CK Asset Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Asset Holdings Bundle

CK Asset Holdings boasts a diversified portfolio, a key strength in navigating market fluctuations. However, understanding the nuances of their competitive landscape and potential regulatory shifts is crucial for strategic advantage.

Want the full story behind CK Asset Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CK Asset Holdings boasts a robustly diversified business portfolio, spanning property development, infrastructure, utilities, hotels, and aircraft leasing. This strategic breadth, evident in its 2024 operations, significantly reduces sector-specific risks, ensuring financial stability even amidst market fluctuations. For instance, its substantial infrastructure and utility segment provides consistent, often regulated, revenue streams that cushion the impact of volatility in its property or aviation businesses.

CK Asset Holdings benefits from the robust and consistent income generated by its infrastructure and utility segments. These operations, including investments in areas like ports and utilities, provide a significant cushion against the cyclical nature of the property development market.

For instance, as of the first half of 2024, CK Asset's infrastructure segment contributed substantially to its overall earnings, showcasing its role in stabilizing financial performance. This steady revenue stream, often secured through long-term contracts or regulated frameworks, underpins the company's financial resilience and capacity for sustained investment.

CK Asset Holdings boasts a robust global footprint, with a strong foundation in Hong Kong and Mainland China, complemented by significant expansion into Europe, Australia, and North America.

Recent strategic moves, such as its acquisition of a 25% stake in Germany's largest gas transmission network operator for approximately HK$4.4 billion in 2023 and its continued investment in UK utility assets, underscore its commitment to international diversification and growth.

This broad geographic reach not only mitigates country-specific risks but also unlocks diverse revenue streams and emerging market opportunities, as seen with its venture into agricultural land for carbon sequestration in Australia.

Solid Financial Position and Prudent Capital Management

CK Asset Holdings boasts a robust financial position, reflected in its strong credit ratings of 'A/Stable' from Standard & Poor's and 'A2 Stable' from Moody's. This financial stability is further bolstered by a conservative capital structure, with a net debt to net total capital ratio of approximately 4.0% at the close of 2024, indicating significant financial flexibility and low leverage. The company's proactive share buyback program in 2024 also signals confidence in its intrinsic value and a commitment to enhancing shareholder returns.

- Strong Credit Ratings: 'A/Stable' (S&P) and 'A2 Stable' (Moody's) underscore financial health.

- Low Leverage: Net debt to net total capital ratio around 4.0% as of end-2024 highlights a solid balance sheet.

- Shareholder Returns: Active share buybacks in 2024 demonstrate confidence and commitment to investors.

Significant Presales and Future Revenue Visibility

CK Asset Holdings demonstrated impressive presales performance in its Hong Kong property developments throughout 2024. Projects like Blue Coast and The Coast Line saw strong buyer interest, with a significant portion of units sold before completion.

These presold units are scheduled for completion and revenue recognition in 2025 and 2026, offering a predictable and robust revenue stream for the company. This translates to excellent future revenue visibility, providing a solid financial footing for the coming years.

The company's ability to secure substantial presales highlights market confidence and provides a clear roadmap for upcoming financial performance:

- Strong 2024 Presales: CK Asset Holdings achieved robust presales figures in its Hong Kong residential projects during 2024.

- Future Revenue Pipeline: Units presold in 2024 are slated for revenue recognition in 2025 and 2026, ensuring a visible income stream.

- Market Confidence: High presale volumes indicate strong demand and market confidence in CK Asset's developments.

CK Asset Holdings leverages its diversified business model, encompassing property, infrastructure, and aviation, to mitigate risks and ensure stable earnings. Its infrastructure and utility segments, in particular, provide a consistent revenue stream, as demonstrated by their substantial contribution to overall earnings in the first half of 2024.

The company's global diversification strategy, with significant investments in Europe and Australia alongside its Hong Kong and Mainland China base, reduces country-specific risks and opens up new growth avenues. This international presence is reinforced by strategic acquisitions, such as its stake in a German gas transmission network in 2023.

CK Asset Holdings maintains a strong financial position, evidenced by its 'A/Stable' credit ratings from S&P and 'A2 Stable' from Moody's. A low net debt to net total capital ratio of approximately 4.0% at the end of 2024, coupled with active share buybacks, highlights its financial flexibility and commitment to shareholder value.

