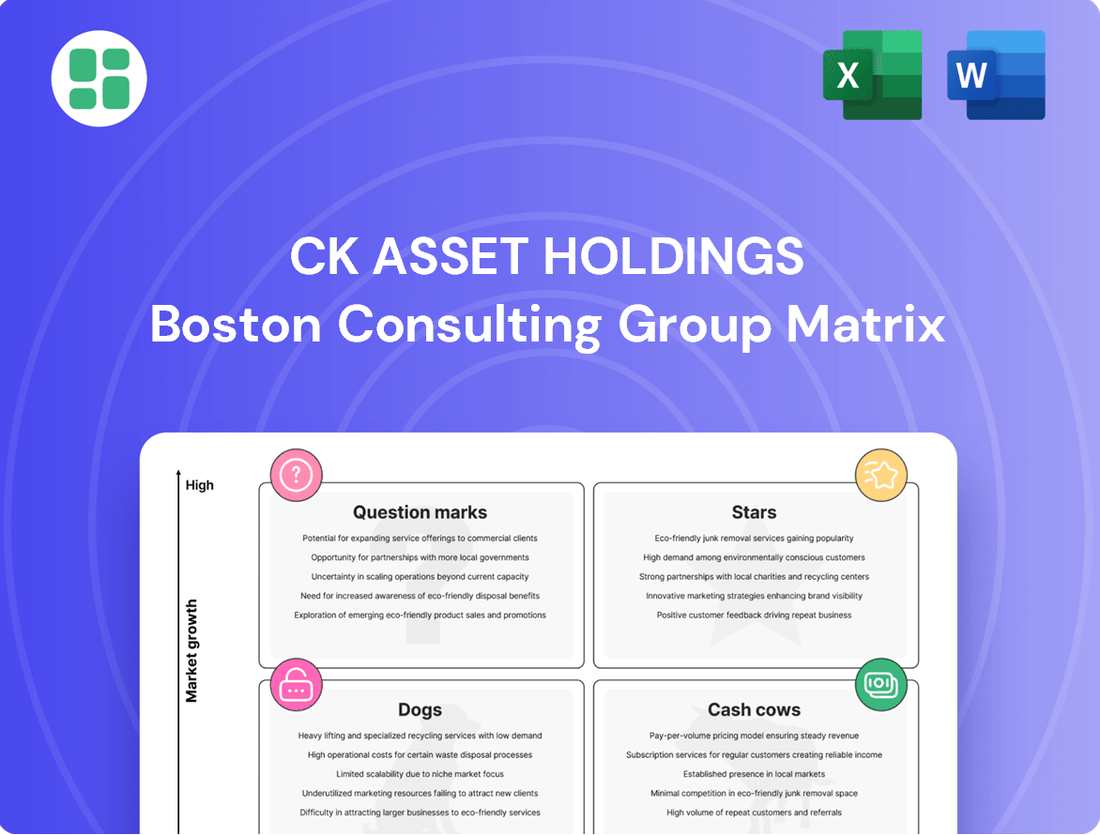

CK Asset Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Asset Holdings Bundle

Unlock the strategic potential of CK Asset Holdings with our comprehensive BCG Matrix analysis. Discover which of their diverse business units are poised for growth (Stars), generating consistent profits (Cash Cows), lagging behind (Dogs), or require careful consideration (Question Marks). Don't miss out on critical insights that can shape your investment decisions.

This preview offers a glimpse into the strategic positioning of CK Asset Holdings. For a complete, actionable understanding of their portfolio, including detailed quadrant placements and data-driven recommendations, purchase the full BCG Matrix report. It's your roadmap to identifying opportunities and mitigating risks.

Stars

CK Asset Holdings is strategically building a robust global infrastructure and utility portfolio. Their investments span essential services and social infrastructure in key markets like the UK, Germany, and Australia. For instance, they've invested in elderly care facilities in Germany and agricultural land in Australia aimed at carbon sequestration.

These infrastructure and utility assets are crucial for CK Asset Holdings' future growth. They offer stable, recurring income streams, often from regulated or contracted operations. This focus on predictable revenue makes them a significant component of the company's long-term strategy and profitability outlook.

CK Asset Holdings' strategic international property development, particularly in Singapore with projects like Perfect Ten which sold out in 2024, showcases resilience despite Hong Kong and Mainland China market headwinds. These ventures are key growth drivers, capitalizing on robust overseas demand and favorable conditions to bolster future revenue.

CK Asset Holdings' acquisition of Civitas Social Housing PLC in the UK marks a significant move into social infrastructure, specifically social care housing. This strategic acquisition positions these assets as a 'Star' within the company's BCG Matrix, reflecting their high growth potential and stable income generation.

