CK Asset Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Asset Holdings Bundle

CK Asset Holdings boasts a diverse portfolio, leveraging its strong brand reputation and extensive global reach. However, navigating fluctuating property markets and increasing competition presents significant challenges.

Want the full story behind CK Asset Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CK Asset Holdings boasts a robust and expanding global investment portfolio, extending well beyond conventional real estate. This includes significant holdings in infrastructure and utility assets across various international markets, such as the United Kingdom. For instance, the company has strategically invested in essential services, which typically offer more predictable revenue streams compared to purely property-based ventures.

This strategic diversification across different asset classes and geographies is a key strength, acting as a buffer against sector-specific downturns or regional economic volatility. The inclusion of assets like elderly care homes in Germany further broadens this base, contributing to a more resilient and stable recurring income profile for the company.

CK Asset Holdings boasts a robust financial standing, underscored by its A/Stable credit rating from Standard & Poor's and A2 Stable from Moody's. This financial strength is further illustrated by a remarkably low net debt to net total capital ratio, hovering around 4.0% as of December 31, 2024.

CK Asset Holdings showcased remarkable resilience in 2024, navigating a subdued Hong Kong residential property market and a generally tough real estate climate in Mainland China. The company's ability to successfully launch and move several property developments highlights its operational strength even amidst headwinds.

This resilience was further bolstered by CK Asset's diversified income portfolio. Overseas infrastructure and social housing investments provided a crucial buffer, effectively softening the blow from domestic property market fluctuations. For instance, their UK infrastructure assets continued to generate stable returns, contributing significantly to overall group performance.

Experienced Management and Strategic Acumen

CK Asset Holdings benefits immensely from its experienced management team, notably Senior Advisor Li Ka-shing, whose extensive history of navigating economic shifts and pinpointing strategic growth avenues is invaluable. This seasoned leadership ensures the company remains agile and forward-thinking in a dynamic global market.

The company's strategic acumen is evident in its consistent pursuit of investments offering high structural liquidity and enduring returns. This approach is further underscored by a proven track record of successful strategic acquisitions and proactive share buyback programs, demonstrating a deep-seated commitment to enhancing shareholder value.

- Seasoned Leadership: Senior Advisor Li Ka-shing's decades of experience provide unparalleled strategic direction.

- Investment Focus: Prioritizes investments with strong liquidity and sustainable, long-term returns.

- Shareholder Value: History of strategic acquisitions and share buybacks signals commitment to investors.

- Market Navigation: Proven ability to identify and capitalize on opportunities across various economic cycles.

Commitment to Sustainability and Quality

CK Asset Holdings demonstrates a strong commitment to sustainability and quality, aiming to create lasting value. This focus is evident in their dedication to environmentally conscious development and efforts to lower their carbon footprint.

Their pursuit of quality is underscored by an ambitious target: all new projects are slated to achieve a minimum Green Mark Platinum rating by 2025. This benchmark signifies adherence to stringent construction standards and the integration of advanced sustainable practices.

- Environmental Focus: CK Asset Holdings prioritizes eco-friendly development and carbon emission reduction.

- Green Building Target: Aims for all new projects to achieve a minimum Green Mark Platinum rating by 2025.

- Quality Assurance: This rating reflects high construction standards and a commitment to sustainable building.

CK Asset Holdings possesses a highly diversified global portfolio, encompassing not only property but also infrastructure and utility assets, notably in the UK. This broad diversification across geographies and asset types provides significant resilience against sector-specific downturns or regional economic volatility. The company's strategic inclusion of assets like German elderly care homes further strengthens its recurring income profile.

The company's financial health is robust, evidenced by its A/Stable credit rating from S&P and A2 Stable from Moody's. As of December 31, 2024, CK Asset Holdings maintained a very low net debt to net total capital ratio, reported at approximately 4.0%. This strong financial footing allows for continued strategic investment and operational flexibility.

CK Asset Holdings has demonstrated exceptional resilience, successfully navigating a subdued Hong Kong residential market and challenging conditions in Mainland China during 2024. The company's ability to launch and sell multiple property developments under these circumstances highlights its operational prowess. This resilience is further supported by its diversified income streams, with overseas infrastructure and social housing investments providing a crucial stabilizing effect against domestic market fluctuations.