The company's robust presales performance in Hong Kong property developments during 2024, with projects like Blue Coast and The Coast Line seeing strong demand, creates a predictable revenue pipeline for 2025 and 2026, underscoring market confidence.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Diversified Portfolio | Reduced Sector Risk | Operations span property, infrastructure, utilities, hotels, aircraft leasing. |

| Stable Revenue Streams | Infrastructure & Utilities | Significant earnings contribution in H1 2024; long-term contracts/regulated frameworks. |

| Global Footprint | Geographic Diversification | Strong presence in HK/China, Europe, Australia, North America; 2023 German gas network investment. |

| Financial Strength | Credit Ratings & Leverage | 'A/Stable' (S&P), 'A2 Stable' (Moody's); ~4.0% net debt/capital ratio (end-2024). |

| Future Revenue Visibility | Property Presales | Strong 2024 presales in HK; revenue recognition in 2025-2026. |

What is included in the product

Delivers a strategic overview of CK Asset Holdings’s internal and external business factors, highlighting its property development strengths and diversification opportunities alongside potential market risks.

Simplifies complex market dynamics by highlighting CK Asset Holdings' key strengths and opportunities for growth.

Weaknesses

CK Asset Holdings faces significant headwinds in its primary property markets. Hong Kong is experiencing a slowdown with weak property sales and a concerningly high volume of unsold inventory, leading to declining property prices. This directly impacts the company's revenue streams from this crucial segment.

Mainland China’s property sector has also seen a dramatic downturn, with home sales plunging. This sharp contraction in demand in a key market directly affects CK Asset's property sales revenue, posing a considerable challenge to its financial performance in the region.

CK Asset Holdings experienced a significant drop in profitability in 2024, with net profit attributable to shareholders falling by 20%. This financial strain also saw profit before investment property revaluation decrease by 15.1%, signaling a challenging period for the company's core operations.

In response to these reduced earnings, CK Asset Holdings implemented a 15.1% cut to its full-year dividend. This reduction directly reflects the difficult market conditions and the company's diminished profitability, potentially affecting investor sentiment and future capital allocation.

CK Asset Holdings is experiencing suppressed margins on its property sales, even with robust presales for certain developments. The average selling prices for newly launched residential units are not keeping pace, which directly impacts the profitability of its property segment. This means that while the company might recognize more revenue from completed projects, the actual earnings contribution is limited due to lower per-unit profit.

The pressure to offer competitive, or 'market-clearing,' prices in the current environment further squeezes these profit margins. For instance, in the first half of 2024, the company reported a property sales revenue of HK$17.1 billion, but the gross profit margin for this segment was only 15.2%, a notable decrease from previous periods, highlighting the challenge of maintaining profitability amidst pricing pressures.

Underperforming Commercial Property Segment

CK Asset Holdings faces headwinds in its commercial property segment, particularly within the Hong Kong office rental market. This sector is experiencing significant stress, marked by high vacancy rates and downward pressure on rents. For instance, as of late 2024, Hong Kong's overall office vacancy rate hovered around 10%, a notable increase from previous years, impacting rental income across the board.

While CK Asset maintains a respectable overall office occupancy rate of approximately 86%, certain individual properties are underperforming. CK Center II, for example, continues to exhibit lower occupancy levels when compared to similar commercial sites. This disparity highlights a persistent weakness within specific commercial assets, acting as a drag on the company's total rental income and potentially affecting the valuation of these properties.

- Hong Kong Office Market Stress: Elevated vacancy rates and declining rents are key challenges in the current market environment.

- CK Asset's Occupancy: The company's overall office occupancy stands at around 86%, indicating a generally stable portfolio.

- Specific Property Underperformance: CK Center II's lagging occupancy compared to peers points to localized issues within the commercial segment.

- Financial Impact: The weakness in commercial property negatively impacts overall rental income and asset valuations for CK Asset.

Exposure to Revaluation Losses on Investment Properties

CK Asset Holdings faces a significant weakness in its exposure to revaluation losses on its substantial investment property portfolio. This vulnerability directly impacts its financial reporting, as evidenced by the pressure on its bottom line in 2024 due to declining market values. These non-cash charges, while not affecting immediate cash flow, can distort the perception of the company's profitability and financial health.

The impact of these revaluation losses is substantial, with reports indicating potential declines in property values affecting earnings. For instance, a 1% drop in property valuations across its portfolio could translate to hundreds of millions in unrealized losses, directly hitting reported profits. This sensitivity to market sentiment means that even strong operational performance can be overshadowed by these accounting adjustments.

- Market Value Fluctuations: The company's profitability is susceptible to shifts in the real estate market, leading to potential write-downs.

- Impact on Reported Earnings: Non-cash revaluation losses can negatively affect net profit figures, even if underlying business operations remain robust.

