CK Asset Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Asset Holdings Bundle

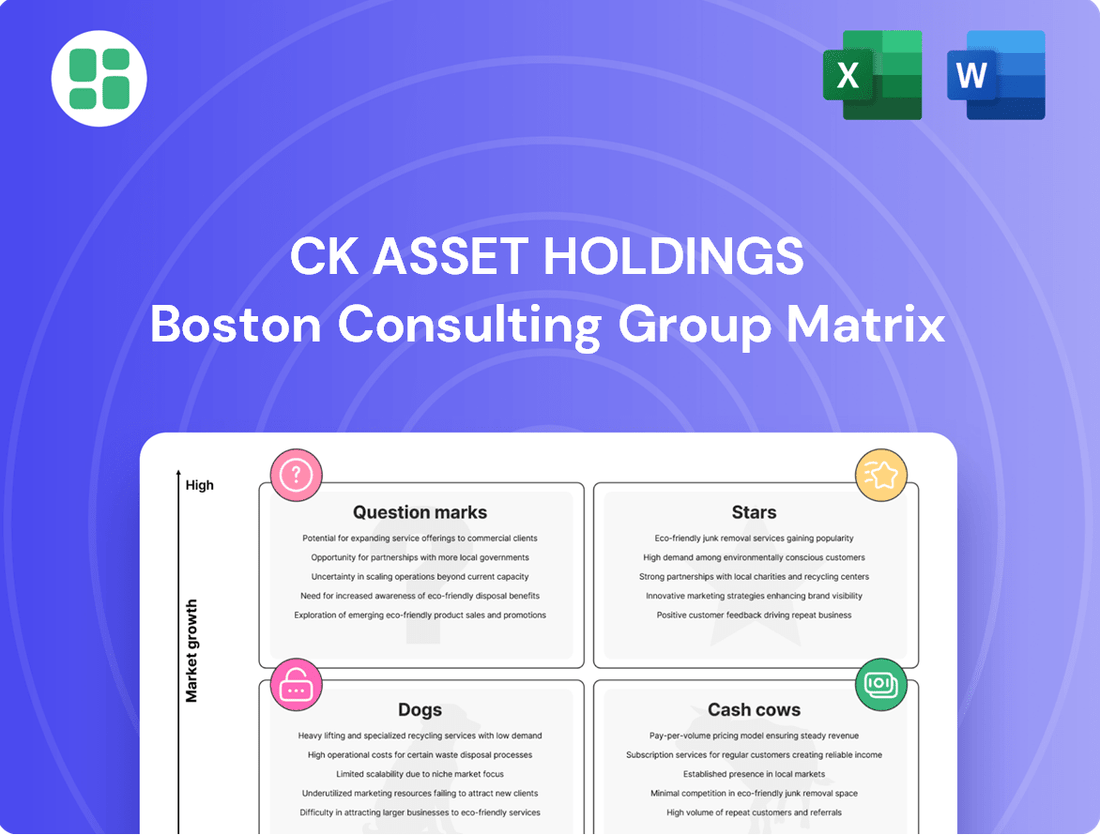

Curious about CK Asset Holdings' strategic positioning? This glimpse into their BCG Matrix reveals which ventures are poised for growth and which require careful management. To truly unlock the strategic advantage and understand the nuances of their portfolio, dive into the full BCG Matrix report for a comprehensive breakdown and actionable insights.

Don't settle for a partial view of CK Asset Holdings' market performance. The complete BCG Matrix provides a detailed quadrant-by-quadrant analysis, highlighting their Stars, Cash Cows, Dogs, and Question Marks. Purchase the full report to gain the strategic clarity needed to make informed investment decisions and optimize their business operations.

Stars

CK Asset Holdings significantly bolstered its UK renewable energy portfolio in 2024, acquiring Powerlink Renewable Assets and a suite of operating onshore wind farms through its joint ventures. This strategic expansion taps into the burgeoning demand for sustainable energy, fueled by global decarbonization efforts. These investments position CK Asset Holdings to capture substantial market share within the UK's high-growth renewable sector, exhibiting characteristics of a potential star in the BCG matrix.

In 2024, CK Asset Holdings made a strategic move into Germany's elderly care and assisted living sector. This expansion aligns with strong demographic trends, as Germany's aging population presents a significant growth opportunity. The company is establishing a foothold in this promising, high-growth market segment.

This new venture is positioned as a potential 'Star' in CK Asset Holdings' portfolio. The German elderly care market is projected for robust expansion, driven by an increasing number of individuals requiring assisted living services. Success here could lead to substantial future returns and market leadership.

