CK Asset Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Asset Holdings Bundle

Discover the core components of CK Asset Holdings's diversified business model, from its extensive property portfolio to its strategic investments in infrastructure and technology. This Business Model Canvas provides a clear overview of how they generate value and maintain a competitive edge.

Unlock the full strategic blueprint behind CK Asset Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CK Asset Holdings frequently partners with entities like CK Infrastructure Holdings Limited (CKI) and Power Assets Holdings Limited (PAH) through strategic joint ventures. These collaborations are pivotal for pursuing substantial global infrastructure and utility asset acquisitions, effectively pooling capital, specialized knowledge, and risk.

These joint ventures enable CK Asset Holdings to participate in major investment opportunities that might otherwise be too large or complex to manage alone. For instance, in 2023, CK Asset Holdings, alongside CKI and PAH, was involved in the acquisition of a significant stake in a portfolio of UK onshore wind farms, demonstrating the practical application of these partnerships in the renewable energy sector.

CK Asset Holdings actively collaborates with government and regulatory bodies to secure essential permits and land grants for its extensive property development and infrastructure projects. This engagement is vital for navigating complex approval processes and ensuring compliance with regulations in its core markets.

In 2024, the company's ability to secure these approvals efficiently directly impacts its project timelines and financial performance, particularly in major developments within Hong Kong and Mainland China. For instance, timely land grants and building plan approvals are critical for the successful execution of large-scale residential and commercial ventures.

CK Asset Holdings collaborates with numerous construction and engineering firms to bring its extensive property development projects to life. These partnerships are crucial for ensuring the physical construction, innovative design, and punctual delivery of residential, commercial, and industrial properties, all while upholding rigorous quality benchmarks.

For instance, in 2024, CK Asset Holdings continued to leverage the expertise of specialized contractors for projects like the development of new residential towers in Hong Kong and the expansion of its commercial portfolio in key international markets. These firms provide the skilled labor, advanced machinery, and specialized knowledge necessary for complex builds, from foundations to finishing touches.

Financial Institutions

CK Asset Holdings maintains crucial relationships with a wide array of financial institutions, including major banks and other lenders. These partnerships are fundamental for securing the substantial project financing required for its diverse real estate developments and infrastructure projects. For instance, in 2023, CK Asset Holdings successfully raised significant capital through various syndicated loans and bond issuances, demonstrating the strength of its banking relationships.

This robust financial backing is essential for both opportunistic acquisitions and the day-to-day operational management of its capital. The company's ability to access credit lines and favorable loan terms directly supports its strategic growth initiatives and the expansion of its investment portfolio. As of early 2024, CK Asset Holdings continues to leverage these relationships to fund new ventures and manage its global asset base effectively.

- Access to Project Financing: Banks provide the necessary capital for large-scale property development and infrastructure projects.

- Capital Management: Financial institutions facilitate loans and credit facilities crucial for acquisitions and operational needs.

- Strategic Growth Support: Strong financial partnerships enable CK Asset Holdings to pursue its expansion strategies and invest in new opportunities.

- Diversified Funding Sources: Relationships with multiple institutions ensure a stable and varied capital structure.

Real Estate Agencies and Sales Channels

CK Asset Holdings leverages a robust network of real estate agencies and sales channels to effectively market and sell its extensive property portfolio. These collaborations are crucial for reaching a wider spectrum of potential buyers and renters, ensuring efficient transactions across its diverse developments.

These partnerships provide CK Asset Holdings with access to established client bases and market expertise, significantly enhancing sales velocity. For instance, in 2024, the Hong Kong property market saw continued activity, with agencies playing a pivotal role in navigating buyer sentiment and transaction volumes.

The strategic engagement with these agencies allows CK Asset Holdings to tap into specialized sales teams who are adept at promoting various property types, from residential towers to commercial spaces. This synergy helps in optimizing marketing campaigns and achieving sales targets efficiently.

- Broad Market Reach: Partnerships with prominent real estate agencies expand CK Asset Holdings' customer access beyond its direct marketing efforts.

- Sales Efficiency: Leveraging established sales channels and broker networks accelerates the leasing and sale of properties.

- Market Intelligence: Agencies provide valuable insights into market trends and buyer preferences, informing sales strategies.

- Diverse Property Marketing: Collaborations facilitate tailored marketing approaches for different segments of CK Asset Holdings' property offerings.

CK Asset Holdings' key partnerships extend to technology providers and service operators, crucial for enhancing its property management and infrastructure operations. These collaborations ensure the integration of smart technologies and efficient service delivery, improving asset value and tenant experience.

In 2024, the company has been actively exploring partnerships for smart building solutions and sustainable energy management systems across its portfolio. This focus on technological integration aims to optimize operational efficiency and attract environmentally conscious tenants and investors.

What is included in the product

A comprehensive overview of CK Asset Holdings' business model, detailing its diverse property development, investment, and infrastructure segments, with a focus on its global reach and diversified revenue streams.

This model outlines CK Asset Holdings' strategic approach to customer segments, value propositions, and key resources within its property and infrastructure businesses.

CK Asset Holdings' Business Model Canvas offers a clear, one-page snapshot of their diversified operations, simplifying complex strategies for stakeholders.

It effectively addresses the pain point of information overload by condensing CK Asset Holdings' multifaceted business into a digestible format for quick review and strategic alignment.

Activities

CK Asset Holdings' primary engine is its comprehensive property development and sales operations. This encompasses the entire journey from securing land, meticulously planning and designing, to the actual construction and subsequent sale of a diverse range of properties, including homes, offices, and industrial spaces.

