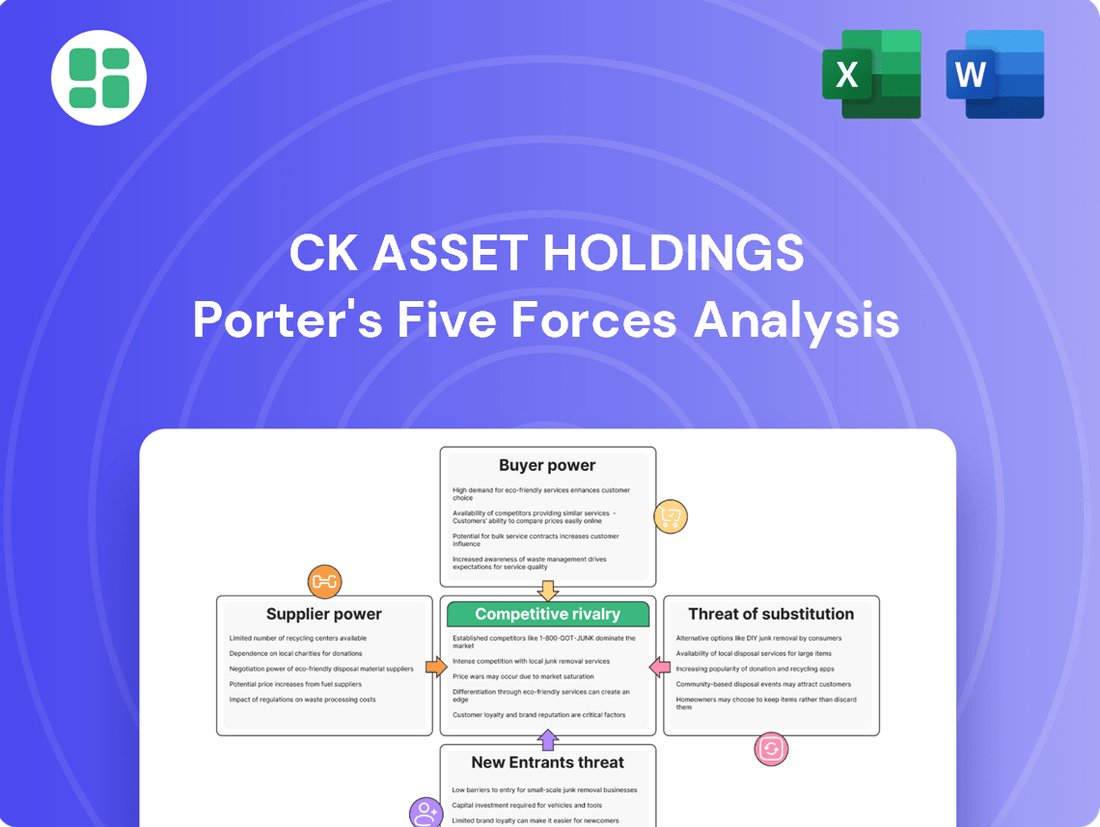

CK Asset Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Asset Holdings Bundle

CK Asset Holdings navigates a complex landscape where buyer power can significantly impact pricing, and the threat of new entrants demands constant innovation. Understanding the intensity of rivalry and the influence of suppliers is crucial for strategic planning.

The complete report reveals the real forces shaping CK Asset Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The availability of prime land in Hong Kong and Mainland China, CK Asset Holdings' core operating regions, is notably constrained. This scarcity directly translates into significant bargaining power for land suppliers, as demand consistently outstrips supply for desirable locations.

High land premiums, a direct consequence of this limited availability, substantially influence CK Asset Holdings' development costs and overall project profitability. For instance, in the first half of 2024, land acquisition costs represented a significant portion of project expenditures, impacting the feasibility of new ventures.