Despite a generally subdued Hong Kong property market in 2024, prime residential developments like CK Asset's Blue Coast in Wong Chuk Hang have experienced exceptional demand, with strong initial sales. This indicates a persistent appetite for high-quality, well-situated properties.

The success of projects like Blue Coast, which saw over 1,000 buyers register for its first batch of units, underscores the resilience of the premium segment. CK Asset's ability to secure and deliver such desirable projects positions them to capitalize on market recovery and maintain a strong presence in this lucrative sector.

Strategic Overseas Property Development (e.g., Singapore)

CK Asset Holdings' strategic overseas property development, exemplified by the full sale of its Perfect Ten residential project in Singapore during 2024, demonstrates a strong performance in key international markets. This success underscores the company's ability to identify and capitalize on opportunities in high-demand segments, particularly in affluent urban centers. Such achievements in Singapore, a market known for its robust real estate sector and premium pricing, position CK Asset favorably for continued international expansion and profitability.

The Singaporean market, especially for luxury residential properties, offers significant growth potential and attractive returns when projects are well-executed. CK Asset's ability to fully divest the Perfect Ten project in 2024 is a testament to their effective market penetration and sales strategy. This achievement validates their approach to selecting and developing properties in markets that exhibit strong underlying demand and a capacity for high-value transactions.

- 2024 Singapore Property Market Performance: CK Asset's Perfect Ten project achieved full sales, indicating robust demand for high-end residential units.

- High Growth Potential: Targeted developments in strong international markets like Singapore can yield significant returns due to premium pricing and sustained buyer interest.

- Strategic Market Execution: Successful monetization of projects like Perfect Ten highlights CK Asset's proficiency in navigating and succeeding within competitive overseas real estate landscapes.

- Future Growth Drivers: Continued identification and successful execution of similar ventures in well-performing global markets are key to CK Asset's ongoing growth trajectory.

Regulated Gas Distribution in Northern Ireland (Phoenix Energy)

CK Asset Holdings' acquisition of Phoenix Energy in early 2024 positions it within the regulated gas distribution sector in Northern Ireland. This move grants the company a substantial interest in the region's largest natural gas network.

The acquisition, structured as a joint venture, is significant because it secures a dominant market share in a sector governed by a supportive regulatory framework. This offers a predictable and potentially growing revenue stream from a vital piece of infrastructure.

- Dominant Market Position: Phoenix Energy holds a commanding presence in Northern Ireland's gas distribution, serving over 300,000 customers as of early 2024.

- Regulated Asset Stability: The utility operates under a regulatory framework, suggesting a degree of revenue predictability and stability.

- Infrastructure Investment: This acquisition aligns with investments in critical infrastructure, a sector often characterized by long-term demand.

- Joint Venture Structure: The joint venture approach to this acquisition may offer shared risk and capital deployment benefits.

CK Asset's UK renewable energy acquisitions in 2024, including Powerlink Renewable Assets, position the company for significant growth in a high-demand sector. These ventures into onshore wind farms, backed by strategic joint ventures, are poised to capture substantial market share. The company's expansion into this green energy space reflects a clear strategy to capitalize on global decarbonization trends, showcasing the characteristics of a 'Star' performer within its portfolio.

The German elderly care market, with its strong demographic tailwinds, presents a significant growth avenue for CK Asset, as evidenced by its 2024 market entry. This strategic expansion into assisted living services targets a sector with projected robust expansion. The company's commitment to this area, driven by an aging population, positions it to become a leader and achieve substantial future returns.

CK Asset's premium Hong Kong residential projects, like the highly sought-after Blue Coast in 2024, demonstrate the company's ability to thrive even in a challenging property market. The overwhelming buyer registration for initial unit releases highlights the enduring appeal of quality, well-located properties. This success in the premium segment underscores CK Asset's capacity to leverage market recovery and maintain a strong position.

The full sale of CK Asset's Perfect Ten residential project in Singapore during 2024 exemplifies successful strategic execution in international property markets. This achievement in a market known for its premium pricing and sustained buyer interest validates the company's approach to identifying and developing high-value assets. Such ventures are crucial drivers for CK Asset's ongoing global growth and profitability.

CK Asset's acquisition of Phoenix Energy in early 2024 secured a dominant position in Northern Ireland's gas distribution network, a regulated utility with a substantial customer base. This move into a vital infrastructure sector, operating under a predictable regulatory framework, is set to provide stable and growing revenue streams. The joint venture structure offers a balanced approach to capital deployment and risk management.

What is included in the product

Highlights which CK Asset Holdings units to invest in, hold, or divest based on market growth and share.