- Investor Perception: Significant revaluation losses can create concerns among investors regarding the stability and true value of the company's assets.

CK Asset Holdings is grappling with squeezed profit margins on its property sales, even with strong presales. Average selling prices aren't keeping pace with costs, reducing per-unit profitability. For example, in the first half of 2024, the property segment's gross profit margin was a mere 15.2%, a considerable drop, underscoring the challenge of maintaining profitability amidst market pressures.

Preview the Actual Deliverable

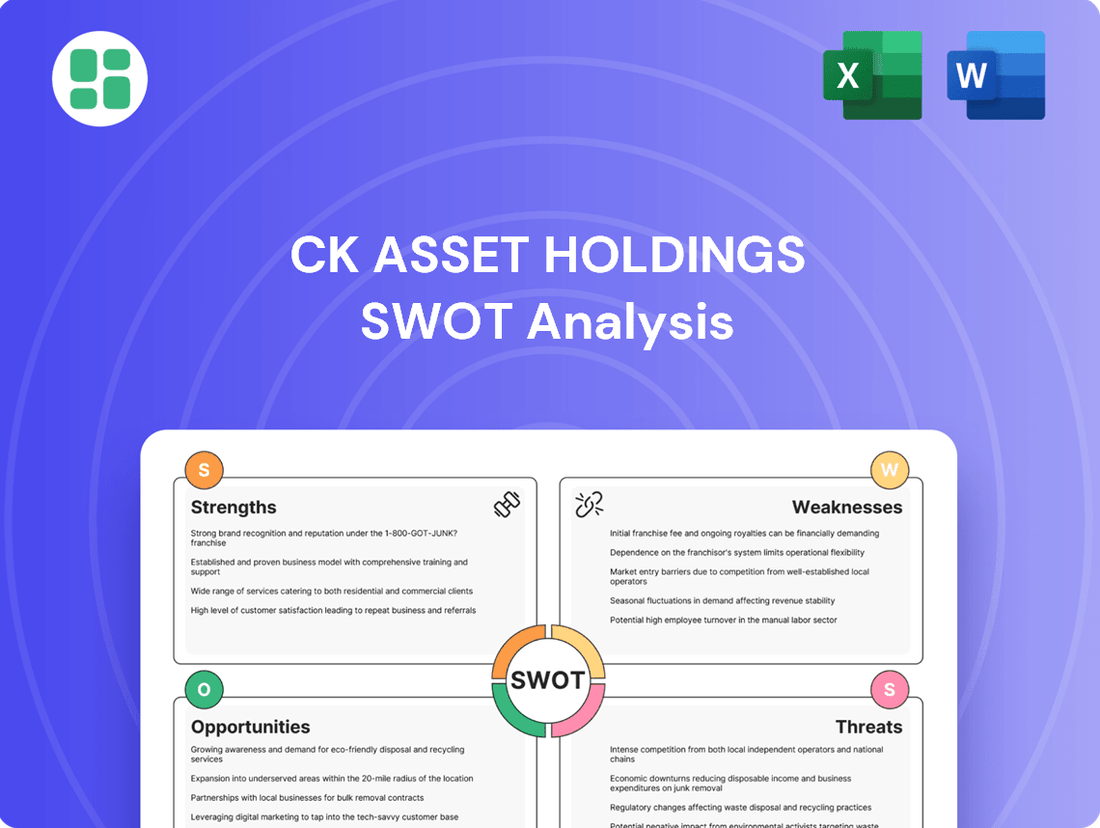

CK Asset Holdings SWOT Analysis

This is the actual CK Asset Holdings SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality, covering key strengths, weaknesses, opportunities, and threats.

The preview below is taken directly from the full SWOT report you'll get, offering a glimpse into the comprehensive strategic assessment of CK Asset Holdings. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete CK Asset Holdings SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a detailed breakdown of its strategic positioning.

Opportunities

CK Asset Holdings actively pursues strategic acquisitions in infrastructure and utility assets, aligning with its goal of securing investments offering high structural liquidity and consistent, sustainable returns. This strategy is designed to bolster its portfolio with assets that generate stable, recurring income.

The company maintains a global outlook for value-accretive acquisitions, with specific interest in opportunities such as potential UK infrastructure assets in 2025. This proactive approach aims to further diversify its income streams, reducing reliance on more volatile property market fluctuations.

