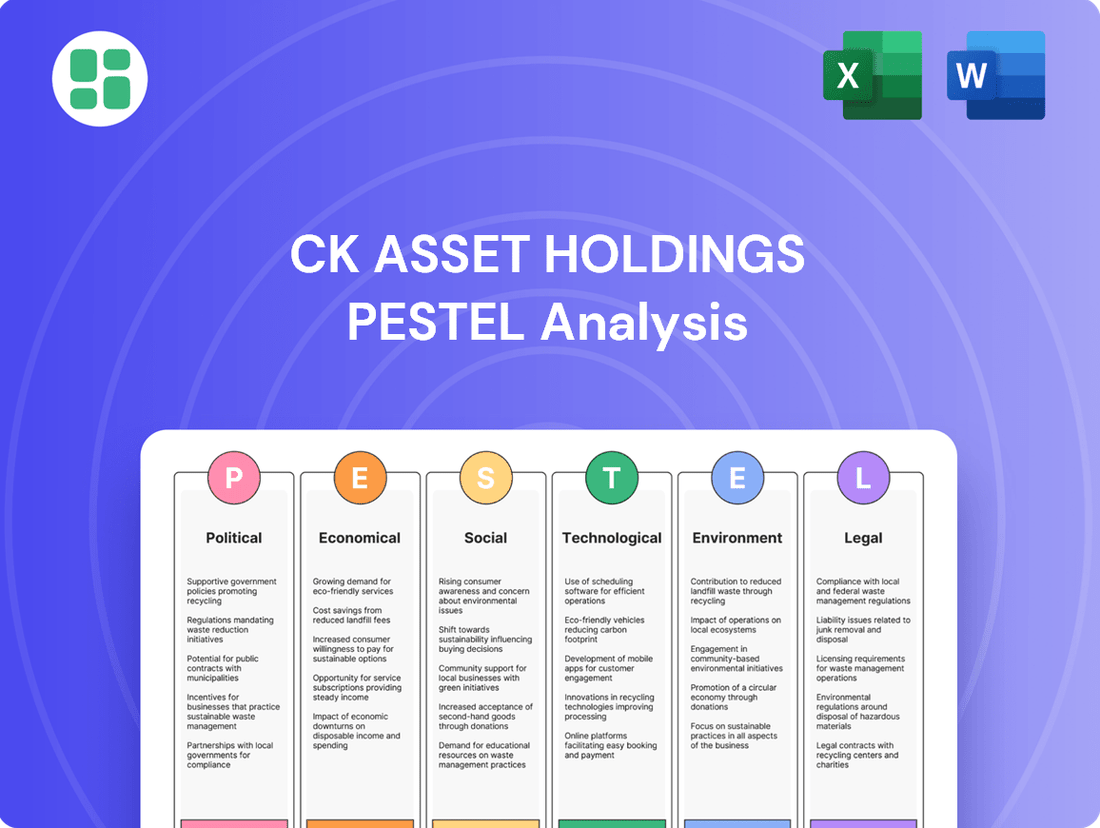

CK Asset Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Asset Holdings Bundle

Unlock the secrets to CK Asset Holdings's strategic positioning by understanding the intricate web of political, economic, social, technological, legal, and environmental factors influencing its operations. Our meticulously researched PESTLE analysis provides a critical roadmap for navigating these external forces.

Gain a competitive advantage by leveraging our expert insights into how global trends, regulatory shifts, and technological advancements are shaping CK Asset Holdings's future. This comprehensive analysis is your key to informed decision-making.

Don't be left behind in a rapidly evolving market. Download our full PESTLE Analysis of CK Asset Holdings now to access actionable intelligence and proactively adapt your strategies for sustained success.

Political factors

Government policies in Hong Kong and Mainland China are pivotal for CK Asset Holdings, shaping the property landscape through land supply, urban planning, and development quotas. These regulations directly affect the availability of land for new projects and the feasibility of expansion strategies.

For instance, Hong Kong's land auction system and urban renewal initiatives, alongside Mainland China's zoning laws and housing market regulations, create both opportunities and constraints. CK Asset Holdings must closely monitor shifts in these policies, such as the Hong Kong government's commitment to increasing land supply, which saw approximately 3,200 hectares of developable land identified as of early 2024, to inform its strategic investment decisions and ensure long-term growth.

CK Asset Holdings, as a global player, faces significant exposure to geopolitical tensions. For instance, the ongoing trade friction between the United States and China, which intensified in 2023 and continues to evolve, directly impacts global supply chains and investment sentiment, potentially affecting CK Asset's international projects and property valuations.

Shifts in international relations, such as the evolving dynamics within the European Union or new trade agreements, can alter market access and operational costs. The company's substantial property portfolio, including significant holdings in the UK and mainland China, means that diplomatic realignments or trade policy changes in these key regions could materially impact its financial performance and strategic expansion plans throughout 2024 and into 2025.

