Net Serviços de Comunicação Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Net Serviços de Comunicação Bundle

Unlock the strategic potential of Net Serviços de Comunicação with a comprehensive BCG Matrix analysis. Understand which of their offerings are market leaders, which are generating consistent revenue, and which require careful consideration for future investment. This preview offers a glimpse into their product portfolio's performance.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

5G Mobile Services, represented by Claro, is a strong contender in Brazil's booming 5G sector. The market expanded dramatically, with user numbers jumping over 90% in the year leading up to January 2025, and forecasts predict over 60 million users by year-end 2025.

Claro's dominance is evident, holding a substantial 34.1% of 5G accesses in February 2025. Furthermore, their grip on the 5G device market was strong in Q3 2024, with a 39% share, solidifying their star status in this high-growth area.

Claro's postpaid mobile segment is a definite star in Net Serviços de Comunicação's portfolio. This area has seen impressive growth, with a nearly 5% jump in subscriptions during 2024. The company also added a substantial 987,000 new customers in the first quarter of 2025, showcasing strong momentum.

Fiber optic broadband in Brazil is a significant growth area for Net Serviços de Comunicação. By January 2025, fiber represented a substantial 77.1% of all fixed internet connections, a figure expected to climb with a projected compound annual growth rate of 7.1% through 2030. This robust expansion underscores the technology's increasing importance and adoption.

Claro, a major player in Brazil's telecommunications landscape, held a 20.1% share of the fixed broadband market in the first quarter of 2025. The company's ongoing investment in expanding its fiber optic network to more households directly leverages this high-growth market. This strategic focus on fiber positions it as a key Star within Net Serviços de Comunicação's portfolio, poised to generate substantial future revenue.

Corporate Connectivity Solutions

Claro's Corporate Connectivity Solutions, primarily through its Embratel brand, are demonstrating robust expansion in advanced enterprise offerings. This segment is characterized by substantial growth in areas like SD-WAN, satellite services, and security solutions, reflecting a strong market demand driven by ongoing digital transformation initiatives among businesses.

In the third quarter of 2024, Embratel reported impressive year-over-year growth figures: SD-WAN services saw a 45.1% increase, satellite services grew by 39%, and security services expanded by 28.8%. These figures highlight the company's success in capturing market share within these high-value, complex service categories.

- SD-WAN Growth: 45.1% increase in Q3 2024.

- Satellite Services Growth: 39% increase in Q3 2024.

- Security Services Expansion: 28.8% increase in Q3 2024.

- Market Driver: High demand from businesses undergoing digital transformation.

Bundled Services

Bundled services are a cornerstone of Claro's strategy, combining mobile, fixed broadband, and pay-TV. This integrated approach is a significant growth driver, fostering customer loyalty by offering convenience and value. In 2024, this strategy continued to prove effective in increasing average revenue per user (ARPU) by encouraging customers to adopt multiple services.

Claro's bundled packages are designed to capture a larger portion of household telecommunications spending. By cross-selling and up-selling these integrated offerings, the company enhances its market position. This strategy directly addresses the growing consumer demand for seamless digital experiences across various platforms.

- Growth Driver: Bundled services significantly contribute to Claro's revenue growth by increasing customer stickiness.

- ARPU Enhancement: Combining multiple services allows Claro to raise the average revenue generated per customer.

- Market Share Capture: Integrated offerings help Claro secure a more substantial share of the overall telecom market.

- Consumer Needs: The strategy aligns with evolving consumer preferences for consolidated and convenient digital solutions.

Claro's 5G mobile services and its postpaid segment are clear Stars, showing exceptional growth and market penetration. The company's fiber optic broadband offerings also fall into this category, benefiting from Brazil's rapid digital infrastructure expansion.

Embratel's corporate connectivity solutions, particularly SD-WAN and security services, are also Stars. These segments are experiencing significant demand driven by business digital transformation, with strong year-over-year growth reported in late 2024.