The appeal of social housing lies in its long-term leases and rental income often adjusted for inflation, providing a predictable and growing revenue stream. This aligns perfectly with CK Asset Holdings' objective to broaden its base of recurring income, a key strategy for portfolio stability and growth.

As of early 2024, the UK social housing sector continues to demonstrate resilience, supported by government initiatives and an aging population, which drives demand for specialized housing solutions. This sustained demand underpins the 'Star' classification for these investments, suggesting they will be significant contributors to future earnings.

Future Property Launches in Resilient Markets

CK Asset Holdings is strategically positioning itself with five new property launches planned for 2025, targeting resilient markets in Hong Kong and beyond. This proactive approach aims to capitalize on sustained demand, even amidst broader market softness.

The company's confidence is bolstered by the strong performance of recent projects, such as the pre-sales success of Blue Coast and Blue Coast II in Wong Chuk Hang. This demonstrates a clear appetite for well-situated, quality developments.

- Project Pipeline: Five new property developments slated for launch in 2025.

- Geographic Focus: Key markets include Hong Kong, with potential expansion to other regions.

- Market Validation: Successful pre-sales of Blue Coast and Blue Coast II indicate robust demand for prime locations.

- Growth Potential: These upcoming launches are anticipated to become significant contributors to CK Asset's revenue streams.

Diversified Global Investment Strategy

CK Asset Holdings pursues a diversified global investment strategy, focusing on assets with strong liquidity and consistent returns across various sectors and regions. This approach allows the company to identify and nurture new, successful ventures, effectively positioning them as Stars in its portfolio. The company actively seeks to grow its recurring income streams beyond traditional real estate, targeting markets with significant growth potential and opportunities for market leadership.

- Global Diversification: CK Asset Holdings' strategy spans multiple continents, reducing reliance on any single market.

- Liquidity and Returns: The focus is on investments that offer both immediate cash flow and long-term capital appreciation.

- Recurring Income Growth: A key objective is expanding the base of stable, predictable income sources.

- Market Leadership: The company aims to invest in segments where it can achieve or maintain a dominant market position.

CK Asset Holdings' social housing investments, particularly the acquisition of Civitas Social Housing PLC in the UK, are classified as Stars in its BCG Matrix. These assets exhibit high growth potential due to sustained demand driven by government initiatives and an aging population. The long-term leases, often inflation-adjusted, provide predictable and growing recurring income streams, aligning with the company's strategy for portfolio stability.

The UK social housing sector's resilience, as observed in early 2024, further solidifies this Star classification. This segment is expected to be a significant contributor to CK Asset Holdings' future earnings, reflecting its strong market position and growth prospects.

| Asset Class | BCG Category | Key Growth Drivers | Income Stability | 2024/2025 Outlook |

|---|---|---|---|---|

| UK Social Housing | Star | Government initiatives, aging population, long-term leases | High (inflation-adjusted) | Continued resilience and growth |

| Singapore Property Development | Star | Robust overseas demand, prime locations | Moderate (project-driven) | Strong pipeline with 2025 launches |

What is included in the product

CK Asset Holdings' BCG Matrix offers a tailored analysis of its diverse property and infrastructure portfolio, guiding strategic investment decisions.

CK Asset Holdings BCG Matrix: Visualize portfolio health and strategically allocate resources.

CK Asset Holdings BCG Matrix: Identify growth opportunities and divest underperforming assets.

Cash Cows

CK Asset Holdings' Hong Kong investment properties, primarily comprising office and retail spaces, are a prime example of a Cash Cow. These assets offer a significant and dependable stream of recurring rental income, underpinning the company's financial stability. For instance, as of the first half of 2024, the company reported a robust occupancy rate for its overall office portfolio, hovering around 86%, demonstrating consistent demand and rental generation.

While the Hong Kong market for retail and office spaces has faced certain headwinds, CK Asset's well-established properties, particularly those with high occupancy, continue to be strong cash generators. This consistent performance in a mature market, characterized by a substantial market share, solidifies their position as a reliable Cash Cow for CK Asset Holdings.

CK Asset Holdings' Mainland China investment properties are a prime example of a Cash Cow. These established assets generate consistent rental income, a testament to their high market share in a mature property market.

The company benefits from strong cash flow from these properties, requiring minimal promotional investment. This steady income stream is crucial for funding other business segments. For instance, in 2023, CK Asset reported rental income from its Mainland China portfolio contributing significantly to its overall earnings, demonstrating its Cash Cow status.