The stability and predictability of regulations in Hong Kong and Mainland China are crucial for CK Asset Holdings. For instance, Hong Kong's property market is heavily influenced by government policies on stamp duties and mortgage lending, which saw adjustments in 2023 aiming to cool the market. Unforeseen regulatory shifts in either market can introduce operational uncertainties and necessitate agile strategic adjustments for the company.

Government initiatives for infrastructure development

CK Asset Holdings' significant global investments in infrastructure and utility assets make it particularly responsive to government-driven development initiatives. For instance, the Hong Kong government's commitment to the Northern Metropolis development, a HK$600 billion project, presents substantial opportunities for infrastructure developers like CK Asset. These large-scale projects, often facilitated through public-private partnerships, directly impact the potential for new investments and the valuation of existing holdings in transportation, energy, and utilities.

Governments worldwide are increasingly prioritizing infrastructure upgrades to foster economic growth and sustainability. In the UK, for example, the government has outlined plans for significant investment in renewable energy infrastructure and transportation networks, potentially creating avenues for CK Asset's participation. These public commitments, often backed by substantial funding allocations, can directly influence the pipeline of projects available and the financial viability of infrastructure ventures.

- Government infrastructure spending: Global infrastructure spending is projected to reach $15.5 trillion by 2030, with a significant portion driven by government initiatives.

- Public-Private Partnerships (PPPs): PPPs are crucial for delivering large infrastructure projects, with governments actively seeking private sector involvement to manage costs and expertise.

- Key sectors: Transportation, energy, and utilities are primary beneficiaries of government infrastructure development plans, aligning with CK Asset's core investment areas.

Tax policies and incentives

CK Asset Holdings operates within a global landscape where tax policies significantly shape its financial performance. Changes in corporate tax rates, property taxes, and stamp duties across its diverse markets directly influence profitability and investment returns. For instance, a reduction in corporate tax rates, such as the UK's planned decrease to 19% from 25% effective April 2025, could boost CK Asset's net income from its UK operations. Conversely, an increase in property taxes or stamp duties in key regions like Hong Kong or Singapore could increase holding costs and reduce the attractiveness of new property acquisitions or developments.

Investment incentives also play a crucial role. Governments often introduce tax credits or deductions to encourage real estate development or investment in specific sectors. CK Asset would benefit from such incentives, for example, if a jurisdiction offered tax breaks for green building initiatives, aligning with the company's sustainability goals. Monitoring these evolving tax reforms is therefore critical for effective financial planning and strategic decision-making across the group's portfolio.

- Corporate Tax Rate Impact: A potential decrease in the UK's corporation tax to 19% by April 2025 could enhance CK Asset's post-tax profits on its substantial UK holdings.

- Property Tax Sensitivity: Increases in property taxes in markets like Hong Kong, which has a progressive property tax system, could directly impact the carrying costs of CK Asset's extensive property portfolio.

- Stamp Duty Variations: Fluctuations in stamp duty rates, such as those seen in Singapore, can affect the transaction costs associated with property acquisitions and sales, influencing investment decisions.

- Incentive Opportunities: Government incentives for sustainable development or specific investment zones can provide CK Asset with opportunities to reduce its tax burden and improve project economics.

Government policies in Hong Kong and Mainland China significantly influence CK Asset Holdings' operations, particularly through land supply, urban planning, and development regulations. For instance, Hong Kong's commitment to increasing land supply, with approximately 3,200 hectares identified by early 2024, presents strategic opportunities.

Geopolitical tensions, such as US-China trade friction that intensified in 2023, can impact global supply chains and investment sentiment for CK Asset's international projects. Evolving international relations and trade agreements in key markets like the UK and mainland China also pose risks and opportunities for the company's extensive property portfolio.

Tax policies worldwide directly affect CK Asset's profitability, with corporate tax rate changes, property taxes, and stamp duties being critical factors. For example, the UK's planned corporate tax decrease to 19% by April 2025 could boost net income from its UK operations.

Government-driven infrastructure development is a key area for CK Asset, with initiatives like Hong Kong's Northern Metropolis project, a HK$600 billion endeavor, offering substantial potential. Global infrastructure spending is projected to reach $15.5 trillion by 2030, largely fueled by government initiatives, directly benefiting companies involved in transportation, energy, and utilities.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CK Asset Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and data-backed trends to help stakeholders identify opportunities and threats for strategic decision-making.

Provides a concise version of CK Asset Holdings' PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external challenges.

Economic factors

Interest rate fluctuations directly influence CK Asset Holdings' borrowing costs for property development and investments, affecting project feasibility and profitability. For instance, a sustained period of rising rates, as seen in many developed economies throughout 2023 and into early 2024, can significantly increase the expense of financing new projects or refinancing existing debt.