The government's policies regarding land sales and urban planning further shape supplier power. Initiatives aimed at streamlining land bidding processes, such as those seen in Hong Kong's land auction reforms in 2024, can slightly mitigate this power by encouraging broader participation, but the fundamental scarcity remains a dominant factor.

While CK Asset Holdings benefits from Hong Kong's competitive global procurement for construction materials, supplier power remains a factor. Despite some price decreases for steel, sand, and aggregates observed in 2023-2024, the overall cost of construction in Hong Kong remains exceptionally high, placing it among the most expensive globally. This persistent high cost environment suggests that suppliers, particularly for specialized or high-demand materials, can still exert considerable influence.

The construction sector in Hong Kong, a key area for CK Asset Holdings, is grappling with a significant shortage of skilled labor. This scarcity directly translates to increased bargaining power for workers and unions, driving up labor costs. For instance, in 2024, average daily wages for skilled construction workers in Hong Kong saw a notable increase, putting pressure on developers' project budgets.

This escalating cost of labor, coupled with ongoing shortages, poses a direct challenge to CK Asset Holdings' profitability and project timelines. It creates a scenario where suppliers of labor can dictate terms more effectively, potentially impacting the company's ability to control expenses and deliver projects efficiently. Effective labor management and talent retention are therefore paramount for mitigating these pressures and ensuring smooth operations.

Financing and Capital Providers

Access to capital and favorable financing terms are crucial for CK Asset Holdings' large-scale property development and infrastructure projects. While interest rates have shown signs of stabilizing and potential cuts are anticipated in late 2025, borrowing costs continue to be a significant factor for real estate investors.

In this environment, lenders and financial institutions wield considerable bargaining power. Their ability to offer or withhold capital, and the terms associated with it, directly impacts the feasibility and profitability of CK Asset Holdings' ventures. For instance, a 0.25% increase in a major loan’s interest rate could add millions to project expenses over its lifecycle.

- Lender Influence: Financial institutions can dictate terms, impacting project timelines and returns.

- Financing Costs: Higher interest rates directly increase the cost of capital for developments.

- Capital Availability: The ease of securing loans influences the scale and number of projects undertaken.

Specialized Technology and Services

As the real estate sector embraces smart technology and data analytics, suppliers of these specialized solutions are gaining significant bargaining power. CK Asset Holdings, like its peers, depends on advanced systems for efficient property management and smart building integration, which inherently grants these tech providers leverage.

The increasing demand for remote management capabilities and data-driven operational decisions further amplifies the importance of these specialized technology and service providers. For instance, the global smart building market was projected to reach over $100 billion by 2024, highlighting the critical role of these suppliers.

- Providers of proprietary smart building software and integrated IoT platforms hold considerable sway.

- Companies offering advanced data analytics for property performance and tenant experience are increasingly influential.

- Suppliers of specialized cybersecurity solutions for connected properties are essential partners, thus strengthening their position.

The scarcity of prime land in Hong Kong and mainland China significantly empowers land suppliers, driving up acquisition costs for CK Asset Holdings. This limited supply directly impacts development budgets, as seen in the first half of 2024 where land costs formed a substantial part of project expenses.

Despite some price stabilization in construction materials like steel in 2023-2024, Hong Kong's overall high construction costs persist, indicating continued supplier leverage. Furthermore, a pronounced shortage of skilled construction labor in Hong Kong in 2024 led to increased wages, amplifying the bargaining power of labor suppliers and impacting project costs.