The CK Asset Holdings BCG Matrix provides a clear, one-page overview of each business unit's position, alleviating the pain of scattered data.

Cash Cows

CK Asset Holdings’ established Hong Kong investment property portfolio, comprising office, retail, and industrial assets, represents a significant Cash Cow. Despite a recent market slowdown and some increased vacancy, these prime location properties continue to provide substantial and stable recurring rental income, a testament to their long-standing market presence.

CK Asset Holdings' core Mainland China investment properties represent a significant Cash Cow. These assets, spread across major cities, offer a steady stream of income, bolstered by CK Asset's long-standing presence in these mature markets.

The portfolio, a mix of residential and commercial spaces, consistently delivers robust profit margins and substantial cash flow. For instance, in 2023, CK Asset reported a significant portion of its recurring income derived from its property investments, highlighting the dependable nature of these Cash Cows.

CK Asset Holdings' diversified global infrastructure and utility assets, managed through joint ventures with CK Infrastructure Holdings and Power Assets Holdings, represent significant cash cows. These regulated businesses are known for their stability and consistent, recurring income streams, making them a foundational element of the group's financial strength.

These essential services boast high market share and demonstrate resilience against broader economic downturns, consistently generating surplus cash. For instance, as of the first half of 2024, CK Infrastructure Holdings reported a substantial contribution from its diversified portfolio, with key segments like water and energy infrastructure showing robust performance and cash flow generation, underscoring their cash cow status.

Hotel and Serviced Suites Operations in Hong Kong

CK Asset Holdings' hotel and serviced suite operations in Hong Kong, encompassing brands such as Harbour Grand and Harbour Plaza, represent a stable Cash Cow. In 2024, these properties demonstrated robust performance with hotels achieving an 82% occupancy rate and serviced suites reaching an impressive 91%.

These operations, while not a primary engine for rapid expansion, consistently deliver a substantial and reliable stream of income. Their strong market presence in a well-established hospitality sector highlights their mature yet highly effective contribution to the Group's overall financial health.

- High Occupancy Rates: Hotels at 82% and serviced suites at 91% in 2024.

- Stable Revenue Source: Consistent income generation from a mature market segment.

- Strong Market Share: Dominant position within Hong Kong's hospitality industry.

- Contribution to Profitability: Reliable financial performance bolstering overall company results.

Property and Project Management Services

CK Asset Holdings' property and project management services function as a classic Cash Cow within its business portfolio. These operations capitalize on the company's vast real estate holdings and decades of experience, generating stable, predictable income streams.

While the overall real estate market might experience moderate growth, this segment benefits from CK Asset's dominant market share, managing both its proprietary developments and potentially external projects. This consistent fee-based revenue is crucial for funding other ventures and maintaining overall financial health.

- Stable Fee Income: Generates reliable revenue through management fees, insulating it from market volatility.

- Leverages Existing Portfolio: Utilizes extensive property assets to maximize management efficiency and profitability.

- Low Growth, High Share: Operates in a mature segment where its established position ensures consistent earnings.

- Contribution to Profitability: Provides a steady financial backbone, supporting investment in higher-growth areas.

CK Asset Holdings' established Hong Kong investment property portfolio, including office, retail, and industrial assets, serves as a significant Cash Cow. These prime location properties continue to provide substantial and stable recurring rental income, demonstrating their enduring market presence and consistent revenue generation.

The group's core Mainland China investment properties also represent a key Cash Cow, offering a steady income stream from assets across major cities. This stability is a direct result of CK Asset's long-standing presence and deep understanding of these mature markets, ensuring reliable cash flow.

Diversified global infrastructure and utility assets, managed through joint ventures, are foundational cash cows. These regulated businesses, like those in water and energy infrastructure, consistently generate surplus cash due to high market share and resilience, as evidenced by robust performance in the first half of 2024.

| Asset Class | Primary Contribution | Market Position | Financial Characteristic |

| Hong Kong Investment Properties | Recurring Rental Income | Prime Locations, Established Presence | Stable, Substantial Cash Flow |

| Mainland China Investment Properties | Steady Income Stream | Major Cities, Mature Markets | Reliable, Consistent Earnings |

| Global Infrastructure & Utilities | Surplus Cash Generation | High Market Share, Resilient | Stable, Recurring Income |

Full Transparency, Always

CK Asset Holdings BCG Matrix

The CK Asset Holdings BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report ready for your strategic planning. You can confidently use this preview as a direct representation of the comprehensive BCG Matrix analysis you will acquire.