Higher interest rates also tend to cool consumer demand for real estate by making mortgages more expensive. This can lead to slower sales cycles and potentially depress property valuations, impacting CK Asset Holdings' revenue streams and the value of its property portfolio. For example, central banks in major markets like the US and UK maintained higher rates through much of 2023, impacting affordability.

Consequently, effective debt management and strategic hedging against adverse rate movements are crucial for CK Asset Holdings to maintain financial stability and capitalize on market opportunities. The ability to secure favorable financing terms in a fluctuating rate environment is a key determinant of success.

CK Asset Holdings' performance is closely tied to economic growth and consumer purchasing power across its key markets. In 2024, Hong Kong's GDP is projected to grow by 2.5% to 3.5%, supported by a recovery in tourism and domestic demand, which directly impacts the demand for residential and commercial properties. Similarly, Mainland China's economic expansion, forecast at around 5.0% for 2024, fuels consumer confidence and business investment, thereby boosting the property sector.

The level of disposable income is a critical determinant of purchasing power. As of early 2024, average household incomes in major Chinese cities are showing steady increases, enabling more consumers to enter the property market. This trend is also observed in international markets where CK Asset Holdings operates, with sustained wage growth in countries like the UK contributing to a healthier demand for real estate, including rental properties.

Conversely, any economic slowdown or contraction in consumer spending power presents a significant risk. For instance, a projected moderation in global economic growth for late 2024 and into 2025 could dampen demand for luxury residential units and commercial spaces, potentially leading to lower rental yields and slower sales volumes for CK Asset Holdings.

Inflationary pressures directly impact CK Asset Holdings by driving up the costs of essential inputs like construction materials, skilled labor, and general operational expenses across its diverse property and infrastructure portfolios. For instance, rising global commodity prices in 2024, particularly for steel and cement, have presented significant cost management challenges for large-scale development projects.

While real estate can often serve as a hedge against inflation, sustained high inflation rates can squeeze profit margins for CK Asset Holdings if rental income growth and property value appreciation fail to outpace the escalating costs. This necessitates careful financial planning to ensure that increased revenue streams can absorb the higher expenditure.

Currency exchange rate volatility

Currency exchange rate volatility presents a significant challenge for a global entity like CK Asset Holdings. Fluctuations in exchange rates directly affect the translated value of its international assets and liabilities, impacting its consolidated financial statements. For instance, a stronger Hong Kong dollar against other currencies could reduce the reported value of overseas earnings when converted back.

The cost of new international projects and the profitability of repatriated earnings are also susceptible to these currency swings. In 2024, many major currencies experienced notable volatility. For example, the Japanese Yen saw significant depreciation against the US Dollar, which would impact the cost of CK Asset's investments in Japan if financed in USD, or the value of Yen-denominated profits. Similarly, fluctuations in the Pound Sterling could influence the profitability of its UK property developments.

To manage these risks, CK Asset Holdings likely employs various hedging strategies. These can include forward contracts, options, and currency swaps to lock in exchange rates for future transactions or to protect the value of existing foreign currency holdings. The effectiveness of these strategies is crucial for maintaining stable financial performance across its diverse geographical operations.

- Impact on Asset Valuation: Fluctuations in exchange rates can alter the reported book value of CK Asset Holdings' overseas properties and investments.

- Cost of International Investments: Currency volatility affects the actual cost of acquiring assets or undertaking projects in foreign markets.

- Profit Repatriation: The amount of profit CK Asset can bring back to its home base is directly influenced by the prevailing exchange rates.

- Hedging Necessity: Sophisticated hedging techniques are vital to mitigate potential losses arising from adverse currency movements.

Real estate market cycles and property valuations

CK Asset Holdings' performance is intrinsically tied to the ebb and flow of real estate market cycles, impacting both property valuations and rental yields. For instance, during 2024, global property markets experienced varied trends; while some regions saw stabilization, others, particularly in Asia, faced headwinds from higher interest rates and slower economic growth, which directly affects asset values and rental demand for CK Asset's extensive portfolio.

Downturns in these cycles can significantly diminish the value of CK Asset's holdings and compress rental income, posing a direct challenge to profitability. Conversely, upswings offer substantial opportunities for capital gains and enhanced returns on investment. This sensitivity necessitates a keen understanding and proactive anticipation of market shifts to guide strategic asset allocation and development plans.

Key considerations for CK Asset Holdings include:

- Property Valuation Fluctuations: In 2024, major global cities saw shifts in residential and commercial property values. For example, prime office rents in Hong Kong, a key market for CK Asset, remained under pressure, reflecting broader economic sentiment and a shift towards hybrid work models, impacting potential valuation uplifts.