CK Asset Holdings' established infrastructure and utility operations, particularly in regulated sectors like energy and water, are classic Cash Cows. These assets, with their stable and predictable recurring income streams, benefit from high market share in mature, low-growth markets.

For instance, CK Infrastructure Holdings, a significant part of CK Asset's portfolio, reported a substantial contribution to group revenue. In 2023, CK Infrastructure's diverse portfolio of infrastructure and utility assets, spanning energy, water, and transportation, continued to demonstrate resilience, generating consistent cash flows that underpin the group's financial strength.

Property and Project Management Services

CK Asset Holdings' property and project management services division functions as a classic Cash Cow within its BCG Matrix. This segment, primarily focused on Hong Kong and Mainland China, manages an extensive portfolio encompassing approximately 254 million square feet as of 2024.

The division consistently generates reliable management fees and contributions to the company's overall performance. Its operations are situated in mature markets where established relationships and a significant market share are key advantages. This maturity means that the need for substantial new investment is minimal, primarily requiring only upkeep for existing assets, which solidifies its position as a steady source of cash.

- Managed Portfolio Size: Approximately 254 million sq.ft. in 2024, primarily in Hong Kong and Mainland China.

- Revenue Generation: Consistent management fees and contributions from a vast property portfolio.

- Market Position: Operates in mature markets with high market share and established client relationships.

- Investment Needs: Requires relatively low new investment, mainly for maintenance, ensuring strong cash flow.

Hotel and Serviced Suite Operations

CK Asset Holdings' hotel and serviced suite operations, especially those in Hong Kong, have demonstrated robust performance. This segment has seen a notable increase in revenue and its overall contribution to the company's financials. A key driver for this growth is the resurgence of inbound tourism, coupled with the company's strategic approach to managing its property portfolio effectively.

These established operations are a prime example of a 'Cash Cow' within CK Asset Holdings' portfolio. They consistently generate a stable, recurring income stream, a characteristic of mature hospitality markets. Despite potential market fluctuations, these properties maintain high occupancy rates, underscoring their reliable revenue-generating capacity through efficient management and ongoing optimization efforts.

- Revenue Growth: The hotel and serviced suite segment has experienced increased revenue, benefiting from a strong recovery in tourism.

- High Occupancy: Established properties consistently achieve high occupancy rates, ensuring a steady income flow.

- Stable Income Stream: These operations provide a reliable and recurring source of cash, characteristic of a mature market.

- Portfolio Optimization: Strategic management and optimization of the hotel and serviced suite portfolio contribute to their 'Cash Cow' status.

CK Asset Holdings' portfolio of mature retail properties, particularly those in prime Hong Kong locations, represents a significant Cash Cow. These established assets benefit from consistent foot traffic and rental demand, translating into a reliable income stream. The company's strategic management ensures high occupancy, even amidst evolving retail landscapes.

These retail assets, characterized by their prime locations and established tenant bases, require minimal reinvestment beyond routine maintenance. This allows them to generate substantial free cash flow, which is vital for funding growth initiatives in other business segments. For example, CK Asset's prime retail holdings continued to deliver steady rental income throughout 2023, contributing positively to the group's overall financial performance.

| Asset Class | Market Position | Cash Flow Generation | Investment Needs |

| Hong Kong Retail Properties | Prime locations, high foot traffic, established tenants | Stable and recurring rental income | Low, primarily maintenance |

| Hong Kong Office Properties | High occupancy (approx. 86% in H1 2024), consistent demand | Dependable recurring rental income | Low, focused on upkeep |

| Mainland China Investment Properties | High market share in mature markets | Consistent rental income, strong cash flow | Minimal promotional investment |

| Infrastructure & Utilities | Regulated sectors, stable demand, high market share | Predictable recurring income streams | Low, focused on operational efficiency |

| Property & Project Management | 254 million sq.ft. managed (2024), mature markets | Reliable management fees | Low, mainly for maintenance |

| Hotels & Serviced Suites | High occupancy, strong tourism recovery | Stable, recurring income stream | Low, portfolio optimization |

Preview = Final Product

CK Asset Holdings BCG Matrix

The CK Asset Holdings BCG Matrix you are currently previewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, contains no watermarks or demo content, ensuring you get a professional and actionable strategic tool. You can confidently use this preview as a direct representation of the final document, ready for immediate integration into your business planning and decision-making processes.

Dogs

CK Asset Holdings' aircraft leasing segment was classified as a 'Dog' in its BCG Matrix analysis, reflecting its challenging market position. The company strategically exited this business in late 2021, divesting it for a substantial $4.28 billion.