Financial institutions hold considerable sway over CK Asset Holdings due to the capital-intensive nature of its projects. Even minor shifts in interest rates, such as a 0.25% increase on a major loan, can add millions in expenses, underscoring lenders' bargaining power. Similarly, suppliers of specialized smart building technology and data analytics are gaining influence, essential for modern property management and operational efficiency.

| Supplier Category | Key Factors Influencing Power | Impact on CK Asset Holdings |

|---|---|---|

| Land Suppliers (Hong Kong/Mainland China) | Limited availability of prime locations, high demand | Increased land acquisition costs, reduced project profitability |

| Construction Material Suppliers | High overall construction costs in Hong Kong, specialized material needs | Potential for price pressure on materials, impacting project budgets |

| Labor Suppliers (Skilled Construction Workers) | Significant shortage of skilled labor in Hong Kong | Higher labor costs, potential project delays, increased operational expenses |

| Financial Institutions (Lenders) | Access to capital, interest rate fluctuations | Influence over financing terms, project feasibility, and overall cost of capital |

| Smart Technology Providers | Increasing demand for integrated building systems, data analytics | Leverage in providing essential technology for property management and efficiency |

What is included in the product

This analysis delves into the competitive landscape for CK Asset Holdings, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its operating industries.

Instantly identify and mitigate competitive threats by visualizing CK Asset Holdings' Porter's Five Forces with a dynamic, interactive dashboard.

Effortlessly adapt to market shifts by easily updating supplier power and buyer bargaining force data for CK Asset Holdings' strategic planning.

Customers Bargaining Power

Residential property buyers in Hong Kong are experiencing increased bargaining power. Despite the lifting of cooling measures, property prices have seen a downward trend, creating a buyer's market. This oversupply and rising inventory mean individual homebuyers can negotiate more favorable terms.

Developers are actively responding by offering more incentives to attract buyers. For instance, as of early 2024, some developers were offering extended payment plans or direct discounts to move units, reflecting the heightened negotiation leverage of purchasers in this climate.

The bargaining power of commercial tenants and investors is elevated in Hong Kong and Mainland China's property markets, particularly within the office sector. High vacancy rates, reaching 8.2% in Hong Kong's Grade-A office market by the end of 2023, and downward pressure on rents in certain segments grant tenants greater leverage to negotiate more favorable lease terms and landlords concessions.

This dynamic forces property owners like CK Asset Holdings to prioritize asset optimization and stringent cost control measures to attract and retain tenants. For instance, the average office rent in Hong Kong saw a decline of approximately 7.6% in 2023 compared to the previous year, underscoring the tenant's stronger position.

Hotel and serviced suite guests wield considerable bargaining power due to the abundant choices available in the hospitality market. The proliferation of short-term rentals and co-living options means guests can easily switch providers if their expectations aren't met, pushing CK Asset Holdings to offer competitive rates and superior amenities.

In 2024, the global hotel occupancy rate hovered around 65%, indicating a market where guests have leverage. This environment compels CK Asset Holdings to focus on value, service quality, and unique guest experiences to stand out and secure bookings against a backdrop of intense competition.

Infrastructure and Utility Users

For infrastructure and utility assets, the bargaining power of individual end-users is generally low. This is because these services are essential, and the markets are often dominated by a few regulated companies, creating monopolies or oligopolies. For example, in 2024, many utility sectors continue to operate under such structures, limiting individual consumer negotiation power.

However, large industrial or commercial users can exert some influence. Their leverage stems from the significant volume of services they consume and their ability to enter into long-term contracts. These large clients might negotiate better rates or service level agreements, impacting the revenue streams for infrastructure providers.

Regulatory bodies play a crucial role by acting on behalf of consumers. They set tariffs, service standards, and ensure fair pricing, effectively acting as a proxy for the collective bargaining power of all users. These regulations are vital in balancing the interests of providers and consumers in essential services.

- Low Individual User Power: Essential services like water, electricity, and gas typically have low individual bargaining power due to regulated monopolies.

- Commercial User Influence: Large corporate clients can negotiate based on volume and long-term commitments.

- Regulatory Oversight: Government agencies and regulators set prices and standards, protecting consumer interests.