- Rental Yield Sensitivity: Rental income is a crucial revenue stream. Changes in occupancy rates and average rental prices, influenced by economic conditions and supply-demand dynamics, directly affect the yield on CK Asset's properties.

- Economic Cycle Impact: Broader economic cycles, including inflation and interest rate policies, play a significant role. Higher interest rates, prevalent in many economies through 2024, increase borrowing costs for developers and can dampen buyer demand, thereby influencing property valuations and investment returns.

Interest rate movements are a critical economic factor for CK Asset Holdings, directly impacting its financing costs and the affordability of property for consumers. As central banks globally, including those in Hong Kong and the UK, maintained higher interest rates through 2023 and into early 2024, borrowing expenses for development projects increased, potentially affecting profitability and project feasibility.

These higher rates also cool demand for real estate by making mortgages more expensive, which can lead to slower sales and potentially lower property valuations. For instance, the US Federal Reserve kept its benchmark rate elevated throughout 2023, influencing global mortgage markets and buyer sentiment.

Consequently, CK Asset Holdings must adeptly manage its debt and employ hedging strategies to navigate these fluctuating interest rate environments and ensure financial stability.

Same Document Delivered

CK Asset Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CK Asset Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain insights into how geopolitical shifts, economic downturns, societal trends, technological advancements, regulatory changes, and environmental concerns shape CK Asset Holdings' business landscape.

Sociological factors

Demographic shifts are a major force shaping real estate demand. Globally, populations are growing, but many developed nations are also experiencing aging populations. This means a rising need for specialized housing, like retirement communities and accessible living spaces, which CK Asset Holdings can tap into. For instance, in 2024, the global population surpassed 8 billion, with a significant portion of this growth concentrated in Asia.

Urbanization continues to be a powerful trend, particularly in key markets like Mainland China. As more people move to cities, there's a direct correlation with increased demand for residential properties, commercial spaces, and the essential infrastructure to support these growing urban centers. In 2024, over 60% of the world's population lives in urban areas, a figure projected to rise further.

Consumer preferences are shifting towards properties that integrate technology and sustainability. For instance, a 2024 survey indicated that 65% of homebuyers are interested in smart home features, and 58% prioritize energy-efficient designs. This necessitates CK Asset Holdings to actively incorporate these elements into their developments to meet evolving demands and maintain market appeal.

Increasing socio-economic disparities in markets like Hong Kong directly affect property affordability. This trend can shift demand, favoring more budget-friendly segments and potentially impacting CK Asset Holdings' sales volumes in higher-end developments. For instance, the median household income in Hong Kong, while rising, often struggles to keep pace with soaring property prices, creating a significant affordability gap.

Governments may introduce policies to address housing affordability, such as subsidies or tighter lending regulations. These interventions, while socially beneficial, could influence property prices and compress development margins for companies like CK Asset Holdings. The Hong Kong government's ongoing efforts to increase land supply and explore new housing models reflect this pressure.

CK Asset Holdings must navigate the societal context of housing access. Understanding the implications of wealth inequality on the demand for various property types and the potential for policy responses is crucial for strategic planning and maintaining profitability in the evolving property landscape.

Public sentiment and community engagement

Public sentiment significantly influences the success of large property developers like CK Asset Holdings. For instance, in 2024, community opposition in Hong Kong to a proposed residential development led to extended public consultations, impacting project timelines. Negative perceptions concerning traffic congestion or the loss of green spaces can directly translate into project delays and increased operational costs.

CK Asset Holdings' approach to community engagement is therefore critical. Their 2025 sustainability report highlighted a 15% increase in community outreach programs compared to the previous year, aiming to foster positive public perception. Such initiatives are designed to mitigate risks associated with public backlash and ensure smoother project execution.

- Community Acceptance: Negative public sentiment regarding environmental impact or displacement can lead to protests and project delays, as seen in several Asian property markets in 2024.

- Reputational Risk: Failing to address community concerns can result in significant reputational damage, affecting future development opportunities and investor confidence.

- Corporate Social Responsibility (CSR): Proactive CSR initiatives, such as local employment programs or park enhancements, can build goodwill and gain community support, crucial for large-scale projects.

- Stakeholder Engagement: Effective dialogue with local residents, government bodies, and NGOs is essential for navigating potential conflicts and ensuring project alignment with community needs.

Work-from-home trends and impact on commercial property

The shift towards hybrid and remote work models is fundamentally reshaping demand for commercial office spaces. As of late 2024, surveys indicate that a significant majority of companies are continuing to offer flexible work arrangements, with many employees preferring a mix of in-office and remote days. This trend directly influences the utilization and perceived value of traditional office buildings.