This decision stemmed from the sector's heightened risk and unpredictable return profiles, significantly impacted by the COVID-19 pandemic. Such a divestiture aligns with the 'Dog' quadrant's characteristics: low market growth and potential competitive disadvantages, making it a logical move to reallocate capital to more promising ventures.

CK Asset Holdings' commercial office spaces in Hong Kong, particularly those experiencing high vacancies and declining rental income, would likely be classified as Dogs in a BCG Matrix. The Hong Kong office market in 2024 saw vacancy rates hovering around 17%, a significant indicator of oversupply and weakened demand, with rental reversions continuing to be negative for prime locations.

Properties like Cheung Kong Center II, if facing intense competition and struggling to maintain occupancy, fit the Dog profile. Despite CK Asset's overall portfolio occupancy being around 86% as of late 2024, specific assets within this segment are likely in a low-growth, low-market-share position, requiring careful strategic consideration.

CK Asset Holdings' legacy or non-strategic land bank parcels represent assets that are no longer central to the company's core development plans. These might include older properties or those in locations with diminishing demand, acquired at potentially higher costs. For instance, in 2024, the company continued to manage its extensive property portfolio, with a portion of its land bank categorized as less strategic, impacting capital allocation efficiency.

Specific Residential Projects with Suppressed Margins

CK Asset Holdings might have specific residential projects that are experiencing suppressed profit margins. This can happen, particularly with developments that have lower average selling prices, especially when they are launched into tougher market conditions. If these projects aren't bringing in enough profit compared to what it cost to build them, they could be considered as cash traps.

These particular projects might be struggling to contribute significantly to the company's overall profitability. They could be at a point where they are just about breaking even or offering very small returns on the investment made. This situation warrants careful management and strategic consideration within the broader portfolio.

- Cash Traps: Projects with suppressed margins, especially those with lower average selling prices in challenging markets, may function as cash traps if they struggle to generate sufficient profit relative to development costs, leading to minimal returns.

- Profitability Concerns: The focus shifts to projects that, despite sales recovery, may not be yielding the expected profit margins due to market pressures or pricing strategies.

- Strategic Review: Such projects necessitate a strategic review to assess their future viability and potential for margin improvement or alternative disposition.

Non-Core, Underperforming Overseas Assets

Non-core, underperforming overseas assets for CK Asset Holdings would represent smaller, non-strategic holdings outside of its primary property and infrastructure businesses. These assets might be situated in markets with subdued economic growth and where CK Asset has a minimal market presence.

These could be legacy investments that haven't delivered significant returns, potentially dragging down overall profitability. For instance, if CK Asset had a small retail property portfolio in a mature European market experiencing low consumer spending growth, it might fall into this category. In 2024, many companies are reviewing their international portfolios for such non-essential assets.

- Low Growth Markets: Assets located in regions with projected GDP growth below the global average.

- Limited Market Share: Holdings where CK Asset's presence is minor compared to local competitors.

- Non-Strategic Fit: Investments that do not align with the company's core competencies or long-term strategic objectives.

- Divestiture Candidates: Assets that could be sold to unlock capital and refocus resources on more promising ventures.

CK Asset Holdings' "Dogs" are assets with low market share and low growth potential, often requiring significant capital to maintain but generating minimal returns. These are typically non-core or underperforming segments of the business.

Examples include specific commercial office spaces in Hong Kong with high vacancies, as seen with vacancy rates around 17% in 2024, and legacy land bank parcels that are no longer central to development plans.

These segments may also encompass underperforming overseas assets in low-growth markets or residential projects with suppressed profit margins, acting as potential cash traps.

Strategic divestment or careful management is usually employed for these "Dog" assets to reallocate capital to more promising areas.

Question Marks

CK Asset Holdings' move into acquiring Australian agricultural land for carbon sequestration places this venture squarely in the Question Mark quadrant of the BCG matrix. This is a nascent, rapidly expanding sector driven by global climate action. For instance, Australia's carbon farming industry is projected to grow significantly, with the government aiming for net-zero emissions by 2050, creating demand for sequestration projects.

While the potential for high growth in the environmental market is undeniable, CK Asset's market share and profitability in this specific niche are yet to be established. The capital expenditure required for land acquisition, carbon monitoring, and verification can be substantial, leading to high cash consumption. The immediate returns are uncertain, as the long-term efficacy and market value of carbon credits can fluctuate.

CK Asset Holdings' investment in German elderly care and assisted living homes positions it within a demographic-driven, high-growth European sector. This venture is considered a Question Mark in the BCG Matrix due to its novelty for CK Asset and likely low initial market share in a growing, yet competitive, market. Significant investment is needed to build brand recognition and operational scale.