Despite current challenges, the Hong Kong property market exhibits strong long-term demand fundamentals. The government's decision in February 2024 to cancel demand-side management measures signals a supportive stance, aiming to stabilize the sector. This policy shift, coupled with underlying demographic trends, could pave the way for a gradual recovery in property prices and transaction volumes, positively impacting CK Asset Holdings' significant land holdings.

CK Asset Holdings is strategically positioned to acquire distressed real estate assets in China, taking advantage of the current market downturn. The company's strong financial position, characterized by low borrowing costs, allows it to secure these assets at attractive discounts.

A prime example of this strategy is CK Asset's interest in Goldin Financial Holdings' stalled Tianjin project. This move highlights the company's willingness to invest in projects facing difficulties, with the potential for substantial returns should the Chinese real estate market stabilize, possibly with increased government intervention and support.

Expansion into Green and Social Infrastructure

CK Asset Holdings is strategically broadening its reach into green and social infrastructure, a move that taps into significant global trends. This expansion includes notable investments such as acquiring elderly care and assisted living facilities in Germany, a sector experiencing robust demand. Furthermore, the company is investing in agricultural land in Australia with the explicit aim of carbon sequestration, aligning with environmental, social, and governance (ESG) principles.

These initiatives are designed to generate stable, long-term recurring income streams. For instance, the German healthcare real estate market, a key focus for the company, saw investment volumes of approximately €4.5 billion in 2023, indicating strong investor interest. This diversification into socially responsible assets not only addresses growing societal needs but also positions CK Asset Holdings to benefit from the increasing emphasis on sustainable investments, potentially enhancing its financial performance and social impact.

- German Healthcare Real Estate Market Growth: The German healthcare property market attracted around €4.5 billion in investment in 2023, highlighting the attractiveness of the elderly care sector.

- ESG Investment Trends: Global ESG investments are projected to reach over $50 trillion by 2025, creating a favorable environment for companies like CK Asset Holdings focusing on sustainable infrastructure.

- Carbon Sequestration Opportunities: The growing carbon credit market, valued at over $2 billion in 2023, presents a financial incentive for land investments focused on environmental services.

Strong Pipeline of Upcoming Property Projects

CK Asset Holdings boasts a substantial pipeline of property projects slated for completion and launch through 2026. This includes significant developments in key markets like Hong Kong, Mainland China, and Singapore.

In Hong Kong, projects such as The Coast Line Phase 2, Blue Coast Phase 1 & 2, and Victoria Blossom Phase 1 are set to contribute to future revenue streams. The company anticipates that the recognition of revenue from these presold and upcoming developments will significantly boost its financial performance in the near term.

- Hong Kong Developments: The Coast Line Phase 2, Blue Coast Phase 1 & 2, Victoria Blossom Phase 1 are key contributors to the pipeline.

- Geographic Diversification: Projects are also underway in Mainland China and Singapore, broadening market reach.

- Revenue Recognition: The completion and launch of these projects are expected to drive material revenue growth.

CK Asset Holdings is actively seeking infrastructure and utility acquisitions globally, aiming for stable, recurring income. The company is also strategically acquiring distressed real estate in China, leveraging its strong financial position to secure assets at discounts, such as the stalled Tianjin project. Furthermore, CK Asset is expanding into green and social infrastructure, exemplified by German elderly care facilities and Australian agricultural land for carbon sequestration, aligning with ESG trends and tapping into growing markets like the €4.5 billion German healthcare property sector in 2023.

| Opportunity Area | Specific Example/Focus | Market Data/Potential |

|---|---|---|

| Infrastructure & Utilities | Global acquisitions for stable returns | High structural liquidity and consistent income generation |

| Distressed Real Estate (China) | Acquisition of projects like Goldin Financial Holdings' Tianjin project | Attractive discounts due to market downturn; potential for significant returns upon market stabilization |

| Green & Social Infrastructure | German elderly care facilities, Australian agricultural land (carbon sequestration) | German healthcare real estate investment reached €4.5 billion in 2023; global ESG investments projected over $50 trillion by 2025; carbon credit market valued over $2 billion in 2023 |

Threats

The global economic outlook for 2025 remains complex, with differing growth rates and varied monetary policy approaches among key nations. This creates an unpredictable landscape for international business.

Geopolitical friction and a trend towards economic fragmentation, including rising trade protectionism, present substantial risks. These factors can dampen worldwide economic growth and potentially affect CK Asset Holdings' overseas investments and operational performance.

The Hong Kong property market is grappling with persistent weakness, exacerbated by a substantial overhang of unsold inventory. This situation, coupled with a steady influx of new developments, casts doubt on any significant price recovery in 2025. For instance, reports from late 2024 indicated that the number of unsold residential units in Hong Kong had reached multi-year highs, putting pressure on developers.