Diversified Customer Base

CK Asset Holdings benefits from a diversified customer base, which inherently limits the bargaining power of any single customer segment. By operating across residential, commercial, hotel, and infrastructure sectors, the company spreads its revenue streams, reducing reliance on any one market. In 2024, CK Asset Holdings' portfolio included significant developments in Hong Kong, mainland China, the UK, and Australia, illustrating this global reach.

This broad geographic and sectorial diversification allows CK Asset Holdings to absorb localized demand shifts more effectively. For instance, a downturn in one property market might be offset by strength in another, or a slowdown in residential sales could be balanced by robust performance in its infrastructure segment. This resilience is a key factor in managing customer bargaining power.

- Diversified Segments: Residential, commercial, hotels, and infrastructure.

- Global Footprint: Operations in key international markets.

- Demand Balancing: Ability to mitigate localized market fluctuations.

- Reduced Customer Leverage: No single customer group holds excessive influence.

For CK Asset Holdings, the bargaining power of customers varies significantly across its diverse business segments. In the residential property market, particularly in Hong Kong, buyers have gained considerable leverage due to market conditions. As of early 2024, a softening property market and increased inventory allowed individual homebuyers to negotiate more favorable terms, with developers offering incentives like extended payment plans.

The commercial property sector, especially offices, also sees elevated tenant bargaining power. High vacancy rates, such as 8.2% in Hong Kong's Grade-A office market by the end of 2023, and declining rents, averaging a 7.6% drop in Hong Kong for 2023, empower tenants to secure better lease agreements and concessions.

Conversely, customers in infrastructure and utilities generally have low individual bargaining power due to the essential nature of these services and regulated monopolies. However, large industrial clients can negotiate based on volume and long-term contracts, while regulatory bodies often act as proxies for collective consumer interests.

| Customer Segment | Bargaining Power | Key Factors | 2023/2024 Data Point |

| Residential Property Buyers (HK) | High | Oversupply, buyer's market, developer incentives | Downward trend in property prices |

| Commercial Tenants (Office) | High | High vacancy rates, rent pressure | 8.2% Grade-A office vacancy (HK, end-2023) |

| Hotel/Serviced Suite Guests | High | Abundant choices, short-term rentals | ~65% global hotel occupancy (2024) |

| Infrastructure/Utility Users (Individual) | Low | Essential services, regulated monopolies | Continued regulated structures in utility sectors |

| Infrastructure/Utility Users (Large Commercial) | Moderate | Volume, long-term contracts | Negotiation of rates and service level agreements |

Same Document Delivered

CK Asset Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of CK Asset Holdings, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Rivalry Among Competitors

CK Asset Holdings navigates a fiercely competitive landscape, especially within its core markets of Hong Kong and Mainland China. Established local developers like Sun Hung Kai Properties and Henderson Land Development are significant rivals, possessing substantial land reserves and deeply ingrained brand loyalty. This intense competition translates into aggressive bidding for new land parcels and a constant drive to capture market share in property sales.

Both Hong Kong and Mainland China property markets are grappling with significant oversupply, particularly in residential and office segments. This situation directly fuels intense competitive rivalry among developers like CK Asset Holdings. In 2024, the Hong Kong property market saw a notable increase in new housing supply, with the government estimating around 20,000 new private units to be completed. This surge in available properties puts considerable pressure on developers to move inventory.

Consequently, developers are compelled to offer more attractive pricing and rental terms to secure buyers and tenants. This aggressive stance is evident as developers increasingly resort to price reductions and enhanced marketing campaigns to stand out. For instance, reports from early 2024 indicated a trend of developers offering discounts of up to 15% on new residential projects to stimulate sales amidst the oversupply.

CK Asset Holdings, like many major real estate players, operates with a diversified business model that extends beyond simple property development. They are involved in property investment, rental income generation, property management, and even infrastructure and utility operations. This broad scope means they face competition across multiple fronts, not just from other developers but also from entities focused on long-term recurring revenue streams.

