Net Serviços de Comunicação Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Net Serviços de Comunicação Bundle

Net Serviços de Comunicação operates in a dynamic telecom landscape, facing intense rivalry from established players and the constant threat of disruptive technologies. Understanding the bargaining power of its buyers and the influence of its suppliers is crucial for navigating this competitive terrain.

The complete report reveals the real forces shaping Net Serviços de Comunicação’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The telecommunications sector, including players like Claro Brasil, is heavily reliant on a handful of global infrastructure providers such as Ericsson and Huawei. These companies dominate the market for specialized network equipment, essential for everything from core network functions to the critical 5G network expansion. Their specialized nature and the substantial investment required for their products grant them considerable leverage.

Claro Brasil, as a significant operator, must source its extensive mobile and fixed network infrastructure from these few key players. This dependence creates high switching costs for Claro, as replacing existing, deeply integrated infrastructure from one supplier with another is both technically complex and financially burdensome. Consequently, Claro's ability to negotiate favorable terms with these infrastructure giants is constrained.

Recent governmental actions, such as the trebling of tariffs on fiber optic equipment to 35% in October 2024, directly impact the cost structure for telecom operators like Claro.

This increase in import duties strengthens the bargaining power of domestic equipment suppliers, if available, or forces operators to absorb higher costs from international suppliers, potentially affecting profitability.

Despite the overall decline in the traditional pay-TV sector, Net Serviços de Comunicação, operating as Claro, still depends on content providers for its channel lineup and programming. This reliance means these providers can exert significant influence. For instance, in 2023, the pay-TV market in Brazil saw a continued subscriber decline, with estimates suggesting a drop of around 5% year-over-year, underscoring the shifting landscape.

However, the growing dominance of streaming services presents a potential long-term shift in power dynamics. As consumers increasingly opt for on-demand content via platforms like Netflix, Disney+, and Amazon Prime Video, the traditional pay-TV content providers may find their leverage diminishing. This trend is supported by data showing a substantial increase in over-the-top (OTT) service subscriptions in Brazil, with growth rates exceeding 15% in recent years, indicating a clear consumer preference evolution.

Regulatory Compliance Requirements

ANATEL's dynamic regulatory landscape significantly impacts supplier bargaining power. For instance, new cybersecurity audit guidelines for telecom equipment suppliers, effective November 2025, and mandates for specific call identification mean suppliers must invest in and demonstrate compliance with evolving technical standards. This creates an advantage for those already equipped to meet these stringent requirements.

Suppliers who can readily adapt to and meet these updated regulatory demands, such as adhering to ANATEL's requirements for specific call identification or the upcoming cybersecurity audit guidelines, gain leverage. Claro, like other telecom operators, relies on these suppliers for lawful and compliant operations, making adherence to these rules a critical factor in supplier selection and negotiation.

The bargaining power of suppliers is bolstered when they can demonstrate a proven track record of meeting complex regulatory mandates. For example, suppliers who proactively implement solutions aligned with ANATEL's evolving directives, like those pertaining to data privacy and network security, are in a stronger position. This is particularly relevant as the telecom sector faces increased scrutiny on data protection and service integrity.

- Evolving ANATEL Regulations: New cybersecurity audit guidelines for telecom equipment suppliers are set to take effect in November 2025, alongside ongoing requirements for specific call identification.

- Supplier Advantage: Suppliers capable of meeting these stringent and updated regulatory requirements possess greater bargaining power, as their products are crucial for Claro's compliance.

- Technical Standards Adherence: Mandates for adherence to specific technical standards further empower suppliers who can demonstrate this capability.

Skilled Labor and Specialized Software Vendors

The increasing complexity of telecommunication networks, particularly with the rollout of 5G and fiber optics, significantly elevates the bargaining power of suppliers of skilled labor and specialized software. These advanced technologies demand niche expertise for network design, deployment, maintenance, and customer service, making specialized talent scarce.

Vendors providing critical software solutions for network management, billing, and customer relationship management, such as Amdocs or Oracle Communications, hold considerable sway. Their proprietary systems and deep integration knowledge are essential for seamless operations. For instance, Amdocs reported revenues of $4.1 billion in fiscal year 2023, highlighting the substantial market for such specialized solutions.

- High Demand for Specialized Skills: The intricate nature of 5G and fiber optic infrastructure requires engineers and technicians with advanced certifications and experience, driving up labor costs.

