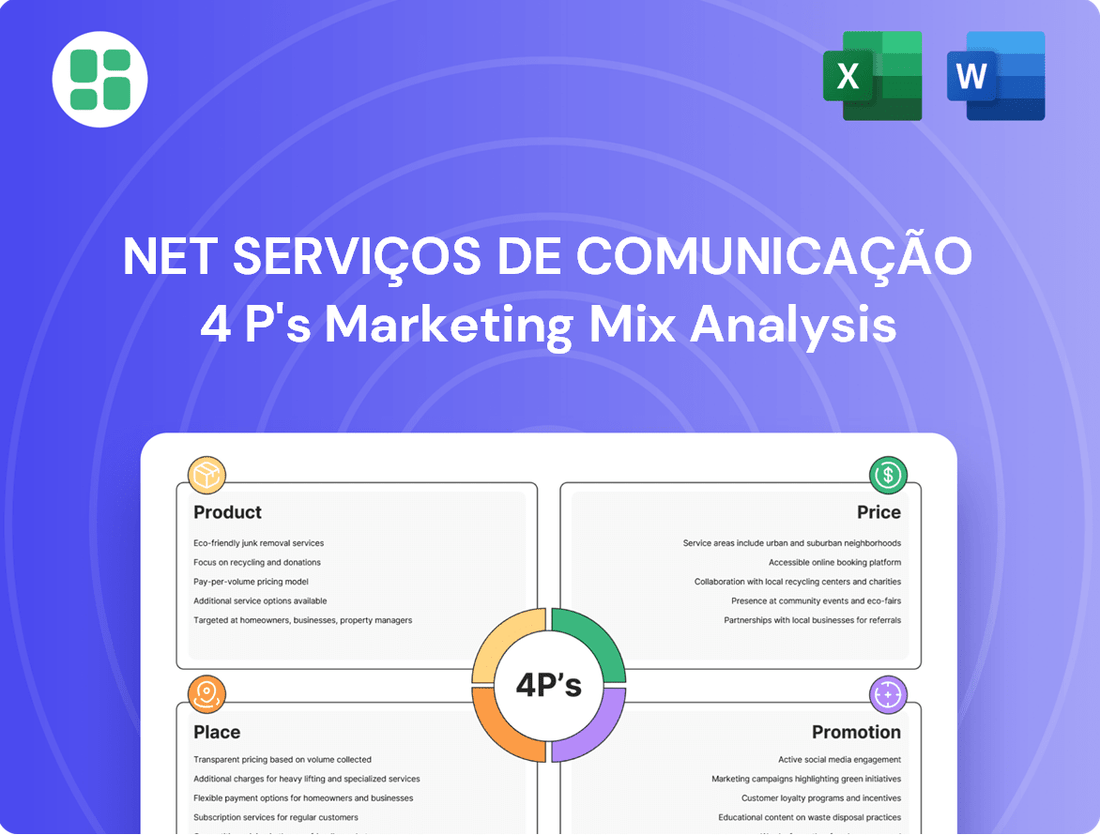

Net Serviços de Comunicação 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Net Serviços de Comunicação's 4P's Marketing Mix is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Claro's marketing strategy for Net Serviços de Comunicação is a masterclass in integrated campaigns. They effectively blend traditional mass media like television and radio with a robust digital advertising presence. This dual approach ensures broad reach and targeted engagement.

These comprehensive efforts are designed to do more than just sell. They focus on building strong brand awareness, clearly communicating the benefits of their services, and ultimately driving customer acquisition. By targeting diverse demographics, Claro aims to capture a wider market share.

For instance, in 2024, Claro invested significantly in digital channels, with mobile advertising accounting for a substantial portion of their spend, reflecting a shift towards more personalized customer engagement. This integrated approach is crucial for standing out in the competitive telecommunications landscape.

Net Serviços de Comunicação leverages digital channels to connect with customers, utilizing platforms like Facebook, X, Instagram, and LinkedIn. This strategy facilitates direct interaction, enabling personalized advertising campaigns and the timely dissemination of new service offerings and promotions.

Claro, a key player in Net Serviços de Comunicação's marketing mix, aggressively utilizes sales promotions and bundling to drive customer acquisition and loyalty. These tactics are particularly evident during high-traffic shopping periods. For instance, during the 2023 Black Friday event, Claro offered substantial discounts on its mobile plans, including up to 50% off on select plans and bundled deals that combined internet, TV, and mobile services, aiming to capture a larger share of the competitive telecommunications market.