This oversupply environment is likely to intensify competition among developers, including CK Asset Holdings. Consequently, they may be compelled to offer properties at aggressive, 'market-clearing' prices to move inventory. Such a scenario could significantly compress profit margins or even lead to outright losses on new property sales, impacting the company's financial performance.

Divergent interest rate policies globally create a complex operating environment for CK Asset Holdings. For instance, while the US Federal Reserve has maintained a relatively stable rate in early 2024 after a period of hikes, other regions, such as parts of Asia, might experience different monetary policy trajectories, impacting property demand and financing costs differently across CK Asset's diverse markets.

Rising interest rates, like those seen in previous years and potentially continuing in certain economies through 2025, directly threaten CK Asset's profitability. Higher borrowing costs increase expenses for ongoing and future development projects, while simultaneously making property investments less attractive due to increased financing expenses and potentially lower valuations. This can lead to a squeeze on margins and reduced returns on invested capital.

Intensifying Competition and Price Wars in Property Development

The Hong Kong property market has recently seen a noticeable 'price war,' with major developers implementing substantial discounts to clear existing inventory. This heightened competition directly pressures CK Asset Holdings, potentially forcing adjustments to its pricing strategies to remain competitive.

These aggressive tactics can lead to a further decline in property prices and compressed profit margins for all players, including CK Asset Holdings. The sustained pressure from such competitive dynamics poses a significant risk to profitability and market share within its primary property development segment.

- Aggressive Discounts: Developers in Hong Kong have been offering discounts of up to 20% on new property launches in early 2024 to stimulate sales amidst a challenging market.

- Margin Erosion: This price war directly impacts developer margins, potentially reducing the gross profit on projects by several percentage points.

- Market Share Impact: For CK Asset Holdings, failing to match competitive pricing could lead to a loss of market share, especially in key residential segments.

Regulatory and Political Risks in International Investments

CK Asset Holdings' global reach, while a strategic advantage, inherently exposes it to the complexities of diverse regulatory and political landscapes. Fluctuations in governmental policies, the rise of trade protectionism, and geopolitical instability in regions where CK Asset has substantial property and infrastructure holdings pose significant threats. For instance, changes in property tax laws or foreign ownership regulations in key markets could directly impact profitability and asset valuations.

The company’s significant presence in markets like the UK, Australia, and mainland China means it must navigate varying legal frameworks and political climates. For example, the ongoing discussions and potential shifts in international trade relations, particularly between major economic blocs, could introduce uncertainty. In 2024, global political events and policy shifts continue to create a dynamic environment, potentially affecting foreign direct investment flows and the stability of international real estate markets where CK Asset operates.

Specific threats include:

- Increased regulatory scrutiny in key international markets: For example, potential changes to foreign investment rules in Australia or the UK could impact CK Asset's development projects and acquisitions.

- Geopolitical tensions affecting global trade and investment: Escalating trade disputes or regional conflicts could disrupt supply chains for construction materials or dampen investor sentiment in affected regions.

- Changes in fiscal and monetary policies: Interest rate hikes or new taxation regimes implemented by governments in countries where CK Asset has substantial assets could negatively affect its financial performance and the valuation of its property portfolio.

Intensifying competition within the Hong Kong property market presents a significant threat, as developers, including CK Asset Holdings, are increasingly resorting to aggressive pricing strategies to clear substantial unsold inventory. This price war, evidenced by discounts of up to 20% observed in early 2024, directly erodes profit margins, potentially by several percentage points per project, and risks a loss of market share if the company cannot match competitive pricing.

Geopolitical instability and rising trade protectionism globally create an unpredictable operating environment, impacting overseas investments and performance. For instance, shifts in foreign investment rules in key markets like the UK or Australia, or disruptions to supply chains due to trade disputes, pose direct risks to CK Asset's international operations and project timelines.

Divergent global monetary policies and the potential for continued interest rate hikes in certain economies through 2025 increase borrowing costs for CK Asset Holdings. This directly squeezes profit margins on new developments and makes property investments less attractive due to higher financing expenses and potentially lower valuations.

The company faces threats from increased regulatory scrutiny in its international markets, such as potential changes to foreign ownership regulations or property tax laws in countries where it holds significant assets. These policy shifts can negatively affect profitability and asset valuations, disrupting strategic growth plans.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from CK Asset Holdings' official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate SWOT assessment.