- Proprietary Software Solutions: Companies like Amdocs offer integrated platforms for network operations and customer management, creating high switching costs for telecom operators.

- Integration Complexity: Implementing and maintaining these specialized systems involves significant technical challenges, further strengthening the position of experienced vendors.

- Limited Supplier Pool: The number of companies capable of providing end-to-end solutions for modern telecom networks is relatively small, concentrating power among these key suppliers.

The bargaining power of suppliers for Net Serviços de Comunicação, particularly for critical network infrastructure like 5G equipment, remains substantial due to the limited number of global providers such as Ericsson and Huawei. These suppliers command significant leverage due to the highly specialized nature of their products and the immense capital investment required for their development and manufacturing.

Claro Brasil faces high switching costs when dealing with these infrastructure providers, as integrating new equipment into existing, complex networks is both technically challenging and financially prohibitive. This dependence restricts Claro's ability to negotiate favorable terms, especially as governmental actions, like the October 2024 tariff increase on fiber optic equipment to 35%, further empower domestic or international suppliers by increasing overall costs.

The power of specialized software and skilled labor suppliers is also amplified by the increasing complexity of telecommunications networks, particularly with the ongoing 5G and fiber optic deployments. Companies like Amdocs, which reported $4.1 billion in revenue in fiscal year 2023, provide essential, proprietary solutions for network management and customer relations, creating high switching costs and strengthening their negotiating position.

| Supplier Category | Key Players | Basis of Bargaining Power | Impact on Net Serviços (Claro) |

| Network Infrastructure | Ericsson, Huawei | High R&D costs, specialized technology, limited competitors | High dependence, significant switching costs, constrained negotiation |

| Specialized Software | Amdocs, Oracle Communications | Proprietary systems, deep integration knowledge, high implementation costs | Essential for operations, significant leverage in pricing and terms |

| Skilled Labor | Certified 5G/Fiber Technicians, Network Engineers | Scarcity of niche expertise, high demand for advanced skills | Increased labor costs, reliance on suppliers for critical project execution |

What is included in the product

This analysis of Net Serviços de Comunicação's competitive landscape reveals the intensity of rivalry, the bargaining power of suppliers and buyers, and the threat of new entrants and substitutes.

Instantly identify and mitigate competitive threats with a visual breakdown of Net Serviços de Comunicação's market landscape.

Customers Bargaining Power

The Brazilian telecommunications landscape is a battleground, with giants like Vivo (Telefônica Brasil) and TIM Brasil vying for market share alongside a multitude of regional Internet Service Providers (ISPs). This fierce competition means customers have abundant options for mobile, fixed broadband, and pay-TV services.

With so many providers, customers can easily switch if they find better pricing or superior service quality. For instance, in 2023, the Brazilian telecommunications sector saw significant investment, with companies like TIM Brasil investing heavily in network expansion, further intensifying the competitive environment and giving customers more leverage.

Brazilian consumers exhibit significant price sensitivity, actively searching for cost-effective and adaptable mobile plans, often bundled with other communication services. This trend was particularly pronounced in Q1 2025, with inflation hovering around 4.5% and interest rates impacting disposable income, forcing telecom providers to focus on competitive pricing strategies to maintain market share.

The ease of number portability in Brazil, a key regulatory provision, empowers customers by allowing them to switch mobile and fixed-line providers without losing their existing phone numbers. This directly lowers the costs and hassle associated with changing services, thereby amplifying customer bargaining power.

This regulatory environment forces telecommunications companies like Net Serviços de Comunicação to compete more aggressively on service quality and pricing to retain their customer base. In 2024, the Brazilian telecommunications market saw continued high competition, with operators investing heavily in network upgrades and customer retention programs, partly driven by the ease of switching.

Bundling and Loyalty Programs

Bundling services, such as mobile, broadband, and pay-TV, is a common strategy employed by Claro and its competitors to foster customer loyalty and offer convenience. This approach aims to increase switching costs for consumers, making it less appealing to move to a different provider. For instance, in 2023, the Brazilian telecommunications market saw significant competition in bundled offerings, with providers actively marketing these packages to retain subscribers.

While these bundled packages can enhance customer stickiness, the bargaining power of customers remains significant. Consumers continuously evaluate the overall value proposition, comparing bundled deals against individual service costs and competitor packages. This ongoing assessment ensures that providers must remain competitive on price and service quality to maintain their customer base, preventing excessive price increases.