The company boasts a substantial land portfolio strategically positioned across Hong Kong, Mainland China, and international markets. This extensive land bank is crucial for sustaining its development pipeline, with continuous efforts focused on acquiring new sites to ensure future project continuity and growth.

For 2024, CK Asset Holdings reported significant progress in its development activities. For instance, the company achieved substantial sales from its residential projects in Hong Kong, contributing significantly to its revenue streams. Overseas, particularly in the UK, their developments continued to attract strong buyer interest, underscoring their global reach and execution capabilities.

CK Asset Holdings actively invests in and manages a broad range of income-producing properties. This portfolio includes retail, office, and industrial assets, demonstrating a diversified approach to real estate. The company's focus is on optimizing these properties to generate consistent rental income and appreciate in value over time.

The management of these properties involves crucial activities like tenant acquisition and retention, ensuring optimal occupancy rates. Furthermore, CK Asset Holdings undertakes regular maintenance and strategic upgrades to enhance the appeal and functionality of its properties. This proactive management strategy is key to maximizing rental yields and preserving long-term asset value.

For instance, as of the first half of 2024, CK Asset Holdings reported significant contributions from its property rental income. The company's commitment to strategic property investment and diligent management continues to be a cornerstone of its financial performance, underscoring its expertise in the real estate sector.

CK Asset Holdings actively manages its portfolio of hotels and serviced suites, focusing on delivering high-quality accommodation and guest experiences. This operational segment is crucial for diversifying the company's revenue streams and capitalizing on its extensive property management capabilities.

In 2024, the company continued to refine its hospitality operations, aiming to optimize occupancy rates and service standards across its properties. This segment not only generates rental income but also enhances the overall value and appeal of CK Asset's real estate holdings.

Infrastructure and Utility Asset Investment

CK Asset Holdings is actively expanding its strategic investments in infrastructure and utility assets worldwide. This is a significant and growing part of their business model, focusing on sectors like energy, social infrastructure, and waste management.

These investments are designed to create stable, long-term recurring income streams, offering a valuable diversification away from their core property development and investment activities. For instance, in 2024, the company continued to assess opportunities in renewable energy projects, a sector showing robust growth potential.

The company's commitment to this area is underscored by its ongoing efforts to build a resilient and diversified portfolio. This strategy aims to provide a steady revenue base and capitalize on global infrastructure needs.

- Global Infrastructure Expansion: CK Asset Holdings is strategically investing in infrastructure and utility assets across international markets.

- Diversification Strategy: These investments aim to generate stable, long-term recurring income, diversifying beyond traditional real estate.

- Sector Focus: Key areas of interest include energy, social infrastructure, and waste management.

- 2024 Outlook: The company actively evaluated opportunities in growth sectors like renewable energy during 2024.

Strategic Acquisitions and Portfolio Diversification

CK Asset Holdings actively pursues strategic acquisitions to broaden its global revenue streams and diversify its investment holdings. This forward-thinking strategy is designed to bolster shareholder value and ensure financial resilience in fluctuating market conditions.

The company's commitment to diversification is evident in its ongoing efforts to identify and integrate new ventures across different industries and geographical regions. For instance, in 2024, CK Asset Holdings continued to explore opportunities in sectors such as infrastructure, utilities, and property, aiming to create a more robust and balanced portfolio.

- Global Expansion: CK Asset Holdings seeks acquisitions to increase its international income base.

- Portfolio Diversification: The company aims to spread investments across various sectors and geographies.

- Shareholder Value: Strategic acquisitions are pursued to enhance long-term returns for investors.

- Financial Stability: Diversification efforts contribute to maintaining financial stability during market volatility.

CK Asset Holdings' key activities revolve around developing and selling properties, managing income-generating real estate, operating hotels, and investing in infrastructure and utilities. The company also strategically pursues acquisitions to broaden its global reach and diversify its investment portfolio.

In 2024, CK Asset Holdings demonstrated robust activity across its segments. The company achieved substantial sales from its Hong Kong residential projects and saw continued buyer interest in its UK developments. Rental income also remained a significant contributor, with ongoing efforts to optimize occupancy and asset value through proactive management and strategic upgrades.

Furthermore, CK Asset Holdings actively evaluated opportunities in growth sectors like renewable energy, underscoring its commitment to diversifying its revenue streams and building a resilient portfolio.