Claro's bundled services strategy is a key Star, effectively driving ARPU and customer loyalty by integrating mobile, broadband, and pay-TV. This approach capitalizes on consumer demand for consolidated digital experiences.

| Category | Claro's Performance Indicator | Growth/Share | Timeframe |

|---|---|---|---|

| 5G Mobile Services | Market Share | 34.1% | Feb 2025 |

| Postpaid Mobile | Subscription Growth | ~5% | 2024 |

| Fiber Optic Broadband | Fixed Internet Share | 77.1% | Jan 2025 |

| Corporate Connectivity (SD-WAN) | Year-over-Year Growth | 45.1% | Q3 2024 |

| Bundled Services | ARPU Impact | Positive | 2024 |

What is included in the product

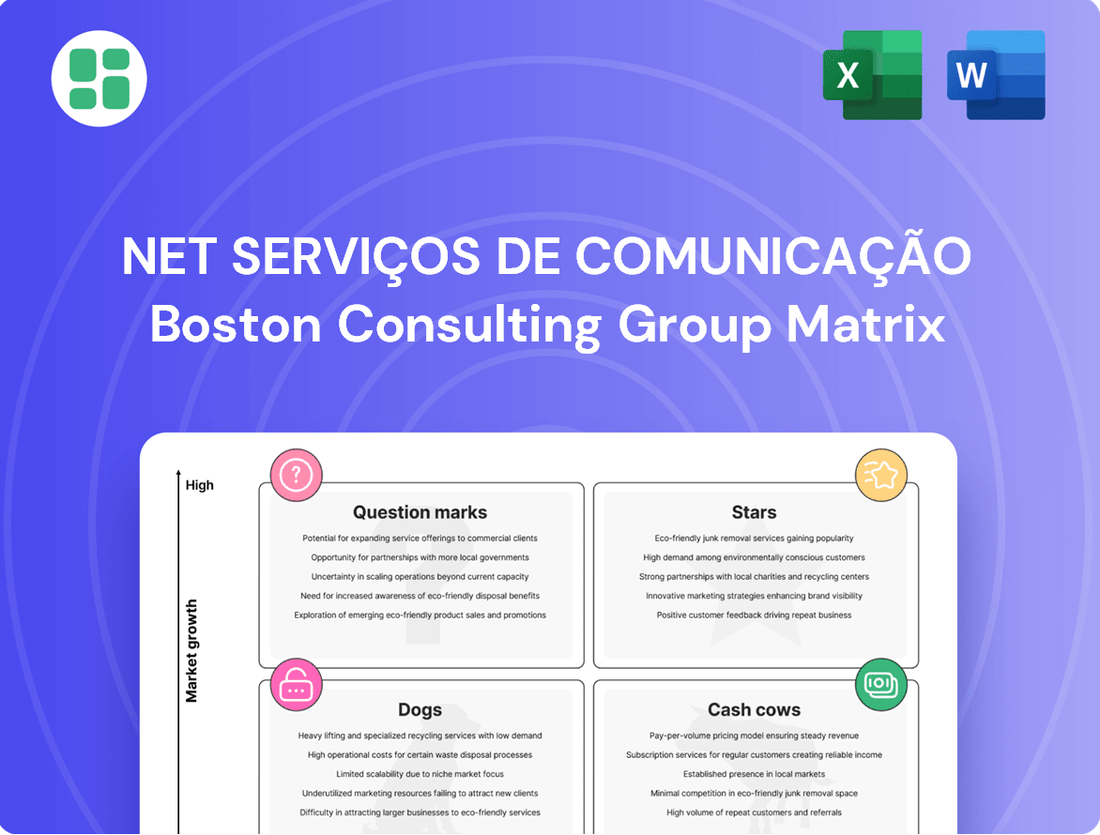

This BCG Matrix analysis of Net Serviços de Comunicação identifies its Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights on investment, holding, or divestment for each business unit.

A clear BCG Matrix visualizes Net Serviços' portfolio, easing the pain of strategic resource allocation.

Cash Cows

Claro's overall fixed broadband services in Brazil represent a classic Cash Cow for Net Serviços de Comunicação. As of early 2025, Claro commands roughly 20% of the market, a testament to its long-standing presence and customer loyalty.

This significant market share translates into a reliable and substantial cash flow. Even as fiber optic technology drives growth, the existing customer base across various broadband technologies provides a stable revenue foundation that requires minimal new capital investment for maintenance.