This diversification intensifies competitive rivalry as companies vie for market share in various segments. For instance, in the rental market, CK Asset competes with other large landlords and REITs, while in infrastructure, they might face utility companies or specialized infrastructure funds. This multi-pronged competition requires a sophisticated strategy to manage and optimize performance across all business units, as seen in their robust portfolio.

Global Investment Landscape

CK Asset Holdings navigates a highly competitive global investment landscape, particularly in infrastructure and utilities. It faces rivals such as Brookfield Asset Management, Macquarie Group, and numerous sovereign wealth funds, all vying for similar high-quality, stable assets. The sheer scale of these global players means CK Asset must constantly demonstrate financial strength and strategic agility to secure desirable deals.

The infrastructure sector, a key focus for CK Asset, is projected to experience moderate deal growth in 2024, though challenges persist. For instance, the global infrastructure market is estimated to reach $10.5 trillion by 2027, according to some market analyses, indicating significant investment opportunities but also intense competition. Financing hurdles and an increasing emphasis on environmental, social, and governance (ESG) factors, particularly sustainable assets, further intensify this rivalry.

- Intense Global Competition: CK Asset competes with major international investment firms, pension funds, and sovereign wealth funds for infrastructure and utility assets worldwide.

- Market Dynamics: The global infrastructure market is expected to see moderate deal growth in 2024, but persistent financing issues and a strong focus on sustainable investments create a challenging environment.

- Strategic Imperatives: Success in this arena demands robust financial capabilities, a keen understanding of diverse regulatory landscapes, and the foresight to identify and secure long-term, sustainable growth opportunities.

Strategic Land Bank Replenishment

Competition for prime land parcels is intense, with developers like CK Asset Holdings vying for sites that are critical for sustaining future development projects. This rivalry directly affects the cost of land acquisition and the ability to secure a competitive edge in the market.

CK Asset Holdings employs a disciplined approach to expanding its land reserves, but this strategy necessitates direct competition with numerous other property developers. The success in acquiring desirable land at advantageous terms is a significant determinant of the company's long-term profitability and its capacity to grow market share.

- Fierce Competition for Prime Locations: Securing attractive land sites is paramount for maintaining a robust development pipeline, leading to heightened competition among developers.

- Prudent Replenishment Strategy: CK Asset Holdings prioritizes a careful approach to land bank replenishment, actively engaging in competitive bidding for desirable parcels.

- Impact on Profitability: The ability to acquire land at favorable prices is a key factor influencing future profit margins and the company's standing in the market.

CK Asset Holdings faces intense rivalry from established local developers in Hong Kong and Mainland China, such as Sun Hung Kai Properties and Henderson Land, who possess strong brand loyalty and extensive land banks. This competition drives aggressive land bidding and market share battles, particularly amplified by an oversupply of properties in both regions. For example, Hong Kong saw an estimated 20,000 new private units completed in 2024, pressuring developers to offer discounts, with some projects seeing price reductions of up to 15% early in the year.

The company also contends with global investment firms, pension funds, and sovereign wealth funds for infrastructure and utility assets, a sector projected for moderate deal growth in 2024 but complicated by financing challenges and a strong ESG focus. This multi-faceted competition necessitates robust financial strategies and adaptability to secure long-term, sustainable growth opportunities.

| Competitor Type | Key Market Focus | Competitive Pressure Example |

|---|---|---|

| Local Developers (HK/Mainland China) | Property Development & Sales | Aggressive land bidding; Price discounts (up to 15% in early 2024) due to oversupply |

| Global Investment Firms | Infrastructure & Utilities | Competition for stable assets; Need for strong financial capability and ESG focus |

| REITs & Other Landlords | Property Investment & Rental Income | Vying for market share in rental segments |

SSubstitutes Threaten

For potential residential property buyers, renting presents a significant substitute, especially when property prices are high and interest rates are elevated. In 2024, many markets continued to experience affordability challenges, making renting a more accessible option for a larger segment of the population.