Full Document Unlocks After Purchase

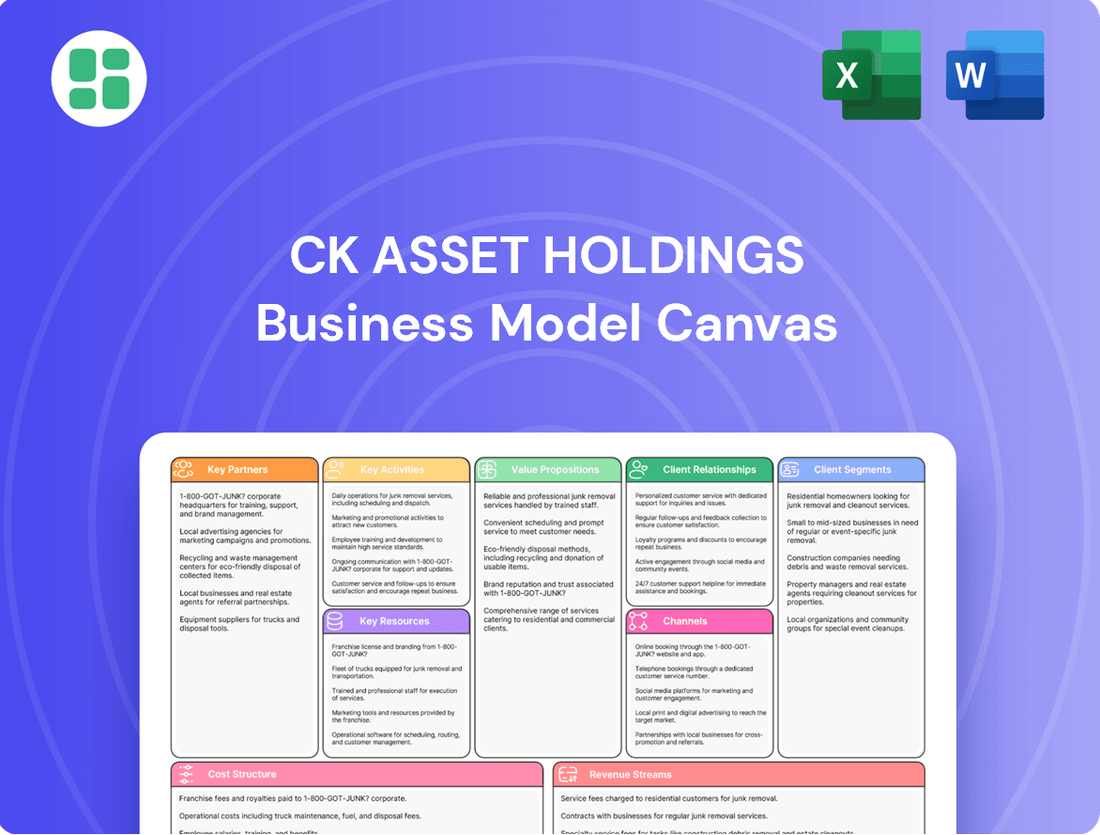

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive overview details CK Asset Holdings' strategic approach, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You are seeing a genuine snapshot of the complete analysis, ensuring you know precisely what you are acquiring.

Resources

CK Asset Holdings' extensive land bank and property portfolio are the bedrock of its business. This includes a significant amount of land earmarked for future development projects, providing a pipeline for sustained growth. As of the first half of 2024, the company’s property portfolio comprised a diverse range of assets, including residential, commercial, industrial, and hotel properties, strategically located across key international markets.

CK Asset Holdings boasts a formidable financial foundation, marked by significant capital reserves and robust liquidity. This strength is underscored by consistently high credit ratings from major agencies like Standard & Poor's and Moody's, reflecting their sound financial management.

This financial prowess directly fuels their capacity for undertaking substantial investments and executing strategic acquisitions. For instance, in 2024, the company continued its focus on opportunistic property acquisitions globally, leveraging its strong balance sheet to secure attractive assets.

CK Asset Holdings' experienced management team is a cornerstone, boasting extensive expertise in property development, investment, and asset management. This seasoned leadership guides the company's strategic direction and ensures efficient operations across its global portfolio.

The company's skilled workforce is another critical resource, encompassing a vast array of talent necessary for its diverse operations, from construction and project management to customer service and financial analysis. This human capital is instrumental in driving both operational efficiency and the successful execution of the company's ambitious growth strategies.

Diversified Global Investment Portfolio

CK Asset Holdings' business model leverages a diversified global investment portfolio that extends beyond its core property development. This includes substantial holdings in infrastructure and utility assets, such as ports, airports, and energy networks, spread across multiple international markets. This strategic diversification is a key resource, generating stable, recurring income streams and significantly reducing overall investment risk by not being overly reliant on any single sector or geographic location.

The company's commitment to this diversified approach is evident in its financial performance. For instance, in 2023, CK Asset Holdings reported a substantial portion of its revenue derived from its international property and infrastructure segments, underscoring the stability these assets provide. This broad asset base allows the company to weather economic downturns more effectively than a purely real estate-focused entity.

- Infrastructure and Utilities: Significant global investments in essential services provide consistent revenue.

- Risk Mitigation: Diversification across sectors and geographies reduces exposure to single-market volatility.

- Stable Income: Recurring revenue from infrastructure assets complements cyclical property income.

- Global Reach: Operations in numerous countries offer broad market access and resilience.

Strong Brand Reputation and Market Presence

CK Asset Holdings capitalizes on its robust brand reputation and extensive market presence, especially within Hong Kong and Mainland China, to draw in customers and forge strategic partnerships. This established brand equity is a direct result of a consistent history of delivering quality and reliability in its property development and investment ventures.

The company’s strong market positioning allows it to command customer loyalty and attract premium pricing. For instance, in 2023, CK Asset Holdings reported a revenue of HK$63.1 billion, underscoring its significant market share and the continued demand for its offerings, which are bolstered by its reputable brand.

- Brand Recognition: CK Asset Holdings is a household name in its core markets, synonymous with quality and trust in real estate.

- Market Penetration: The company maintains a substantial footprint in Hong Kong and Mainland China, enabling broad customer reach.

- Customer Trust: A long-standing track record of successful projects builds confidence among buyers and investors.

- Partnership Appeal: Its strong market presence makes it an attractive partner for joint ventures and collaborations.

CK Asset Holdings' key resources include its substantial property portfolio, a strong financial position with significant capital and liquidity, an experienced management team, a skilled workforce, and a diversified global investment base in infrastructure and utilities. Its robust brand reputation and extensive market presence, particularly in Hong Kong and Mainland China, are also critical assets.

The company's financial strength is a significant enabler, allowing for large-scale investments and strategic acquisitions. For example, CK Asset Holdings maintained a healthy cash position throughout 2024, facilitating its ongoing global property acquisition strategy.