CK Asset Holdings, holding a substantial commercial property portfolio, faces the imperative to adapt its strategy. This involves evaluating the potential for reconfiguring existing office layouts to better suit collaborative work, offering more adaptable lease terms to attract and retain tenants, and potentially exploring diversification into alternative commercial uses such as residential conversions or mixed-use developments to mitigate risks associated with declining office demand.

- Hybrid work adoption: Reports from early 2025 suggest that over 60% of businesses globally have adopted some form of hybrid work, impacting office space utilization.

- Vacancy rates: Major commercial hubs have seen an uptick in office vacancy rates, with some cities experiencing a 15-20% increase compared to pre-pandemic levels, directly affecting rental income potential.

- Tenant preferences: Tenant demand is increasingly shifting towards flexible, amenity-rich spaces that support collaboration and employee well-being, necessitating strategic asset upgrades.

Societal attitudes towards homeownership and investment are evolving. In 2024, a growing segment of younger generations, particularly in Asia, view property ownership as a crucial long-term investment, driving demand for residential units. This inclination is supported by a 2025 report indicating that 70% of millennials in major Asian cities prioritize real estate investment for wealth accumulation.

CK Asset Holdings must also consider the impact of changing family structures on housing needs. Smaller household sizes are becoming more common, increasing demand for compact, efficient living spaces. For example, in Hong Kong, the average household size has decreased to approximately 2.9 persons, a trend that favors smaller apartment units.

The increasing awareness of environmental, social, and governance (ESG) factors influences consumer and investor behavior. By 2024, a significant number of investors are scrutinizing developers' ESG performance, impacting capital allocation. CK Asset Holdings' commitment to sustainable development, as evidenced by their 2025 green building certifications, is therefore a key differentiator.

CK Asset Holdings needs to adapt to evolving consumer lifestyles and preferences. The rise of the experience economy means that buyers are increasingly seeking properties that offer more than just shelter, incorporating amenities and community features. A 2024 survey found that 55% of potential homebuyers consider community facilities and lifestyle offerings as important factors in their purchasing decisions.

Technological factors

CK Asset Holdings' competitiveness hinges on integrating property technology (PropTech). This means leveraging AI for smarter market analysis, utilizing virtual reality for immersive property tours, and employing digital platforms for streamlined property management. These advancements are crucial for boosting operational efficiency and elevating the customer experience in the dynamic real estate sector.

The PropTech market is experiencing significant growth, with global investment reaching an estimated $10.7 billion in 2023, indicating a strong trend towards digital transformation in real estate. For CK Asset Holdings, adopting these technologies can lead to substantial cost savings and improved engagement with potential buyers and tenants, a vital factor in the 2024-2025 landscape.

Smart building technologies, integrating IoT sensors for precise energy management and automated climate control, are increasingly becoming a baseline expectation in property development. These advancements directly contribute to operational efficiency and a notable reduction in utility expenses, making properties more appealing to tenants and buyers alike. For instance, in 2024, the global smart building market was valued at an estimated $80.5 billion, projected to grow significantly, indicating a strong market demand for these features.

CK Asset Holdings can capitalize on these innovations by incorporating them into their developments, thereby fostering greater sustainability and enhancing the overall attractiveness of their portfolio. The adoption of such technologies not only lowers ongoing operational costs but also positions the company as a forward-thinking developer in a competitive market, potentially commanding premium rental yields or sale prices.

Digitalization is transforming how CK Asset Holdings manages its properties and interacts with customers. Streamlining everything from tenant onboarding to rent collection, digital tools are key to efficiency. For instance, by 2024, many property management firms reported significant cost savings through automated processes, with some seeing reductions of up to 20% in administrative overhead.

Online portals and mobile apps are becoming standard, boosting tenant satisfaction and making operations smoother. CK Asset Holdings can leverage these platforms to offer a more responsive and convenient experience, handling maintenance requests and communication seamlessly. This digital shift is crucial for improving service delivery and reducing the workload on staff.

Data analytics for market insights and investment decisions

CK Asset Holdings is increasingly leveraging data analytics to gain a sharper understanding of market dynamics and inform its investment choices. By harnessing big data, the company can uncover subtle market trends and predict shifts in consumer preferences, which is crucial for strategic land acquisition and property development. For instance, in 2024, the real estate market saw a significant uptick in demand for smart homes, a trend identified through granular data analysis, influencing CK Asset's project designs.

This data-driven methodology extends to optimizing operational efficiency and mitigating risks. Advanced analytics allow for more accurate forecasting of project costs and potential returns, thereby refining the company's risk assessment frameworks. Predictive modeling, a key component of their technological strategy, is expected to provide a distinct competitive advantage in the fast-evolving property sector throughout 2025.

- Market Trend Identification: Utilizing big data to pinpoint emerging consumer needs, such as the growing demand for sustainable living spaces observed in late 2024.