Dogs

CK Asset Holdings' older or less strategically positioned Hong Kong office properties could be classified as Dogs in the BCG Matrix. The Hong Kong office market experienced significant headwinds in 2024, with vacancy rates climbing and new developments adding to supply. This environment is projected to cause rental declines of 5-10% in 2025, directly impacting properties that already struggle with occupancy and rental income.

Hong Kong's retail sector faced considerable headwinds in 2024. Total retail sales saw a notable decrease, putting immense pressure on both rental income and property values across the city. This downturn particularly impacted lower-tier street-level retail spaces and less desirable locations, which are finding it increasingly difficult to secure and retain tenants, leading to falling rents.

For CK Asset Holdings, these struggling retail segments in Hong Kong are categorized as Dogs in the BCG Matrix. They represent assets with low market share and low growth potential. The persistent decline in sales and rental yields in these specific areas signifies a segment that requires careful management or divestment, as they are unlikely to contribute significantly to the company's future growth.

CK Asset Holdings has a history of divesting property assets, demonstrating a strategic approach to managing its portfolio. This includes shedding underperforming or non-strategic holdings to optimize resource allocation.

Smaller, non-core assets that do not align with the company's primary growth strategies and yield minimal returns are categorized here. These assets might also demand significant investment for maintenance without promising substantial future growth.

For instance, in 2023, CK Asset Holdings reported a significant reduction in its property portfolio through strategic sales, including the disposal of certain overseas commercial properties, freeing up capital for more promising ventures.

Pub Operations Facing Rising Costs

CK Asset Holdings' pub operations, while contributing to earnings before interest, taxes, depreciation, and amortization (EBITDA), are navigating a landscape of escalating operational expenses and intense market competition throughout 2024. This environment points towards a segment with subdued growth potential and potentially contracting profit margins.

Efforts to rebound sales volumes are underway, but the persistent challenges in the operating environment may firmly position this segment within the 'Dog' category of the BCG Matrix.

- Rising Costs: Anticipated increases in labor, utilities, and supply chain expenses in 2024 will likely squeeze profit margins for pub operations.

- Competitive Pressures: The pub sector faces ongoing competition from various entertainment and dining options, limiting pricing power and growth opportunities.

- Low Growth Prospects: Mature markets and changing consumer preferences contribute to a generally low growth outlook for traditional pub businesses.

- Potential Margin Erosion: Despite sales recovery initiatives, the combination of rising costs and competitive pressures could lead to a decline in profitability.

Older Properties Not Meeting Sustainability Standards

CK Asset Holdings' older properties that don't meet current sustainability standards present a challenge. With the company aiming for Green Mark Platinum ratings for new developments by 2025, these existing assets could see reduced appeal to tenants and purchasers. This trend might translate into lower occupancy rates and increased expenses for necessary upgrades.

- Declining Demand: Properties lacking modern eco-friendly features may become less desirable in a market increasingly focused on sustainability.

- Retrofitting Costs: Bringing older buildings up to current environmental benchmarks can incur significant capital expenditure.

- Reduced Competitiveness: Failure to adapt to sustainability trends could lead to a loss of market share compared to more environmentally conscious competitors.

CK Asset Holdings' underperforming assets, such as older Hong Kong retail spaces and pubs facing rising costs, are categorized as Dogs in the BCG Matrix. These segments exhibit low market share and low growth prospects, with declining rents and squeezed profit margins observed throughout 2024. For example, the Hong Kong retail sector saw a notable decrease in total sales in 2024, impacting less desirable locations. Similarly, pub operations contend with escalating operational expenses and intense competition, potentially leading to margin erosion.

| Asset Category | BCG Classification | Key Challenges (2024) | Growth Outlook | Financial Impact |

| Older HK Office Properties | Dogs | High vacancy, new supply, projected rental declines (5-10% in 2025) | Low | Reduced rental income |

| Lower-Tier HK Retail | Dogs | Decreased retail sales, tenant retention issues, falling rents | Low | Diminished rental yields |

| Pub Operations | Dogs | Rising operational costs (labor, utilities), intense competition | Low | Contracting profit margins |

Question Marks

CK Asset Holdings is slated to introduce five new residential projects in Hong Kong in 2025, focusing on the mass-market segment in key areas like Anderson Road and Kai Tak. These developments are positioned as potential 'Stars' within the BCG framework, requiring significant capital investment and strategic execution to gain traction in a competitive landscape. The success of these projects hinges on CK Asset's ability to capture substantial market share amidst anticipated market recovery.