The integration of infrastructure and utility assets provides stable, recurring income streams, complementing its property development activities and offering a degree of resilience against market fluctuations. This diversification was a key factor in the company's performance in 2023, contributing significantly to its overall revenue.

CK Asset Holdings' brand equity, built on a history of quality and reliability, fosters customer loyalty and supports premium pricing, as evidenced by its HK$63.1 billion revenue in 2023.

| Key Resource | Description | Impact | 2023 Data Point |

|---|---|---|---|

| Property Portfolio | Extensive land bank and diverse property assets globally. | Pipeline for growth, revenue generation. | Significant portion of HK$63.1 billion revenue. |

| Financial Strength | High capital reserves, robust liquidity, strong credit ratings. | Enables large investments, acquisitions, operational flexibility. | Maintained healthy cash position in H1 2024. |

| Infrastructure & Utilities | Global investments in essential services. | Stable, recurring income, risk mitigation. | Provided consistent revenue streams complementing property income. |

| Brand Reputation | Established presence and trust in core markets. | Customer loyalty, premium pricing, partnership appeal. | Underpinned strong market share and demand. |

Value Propositions

CK Asset Holdings focuses on developing high-quality, well-located properties, a cornerstone of their business model. They meticulously plan and construct residential, commercial, and industrial spaces, primarily in prime areas of Hong Kong and Mainland China.

These developments are crafted to cater to a wide range of customer needs, with a strong emphasis on superior quality, thoughtful design, and unparalleled convenience. For instance, in 2024, CK Asset Holdings continued its strategic expansion, with significant developments in key urban centers contributing to their robust asset portfolio.

CK Asset Holdings is dedicated to building enduring shareholder value, aiming for consistent returns through a carefully managed, diversified portfolio. This approach prioritizes long-term growth and stability, even when the economic climate presents challenges.

The company's strategy focuses on generating both regular dividend income and capital appreciation for its investors. For instance, in 2023, CK Asset Holdings reported a net profit attributable to shareholders of HK$10.9 billion, demonstrating its capacity to deliver financial results.

CK Asset Holdings offers investors a robust portfolio, strategically spread across property development, investment properties, hospitality, and essential global infrastructure and utility assets. This broad diversification is designed to cushion against economic downturns and ensure consistent income generation.

For instance, in 2024, the company's infrastructure and utilities segment continued to provide a stable base, contributing significantly to recurring income. This segment, which includes interests in ports, energy, and water utilities, demonstrates resilience even when property markets face headwinds.

Expert Property and Asset Management

CK Asset Holdings leverages its expert property and asset management capabilities to ensure the efficient operation and value enhancement of its vast portfolio. This core strength translates into reliability and superior quality for both tenants and business partners.

This expertise is crucial for maintaining the appeal and profitability of their diverse holdings, which include residential, commercial, and infrastructure assets. For instance, as of the first half of 2024, the company reported significant contributions from its property rental income, underscoring the effectiveness of its management strategies.

Key aspects of their expert management include:

- Proactive maintenance and operational efficiency: Minimizing downtime and maximizing asset lifespan.

- Tenant relationship management: Fostering loyalty and ensuring high occupancy rates.

- Strategic asset enhancement: Identifying and implementing upgrades to boost rental yields and property values.

- Risk mitigation: Implementing robust systems to safeguard assets and ensure compliance.

Commitment to Sustainability and Community

CK Asset Holdings actively embeds Environmental, Social, and Governance (ESG) principles across its business, reflecting a deep commitment to sustainable development and community well-being. This dedication is evident in their operational strategies and corporate citizenship efforts, aiming for responsible growth.

The company's focus on sustainability includes concrete actions for carbon footprint reduction. For instance, in 2024, CK Asset Holdings continued to invest in energy-efficient building technologies and renewable energy sources, contributing to a greener operational model.

Beyond environmental concerns, CK Asset Holdings prioritizes community engagement and support. Their initiatives in 2024 aimed to foster local development and provide resources for community enhancement, demonstrating a commitment to social responsibility.

- ESG Integration: CK Asset Holdings incorporates ESG factors into its core business strategy, aligning financial performance with environmental and social impact.

- Carbon Reduction Efforts: The company actively pursues initiatives to lower greenhouse gas emissions, investing in sustainable building designs and operational efficiencies.

- Community Support: CK Asset Holdings engages in various programs to uplift and support the communities in which it operates, fostering positive social impact.

- Stakeholder Appeal: These commitments resonate with an increasing number of socially conscious investors and stakeholders who value responsible corporate behavior.

CK Asset Holdings offers meticulously developed properties in prime locations, ensuring high quality and desirability for residents and businesses. Their strategic focus on well-located assets, particularly in Hong Kong and Mainland China, underpins their value proposition.

The company provides a diversified investment portfolio, spanning property, infrastructure, and utilities, which aims to deliver consistent returns and capital appreciation. This broad diversification helps mitigate risks and ensures stable income streams, as seen in their 2023 net profit of HK$10.9 billion.

CK Asset Holdings leverages expert management to enhance asset value and operational efficiency across its diverse holdings. This hands-on approach ensures high occupancy rates and sustained profitability, with significant contributions from rental income reported in the first half of 2024.