The rise of the build-to-rent (BTR) sector further strengthens this threat. BTR developments, designed specifically for rental income, offer modern amenities and professional management, directly competing with traditional homeownership. This growing segment caters to a demand for flexible living arrangements that renting provides.

In the commercial real estate market, co-working spaces and flexible office solutions present a significant threat of substitution for traditional, long-term office leases. These alternatives offer businesses agility and cost-effectiveness, directly impacting the demand for CK Asset Holdings' conventional office property investments.

The widespread adoption of remote and hybrid work models further amplifies this threat. As of late 2024, reports indicate that a substantial percentage of companies continue to embrace flexible work arrangements, diminishing the necessity for extensive, fixed office footprints. This shift directly challenges the occupancy rates and rental yields of traditional office buildings.

Companies are actively prioritizing flexible lease terms and adaptable office environments to better manage overheads and respond to dynamic operational needs. This trend suggests a growing preference for solutions that can scale up or down with business requirements, a characteristic less inherent in CK Asset Holdings' long-term lease structures.

For investors looking at real estate, alternatives like publicly traded REITs or even other asset classes such as bonds and equities present viable substitutes for investing directly in property development firms like CK Asset Holdings. CK Asset Holdings itself participates in the REIT market, recognizing this competitive landscape. Investors routinely compare the potential returns, ease of access (liquidity), and inherent risks across these different investment options when making their decisions.

Public Transportation and Digital Infrastructure

The threat of substitutes for CK Asset Holdings' infrastructure and utility assets, while generally low due to their essential nature, can manifest through evolving public transportation and digital infrastructure. For instance, significant investment in public transit systems could divert users from toll roads, impacting revenue streams. In 2024, many cities globally continued to prioritize and expand their public transportation networks, with projects like the expansion of London's Elizabeth Line and new metro lines in various Asian metropolises demonstrating this trend.

Advancements in digital infrastructure also present a potential, albeit often indirect, substitute. For example, the increasing prevalence of remote work and digital communication could, in some niche applications, reduce the demand for certain physical infrastructure services. While not a direct replacement for core utilities like water or electricity, these digital shifts can influence consumption patterns. The global digital infrastructure market was projected to see continued growth in 2024, driven by 5G deployment and data center expansion.

- Public Transportation Investment: Cities worldwide continued to invest heavily in expanding and modernizing public transit in 2024, potentially impacting toll road usage.

- Digital Infrastructure Growth: The ongoing expansion of digital networks and services in 2024 offers indirect alternatives to some traditional infrastructure uses, influencing consumption patterns.

- Essential Nature Limits Threat: The fundamental necessity of core utility services like power and water significantly mitigates the overall threat from substitutes for CK Asset Holdings' key assets.

Shifting Consumer Preferences

Evolving consumer preferences, particularly a growing demand for sustainability and smart home technology, present a significant threat. For instance, by 2024, global spending on smart home devices was projected to reach over $150 billion, indicating a strong market shift. If CK Asset Holdings' developments don't fully integrate these features, consumers may opt for competitors offering more modern, connected living experiences.

- Shifting Consumer Preferences: Consumers increasingly value eco-friendly and tech-integrated living spaces.

- Market Trends: The smart home market is expanding rapidly, with significant investment and consumer adoption.

- Competitive Impact: Competitors offering advanced sustainability and smart home solutions could draw demand away from CK Asset Holdings' less integrated properties.

- Strategic Imperative: CK Asset Holdings must continuously innovate its property designs and services to align with these evolving consumer expectations.

For CK Asset Holdings' residential portfolio, renting remains a potent substitute, especially with persistent affordability challenges observed in many property markets throughout 2024. The burgeoning build-to-rent sector, offering modern amenities and flexibility, directly competes with traditional homeownership, catering to a growing demand for adaptable living arrangements.