The effectiveness of loyalty programs and bundling is directly tied to customer perception of value. If a bundled offering is perceived as overpriced or less convenient than assembling services separately from different providers, customers will leverage their bargaining power to seek better alternatives. This dynamic forces companies like Claro to innovate and refine their bundled strategies to truly align with customer needs and market expectations.

- Bundling Strategy: Claro and competitors offer integrated packages of mobile, broadband, and pay-TV to enhance customer loyalty and perceived value.

- Customer Evaluation: Despite bundling, customers retain bargaining power by assessing the overall value against competitor offerings and individual service costs.

- Market Context (2023): The Brazilian telecom market experienced intense competition in bundled services, highlighting the need for attractive value propositions to retain subscribers.

Access to Diverse Information and Comparison Tools

Customers today have an unprecedented amount of information at their fingertips. Online comparison sites and extensive peer reviews allow them to thoroughly research and evaluate telecom services before making a commitment. This transparency directly fuels their bargaining power.

For instance, in 2023, a significant portion of consumers, estimated to be over 70% in many developed markets, actively used online resources to compare mobile plans and internet providers. This readily available data empowers them to pinpoint the best value, forcing providers like Net Serviços de Comunicação to compete more aggressively on price and service quality.

- Informed Decision-Making: Access to detailed service comparisons and customer feedback enables users to make more educated choices.

- Price Sensitivity: Easy comparison of pricing structures across providers intensifies price competition.

- Switching Behavior: Transparency in service quality and pricing encourages customers to switch providers if better deals are found.

- Negotiation Leverage: Well-informed customers can leverage their knowledge to negotiate better terms or discounts.

The bargaining power of customers in Brazil's telecommunications sector is substantial, driven by intense competition and regulatory support for switching. In 2024, with inflation impacting household budgets, consumers are particularly attuned to pricing, actively seeking the best value. This environment forces providers like Net Serviços de Comunicação to offer competitive rates and superior service to retain their customer base.

The ease of number portability, a key regulatory feature, significantly reduces the friction for customers wanting to switch providers. This, combined with readily available online information and comparison tools, empowers consumers to make informed decisions and leverage their knowledge for better deals. For example, in Q1 2025, many consumers were observed actively comparing bundled service offerings, leading providers to focus on value-added packages.

| Factor | Impact on Bargaining Power | 2024/2025 Context |

|---|---|---|

| Competition Level | High | Intense rivalry among major players and ISPs |

| Price Sensitivity | High | Consumers actively seek cost-effective plans due to economic conditions |

| Number Portability | High | Facilitates easy switching without losing phone numbers |

| Information Availability | High | Online comparisons and reviews empower informed choices |