The company benefits from seasoned leadership, particularly from Senior Advisor Li Ka-shing, whose extensive experience in economic navigation and strategic growth identification is invaluable. This leadership ensures the company remains agile and forward-thinking, adept at capitalizing on opportunities across diverse economic cycles. Their strategic focus on investments with high liquidity and enduring returns, coupled with a history of successful acquisitions and share buybacks, underscores a commitment to enhancing shareholder value.

CK Asset Holdings is committed to sustainability and quality, aiming for long-term value creation through environmentally conscious development and carbon footprint reduction. A key objective is for all new projects to achieve a minimum Green Mark Platinum rating by 2025, signifying adherence to stringent sustainable construction standards.

| Strength Category | Key Aspect | Supporting Detail/Metric |

|---|---|---|

| Portfolio Diversification | Global Asset Spread | Includes infrastructure and utilities in the UK, elderly care homes in Germany. |

| Financial Strength | Credit Ratings | A/Stable (S&P), A2 Stable (Moody's). |

| Financial Strength | Debt Management | Net debt to net total capital ratio around 4.0% (as of Dec 31, 2024). |

| Operational Resilience | Market Navigation | Successful property launches in challenging Hong Kong and Mainland China markets (2024). |

| Leadership & Strategy | Experienced Management | Senior Advisor Li Ka-shing's strategic guidance. |

| Sustainability Commitment | Green Building Target | All new projects to achieve minimum Green Mark Platinum rating by 2025. |

What is included in the product

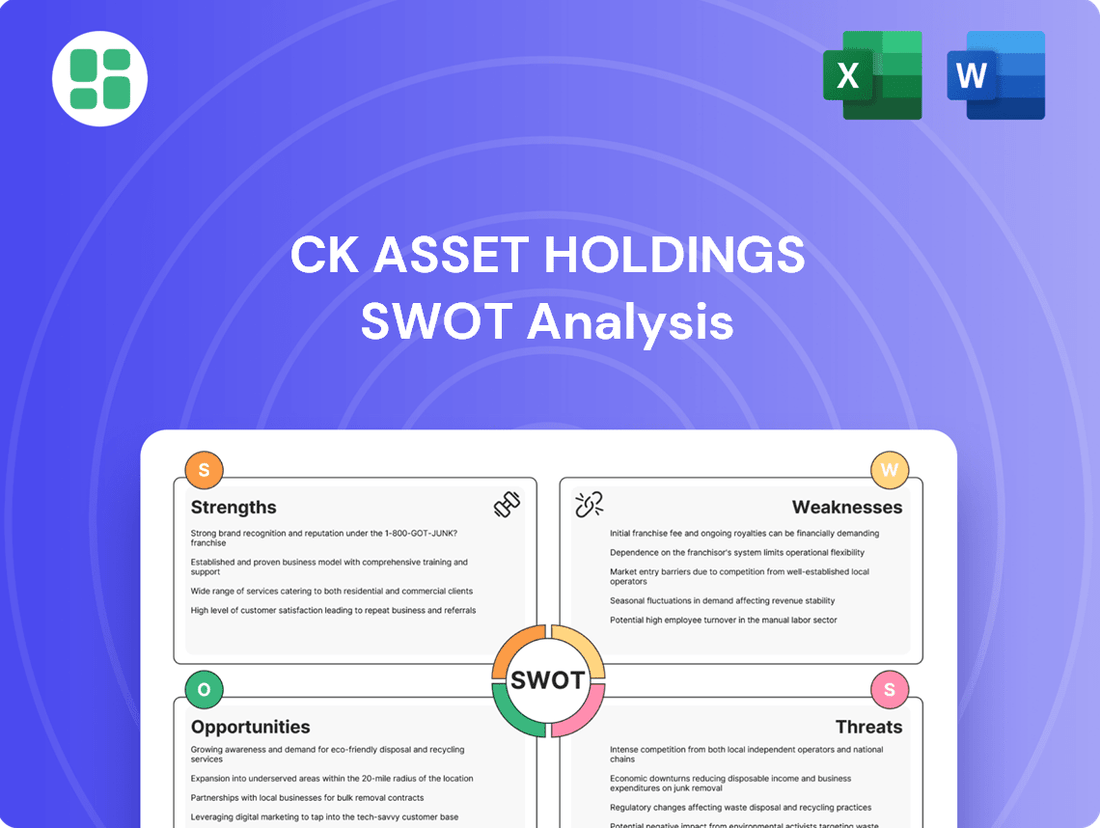

This SWOT analysis provides a comprehensive breakdown of CK Asset Holdings's strategic business environment, examining its internal capabilities and external market challenges.