Furthermore, the company's commitment to ESG principles, including carbon reduction efforts and community support, appeals to a growing segment of socially conscious investors. Their investments in energy-efficient technologies in 2024 highlight this dedication to sustainable growth.

| Segment | 2023 Performance Highlight | 2024 Focus |

|---|---|---|

| Property Development & Investment | HK$10.9 billion net profit attributable to shareholders | Continued expansion in key urban centers |

| Infrastructure & Utilities | Provided stable recurring income | Maintaining operational resilience and growth |

| Hospitality | Contributed to overall portfolio stability | Enhancing guest experience and operational efficiency |

Customer Relationships

CK Asset Holdings cultivates direct relationships with residential property purchasers via its sales galleries and dedicated customer service departments. This approach ensures personalized guidance throughout the buying process and robust after-sales support.

These direct interactions are vital for fostering trust and streamlining property transactions. For instance, in 2023, the company reported significant sales volume across its residential projects, underscoring the effectiveness of its direct engagement strategy.

CK Asset Holdings prioritizes clear communication with its investors. They regularly share financial reports and make timely announcements, ensuring shareholders and the broader financial community have access to up-to-date information.

This proactive approach, including investor briefings, builds trust and helps stakeholders make well-informed decisions. For instance, in 2024, the company consistently provided detailed interim and final financial results, allowing investors to track performance and understand strategic developments.

CK Asset Holdings prioritizes tenant and occupant satisfaction through comprehensive property management for its diverse portfolio. This includes dedicated support for commercial, retail, and residential spaces, ensuring a high quality of living and working environments.

In 2024, the company continued to invest in responsive customer service, aiming to efficiently address tenant needs and maintain strong relationships across its rental properties. This focus on support is crucial for tenant retention and overall property value.

Strategic Partnership Management

CK Asset Holdings actively fosters enduring, cooperative ties with its joint venture collaborators, especially on significant infrastructure and property ventures. This strategic approach ensures mutual growth and project success.

- Joint Venture Focus CK Asset Holdings prioritizes long-term partnerships for major projects, exemplified by its involvement in the Hong Kong International Theme Park.

- Collaborative Engagement The company engages in consistent dialogue and shared decision-making processes with its partners, ensuring strategic alignment.

- Objective Alignment Maintaining shared strategic objectives is paramount, facilitating smooth execution and risk mitigation in complex developments.

Community Engagement Initiatives

CK Asset Holdings actively fosters community ties through its commitment to social responsibility. In 2024, the company continued to invest in educational programs, aiming to uplift underprivileged youth and promote lifelong learning.

These initiatives are designed not only to give back but also to build a stronger, more engaged relationship with the communities where CK Asset Holdings operates. By providing access to essential services and opportunities, the company reinforces its image as a trusted and valuable corporate citizen.

- Educational Programs: Supporting students through scholarships and learning resources.

- Healthcare Services: Contributing to community well-being via health-focused projects.

- Reputation Enhancement: Strengthening brand loyalty and trust through tangible social impact.

- Societal Improvement: Demonstrating a commitment to broader economic and social development.

CK Asset Holdings maintains direct customer relationships through sales galleries and dedicated service teams for property buyers, ensuring personalized support and fostering trust. For its rental properties, the company focuses on tenant satisfaction via responsive property management, crucial for retention. Furthermore, CK Asset Holdings cultivates long-term cooperative ties with joint venture partners, emphasizing shared objectives for project success.

| Relationship Type | Key Engagement Method | 2024 Focus/Data Point |

|---|---|---|

| Property Buyers | Direct sales galleries, after-sales support | Continued emphasis on personalized guidance and transaction streamlining. |

| Tenants/Occupants | Comprehensive property management, responsive service | Investment in efficient tenant support for high-quality living and working environments. |

| Investors | Regular financial reports, investor briefings | Consistent provision of detailed interim and final financial results. |

| Joint Venture Partners | Consistent dialogue, shared decision-making | Prioritizing long-term partnerships for major infrastructure and property ventures. |

| Communities | Social responsibility initiatives (e.g., education) | Continued investment in programs uplifting underprivileged youth. |

Channels

CK Asset Holdings leverages dedicated sales galleries and showrooms in prime locations to present new property developments. These physical spaces offer prospective buyers an immersive experience, allowing them to view units firsthand and access detailed project information, thereby facilitating direct sales.

In 2024, CK Asset Holdings continued to invest in these high-impact sales channels. For instance, the launch of their luxury residential project in Hong Kong saw significant footfall at its meticulously designed showroom, contributing to a strong initial sales phase.

CK Asset Holdings actively utilizes its official website and various digital channels to disseminate corporate information, investor relations updates, and property listings. This robust online presence is crucial for broad communication and engaging with stakeholders, offering a centralized hub for news and developments.

In 2024, the company continued to enhance its digital footprint, providing easy access to financial reports and project details. For instance, their investor relations section offers comprehensive data, including annual reports and interim results, facilitating informed decision-making for shareholders and potential investors.

CK Asset Holdings leverages a vast network of real estate agencies and brokers to effectively market and sell its diverse property portfolio. This strategic reliance on external partners significantly broadens the company's market penetration, tapping into a wider spectrum of potential buyers and tenants across various geographical locations.

In 2024, the global real estate market continued to show resilience, with agencies playing a crucial role in navigating complex transactions. CK Asset Holdings' partnerships allow it to access specialized market knowledge and buyer databases, which are vital for optimizing sales and leasing efforts, especially in competitive urban environments.

Financial Reports and Investor Briefings

CK Asset Holdings actively engages with its stakeholders through the consistent publication of annual and interim financial reports. These documents are crucial for transparency, offering a detailed look at the company's performance and financial health.