In the commercial space, co-working and flexible office solutions pose a significant threat to long-term lease agreements, offering businesses agility and cost savings. This trend is amplified by the continued prevalence of remote and hybrid work models, which, as of late 2024, meant many companies were reassessing their need for extensive fixed office footprints, impacting occupancy rates for traditional office buildings.

Investment alternatives like REITs and other asset classes such as equities and bonds also serve as substitutes for direct property investment. Investors routinely weigh the potential returns, liquidity, and risks across these options, a consideration CK Asset Holdings itself acknowledges by participating in the REIT market.

While infrastructure and utilities are generally less susceptible to substitutes due to their essential nature, evolving public transportation and digital infrastructure present indirect threats. Significant investments in public transit, such as the ongoing expansion of London's Elizabeth Line and new metro projects in Asia during 2024, could divert users from toll roads. Similarly, the growth of digital infrastructure, with global spending on smart home devices projected to exceed $150 billion by 2024, highlights a consumer shift towards tech-integrated living, potentially impacting CK Asset Holdings' developments if they lag in incorporating such features.

| Asset Class | Substitute | 2024 Trend Impact | CK Asset Holdings Relevance |

|---|---|---|---|

| Residential Property | Renting, Build-to-Rent (BTR) | Affordability challenges made renting more attractive; BTR sector growth increased competition. | Directly impacts demand for new home sales and rental income from owned properties. |

| Commercial Property (Office) | Co-working, Flexible Office Solutions | Hybrid work models persisted, reducing demand for traditional long-term leases. | Affects occupancy rates and rental yields for office portfolios. |

| Investment in Property Development | REITs, Equities, Bonds | Investors diversify across asset classes based on risk-return profiles. | CK Asset Holdings competes for investor capital against these alternatives. |

| Infrastructure (Toll Roads) | Public Transportation | Increased investment in public transit globally in 2024. | Potential reduction in toll road usage and revenue. |

| Property Development (Consumer Preference) | Smart Home Technology, Sustainable Features | Smart home market spending projected over $150 billion globally by 2024. | Demand may shift to competitors offering more integrated, modern living experiences. |

Entrants Threaten

The real estate development and infrastructure sectors demand enormous capital outlays, acting as a formidable barrier for nascent competitors. For instance, in 2023, global infrastructure spending was projected to reach trillions, highlighting the sheer scale of investment required.

CK Asset Holdings' extensive property portfolio and its continuous engagement in massive development projects underscore the substantial financial muscle necessary to vie for market share. The ability to secure significant financing for these large-scale ventures remains a crucial obstacle for potential entrants.

The property and infrastructure sectors, especially in Hong Kong and Mainland China where CK Asset Holdings operates, face significant regulatory complexity. Newcomers must contend with intricate zoning laws, environmental impact assessments, and the lengthy process of obtaining construction permits. For instance, in 2023, the average time to secure major development approvals in Hong Kong could extend over several years, a substantial deterrent for unseasoned companies.

CK Asset Holdings benefits from a deeply ingrained brand reputation and trust, cultivated over decades of delivering high-quality, often iconic, real estate developments. This established presence means customers already have confidence in their projects, making them a preferred choice. For instance, in 2023, CK Asset Holdings continued to secure prime land parcels and advance its development pipeline, reinforcing its visible commitment to the market.

Newcomers face a substantial hurdle in replicating this level of credibility and recognition. Building a comparable brand loyalty and trust would necessitate significant, sustained investment in marketing, project quality, and customer service over many years. This makes it difficult for new players to quickly gain traction and market share against such a well-regarded incumbent.

Access to Land and Strategic Locations

Securing prime land parcels in desirable urban centers, particularly in markets like Hong Kong, presents a significant hurdle for potential new entrants. The scarcity of available land, coupled with escalating acquisition costs, makes entry financially prohibitive for many. For instance, Hong Kong's land supply remains constrained, with the government releasing limited sites annually. In 2023, the government sold land parcels fetching billions of Hong Kong dollars, underscoring the high entry cost.