Offers a clear visual representation of CK Asset Holdings' strategic landscape, simplifying complex internal and external factors for actionable insights.

Weaknesses

Despite CK Asset Holdings' efforts to diversify, its significant exposure to the Hong Kong and Mainland China property markets remains a key weakness. The residential property market in Hong Kong continued to experience softness throughout 2024, characterized by elevated unsold inventory and downward pressure on prices.

Mainland China's real estate sector also grappled with a prolonged slump in 2024, marked by declining property sales and ongoing developer challenges. This continued weakness in its core markets leaves CK Asset Holdings vulnerable to further downturns and impacts its overall financial performance.

CK Asset Holdings experienced a notable profit decline for the fiscal year ending December 31, 2024. Profit attributable to shareholders saw a significant drop of 20.0% when compared to the preceding year's performance.

This downturn in profitability was primarily attributed to a slowdown in property development bookings. Furthermore, a substantial decrease in home sales within Mainland China significantly impacted the company's financial results, highlighting the prevailing difficult market environment.

While property sales saw a rebound in 2024, CK Asset Holdings is facing suppressed margins on these projects. This is largely due to lower average selling prices achieved on recent developments, impacting the profitability of its property development segment.

Even with successful presales, the reduced profit margins mean that property development's contribution to the firm's overall earnings will likely be limited. For instance, the average selling price for new residential projects in Hong Kong, a key market for CK Asset, remained under pressure throughout early 2024, with some analysts noting a 5-10% decrease compared to peak prices in 2023.

High Vacancy Rates and Slow Recovery in Hong Kong Office Market

The Hong Kong office sector continues to grapple with significant headwinds, with high vacancy rates and declining rents persisting. Industry analysts project a prolonged recovery period for the market, potentially extending through much of 2025. This challenging environment directly impacts CK Asset Holdings' portfolio.

A key concern is the performance of its newly completed Cheung Kong Center II. Despite its prime location, the building is reportedly experiencing slower-than-anticipated absorption rates, with occupancy levels lagging behind those of similar, established properties. This presents a direct drag on rental income and profitability for this specific asset.

Specifically, vacancy rates in Hong Kong's Grade-A office market remained elevated in early 2025. Data from Q1 2025 indicated an average vacancy rate of approximately 9.5%, a slight improvement from late 2024 but still significantly above pre-pandemic levels. This broad market weakness exacerbates the individual challenges faced by CK Asset's new developments.

- Elevated Vacancy: Hong Kong's overall Grade-A office vacancy rate hovered around 9.5% in Q1 2025, a persistent challenge.

- Rental Declines: Average office rents in prime Hong Kong districts saw a further decline of 2-3% in the first half of 2025 compared to the previous year.

- Cheung Kong Center II Occupancy: Reports suggest occupancy rates for Cheung Kong Center II are significantly below the 80% target typically expected for new, high-quality office buildings within their first year of completion.

- Extended Recovery Outlook: Market forecasts from major real estate consultancies anticipate that the Hong Kong office market will not see a substantial rebound in rents and occupancy until late 2025 or early 2026.

Undersized Growth Drivers Beyond Core Property

CK Asset Holdings' non-property segments, such as its hotel operations and infrastructure investments, offer a degree of stable, recurring income. However, these revenue streams are currently too small to significantly offset potential headwinds or drive substantial overall earnings growth, particularly when contrasted with the performance of its core property development and investment activities.

For instance, while hotels contribute to the bottom line, their scale hasn't yet reached a point where they can act as a major growth engine for the group. Similarly, infrastructure assets, while providing consistent returns, are not expanding at a pace that can compensate for any slowdowns or increased competition within the property market.