Investor briefings and presentations serve as key channels for direct communication. During these events, management provides critical financial data and strategic insights, fostering a deeper understanding among shareholders and institutional investors. For instance, in their 2023 interim results, CK Asset Holdings reported a profit attributable to shareholders of HK$5,100 million, demonstrating their ongoing financial activity.

- Annual and Interim Reports: Provide comprehensive financial statements and operational reviews.

- Investor Briefings: Offer direct engagement with management for Q&A and strategic discussions.

- Presentations: Visually communicate key financial highlights and future outlook.

- Shareholder Communications: Ensure timely dissemination of material information to maintain investor confidence.

Direct Property Management and Hospitality Operations

CK Asset Holdings directly manages its investment properties, hotels, and serviced suites. This direct approach allows for seamless interaction with tenants, guests, and property owners, facilitating ongoing services, maintenance, and bookings.

This direct channel is crucial for maintaining high service standards and building strong relationships. For instance, in 2024, the company continued to focus on enhancing the guest experience across its hospitality portfolio, which includes properties in key global cities.

- Direct Tenant Engagement: Facilitates personalized service and efficient issue resolution for residential and commercial tenants.

- Hotel and Serviced Suite Operations: Ensures quality control and direct customer feedback for hospitality offerings.

- Property Owner Relations: Manages relationships and provides reporting for third-party property management services.

- Booking and Reservation Management: Streamlines direct bookings, maximizing occupancy and revenue.

CK Asset Holdings utilizes a multi-channel approach for customer interaction and sales, encompassing physical sales galleries, a robust online presence, and strategic partnerships with real estate agencies. These channels are critical for reaching diverse customer segments and facilitating property transactions.

In 2024, the company continued to emphasize direct customer engagement through its property showrooms and digital platforms, ensuring a seamless experience from initial inquiry to final purchase. This integrated strategy aims to maximize market reach and customer satisfaction across its global property portfolio.

CK Asset Holdings also maintains direct operational control over its hospitality and property management services, fostering strong relationships with tenants and guests. This direct management allows for enhanced service delivery and brand consistency.

| Channel | Description | 2024 Focus/Example |

|---|---|---|

| Sales Galleries/Showrooms | Physical spaces for property viewing and sales. | Continued investment in prime locations for new developments, enhancing immersive buyer experiences. |

| Official Website & Digital Channels | Online platform for corporate information, investor relations, and property listings. | Enhanced digital footprint for easy access to financial reports and project details, supporting investor engagement. |

| Real Estate Agencies & Brokers | External partners for broad market penetration and sales. | Leveraging specialized market knowledge and buyer databases to optimize sales and leasing in competitive urban markets. |

| Direct Operations (Hospitality/Property Management) | Direct management of properties, hotels, and serviced suites. | Focus on enhancing guest experience and maintaining high service standards across global hospitality assets. |

Customer Segments

Residential property buyers represent a core customer segment for CK Asset Holdings, encompassing individuals and families looking for homes in Hong Kong, Mainland China, the UK, and Singapore. This group spans from those seeking affordable mass-market housing to affluent individuals desiring luxury residences.

These buyers prioritize key factors such as prime locations, superior construction quality, and the established brand reputation of developers like CK Asset Holdings. For instance, in 2024, the Hong Kong property market saw continued demand for well-located, quality developments, reflecting this segment's preferences.

Commercial and retail tenants are the backbone of CK Asset Holdings' property portfolio. This segment includes a wide array of businesses, from burgeoning startups needing flexible office solutions to established corporations requiring significant retail footprints or industrial hubs. They are actively seeking prime locations that offer high foot traffic and accessibility, alongside contemporary facilities and reliable property management to ensure smooth operations.

In 2024, the demand for well-located commercial and retail spaces remained robust, particularly in key urban centers where CK Asset Holdings has a strong presence. For instance, their properties in Hong Kong, a global financial nexus, continue to attract a diverse tenant base. The company's focus on providing modern amenities, such as advanced connectivity and sustainable building features, directly addresses the evolving needs of these businesses, aiming to foster long-term tenancy and operational efficiency.

Institutional investors, including major pension funds and investment corporations, represent a key customer segment for CK Asset Holdings. These entities are primarily driven by the pursuit of stable, long-term returns across a variety of asset classes. Their interest in CK Asset Holdings is particularly focused on portfolios offering consistent income streams and inherent resilience, such as infrastructure, utility operations, and prime investment properties.

Individual Investors and Shareholders

Individual investors and shareholders are a crucial customer segment for CK Asset Holdings, looking for growth and steady income from their investments. They closely monitor the company's financial health and strategic moves, aiming to maximize their returns.

These investors are motivated by CK Asset Holdings' track record and future prospects. For instance, as of the first half of 2024, CK Asset Holdings reported a net profit attributable to shareholders of HK$5,067 million, demonstrating its ability to generate value.

- Capital Appreciation: Seeking an increase in the value of their CK Asset Holdings shares over time.

- Dividend Income: Relying on the company for regular dividend payouts, contributing to their investment income.

- Financial Performance Monitoring: Actively tracking earnings reports, asset valuations, and debt levels.

- Strategic Direction Analysis: Evaluating management's decisions regarding property development, investments, and acquisitions.

Hotel Guests and Serviced Suite Occupants

CK Asset Holdings caters to a diverse range of hotel guests and serviced suite occupants. This includes transient travelers, such as tourists and holidaymakers, who require comfortable and convenient lodging for shorter durations. In 2024, the global tourism market continued its recovery, with many regions seeing a significant uptick in leisure travel.