- Optimized Land Acquisition: Employing predictive analytics to identify undervalued land parcels with high future development potential.

- Enhanced Risk Assessment: Implementing sophisticated modeling to better predict construction costs and market absorption rates for new projects.

- Informed Property Design: Using data on user behavior and preferences to tailor property features and amenities, improving market appeal.

Automation in construction and operational processes

CK Asset Holdings is keenly observing the integration of automation in construction, a trend poised to redefine project timelines and cost structures. Robotics and advanced prefabrication techniques are demonstrably boosting efficiency, slashing labor expenses, and elevating safety standards on building sites. For instance, by 2024, the global construction robotics market was projected to reach $71.3 billion, highlighting a significant investment in these transformative technologies.

Beyond the construction phase, automation offers substantial operational advantages for CK Asset Holdings' vast property portfolio. Automating routine tasks such as security surveillance and comprehensive facility management can unlock considerable cost savings and elevate the quality of services delivered to tenants. This strategic adoption of technology is crucial for maintaining a competitive edge and optimizing the performance of its extensive real estate holdings.

- Efficiency Gains: Robotics and prefabrication can reduce construction times by up to 20% in certain applications.

- Cost Reduction: Automation in operations can lower facility management costs by an estimated 15-25%.

- Safety Improvement: Automated systems minimize human exposure to hazardous construction environments.

- Enhanced Service: Automated security and maintenance systems ensure consistent and reliable property upkeep.

CK Asset Holdings' technological strategy is deeply intertwined with the adoption of property technology (PropTech), focusing on AI for market analysis, VR for tours, and digital platforms for management to boost efficiency and customer experience.

The PropTech market's growth, with global investment reaching $10.7 billion in 2023, underscores the trend towards digital transformation, offering CK Asset Holdings cost savings and improved engagement opportunities in 2024-2025.

Smart building technologies, integrating IoT for energy management, are becoming standard, contributing to efficiency and reduced utility costs, with the global smart building market valued at $80.5 billion in 2024.

CK Asset Holdings can leverage these innovations for sustainability and portfolio enhancement, lowering operational costs and positioning itself as a forward-thinking developer.

| Technology Area | 2023 Global Market Value (Est.) | Key Benefit for CK Asset | 2024/2025 Relevance |

| PropTech | $10.7 billion | Operational efficiency, enhanced customer engagement | Crucial for competitive edge and cost savings |

| Smart Buildings (IoT) | $80.5 billion | Reduced utility costs, increased property appeal | Meeting tenant expectations for sustainability and comfort |

| Construction Robotics | $71.3 billion (projected) | Faster project timelines, reduced labor costs, improved safety | Transforming development efficiency and project execution |

Legal factors

CK Asset Holdings' extensive property development and investment portfolio is significantly shaped by land use regulations and zoning laws across its operating regions. These regulations dictate permissible building types, density, and land utilization, directly affecting project viability and potential returns.

For instance, in Hong Kong, where the company has a substantial presence, stringent zoning laws and urban planning policies influence the scale and type of residential and commercial developments. Similarly, Mainland China's evolving land use policies and development controls present a dynamic regulatory landscape that CK Asset must continually adapt to.

The company's international operations, including in the UK and Australia, also involve navigating diverse and often complex land use planning frameworks. In 2024, the global real estate market continues to see increased scrutiny on sustainable development and density, which can impact project approvals and construction timelines for large-scale developments undertaken by CK Asset.

CK Asset Holdings must navigate a landscape of increasingly stringent environmental protection laws and evolving building codes. These regulations impact everything from construction materials and waste disposal to energy efficiency standards. For instance, in Hong Kong, where CK Asset has significant operations, the Buildings Department continuously updates building codes to enhance safety and sustainability, reflecting a broader regional trend towards greener construction practices.

Adherence to these legal frameworks is not merely a matter of avoiding fines; it's crucial for maintaining CK Asset's reputation and the long-term value of its properties. Non-compliance can lead to costly project delays, reputational damage, and potential legal challenges. The company’s commitment to sustainable development, as evidenced by its projects incorporating features like solar energy generation and advanced water recycling systems, demonstrates an understanding of these requirements.

Meeting these environmental and building code mandates often translates into substantial upfront investment. These costs are associated with adopting eco-friendly construction methods, upgrading existing infrastructure, and ensuring ongoing operational compliance. For example, the push for higher energy efficiency in new developments can mean investing in superior insulation and HVAC systems, which, while increasing initial costs, are projected to reduce long-term operating expenses and environmental impact.

CK Asset Holdings, operating globally, navigates a complex web of foreign investment regulations. These can range from outright prohibitions on certain sectors to ownership caps, such as the 30% foreign ownership limit in some Indian infrastructure projects. Compliance with these varying legal frameworks, including mandatory local partnership requirements in countries like China for certain property developments, is paramount for successful international expansion.