What You See Is What You Get

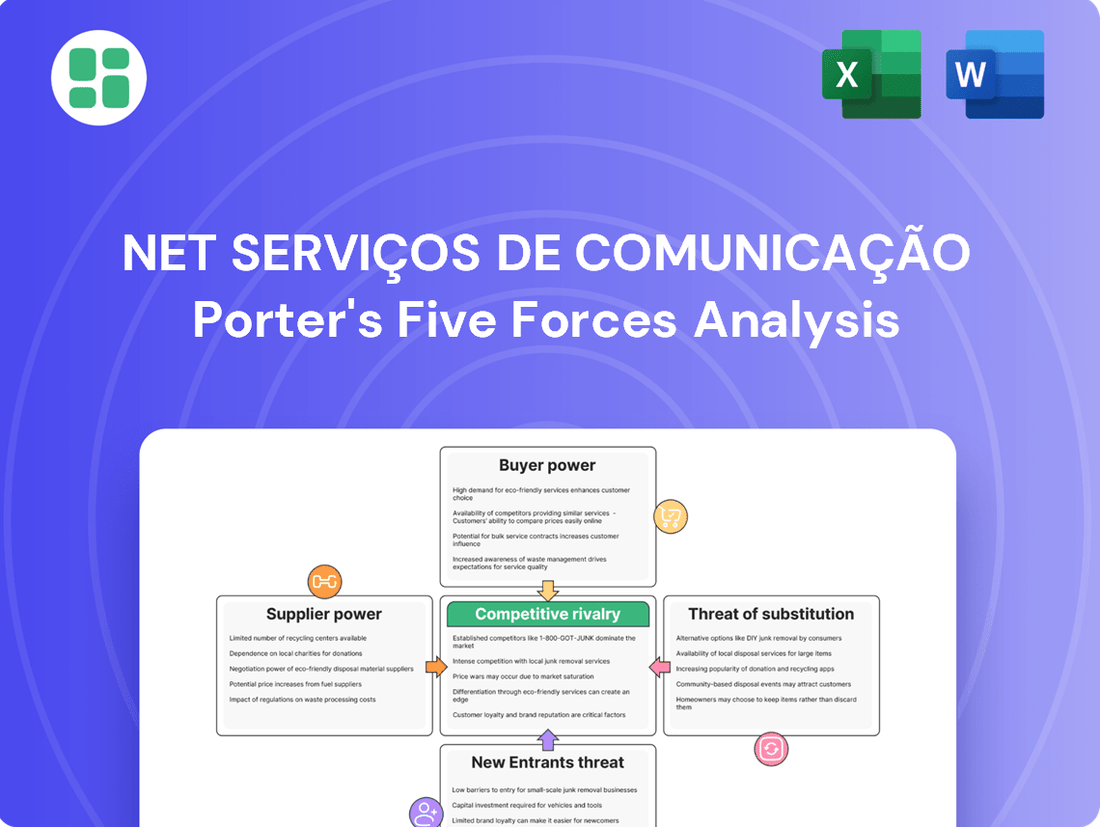

Net Serviços de Comunicação Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Net Serviços de Comunicação, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, offering valuable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. Rest assured, there are no placeholders or mockups; what you preview is precisely what you will download and utilize for your strategic planning.

Rivalry Among Competitors

The Brazilian telecommunications landscape is a battleground dominated by giants like Claro, Vivo, and TIM Brasil. These major players, with deep pockets and extensive infrastructure, are locked in a perpetual struggle for customers across mobile, fixed broadband, and pay-TV services. This intense competition forces constant innovation and aggressive pricing strategies, making it difficult for smaller or newer entrants to gain a foothold.

The aggressive rollout of 5G and fiber optic networks is a significant driver of competitive rivalry in the telecommunications sector. Companies are heavily investing billions to expand these advanced infrastructures, aiming to provide superior speeds and enhanced user experiences. For instance, in 2024, major telecom operators globally committed substantial capital expenditures towards 5G spectrum acquisition and network build-out, fueling an intense race to market.

This technological arms race intensifies competition as firms vie for market share by attracting new customers and upgrading existing ones with faster, more reliable connectivity. The ability to offer cutting-edge services through these networks becomes a crucial differentiator, forcing competitors to match or exceed performance benchmarks to remain relevant and capture a larger portion of the growing demand for high-speed data.

Net Serviços de Comunicação, like other major Brazilian telecom operators, is navigating a market where prepaid mobile subscriptions are seeing modest declines. This trend pushes companies to concentrate their efforts on the more profitable postpaid mobile segment and the growing fixed broadband market. This strategic pivot intensifies rivalry as operators vie for high-value customers.

Competition in these lucrative segments is fierce, characterized by aggressive marketing of attractive plans, a strong emphasis on service quality, and the bundling of services. For instance, as of early 2024, major players are actively promoting converged offers that combine mobile, fixed internet, and pay-TV, aiming to lock in customers and increase average revenue per user (ARPU).

Emergence and Consolidation of Regional ISPs

Beyond the major national providers, the Brazilian fixed broadband market is characterized by the significant emergence and consolidation of regional Internet Service Providers (ISPs). These regional players, often focusing on underserved or specific geographic areas, collectively hold a substantial portion of the market, creating a more fragmented competitive landscape than national figures might suggest. For instance, by the end of 2023, while Vivo and Claro dominated, a multitude of smaller regional ISPs were actively competing, particularly in interior cities and less densely populated regions, pushing larger entities to refine their regional market entry and expansion strategies.

This localized competition forces larger national ISPs to tailor their service offerings and pricing models to effectively penetrate and compete within these diverse regional markets. The presence of these agile regional providers means that broad, one-size-fits-all strategies are often insufficient. Companies must understand the unique demands and competitive dynamics of each region to gain market share, a challenge underscored by the fact that in many smaller Brazilian municipalities, regional ISPs are the primary or even sole broadband providers.