Business professionals represent another key customer segment. These individuals often stay in CK Asset Holdings' properties for conferences, meetings, and project-based work, valuing amenities that support productivity and connectivity. The demand for business travel has shown a steady increase throughout 2024 as companies resume more in-person interactions.

Furthermore, long-stay residents, including expatriates, relocating individuals, and those seeking temporary housing solutions, are crucial. Serviced suites offer the flexibility and home-like comforts that appeal to this group. The serviced apartment sector has experienced robust growth, driven by both corporate relocation programs and individual preferences for extended-stay options.

- Travelers: Seeking comfortable and convenient accommodation for leisure or short trips.

- Business Professionals: Requiring productive environments and amenities for work-related stays.

- Long-Stay Residents: Opting for flexible, home-like living arrangements for extended periods.

CK Asset Holdings serves a broad customer base, from individual home buyers to large institutional investors. The company's residential property segment caters to both mass-market and luxury buyers, prioritizing location and quality. Their commercial and retail operations attract businesses seeking prime, accessible spaces with modern facilities.

Institutional investors are drawn to CK Asset Holdings for stable, long-term returns from infrastructure, utilities, and prime properties. Individual investors focus on capital appreciation and dividend income, closely monitoring the company's financial performance, which in the first half of 2024 showed a net profit of HK$5,067 million.

The hospitality segment targets travelers, business professionals, and long-stay residents with comfortable and productive accommodation options. The serviced apartment sector, in particular, has seen growth driven by corporate and individual demand for extended-stay solutions.

| Customer Segment | Key Needs/Motivations | 2024 Relevance/Data Point |

|---|---|---|

| Residential Property Buyers | Location, Quality, Brand Reputation | Continued demand for well-located, quality developments in Hong Kong. |

| Commercial & Retail Tenants | Prime Location, Foot Traffic, Modern Facilities | Robust demand for spaces in key urban centers like Hong Kong. |

| Institutional Investors | Stable Long-Term Returns, Income Streams | Interest in infrastructure, utilities, and prime investment properties. |

| Individual Investors/Shareholders | Capital Appreciation, Dividend Income | Net profit attributable to shareholders was HK$5,067 million (H1 2024). |

| Hotel Guests & Serviced Suite Occupants | Comfort, Convenience, Productivity, Flexibility | Global tourism recovery and steady increase in business travel in 2024. |

Cost Structure

Land acquisition is a significant expense for CK Asset Holdings, forming a dominant part of its cost structure. This outlay is critical for securing sites for future property developments, with costs varying greatly depending on the specific location and prevailing market dynamics. For instance, in 2024, the company continued to invest heavily in prime real estate, with major land purchases in Hong Kong and mainland China contributing substantially to its capital expenditure.

Construction and development expenses represent a substantial portion of CK Asset Holdings' cost structure, encompassing the physical building of residential, commercial, and industrial properties. These costs are directly tied to the execution of their property development projects.

Key outlays involve material procurement, skilled labor wages, and fees paid to various contractors and specialized consultants involved in the design and engineering phases. This is a continuous investment across their diverse portfolio of ongoing developments.

For instance, in 2024, CK Asset Holdings reported significant capital expenditures related to ongoing property development projects, reflecting the inherent costs of bringing new real estate to market. These investments are crucial for expanding their property holdings and generating future revenue streams.

Financing costs, particularly interest payments on debt, are a significant component of CK Asset Holdings' expense structure due to the capital-intensive nature of its property development and infrastructure businesses. For instance, in 2023, the company reported finance costs of HK$5.9 billion, reflecting the substantial borrowing required to fund its extensive project pipeline.

Operational and Administrative Expenses

Operational and administrative expenses are a significant component of CK Asset Holdings' cost structure. These recurring costs encompass a broad range of expenditures necessary to maintain and grow the business.

Key elements include general administrative overheads, which cover the day-to-day running of the company, and property management fees for their extensive existing portfolios. Marketing and sales expenses are also crucial, particularly for new property launches, to attract buyers and tenants. Furthermore, employee salaries and benefits across all business segments represent a substantial outlay.

For instance, in 2023, CK Asset Holdings reported operating expenses of HK$19.06 billion. This figure reflects the ongoing investment in personnel, property upkeep, and promotional activities essential for their diversified operations.

- General Administrative Overheads: Costs associated with the overall management and support functions of the company.

- Property Management Fees: Expenses incurred in managing and maintaining the group's real estate assets.

- Marketing and Sales Expenses: Investments made to promote and sell new developments and existing properties.

- Employee Salaries and Benefits: Compensation and welfare costs for the workforce across all business divisions.

Maintenance and Capital Expenditure for Existing Assets

CK Asset Holdings consistently allocates significant resources to maintaining its extensive portfolio of properties and infrastructure. These ongoing costs cover routine upkeep, necessary repairs, and planned refurbishments to ensure the quality and appeal of its investment properties, hotels, and infrastructure assets.

Beyond routine maintenance, the company makes strategic capital expenditures to upgrade and enhance the long-term value of its holdings. This proactive approach aims to improve asset performance and secure future revenue streams.

- Maintenance Expenses: For the year ended December 31, 2023, CK Asset Holdings reported property, plant, and equipment maintenance costs. While specific figures for maintenance alone are not itemized separately from depreciation in all public disclosures, the overall expenditure on maintaining operational readiness is substantial.

- Capital Expenditures: In 2023, CK Asset Holdings’ capital expenditure on property, plant, and equipment, which includes upgrades and enhancements to existing assets, was a key component of its financial activities. For instance, the company continued investments in its global property portfolio, including significant developments and acquisitions that inherently involve capital outlays for enhancement.