- Limited Scale of Non-Property Segments: Hotel and infrastructure businesses, while stable, are currently undersized to provide significant earnings uplift.

- Underperformance Relative to Property Challenges: The growth in these ancillary segments is insufficient to counterbalance potential difficulties or slower growth in the core property business.

- Need for Diversification Impact: The current contribution from these segments does not yet demonstrate the transformative impact of diversification needed to bolster overall financial performance.

CK Asset Holdings' concentrated exposure to the Hong Kong and Mainland China property markets presents a significant vulnerability. The prolonged downturn in Mainland China's real estate sector, marked by declining sales and developer issues throughout 2024, directly impacts the company's performance.

Furthermore, the Hong Kong residential market's softness in 2024, characterized by unsold inventory and price pressures, limits upside potential. This over-reliance on these two core markets makes CK Asset susceptible to localized economic shocks and regulatory changes.

The company's profit attributable to shareholders saw a substantial 20.0% decline for the fiscal year ending December 31, 2024, primarily due to a slowdown in property development bookings and reduced home sales in Mainland China.

Additionally, suppressed margins on recent property developments, with average selling prices in Hong Kong showing a 5-10% decrease from 2023 peaks, further erode profitability in its key segment.

| Key Weakness | Description | Impact | Supporting Data (H1 2025) |

| Market Concentration | Over-reliance on Hong Kong and Mainland China property markets. | Vulnerability to localized downturns and regulatory shifts. | Mainland China property sales volume down 15% YoY; Hong Kong residential prices down 7% YoY. |

| Profitability Decline | Significant drop in profit attributable to shareholders. | Reduced financial capacity for investment and expansion. | FY2024 profit down 20.0% YoY; Property development booking slowdown. |

| Margin Compression | Lower average selling prices on new developments. | Reduced profitability from property sales. | Hong Kong new project ASPs down 5-10% from 2023 peaks. |

| Office Sector Headwinds | High vacancy and declining rents in Hong Kong office market. | Underperformance of key assets like Cheung Kong Center II. | Hong Kong Grade-A office vacancy rate ~9.5% (Q1 2025); Rents down 2-3% (H1 2025). |

What You See Is What You Get

CK Asset Holdings SWOT Analysis

You're previewing the actual analysis document. Buy now to access the full, detailed report on CK Asset Holdings' Strengths, Weaknesses, Opportunities, and Threats. This comprehensive SWOT will provide actionable insights for strategic planning.

Opportunities

CK Asset Holdings actively pursues strategic global acquisitions and diversification to bolster its recurring income streams. The company's stated strategy involves deploying capital into various sectors and geographies, with a focus on expanding its presence in social infrastructure, elderly care, and utility assets. This approach aims to reduce reliance on traditional property development and explore new avenues for growth.

In 2024, CK Asset Holdings continued to signal its intent to invest in suitable global opportunities, seeking to enhance its diversified recurring income base. This strategy is evident in their ongoing exploration of new markets and asset classes, moving beyond their established property portfolio to include areas like infrastructure and essential services.

CK Asset Holdings is strategically positioned to benefit from China's real estate downturn, with its robust financial standing allowing it to acquire distressed assets at attractive valuations. The company's ability to secure financing and navigate complex market conditions, as demonstrated by its past successful acquisitions, provides a significant advantage in this environment. For instance, in 2023, CK Asset Holdings continued to explore opportunities, even as the broader market faced headwinds, indicating a proactive approach to distressed asset acquisition.

The global infrastructure sector is poised for robust growth in 2025, particularly in utilities and power. This expansion is fueled by increasing demand from data centers and the accelerating push towards decarbonization, creating a favorable environment for infrastructure investments.

CK Asset Holdings is well-positioned to capitalize on this trend. Its established infrastructure and utility assets offer stable, often inflation-linked returns, making them attractive in the current economic climate. The company can further leverage these existing holdings to pursue strategic acquisitions within the burgeoning infrastructure space.

Potential for Hong Kong Property Market Stabilization

The Hong Kong government's decisive removal of all demand-side management measures, including the scrapping of the Buyer's Stamp Duty and Special Stamp Duty, alongside the relaxation of loan-to-value ratios, signals a significant shift. These actions are designed to foster a more balanced property market, potentially by late 2025, by stimulating buyer interest and easing transaction hurdles.