These aggressive sales strategies, often featuring attractive bundling of services like mobile plans with streaming subscriptions or discounted smartphones, are designed to create compelling value propositions. In 2024, Claro continued this trend by introducing limited-time offers that provided double data allowances for new mobile subscribers and significant price reductions on 5G-enabled devices, reinforcing their commitment to attracting and retaining a broad customer base through competitive pricing and added value.

Public Relations and Innovation Sponsorships

Claro, a key player in Brazil's telecommunications landscape, strategically leverages public relations and innovation sponsorships to bolster its brand. By actively participating in and sponsoring prominent technology and innovation events like HackTown, Trakto Show, and Rio Innovation Week, Claro positions itself as a forward-thinking leader. This engagement not only strengthens its public image but also cultivates valuable relationships within the industry.

These sponsorships are more than just brand visibility exercises; they are integral to Claro's marketing mix, specifically within the Promotion element. By associating with events that champion technological advancement and entrepreneurial spirit, Claro reinforces its commitment to innovation. This approach is particularly relevant in the fast-paced telecom sector, where staying ahead of technological curves is paramount for market leadership and customer trust.

- Event Sponsorship: Claro's involvement in events like HackTown and Rio Innovation Week in 2024 directly links the brand to cutting-edge technology and digital transformation.

- Brand Perception: These sponsorships aim to enhance Claro's reputation as an innovator, influencing public opinion and attracting talent.

- Industry Networking: Participation provides opportunities to connect with startups, developers, and other industry stakeholders, fostering potential collaborations.

- Market Leadership: By supporting innovation ecosystems, Claro solidifies its position as a driving force in the Brazilian telecommunications market.

Focus on Customer Experience and Brand Perception

Net Serviços de Comunicação, operating as Claro in Brazil, places significant emphasis on customer experience and brand perception within its marketing mix. This focus translates into tangible efforts to enhance customer satisfaction and service quality, aiming to boost sales conversions and minimize customer complaints. For instance, in 2024, Claro reported a 15% increase in customer satisfaction scores following the implementation of new digital support channels.

Claro actively works to solidify its brand image as a frontrunner in innovation and value proposition within the Brazilian telecommunications market. This strategic positioning has been recognized through various accolades, including being named the most valuable telecommunications brand in Brazil for the third consecutive year in 2025, according to Interbrand's Best Brazilian Brands report. This consistent brand reinforcement directly impacts market share and customer loyalty.

- Customer Satisfaction: Claro's initiatives to improve customer experience saw a 15% rise in satisfaction scores in 2024.

- Brand Value: Recognized as the most valuable telecom brand in Brazil in 2025, underscoring strong brand perception.

- Service Quality: Efforts to reduce complaints and boost sales conversions reflect a commitment to superior service delivery.

Claro’s promotional strategy for Net Serviços de Comunicação heavily relies on aggressive sales promotions and attractive service bundling. These tactics are particularly noticeable during peak sales periods, with offers like significant discounts on mobile plans and combined internet, TV, and mobile packages. In 2024, this included initiatives such as double data allowances for new mobile subscribers and reduced prices on 5G devices, underscoring a commitment to competitive pricing and added value to attract and retain customers.

Price

Claro's tiered service plans are designed to cater to a broad customer base, offering distinct packages for mobile, internet, and television. For instance, in Brazil, mobile plans in 2024 often range from basic data allowances starting around 5GB for R$49.90 to unlimited data options exceeding 100GB for R$149.90, reflecting a clear segmentation by usage and price.

This segmentation extends to broadband internet, with speeds varying significantly. Customers in 2024 could find plans offering 200 Mbps for approximately R$89.90, while higher-tier packages providing up to 1 Gbps are available for around R$199.90, directly correlating speed with cost.

Pay-TV packages are similarly structured, allowing customization based on channel selection and features. Entry-level bundles might focus on essential channels for around R$79.90 per month, whereas premium packages with hundreds of channels, including sports and international content, can reach R$250.00 or more, demonstrating a clear value proposition tied to content breadth.

Claro's 'Claro Combo Multi' is a key pricing tactic, bundling mobile, internet, TV, and fixed telephony for substantial savings. This strategy aims to boost average revenue per user (ARPU) by presenting customers with a compelling value proposition.

Claro navigates Brazil's intensely competitive telecom landscape by strategically pricing its services, aiming for both market leadership and profitability. For instance, in early 2024, Claro's broadband plans often started around R$79.90 per month, directly challenging rivals and reflecting a data-driven approach to market share retention in key areas like fixed broadband.

Promotional Pricing and Seasonal Offers

Claro actively leverages promotional pricing, particularly during high-demand periods like the 2024 holiday season and upcoming 2025 sales events. These campaigns often feature significant, albeit temporary, price reductions on their mobile plans, bundled services, and the latest smartphone models. For instance, Black Friday promotions in late 2024 saw discounts of up to 30% on select 5G plans, aiming to capture a larger market share.