New international property market entries for CK Asset Holdings would be classified as Stars. These ventures are in high-growth markets but require significant investment to build brand recognition and market share. For example, CK Asset's recent acquisition of a prime residential development site in Sydney, Australia in early 2024, represents such an entry into a market where its presence is still developing.

Technological Investments for Operational Efficiency

CK Asset Holdings' dedication to technological investments, especially within its hotel and serviced suite divisions, places these initiatives squarely in the 'Question Mark' quadrant of the BCG Matrix. This strategic focus aims to streamline operations and elevate customer engagement, but the direct impact on market share and immediate profitability remains uncertain as these technologies mature and are integrated.

These investments are critical for maintaining a competitive edge in the evolving hospitality sector. For instance, the company has been exploring AI-powered customer service platforms and smart room technologies. In 2024, the hospitality industry saw significant digital transformation efforts, with companies investing in areas like contactless check-in and personalized guest experiences. CK Asset's commitment aligns with this trend, seeking to optimize resource allocation and enhance guest satisfaction through digital means.

- Focus on AI and Automation: Implementing AI for customer service chatbots and automating back-office tasks to reduce operational costs and improve response times.

- Smart Room Technology Integration: Enhancing guest experiences through connected devices, personalized environmental controls, and efficient energy management systems.

- Data Analytics for Efficiency: Leveraging data analytics to understand guest preferences, optimize staffing, and improve inventory management in hotel operations.

- Digital Transformation in Serviced Suites: Offering seamless digital platforms for booking, communication, and amenity access within serviced apartment offerings.

Exploration of Investments Beyond Traditional Infrastructure

CK Asset Holdings, under Chairman Victor Li Tzar-kuoi, is actively seeking investment opportunities outside its traditional infrastructure comfort zone. This strategic shift indicates a deliberate move into nascent or rapidly evolving sectors where the company currently holds minimal to no market presence.

These ventures are essentially question marks in the BCG matrix, representing potential future growth engines that necessitate thorough due diligence and substantial investment. The aim is to identify and cultivate these into 'Stars' within the company's portfolio.

For instance, CK Asset's 2024 interim report showed a continued strong performance in its core infrastructure and property segments, but also highlighted exploratory discussions in areas like renewable energy technology and digital infrastructure solutions. These new avenues are crucial for long-term diversification and capturing emerging market trends.

- Diversification Strategy: CK Asset is actively exploring investments in sectors beyond traditional infrastructure to broaden its revenue streams.

- Emerging Sectors: The company is looking at areas with high growth potential where it currently has a low market share.

- Capital Allocation: These new ventures will require significant capital and careful evaluation to assess their future viability and potential to become market leaders.

- 2024 Focus: CK Asset's 2024 financial disclosures indicate ongoing research into areas like green technology and digital services, signaling a commitment to this diversification.

CK Asset's ventures into new, high-growth sectors where it has a limited market presence are classified as Question Marks in the BCG Matrix. These represent opportunities with significant potential but also considerable risk and uncertainty regarding future success and market share capture. The company is strategically allocating capital to these areas, aiming to nurture them into future Stars.

For example, CK Asset's exploration into renewable energy technology and digital infrastructure solutions in 2024 exemplifies this strategy. These nascent fields demand substantial investment for research, development, and market penetration, with the ultimate return on investment and competitive positioning yet to be determined. The company's 2024 interim report highlighted these exploratory discussions, underscoring their importance for long-term portfolio diversification.

| Venture Area | BCG Quadrant | Rationale | 2024 Context/Data |

|---|---|---|---|

| Australian Agricultural Land (Carbon Sequestration) | Question Mark | Nascent sector, high growth potential, but CK Asset's market share and profitability are unproven. High initial CAPEX. | Australia's carbon farming industry poised for growth driven by net-zero targets. |

| German Elderly Care/Assisted Living | Question Mark | Demographic-driven, high-growth European market, but new to CK Asset with likely low initial market share. | Significant investment needed for brand building and operational scale. |

| Technology Investments (Hotels/Serviced Suites) | Question Mark | Focus on AI, smart rooms, and data analytics to improve efficiency and guest experience. Impact on market share and immediate profitability uncertain. | Industry-wide digital transformation trend in hospitality in 2024. |

| Exploratory Investments (Renewable Energy, Digital Infrastructure) | Question Mark | Strategic diversification into evolving sectors with currently minimal market presence for CK Asset. | 2024 interim report indicated ongoing research into these areas. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.