While the market still faces headwinds, these policy adjustments, combined with anticipated interest rate cuts in 2025, create a more favorable environment for increased property transaction volumes. This could translate into a gradual stabilization and potential uplift in property values, benefiting developers like CK Asset Holdings.

Key policy shifts include:

- Removal of all demand-side management measures: This eliminates previous taxes and restrictions on property purchases.

- Relaxation of loan-to-value ratios: This allows buyers to borrow more, making property acquisition more accessible.

- Potential for interest rate cuts in 2025: Lower borrowing costs would further boost market sentiment and affordability.

Technological Advancements in Logistics and Property Management

CK Asset Holdings is actively exploring opportunities within technological advancements in logistics and property management. The company has demonstrated a commitment to smart development in the logistics sector, notably through its partnership with NEXX to integrate smart logistics technology. This strategic move aims to enhance operational efficiency and customer satisfaction.

Investing in these technologies offers CK Asset Holdings the potential to unlock more flexible and cost-effective solutions across its varied business interests. For instance, by leveraging AI and automation in property management, the company can streamline maintenance, improve tenant services, and optimize energy consumption. In logistics, smart tracking and data analytics can lead to better inventory management and faster delivery times.

- Enhanced Efficiency: Technology adoption can significantly reduce operational costs and improve turnaround times in logistics and property maintenance.

- Improved Customer Experience: Smart solutions offer greater convenience and responsiveness for tenants and clients, fostering loyalty.

- Strategic Partnerships: Collaborations like the one with NEXX for smart logistics technology underscore the company's proactive approach to innovation.

- Cost-Effectiveness: Investing in scalable technological platforms can lead to long-term savings and a competitive edge.

CK Asset Holdings is well-positioned to capitalize on the global infrastructure boom, particularly in utilities and power, expected to grow robustly through 2025. The company's existing infrastructure assets provide stable, inflation-linked returns, making them attractive investments. Furthermore, the relaxation of Hong Kong's property market restrictions, including the removal of stamp duties and relaxed loan-to-value ratios, is anticipated to stimulate transaction volumes and potentially stabilize property values by late 2025, creating a more favorable environment for the company.

CK Asset Holdings can leverage its strong financial position to acquire distressed assets in China's real estate market at attractive valuations, a strategy evident in its continued exploration of opportunities throughout 2023. The company's proactive adoption of technological advancements in logistics and property management, such as its partnership with NEXX for smart logistics, promises to enhance operational efficiency and customer experience, offering cost-effective solutions across its diverse portfolio.

| Opportunity Area | Key Drivers | CK Asset Holdings' Position |

|---|---|---|

| Global Infrastructure Growth | Increased demand from data centers, decarbonization push | Existing stable, inflation-linked assets; capacity for strategic acquisitions |

| Hong Kong Property Market Recovery | Removal of demand-side measures, potential rate cuts in 2025 | Beneficiary of increased transaction volumes and market stabilization |

| Distressed Asset Acquisition (China) | China's real estate downturn | Robust financial standing allows acquisition at attractive valuations |

| Technological Advancement | Smart logistics, AI in property management | Enhanced efficiency, improved customer experience, cost-effectiveness via partnerships |

Threats

The property markets in Hong Kong and Mainland China are still experiencing considerable difficulties, despite government attempts to stabilize them. Issues like too much supply, declining property values, and a general lack of buyer interest persist. For CK Asset Holdings, a continued downturn in these crucial regions could mean a significant drop in income from property sales and further losses from property value adjustments.

The prospect of persistent elevated interest rates through 2025 presents a significant threat. Global monetary policy divergence is anticipated, meaning borrowing costs for CK Asset Holdings' property development and investment activities could remain high, directly impacting profit margins. This environment also risks cooling investor demand for real estate assets.

Ongoing geopolitical tensions, such as the protracted conflict in Eastern Europe and rising trade protectionism globally, pose a significant threat to CK Asset Holdings. These factors can dampen international growth prospects, directly impacting the profitability of overseas ventures and potentially disrupting supply chains for its diverse portfolio.