Claro's traditional pay-TV services, encompassing cable and direct-to-home (DTH), represent a significant cash cow for Net Serviços de Comunicação. As of February 2025, Claro holds a dominant 52.7% share of the Brazilian pay-TV market, underscoring its established strength in this mature segment.

Despite the overall market contraction, Claro's substantial subscriber numbers continue to yield robust revenue and healthy profit margins. This consistent cash flow allows the company to effectively cross-sell other services, thereby maximizing the profitability of its pay-TV operations and providing capital for investment in growth areas.

Fixed Telephony Services, represented by Claro's position, operates within a mature and declining market in Brazil. As of early 2025, Claro holds approximately 31% of this shrinking segment.

Despite the overall market contraction driven by the rise of mobile communication, Claro's substantial existing infrastructure and loyal customer base continue to generate consistent, predictable cash flow. This steady income stream is a hallmark of a cash cow.

Strategic decisions for this segment focus on maximizing returns from current assets with minimal new investment. The goal is to efficiently extract value from the established subscriber base and infrastructure, rather than pursuing growth initiatives.

Legacy Mobile Services (4G)

Legacy Mobile Services (4G) represent a significant cash cow for Net Serviços de Comunicação. Despite the advancements in 5G technology, 4G continues to dominate the Brazilian mobile landscape, accounting for over 70% of all mobile lines as of early 2025. This sustained demand, coupled with Claro's substantial market share of approximately 33% in the overall mobile sector, translates into a large and stable subscriber base for 4G services.

The mature infrastructure supporting 4G requires minimal incremental investment, allowing Net Serviços de Comunicação to generate consistent and substantial revenue from this segment. This reliable income stream is crucial for funding investments in newer technologies and supporting other business units within the company's portfolio.

- Dominant Market Share: 4G services still represent over 70% of Brazilian mobile lines in early 2025.

- Stable Revenue Generation: Claro's ~33% overall mobile market share ensures a large 4G subscriber base.

- Mature Infrastructure: Low incremental investment needs contribute to high profitability.

- Financial Contribution: This segment reliably fuels the company's financial performance.

Voice and Messaging Services (Traditional)

Traditional voice and messaging services, despite not being high-growth sectors, are still crucial for Claro, consistently bringing in significant revenue from its large mobile and fixed customer base. These services are deeply ingrained in how people and businesses communicate daily.

Claro's strong market position in these essential services guarantees a steady stream of cash. This stability means that these offerings require very little new investment in promotions or infrastructure upgrades.

- Revenue Generation: In 2024, despite market shifts, traditional voice and messaging services continued to be a bedrock for telecom providers like Claro, contributing a substantial portion of their overall revenue. For instance, while specific figures for Claro’s traditional services aren't publicly broken out in detail, the broader Brazilian telecom market saw continued, albeit slower, revenue from these segments.

- Customer Habits: These services remain fundamental, with millions of Brazilians relying on them for daily communication, underscoring their embedded nature in consumer behavior and business operations.

- Cash Flow Stability: The mature nature of these services means they generate predictable cash flow with minimal incremental investment needed for growth, unlike newer, more dynamic service areas.

Claro's traditional voice and messaging services, while mature, remain vital cash cows for Net Serviços de Comunicação due to their consistent revenue generation. These services benefit from ingrained customer habits and a substantial user base, requiring minimal new capital for maintenance.

| Service Segment | Market Share (Early 2025) | Cash Flow Characteristic | Investment Needs |

|---|---|---|---|

| Fixed Broadband | ~20% | Reliable and substantial | Minimal for maintenance |

| Pay-TV | 52.7% | Robust revenue, healthy margins | Low, supports cross-selling |

| Fixed Telephony | ~31% | Consistent and predictable | Minimal, focuses on extraction |

| Legacy Mobile (4G) | ~33% (overall mobile) | Consistent and substantial | Minimal incremental |

Preview = Final Product

Net Serviços de Comunicação BCG Matrix

The Net Serviços de Comunicação BCG Matrix preview you see is the exact, fully formatted document you will receive after purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready report ready for immediate strategic application. You can confidently use this preview as a true representation of the comprehensive BCG Matrix analysis you'll be acquiring. Once purchased, this document will be instantly downloadable, allowing you to seamlessly integrate it into your business planning and decision-making processes.