- Regional ISPs hold a significant, though fragmented, share of Brazil's fixed broadband market.

- This localized competition compels national players to adapt strategies for regional penetration.

- By late 2023, numerous regional ISPs were actively competing, especially in less urbanized areas.

Declining Traditional Segments Driving Innovation

The persistent drop in traditional fixed telephony and pay-TV subscriptions is a major catalyst for innovation among telecom operators like Net Serviços de Comunicação. This decline compels them to explore new avenues and enhance existing services to offset revenue losses.

This dynamic directly fuels competitive rivalry, as companies aggressively vie for market share in more promising sectors. The battle is particularly fierce in mobile data, high-speed broadband, and the burgeoning market for value-added digital services.

- Declining Revenue Streams: Traditional services, once the bedrock of telecom revenue, are shrinking. For instance, Brazil saw a significant year-over-year decline in fixed-line subscriptions throughout 2023 and into early 2024, pushing operators to find alternatives.

- Intensified Competition in Growth Areas: As a result, competition in mobile data and broadband has become a zero-sum game. Companies are investing heavily in network upgrades and aggressive pricing strategies to attract and retain customers.

- Focus on Value-Added Services: Operators are increasingly diversifying into areas like streaming content, cloud services, and IoT solutions to create new revenue streams and differentiate themselves in a crowded market.

The competitive rivalry within Brazil's telecommunications sector is exceptionally high, driven by a few dominant national players and a growing number of agile regional ISPs. This intense landscape forces constant innovation and aggressive pricing, particularly as companies pivot from declining traditional services to high-growth areas like mobile data and fixed broadband.

The race to deploy advanced infrastructure, such as 5G and fiber optics, further escalates this rivalry, with substantial capital expenditures being made by major operators. For instance, global telecom capex for network expansion and spectrum acquisition in 2024 reached tens of billions of dollars, reflecting this aggressive competition.

Companies are actively pursuing strategies like service bundling and focusing on high-value postpaid and broadband customers to capture market share. This dynamic is evident as operators promote converged offers to enhance customer retention and increase average revenue per user.

| Operator | Estimated Market Share (Fixed Broadband, Early 2024) | Key Competitive Strategy |

|---|---|---|

| Vivo | ~30-35% | Aggressive fiber expansion, bundled services |

| Claro | ~25-30% | Strong convergent offers, 5G leadership |

| TIM Brasil | ~15-20% | Focus on mobile data, network modernization |

| Regional ISPs | ~20-25% (combined) | Localized service, niche market penetration |

SSubstitutes Threaten

The most significant threat of substitutes for Net Serviços de Comunicação comes from over-the-top (OTT) streaming services. Services like Netflix, Amazon Prime Video, and Disney+ have seen a substantial rise in adoption across Brazil, directly competing with traditional pay-TV offerings. This shift has led to a noticeable decline in pay-TV subscriptions, forcing companies like Net to re-evaluate their content and service strategies to remain competitive.

Free messaging and VoIP applications like WhatsApp and Telegram present a significant threat to traditional communication services offered by companies like Net Serviços de Comunicação. These platforms allow users to send text messages and make voice or video calls over the internet at no extra cost, directly replacing revenue streams from SMS and voice plans. For instance, global WhatsApp usage reached over two billion monthly active users by early 2024, demonstrating its widespread adoption and the scale of its substitution effect.

The widespread availability of public and private Wi-Fi networks presents a significant threat of substitution for mobile data services. Consumers increasingly offload their data usage to Wi-Fi, especially in areas with strong signals, directly impacting the demand for cellular data plans. This trend can lead to a reduction in average revenue per user (ARPU) for mobile operators, as customers consume less of their paid mobile data. For instance, in 2024, the global public Wi-Fi user base continued to expand, with many consumers actively seeking out these free or low-cost alternatives to conserve their mobile data allowances.

Fixed Wireless Access (FWA) and Satellite Internet

Emerging technologies like Fixed Wireless Access (FWA) and satellite internet providers, such as Starlink and Hughes Network Systems, present a growing threat to traditional fixed broadband services. These alternatives offer competitive connectivity, particularly in areas where deploying extensive fiber infrastructure is challenging or cost-prohibitive.

The increasing reach and improving speeds of these substitute technologies mean that customers in underserved or remote regions have more viable options for internet access. This directly impacts the customer base and pricing power of incumbent fixed broadband providers like Net Serviços de Comunicação.