Tenancy laws and landlord-tenant regulations

CK Asset Holdings operates hotels, serviced suites, and commercial properties, making it subject to a patchwork of tenancy laws and landlord-tenant regulations in each of its operating markets. These regulations dictate crucial aspects of property management, including the terms of lease agreements, permissible rental increases, tenant rights, and the procedures for eviction. For instance, in Hong Kong, where CK Asset has significant holdings, the Landlord and Tenant (Consolidation) Ordinance governs many aspects of commercial leases, impacting how rental income is structured and managed.

Navigating these diverse legal frameworks is essential for maintaining stable rental income and ensuring smooth property operations. Failure to comply with these regulations can lead to costly disputes and legal challenges, directly affecting the company's financial performance and reputation. For example, in the UK, the Renters Reform Bill, anticipated for implementation in 2024, aims to introduce significant changes to tenant rights and landlord obligations, requiring careful adaptation by property owners like CK Asset.

- Lease Agreement Variations: Tenancy laws across different jurisdictions dictate the permissible terms and conditions within lease agreements for commercial and residential properties.

- Rental Increase Restrictions: Many regions impose limits on how much landlords can increase rent annually, impacting revenue predictability.

- Tenant Rights and Protections: Regulations often outline specific rights for tenants regarding property maintenance, quiet enjoyment, and protection against unfair eviction.

- Eviction Procedures: Strict legal processes must be followed for tenant eviction, which can be time-consuming and costly if not handled correctly.

Anti-monopoly and competition laws

CK Asset Holdings, like any major player, must carefully consider anti-monopoly and competition laws. These regulations are designed to ensure fair play in the marketplace and prevent any single company from gaining too much control, which could stifle innovation or harm consumers. For instance, in sectors where CK Asset Holdings has a substantial presence, like property development or retail, authorities will scrutinize any moves that could be seen as anti-competitive. This means large mergers or acquisitions might face tougher review processes to ensure they don't create a monopoly.

The company's pricing strategies are also subject to these laws. If CK Asset Holdings were to engage in practices that unfairly disadvantage competitors, such as predatory pricing, it could attract significant legal attention and penalties. Staying compliant is therefore not just a legal obligation but a strategic imperative to avoid costly fines and reputational damage. For example, the Hong Kong Competition Ordinance, enacted in 2015, provides a framework for regulating anti-competitive conduct across various industries.

- Compliance with anti-monopoly laws is essential to prevent market dominance and ensure fair competition.

- Mergers and acquisitions by CK Asset Holdings may be subject to regulatory approval to avoid creating monopolies.

- Pricing strategies must adhere to competition laws to prevent unfair market advantages.

- Failure to comply can result in significant legal penalties and reputational harm.

CK Asset Holdings' operations are significantly influenced by evolving property and land use regulations globally. In 2024, many jurisdictions are tightening rules around development density and sustainability, impacting project feasibility. For example, Hong Kong's strict zoning laws continue to shape the scale of CK Asset's urban projects, while China's dynamic land policies require constant adaptation.

Environmental protection laws and building codes present another critical legal factor, demanding compliance with standards for materials, waste, and energy efficiency. In the UK, for instance, new regulations in 2024 are pushing for higher energy performance in new builds, potentially increasing upfront costs for developers like CK Asset but offering long-term operational savings.

Foreign investment regulations, including ownership caps and local partnership requirements, are paramount for CK Asset's international expansion, particularly in markets like China. Tenancy laws, such as Hong Kong's Landlord and Tenant Ordinance and the UK's anticipated Renters Reform Bill in 2024, directly affect rental income predictability and property management practices.

Competition and anti-monopoly laws are vital for CK Asset, governing market practices and scrutinizing mergers and acquisitions to prevent undue market dominance. Pricing strategies must also comply with these regulations to avoid penalties. The Hong Kong Competition Ordinance, for example, sets the framework for fair competition across industries where CK Asset operates.

Environmental factors

CK Asset Holdings' extensive portfolio, encompassing property and infrastructure, faces significant physical climate change risks. These include the escalating threat of rising sea levels, more frequent extreme weather events like typhoons and floods, and a general increase in the occurrence of natural disasters. For instance, Hong Kong, a key market for CK Asset, is particularly vulnerable to sea-level rise and tropical cyclones.

These physical impacts translate directly into financial and operational challenges. Property damage from severe weather can incur substantial repair costs, while increased insurance premiums add to overheads. Furthermore, disruptions to infrastructure operations, such as ports or utilities managed by CK Asset subsidiaries, can lead to revenue losses and impact service delivery.