Dogs

Claro's mobile subscriber base still includes users on older 2G and 3G networks, though these technologies represent a shrinking portion of total mobile accesses in Brazil. In 2024, the overall decline in 2G/3G subscriptions continued, with industry data indicating a significant drop year-over-year as users migrate to newer, faster networks.

These legacy technologies offer limited growth potential and are not slated for substantial future investment, as the market's focus has firmly shifted to 4G and 5G deployments. This strategic pivot means that revenue generation from these older connections is minimal and the segment is being systematically retired.

Claro's residential satellite internet offering is a niche segment with a minimal market presence. As of January 2025, Claro held only a 2.1% market share in this area, significantly trailing specialized providers.

This low market share suggests that residential satellite internet is not a strategic growth driver for Claro's broader broadband operations. The segment caters to specific, often rural, underserved regions but doesn't offer substantial revenue potential compared to the investment needed.

Within Net Serviços de Comunicação's portfolio, the traditional pay-TV satellite technology, while part of the broader Claro offering, is showing signs of contraction. Despite Claro's overall market strength, this specific delivery method is seeing subscriber attrition.

The shift towards fiber optics and over-the-top (OTT) streaming services is directly impacting satellite TV's subscriber base, leading to increased churn. This segment presents limited avenues for future growth, making substantial investment unlikely as the company prioritizes more contemporary platforms.

Low-Value Prepaid Mobile Segments

The low-value prepaid mobile segment, represented by Claro in the BCG Matrix for Net Serviços de Comunicação, is characterized by significant challenges. In Q2 2025, América Móvil Brazil, which includes Claro, saw net disconnections in its prepaid mobile subscriber base. This indicates a shrinking market share within this specific segment.

Customers in this low-value prepaid segment typically exhibit lower average revenue per user (ARPU) and higher churn rates. For instance, ARPU for prepaid services in Brazil has historically been lower than postpaid, and the churn rate can exceed 20% annually, making customer acquisition and retention costly.

- Declining Subscriber Base: Net disconnections in Q2 2025 for América Móvil Brazil's prepaid segment highlight a shrinking market.

- Low ARPU and High Churn: Customers in this segment generate less revenue and are more likely to switch providers, increasing operational costs.

- Resource Drain: Significant marketing and retention investments are required for minimal returns, classifying this as a 'dog' in the BCG Matrix.

- Limited Growth Prospects: The segment offers little potential for substantial future growth, making it a low priority for resource allocation.

Legacy Fixed Telephony Lines (Copper/Older Infrastructure)

Legacy fixed telephony lines, predominantly copper-based, represent a significant challenge for Net Serviços de Comunicação within the broader telecommunications landscape. Despite Claro's overall market presence, these older infrastructure lines are experiencing a consistent decline in subscriber numbers. For instance, in 2024, the global fixed-line market continued its downward trend, with many developed nations seeing annual decreases of 2-5% in active lines.

These legacy connections operate in a market characterized by zero growth potential and are primarily maintained for a shrinking base of existing, often long-term, customers. The cost of maintaining this aging infrastructure often outweighs the revenue generated, making further investment impractical. Companies are increasingly looking towards migrating these customers to newer technologies like fiber optics.

The strategic approach for Net Serviços de Comunicação regarding these legacy lines is clear: minimal investment and a focus on eventual divestiture or a managed migration strategy. The goal is to phase out these operations efficiently, freeing up resources for more promising growth areas.

- Declining Subscriber Base: Legacy fixed lines are losing customers year after year, reflecting a shrinking market.

- Zero Growth Potential: Unlike newer technologies, these lines offer no opportunity for expansion or increased revenue.

- High Maintenance Costs: The cost to maintain outdated copper infrastructure is often disproportionate to the service's revenue.

- Strategic Focus on Migration/Divestiture: Net Serviços de Comunicação is likely to prioritize moving customers to modern services or exiting this segment.