- FWA Expansion: FWA networks, utilizing cellular technologies like 5G, are expanding their coverage, offering speeds comparable to some fixed broadband plans.

- Satellite Internet Growth: Satellite internet services, notably Starlink, have seen significant user adoption, providing broadband to previously unconnected areas. For instance, Starlink reported over 2.7 million subscribers globally by the end of 2023, a substantial increase from previous years.

- Price Sensitivity: The cost-effectiveness of these substitutes can be a major draw for price-sensitive consumers, forcing traditional providers to consider their own pricing strategies.

- Infrastructure Limitations: In regions with limited fiber optic deployment, the threat from FWA and satellite internet is amplified, as these technologies bypass the need for extensive physical cabling.

Self-Service Digital Communication Platforms

The rise of self-service digital communication platforms presents a significant threat of substitutes for traditional telecom services offered by Net Serviços de Comunicação. Beyond basic voice and data, these platforms offer integrated solutions that can replace many business-focused fixed-line functionalities.

Cloud-based communication suites and advanced video conferencing tools are increasingly sophisticated. For instance, by mid-2024, the global video conferencing market was projected to reach over $20 billion, indicating substantial adoption. These platforms allow businesses to conduct meetings, share files, and manage internal communications, often at a lower cost and with greater flexibility than traditional leased lines and PBX systems.

This shift directly impacts Net Serviços de Comunicação by reducing the perceived necessity of their core offerings for certain business needs. Companies can leverage platforms like Microsoft Teams, Zoom, or Slack, which bundle many communication features, thereby decreasing their reliance on dedicated telecom infrastructure for these functions.

- Digital platforms offer integrated communication and collaboration tools, directly substituting for traditional business fixed-line services.

- Cloud-based solutions and video conferencing are gaining widespread adoption, with the global video conferencing market expected to exceed $20 billion by mid-2024.

- Businesses are reducing reliance on traditional telephony and data lines by utilizing these versatile and often more cost-effective digital alternatives.

The threat of substitutes for Net Serviços de Comunicação is substantial, driven by evolving consumer preferences and technological advancements. Over-the-top (OTT) streaming services and free communication apps directly erode traditional pay-TV and voice/messaging revenues, respectively. Furthermore, the proliferation of Wi-Fi networks and the rise of Fixed Wireless Access (FWA) and satellite internet challenge Net's core broadband offerings, especially in areas with less developed fiber infrastructure.

| Substitute Category | Key Players/Technologies | Impact on Net Serviços de Comunicação | Relevant Data Point (as of early-mid 2024) |

|---|---|---|---|

| Content Streaming | Netflix, Amazon Prime Video, Disney+ | Decreased pay-TV subscriptions | Global WhatsApp usage > 2 billion monthly active users |

| Communication Apps | WhatsApp, Telegram | Reduced SMS and voice revenue | Global video conferencing market projected > $20 billion by mid-2024 |

| Internet Access | Public Wi-Fi, FWA, Satellite Internet (Starlink) | Lower demand for mobile data and fixed broadband | Starlink subscribers > 2.7 million globally by end of 2023 |

Entrants Threaten

The telecommunications sector, particularly in Brazil, demands enormous capital outlays for constructing and sustaining widespread network infrastructure, including the rollout of 5G and fiber optics. For instance, in 2023, major Brazilian telecom operators collectively invested billions of dollars in network upgrades and expansion, with a significant portion dedicated to 5G spectrum acquisition and deployment.

These substantial initial expenditures present a significant hurdle for prospective new entrants, making it difficult for them to challenge established companies like Claro, which already possess extensive and depreciated infrastructure assets.

Brazil's telecommunications sector is a minefield of regulations, primarily governed by ANATEL. New companies looking to enter must navigate a labyrinth of licensing procedures, participate in costly spectrum auctions, and adhere to stringent compliance mandates. For instance, in 2024, ANATEL continued to refine rules around data privacy and network security, adding layers of complexity.

This intricate regulatory framework acts as a substantial barrier to entry. It requires new players to invest heavily in legal expertise and administrative resources just to understand and comply with the existing rules. The sheer administrative burden and the potential for penalties for non-compliance deter many potential new entrants who may lack the necessary capital and experience.