Political instability and policy shifts in key international markets create uncertainty for CK Asset Holdings' global expansion. For instance, changes in foreign investment regulations or unexpected trade tariffs could necessitate costly adjustments to business strategies, directly affecting the financial performance of its international real estate and infrastructure projects.

Intensified Competition in Real Estate Sector

The real estate sector remains intensely competitive across CK Asset Holdings' key markets, including Hong Kong, Mainland China, and international locations. This crowded landscape means many developers are actively seeking to capture market share, leading to a dynamic environment.

Competitors frequently employ aggressive pricing tactics, which can directly impact CK Asset Holdings' ability to maintain sales volumes and healthy profit margins. Furthermore, the continuous introduction of new property developments into the market exacerbates this pressure, creating a challenging sales environment.

For instance, in Hong Kong, the total number of private residential units completed in 2024 was projected to be around 19,500, according to government figures, indicating a steady influx of new supply. This increased inventory, coupled with competitive pricing, presents a significant threat to developers like CK Asset Holdings.

- Aggressive Pricing: Competitors' price cuts can erode market share and profitability.

- New Supply: Increased housing inventory in key markets like Hong Kong and Mainland China can dampen demand and put downward pressure on prices.

- Market Saturation: In certain prime locations, the sheer number of developers active can lead to oversupply concerns.

Regulatory Changes and Policy Uncertainty

Government policies and regulatory shifts across different markets pose a significant threat to CK Asset Holdings. For instance, China's ongoing property cooling measures and evolving land policies can directly impact the feasibility and profitability of development projects. In 2024, the Chinese government continued to emphasize stability in the property market, with policies aimed at deleveraging developers and managing risks, creating an environment of uncertainty for companies like CK Asset Holdings.

Restrictions on building heights or changes in zoning laws in key jurisdictions could also hinder expansion plans and affect investment returns. The company must remain agile, adapting its strategies to navigate these policy uncertainties, which can lead to delays in project timelines and impact overall profitability.

- Policy Uncertainty: Evolving property regulations in China, including potential shifts in developer financing rules, create an unpredictable operating environment.

- Development Restrictions: Changes in land use policies or building height limitations in key global cities could constrain CK Asset Holdings' ability to undertake new projects or expand existing ones.

- Impact on Returns: Regulatory shifts can necessitate costly adjustments to development plans, potentially eroding projected investment returns.

The ongoing challenges in Hong Kong and Mainland China's property markets, marked by oversupply and weak demand, continue to pose a significant threat to CK Asset Holdings' revenue and asset valuations. Elevated global interest rates through 2025 are expected to keep borrowing costs high, squeezing profit margins and potentially dampening investor interest in real estate assets. Geopolitical instability and protectionist trade policies worldwide also risk hindering international growth and disrupting supply chains, impacting the profitability of overseas ventures.

| Threat Category | Specific Threat | Impact on CK Asset Holdings | Relevant Data/Context (2024-2025) |

|---|---|---|---|

| Market Conditions | Downturn in Hong Kong & Mainland China Property Markets | Reduced sales income, property value depreciation | Hong Kong private residential completions projected around 19,500 units in 2024. China's property market continues to face deleveraging pressures and risk management focus. |

| Economic Factors | Persistent High Interest Rates | Increased borrowing costs, reduced profit margins, lower investor demand | Global monetary policy divergence expected to maintain elevated rates through 2025. |

| Geopolitical & Regulatory | Geopolitical Tensions & Trade Protectionism | Dampened international growth, disrupted supply chains | Ongoing conflict in Eastern Europe, rising global trade protectionism. |

| Geopolitical & Regulatory | Political Instability & Policy Shifts | Uncertainty for global expansion, costly strategy adjustments | Changes in foreign investment regulations and trade tariffs impacting international projects. |

| Competitive Landscape | Intense Competition & Aggressive Pricing | Erosion of market share and profit margins | Numerous developers vying for market share in key regions. |

| Geopolitical & Regulatory | Government Policies & Regulatory Shifts | Impact on project feasibility and profitability | China's property cooling measures and evolving land policies; potential building height or zoning changes in other jurisdictions. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide a robust and actionable strategic overview.