The low-value prepaid mobile segment, representing a 'dog' for Net Serviços de Comunicação, saw net disconnections in Q2 2025 for América Móvil Brazil. This segment is characterized by low average revenue per user (ARPU) and high churn rates, making it costly to maintain. Significant marketing and retention investments yield minimal returns, further classifying it as a 'dog' with limited future growth prospects.

| Segment | BCG Category | Key Metrics (2024-2025) | Strategic Implication |

|---|---|---|---|

| Prepaid Mobile | Dog | Net disconnections (Q2 2025); Low ARPU; High churn (>20% annually) | Resource drain, minimal returns, low growth potential |

| Legacy Fixed Telephony | Dog | Consistent subscriber decline; Zero growth potential; High maintenance costs | Managed migration or divestiture focus |

| Traditional Pay-TV Satellite | Dog | Subscriber attrition due to fiber/OTT shift | Limited growth, low investment priority |

| Residential Satellite Internet | Dog | 2.1% market share (Jan 2025); Niche, underserved regions | Not a strategic growth driver |

Question Marks

The Internet of Things (IoT) and Machine-to-Machine (M2M) connectivity represent a significant growth area for Net Serviços de Comunicação, likely placing this segment in the question mark category of the BCG matrix. Brazil's IoT market is expanding rapidly, with projections indicating a substantial rise in connected devices. Claro, a key player under América Móvil, is well-positioned to benefit from this trend, as evidenced by reported M2M additions in Brazil.

While Claro has a strong foundation in traditional connectivity, its specific market share and leadership in the dynamic and fragmented IoT/M2M sector are still solidifying. This requires ongoing strategic investment to translate the market's potential into a dominant position, much like other question mark businesses that need focused resources to achieve market leadership.

Claro tv+, the streaming-focused pay-TV offering from Net Serviços de Comunicação, has achieved a significant milestone, surpassing 1 million subscribers in the first half of 2024. This growth trajectory highlights its expansion into a dynamic and rapidly expanding market segment.

While Claro tv+ shows promise with its increasing subscriber base and integration of new streaming services, its position within the broader, highly competitive streaming and Over-The-Top (OTT) market is still developing. Global streaming giants dominate this space, suggesting Claro's current market share remains relatively modest.

To ascend to a Star position within the BCG Matrix, Claro tv+ requires substantial and sustained investment. This includes bolstering its content library, enhancing platform technology, and executing robust marketing strategies to capture greater market adoption and solidify its competitive standing.

Claro, via Embratel, is experiencing robust revenue expansion in advanced enterprise solutions such as SD-WAN and security services. This surge highlights the significant demand within these rapidly growing business-to-business sectors, indicating a strong market reception for these offerings.

Despite this promising growth, Claro's market share and its ability to differentiate itself from specialized IT service providers and major cloud players in these intricate segments are still developing. Sustained, substantial investments in technology infrastructure, specialized talent, and sales capabilities are crucial for Claro to establish a leading position in these competitive advanced corporate connectivity markets.

New 5G Applications and Vertical Solutions

New 5G applications are poised to unlock significant growth beyond traditional mobile services, targeting high-potential vertical markets. Think of smart cities, where 5G can enable real-time traffic management and public safety systems, or industrial automation, driving efficiency through connected machinery and predictive maintenance. Enhanced immersive experiences, such as augmented and virtual reality, also represent a key area for future development.

Claro is actively investing in its 5G infrastructure to support these emerging applications. However, the full realization of these innovative use cases is still in its nascent stages. Success hinges on continued research and development, strategic partnerships across industries, and robust market education to drive widespread adoption of these advanced capabilities.

- Smart Cities: Potential for IoT device connectivity at scale, enabling efficient resource management and improved urban living.

- Industrial Automation: Low latency and high reliability of 5G are critical for real-time control of robots and machinery in manufacturing.

- Immersive Experiences: 5G's bandwidth supports high-definition streaming for AR/VR applications, transforming entertainment and training.

- Healthcare: Enabling remote surgery and advanced telemedicine through reliable, high-speed connectivity.

Wholesale Network Services (Fiber/Backbone Capacity)

Claro's substantial investments in expanding its fiber network and backbone capacity across Brazil position it to be a key player in the wholesale network services market. This segment is experiencing robust growth due to the increasing demand for reliable, high-speed connectivity nationwide.

While Claro possesses the infrastructure to serve other operators and smaller ISPs, its current market penetration and specific strategy for this wholesale segment remain areas for focused development. Capturing the full potential of this high-growth market hinges on strategic business development efforts.