Early-stage investments in emerging technology infrastructure, such as nascent digital infrastructure or decarbonization projects where CK Asset Holdings has a low current market share, would be classified as Stars under the BCG Matrix. These ventures require substantial capital expenditure but offer significant growth potential, aligning with global infrastructure mega-trends. For instance, the data center market alone saw global investment reach an estimated $200 billion in 2023, with continued strong growth projected for 2024 and beyond, driven by AI and cloud computing demands.

Expansion into new, untapped overseas property markets would position CK Asset Holdings within the 'Question Marks' category of the BCG Matrix. These ventures carry significant risk due to the lack of established market presence and understanding. For instance, entering a developing African nation's real estate sector, where CK Asset has minimal prior engagement, would necessitate substantial upfront capital for market research, land acquisition, and initial development.

Strategic Collaborations in Nascent Sectors

Strategic collaborations in nascent sectors, where CK Asset Holdings might invest in new, high-growth areas without an established market position, would classify these ventures as 'Question Marks' within the BCG Matrix. These initiatives demand substantial capital to nurture their potential, aligning with the characteristic resource intensity of such opportunities.

For example, CK Asset's reported interest in exploring opportunities within the burgeoning electric vehicle charging infrastructure sector, a field where their current market penetration is minimal, exemplifies a potential Question Mark. In 2024, the global EV charging market was valued at approximately USD 25 billion, with projections indicating significant compound annual growth rates, necessitating considerable upfront investment for market entry and expansion.

- Nascent Sector Investment: CK Asset's collaborations in areas like advanced battery technology or sustainable urban mobility would fit the Question Mark profile.

- High Growth Potential: These sectors often exhibit rapid expansion, but their future market share is uncertain, requiring strategic bets.

- Capital Intensive: Developing new technologies or business models in these areas, such as establishing a nationwide EV charging network, typically demands substantial financial commitment.

Innovative Green Building Technologies and Solutions

CK Asset Holdings' focus on sustainability, targeting Green Mark Platinum ratings, necessitates investment in innovative green building technologies. This strategic push indicates a commitment to environmentally responsible development, potentially involving advanced materials, energy-efficient systems, and smart building management solutions. For example, CK Asset's development of the Grand Central project in Hong Kong, which incorporates advanced facade designs for thermal insulation and energy efficiency, exemplifies this commitment.

The implementation of these cutting-edge green building solutions, particularly those that are novel to the company's portfolio, could place them in the 'Question Mark' category of the BCG matrix. This is because the initial adoption and scaling of these technologies often come with significant upfront capital expenditure. For instance, the integration of sophisticated renewable energy systems or novel waste management technologies might require substantial initial investment before widespread adoption and proven profitability are achieved. The company needs to carefully assess the market demand and the long-term return on investment for these emerging green building practices.

- High Upfront Costs: Investment in new green technologies, such as advanced solar integration or high-performance insulation materials, can be substantial. For example, a new building might see costs increase by 5-15% for achieving higher green building certifications.

- Market Acceptance and ROI: Demonstrating the tangible benefits and financial returns of these innovative solutions to the market and stakeholders is crucial for their successful scaling.

- Technological Risk: Emerging technologies may face unforeseen challenges in performance or integration, requiring ongoing research and development.

- Regulatory Landscape: Staying abreast of evolving green building regulations and incentives is vital for the successful deployment of new technologies.

CK Asset Holdings' ventures into undeveloped overseas property markets represent 'Question Marks' due to their inherent risks and the need for significant capital investment in areas where the company has little prior experience. These new markets demand substantial upfront spending for research, land acquisition, and initial development to establish a foothold.

Strategic investments in emerging sectors, such as the electric vehicle charging infrastructure, also fall into the 'Question Mark' category. These areas offer high growth potential but require considerable capital commitment for market entry and expansion, as seen with the global EV charging market valued at approximately USD 25 billion in 2024.

The adoption of novel green building technologies by CK Asset Holdings, aiming for certifications like Green Mark Platinum, also positions these initiatives as 'Question Marks'. While these advancements enhance sustainability, they often entail substantial upfront costs and require careful assessment of market acceptance and return on investment.

| Category | Description | Example for CK Asset | Key Considerations |

| Question Mark | Low market share, high market growth potential. Requires significant investment to grow. | Entering new, untapped overseas property markets. | Market research, land acquisition costs, understanding local regulations. |

| Question Mark | Low market share, high market growth potential. Requires significant investment to grow. | Investments in EV charging infrastructure. | High upfront capital, market penetration strategy, technological integration. |

| Question Mark | Low market share, high market growth potential. Requires significant investment to grow. | Adoption of novel green building technologies. | High initial costs, demonstrating ROI, technological risk, regulatory compliance. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial disclosures, detailed market research, and competitor analysis to provide a clear strategic overview.