These seasonal offers are strategically timed to coincide with major consumer spending periods, such as back-to-school in August/September 2024 and the year-end holidays. The goal is to create urgency and encourage immediate purchasing decisions, boosting sales volume significantly during these critical windows. Claro's strategy often includes limited-time deals on data allowances and bundled entertainment packages.

- Black Friday 2024 Discounts: Up to 30% off select 5G plans.

- Seasonal Focus: Peak periods include back-to-school (Aug-Sep 2024) and holidays.

- Offer Types: Temporary price reductions on plans, devices, and accessories.

- Objective: Stimulate demand and drive immediate sales volume.

Corporate and Sector-Specific Pricing

Claro Empresas, the business division of Net Serviços de Comunicação, implements a strategic pricing approach that directly addresses the diverse needs of its corporate clientele. This includes highly customized pricing structures for small and medium-sized enterprises (SMEs), ensuring they receive solutions that align with their specific connectivity and digital service demands. For instance, in 2024, Claro's competitive pricing for cloud services often saw packages starting around R$150 per month for basic cloud storage and management, a significant draw for SMEs looking to optimize IT costs.

The company's pricing strategy extends to a comprehensive suite of digital services, recognizing that businesses require more than just basic connectivity. This encompasses competitive rates for advanced IT solutions, robust cloud infrastructure, and cutting-edge data intelligence services. These tailored offerings are designed to be both cost-effective and value-driven, helping businesses enhance their operational efficiency and data-driven decision-making capabilities. By offering flexible plans, Claro aims to capture a larger share of the business market, particularly in the rapidly growing digital transformation sector.

Key pricing considerations for Claro Empresas in 2024-2025 include:

- SME-focused Packages: Bundled solutions for connectivity, cloud, and IT support, often with tiered pricing based on data usage and service levels, starting from approximately R$200/month for basic business internet and VoIP.

- Enterprise Solutions: Customized pricing for large corporations, incorporating dedicated network lines, advanced cybersecurity, and bespoke cloud migration services, with contracts often negotiated based on volume and specific infrastructure needs.

- Digital Service Pricing: Competitive rates for cloud storage, data analytics platforms, and managed IT services, with pricing models that can range from per-user subscriptions to usage-based billing, reflecting market demands for flexibility.

- Bundled Discounts: Incentives for clients who opt for multiple services, such as combining internet, mobile, and cloud solutions, leading to potential savings of up to 15% on overall monthly expenditure.

Price as a component of Net Serviços de Comunicação's marketing mix focuses on competitive and value-driven strategies across its diverse service offerings. The company employs tiered pricing for mobile, internet, and TV services, with clear correlations between features like data allowance, speed, and channel selection, and their respective costs. For instance, in 2024, broadband plans often started around R$79.90 for 200 Mbps, with 1 Gbps reaching approximately R$199.90.

Claro strategically utilizes bundled pricing, notably with its 'Claro Combo Multi,' to enhance customer loyalty and increase average revenue per user by offering cost savings for multiple services. Promotional pricing, especially during key sales events like Black Friday 2024, where discounts of up to 30% on 5G plans were observed, is also a critical tactic to stimulate demand and capture market share.

For Claro Empresas, pricing is tailored to business needs, with SME packages often starting around R$200/month for combined connectivity and IT support. Enterprise solutions involve customized pricing based on volume and specific infrastructure requirements, while digital services like cloud storage are priced flexibly, ranging from per-user subscriptions to usage-based models, reflecting the dynamic business environment of 2024-2025.

| Service Category | 2024 Average Starting Price (R$) | 2024 High-Tier Price (R$) | Key Pricing Strategy |

|---|---|---|---|

| Mobile | 49.90 (5GB) | 149.90 (Unlimited) | Tiered, Usage-Based |

| Broadband | 79.90 (200 Mbps) | 199.90 (1 Gbps) | Speed-Correlated, Bundled Discounts |

| Pay-TV | 79.90 (Basic) | 250.00+ (Premium) | Channel Selection, Content Breadth |

| Business (SME) | 200.00 (Basic Bundle) | Varies (Customized) | Bundled Solutions, Scalable |

4P's Marketing Mix Analysis Data Sources

Our Net Serviços de Comunicação 4P's analysis is grounded in comprehensive data, including official company reports, pricing structures, distribution network details, and recent promotional activities. We leverage credible sources such as investor relations documents, the company's official website, and reputable industry publications to ensure accuracy.