- Asset Enhancement: These expenditures are crucial for retaining competitive advantage, particularly in the hospitality and prime real estate sectors, where asset quality directly impacts market position and rental yields.

CK Asset Holdings' cost structure is heavily influenced by land acquisition, construction, and financing. These are the core expenses tied to its property development and investment activities.

Operational and administrative costs, along with ongoing maintenance and asset enhancement, form another significant layer of expenditure necessary for business continuity and value preservation.

In 2023, financing costs alone reached HK$5.9 billion, highlighting the substantial debt burden for its capital-intensive operations.

Additionally, operating expenses in 2023 amounted to HK$19.06 billion, reflecting the broad range of costs to run its diverse business segments.

| Cost Category | Key Components | 2023 Data (HK$ Billion) |

|---|---|---|

| Land Acquisition | Site purchases for development | Significant capital expenditure (specific figures vary by project) |

| Construction & Development | Materials, labor, contractor fees | Substantial ongoing investment |

| Financing Costs | Interest on debt | 5.9 |

| Operational & Administrative | Overheads, property management, marketing, salaries | 19.06 (Operating Expenses) |

| Maintenance & Enhancement | Upkeep, repairs, upgrades | Ongoing capital expenditure for asset value preservation |

Revenue Streams

CK Asset Holdings' primary revenue stream originates from the sale of its developed properties. This encompasses a diverse portfolio of residential, commercial, and industrial real estate projects. The company generates income not only from completed developments but also through pre-sales of properties still under construction, a significant contributor to its financial performance.

In 2024, CK Asset Holdings continued to leverage its property sales as a core revenue driver. For instance, the company reported substantial contributions from its residential projects in Hong Kong and mainland China. The sale of these units, both completed and off-plan, formed a cornerstone of its financial results for the year, underscoring the importance of this segment to its overall business model.

CK Asset Holdings generates consistent, recurring revenue through its substantial portfolio of investment properties. This includes a diverse range of assets like office buildings, retail spaces, and industrial properties, offering a stable income foundation.

In 2024, the company continued to leverage its property holdings for rental income. For instance, its significant presence in the Hong Kong office market, a key driver of rental revenue, remained a cornerstone of its financial stability.

The rental income stream is crucial for CK Asset Holdings, providing a predictable cash flow that supports ongoing operations and future investments. This recurring revenue model underpins the company's financial resilience.

CK Asset Holdings generates significant income from its hotel and serviced suite operations, a key component of its property segment. This revenue stream is built upon a foundation of room bookings, complemented by robust sales from food and beverage outlets and a variety of other hospitality services offered within its properties.

In 2024, the company’s commitment to enhancing guest experiences and optimizing operational efficiency continued to drive performance in this segment. For instance, its portfolio of hotels and serviced suites across major global cities aims to capture both leisure and business travel markets, contributing to a stable and diversified income base.

Returns from Infrastructure and Utility Investments

CK Asset Holdings sees a growing contribution to its revenue from dividends and returns generated by its strategic infrastructure and utility investments worldwide. These types of assets are known for offering stable, predictable cash flows that often keep pace with inflation over the long term.

These investments provide a reliable income stream, bolstering the company's financial stability. For instance, in 2024, the company continued to benefit from its diverse portfolio of such assets, which are crucial for generating recurring income.

- Infrastructure and Utility Investments: Global portfolio generating stable, recurring cash flows.

- Inflation-Linked Returns: Assets designed to maintain value and income against rising prices.

- Long-Term Recurring Cash Flows: Predictable income streams from essential services and infrastructure.

- Strategic Global Presence: Investments spread across various geographies for diversification and stability.

Property and Project Management Fees

CK Asset Holdings generates income through property and project management fees. This revenue stream stems from overseeing its extensive portfolio and potentially managing properties for third parties or joint ventures, capitalizing on its operational expertise.

- Property Management Fees: Revenue generated from the ongoing operation and leasing of its diverse property holdings.

- Project Management Fees: Income derived from overseeing the development and construction of new projects, both for its own ventures and potentially for external clients.

- Leveraging Expertise: CK Asset Holdings utilizes its established skills in efficient asset operation and development to create value and generate fee-based income.

CK Asset Holdings' revenue streams are diversified, primarily driven by property sales and rental income from its extensive investment property portfolio. The company also benefits from recurring income generated by its hotel and serviced suite operations, alongside dividends and returns from strategic infrastructure and utility investments. Additionally, property and project management fees contribute to its income base, leveraging its operational expertise.

| Revenue Stream | Description | 2024 Significance |

|---|---|---|

| Property Sales | Income from the sale of residential, commercial, and industrial properties. | Continued to be a core driver, with significant contributions from Hong Kong and mainland China residential projects. |

| Rental Income | Recurring revenue from leasing office buildings, retail spaces, and industrial properties. | Provided a stable income foundation, with Hong Kong's office market being a key contributor. |

| Hotel & Serviced Suites | Revenue from room bookings, food and beverage, and other hospitality services. | Aimed to capture leisure and business travel markets across global cities, enhancing operational efficiency. |

| Infrastructure & Utilities | Dividends and returns from global infrastructure and utility investments. | Offered stable, predictable, inflation-linked cash flows, crucial for recurring income generation. |

| Management Fees | Fees earned from property and project management services. | Leveraged operational expertise to generate fee-based income from its portfolio and potentially third parties. |

Business Model Canvas Data Sources

The CK Asset Holdings Business Model Canvas is built upon a foundation of extensive market research, financial performance analysis, and internal operational data. These sources ensure a comprehensive understanding of our target markets and economic viability.