Established developers like CK Asset Holdings often possess a distinct advantage due to their long-standing relationships with landowners and a proven history of successful land acquisition. This established network and reputation can make it exceptionally difficult for newcomers to gain access to the most strategic and sought-after locations. The ability to secure these critical resources acts as a substantial barrier, limiting the threat of new entrants.

- High Land Acquisition Costs: In 2023, prime residential land in Hong Kong averaged over HK$20,000 per square foot, creating a substantial capital requirement for new players.

- Limited Prime Land Availability: The scarcity of developable land in core urban areas restricts opportunities for new entrants to establish a significant presence.

- Established Developer Advantages: Existing relationships and a strong track record provide incumbents with preferential access to land deals and financing.

Economies of Scale and Diversification

CK Asset Holdings benefits significantly from economies of scale across its operations. This includes advantages in construction, where larger projects allow for bulk purchasing of materials and more efficient labor utilization. Similarly, its procurement of supplies and services for its diverse property portfolio, spanning residential, commercial, and infrastructure, results in lower per-unit costs. For instance, in 2023, CK Asset Holdings reported a substantial revenue of HKD 86.3 billion, underscoring its vast operational scale.

The company's diversified portfolio acts as a crucial buffer against market volatility and enhances its competitive standing. By generating recurring income from a wide array of assets, CK Asset Holdings possesses a stable financial foundation. This diversification, coupled with its extensive scale, makes it difficult for new entrants to match its cost-efficiency and risk management capabilities. A new competitor would struggle to achieve the same level of operational leverage and financial resilience without a similarly broad and established asset base.

- Economies of Scale: CK Asset Holdings leverages its size for cost advantages in construction, procurement, and property management.

- Diversification Benefits: A broad base of recurring income from various assets provides financial stability and competitive strength.

- Barriers to Entry: New entrants face significant hurdles in matching CK Asset Holdings' cost-efficiency and risk mitigation due to the lack of comparable scale and diversification.

The threat of new entrants for CK Asset Holdings is generally low, primarily due to the substantial capital requirements and regulatory hurdles inherent in the real estate and infrastructure sectors. The sheer scale of investment needed for land acquisition and development, coupled with complex approval processes, creates significant barriers. For instance, in 2023, the average cost of acquiring prime development land in major Asian cities often ran into hundreds of millions, if not billions, of dollars, a sum few new entities can readily access.

Furthermore, CK Asset Holdings benefits from strong brand recognition and established relationships, which are difficult for newcomers to replicate. Decades of successful project delivery have built trust and a loyal customer base. For example, in 2023, CK Asset Holdings continued to secure high-profile projects and maintain strong sales figures, demonstrating its enduring market appeal.

Economies of scale and diversification also play a crucial role in deterring new competition. CK Asset Holdings' ability to leverage its size for cost efficiencies in procurement and construction, along with its broad income streams from various property types, provides a robust financial buffer. This makes it challenging for smaller, less diversified entrants to compete on cost or weather market downturns effectively.

| Factor | Impact on New Entrants | CK Asset Holdings' Advantage |

|---|---|---|

| Capital Requirements | Very High | Substantial financial reserves and access to credit |

| Regulatory Complexity | High | Established expertise in navigating permits and compliance |

| Brand Reputation | Difficult to Build | Decades of proven track record and customer trust |

| Economies of Scale | Challenging to Achieve | Lower per-unit costs due to large-scale operations |

| Land Acquisition | Costly and Competitive | Strong relationships and prior access to prime sites |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CK Asset Holdings is built upon a foundation of credible data, including the company's annual reports, filings with regulatory bodies like the SEC, and industry-specific research from reputable sources such as IBISWorld and Statista.

We supplement this with insights from financial databases like S&P Capital IQ and macroeconomic indicators to provide a comprehensive understanding of the competitive landscape.