- Market Potential: The wholesale fiber and backbone capacity market in Brazil is expanding rapidly, driven by the increasing need for robust connectivity solutions across the country.

- Claro's Infrastructure: Claro's ongoing extensive fiber network expansion and high-capacity backbone infrastructure projects provide the foundational assets to serve this market.

- Strategic Focus: The company's current market share and strategic approach to wholesale network services represent a potential growth area that requires dedicated business development to maximize its impact.

- Growth Drivers: Demand from other telecom operators and smaller Internet Service Providers (ISPs) for reliable and high-capacity network access fuels the growth of this segment.

The burgeoning Internet of Things (IoT) and Machine-to-Machine (M2M) sectors in Brazil represent a significant opportunity for Net Serviços de Comunicação, placing these segments squarely in the question mark category of the BCG Matrix. Brazil's IoT market is on a strong upward trajectory, with a substantial increase in connected devices anticipated. Claro, a prominent entity within América Móvil, is strategically positioned to capitalize on this expansion, as demonstrated by reported M2M connection growth in Brazil.

While Claro benefits from a solid foundation in traditional connectivity, its market share and leadership within the dynamic and often fragmented IoT/M2M landscape are still being established. This necessitates continued strategic investment to translate market potential into market dominance, mirroring the trajectory of other question mark businesses that require focused resources to achieve leadership positions.

Claro tv+, the streaming-focused pay-TV offering from Net Serviços de Comunicação, achieved a significant milestone in the first half of 2024, surpassing one million subscribers. This growth underscores its expansion into a dynamic and rapidly growing market segment, indicating strong consumer adoption.

Despite its promising subscriber growth and integration of new streaming services, Claro tv+'s position within the highly competitive global streaming and Over-The-Top (OTT) market is still developing. Major global streaming platforms continue to dominate, suggesting Claro's current market share remains relatively modest in comparison.

To transition into a Star position within the BCG Matrix, Claro tv+ requires substantial and ongoing investment. This includes enhancing its content library, upgrading platform technology, and implementing effective marketing strategies to drive broader market adoption and solidify its competitive standing.

Claro, through Embratel, is experiencing robust revenue growth in advanced enterprise solutions such as SD-WAN and security services. This surge reflects significant demand in these rapidly expanding business-to-business sectors, indicating a positive market reception for these offerings.

However, Claro's market share and its ability to differentiate itself from specialized IT service providers and major cloud players in these complex segments are still evolving. Sustained, significant investments in technology infrastructure, specialized talent, and sales capabilities are crucial for Claro to secure a leading position in these competitive advanced corporate connectivity markets.

New 5G applications are set to unlock substantial growth beyond traditional mobile services, targeting high-potential vertical markets. Examples include smart cities, where 5G can optimize real-time traffic management and public safety, and industrial automation, boosting efficiency through connected machinery and predictive maintenance. Enhanced immersive experiences, such as augmented and virtual reality, also represent key areas for future development.

Claro is actively investing in its 5G infrastructure to support these emerging applications. Nevertheless, the full realization of these innovative use cases is still in its early stages. Success will depend on continued research and development, strategic industry partnerships, and robust market education to encourage widespread adoption of these advanced capabilities.

Claro's substantial investments in expanding its fiber network and backbone capacity across Brazil position it well for the wholesale network services market. This segment is experiencing robust growth due to the escalating demand for reliable, high-speed connectivity nationwide.

While Claro possesses the necessary infrastructure to serve other operators and smaller ISPs, its current market penetration and specific strategy for this wholesale segment require focused development. Capturing the full potential of this high-growth market hinges on dedicated business development efforts.

| Segment | Market Growth | Relative Market Share | BCG Category |

| IoT/M2M Connectivity | High | Low to Medium | Question Mark |

| Claro tv+ (Streaming) | High | Low | Question Mark |

| Advanced Enterprise Solutions (SD-WAN, Security) | High | Low to Medium | Question Mark |

| 5G Applications (Smart Cities, Industrial Automation) | High | Low | Question Mark |

| Wholesale Network Services (Fiber, Backbone) | High | Low to Medium | Question Mark |

BCG Matrix Data Sources

Our Net Serviços de Comunicação BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.