Incumbent telecom operators in Brazil, such as Claro, leverage substantial economies of scale. This advantage stems from their vast existing customer bases and deeply entrenched infrastructure, allowing for lower per-unit costs in network operations, equipment procurement, and marketing. For instance, in 2023, Claro Brasil reported a significant market share in mobile subscriptions, a testament to its scale.

New entrants face a formidable barrier in replicating these cost efficiencies. Without a comparable customer base and established network, they must make massive initial investments to achieve even a fraction of the scale enjoyed by incumbents. This makes it incredibly challenging for newcomers to compete on price or service quality without aggressive, capital-intensive market penetration strategies.

Brand Loyalty and Customer Lock-in

Net Serviços de Comunicação benefits from significant brand loyalty cultivated over years of operation. Established players have invested heavily in marketing and service quality, creating strong customer preferences that are difficult for newcomers to dislodge. This loyalty is often amplified by bundled service packages and contractual obligations, effectively locking in existing customers.

For new entrants, the primary hurdle is overcoming this ingrained customer loyalty and the associated switching costs. Potential customers may perceive the risk of switching to an unknown provider as outweighing the potential benefits, especially if current services meet their needs adequately. For instance, in the Brazilian telecommunications market, major players like Vivo and Claro have consistently reported high customer retention rates, often exceeding 90% for their postpaid mobile services, making it a challenging environment for new entrants to gain substantial market share.

- Brand Recognition: Established brands like Net Serviços have decades of market presence, fostering trust and familiarity among consumers.

- Bundled Services: Offering packages that combine internet, TV, and mobile services creates a more integrated and convenient experience, increasing customer stickiness.

- Customer Lock-in: Long-term contracts and early termination fees can significantly deter customers from switching providers, even if more competitive offers emerge.

- Switching Costs: Beyond financial penalties, customers face the hassle of changing providers, potentially losing existing benefits or requiring new equipment.

Access to Essential Facilities and Spectrum

New players in the telecommunications sector face significant hurdles in securing the fundamental infrastructure needed to compete. Accessing critical assets like extensive fiber optic networks, strategically located mobile towers, and essential radio spectrum frequencies is paramount for establishing a viable service.

While some neutral fiber providers offer leasing options, the cost and availability of these essential facilities can be prohibitive for newcomers. Furthermore, obtaining the necessary spectrum licenses through government auctions is a notoriously expensive and intensely competitive process. For instance, in the 2021 Brazilian 5G spectrum auction, the government raised R$47.2 billion (approximately $9 billion USD at the time), highlighting the substantial capital investment required just to enter the market.

- High Capital Investment: Acquiring or leasing fiber optic backbones and mobile towers demands significant upfront capital.

- Spectrum Scarcity and Cost: Essential radio frequencies are limited, leading to high auction prices and intense competition among bidders.

- Limited Availability of Neutral Infrastructure: While neutral fiber providers exist, securing access at competitive rates remains a challenge for new entrants.

The threat of new entrants for Net Serviços de Comunicação is significantly mitigated by the immense capital required to build and maintain telecommunications infrastructure, including 5G and fiber optics. In 2023 alone, major Brazilian telecom companies invested billions in network upgrades, with a substantial portion allocated to 5G spectrum and deployment, making it exceedingly difficult for newcomers to match these outlays.

Navigating Brazil's complex regulatory landscape, overseen by ANATEL, presents another formidable barrier. New entrants must contend with licensing, costly spectrum auctions, and stringent compliance rules, such as those refined in 2024 for data privacy and network security, demanding significant legal and administrative resources.

Established players like Net Serviços benefit from substantial economies of scale, derived from vast customer bases and entrenched infrastructure, allowing for lower per-unit costs. In 2023, Claro Brasil's significant market share in mobile subscriptions exemplifies this advantage, making it challenging for new entrants to achieve comparable cost efficiencies and compete on price or service quality without massive investment.

Furthermore, deep-rooted customer loyalty, often reinforced by bundled services and contractual obligations, creates a significant hurdle for new entrants. High customer retention rates, often exceeding 90% for postpaid mobile services among major players like Vivo and Claro in 2023, underscore the difficulty in attracting and retaining customers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Net Serviços de Comunicação is built upon a foundation of public financial reports, regulatory filings from ANATEL, and industry-specific market research from reputable sources like Teleco and IDC. This comprehensive data set allows for a thorough evaluation of competitive intensity and market dynamics.