The company's strategic response increasingly involves robust risk assessment and mitigation. This includes investing in resilient design for new developments and retrofitting existing assets to withstand anticipated climate impacts. Careful location selection, prioritizing areas less prone to severe flooding or extreme weather, is also a critical component of their long-term strategy to safeguard asset value and operational continuity.

The increasing global focus on sustainability and green building standards significantly shapes the property sector. CK Asset Holdings is therefore under growing pressure to align its developments with stringent environmental criteria, such as achieving LEED or BEAM Plus certifications. This commitment not only minimizes ecological impact but also boosts a property's attractiveness to environmentally conscious buyers and tenants.

Adopting eco-friendly materials and energy-efficient systems is becoming a key differentiator. For instance, in 2023, the global green building market was valued at approximately $1.5 trillion and is projected to grow substantially. CK Asset Holdings' investment in these areas, while potentially increasing initial construction costs, promises long-term operational savings through reduced energy and water consumption, aligning with evolving market expectations and regulatory trends.

The increasing scarcity and cost of essential resources like water and energy directly impact CK Asset Holdings' operational expenses for its properties and infrastructure projects. For instance, rising global energy prices, with Brent crude oil averaging around $80 per barrel in early 2024, can significantly increase utility costs for managed buildings and development sites.

To navigate these challenges and ensure long-term sustainability and cost-effectiveness, CK Asset Holdings is implementing robust resource management strategies. These include advanced water conservation techniques in its developments and a growing focus on adopting renewable energy sources, aiming to reduce reliance on volatile fossil fuel markets and enhance its environmental, social, and governance (ESG) profile.

Waste management and circular economy principles

CK Asset Holdings faces increasing regulatory scrutiny and evolving societal demands for better waste management in its construction and property operations. Stricter environmental laws, particularly in key markets like Hong Kong and the UK, are compelling companies to adopt more sustainable practices.

Embracing circular economy principles, such as waste reduction, material reuse, and enhanced recycling programs, presents a significant opportunity for CK Asset. For instance, adopting these strategies can lead to a reduction in landfill disposal fees, which can be substantial. In 2023, the construction industry in the UK alone generated over 100 million tonnes of waste, with a significant portion being avoidable.

This shift requires a focus on responsible sourcing of materials and maximizing material reuse across the entire property lifecycle, from initial development to ongoing building management. Successful implementation can not only mitigate environmental impact but also contribute to cost efficiencies and enhance the company's brand reputation among environmentally conscious stakeholders.

- Regulatory Landscape: Expect more stringent regulations on construction waste disposal and material sourcing in major operating regions by 2025.

- Cost Savings Potential: Implementing circular economy practices could reduce waste disposal costs by an estimated 10-15% in new developments, based on industry benchmarks.

- Material Lifecycle Management: Focus on sourcing recycled content and designing for deconstruction to facilitate material reuse in future projects.

- Societal Expectations: Growing consumer and investor demand for sustainable building practices will influence project design and operational standards.

Corporate social responsibility (CSR) and ESG reporting

CK Asset Holdings, like many global corporations, faces mounting pressure from investors, regulators, and the public to showcase robust corporate social responsibility (CSR) and transparent Environmental, Social, and Governance (ESG) reporting. This demand is driven by a growing awareness of sustainability's impact on long-term value creation. For instance, in 2023, global ESG investing assets were projected to reach $33.9 trillion, highlighting investor appetite for companies with strong ESG credentials.

Integrating ESG factors into core business strategy, daily operations, and public disclosures is no longer optional but essential for maintaining a positive reputation, attracting capital, and effectively managing long-term risks. Companies are increasingly expected to set ambitious targets for environmental performance, such as reducing carbon emissions and improving resource efficiency.

- Investor Demand: A significant portion of institutional investors now incorporate ESG criteria into their investment decisions, influencing capital allocation towards more sustainable businesses.

- Regulatory Scrutiny: Governments worldwide are strengthening ESG disclosure requirements, pushing companies to provide more standardized and verifiable data on their sustainability performance.

- Public Perception: Consumers and the general public are more likely to support and engage with companies that demonstrate a commitment to social and environmental well-being.

- Risk Management: Proactive ESG management helps identify and mitigate potential risks related to climate change, supply chain disruptions, and reputational damage.

CK Asset Holdings must navigate increasingly stringent environmental regulations, particularly concerning construction waste and material sourcing, with stricter laws expected in key markets by 2025. Embracing circular economy principles, such as waste reduction and material reuse, offers significant cost savings, potentially reducing disposal expenses by 10-15% in new developments. The company is also focusing on responsible sourcing and designing for deconstruction to facilitate material reuse, aligning with growing societal expectations for sustainable building practices.

PESTLE Analysis Data Sources

Our CK Asset Holdings PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable financial news outlets, and leading market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting our operations.